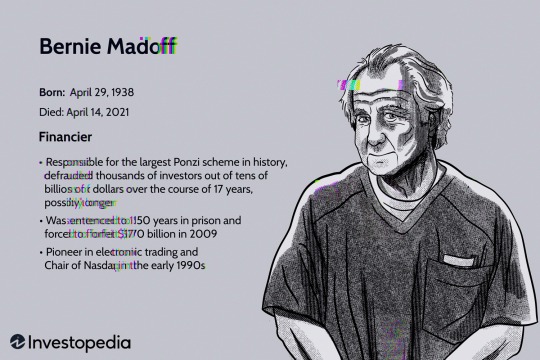

#Bernie Madoff

Text

Had to redo it ;-/

10 notes

·

View notes

Text

youtube

PEGA NA MENTIRA! CINCO FILMES QUE MOSTRAM QUE A MENTIRA TEM PERNA CURTA PRA VER NO STREAMING!

#april fool's day#dia da mentira#emma stone#easy a#helen mirren#jim carrey#liar liar#liar#lies#lie#mentiras#mentira#die flascher#the wizard of lies#robert de niro#bernie madoff#the good liar#ian mckellen#Youtube

2 notes

·

View notes

Photo

The Wizard Of Lies (2017)

#2017#film#movie#The Wizard Of Lies#Robert De Niro#Bernie Madoff#Michelle Pfeiffer#Ruth Madoff#Alessandro Nivola#Mark Madoff#Nathan Darrow#Andrew Madoff#Wall Street#New York#New York City#NYC#Ponzi scheme

4 notes

·

View notes

Text

youtube

Bernie Madoff scammed Wall Street for decades

But when his victims needed to take out more than their usual things began to unravel. Watch as his secret history unfolds.

6 notes

·

View notes

Text

Fave part of the Bernie Madoff doc is the b roll footage of Guy That Looks Kinda Like Bernie Madoff Standing Ominously

6 notes

·

View notes

Text

277 - Bernie Madoff

#crime culture#crime#culture#podcast#true crime#true crime podcast#tcc#pop culture#episode 277#bernie madoff#money#financial crime#ponzi scheme#stock market#listeners#listen to this

4 notes

·

View notes

Video

youtube

A recent Netflix documentary series called Madoff: The Monster of Wall Street by Emmy Award–winning filmmaker Joe Berlinger tells the story of the largest Ponzi scheme in history.

Besides the infamous character mentioned in its title, the series' other villain is the Securities and Exchange Commission (SEC), which received complaints about Bernie Madoff starting in the early 1990s, and yet, it not only failed to catch him but helped enable his fraud. During one investigation, all SEC investigators had to do was check an account number to verify trades had actually occurred, which they hadn't, of course, because all of Madoff's trades were fake.

The Netflix series acknowledges that the SEC was complicit in Madoff's scam and that he could have been caught if one investigator assigned to the case had done about 30 minutes of checking. But then it also blames deregulation and free market capitalism for making the fraud possible.

"Resources that had been in New York City, on Wall Street's doorstep, devoted to white-collar crime, to fraud, were being steered away [from Wall Street]," says Henriques of the George W. Bush administration era during which Madoff's operation reached its peak. "For the SEC, this was an exacerbation of an existing problem, as a result of a deregulatory campaign that began with the election of Ronald Reagan in 1980."

Instead of making lazy allusions to the evils of free market capitalism, to better understand the lessons of the Madoff saga, director Joe Berlinger should have consulted the work of the free market economist George Stigler, who won the Nobel Prize in part for his work on "regulatory capture."

In a 1971 paper, "The Theory of Economic Regulation," Stigler argues that while many people believe that "regulation is instituted primarily for the protection and benefit of the public," in fact, it mainly serves the purposes of the largest companies being regulated, which form a symbiotic relationship with their regulatory overseers.

"My thesis is that the industry body in the long run must act by and for the industry," said Stigler in a 1971 speech before the American Enterprise Institute. "The political realities of life dictate that the regulatory bodies become affiliated with and help in what it believes to be the necessary conditions for the survival of its industry."

Stigler's essay focuses mainly on how regulators help existing companies by protecting them from competition, but his theory can also be used to better understand the SEC's failure to catch Madoff. In a 1972 essay, Stigler writes that "the regulating agency must eventually become the agency of the regulated industry…. each needs the other." That's because the career lawyers at the SEC making the decisions have much more to gain personally from having a positive relationship with big industry players than antagonizing them.

What if Harry Markopolos' warnings hadn't been filtered through the SEC? The average person might be better equipped to spot a con man than we give him credit for. But the myth that regulators are primarily motivated to protect the interests of the public causes many to suspend their better judgment.

"The individual consumer, if he is not hampered, is in general capable of a large measure of self-defense against fraud, mishaps, bad luck, and the like," said Stigler in his 1971 speech. "Not all consumers are intellectually competent and well-informed, but most consumers know how to build up defenses against the many vicissitudes that lie in real life. And it is primarily because we have socially so often hampered these effects that we have injured the consumer."

The big takeaway from Madoff: The Monster of Wall Street is that regulators unwittingly facilitated his fraud, just as they may have done with Sam Bankman-Fried and his alleged con. As you watch the Netflix series, think about whether we should really be giving these regulators more time or power. Are they helping us or themselves?

