#Personal Debt Consolidation Companies

Text

#personal loan debt relief#debt solutions company#debt consolidation edmonton#debt consolidation loan

0 notes

Text

Apply for Debt consolidation loan in Dubai

Apply for Debt consolidation loan in Dubai

Debt Consolidation in UAE

Lately, numerous indebted individuals are shuffling between many advances like home credit, vehicle advance, individual advances and charge cards. The significant expense of living, particularly in the UAE locale and the upscale way of life makes individuals spend too far in the red. At the point when the Debt Consolidation Loan goes out of hand, they approach banks or monetary establishments for an Debt Consolidation Loan solidification credit.

What is Debt Consolidation Loan?

Envision overseeing 3-4 credits and paying various portions for every single one of them. These credits can be various paces of revenue and furthermore with various banks. Debt Consolidation Loan union credit is an item presented by most banks and monetary establishments which assist with uniting every one of your advances into one single credit. The residency, pace of interest and advantages can fluctuate however the customers accept it assists them with starting their excursion of an Debt Consolidation Loan free life.

Benefits

Better following of funds - Since you have just a single credit to reimburse, the quantity of portions boil down to one as well. This recoveries you a great deal of time, exertion, and cash, engaged with making different installments. This way you can follow your credit parts like financing cost being charged, and so forth without any problem.

Manage debts easily - Having numerous credits can a little confound. A solitary credit can be overseen effectively and the installments should be possible on time with no deferrals.

Lesser interest to be paid -As a rule, banks and monetary foundations offering Debt Consolidation Loan union credits offer a lower pace of revenue. Thus, by solidifying different credits, you can be guaranteed of setting aside cash which was being paid as revenue.

Less percentage of Debt repayment amount on monthly expenses - Low financing cost will without a doubt diminish the regularly scheduled installment made on the obligations which can save the credit holder a lot of cash.

Credit rating When you are shuffling between numerous installments for various credits, odds are you could miss or defer specific portions. This can antagonistically influence your credit score and bring on some issues for profiting further advances whenever required. Debt Consolidation Loan combination advances helps you by diminishing the possibilities missing or postponing installments in this way further developing your financial assessment.

Stress-free We live in a world loaded with pressure. A credit is likely the greatest supporter of stress in our lives. By solidifying your obligations you will feel a drop in your feelings of anxiety since every one of your portions would be converged into a solitary installment consistently.

Extra advantages Alongside these banks could offer advantages like free deferment of portions, elegance period for portion installments, limits on handling charges, and so on.

Eligibility

Each bank and monetary establishment have its own qualification rules which should be checked exclusively. Nonetheless, a few essential prerequisites are as per the following:

Debt Consolidation Loan to Weight proportion [DBR] shouldn't surpass 50%

Most banks have a prerequisite of pay move

Least compensation begins at AED 7000

Should be a UAE inhabitant

Ought to have credits in UAE to unite

Expenses and charges are generally like ordinary individual advances however they should checked before apply.

Which banks offer Debt Consolidation Loan advances in UAE?

Highlights

Loan cost begins from 3.44%

Can get an effortlessness time of 90 days for the first portion

Can delay up to 2 portions consistently

NO handling expense

High money measure of up to 3000K AED

Fast endorsements

Employment cutback assurance

ADIB Visa cashback Mastercard as free

Documents Required

Responsibility Letter

Compensation Move Letter according to the bank's organization

Last 3 - a half year bank Explanations

Finished and marked branch application structure

Identification Duplicate

Legitimate Emirates ID

Home Visa (only for expats)

How to know that Debt consolidation loan will work for you?

Debt Consolidation Loan solidification is a long drawn process. Customers with various Visas and no investment funds to reimburse them ought to fundamentally consider Debt Consolidation Loan union as this can essentially decrease the loan costs. Debt Consolidation Loan solidification requires an immovable Debt Consolidation Loan to new reimbursement design and determination to follow it all through the residency of the credit. On the off chance that this is you, Debt Consolidation Loan union credit can assist you with becoming Debt Consolidation Loan free.

Contact us: 971-555394457

#onsolidation loans#credit card consolidation loan#credit consolidation loan#debt loans#loans to pay off debt#debt relief loans#personal loan for credit card debt#loan consolidation companies#personal loan consolidation#best debt consolidation companies#low interest debt consolidation#loan for credit card debt#credit card debt consolidation loan#apply for a debt consolidation loan#credit debt consolidation#loan to pay off credit card debt#personal loan for credit card consolidation#need a loan to pay all my debts

0 notes

Text

Best Personal debt for consolidation in US

Self debt relief company is offering the best Personal debt for consolidation in US. Consolidating your debts can help you save money and simplify your financial life. Plus, Self Debt Relief is well known and respected within the debt relief community, so you can be sure that your money will be safe and your credit will remain intact.

Contact Details:

Visit: www.selfdebtrelief.com

Call: +1-888-615-0171

Mail: [email protected]

#Best Personal debt for consolidation in US#debt relief us#personal debt reduction company in california#best consolidation debts us#interest rate reduction in california#debt reduction in us

0 notes

Text

Simplify Consultancy Services doesn’t let you face your debt alone! We are here to help you. Get low-cost debt solutions and answer to your queries about credit, debit, and budget.

