#auditing company

Text

The Indian Partnership Act of 1932 is a piece of legislation that controls how partnerships are formed and run in India. It offers a framework for the legal rights, obligations, and liabilities of people running partnership businesses. The purpose of the act was to establish and codify Indian partnership law.

Key features of the Indian Partnership Act of 1932

Definition of Partnership:

According to the legislation, a partnership is a relationship between individuals who have decided to split the earnings of a firm that is run by all of them together or by any one of them acting alone.

Formation of Partnership:

It describes the steps involved in creating a partnership, such as the need for an agreement, the minimum and maximum number of members, and the significance of splitting gains and losses.

Rights and Duties of Partners:

The legislation outlines the responsibilities and rights of partners, including their obligations to act loyally and in good faith as well as their rights to take part in the company's management and split profits and losses.

Registration of Firms:

The act emphasizes the importance of registering a partnership firm. While registration is not mandatory, it provides certain legal benefits, including the ability to sue third parties and fellow partners.

Dissolution of Partnership:

The act details the various circumstances under which a partnership may be dissolved, such as by mutual agreement, on the death of a partner, or by court order.

Liabilities of Partners: It talks about how partners in a partnership have unlimited responsibility, meaning that the firm's obligations and liabilities can be settled with the partners' personal assets.

Minor's Position in Partnership:

The act deals with the capacity of a minor to become a partner, specifying the limitations on a minor's rights and liabilities in the partnership.

Over time, changes have been made to the Indian Partnership Act of 1932 to ensure that it remains compliant with evolving legal requirements and commercial practices. It is essential to give India's partnerships a legal foundation and give direction to people and organizations working together on economic projects.

Pros and cons of partnership Firm Registration

Pros:

1. Legal Recognition:

Prospective Rights: The partnership gains legal status through registration, enabling it to bring lawsuits against other partners and third parties in the event of a disagreement.

Evidence of Existence: A registered firm has a legal document (the partnership deed) that serves as evidence of its existence and the terms of the partnership.

2. Credibility and Trust:

Business Credibility: Getting registered can help the partnership seem more credible to suppliers, consumers, and financial institutions.

Building Trust: It may instill confidence in clients and partners, as they can verify the legal status and authenticity of the partnership.

3. Access to Legal Remedies: Unregistered partnerships might not be able to access certain legal remedies and benefits that are available to registered partnerships.

4. Tax Benefits: Registered firms may be entitled to specific exemptions or deductions, as well as particular tax benefits.

5. Continuity: Registration can ensure continuity, especially in cases of changes in partners or other structural modifications.

Cons:

1. Cost and Formalities:

There are costs associated with the registration process, including fees and expenses related to drafting and notarizing the partnership deed. The registration process involves formalities and paperwork, which can be time-consuming and may require professional assistance.

2. Public Disclosure:

The relationship details become public information after they are registered, which may not be ideal for people who value their privacy.

3. Limited Liability Concerns:

Partners in an unregistered firm also have unlimited liability, but registration doesn't provide protection against personal liability.

4. Flexibility and Informality:

Registration may impose certain obligations and restrictions, limiting the flexibility that unregistered partnerships may enjoy. Unregistered partnerships can be less formal in their operations, which may be an advantage for some businesses.

5. Limited Legal Advantages:

Unregistered partnerships still have some legal status and rights, although the benefits of registration may be limited.

The choice to register a partnership firm is ultimately based on several variables, such as the type of business, the partners' preferences, and the financial and legal ramifications of doing so. It is advisable to get advice from financial and legal experts to make an informed decision that takes into account the unique conditions of the partnership.

Key Elements of Partnership Registration In India

1. Partnership Deed:

Creation: The first step is to draft a partnership deed, which is a written agreement outlining the terms and conditions of the partnership.

Contents: Information including the company name, partner names and addresses, the type of business, capital contributions, profit-sharing percentages, and other pertinent clauses are usually included in the partnership deed.

Stamp Duty: The non-judicial stamp paper on which the partnership deed is executed is required, and the stamp duty payable is determined by the capital contribution of the partners.

2. Application for Registration:

Form: Form 1, the application for the registration of the partnership firm, must be completed by partners and submitted.

Information Required: The application contains information on the firm, including its name, address, and any duration, as well as the partners' names and contact information.

Attachment of Documents: Along with the application, a copy of the partnership deed and an affidavit stating that all the information provided is true and genuine must be submitted.

3. Payment of Fees:

Registration Fee: Partners need to pay the prescribed registration fee based on the state in which the firm is registered.

Stamp Duty: There can be additional stamp duty required for the registration procedure on top of the stamp duty on the partnership deed.

