Text

📞 WhatsApp: +918860632015

📧 Email: [email protected]

Get motivated and supercharge your business with AccTeez solutions! 🚀🌐 We've got the answers to make your business thrive. Let's achieve success together! 💼🌟

#AccTeez#AccTeezindia#Gst#ITR#Business#small business#trademark#fssai#food license#faridabad#haryana#delhi#stressfree#startup#entrepreneur

0 notes

Text

📞 WhatsApp:- +918860632015

📧 Email: [email protected]

Happy New Year 2024 from AccTeez! Wishing you joy, success, and prosperity. Thank you for choosing us as your trusted tax consultants. Cheers to a prosperous year ahead! 🎉🥳

#AccTeez#AccTeezindia#newyear#love#2024#happynewyear#accounting#business#accountant#finance#tax#smallbusiness

0 notes

Text

📞 WhatsApp:- +918860632015

📧 Email: [email protected]

Contact us now for expert assistance!

Craving success in the food industry? 🍽️✨ Accteez is your go-to for hassle-free food licensing.

0 notes

Text

📞 WhatsApp:- +918860632015

📧 Email: [email protected]

Launch your Cloud Kitchen effortlessly with Accteez by your side! 🌐✨ Ready to start? Contact us now

#accteez#accteezindia#CloudKitchen#AccteezGuidance#food#foodie#fooddelivery#homecooking#homecooked#sharedkitchen

0 notes

Text

Contact for assistance:

📞 WhatsApp: https://wa.me/+918860632015

📧 Email: [email protected]

Link Aadhaar Card with PAN (Complete Process):

⚫Visit https://www.incometaxindiaefiling.gov.in/.

⚫Log in or register.

⚫Find Aadhaar linking option.

⚫Enter PAN, Aadhaar, details.

⚫Verify via OTP on mobile.

SMS Method:

SMS UIDPAN <12-digit Aadhaar> <10-digit PAN> to 567678 or 56161.

Note: Ensure name, DOB, gender match on both cards. For assistance, contact the provided details.

0 notes

Text

Wishing you a Merry Christmas from Accteez! 🎄✨ Trust us to unwrap the gift of seamless accounting services for your business success. Cheers to a prosperous New Year! 🎁📊

📞 Call +91-8860632015 or 📧 Email [email protected]

#MerryChristmas#AccteezSuccess#AccountingMagic#accounting#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur

0 notes

Text

Oops, missed filing of your Income Tax Return (ITR) on time? No worries! 🔄You can still fix it. The last day to submit late returns is 🗓️December 31, 2023.

Hurry up Call AccTeez @8860632015, or Email - [email protected] and get it done.

💼💸To stay on track with your finances Follow Us!

#accteez#accteezindia#incometax#business#startup#2023#lastdate#money#growth#accountant#charteredaccountant

0 notes

Text

Accteez offers more than licenses – we provide peace of mind! Expert services at your fingertips.

Call 8860632015 or email [email protected] to get started.

Your journey to success begins here! #AccteezJourney #BusinessPeace

0 notes

Text

Oops, missed filing of your Income Tax Return (ITR) on time? No worries! 🔄You can still fix it. The last day to submit late returns is 🗓️December 31, 2023.

Hurry up Call AccTeez @8860632015, or Email - [email protected] and get it done.

💼💸To stay on track with your finances Follow Us!

0 notes

Text

🚨 Attention Taxpayers! ⚠️ Urgent Alert from Income Tax Department: Your ITR for A.Y. 2023-24 is pending. Take action now on the Compliance Portal to avoid any consequences.

📞 Call +91-8860632015 or 📧 Email [email protected]

0 notes

Text

Achieve your business goals with Accteez! 🚀 Curious about GST or tax strategies? Connect with our experts 👇

📞 Call +91-8860632015 📧 Email [email protected]

0 notes

Text

Did you know? Section 17(5) imposes limitations on utilizing specific GST inputs for settling GST obligations. An example of such non-eligible expenses includes membership fees incurred at clubs, health centers, or fitness facilities subject to GST charges, which cannot be claimed for GST benefits.

