#penny stocks 2022

Text

Penny Stocks Risk and Rewards Analysis

#penny stocks#penny stocks to buy now#best penny stocks#how to trade penny stocks#penny stock#best penny stocks to buy now#penny stocks for beginners#penny stocks to buy#stock market#penny stock trading#trading penny stocks#stocks to buy#what are penny stocks#top penny stocks#penny stocks 2023#penny stocks 2022#stocks#stock analysis#stocks to buy now#fundamental analysis of penny stocks#how to buy penny stocks#best penny stocks 2022

0 notes

Text

इस कंपनी के शेयर ने 1 लाख को बना दिया 13 लाख, सिर्फ 6 महीने में दिया 866 फीसदी रिटर्न

इस कंपनी के शेयर ने 1 लाख को बना दिया 13 लाख, सिर्फ 6 महीने में दिया 866 फीसदी रिटर्न

Multibagger Stock 2022: शेयर बाजार में कई कंपनियों के स्टॉक्स ने निवेशकों को मालामाल किया है. आज हम आपको एक ऐसे पेनी स्टॉक के बारे में बताएंगे, जिसने निवेशकों को एक साल में 747.92 फीसदी का रिटर्न दिया है. बता दें शेयर बाजार से निवेशक इस समय बंपर कमाई कर रहे हैं. कोरोना काल में कई कंपनियों ने निवेशकों को शानदार रिटर्न दिया है.

सेंसेक्स-निफ्टी 9 फीसदी फिसले

हेमंग रिसोर्सेज (Hemang Resources Share…

View On WordPress

#business news in hindi#Hemang Resources Share Price#Hemang Resources Share shares#multibagger penny stocks#Multibagger stocks#multibagger stocks for 2022#multibagger stocks for 2023#multibagger stocks for 2025#multibagger stocks for next 10 years#multibagger stocks in india#multibagger stocks list#multibagger stocks list for 2022#बिजनेस न्यूज इन हिंदी#मल्टीबैगर शेयर 2022#मल्टीबैगर स्टॉक#मल्टीबैगर स्टॉक 2023#मल्टीबैगर स्टॉक 2025#मल्टीबैगर स्टॉक प्राइस

0 notes

Text

इस कंपनी के शेयर ने 1 लाख को बना दिया 13 लाख, सिर्फ 6 महीने में दिया 866 फीसदी रिटर्न

इस कंपनी के शेयर ने 1 लाख को बना दिया 13 लाख, सिर्फ 6 महीने में दिया 866 फीसदी रिटर्न

Multibagger Stock 2022: शेयर बाजार में कई कंपनियों के स्टॉक्स ने निवेशकों को मालामाल किया है. आज हम आपको एक ऐसे पेनी स्टॉक के बारे में बताएंगे, जिसने निवेशकों को एक साल में 747.92 फीसदी का रिटर्न दिया है. बता दें शेयर बाजार से निवेशक इस समय बंपर कमाई कर रहे हैं. कोरोना काल में कई कंपनियों ने निवेशकों को शानदार रिटर्न दिया है.

सेंसेक्स-निफ्टी 9 फीसदी फिसले

हेमंग रिसोर्सेज (Hemang Resources Share…

View On WordPress

#business news in hindi#Hemang Resources Share Price#Hemang Resources Share shares#multibagger penny stocks#Multibagger stocks#multibagger stocks for 2022#multibagger stocks for 2023#multibagger stocks for 2025#multibagger stocks for next 10 years#multibagger stocks in india#multibagger stocks list#multibagger stocks list for 2022#बिजनेस न्यूज इन हिंदी#मल्टीबैगर शेयर 2022#मल्टीबैगर स्टॉक#मल्टीबैगर स्टॉक 2023#मल्टीबैगर स्टॉक 2025#मल्टीबैगर स्टॉक प्राइस

0 notes

Text

इस कंपनी के शेयर ने 1 लाख को बना दिया 13 लाख, सिर्फ 6 महीने में दिया 866 फीसदी रिटर्न

इस कंपनी के शेयर ने 1 लाख को बना दिया 13 लाख, सिर्फ 6 महीने में दिया 866 फीसदी रिटर्न

Multibagger Stock 2022: शेयर बाजार में कई कंपनियों के स्टॉक्स ने निवेशकों को मालामाल किया है. आज हम आपको एक ऐसे पेनी स्टॉक के बारे में बताएंगे, जिसने निवेशकों को एक साल में 747.92 फीसदी का रिटर्न दिया है. बता दें शेयर बाजार से निवेशक इस समय बंपर कमाई कर रहे हैं. कोरोना काल में कई कंपनियों ने निवेशकों को शानदार रिटर्न दिया है.

सेंसेक्स-निफ्टी 9 फीसदी फिसले

हेमंग रिसोर्सेज (Hemang Resources Share…

View On WordPress

#business news in hindi#Hemang Resources Share Price#Hemang Resources Share shares#multibagger penny stocks#Multibagger stocks#multibagger stocks for 2022#multibagger stocks for 2023#multibagger stocks for 2025#multibagger stocks for next 10 years#multibagger stocks in india#multibagger stocks list#multibagger stocks list for 2022#बिजनेस न्यूज इन हिंदी#मल्टीबैगर शेयर 2022#मल्टीबैगर स्टॉक#मल्टीबैगर स्टॉक 2023#मल्टीबैगर स्टॉक 2025#मल्टीबैगर स्टॉक प्राइस

0 notes

Text

Top EV Stocks in India... (not Tata Motors)

Top EV Stocks in India… (not Tata Motors)

Get out of all petrol two-wheeler stocks… they are heading for a disruption… and they are not ready for that at all. What they have on offer is half the range of its competition yet priced 40% more than its competition.