4. Submission to the Registrar of Firms:

Regional Registrar: The completed application, along with the necessary documents and fees, is submitted to the Registrar of Firms in the region where the business is located.

Verification: The Registrar may verify the documents and, if satisfied, enter the details in the Register of Firms.

5. Certificate of Registration:

Issuance: The Registrar issues a Certificate of Registration following a successful registration. This certificate is evidence of the partnership's existence.

Validity: In general, the certificate is valid for the time frame specified in the partnership agreement.

6. Public Notice:

Optional Public Notice: Although it is not required, partners may decide to notify the public and prospective stakeholders about the partnership's creation by placing an announcement in the local newspaper.

7. PAN and TAN Application:

PAN and TAN: For taxation purposes, partnerships must get a Permanent Account Number or PAN. The partnership needs to obtain a TAN (Tax Deduction and Collection Account Number) if it is required to deduct taxes at source.

8. Bank Account:

Bank Account Opening: Partners should use the Certificate of Registration and other required paperwork to open a bank account in the partnership's name.

9. Compliance and Renewal:

Annual Filing: As long as the partners keep correct financial records and follow tax requirements, there is no need for an annual file.

Renewal: Generally speaking, the partnership registration is good for the time frame given in the partnership agreement. Partners may need to renew the registration if there are any modifications or if the collaboration lasts longer than expected.

#company registration in kochi#tax consultancy#partnership firm registration#accounting consultancy#financial consultancy#GST registration#auditing company#cost accounting services#ISO registration#UAE Vat Registration in kochi#legal advisory services

0 notes

Text

Understanding VAT Returns in Saudi Arabia : An Overview for Beginners

Starting a business in Saudi Arabia or already operating one there? It is crucial to know about VAT or Value-Added Tax to ensure the success and growth of your company.

This blog will be a complete beginner’s introduction to VAT returns in Saudi Arabia, including what they entail, why they are important, and how to claim them.

By the end of this post, you should have a better understanding of how VAT returns can benefit your business and how to successfully claim them.

What exactly are VAT returns?

VAT returns allow businesses to lower their tax bill by recovering back VAT paid on specific costs. There are two forms of VAT returns in Saudi Arabia: input VAT and export VAT returns.

Input VAT returns are available for purchases of goods and services used in the manufacture or sale of taxable products or services.

whilst export VAT returns are available for enterprises that export goods or services outside of the Gulf Cooperation Council (GCC) territory.

What is the significance of VAT return?

VAT returns may have a big influence on a company’s bottom line. Businesses can minimize their tax bill and enhance their cash flow by claiming back VAT paid on costs. This can help organizations stay competitive and reinvest in their growth and development.

How can businesses claim VAT returns in Saudi Arabia ?

Businesses in Saudi Arabia must satisfy certain requirements and follow particular processes in order to claim VAT returns. Businesses, for example, must keep sufficient documentation to support refund claims, file refund applications within particular time constraints, and follow VAT requirements.

In Saudi Arabia, beginners may find getting VAT returns complicated and time consuming. That is why it is critical to seek the advice of a top accounting firm in Riyadh, Saudi Arabia that has worked with firms similar to yours and can give customised solutions to assist you maximise your VAT return advantages.

Who has to file VAT returns in Saudi Arabia?

Every taxable person registered under KSA VAT law must file the VAT returns in Saudi Arabia either monthly or quarterly, depending on their annual turnover.

Even if a taxable person has no transactions during a tax period, they are still required to submit a “Nil” return for that time period.

Types of VAT returns in Saudi Arabia

https://arabianaccess.com/blog/wp-content/uploads/2023/05/Types-of-VAT-returns-in-Saudi-Arabia.jpg

KSA VAT involves the filing of VAT returns for a particular tax period, which may be either monthly or quarterly.

Monthly VAT returns

Monthly VAT return filing is a legal requirement for companies with annual sales of over SAR 40 million.

Between the first and the last day of the month after the conclusion of the tax period, the taxpayers must submit their monthly VAT returns. Taxpayers must submit their March VAT returns between April 1 and April 30, for instance.

Quarterly VAT returns

Companies with yearly sales of SAR 40 million or less can file quarterly tax returns.

The first and last days of the month after the end of the quarter are when taxpayers can submit their quarterly VAT returns.

For instance, taxpayers must submit their VAT returns between January 1 and January 31, for the quarter from October to December.

What Indians should know about “expat tax” in Saudi Arabia?

https://arabianaccess.com/blog/wp-content/uploads/2023/05/What-Indians-should-know-about-expat-tax-in-Saudi-Arabia.jpg

Are you an Indian expat operating a business in Saudi Arabia and seeking VAT returns to reduce your tax obligations?