However, here's a valuable tip: Membership fees paid by employees to trade associations qualify as business expenses and can be utilized as GST inputs for your business. @accteezindia follow us for more such valuable tips! For GST and other tax-related queries, feel free to call or WhatsApp us +91-8860632015. Enhance your understanding of GST for maximum financial benefits! 📚💰

#accteez#accteezindia#gst#gstupdates#gstindia#gstr#gstregistration#gstcouncil#gstreturns#incometaxindia#tax#taxes#finance#accounting#accountant#club#hotel#health#fitness#tradeassociation#insta#reels#delhi#trendingreels#tips#business#startup#india

1 note

·

View note

Text

⏰ Don't miss out! The clock is ticking! Secure your financial future by filing your Income Tax Return before the deadline. Trust AccTeez for a smooth and timely filing experience. Act now, the last date is 31-12-2023! 📊💼

📞 Call +91-8860632015 📧 Email [email protected]

#incometax#tax#taxes#taxseason#accounting#finance#accountant#taxpreparer#taxrefund#taxreturn#incometaxreturn#entrepreneur#money#bookkeeping#incometaxindia#taxtips#irs#taxplanning#taxation#incometaxseason#business#businessowner#smallbusiness#startup#india

1 note

·

View note

Text

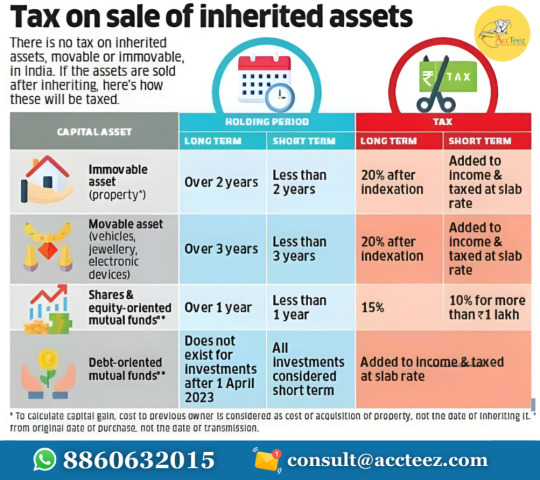

Understanding Tax on the Sale of Inherited Assets: AccTeez simplifies the complexities. Explore our expert guidance on navigating tax implications when selling inherited assets. Trust us to provide clarity and strategic solutions for seamless financial planning.

📞 Call +91-8860632015 📧 Email [email protected]

#accteez#accteezindia#taxplanning#inheritedassets#accteezadvisory#incometax#tax#taxes#taxseason#gst#accounting#finance#accountant#taxpreparer#taxrefund#taxreturn#incometaxreturn#money#bookkeeping#incometaxindia#taxtips#taxpreparation#irs#incometaxseason#taxconsultant#ca#payroll#entrepreneur#business#smallbusiness

1 note

·

View note

Text

Mastering GST: Your Daily Dose of Expertise! 🚀💡 AccTeez brings you invaluable strategies for seamless GST management in today's tip. Empower your financial journey.

📞 Call +91-8860632015 📧 Email [email protected]

#accteez#accteezindia#taxupdates#gst#incometax#tax#business#accounting#gstupdates#gstindia#ca#gstr#charteredaccountant#finance#accountant#taxes#gstregistration#gstreturns#taxation#startup#incometaxindia#incometaxreturn#itr#gstcouncil#commerce#smallbusiness#faridabad#delhi#noida#gurgaon

1 note

·

View note

Text

Celebrating the divine teachings and universal wisdom of Guru Nanak Dev Ji on the auspicious occasion of Guru Nanak Jayanti. May the light of his teachings guide us towards compassion, equality, and harmony. Happy Guru Nanak Jayanti to all! 🙏✨

📞 Call +91-8860632015 📧 Email [email protected]

#accteez#accteezindia#gurunanakjayanti#punjabi#punjab#singh#waheguru#goldentemple#waheguruji#gurugranthsahibji#gurudwara#gurunanakdevji#sikhi#khalsa#incometaxreturn#itr#gst#finance#tax#accounting#fssai#iec#msme#trademark#iso#esic#pf#commerce#business#startup

1 note

·

View note

Text

Mastering GST: Your Daily Dose of Expertise! 🚀💡 AccTeez brings you invaluable strategies for seamless GST management in today's tip. Empower your financial journey.

📞 Call +91-8860632015 📧 Email [email protected]

#accteez#accteezindia#taxupdates#gst#incometax#tax#business#gstupdates#gstindia#ca#gstr#finance#accountant#taxes#gstreturns#taxation#startup#incometaxindia#incometaxreturn#itr#gstcouncil#commerce#smallbusiness#noida#india

0 notes