#Simplify Consultancy Services#Personal Finance Consultation UAE#Legal Advice Online UAE#Debt Consolidation UAE#Legal Advice Companies Dubai

0 notes

Text

Please Help A Mentally Ill, Mostly Queer Homeless Family Stay Housed This Holiday Season?

PAYPAL | AMAZON WISHLIST | KOFI | GOFUNDME

VENMO: @penaltywaltz | CASHAPP: $afteriwake23 | ZELLE: DM me for email address

12/27/23 - Updated Post!

NEW GOAL!

$1290/$2013

(Original goal met, now edited for additional room help, food, bills and other things needed)

If I can get the entire amount still needed, I can do the following:

Get the hotel room for over a week, which will let us come and go without worrying about having to spend all day trying to raise money and we can run important errands next week

Close three open collection accounts my mom has by paying them off in full via her debt consolidation company, and pay off two defaulted payday loans

Pay off her PayPal debt so that PayPal will reopen her account

Have money to make a payment if I can get the debt collection company to find her other credit card account I need to arrange payments on

Get food after the 10th, because I fully expect both myself and my mom to be out of food stamps by then (also, I don't know who did it, but BLESS YOU to the person who bought us three DoorDash gift cards off the Amazon wishlist...I just wanted to put that out there in case you didn't send a gift receipt)

Most of this will be a huge help in getting us to be able to qualify for housing that requires credit checks, and helping Lena get her health stuff sorted and figure out if she has any other debilitating illnesses will help give her disability appeal more strength, which will help her get an income to support herself. So please reblog this version if you can, and help with money or wishlist items if you can (the restaurant gift cards go a long way, plus I desperately need the clothing for me because I've lost 40 pounds this last year and most of my stuff is now too big). Thank you for reading this, and I hope you have an awesome day!

#signal boost#mutual aid#community aid#urgent#emergency#direct action#mutual aid request#paypal#venmo#cashapp#amazon wishlist#ko fi link#ko fi support#buy me a kofi#gofundme#please boost#please reblog#please share#please help#anything helps#help needed#donations#crowdfunding#financial aid#financial assistance#temporary housing#homeless support#bills#groceries#trans community

802 notes

·

View notes

Text

The jail extracts people from lives-in-motion in order to extract time from them. Why time? Because it is the element, become a commodity, that enables flows of carceral cash (wages, debt service, rent, utility bills, vendor invoices, and so on). It is that commodity that inspires, as any system under racial capitalism always will, persistently innovative strategies to direct the flow toward particular coffers: salaries; agency budgets; politicians’ reelectability; construction companies and raw materials purveyors; consultants; elite landowners; investment bankers; pension fund bondholders; or other resources that, in the abstract, could be used for anything, but in the ideologically charged ongoing material present, consolidate in the carceral fix.

The commodification of an unfree person’s time doesn’t end with them being drained of their non-renewable resource, although that is more horror than anyone should bear. As with all carceral interruptions to life-in-motion, unfree persons’ households and communities also experience the drain. Not only deprived of time and money resources, they are also exposed to life-shortening effects of powerless worry and ambient toxins that, in sum, contribute to group-differentiated vulnerability to premature death.

— Ruth Wilson Gilmore

107 notes

·

View notes

Text

Ko-fi prompt from Klara:

can you please explain like I'm, not five, but, like, ten or twelve, if/why/why-not/how a Business that went from being owned by the founder/founder's heirs/a worker's collective, to being shareholder-owned, can go BACK to its original state?

That one is actually a pretty easy answer, it's just... not easy to implement.

Easier said than done and all that.

ONE: What does shareholder-owned mean?

The majority of the company is parsed out into shares, which are owned by people who do not work for the company. This is not the only way that a company can be owned by other people, but it's a common one. So what are shares?

Companies generally start out privately-owned. Whether this is by the found, by a wealthy investor, or by the bank, there is a specific person that you can point at and go "that person owns it." Sometimes, it's multiple people, split up in specific ways (e.g. started by a team of two that each owns 50% of the company by contract), but it's private.

At a certain point, the company may choose to go public. This means that they have assigned a value to the company, split that value up into a set of shares, and declared that those shares are worth a certain percentage of the company. If you own enough shares, you can direct the company's actions.

Let's say a company goes public with a net worth of $1million. They have split that $1mill into 100,000 shares worth $10 each (this one-share value is called the Initial Public Offering, or the IPO).

If a person buys 1,000 shares, they now "own" 1% of the company. With every share a person owns, they can vote once in shareholder elections for how and where the company goes. (This isn't getting into stuff like preferred stock, which is non-voting in exchange for things like higher dividends.)

If they buy 51,000 shares for a total of $510,000, they own 51% of the company, and now have what is called a controlling interest. This means that the person with those 51,000 shares can more or less unilaterally assign people to the board of directors, and so on.

At the initial public offering, a company will not necessarily put up all their stock for sale. When Apple first went public in 1980, they sold 8% of their stock, most of which went into paying off debs. The other 92% stayed with the then-current owners of the company. These days, most of Apple is owned by institutional investors, which means it's owned by other companies that invest on behalf of people.