Seeking a nearby tax accountant in Riyadh, Saudi Arabia?

The Saudi government imposes an “expat levy” on all foreign employees and their families living in Saudi Arabia. Foreigners working in Saudi Arabia are subject to a flat tax rate of 20% on their earnings. As an Indian working in Saudi Arabia, you may be subject to this expat tax.

However, the Saudi Arabian government does provide several exemptions and discounts for expatriates. In addition, you may be eligible for a tax-free personal allowance, which is currently set at SAR 18,750 per year.

Furthermore, certain expenses related to your job, such as housing and school costs, may be tax deductible.

For the purpose of correctly calculating taxes due, it’s critical to maintain precise records of all income and expenses throughout the year.

Moreover, it’s also important to keep in mind that tax laws and regulations in Saudi Arabia might change regularly. Therefore, expats should keep up with any modifications that might affect their tax obligations.

Many expats in Saudi Arabia decide to work with an expat tax advisor in Riyadh, who can offer advice on their unique tax position in order to help ensure compliance with tax rules and regulations. An experienced tax expert may guide expats through the complexities of the tax code and reduce their tax bill.

Maximizing Your Business’s VAT Return Benefits

Businesses in Saudi Arabia can employ a variety of tactics to maximise their VAT refund benefits. Here are some pointers to get you started:

Maintain correct records – Maintaining proper records is critical for obtaining VAT refunds. Businesses should keep adequate paperwork, such as invoices and receipts, to support their refund claims.

Be careful of the deadlines – It is critical to file your VAT refund applications within the time limitations indicated to prevent losing your refund advantages.

Work with an accounting company – Collaborating with an accounting firm that has expertise dealing with Saudi Arabian companies can provide you the direction and assistance you need to get the most out of your VAT refund.

Review your business operations – It’s crucial to assess your operations to make sure you’re utilizing all of your prospects for a VAT refund. For instance, companies may be entitled for export VAT refunds if they export products or services outside of the GCC.

It’s important to remember that tax laws can be complicated, and your unique situation may affect the specific rules and regulations.

It’s always advantageous to consult with a trained tax return accountant in Riyadh, Saudi Arabia who can provide you with advice on your tax responsibilities and assist you to reduce your tax payment.

In conclusion, VAT returns may be a useful tool for Saudi Arabian companies.

By understanding VAT returns, their significance, and how to apply for them, businesses can strengthen their financial position and remain competitive.

Reach out to a top accounting firm in Riyadh, Saudi Arabia, like Arabian Access, which can provide service even as an accountant for the self-employed in Riyadh, Saudi Arabia.

Get the guidance you need from us if you’re new to the subject and want to learn more about VAT returns in Saudi Arabia.

#auditing#Auditing Company#Auditing Firms#Auditing Services#Internal Audit#Value Added Tax#Expat tax#Export VAT returns#Financial Analysis#Monthly returns#Quarterly returns#VAT returns

0 notes

Text

Did you know that India's dairy market is projected to reach $124.93bn in 2023? That's a growth of over 8% from 2022!

The Indian #dairy market is one of the most dynamic and fastest-growing in the world. Learn more about this exciting market in our latest article.

Click the link to read the full article and learn more about the future of the dairy business in India. - https://www.instagram.com/p/CvZLae8v80L/?img_index=1

#research gates#researchers#market researchers#qualitative research#action research#operations research#quantitative and qualitative research#consumer research#audit company#experimental research#market research analyst#business research#Research Consultants#Researchers#market research consultants#Market Researchers#Audit Company#Auditing Company#Company Audit#mystery shopping#secret shopper

0 notes

Link

An organization's internal controls, including its corporate governance and accounting procedures, are assessed by internal audit. By recognising issues and making corrections before they are found in an external audit, they help to preserve operational efficiency and assure compliance with laws and regulations, accurate and timely financial reporting, and data collecting.

The operations and corporate governance of a corporation are greatly influenced by internal auditing services. Internal audits check the correctness of a company's accounting and audit trails as well as operating performance and legal and regulatory compliance.

Additionally, they protect against potential fraud, waste, and abuse and look for weaknesses in internal controls. Internal audits offer management and the board of directors value-added recommendations, suggesting changes to existing procedures and practises, which may include supply-chain management and information technology systems if they are not operating as planned.

Internal audits are offered by Spectrum daily, weekly, monthly, or yearly. We also take into account special criteria that may call for more regular audits of some departments than others.

At the conclusion of each audit, we typically publish reports that include a summary of the conclusions, recommendations, and any answers or action plans from management. An audit report must have an executive summary, a body with the specific concerns or discoveries found, relevant recommendations, or action plans, and an appendix with information on the auditing process, such as extensive graphs and charts.

