#income investing

Text

Investing for Income

For many, the concept of revenue is changing. No longer just a paycheck away, it now comes from innovative and strategic investments that guarantee a steady stream of income over time. This transformative approach operates through income investing, an effective way to generate regular returns from your investment portfolio.

Visit us: https://www.truproelites.com/investing-for-income

#investing for income#income investing#investment income#investment opportunities#income investments#income investment#investment earnings#income from investments#invest opportunities#investing income#how to invest for income#invest and earn money#investment for income#income from investment

0 notes

Text

Building an Income Portfolio with Dividends

Thrilled to publish this guide on constructing dividend income portfolios! Covers lessons on selecting stocks, balancing yield & growth, diversifying across sectors, utilizing funds, & maintaining the portfolio. Hope this helps fellow dividend investors!

For generations, dividends have been a cornerstone strategy for investors seeking to generate consistent income from the stock market. By constructing a diversified portfolio composed of dividend-paying stocks across various sectors, investors can create a regular stream of dividend payments that can provide living income or be reinvested to compound earnings. Dividend stocks also offer…

View On WordPress

#building an income portfolio#dividend etfs#dividend funds#dividend growth stocks#dividend stocks#dividends#high dividend stocks#income investing#portfolio income#reinvesting dividends

1 note

·

View note

Text

Indolandn.com Review (Is Indolandn.com Legit Or Scam? Investment Scam⚠️

Indolandn.com Review (Is Indolandn.com Legit Or Scam? Investment Scam⚠️

Like I’ve always said, making money online is limitless especially when it comes to investment. There are numerous ways to invest, and it all starts from the popular way; investing in stocks, bonds, commodities, cryptocurrencies, and investment sites. Have you heard of investment in farm stocks/animals before? Well, indolandn.com is a new investment site whose investment focuses on farm…

View On WordPress

#investing offers#investing#website review#task paying site#app review#business#finance#investments#investor#wealth#income earners#income investing#income streams#financial#savings#make money fast#make money for free#make money from home#make money today#make money as an affiliate#make money websites#make money online

0 notes

Text

sometimes you watch shows because your friends love them and recommend them. sometimes you watch shows because of a random video clip you saw on tumblr last week

#this is about fruits basket#its like actually good and im invested now. obsessed with how all the random minor side characters get whole dedicated backstory episodes#why dont we do this anymore#i meant to watch (2001) but the piracy site tricked me and gave me (2019) despite saying (2001)#which is fine. im enjoying it. but also i need to go watch (2001) afterwards#also sorry not sorry for the incoming art spam#she speaks

68 notes

·

View notes

Text

Decided I need to sacrifice some savings and just invest in filling out my etsy shop with a wider variety of prints. Like it should be beneficial in the long run, and then ppl aren't just stuck getting more from inprnt esp cuz they don't ship well to the UK where I'm actually based lol. Also etsy sales also give me more of a cut so.

Plus I need more of my art as physical prints there tbh. I'm gonna look at what's been selling well on inprnt and get some of them made into my usual 400gsm silk card prints. If anyone has any preferences feel free to let me know, but I gotta be sure things are gonna sell to make a profit on what it's gonna cost me to make them.

#Anyway this a long and boring way of saying: more prints incoming#I like inprnt but they take ages to pay me and I have no control over the prints themselves#Art is my job rn so it makes sense to invest (famous last words)#That being said if anyone wants to pre-order anything it would really help me cover the cost of getting things made :)

33 notes

·

View notes

Text

People should get reimbursed for commute time

If it takes someone over an hour to get tk work, that should be part of their pay.

Many people have to commute long distances/through areas of slow traffic because they cannot afford to live closer to their workplace. This is also why work from home is a big thing.

If corporations want people to return to their offices, they need to make it appealing enough. I'm not going to fight through traffic for 2 hrs in my free time just to sit at a computer all day, when I could just stay home and don't waste that time.

Corporations would be forced to invest in local affordable housing, perhaps even affording housing credits. They would need to invest in local infrastructure (which in the US is falling to pieces) and improve public transport in their area (faster commute -> less cost to the company, less cars on road -> traffic moves faster, employees without cars would still be able to get to work). Also people would be less stressed and actually take the time to drive safely because they wouldn't feel the need to rush. It would make companies actually take an interest in how their workers get to work and investing in local communities.