Share Price movement over last 5 yrs of Olectra Greentech, JBM Auto, Tata Motors & Ashok Leyland

Well the game just got started… there is going to be more… like Oppo, Vivo,…

View On WordPress

#Best eBus company in India#best ebus maker in India#best green energy stocks#best green energy stocks 2022#best renewable energy stocks#best solar energy stocks in india#best stock for ev revolution#clean energy stocks#ev battery stocks#ev car share#ev manufacturing companies#ev space stocks#ev stocks india#ev stocks list#green energy penny stocks#green energy stocks#green energy stocks in india#green energy stocks to buy in#renewable energy penny stocks#renewable energy stocks#renewable energy stocks in india#solar energy penny stocks#solar energy stock in india#solar energy stocks#stocks to benefit from ev#top EV company in India#top green energy stocks

0 notes

Text

5 पेनी स्टॉक जो निवेशकों को कर रहे मालामाल, क्या आपके पास है?

5 पेनी स्टॉक जो निवेशकों को कर रहे मालामाल, क्या आपके पास है?

कैसर कॉर्पोरेशन (Kaiser Corporation) : कैसर कॉर्पोरेशन के स्टॉक में साल 2022 में अब तक 2834 फीसदी की बढ़ोतरी हो चुकी है. 31 दिसंबर 2021 को इसके एक शेयर की कीमत 2.79 रुपए थी, जो आज बढ़कर 85.70 रुपए हो गई है. एक साल में इस शेयर में 23,062 फीसदी का उछाल आया है. 30 जून को इस शेयर की कीमत 0.35 पैसे था.

Source link

View On WordPress

#Alliance Integrated Metallic#Gallop Enterprises#Gallop Enterprises share#Hemang Resources#Kaiser Corporation Share price#Mid India Industries#Multibagger stock#Multibagger Stock 2022#penny stock#stock market

0 notes

Text

By Jake Johnson

Common Dreams

Jan. 6, 2024

"Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies," said Sen. Sheldon Whitehouse.

Legislation introduced Tuesday by a pair of Democratic lawmakers would close a loophole that lets billionaires donate assets to dark money organizations without paying any taxes.

The U.S. tax code allows write-offs when appreciated assets such as shares of stock are donated to a charity, but the tax break doesn't apply when the assets are given to political groups.

However, donations to 501(c)(4) organizations—which are allowed to engage in some political activity as long as it's not their primary purpose—are exempt from capital gains taxes, a loophole that Sen. Sheldon Whitehouse (D-R.I.) and Rep. Judy Chu (D-Calif.) are looking to shutter with their End Tax Breaks for Dark Money Act.

Whitehouse, a member of the Senate Judiciary Committee who has focused extensively on the corrupting effects of dark money, said the need for the bill was made clear by what ProPublica and The Lever described as "the largest known donation to a political advocacy group in U.S. history."

The investigative outlets reported in 2022 that billionaire manufacturing magnate Barre Seid donated his 100% ownership stake in Tripp Lite, a maker of electrical equipment, to Marble Freedom Trust, a group controlled by Federalist Society co-chairman Leonard Leo.

The donation, completed in 2021, was worth $1.6 billion. According to ProPublica and The Lever, the structure of the gift allowed Seid to avoid up to $400 million in taxes.

"It's a clear sign of a broken tax code when a single donor can transfer assets worth $1.6 billion to a dark money political group without paying a penny in taxes," Whitehouse said in a statement Tuesday. "Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies."

"We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

If passed, the End Tax Breaks for Dark Money Act would ensure that donations of appreciated assets to 501(c)(4) organizations are subjected to the same rules as gifts to political action committees (PACs) and parties.

"Thanks to the far-right Supreme Court, billionaires already have outsized influence to decide our nation's politics; through a loophole in the tax code, they can even secure massive public subsidies for lobbying and campaigning when they secretly donate their wealth to certain nonprofits instead of traditional political organizations," said Chu. "We can decrease the impact the wealthy have on our politics by applying capital gains taxes to donations of appreciated property to nonprofits that engage in lobbying and political activity—the same way they are already treated when made to traditional political organizations like PACs."

The new bill comes amid an election season that is already flooded with outside spending.

The watchdog OpenSecrets reported last month that super PACs and other groups "have already poured nearly $318 million into spending on presidential and congressional races as of January 14—more than six times as much as had been spent at this point in 2020."

Thanks to the Supreme Court's 2010 Citizens United ruling, super PACs can raise and spend unlimited sums on federal elections—often without being fully transparent about their donors.

Morris Pearl, chairman of the Patriotic Millionaires, said Tuesday that "there is no justifiable reason why wealthy people like me should be allowed to dominate our political system by donating an entire $1.6 billion company to a dark money political group."

"But perhaps more egregious is the $400 million tax break that comes from doing so," said Pearl. "It's a perfect example of how this provision in the tax code is used by the ultrawealthy to manipulate the levers of government while simultaneously dodging their obligation to pay taxes. We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

117 notes

·

View notes

Text

♱ WEAK FOR YOUR LOVE ♱

a/n: i couldn't NOT write for my husband mickey. i haven't churned out a fic this fast in a long time and i'm actually really happy with how it turned out. i hope y'all enjoy it!

day four - cumplay | kinktober 2022

summary: mickey always prided himself on self-control. as a naval wso it was mandatory, but you in a sundress proved to be his weakness.

word count: 2k+

pairing: mickey "fanboy" garcia x f!reader

warnings: MINORS DNI, cussing, teasing, slight exhibitionism, handjob, cumplay.

He nearly fell over his own feet walking into the Hard Deck tonight. Not because he was clumsy. Well…not usually. No, he’d almost fallen due to one thing and one thing only—you sitting prettily on a barstool wearing a new sundress he had no idea you even purchased.

Payback had bumped his shoulder playfully, asking if he was still unsteady from pulling G’s. Even though he knew the real reason why Mickey was standing stock-still a few feet away from the bar. You were there. Staring at your boyfriend with the same lovestruck expression on his face. Payback had never seen two people more in love; so he backed away. Heading towards the group and leaving Mickey to deal with his still reeling mind.

“You’re early tonight,” Mickey said, finally managing to get his feet to move.