Call us today for a consultation.

Tel: +971 4 269 9329 |

E-Mail: [email protected]

0 notes

Text

"you ever read fanfiction and there's something so absurdly specific that it must come from the author's real life experience." me when i write one of those fire lord zuko fics but instead of just saying "paperwork" i write full financial statements for different departments and act like thats normal to write in a fanfiction.

#cal.ibrations#zuko reads fn military-adjacent companies 10-ks#actually now i think about it does the fn have established accounting principles. they give me the vibe everyone is committing crazy fraud#zuko and establishing FNGAAP#zuko & bringing swords to an audit.

183 notes

·

View notes

Text

I Changed My Thesis

Originally, my history BA thesis was going to be deconstructing the Starz/Sky TV collaboration Penny Dreadful.

I changed it.

I had been forcing my way through the show to make notes for my work, but then one day I started thinking about Bill Gunn’s ‘Ganja and Hess’ way too much and it changed my whole concept.

Now, I’ll be writing my thesis on linguistic violence against women and the monstrous feminine in horror, examining terminology used against women and how those words are contextualized historically within horror as a genre.

There’s a lot of material to cover in this paper, as I already have over 50 sources, but to give an idea of what I’m looking at, the following are the movies I’ll be using for the paper:

Am I Quiet Enough For You Yet?

Audition (1999)

Last Night in Soho (2021)

...Will Still Become a Wolf When the Autumn Moon is Bright

Ginger Snaps (2000)

The Company of Wolves (1984)

I Drank All the Blood That I Could

Ganja and Hess (1973)

A Girl Walks Home Alone at Night (2014)

Holy Water Cannot Help You Now

Def By Temptation (1990)

Possession (1981)

They Come to Drink, They Come to Dance, to Sacrifice a Human Heart

The Lure (2015)

She-Creature (2001)

Burned But Not Buried This Time

The Craft (1996)

The VVitch (2015)

So stay tuned for ‘At Least You’ll Sanctify Me When I’m Dead: A History of Linguistic Violence Against Women and the Monstrous Feminine Within Horror’.

This is gonna be fun.

#linguistic violence#monstrous feminine#psychokillers#audition 1999#audition#last night in soho#good for her horror#female killers#werewolves#lycanthropy#ginger snaps#ginger snaps 2000#the company of wolves#vampires#ganja and hess#a girl walks home alone at night#demons#def by temptation#possession#mermaids#siren#the lure#the lure 2015#she creature#she creature 2001#witchcraft#witches#the craft#the vvitch#final girls in film

54 notes

·

View notes

Text

someone stop me pls

#second version of a poll where i forgot to include an option for me to monitor the results#to be completely honest my only worry would be gas but i could carpool i’m friends with some people involved in the company#or i could MAKE friends#shakespeare#william shakespeare#theatre#theater#plays#auditions