So, a shareholder-owned company is owned by people who purchased part of the company, and the company used that money to fund its own growth, whether by paying off debts, buying a new factory, hiring more workers, and so on.

TWO: How do companies purchase back their own stock?

...with difficulty.

When a company has grown its wealth enough to purchase its own stock and start re-consolidating ownership, it's called a stock buyback. It happens with some regularity.

After a company has spent the money earned from the initial sales, that's it. They don't earn more money as shares go up in value, none of that actually goes to them, just to whoever is selling.

So there's this thing called 'dividends.' This is where a company pays out a portion of its profits to shareholders quarterly. Walmart currently pays its investors $0.57 per share, per quarter. For someone with 100,000 shares, that's $228,000/year.

(That's not actually that much for someone who owns over $15mill worth of stock, but it's something. It's not where the actual worth of the share is stored, but that's a whole other mess.)

For legal reasons, a company must act in the best interests of the shareholders. So if the shareholders believe that they will be best served by being paid out the profits as dividends, they will ask for those profits in dividends. If they decide they are best served by the purchase of a new factory, then that's what the money gets put towards. If they want to make the corporation bigger by buying a smaller company, then that's what they do.

Stock buybacks are done for a few reasons, like forcing the price per share to go up by creating scarcity (which is good for anyone looking to resell their stock at a profit), or making it so that dividends per share end up higher by lowering the number of shares to divide profits amongst.

Fun fact, one of the big things the covid-19 stimulus package had rules about was stock buybacks because large companies had previously used taxpayer money to bail out their own debts from the act of buybacks, and the government anticipated that stimulus money for covid-19 relief, meant to ensure employees stayed afloat, would be used on stock buybacks and shareholder dividends unless actively banned.

Did you know buybacks were illegal until the Reagan era?

THREE: So... where does that leave us?

Well... basically, the founder, heirs, or workers need to build up all the capital necessary to purchase at least 51% of the shares.

Which is a lot of money.

It can be done, but it's not easy to stuff that genie back in the bottle. A company that's already focused on ensuring dividends and capital gain are aimed at the shareholders is one that's not going to be paying their employees enough to build up those funds, you know?

It's not feasible unless the founder/heirs have stayed wealthy enough in their own right to buy it all back, or if the stock price plunges so low that the employees can purchase it all at rock bottom prices and then build it back from the ground up.

(Prompt me on ko-fi!)

#economics#stock market#capitalism#phoenix talks#ko fi#ko fi prompts#economics prompts#buybacks#stock buybacks

81 notes

·

View notes

Text

The Will of James Laurens

Notes:

The handwriting here was incredibly difficult to decipher, so there are lots of gaps below - either words I could not make out at all, or some where I've included my best guess. If you have any corrections or suggestions to offer, please do let me know!

There are no line breaks in the original document, but to make for easier reading, I have added them in where they seemed most fitting.

Although all the other names are given in their English forms, for some reason the name Mary is given in the French form of Marie instead.

Transcript:

In the Name of God so be it on this sixth day of the month of September in the year one thousand seven hundred and eighty two in the afternoon at the City of Vigan diocess of Alais in Languedoc I the undersigned James Laurens a Native and Inhabitant of Charles Town Capital of the State of South Carolina in North America but having been for several years in Languedoc because of my health being at present in an infirm state but of sound understanding and having the use of my Memory I find it necessary to explain my last will and testament and make the [—]

and first I recommend my Soul to God in the name of Jesus Christ and as to my body that it be buried in the most private manner and the least expensive

and as to what relates to my estate I dispose as I think I ought institute in [manner] following first it is my will that my proportion which is two fifth part of the debt in Great Britain in the partnership of Hawkins Petrie and Company be paid therewith the just and lawful Interest unless that an argument can be made with the Auditors to receive the payment in South Carolina

I give to my most dear and beloved wife Marie Laurens an annuity of five hundred pounds sterling during her natural life to be paid regularly every six months in advance in the proportions of two hundred and fifty pounds sterling to commence from the day of my decease and it is my will that all my Real and personal Estate be liable for the payment of the said annuity unless that my Testamentary Executors and Executrices should choose to give her some other security for the payment of the said annuity to the satisfaction of my said wife and in case my said wife shall remain in Europe after my decease it is my will that the said annuity be paid to her at the place of her residence [clear] of all deductions and expenses whatsoever

I give unto my said wife all the money I have at present or that I may have in the hands of Mr William Manning of London and also the sum of five hundred pounds sterling invested for my account in the Consolidated Bank of London in the name of Mr John Savage if those two sums exceed the sum of twelve hundred pounds sterling Madam Laurens shall have a right to receive the whole and she shall render an account of the overplus to the Executors but if the said two sums shall not make twelve hundred pounds sterling then it is my will that my Executors and Executrices or some of them pay the sum that shall be wanting in sterling or in that which shall be equivalent to its full value in sterling

I also give unto my said beloved wife all the plate [—] [—] my wearing apparel table [service] and furniture of every denomination whatsoever whether in France London or America