A giggle left your glossy lips. He’d never wanted to lick into your mouth so brazenly before, never wanted to kiss you until you were a panting mess against him, until this moment. Rather than embarrass himself even further in front of his friends, he gestured to Penny, asking for a beer. Something to cool down the searing heat that spread up his spine at just the sight of you sitting there, smiling at him.

“I figured you wouldn’t mind the surprise.”

He chugged a few large gulps of beer in the hopes that it would fix his parched throat. It didn’t.

“I never mind it when you surprise me.”

You sipped at your drink, leaving a small mark of pink gloss on the glass and Mickey’s breath caught in his throat. He hadn’t even gotten a proper look at you in the sundress for fear of dragging you out of the bar right then and there. If there’s one thing he prided himself on, it was his self control. He worked hard on learning to keep it level while he trained as WSO, yet one look at his girl and he was ready to snap within seconds.

“Mickey?” He shivered at the tone of your voice—the same one you used when he was between your thighs, lapping at your pussy like it was the best damn meal he could ever have. “Why won’t you look at me baby?”

He counted in his head to ten, trying to force the blazing arousal down. But then he turned and you batted your lashes at him, a knowing smile playing on your lips. Your sundress had now ridden up your thighs, showing the expanse of your leg down to the heels you wore on your feet. That sight alone had Mickey thanking every god in existence for letting him find you. His eyes trailed back up your body, stopping momentarily at the way the top of your breasts were showing, until he reached your face.

Lust sparked in your eyes, your teeth digging into your bottom lip, and he could physically hear the snap of his self control sever. The beer was forgotten on the bar beside your half finished drink. He’d make sure to pay Penny tomorrow. For now he had something more important to deal with.

Grasping your wrist tightly he yanked you up to your feet, giving you a second to find your balance before he began dragging you towards the door. Payback’s whistle echoed behind him—the teasing sounds of the team letting him know he’d hear their comments tomorrow. But Mickey really couldn’t find it in himself to give a shit. Not when you were moving just as fast as he was and the smell of your perfume was wafting up his nose with each shift of your body.

He was surprised he even made it to his car. Making sure you got in first before rushing to the drivers side and practically jumping in.

“I never even finished my drink mi alma,” you laughed. Wearing this dress was the obvious choice after enduring days without your boyfriend and seeing him struggle to hold himself back from touching you only made it better.

The car started with ease, his hands gripping the wheel tightly so as not to touch you, but he made the second mistake of the night. Turning his head to glance at you. Somewhere between him speeding out of the parking lot and getting onto the street, you pulled up the skirt of your dress until the very tops of your thighs were showing. He could see the crease where your hip connected to your leg and his mouth dried even further.

He wanted to bite that crease, suck on the skin to make sure you felt the indent of his teeth the next day.

“What are you doing?” he asked, his voice deeper than before.

You merely smiled, leaning your head back against the chair and playing with the thin strap that slid halfway down your arm.

“Mi vida.” He sucked in a breath at the sight of the top of your breast showing even more. He knew if he pulled the dress down just a bit more he’d see your peaked nipple pressing against the thin fabric.

“I missed you,” you breathed, pushing the dress down until eventually he could catch a glimpse of your partly bare chest.

He cursed, slamming his foot on the breaks and swerving to the side of the empty road. The car was put in park before he was yanking off his seat belt and reaching for you. While he could have driven the extra five minutes to his place, you looked too enticing for him to even focus on the road anymore. Mickey tried to convince himself that he was doing this for your safety. He was stopping here to prevent any accidents.

But he knew it was bullshit.

Slipping your arms around his neck, you clambered into the front seat of his car that he generously pushed back to give you room. Your head was swimming, eyes dazed and lips parted. He’d never seen a more beautiful sight than this. No sunset up in the sky or view above the clouds would be able to compare to you looking at him as if he’d hung the moon. As if he’d given you every ounce of happiness you could ask for.

Your lips slotted against his, your saccharine moan being swallowed by him. He was in heaven just from the taste of you. Gripping the back of your neck, he molded you to him, chasing the pleasure that spread down his spine and to his cock. He told you when you first started dating that one look from you made him so turned on he became light headed. Of course, you laughed it off as him trying to win you over, but still to this day it remained the truth.

Mickey was ready to break and you hadn’t even touched him yet.

“Baby,” he sighed, catching his breath as you trailed your lips down his neck, tracing the edge of his gold chain with your tongue. “We’ve gotta—fuck—” He groaned when you bit down on his collarbone, sucking a dark purple mark into his skin.

You smiled, glancing up at him through your lashes. “Yeah I agree. We should fuck.”

His laugh was involuntary, the lightness in his head turning him into a pliable mess for you to mold. If it was any other night he’d be adamant on making it home before fucking you. But he hadn’t seen you in days—the polaroids you took together only going so far for him—and he was pretty sure he’d lose his mind if he waited any longer.

Shaking his head to gain some clarity, he cupped your chin, bringing your lips back to his for a sweet kiss that completely opposed what you’d been doing before.

“You’re causing trouble mi vida.”

Your laughter caused his heart to flutter. “Look who’s talking, Fanboy.”

His cock twitched. You never called him by his callsign, choosing instead to use his name and he’d never been against it. But there were times when some part of his brain flared to life at the sound of your voice calling him that. Shit, he’d never heard anything hotter.

“Don’t tell me you don’t like it when I cause trouble,” you said lowly, your hand slipping down to the crotch of his jeans. His hips jolted up, a gasp echoing in the tight space of the car, and he knew…he wouldn’t last long enough to fuck you. He’d be lucky if he held on long enough to let you wrap a hand around him.

“I’m—” He exhaled, eyes rolling back when you opened his jeans, dipped your hand in and brushed your thumb along the outline of his cock. “I’m not gonna last baby.”

“That’s okay.”

He was certain his brain whited out the second you pulled him free, wrapping your hand around his cock. There was something about you in this sundress that turned him into mush—something he wasn’t particularly mad about. Your thumb swiped over the head of his cock, gathering the precum and spreading it downwards. It made his hips buck up into your hand, a broken moan falling from his lips.