I live sort of near DC. We have a HUGE amount of workers commuting into the city and its surrounding cities. Retail workers also have to commute to these cities and suburbs because they cannot afford to live in those areas. My boyfriend commutes an hour to his part time job at a kennel in a rich town. A lot of people live in the more affordable, lower income, far away areas in the nearby states because housing prices in my area are fucking insane. I knew someone who commuted 2+ hours to work and 2+ hours back. There are people who drive even more than that.

And where do these employees have to live? Food deserts. Crumbling infastructure. No parks, no walkability, no public transport, bare bones everything. Only the cities which only the few can afford have basic infrastructure. And even the people living there have to commute to OTHER even richer areas. There's a ton of places where housing developments have just been shoved and are surrounded by nothing but farms. There's nothing local to do, so everyone goes to the closest town and city. It's also why you see a lot of older towns have abandoned main streets. Why have your business cater to the 100 people who live there when you can be in a city with thousands?

There has been some recent interest in paid commute times. 1 2 especially with corporations trying to get workers to go back to the office. Personally, I love working in my office because having a separate space outside my home helps me keep work and home separate and allows me to focus easier since I'm not in "home mode". I don't have room for an office in my parents house so working from home kinda sucks rn even though it would help a lot since I'm disabled. But it is nice being physically near my coworkers, even if it gets annoying sometimes. Also many jobs involve fieldwork (like mine!) which can't be done remotely anyway!

There would be incentive for corporations to keep their employees close AND provide more remote work options for those living farther away. As well as matching pay to fit rent/housing prices in the area (or vice versa).

Also there needs to be something done about corporations having their entire workforce sourced from another country entirely, working for pennies. But that's an even more complicated situation that I don't have experience in.

#long post#its 6am rant time#its so much more sustainable to have people live and work in the same communities#so many resources are spent on commute#i like my drive because it gives me time to wake up and i like just sitting n focusing for a bit#but my commute is also pretty easy since I am going away from the city towards the lower income areas#on the other direction it is backed up completely most days#we drive a lot during work to bc we visit different restoration sites and we get paid for those driving times!#it all comes down to corporations not giving a shit about their employees lives#pls dont try n dox me there are a ton of areas near DC like mine#so its harder than you'd think#but yea ive seen some crazy fucking traffic and commute times#corporations should invest in their communities instead of acting like fucking parasites#remote work#return to office#commute#labor rights#id love if sustainable city experts n economists chimed in#sustainability#sustainable cities#local economy#community

39 notes

·

View notes

Text

ohhhh my god im going to fucking throw up thinking again about the scene where sawashiro almost lopping off ichi's pinky parallels the scene from earlier where arakawa's mom threatens him with scissors

#snap chats#IM GOING TO BE FUCKING SICK !!!!!!!!!#i havent mentioned it before. or if i did its been A Hot Minute but god i think of it a lot#sorry i was just having my morning Arakawa Family In Retrospect thinking and im going to throw up#AND IT WAS OVER MONEY TOO. and the topic of insufficient income was brought up.. fuuuuccckk YOOOOU#triggering myself rewatching the scenes just to validate my points and im going to be even MORE sick#its the way both ichi/arakawa glare at sawashiro/his mother and then getting reprimanded for it. via sharp implement#and the way arakawa interrupts sawashiro and ichi like how his dad had to step in between him and his mom Shut UP#jesus. arakawa wasnt even confrontational bout it like that either bro just walked in on it#his life is a flat circle And What If. I Threw Up.#i thought of translatin this concept via a comic buuuuuttttt </3 no time </3#or energy tbh#im tempted to at the very least make comparative gif sets for these scenes... its so important i point them out....#anyways wow !!!! i love the arakawa family !!!!!!! youre all fucked !!!!!! <- crying#i love the arakawa family because it's so easy to see each member as a protagonist of their own stories#which No Duh Everyones A Protagonist In A Way but it's just espsecially easy to dig into the arakawas' perspectives and feelings#theyre ALL so interesting in how they think and react and the possibility of how theyre thinking and feeling in situations#like im so invested to want to know their perspectives because there's always extra layers to them and its fascinating..#the arakawas are just so intertwined .....

19 notes

·

View notes

Text

What is Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

It is managed by a professional fund manager or an asset management company (AMC) who makes investment decisions on behalf of the investors.

Mutual funds offer good investment opportunities to the investors. Like all investments, they also carry certain risks

SEBI formulates policies and regulates the mutual funds to protect the interest of the investors.

OVERVIEW OF MUTUAL FUNDS INDUSTRY IN INDIA

The mutual fund industry in India was set up through a combination of regulatory changes, legislative reforms and the entry of various market players.