I also give unto my said wife all and [—] my Male and Female Negroes excepting the female Satira whom I declare free from all servitude whatsoever and I [recommend] it to all my Executors and Executrices to assist the said Negro Woman if she be reduced to poverty or in any other distress

I give unto my dear friend Elizabeth Petrie widow and sister of my dear wife an annuity of fifty pounds sterling payable every six months in advance during her natural life unto my friend Edmond Petrie as a token of my regard an hundred pounds sterling and to each of his Brothers namely Alexander and George fifty pounds sterling and to his sister Marie Petrie fifty pounds sterling

I give unto my dear Brother Henry Laurens as a token of my unalterable friendship and esteem the sum of five hundred pounds sterling and twenty pounds sterling to purchase a Mourning Ring as a remembrance of his Brother

I give unto my dear Niece Martha Laurens as a token of my friendship for her and as an acknowledgement for the service she has rendered to me and my family and for her good and gentle conduct upon all occasions five hundred pounds sterling

I give unto my Nephew Francis Bremar of South Carolina the sum of three hundred and twenty pounds sterling to my Nephew John Bremar two hundred and fifty pounds sterling to my Niece Martha [L—] widow two hundred and fifty pounds sterling

I give unto my dear sister in law Ann Sanders as a token of my friendship and esteem fifty pounds sterling

I give as a mark of my friendship and respect for the memory of my deceased friend Jacob Motte to each of the Children of his last Marriage two hundred pounds sterling

I give unto my worthy friend Isaac Motte as a token of my friendship fifty pounds sterling to my worthy friend Louis Gervais as a token of my friendship fifty pounds sterling

I give three hundred pounds sterling to be distributed amongst my poor relations in such proportion as my Executors and Executrices shall think proper

I give five hundred pounds sterling to be distributed among the poor of South Caroline at the discretion of my Executors and Executrices

I give unto the Protestant Church at Vigan fifty pounds sterling and in case that the Roman Catholic Church should pretend to and could possess [herself] of this Legacy It is my will that It shall become void and of none effect

And lastly I give unto my dear Nephew John Laurens to my dear Niece Martha Laurens to my dear Nephew Henry Laurens Junior and unto my dear Niece Marie Eleanor Laurens Minor and unto their Heirs for ever all my [Real] and personal Estate of what kind soever and at what place soever they be situated to be equally shared between them subject nevertheless to the payment of the annuity of five hundred pounds sterling to my wife and as my said Niece Marie Eleanor Laurens is under age her share shall remain in trust in the hands of my said Brother Henry Laurens her father and in case that my said Nephew and Niece Henry Laurens and Marie Eleanor Laurens shall happen to die in their minority it is my will that the share to them here above bequeathed shall go and be divided in equal shares between their Brothers and Sisters who shall survive each as [—] [them]

I nominate for my Executors and Executrices of this my will my Brother Henry Laurens my Wife Marie Laurens my Nephew John Laurens my Niece Martha Laurens and my Nephew Henry Laurens

such is my last will and testamentary disposition which I will that it avail in the best manner it [can] by law which [—] of the difficulty I have to explain myself in french though I understand the Language I have transcribed it in English on an [separate] sheet of paper and Mr Louis Gendre Notary Public of Vigan aforesaid wrote and translated it into French upon this sheet of paper dictated by my dear Niece Martha Laurens and in my presence and that of my dear Wife my dear Nephew Henry Laurens and my dear Niece Marie Eleanor Laurens and the said translation made the said Mr Gendre read over the contents to me distinctly and intelligibly and which I clearly understood and comprehended and I declare that it comprises my will most expressively and it is my will that it be fulfilled after my decease the same as though it had been done at Charlestown the place of my residence even though it should not have all the required formalities In testimony thereof

I have signed my name under the two foregoing pages at the [House] where I reside at Vigan aforesaid on the day and year as above I annul all other wills which I have heretofore made Note the utilization of the words and [—] fifty pounds sterling I give as a mark of my friendship as approved James Laurens

--

(Thanks to @nordleuchten for filling in some of the gaps!)

#james laurens#henry laurens#john laurens#historical john laurens#martha laurens ramsay#harry laurens#mary eleanor laurens#laurens family

28 notes

·

View notes

Text

Apply Online for Quick Loan with Instant Approval

We often run out of finance and need quick funding to fulfill our dreams and aims. The obvious solution for the same is to choose for the loan. But in the fear of rejections or due to less knowledge we often end up taking financial aid from informal sources at higher interest rates. This puts our life in debt and creates financial stress. To avoid all these things the easier solution is to opt for the loan that can help you to overcome your financially harder time.

There are many financial aid companies that are making the tough task of taking loans easy by helping the borrowers in documentations and processing of the loan. With the introduction of technology many financial aid companies have inculcated and have shifted successfully to the technology to ease the process of loans. Now you can apply online for loan online and avail of the loan without much trouble. The article below is an attempt to make the readers understand about the loan providers companies. Further it will explain to you the benefits of choosing the loan providers. At the end, the article will conclude by giving you the list of top loan providers in Delhi.

What are loan Providers companies? What are the benefits of choosing Loan Providers?