“Oh baby,” you cooed, cupping his cheek with your other hand. “Is this all because of me?”

Mickey sighed, feeling the tightness in his stomach build with every stroke of your palm. “It’s the fuckin’ sundress,” he moaned.

He reached up and pulled the straps down until the fabric pooled around your waist, revealing your bare chest to him. Without even thinking about it, he leaned forward and wrapped his lips around your nipple, sucking it into his mouth. The cry you let out made him smile—enjoying that he had the same affect over you that you did him.

“I wore it for you,” you gasped, head falling back and chest pushing even further towards him. “Knew you’d…oh…like it.”

His eyes fell shut, the pleasure building in his body until he could no longer take it and with one more twist of your hand, he flew off the edge of the cliff. Grunting your name, he buried his face into your chest, feeling his balls draw up tight as he spurted over your hand. Every thought left his mind except for one. Just you. The sight of you panting in his lap, your breaths in tune with his, and your hand tenderly stroking his cock to prolong his orgasm.

Mickey could never figure how he got so lucky with you. No matter how many times he asked the question, he still remained without an answer. But it was moments like this when he was basking in the afterglow of a mind-numbing release did he stop asking. He didn’t want to know the answer. Not anymore. He just wanted to relish in the fact that he had you. That is was him you chose to love, him you wanted.

“So pretty,” you mumbled, bringing your hand up and licking along your palm.

“Fuck.”

Scooping up his cum from your hand, he trailed it along your breast, circling you nipple and coating your skin in him. Call it a primal urge in his body to pain you in his release or whatever, but he couldn’t stop the shudder that went down his spine at the sight. He did it again with the other side, watching your face contort in pleasure at the feeling.

“Start the car,” you said against his lips. “I want to fuck you in our bed.”

He nodded, helping you fall to the passenger seat, your dress still wrapped around your waist and breasts shiny with his cum. Just that sight alone caused him to grow half hard again—the need to be inside you growing with every second. He’d be lucky if he didn’t crash the damn car.

Turning over the engine, he attempted to catch his breath. You chose that exact moment to circle your nipple, bringing your finger up to your mouth and moaning at the taste of him. His cock twitched, eyes following your every movement until you looked back at him again, smirking at his dumbstruck expression. You were playing him like a guitar and he loved every second.

Cursing under his breath one last time, he slammed his foot on the gas, taking off down the street, adamant on actually getting home this time—your laughter echoing around him.

#mickey garcia x fem!reader#mickey garcia x you#mickey garcia x reader#mickey garcia x y/n#mickey 'fanboy' garcia#fanboy x reader#fanboy x you#top gun: maverick#mickey garcia smut#my writing#kinktober 2022

281 notes

·

View notes

Text

Kinkmas Day 11 (Argyle x Fem!Reader)

Warnings: smut (18+ only, minors DNI), thigh f*cking, oral (f! receiving), minor drug use

WC: 1.2k

A/N: Sorry for the lack of preview yesterday; I was writing this until the last minute!

Kinkmas 2022 Masterlist

--

“Args, I’m home!” you call out as you turn the key in your apartment door. No sooner does it slam behind you do you pull off your sneakers and breathe a sigh of relief. Working a double shift at Radio Shack on Christmas Eve was like corralling a herd of wildebeests. Customers shouting at you because their ‘perfect gifts’ were out of stock, like they didn’t have 364 other days of the year to shop. And no matter how many times that you tried to explain that merchandise ordering was out of your control, it was like the information went in one ear and out the other. All you wanted was to lay down in your bed and sleep for, like, a million years.

As soon as your boyfriend opens up the bedroom door, the pungent scent of weed permeates through your home. He pads into the living room, eyes bloodshot and a dopey grin on his face.

“I see you’re nice and relaxed,” you scowl at him. You immediately feel bad; it’s not his fault that the manager at Surfer Boy Pizza let him out early for the holiday. And he works hard; he deserves a break. “I’m sorry, babe,” you say quickly, wrapping your arms around his waist for a hug. “Just been a long day.”

Argyle pulls you in closer, pressing a kiss to the top of your head. “Nah, baby, s’cool,” he says in his laid-back manner. “How can I be of service?”

You give him a small smile, the most you can muster with your level of fatigue. “Maybe a foot massage?” you ask hopefully. Years of kneading pizza dough has left him with hands of gold, and you like to use them to your advantage.

He doesn’t give a verbal reply; instead, he opts to scoop you up off your sore feet and bring you into the room, bridal-style. You bury your face in his shoulder and snuggle in close. He lays you on the mattress gently, and you turn over onto your stomach and await his touch. The moment his strong fingers press against the soles of your feet, you let out a soft moan.

“You know how much I love those noises of yours,” Argyle murmurs in your ear. As he leans in, you can feel him, half-hard on the back of your thigh.

You hum a note of happiness. “I can feel it,” you tease him, closing your eyes and burrowing into the pillow. “But I’m sorry, Args; I’m just too tired tonight.” Argyle continues massaging, but the prolonged silence informs you that he wants to say something. “Penny for your thoughts?” you tease.

“Just lookin’ at your beautiful thighs,” he muses, his big hands traveling up from your calves to the tops of your legs, still clothed in your work khakis. “Got me wonderin’, like, how’d I feel between them, y’know?”

You prop yourself up on your elbows and give him a bemused look. “You mean, you wanna fuck my thighs?” As you say it, he grips them tighter.

“Fuck, yes,” he breathes, “I-I mean, if it’s okay with you.”

To his surprise, you sit up slowly and wriggle out of your pants. Argyle runs his tongue along the curve of your ass, and you yelp as he bites down. “You’re just so damn delicious,” he defends himself, earning a giggle from you. You lay back down, and he presses soft kisses along the length of your legs. The plush of his lips and slight stubble along his jawline tickle you, warmth surging throughout your body. He pulls away and you hear the telltale sound of his zipper lowering; he hisses at the relief it brings.