3 notes

·

View notes

Text

The only people who can deceive you completely are people you trust completely. And the price of trusting anyone is that they can betray you like that.

2 notes

·

View notes

Text

Bernie rookie card 2023 editon

monsters series by technodrome1

1 note

·

View note

Text

MADOFF: The Monster of Wall Street

It was such a good documentary. Not too long, not too short.

I would have liked to understand better the fraudulent operation behind that scheme.

Honestly, people are as guilty as Bernie Madoff, they are just so so greedy. How can someone even believe to have 100% return without any loses.

And the institutions are as guilty as him too.

I really felt sorry for the mathematician, Markopolos who knew that Madoff was a fraud and did everything to show it, but no one believed him, until it was too late.

Some people are just too stupid.

Worst JP Morgan Chase "acknowledged a lack of oversight in monitoring Bernie Madoff's bank transactions, but the company claimed that no employee knowingly assisted in the fraud."

Some quotes :

"- And the choice he made was, he could live with himself as a liar much more easily than he could live with himself as a failure." (Episode 1)

"- He's both Bernie's savior, if you will, and Bernie's deep, enraging enemy, because Bernie, as the ultimate control freak, has allowed somebody to basically control him." (Episode 2)

"- For what Madoff needed to reassure his investors. Even before Madoff himself knew what he needed." (Episode 2)

"- A white-collar crime is different than a blue-collar crime. A blue-collar crime, the bodies drop before you investigate. And a white-collar crime, they drop afterwards." (Episode 4)

"- He chose, the methodology of death that he did, a painful solution, to atone for his sins of omission." (Episode 4)

"- Why would anybody trust me to give me business? Turn their money over to me? But the first thing I learned: Whatever you do in this business, never break your word. Your word was your bond, literally, and that was it. You trusted everybody. But nothing in this industry is what it looks like." (Episode 4)

"- People knew not to ask too many questions. If you're getting good returns and you're getting lots of money, and you're not to as any questions, you don't ask any questions. And, you know, greed has a way of doing that to people." (Kotz - Episode 4)

"- JP Morgan Chase has pled guilty to five massive criminal conspiracies involving billions of dollars within the last six years. When they get caught, they're never required to disclose the profits they made on the scheme. They just pay a fine and they go on." (Episode 4)

"- You know, my dad's crime... it killed my brother quickly and it's killing me slowly." (Mark Madoff - Episode 4)

"- Noted psychiatrists that I talked with about Madoff's case hypothesized that what Bernie was grieving was the loss of his family's adoration. It was not so much that he loved them as that he loved having them love him. Which is, of course, pure narcissism and pure sociopath." (Episode 4)

"- And the price of trusting anyone is that they can betray you liked that." (Episode 4)

"- People want to believe in good returns without downside risk. Everybody wants that in their portfolio, but they're chasing the Holy Grail. The Holy Grail doesn't exist in real life, nor does it exist in finance." (Markopolos - Episode 4)

#madoff#bernie madoff#the monster of wall street#madoff the monster of wall street#documentary#netflix

0 notes

Text

Fundador de FTX, Sam Bankman-Fried, encontrado culpable de fraude financiero masivo

El fundador de FTX, Sam Bankman-Fried, fue declarado culpable el jueves de defraudar a los clientes de su ahora en bancarrota casa de cambio de criptomonedas en uno de los fraudes financieros más grandes registrados, un veredicto que cementó la caída del exbillonario de 31 años de gracia.

Un jurado de 12 miembros en la corte federal de Manhattan lo condenó por los siete cargos que enfrentaba…

View On WordPress

#8 mil millones de dólares#Abogados#acusación#Alameda Research#apelación#bancarrota#Bernie Madoff#caída en desgracia#campañas políticas#casa de cambio de criptomonedas#codicia#colapso corporativo#comerciante de información privilegiada#condenas#conspiraciones de fraude bancario#corrupcion#corte federal de Manhattan#culpable#Damian Williams#Departamento de Justicia de EE. UU.#El lobo de Wall Street#equipo de gestión de riesgos#estafa a clientes#estafador Ponzi#fiscal federal#fondos de clientes#fortuna personal#fraude financiero#fundador de FTX#inversiones especulativas

0 notes

Text

Another podcast coming out tonight

2 notes

·

View notes

Text

youtube

Bernie Madoff: The $65 Billion Ponzi Scheme

1 note

·

View note

Link

In case you missed it...

0 notes

Text

youtube

#bernie madoff#the 65 million Ponzi scheme#the ponzi scheme that rocked wall stteet#the casual criminalist#Youtube

0 notes

Text

The greatest scams in the US Stock Market

In the United States stock market, there are some spectacular scams that have been perpetrated over the years. From Ponzi schemes to insider trading, these scams have cost investors billions of dollars and created an atmosphere of mistrust in the stock market. Here we will look at some of the greatest scams in US stock market history and how they were perpetrated.

Bernie Madoff Scandal

The most…

View On WordPress

#Bernie Madoff#fraud#fraudster#pump and dump#scam#scamster#us equity#us market#US stock market#us stocks

0 notes