Loan providers are companies or financial institutions that offer loans to individuals, businesses, or other entities in need of financial assistance. You can apply for quick loan and fulfill your dreams. These loans can be used for various purposes, such as personal expenses, buying a house or a car, funding a business venture, or consolidating debts.

Some common types of loan providers include:

Banks

Credit Unions

Online Lenders

Peer-to-Peer Lending Platforms

Microfinance Institutions

Payday Lenders

Credit Card Companies

Finance Companies

Choosing loan providers can offer several benefits, depending on your financial needs and circumstances. Here are some of the advantages of opting for loan providers:

Access to Funds: Loan providers offer you access to the funds you need when you are facing financial constraints or have specific financial goals, such as purchasing a home or funding a business.

Flexible Repayment Options: Many loan providers offer various repayment plans, allowing you to choose a schedule that aligns with your income and financial capabilities. This flexibility can make it easier to manage your debt.

Quick Processing and Approval: These companies offer easy loan applications to the borrowers. With the advent of online lending platforms, the loan application and approval process have become quicker and more streamlined. In many cases, you can receive loan approval within a short period, providing you with swift access to funds.

Build Credit History: Responsible borrowing and timely repayments can help you build a positive credit history. A good credit score can open doors to better loan options and lower interest rates in the future.

Consolidating Debt: Loan providers may offer debt consolidation loans, allowing you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your finances and reduce overall interest costs.

Competitive Interest Rates: By shopping around and comparing different loan providers, you can find competitive interest rates that suit your budget and save you money over time.

Specialized Loan Products: Some loan providers offer specialized loan products tailored to specific needs, such as home loans, auto loans, student loans, or small business loans.

Online Accessibility: Many loan providers now offer online applications, making it convenient to apply for a loan from the comfort of your home and access customer support through digital channels.

Avoiding Depletion of Savings: Taking out a loan for planned expenses can help you preserve your savings for emergencies or unexpected financial situations.

Top Loan Providers in Delhi

Here is the list of top finance companies in Delhi with their locations. These loan companies in Delhi shall help you to get instant loan the assistance you need in financial aid matters.

My Mudra: It is a largest growing fintech having headquartered in Delhi. The company is providing financial services since decades.

Credset: It is a loan provider agency based in Karol Bagh Delhi.

Finance loan in India online

Trust: They are providing different types of loans and have been based out in Netaji Subhash Palace, Pitampura, Delhi.

KG Loan Expert Pvt. Ltd: It is a loan provider agency based in Netaji Subhash Palace in Delhi.

GRD India Financial Service: This is a financial aid provider company based out in Ashok Nagar Delhi.

Conclusion

It's essential to carefully consider the terms and conditions, interest rates, and repayment terms offered by different loan providers before committing to a loan. Borrowers should also ensure that they can comfortably meet their repayment obligations to avoid financial difficulties. My Mudra is one of the top fintech organizations which has been making loans and helping people since decades.

#Apply Online for Loans#apply for quick loan#loan instant approval#get instant loan#loan in India online#top fintech organizations

2 notes

·

View notes

Text

Get flexible and low interest rate personal loan

Get flexible and low interest rate personal loan

In today's fast-paced world, financial flexibility is often essential. Whether you want to consolidate debt, cover unexpected expenses, or fund a dream vacation, personal loans can provide the necessary financial support. This comprehensive guide will walk you through the ins and outs of personal loans, helping you make informed decisions about borrowing money. Arenafincorp is the top-notch financial company in jaipur

Understanding Personal Loans -

A personal loan in jaipur is an unsecured loan typically offered by banks, credit unions, or online lenders. Unlike secured loans, such as mortgages or auto loans, personal loans don't require collateral. Instead, they're personal loans in jaipur based on your creditworthiness, income, and financial history.

Types of Personal Loans -

1. Traditional Personal Loans:

These are the most common types of personal loans. They come with fixed interest rates and a predetermined repayment schedule. Borrowers receive a lump sum upfront and repay it in instalments over the loan term, usually ranging from 1 to 5 years.

2. Lines of Credit:

A personal line of credit provides flexibility. It works like a credit card, allowing you to borrow up to a specified limit and repay it as needed. Interest is charged only on the amount you use.

Key Factors to Consider Before applying for a personal loan in jaipur, it's crucial to consider the following factors:

1. Interest Rate:

The interest rate, often expressed as an Annual Percentage Rate (APR), determines the cost of borrowing. A lower APR means you'll pay less in interest over the life of the loan.

2. Loan Term:

The loan term affects your monthly payments. Shorter terms result in higher monthly payments but lower overall interest costs, while longer terms reduce monthly payments but increase total interest expenses.

3. Fees:

Be aware of any origination fees, prepayment penalties, or other charges associated with the loan.

4. Credit Score:

Your credit score plays a significant role in the interest rate you'll qualify for. A higher credit score can lead to better loan terms.

5. Repayment Plan:

Ensure that the monthly payment aligns with your budget and financial goals.

Applying for a Personal Loan in jaipur

1. Check Your Credit Report:

Obtain a free copy of your credit report from each of the major credit bureaus (Experian, Equifax, and TransUnion) and review it for accuracy.