“S’fucking perfect; my gorgeous, perfect girl.” Argyle spits onto his hard length. You hear the slickness of his hand gliding to his tip, mixing the saliva with his precum. “Lay on your side for me…good girl, just like that,” he praises as you follow his directions, the coolness of the sheets flitting against your left hip. He takes on the position of the big spoon, rutting against you. He tugs at your panties until he’s got them off completely, discarded somewhere on the floor. You feel the tip of his cock begin to part your inner thighs, and he groans at the pressure.

Argyle grips your ass, giving it a hard spank that leaves you whimpering with pleasure. “Y’like that?” he asks with a smirk.

“M-more,” you plead, crying out when he makes contact again and again and again. He’s growing harder as he thrusts between the plush of your thighs.

“Was gonna take it easy on you tonight,” he coos. “Forgot my girl likes it rough.” He punctuates his statement with another smack before wrapping his arms around your waist to pull you closer. His dick slides against your folds, making you even wetter. “Mm, fuck,” he groans. “Wanted to last longer, but I don’t think I can. Not with you–fuck–feelin’ this good.” His thrusts become more frantic–desperate even–and you feel his warm release trickle down your legs. “Didn’t expect just your thighs to do this to me. Shoulda known better.” He catches his breath and presses thankful kisses along your shoulder blades before getting up to grab a warm cloth for his mess. You mewl as his body leaves the bed, and he chuckles.

“Whas’ wrong, baby?” Argyle teases in his signature Cali drawl, gingerly wiping you down.

You give him a pout. “Y’got me all turned on now,” you whine, bringing his hand down to your wet cunt. “Feel?”

A grin splits your boyfriend’s beautiful face. “That’s no problem, babe.” His tongue peeks out over his lips as he ties his hair back, pins your back to the bed, and dives between your legs. He licks a stripe up your folds, stopping at your clit. He sucks lightly on it as you moan underneath him. He knows how sensitive it is; it’s your favorite place for him to touch.

“Args, right there, holy shit,” you exhale, arching your back before he pushes your hips back down. Pleasure vibrates throughout your core as he laps hungrily at your pussy. The laugh that he gives when your legs twitch only exacerbate your stimulation. “‘S not funny,” you mumble, but that only makes him laugh harder. His ponytail flops over his broad shoulders, and you tug on it as your release overcomes you.

“You…make me…feel…so good,” you pant as you finish. Argyle slows his movements to bring you back down, grin now covered in your slick. He messily wipes his mouth with the back of his hand.

“”Had to return the favor, y’know?” He shrugs like it’s no big deal, like he didn’t just deliver an earth-shattering orgasm with only his tongue. “I’m greedy, but I’m not selfish.”

You swat at him playfully and give your best puppy-dog eyes. “Does that selflessness extend to cuddles?”

“Of course.” He snuggles down under the covers next to you, once again assuming the big spoon role. As soon as you scoot back into him, he groans in both amusement and frustration.

“Those damn thighs,” he mutters to himself before whispering in your ear, “Could I go for round two?”

--

#kinkmas 2022#argyle stranger things#argyle#argyle x y/n#argyle smut#argyle imagine#argyle x female reader#argyle x fem!reader#argyle x reader#argyle x you#smut#stranger things#fanfic#argyle fanfic

212 notes

·

View notes

Text

In 2022, federal prosecutors and the US Securities and Exchange Commission brought securities fraud charges against a group of people who allegedly did pump and dumps using Twitter, Discord and a podcast. We talked about the case at the time. It was typically silly: The defendants went by online nicknames like “MrZackMorris” and “Mystic Mac” and “The Stock Sniper,” the podcast was titled “Pennies: Going in Raw,” the SEC complaint had pictures of a Lamborghini, and the defendants were publicly saying things like “I’ll never get sick of pumping … money into my followers bank accounts. LETS ALL GET RICH!” while they were privately saying things like “We’re robbing f*cking idiots of their money.”

So I couldn’t not write about it. But it was kind of boring, really, just the most garden-variety pump and dump imaginable. “Pretty straightforward fraud,” I called it. “I don’t know why people keep falling for it,” I wrote. There was nothing particularly novel or interesting about this case except I guess the names.

But yesterday a federal judge in Texas dismissed the criminal charges against MrZackMorris and friends in an absolutely wild opinion ruling that, in fact, a pump and dump is not securities fraud, because the people who bought the stock didn’t buy it from the pumpers

Decided to check out the twitter account of one of the guys to see if I found him exulting, no tweets since December 2022 but he does have an amusing header:

9 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the First Quarter of the year in the books, equity markets exhibited strength. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) built on its move higher. The US Dollar Index ($DXY) continued to drift to the upside in consolidation while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to reverse the short term uptrend while Emerging Markets ($EEM) consolidated in a broad range.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially the $SPY on both timeframes. The $QQQ was showing some momentum divergence that could lead to more consolidation or a pullback while the $IWM looked to step up as it broke to 2 year highs.

The week played out with Gold continuing to the upside, printing 4 new all-time highs and ending the week at one while Crude Oil also continued higher making 5 month highs. The US Dollar met resistance and then held in a tight range while Treasuries continued to flirt with a new move lower. The Shanghai Composite jumped to resistance and held there through Wednesday before closing for the week while Emerging Markets are threatening to break the rising channel to the downside.

Volatility rose to 5 month highs and held there Friday. This put pressure on equities mid week and they responded with a move lower. The SPY joined the QQQ pulling back from recent tops with the IWM looking like a possible failed break out. What does this mean for the coming week? Let’s look at some charts.