Unit Trust of India- UTI was founded in 1964, which is when the mutual fund sector in India first started to take off. To mobilize public funds and invest them in the capital markets, UTI was established as a statutory body under the UTI Act, 1963. The idea of mutual funds was greatly popularized in India because to UTI.

Regulatory Framework-In India, the mutual fund industry's regulatory structure began to take shape in the 1990s. The Securities and Exchange Board of India (SEBI) Act, which established SEBI as the governing body for the Indian securities markets, was passed in 1993. Among other market intermediaries, SEBI was responsible with regulating and supervising mutual funds.

The SEBI (Mutual Funds) Regulations,1996- This regulation established the legal foundation for the establishment, administration, and operation of mutual funds in India. These regulations outlined the standards for investor protection, investment restrictions, disclosure requirements, and eligibility requirements for asset management companies (AMCs).

Introduction of Private Sector Mutual Funds: UTI was the only active mutual fund provider in India prior to 1993. Private sector mutual funds were nevertheless permitted to enter the market as a result of the liberalization of the financial sector and the opening up of the Indian economy. Many domestic and foreign financial organizations launched their own AMCs and entered the mutual fund industry.

Product Line Evolution: The mutual fund sector in India has grown and increased its product selection throughout the years. Mutual funds initially mainly offered income and growth opportunities. To address various investor needs and risk profiles, the industry did, however, offer a wider range of products, such as equity funds, debt funds, balanced funds, and specialist sector funds.

Investor Education and Awareness: Serious efforts have been made to educate and raise investor awareness in order to encourage investor involvement in mutual funds. Industry groups, AMCs, and SEBI have run investor awareness campaigns, distributed instructional materials, and supported systems for resolving investor complaints. Systematic Investment Plans (SIPs) were introduced, and this was a significant factor in luring individual investors

Technological Advancements-The mutual fund sector in India has embraced technological development, making it possible for investors to access and invest in mutual funds through online platforms and mobile applications. Investors can now transact, track their investments, and get mutual fund information more easily thanks to digital platforms.

The mutual fund industry in India has developed into a strong and regulated sector through regulatory changes, market competition, and investor-centric initiatives. The sector keeps expanding, drawing in more investors and providing them with a wide variety of investment possibilities around the nation.

#business#writing#investment#mutual funds#security market#money#sebi registered investment advisor#equity#make money tips#savings#financial#raise funds#funds#profit#return#growth#reading#knowledge#personal finance#income

41 notes

·

View notes

Note

Hello 👋 how are you? I love your page and you feel like a comfort person. Thank you. I wanted to ask if you have some ideas regarding jobs and finance for those who don't have full time jobs. Do you have any recommendations for jobs that you can do online and earn passively? Thank you ♥

Hi love! Thank you so much. Glad to hear you enjoy my page and its content <3

Some contract/freelance jobs I would recommend to increase your (potential) passive income include:

Sell items online like Poshmark/Depop, eBay, etc.

Purchase & flip domains

Purchase/resell clothing, accessories, and other trending items

Rent out items or owned spaces (in your home, parking spaces, classes you've purchased from a membership, etc.)

Create a social channel (YouTube/TikTok) or blog with ads

Write an e-book/a course/self-published book

Affiliate marketing

Sell photo presets/templates/photography/art online

Investing in a high-yield savings account (/CD) or dividend stocks

Hope this helps xx

#passiveincome#income streams#financial planning#money making#investment ideas#life advice#personal finance#passive income#online income#freelance jobs#resellercommunity#q/a

24 notes

·

View notes

Text

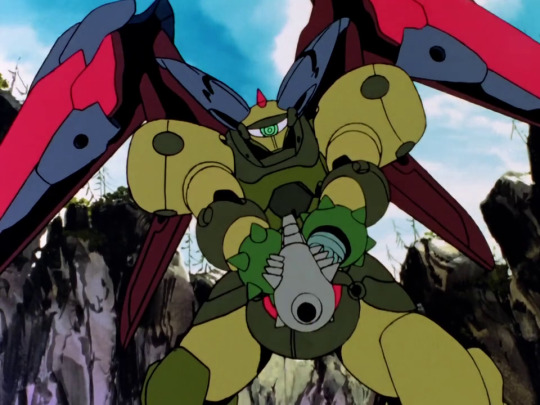

i think that the master custom death army ms are the cutest fucking things. im completely smitten by these mobile suits and it was so based of master to make the devil gundam spit these guys out for him

#g gundam#master asia#genuinely i want to snuggle one#once i have a solid source of income again i WILL be investing in getting a custom plushie made

7 notes

·

View notes

Text

Investing for Income

For many, the concept of revenue is changing. No longer just a paycheck away, it now comes from innovative and strategic investments that guarantee a steady stream of income over time. This transformative approach operates through income investing, an effective way to generate regular returns from your investment portfolio.