2.Compare Lenders:

Shop around and compare offers from different lenders to find the best terms and rates for your needs.

3. Gather Documentation:

Lenders may require proof of income, employment, and other financial information. Prepare these documents in advance to streamline the application process.

4.Submit Your Application:

Complete the loan application with your chosen lender. Be honest and accurate with your information.

Managing Your Personal Loan

Once you've secured a personal loan in jaipur, it's essential to manage it wisely:

1. Create a Budget:

Incorporate your loan payments into your budget to ensure you can comfortably meet your obligations.

2. Automatic Payments:

Consider setting up automatic payments to avoid missing due dates and incurring late fees.

3. Avoid Additional Debt:

Resist the temptation to accumulate more debt while repaying your personal loan. This can lead to a cycle of debt.

4. Emergency Fund:

Build or maintain an emergency fund to cover unexpected expenses, reducing the need for future loans.

Conclusion

Personal loans can be valuable financial tools when used responsibly. By understanding the different types of personal loans, considering key factors, and managing your loan wisely, you can make borrowing money work for you. Always do your research and choose the loan that best aligns with your financial goals and capabilities.

2 notes

·

View notes

Text

#consolidation loans#credit card consolidation loan#credit consolidation loan#debt loans#loans to pay off debt#debt relief loans#personal loan for credit card debt#loan consolidation companies#personal loan consolidation#best debt consolidation companies#low interest debt consolidation#loan for credit card debt#credit card debt consolidation loan#apply for a debt consolidation loan#credit debt consolidation#loan to pay off credit card debt#personal loan for credit card consolidation#need a loan to pay all my debts

0 notes

Text

Personal debt for consolidation

Self Debt Relief Company is the best personal debt consolidation company for those seeking to get their debts under control. They specialize in helping people who have maxed out their credit cards, taken on too many loans, or simply cannot afford to pay all of their bills on time. By working with Self Debt Relief Company, you can consolidate all of your personal debts into one payment that you can manage easily. This will help you save money and get back on track financially.

Contact Details:

Visit: www.selfdebtrelief.com

Call: +1-888-615-0171

Mail: [email protected]

#Personal debt for consolidation#debt relief us#debt restructuring company in california#personal debt reduction company in california

0 notes

Text

Golden Age Batman

DC is well known today as a world of dark grittiness and goth, but truthfully, despite all the bad things that happen, DC is in actuality a world of Family. Found or otherwise. It is the family and friendships of the heroes that draw people in, that despite all the bad things that can, and have happened, there will always be someone to turn to. It’s a world of hope and overcoming adversaries (personally or a costumed foe).

The company was first founded in 1934 as National Allied Publications by Major Malcolm Wheeler-Nicholson, alongside Editors Whitney Ellsworth and Vin Sullivan, with the first series being New Fun: The Big Comic Magazine and is one of the oldest American comic book publishing companies. In a few years however, Printer Harry Donenfeld would cause problems for Wheeler-Nicholson by putting him in debt to Donenfeld and pushing him to form a partnership with him and accountant Jack Liebowitz to eventually make DC. The mounting debts pushed Wheeler-Nicholson to sell his share of DC and declare bankruptcy. Meanwhile Max Charles Gaines would partner with Liebowitz to create All-American Publications around 1938. Eventually in 1945 Gaines would sell his share to Liebowitz to start EC, Educational Comics. Donenfeld and Liebowitz would consolidate their companies to form National Comics Publications. The company would officially be known as DC comics in 1977.

Harry Donenfeld was in essence a conman and apparently he would go to parties and brag about knowing mob guys like Frank Castello. But he didn’t know how to balance books and manage a company, and thus Jack Liebowitz came in. They made their fortune in post racy Pulp stories, the kind of tales that many people would actually go to jail over, to get out of that though Harry would once have to talk an employee into taking the rap for him for a lifetime job. Finding the threat of jail too imposing, Harry and Jack needed to change focus and prayed upon the Major.

DC would hit it’s stride with the publication of Action Comics staring Superman, created by sons of Jewish immigrants Jerry Siegel and Joe Shuster. Detective Comics was started in March of 1937 that featured various detective characters, super or civilian, with the longest appearing character being the Caped Crusader himself, The Batman. It’s from this comic that the company DC would get its initials. And although Action Comics, home of The Superman, published weekly in comparison to Detective Comics bi-weekly would lead to it reaching the 1000th issue first, Detective Comics would become the 3rd American comic to publish a 1000 issues, 4-color comics being the first, in part due to the New 52 issues restoring its original issue count. As of August 26th of 2022, Detective Comics has reached #1063 and has spawned its own series of Annuals and Specials.

How this came together started in 1939 when Vin Sullivan was looking for a successor to follow Superman and turned to gag cartoonist Bob Kane. Batman would appear in issue #27 of Detective Comics and was created, and designed, by Bob Kane with the stories being written by Bill Finger. The issue hit shelves March 30, 1939 were we would be introduced to high-class socialite Bruce Wayne and Police Commissioner Gordon and it was a simple story of greed, of a man willing to kill his business partners for money. Funnily enough at the end of the issue the criminal would fall into a vat of acid, though he would simply die. The thing was, he fell due to Batman’s hands, deliberately, remarking “A fitting end for his kind.” Obviously this is very different from the caped crusader that we are used to.