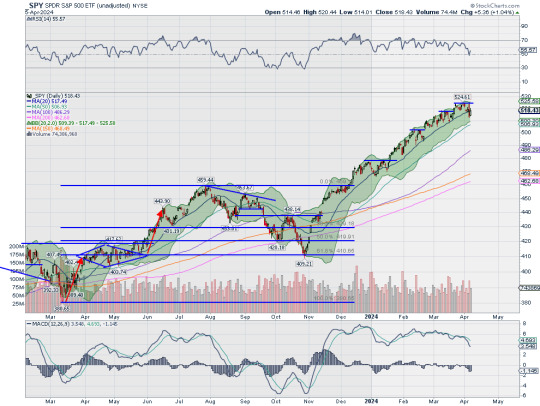

SPY Daily, $SPY

The SPY came into the week just pennies off the all-time high it set the day before. It held there Monday but then gapped down Tuesday to the 20 day SMA. It held there Wednesday and then opened higher in the typical bounce Thursday back at the all-time high. But that did not hold up as 4 Fed Presidents delivered the message that rate hikes will be delayed. It fell back and printed a bearish engulfing Marubozu candle, a potential reversal. Friday, however, did not deliver another move lower, but instead an inside day to the upside had it close back over the 20 day SMA. The RSI is moving back higher after a touch at the midline with the MACD leveling and positive.

The weekly chart, however, printed a bearish engulfing candle. This comes with the RSI overbought but now pulling back and the MACD starting to roll over after a 6 month move higher. The Bollinger Bands® do continue to point higher though. There is resistance at 520.50 and 524.50 with the 138.2% extension of the retracement of the 2022 pullback at 530 then the Cup and Handle target at 560. Support lower is at 517.50 and 513.50 then 510 and 503.50 before 501.50 and 498.50. Uptrend.

SPY Weekly, $SPY

With the first week of April in the books, equity markets are looking in need of a rest. Elsewhere look for Gold to continue its record run higher while Crude Oil continues its move to the upside as well. The US Dollar Index continues to short term trend to the upside while US Treasuries may resume their downtrend. The Shanghai Composite looks to continue the short term move higher while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to remain low making the path easier for equity markets to the upside. Their charts also look strong, especially on the longer timeframe. On the shorter timeframe the QQQ is at risk for some downside with the IWM in a messy short term uptrend and the SPY the strongest but also seeing some profit taking show up. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 5, 2024

2 notes

·

View notes

Text

Synopses for the Tgamm June episodes!

June 11, 2022

Citizen McGee/The Internship

Molly's Mayor For a Day contest turns into a lifetime gig; Molly interns with Weird Larry.

June 18, 2022

The Lucky Penny/Lock, Stock and Peril

Molly and Scratch help Libby improve her luck on Friday the 13th; When the McGee’s get locked in the basement, Molly and Scratch seek help, but have trouble remaining focused.

June 25, 2022

Out of House and Home/Home is Where the Haunt Is

The McGee’s struggle to make ends meet after a hospital trip leaves them nearly broke; Molly does her best to pretend everything is normal while Scratch protects the house.

Source:

https://www.dgepress.com/disneybrandedtelevision/pressrelease/june-2022-programming-highlights/

56 notes

·

View notes

Text

Financial Lesson I learnt in 2022

In the year 2022 I've learnt a lot of this some good, some bad and some have absolutely no purpose whatsoever but here are some financial lessons I learnt in 2022 that have made my life all the better.

1. Every penny you save will one day save you: In the middle of the year I got a job that paid about 7x my previous job and hoped my life would automatically become worthwhile and I wouldn't have to the way I did previously and would have more money in my account but to my greatest surprise, this wasn't the case as I seemed to save less money than when I was at my previous job. This became very evident when my younger brother's school called for resumption suddenly, I realized that I had no money to support him and had to resort to borrowing. If I had saved as I was supposed to I wouldn't have had to beg for money to support my brother's education. So it is important that we save a little money for emergencies; no matter the level of income that you are at currently, try to keep at least 1/10 of your monthly income for emergencies because while we do not pray for them eventualities will always arise: you could lose your job, a family member or yourself can get sick, you can make a bad investment, etc and then in your days of trouble, your savings will save you!

2. If it sounds too good to be true, it most usually is: In Nigeria, it is very common to hear: invest 20,000 and get 100,000. Simple mathematics shows that this kind of investment is trying to 500% returns on your investment and there is currently no business on God's green earth that can do this even for stock traders that invest wisely and safely make around 8-12% returns on their investment. Your average business man doesn't make that much profit, neither does your international business man or even your most experienced crypto trader (which by the way I would advise against if you want your money to be safe). So any business that promises you an absurd amount of returns be it online or physical, is usually a Ponzi scheme that will leave a lot of so-called investors in tears!

3. If you can't afford to pay in cash don't buy it: With the advent of things like Easy Buy, buy now and pay later offers; more and more people are tempted to buy things they cannot afford and sometimes things that they do not need. While this is not something I practice, I have a colleague let's call him Bob that bought a phone using one of these services and it would surprise you that the resulting debt accrued by Bob could not be paid in six months for a phone that just cost around 60000! He was knee deep in debt that he had to take loans to pay the phones cost and this spiralled out of control as he was borrowing from one loan app to pay the other and all this started because he bought a phone he could not pay for in cash!

4. Stay Broke: While this might sound like a terrible advice, hear me out. If for example you're like myself that was making a particular amount and you were living comfortably then you 7x your income and immediately raise your standard of living, spending on frivolities, etc; your account balance and assets will most definitely not reflex your new income. Instead of doing what I did, if you instead try to maintain your standard of living or maybe just raise it a bit and avoid non essential things as much as you possibly can: then you have more money to save, more money to invest in things that will serve your future. So while it might sound counter intuitive, staying broke is one of the things I learnt in the year 2022

5. Don't forget to have fun: In my quest to do better with my finances, I found myself at a place where I completely avoided things that I used to do for fun as I said to myself that they were just excuses to spend money that I should be saving; this mentality change when I cracked and went on a spending spree as I had been starving myself of fun things I used to do. If you don't have fun every once in a while, the day you finally break, you would incure the worst expenses ever. So, keep some money aside for fun things, doesn't have to be too much but just enough to keep the "fun monster" satiated!