21 notes

·

View notes

Text

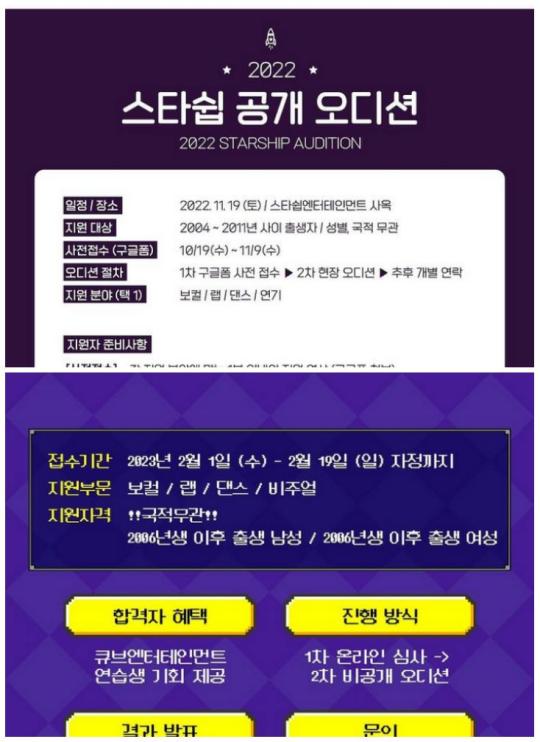

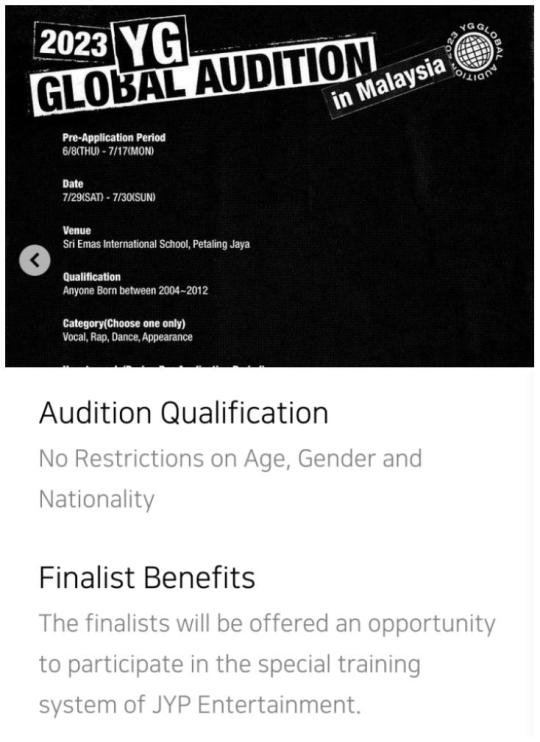

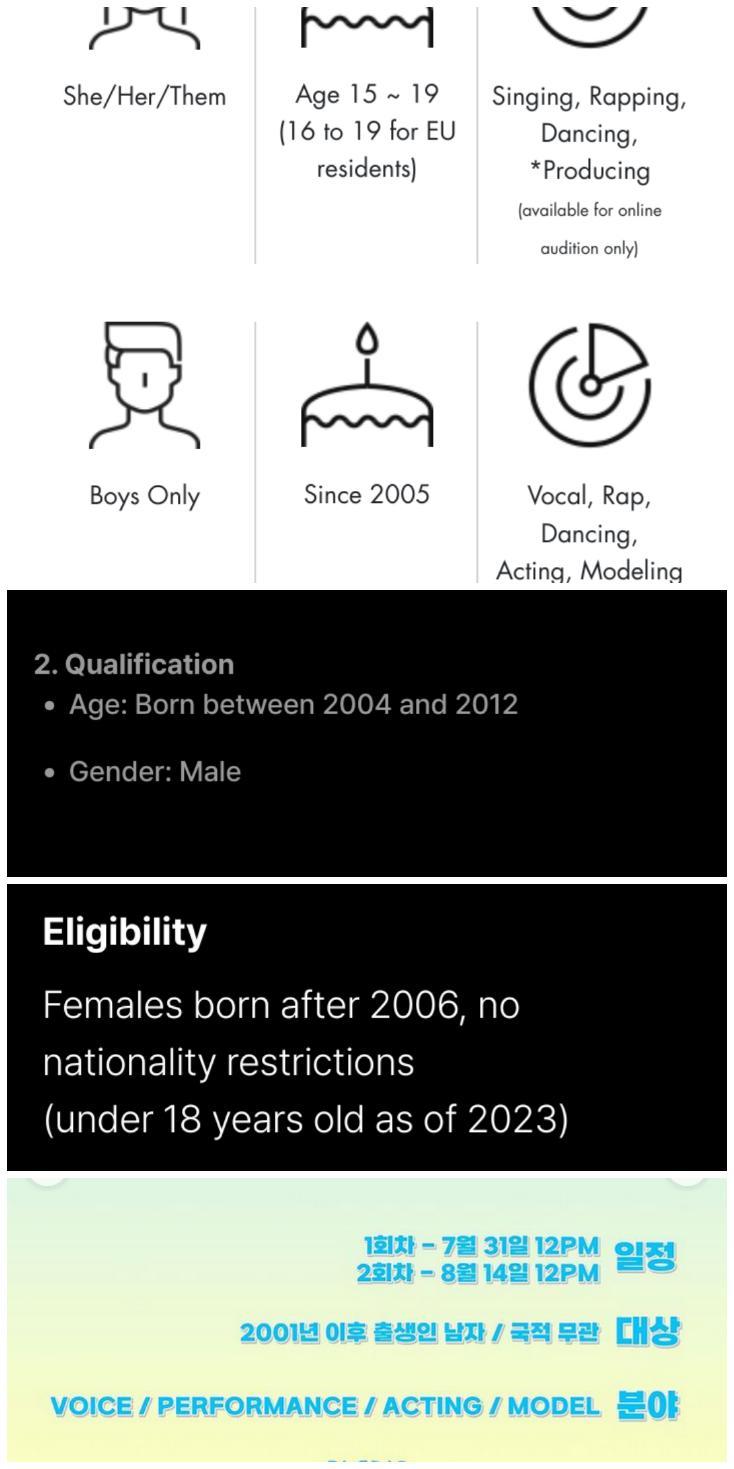

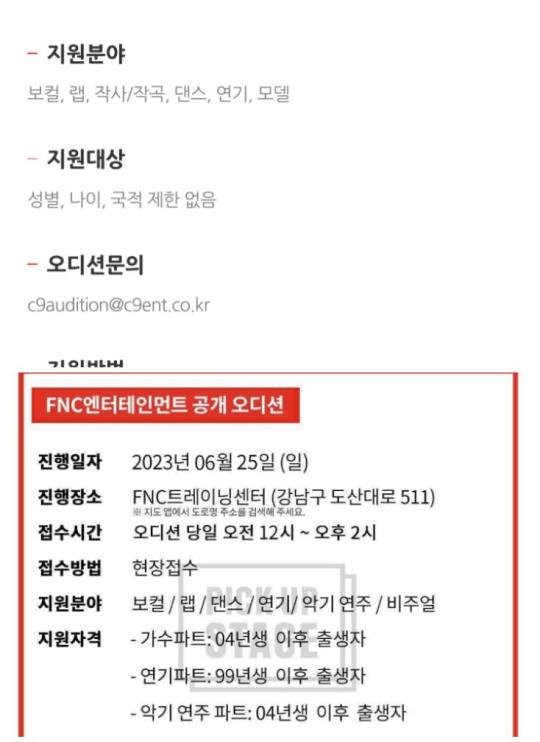

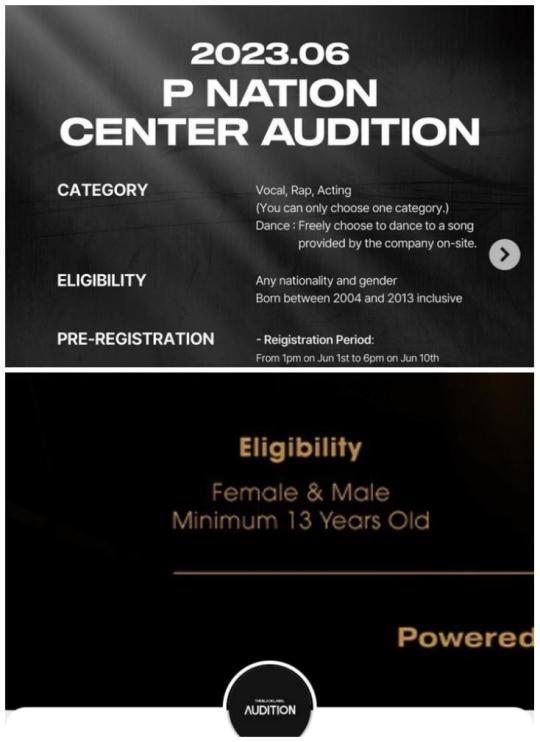

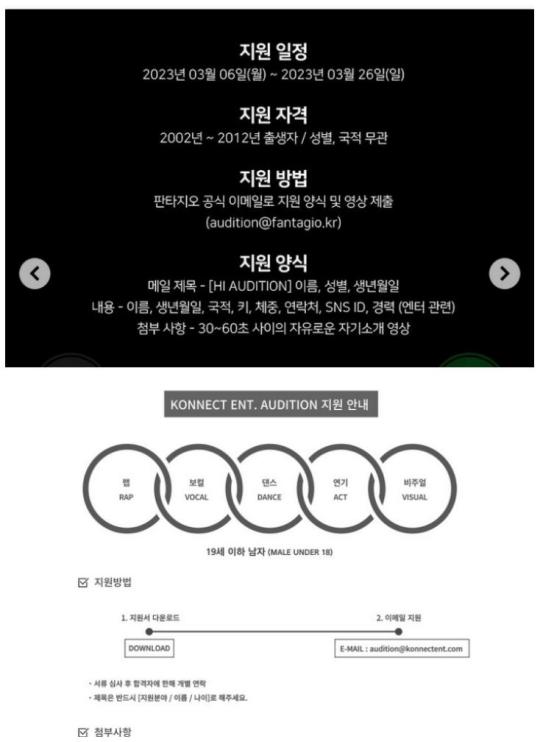

kpop auditions age brackets:

(all info sourced from official pages (ig, audition page on company website))

starship: born 2004-2011 (2022 audition)

cube: born 2006 onwards (2023 audition)

sm: born 2004-2012 (2023 global audition)

wake one: no restrictions (2023 online audition)

yg: born 2004-2012 (2023 global audition in malaysia)

jyp: no restrictions (2023 online audition)

hybe:

- hybe x geffen: only girls ages 15~19, eu residents 16~19 (2023 global girl group audition)

- bighit music: only boys born after 2005 (2023 online audition)

- ador: only boys born 2004-2012 (2023 audition)