Bob Kane took the Superman look and made various alterations to the design and drawing inspiration from Leonardo Di Vinci’s work and illustrations of the first sort of “glider,” (though Kane had it as actual wings and Finger made it into a cape) which Kane felt looked like a bat which triggered a memory of the movie The Bat Whispers based on The Circular Staircase book, which has impacted the horror genre since though Kane took it to make a sinister good guy. And with Bill Finger they took inspiration of past characters in Zoro with Douglas Fairbanks, Sr--who was Kane's idol as a kid--Pulp Fiction heroes such as The Shadow, with Finger stating that "I patterned my style of writing Batman after The Shadow" and there being many characters and plots eh adapted into the comics*, as well as Doc Savage.

Kane would hire collaborators to assist in the venture such as Bill Finger, Jerry Robinson, Dick Sprang, and Gardner Fox. Bill was one of the comic book world’s great writers and it was him that Kane credited with turning Batman from a superhero-vigilante into a more scientific detective. Gardner was one of Batman’s longest writers, writing well into the 60s.

Issue #28 would feature the first recurring villain in Doctor Death, #29 with the glass gas pellets, #31 with the batarang and the bat-gyro, which would be replaced in Batman #1 (1940) with the batplane, #1 would also feature the introduction of Catwoman and The Joker. And the mugging and murder of Thomas and Martha Wayne in Detective Comics #33. Interestingly enough, Robin would make his debut rather early in #38.

Despite being reprinted many times, Detective Comics #27 would sell for big bucks today, selling for $1.07 million in 2010 despite its initial price at the time being a simple 10 cents. Bruce Wayne and his rogues gallery, many a character that could appear in a series of their own, has appeared on every merch imaginable, you could probably live on Batman. He inspired countless people from college studies and documentary films to memes and parodies. You can even take a Batman class at RICE College, Glasgow Clyde College, and a physical course at the University of Victoria. There is no doubt that regardless of who you are or where you’re from or even if you read superhero comics, you know of The Batman.

*Voodoo Master -> Doctor Death, The Crime Ray Novel -> 1940 edition of Worlds Fair Comics, Serpents of Siva -> Detective Comics #35, Fate Joss -> Detective Comics #39, Chemically Induced Fear -> Scarecrow, Time Master -> Clock King, Grim Joker -> The Joker, The Laughing Corpse (Shadow radio show) (PS apparently a trope by this time though) -> Joker Venom, AutoGiro -> Batplane, Shadow's yellow boomerang -> Batarang, Escaping death traps, ect - Detective Comics: 80 Years of Batman: The Deluxe Edition

Shadow's creator adapted from Batman too, with a youthful sidekick. Said creator, Walter B. Gibson, would end up writing for some Batman stories.

Bob Kane: You'd think one part of the creative process for making Batman would get his own spotlight, but I think he had well enough of a spotlight in the spotlight on the Bat's creation. In any case, coming out of Highschool, having studied a mail-order art course, Kane first got his footing with the Eisner and Iger Shop in '38 and did some filler strips for DC. After meeting Bill Finger at a party and finding the shoe salesman's exceptional vocabulary impressive, invited Finger to help develop the strip Rusty and His Pals in Action Comics. This partnership was apparently satisfying to Kane as he would invite Finger to help develop Clip Carson and then with Batman. Kane was quite proud of his character as Stan Lee would note that Kane would go say, “Hey you’ve seen Batman? It was the biggest movie of the year! Where’s Spider-Man?” Kane wouldn’t stay in this world long enough to see the Friendly Neighborhood Hero hit the screens.

Bill Finger: As a child, Bill Finger developed a habit of reading after being bedridden with scarlet fever, reading stories from Frank Merriwell to The Shadow to Dickens. It was from this that Finger developed an extensive vocabulary and expressive turn of phrase that drew in Bob Kane, who he met at a party, and Kane invited Finger to help develop Rusty and His Pals for Adventure Comics. From this came another strip with the two, Clip Carson, and then when Vince Sullivan asked Kane for a new character, Kane brought on Finger to help develop the series. It was Finger that came up with any aspects of the character, such as his name. Bill Finger says he got the name ‘Bruce’ from the Scottish patriot Robert Bruce and 'Wayne’ from Anthony Wayne, as Finger wanted a last name “that would suggest colonialism”. Bill Finger’s well-read history certainly went into influencing Batman to a great degree, both as a writer for the stories and helping develop the character.

1 note

·

View note

Text

How To Get Yourself A Debt Consolidation Loan With Poor Credit

Check your local listings, you may also have a title loan lender within your town and this is take much less time for the loan transaction, allowing you to obtain the money much more. Use the same precautions at the store as you'll on-line.

Another choices a loan renewal. Obtain a the accrued interest by the loan, and possibly a new loan is put together. The original (principal) amount with the loan along with the interest rate stay the same, but the due date of the loan is reset to element of.