6. Make efforts to learn about money and how you can make more of it: Growing up in a religious family we rarely talked about money and living in a country where it is very possible to make money from fraudulent and/or mystic way having too much money is usually regarded as a bad thing but one truth I've learnt about money is that money buys you time for example if you had sufficient money you wouldn't have to work extra hours to make more money. Those hours could be spend with friends and family or used to pursue a hobby rather than bursting your butt on a job you don't really like. So while some people might view money in a bad light I've learnt that money obtained legally and genuinely while it might not buy you happiness as we have always been told, will buy you the time you need to find happiness. So learning about your finances and how to make more money is one of the most important things I learnt in 2022.

8 notes

·

View notes

Photo

Disney Networks June 2022 Programming Highlights

Eureka!

Tusks, Trouble, and All ; Absoflutely Fabulous SERIES PREMIERE 6/22

Everybody Lava Pizza ; Prehistoric Class Pets 6/22 on Disney+ USA - 6/23 on Cable

Follow The Sledder / Stinkpod Day 6/22 on Disney+ USA - 6/24 on Cable

The Ghost And Molly McGee

Citizen McGee ; The Internship 6/11

The Lucky Penny ; Lock, Stock, and Peril 6/18

Out of House and Home ; Home is Where the Haunt Is 6/25

Big City Greens

TBA 6/4

TBA 6/11

TBA 6/18

TBA 6/25

Alice’s Wonderland Bakery

A Special Blend ; The Princess and the Hare 6/10

Mickey Mouse Funhouse

Festival of Heroes! ; I Wander Where Warbler Went? 6/3

The Fantabulous Five (Plus One)! ; Mickey Meets Rocket Mouse! 6/24

Spidey And His Amazing Friends

Catch and Release ; Construction Destruction 6/17

Mira Royal Detective

The Big Jalpur Wedding Mystery SERIES FINALE 6/20

Puppy Dog Pals

Surf's Up, Pups! ; Rock and Roller Pups 6/10

T.O.T.S. Tiny Ones Transport Service

Jingle Birds ; The Iceberg Alley Winter Games 6/3

Baby Fliers ; T.O.T.S The Musical SERIES FINALE 6/10

#Eureka!#Eureka#Disney's Eureka#Disney's Eureka!#The Ghost And Molly McGee#Ghost And Molly McGee#The Curse Of Molly McGee#Curse Of Molly McGee#Big City Greens#BCG#Alice's Wonderland Bakery#Alice In Wonderland#Mickey Mouse Funhouse#Spidey And His Amazing Friends#Spiderman#Mira Royal Detective#Puppy Dog Pals#Puppy Dog Tails#T.O.T.S.#T.O.T.S. Tiny Ones Transport Service#Disney Junior#Disney Jr#Disney Channel

33 notes

·

View notes

Text

How to buy marijuana penny stocks

Clinical and sporting pot use has been legitimised in a developing number of U.S. states and on a public level in Canada, filling a thriving lawful pot industry lately. Weed stocks are presently a superb concentration for financial backers looking for possibly hazardous deals and stock development. In any case, there are sure contemplations related to marijuana stocks that financial backers ought to remember.

Regardless, pot stocks face higher-than-ordinary gamble and instability because of a not insignificant rundown of elements. Many public weed organisations are youthful, problematic endeavours that face a confounded, quick changing business sector that incorporates various regulations across numerous neighbourhood, state, and provincial purviews. Marijuana use is as yet unlawful at the U.S. government level. In any case, 37 states have legitimised marijuana for clinical use in somewhere around one structure as of February 2022 and 19 states have authorised weed for grown-up use as of May 2022.

The difficulties are especially perfect for financial backers with regards to marijuana penny stocks. Financial backers ought to be particularly careful and perform more than their typical expected level of effort while putting resources into these organisations, which incorporate anticipated names like Cansortium Inc. also, Goodness Development Possessions Inc.

Marijuana stocks, addressed by the ETFMG Elective Collect ETF (MJ), a trade exchange store, have emphatically failed to meet expectations of the more extensive market. MJ has given a complete return of - 64.1% throughout the course of recent months, well behind the Russell 1000's all out return of - 12.1%.

MJ focuses on a wide combination of pot industry stocks, including penny stocks.

Here are the main three marijuana penny stocks with the best worth, the quickest development, and the best presentation. The market execution numbers above and all measurements in the tables underneath are as of Oct. 4, 2022.

Best Worth Marijuana Penny Stocks

These are the marijuana penny stocks with the most reduced year following cost to-deals (P/S) proportion. For organisations in beginning phases of improvement or enterprises experiencing significant shocks, this can be subbed as a harsh proportion of a business' worth. A business with higher deals could ultimately create more benefit when it accomplishes, or gets back to, productivity. The P/S proportion shows the amount you're paying for the stock for every dollar of deals created.

Americans purchased billions worth of weed in 2021 and legitimate pot deals could reach $30 billion out of 2022. The Canadian marijuana retail market is extending as well. However pot stocks took a gigantic beating, and a few famous names lost over 80% of their worth last year.

Industry goliath Shelter Development Corp (NASDAQ:CGC) lost 66% of its value esteem in 2021 in spite of rising 150% during a marijuana industry stocks rally of late 2020 to mid 2021 and multiplying during the initial a month and a half of a year ago.

Missing government authorization, U.S. pot administrators keep on major areas of strength for announcing development year-over-year. In any case, their valuations experienced a plunge as financial backer confidence about government legitimization wound down during the year. It's normal that weed change in America could altogether further develop the administrators' business climate, help their profit edges and further develop incomes.

InvestorPlace - Financial exchange News, Stock Exhortation and Exchanging Tips

Authorization in the U.S. could likewise open up new learning experiences for very much financed Canadian marijuana players. Further, Canadian pot stocks could likewise flood if edge choking correctional unit-based extract charge regulation gets reconsidered in 2023.

Hence, any clearness on the way to government legitimization, or fresh insight about charge changes in Canada could list marijuana stock costs. Expansions in financial backer hopefulness connected to U.S. legitimization endeavours generally lifted Canadian marijuana stocks as well. A rising tide lifts all boats, and pot industry penny stocks could flood more than their bigger partners.