- source music: only girls born after 2006 (2023 daily audition)

- pledis: only boys born after 2001 (2022 last member audition)

c9: no restrictions (2023 online audition)

fnc: (singers) born after 2004 (2023 open auditon)

yuehua: no restrictions (2023 online audition)

ist: born 2004-2011 (2023 global audition)

woollim: born before 2012 (woollim x play with me club 2023 new member audition)

mystic: born 2004-2011 (2023 online audition)

p nation: born 2004-2013 (2023 center audition)

black label: minimum 13 years old (2023 the first thailand audition)

top media: born 2006-2012 (2023 audition face to face)

maroo: only boys born 2001-2009 (2022 story audition)

fantagio: born 2002-2012 (2023 fantagio audition)

konnect: boys under 18 (2023 audition)

#i am only using official sources so if i didn't find anything but some random blogs that's why some companies aren't mentioned#or i run out of space#kpop auditions#mellobs

43 notes

·

View notes

Text

I'm going in for my Les Mis costume fitting after work and on the one hand, I'm really excited because it's another moment of OMG I'M REALLY GONNA BE IN LES MIS. IN A PROFESSIONAL PRODUCTION. AT THE LOCAL BELOVED OUTDOOR SUMMER MUSICAL THEATER VENUE.

On the other hand, I'm half expecting that they'll take one look at me and go "Well, of course we can't use you after all, you're too fat."

#fat shaming for ts#this was also why my mother wouldn't let me audition for young cosette when i was little#instead of telling me that we just wouldn't have time if i were to get the part#or even letting me audition safe in the knowledge that i was absolutely not going to get the part#(because i was too fat)#(also too tall)#ANYWAY this company specifically encouraged people of all ages ethnicities AND BODY TYPES#they also are very short on tenors (i am singing tenor for les mis)#so i am just spinning myself up pointlessly#thanks mom!

8 notes

·

View notes

Text

༄ ⭒ 🔥 ✦ * TRAILBLAZERS is finally open for auditions! with a 12 episode run, the show aims to create an innovative SUPERGROUP featuring 8 official members. do you have what it takes to be a trailblazer ? set fire to the world and audition today !

BLAZERS TIP : clicking on the source link leads to the audition page! don’t be shy, sign up as many times as you’d like!

#༄ ⭒ 🔥 * AUDITIONS !#fictional idol community#kpop survival show#fake kpop addition#fictional kpop idol#bts addition#fictional kpop group#fake kpop company#fictional idol group#fake kpop member#fake kpop group#fictional idol oc

27 notes

·

View notes

Text

Something that's become a bit of a running joke at work is that we need to buy a margarita machine as it is a necessary job expense

#the turtle speaks#the story behind this is that a couple of the guys had a training on chargeable expenses#and an example brought up was when that company audited a former contract#they found that someone had billed them for a margarita machine#and they of course told all of us and collectively we just bring it up at any opportunity

10 notes

·

View notes

Text

I wish the company I had emailed about whether they were gonna open auditions had emailed me back...

I really... want to... join... q-q

8 notes

·

View notes

Link

One of the top auditing firms in Sharjah is Spectrum. We're committed to giving our customers the greatest financial support possible. We have experience in every area of company, from audits to financial advice. We provide a wide range of services, with auditing being one of them. We take care of your audit concerns and deliver an excellent audit that complies with your company's requirements.

To make certain that the advice we provide satisfies all of your needs, all of our finance departments collaborate closely with one another. You can give to the shareholders a cumulative report on the financial and operational performance of your company with the aid of Audit Firms In UAE.

Benefits of Hiring Auditing Firms in Sharjah

The International Audit & Assurance Standards Board (IAASB) has developed the International Standards of Auditing (ISAs), and our auditing practises are in accordance with those standards (IAASB).

To make sure that the audits we perform for you are of the highest possible calibre, our member companies periodically assess one another's auditing procedures.

We adhere to the strictest standards of public scrutiny, scepticism, and critical review for our audits.

To help you gain a deeper understanding of your company's finances, our highly educated audit experts will lead you through the whole auditing process.

The audit specialists employed by audit firms in UAE have received training in both internal and external auditing procedures. This aids the business in evaluating its performance and showing its shareholders its financial health and profitability.

You can have a clear understanding of the areas to concentrate on for the growth of your organisation from the thorough audit Spectrum provides.