Visit us: https://www.truproelites.com/investing-for-income

#investing for income#income investing#investment income#investment opportunities#income investments#income investment#investment earnings#income from investments#invest opportunities

0 notes

Text

Earn Money without any invest and any cost at stay your home

Click Here:

#make money online#make money fast#make money tips#make money from home#makemoneytutorials#earn money online#earn money from home#earn money easily#earn money without investment#online business#how to earn money#online earning#earnonline#earn money fast#online income

15 notes

·

View notes

Text

Passive Income System 2.0 Digital - membership area

please join now and get free training + bonuses worth $997

#ecommerce#online earning#digital marketing#membership#businesstips#investment#bussiness#businessgrowth#businessmindset#affiliatemarketing#freetraining#passive income

7 notes

·

View notes

Text

Starzworks.com Review (Is Starzworks Legit Or Scam? Check Answers!)

Starzworks.com Review (Is Starzworks Legit Or Scam? Check Answers!)

Earning online is becoming more, and less difficult these days with different amazing money making platforms. So, if you are not yet making money on starzworks.com, then you are probably missing a lot.

Starzworks on the other hand is a new passive income site which works like most simple task paying site. On this site you are allowed to earn for free (for a while), then you can also boost your…

View On WordPress

#website review#task paying site#app review#investing#business#finance#make money online#make money tips#make money fast#online#earnincome#earnings#income investing#financing#passiveincome#wealth#make money for free#make money as an affiliate

0 notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

28 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. CONGRESS

Put the Good Jobs for Good Airports standards in the FAA reauthorization bill!

104 so far! Help us get to 250 signers!

I’m calling on you to stand with working people, passengers and our communities by supporting Good Jobs for Good Airports standards (GJGA) in the FAA reauthorization bill. Airports should and can be strong, vibrant drivers of good jobs in every part of our country. The Good Jobs for Good Airports standards are central to that mission and our nation’s future prosperity. Billions of our public dollars are invested in our nation’s aviation system every year, and we must ensure that our public resources serve the public good. That includes ensuring airports better serve the needs of our families, our passengers, our communities and the airport service workers who make it all possible.

It is evident that our air travel industry is in crisis. From record flight cancellations during summer travel peaks to mountains of lost luggage during the holiday travel season. Airports are critical publicly-funded infrastructure vital to the health of our local communities and global economy, but right now airports aren't working the way they should for travelers or airport service workers — a largely Black, brown, multiracial and immigrant service workforce. These working people, including cleaners, wheelchair agents, baggage handlers, concessionaires and ramp workers, keep airports safe and running smoothly even through a global pandemic, climate disasters and busy travel seasons. Yet many are underpaid and underprotected--even as some major airlines rake in record profit and billions of our tax dollars are invested in our national air travel system.

Domestic passenger numbers increased by 80% between 2020 and 2021, total industry employment fell by nearly 14%, leaving airport service workers to sometimes clean entire airplanes in as little as five minutes as many take on additional responsibilities outside of their typical job duties. Meanwhile, wages have barely budged for airport service workers in 20 years. The Good Jobs for Good Airports standards has the power to transform workers’ lives by ensuring airport service workers have the pay and benefits they need to care for their families.

The Good Jobs for Good Airports standards would help build a stronger, safer, more resilient air travel industry by making airport service jobs good jobs with living wages and benefits like affordable healthcare for all airport workers. Airport service workers at more than 130 covered airports would be supported through established wage and benefit standards, putting money back into hundreds of local economies and helping families thrive. If passed over 73% of wage increases will go to workers making $20 or less, estimates show.

I urge you to include the Good Jobs for Good Airports standards in the FAA reauthorization bill, and help ensure our public money serves the public good.

▶ Created on September 20, 2023 by Jess Craven

📱 Text SIGN PNXUOF to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PNXUOF#resistbot#FAA reauthorization#Good Jobs for Good Airports#airport workers#aviation industry#public infrastructure#labor rights#economic justice#workers' rights#fair wages#benefits#community support#passenger rights#public investment#economic prosperity#airport service workers#living wages#healthcare#job security#labor standards#economic equity#social welfare#income equality#workplace conditions#economic development#local economies#financial stability#worker empowerment

5 notes

·

View notes