Hence, I've evaluated weed organisations with stock costs underneath $5 an offer, and a base market capitalization of $200 million to some way or another whose illiquidity takes a chance on the littlest issues. Both U.S. pot stocks and Canadian pot names are addressed, independent of their essential posting.

Marijuana stocks are dope, the business' developing like a weed — take your pick of plays on words, however putting resources into marijuana is a long way from a joke. With sporting marijuana legal in 19 states and clinical marijuana lawful in undeniably more, this once-obscure corner of trade has turned into an undeniable industry, yet one still in its beginning phases.

From the outset, marijuana stocks might appear to be to some degree restricted to retail activities. Yet, when you dig somewhat more profound, you'll find a few subsectors inside the business, where everything from biotech and think-tanks to experts in dispersion and utilisation work.

Everything that is expressed, it's memorable critical this is an incipient industry whose primary item is as yet a Timetable 1 medication at the government level. That by itself makes any marijuana venture unsafe, however there are a few different motivations behind for what reason you'll believe should do intensive examination prior to plunging heedlessly into weed stocks.

Why marijuana stocks are interesting and unsafe

A stock's a stock, isn't that so? Definitionally, sure: You're purchasing portions of proprietorship in a public corporation. Yet, marijuana stocks convey a few extra difficulties and dangers, including:

Moderately new industry. Marijuana authorization past therapeutic purposes started in 2012. Thus, numerous marijuana stocks are tiny, falling into the classification of penny stocks, which is a hazardous field for financial backers, particularly fledglings. Youthful organisations are at higher risk of leaving business, their stocks can encounter wide cost swings, they might exchange less every now and again (making it harder to sell when the opportunity arrives) and there's less openly accessible exploration for would-be financial backers. At last, with marijuana not yet lawful on a government level, there could be implementation dangers later on.

Theoretical bet. For every one of the above reasons, marijuana stocks ought to be viewed as speculative ventures as of now. Try not to contribute beyond what you can stand to lose.

Likely tricks. Many individuals are anxious to bring in cash in pot stocks, including trick craftsmen. The Protections and Trade Commission has made explicit awareness of marijuana stocks, advance notice financial backers of potential venture misrepresentation (unlicensed dealers, commitments of ensured returns, spontaneous offers) and market control (counting exchanging interruptions and phoney public statements intended to impact costs).

Unfamiliar stocks. Numerous weed stocks exchanging in the U.S. are Canadian, and they're likewise among the biggest. While wandering abroad in your portfolio, there are a few extra dangers — there might be more restricted admittance to monetary information, for example, examination or organisation reports, than what's expected in the U.S. Furthermore, possibly no legitimate plan of action in the event that a venture is fake.

Not yet embraced by the monetary administrations industry. Since marijuana is unlawful governmentally, many banks are hesitant to contact this industry. Therefore, some speculation experts, like counsels or portfolio supervisors, will not have the option to prescribe marijuana stocks to put resources into. (To buy them all alone, see our bit by bit guide for how to purchase stocks.)

5 notes

·

View notes

Text

Transiting Venus enters Cancer

Sunday, July 17 - Thursday, August 11, 2022

Again, a short transit lasting not even four weeks. It’s kind of difficult for me to write about this, or devote much energy to it, especially since Venus won’t be directly involved in any of the more challenging cosmic situations.

Which is unfortunate, because Venus moving through Cancer can be a time of comfort and healing. Still, twenty-six days isn’t a long time; but as we move through them we’ll probably notice a few definitive impulses:

Art - Monet paintings of flowers, “folk” art (like great-grandma’s hand-made quilts), patriotic themes (🤢), quieter and more soothing music.

Beauty - bosoms, of course. Some of us may go on a kind of nostalgia kick and try out ancient fashions. (Although let Ms M warn you, there are reasons we all stopped wearing platform shoes and blue eye shadow in the 70s.)

Love - for the family, for the motherland (🤢), for food and a well-stocked pantry. We tend to seek partners our families would approve of.

Money - oooo, Cancer can pinch pennies with the best of them! Hanging on to them with those claws. If we can be coaxed to part with our pay, it will be either for food or for home improvements.

Placements in Cancer will feel the most from this transit. If you have anything there, it could become a comfort to you in the weeks ahead. Show it a little love and affection.

Placements in Aries, Libra, and Capricorn are challenged by this transit. There are injustices to be fought, and we’d rather stay safely at home inside our crab shells.

Placements in Taurus, Virgo, Scorpio, and Pisces can be enhanced by this transit if they make the effort.

Placements in Sagittarius and Aquarius have adjustments to make. See above comment about crab shells.

Placements in Gemini and Leo may or may not feel much from this transit - maybe just a little more sentimental and/or weepy than usual, for no apparent reason!

Some important dates:

Friday, July 22 - Venus/Cancer trine Vesta Rx/Pisces

Monday, July 25 - Venus/Cancer square Jupiter/Aries

Sunday, July 31 - Venus/Cancer square Chiron Rx/Aries

Monday, August 1 - Tuesday, August 2 - Venus/Cancer sextile North Node/Taurus, trine South Node/Scorpio; sextile Uranus/Taurus; sextile Mars/Taurus. What a potential relief (or excuse) for such a high-pressure situation as a conjunction between Mars, Uranus, and the North Node - all in Venus’ own sign! It’s giving us some context behind that conjunction’s expression - namely, family (Cancer) values (Venus).

Thursday, August 4 - Venus/Cancer trine Juno Rx/Pisces

Sunday, August 7 - Monday, August 8 - Venus/Cancer trine Neptune Rx/Pisces; square Eris Rx/Aries; opposite Pluto Rx/Capricorn. The other “situation” for Venus. We have a cardinal t-square (Venus opposite Pluto, both square Eris) somewhat ameliorated by the Venus-Neptune trine. What’s going to “win,” our compassion for others or our desire to be left alone?

17 notes

·

View notes