To Know more, Visit website: https://www.spectrumaccounts.com/

Address&Contact

305, Hamsah – A, Ansar Gallery, Al Karama, Dubai, United Arab Emirates. P.O.Box : 379682

+971-50-986-6466 +971-4-269-9329

#Auditing Firms In Sharjah#Audit Firms In UAE#Auditors in Dubai#Auditing Company#Approved Auditors in Dubai

0 notes

Text

everyone here was soooo excited because a national channel was going to bring back this iconic tv series, directed specifically to the youth, from our childhood and adolescence that we are so nostalgic about after 11 years for them to disappoint us all with the trailer because it looks like elite 2.0

#they ruined morangos com açúcar i dont think you guys understand#this was supposed to be a cliché show with bad acting about students and dramas at school not a fucking disappearing mystery show#with parties and sex and whatnot 😭#they're making it release in 10 episode seasons like streaming shows too.... that's not morangos!!!!! anfngngnbg#the vibe is so different that it actually makes no sense why they would try to tie it with the other seasons plot and actors shsjshs#yes morangos had your occasional topics of teenage pregnancy and queerness and all that jazz but it was actually explored well#the way they're making girls kiss and parties happening and everything of those sorts in the new season is literally like any of those#spanish teenage shows with too much sex scenes and it's embarrassing actually.#the essence of our national tv is getting lost because they want to do stuff that 'sells' except morangos never sold because it was trendy#or even good because the acting was honestly not great. it was literally our company and part of our routine all year around almost#it was the show we would arrive from school to watch before dinner every day#we watched them experience the school year at the same time we did and on holidays there was a special summer edition#it was a whole thing that this new version isn't.#it was a novela directed for the youth and not whatever show they're trying to make and i'm so mad#i actually wanted to see it. morangos was special to so many of us everybody knows the songs everybody loves the artists that came from#that generation we all grew up watching it.... literally.#and capitalism strikes again 👍#the auditions were a joke too. they announced auditions for anyone who would like to because another thing about morangos is that it was#a talent factory it gave opportunity to newbie actors and pushed their careers and the new season has a bunch of already renown actors and#actresses and they didn't even care to hide how fake and rigged the public auditons were lol#anyways never building expectations about anything ever again this actually broke my heart man agjshs#i'm gonna mourn this listening to d'zrt 4taste and just girls ✊

10 notes

·

View notes

Text

Unlocking GST Success: Your Guide to Finding the Right GST Expert in India from Mas LLP

In the dynamic world of Indian taxation, Goods and Services Tax (GST) has revolutionized the way businesses operate and comply with tax regulations. Navigating the complexities of GST requires expert guidance and support from seasoned professionals who understand the intricacies of the tax system. At Mas LLP, we pride ourselves on being leading GST expert in India, offering comprehensive solutions tailored to meet the diverse needs of businesses across the country. Let's delve into why Mas LLP is your go-to partner for GST success.

Unparalleled Expertise: With extensive experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our GST expert in India have in-depth knowledge of GST laws, rules, and compliance requirements, enabling us to provide expert guidance and support across a wide range of GST-related matters.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of GST services designed to address the diverse needs of businesses in India. Whether you're a small startup, a mid-sized enterprise, or a multinational corporation, we have the expertise and resources to support you at every stage of your GST journey. From GST registration and compliance to filing returns and managing audits, we handle every aspect of GST with precision and professionalism.

Tailored Approach: We understand that every business is unique, with its own set of goals, objectives, and challenges. That's why we take a tailored approach to GST consulting, offering customized solutions that align with your specific needs and aspirations. Whether you're looking to optimize your GST strategy, mitigate risks, or resolve compliance issues, we work closely with you to develop tailored solutions that deliver results.

Transparency and Trust: At Mas LLP, transparency and trust are at the core of everything we do. We believe in building long-term relationships with our clients based on honesty, integrity, and reliability. Our transparent pricing, clear communication, and ethical business practices ensure that you always know where you stand and can trust us to act in your best interests.

Client-Centric Focus: We're committed to providing exceptional service and support to our clients. Our dedicated team of GST expert in India is here to answer your questions, address your concerns, and provide expert guidance every step of the way. Whether you need assistance with GST planning, compliance, or dispute resolution, we're here to help you achieve your GST goals.

In the competitive landscape of Indian business, having the right GST expert in India by your side can make all the difference. With Mas LLP as your trusted partner, you can navigate the complexities of GST with confidence and clarity. Contact us today to learn more about our GST services in India and take the first step towards GST success.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

pls post the twelfth night audition info @ area shakespeare company my crops are dying

#this show opens in late february how long do they think this rehearsal process is gonna be#also it looks like the company has officially confirmed a season and i guess the winter’s tale got cancelled 😭#it’s twelfth night midsummer night’s dream scottish play hamlet and the jane austen holiday show#theatre#theater#plays#auditions#acting#in all fairness the last time i got cast in a play it was also after an uncertain audition process

6 notes

·

View notes