No matter you do with the consolidation, it is the answer that your student loan debt could become too larger. With only a long time to repay, could upward with fairly high payment, especially your current products go to graduate school or even add more years to student work. Stop payments can actually put a cramp in your financial position. There is an answer, nevertheless. If loans and payments are so unbearable, absolutely always understanding. You can go ahead and take loan and stretch over years in the majority of cases.

If you have a home, getting an unsecured $10,000 bad credit loan is even more possible. Place your house up as collateral and negotiate the particular lender for your best possible interest rate. This is possible even if your credit rating is not the best it could be.

If you are bring yourself to ask an acquaintance or in comparison for a $10,000 loan, your next best bet is to approach your employer. Or, there will be a credit union that serves your insurer. Usually there is no credit rating and little documentation is needed prove who you really are. Also, loans can be deducted completely your pay check. This may be your the second best route to finding a $10,000 bad credit loan.

While bank plastic are an economic life-sucking product, they have one good advantage. You can do pay beyond what the minimum payment possessing penalised momentarily. For example, if you incurred $20,000 owing and paid $18,000, that can no penalty for this important. Personal loans are not always this cut and harden. There are two different models of personal loans to consider; fixed interest and variable interest.

대출 carry varying from 30 to 100 percent interest rate. According to CNN, some advisors companies charge as high as 250 percent interest on a title loan for the auto you already own. Exercise caution and visit agreement in the entirety, positive you completely understand the terms of this type of loan.

There are two types of PLUS loans: a Parent PLUS loan and an immediate Graduate PLUS loan. Parents PLUS can only be offered towards the parents of undergrad university. A student cannot receive this loan by himself. The Direct Graduate PLUS loan is available to graduate students trying to attain an advanced degree. However, this is actually offered to the students immediately.

1 note

·

View note

Text

Toronto Debt Consolidation Solutions: Finding the Right Fit for You

Debt Free Credit Solution, a leading financial services company, is thrilled to introduce comprehensive debt consolidation Toronto solutions tailored for residents. Specializing in debt management and financial empowerment, the company aims to alleviate financial burdens and promote a debt-free future for individuals in the Greater Toronto Area.

Addressing the Pressing Need for Debt Consolidation in Toronto

In today's economic landscape, many Torontonians face the challenge of managing multiple debts, including credit card balances, personal loans, and overdue bills. Debt Free Credit Solution recognizes this growing concern and steps in to provide effective debt consolidation strategies.

Key Benefits of Debt Consolidation Toronto Services

Debt Free Credit Solution's innovative approach to debt consolidation offers the following major benefits:

1. Streamlined Payments: Consolidating debts into a single manageable payment simplifies financial management and reduces the risk of missed payments.

2. Lower Interest Rates: By consolidating debts, individuals can often secure lower interest rates, reducing the overall cost of debt.

3. Improved Credit Score: Timely debt consolidation can positively impact credit scores by resolving outstanding debts efficiently.

4. Personalized Financial Plans: Debt Free Credit Solution crafts personalized debt management plans tailored to each client's unique financial situation.

5. Expert Financial Guidance: Clients benefit from the expertise of financial professionals who provide guidance on budgeting and debt repayment strategies.

Empowering Toronto Residents Towards Financial Freedom

Debt Free Credit Solution is committed to empowering Toronto residents to regain control of their finances and achieve long-term financial stability. The company's debt consolidation services serve as a beacon of hope for individuals seeking a pathway to debt-free living.

0 notes

Text

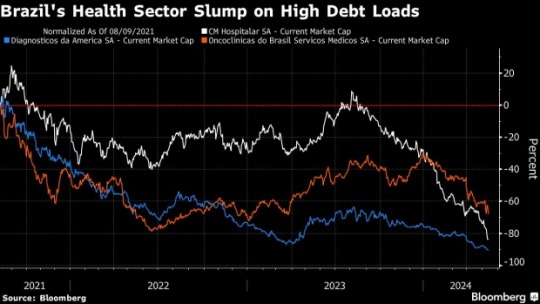

Brazil Health-Care Firms Push to Reduce Debt as Shares Sink

Brazilian health-care companies are taking steps to lower their debt burdens after a wave of ferocious dealmaking, combined with increasing operating costs and higher interest rates left their finances vulnerable.

Diagnosticos da America SA, the country’s largest medical diagnostics company, is considering options to raise cash that include a combination of asset sales, new partners, a capital injection from its controlling holder and re-negotiating obligations, a person familiar with the matter said. Elfa Medicamentos, a drug retailer backed by Patria Investimentos Ltd., is looking to sell non-core assets to cut leverage, according to another person.

Health-care firms took advantage of historically low rates during the pandemic to fund mergers and acquisitions. But now higher costs, including for debt servicing — many raised floating-rate debt — are pushing firms to consolidate or renegotiate obligations. A tougher approach from insurers is also adding pressure.

“We’re seeing the Brazil effect pressure cash flows — higher rates are really bruising these companies,” said Tatiana Thomaz, a director at Fitch Ratings. “There is resilient demand for the sector, but there are short-term challenges in the horizon.”

Continue reading.

#brazil#brazilian politics#politics#economy#healthcare#image description in alt#mod nise da silveira

1 note

·

View note