#goldman sachs

Text

By: Ronn Torossian

The day after hundreds of Pro-Hamas protestors rallied outside of a Manhattan cancer hospital, we learn that the organization which hosts these heinous rallies throughout New York City calling for an elimination to the State of Israel, and mass murder of Jews is funded by Goldman Sachs. Full stop. Period.

Goldman Sachs, one of the largest banks in the world has given $18 Million Dollars to The People’s Forum which organizes these rallies. Goldman Sachs has a fund, where donors send money to send nonprofits and rather than Goldman Sachs saying no, we will not send money to an organization which supports rape and terror, they sign the checks. And Goldman Sachs funds it. Goldman Sachs can refuse to sign the checks – they choose not to. It has been ongoing.

Manolo De Los Santos of the People’s Forum gave a speech Monday in New York City where he said “When we finally deal that final blow to destroy Israel. When the state of Israel is finally destroyed and erased from history, that will be the single most important blow we can give to destroying capitalism.”

The speech preceded a rally, “Flood Manhattan for Gaza MLK Day”, during which pro-Hamas protestors walked the streets of Manhattan blocking traffic, and eventually they protested outside Memorial Sloan Kettering Cancer Center, a hospital. As The New York Post reported protestors screamed: “Make sure they hear you. They’re in the window,” one organizer said through a bullhorn, and another in the crowd chanted, about the cancer center, “MSK, shame on you, you support genocide, too.”

These are people who support rape and baby-killing. On October 7th, the leader of The People’s Forum tweeted about “the heroic resistance of the Palestinian people”, and “the struggle for the national liberation in Palestine.” On October 7 in Manhattan. These protests are a clear call for murder with chants of “Free Palestine from The River to the Sea”, and “Intifada Now” are calls for violence and murder of Jews.

Authorities allow these terrorist Anti-Semitic supporters to block traffic, disrupt the city and threaten Jews. The People’s Forum has hosted Anti-Semitic rallies in NYC since October 8th they are well-funded and well organized and there are also events on Karl Marx, Vladimir Lenin and “the path to revolution.” In the New York Post, a 74-year-old Jewish woman was quoted as saying, “I thought I was in Germany in 1939.” She is right, and in 2024 the free world is either with us or against us. Goldman Sachs is funding calls for the mass murder of Jews. Goldman Sachs is signing checks which pays for Anti-Semitic events in New York City. It must end now. It’s not unlike Outten Golden, a leading law firm in New York City, where their lawyer Kathleen Peratis has visited the Hamas deadly terror tunnels multiple times, praised Hamas leaders, openly opposes a Jewish state and supports BDS.

Elie Wiesel rightfully said: “I swore never to be silent whenever and wherever human beings endure suffering and humiliation. We must always take sides.” Goldman Sachs stop funding this.

25 notes

·

View notes

Text

How Goldman Sachs's "tax-loss harvesting" lets the ultra-rich rake in billions tax-free

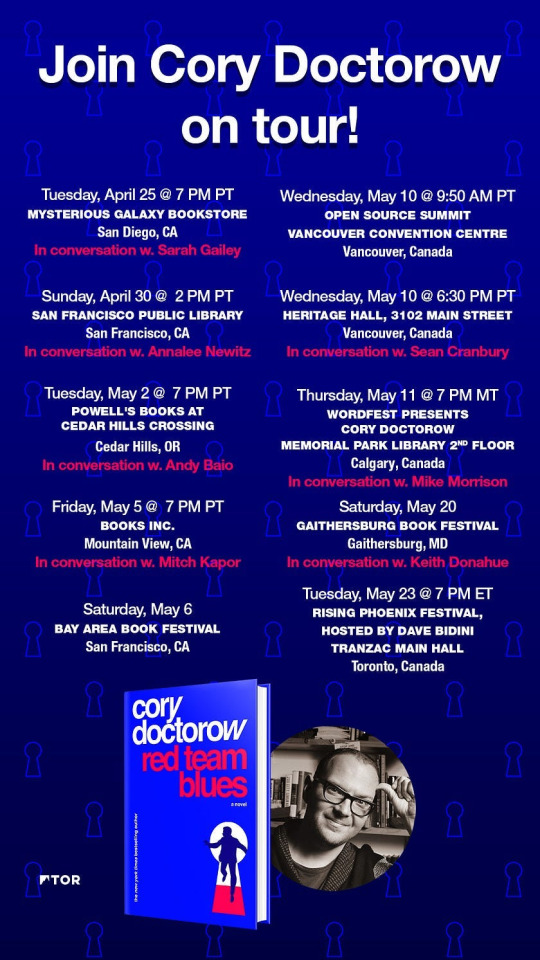

Tomorrow (Apr 25) I’ll be in San Diego for the launch of my new novel, Red Team Blues, at 7PM at Mysterious Galaxy Books, hosted by Sarah Gailey. Please come and say hi!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

With the IRS Files, Propublica ripped away the veil of performative complexity disguising the scams that the ultra-rich use to amass billions and billions (and billions and billions) of dollars, paying next to no tax, or even no tax at all. Each scam is its own little shell game, a set of semantic and accounting tricks used to gussy up otherwise banal rip-offs.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

The finance sector has a cute name for this kind of complexity: MEGO, which stands for "my eyes glaze over." If you're trying to rip off a mark, you just pad out the prospectus, make it so thick they decide there must be something good in there, the same way that any pile of shit that's sufficiently large must have a pony under it...somewhere.

Propublica's writers haven't merely confirmed just how little America's oligarchs pay in tax - they've also de-MEGO-ized each of these scams, like the way that Peter Thiel used the Roth IRA - a tax-shelter for middle-class earners to help save a few thousand dollars for retirement - to make $5 billion without paying one cent in tax:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

One of my favorite IRS Files reports described how Steve Ballmer - the billionaire ex-CEO of Microsoft - laundered vast fortunes into a state of tax-free grace by creating hundreds of millions in "losses" from his basketball team, the LA Clippers. Ballmer paid 12% tax on the $656 million he took out of the Clippers - while the players whose labor generated that fortune paid 30-40% on their earnings:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

That was Propublica's first Ballmer story, back in the summer of 2021. But they ran a followup last February that I missed (it came out while I was on a book tour in Australia), and it's wild: a tale of "loss harvesting," a form of fuckery involving Goldman Sachs that's depraved even by their own standards:

https://www.propublica.org/article/irs-files-taxes-wash-sales-goldman-sachs

Loss farming is a scam that was invented in the 1920s, whereupon it was promptly banned by Congress. But Goldman and other plutocrat Renfields have come up with tiny modern variations on this century-old con that the IRS is either unable or unwilling to address.

Here's how it works. Say you've got a stock portfolio where some of the stocks have gone up and others have gone down. You want to sell the high stocks and hang onto the low ones until they bounce back. But if you sell those stocks that have gone up, you have to "realize" the profit from them and pay 20% capital gains tax on them (capital gains tax is the tax you pay on money you get from owning things; it's much lower than income tax - the tax you pay for doing things).

But you pay tax on your net capital gains - the profits you've made minus the losses you've suffered. What if you sold those loser stocks at the same time? If you made a million on the good stocks and lost a million on the bad ones, your net income is zero - and so is your tax bill.

The problem is that selling stocks when they've gone down is a surefire way to go broke. Every investing book starts with this advice: you will be tempted to hold onto your stocks that are going up, because they might continue to go up. You'll be tempted to sell your stocks that are going down, because they may continue to go down. But if you do that, you'll only sell the stocks that have lost money, and never sell the stocks that have made money, and so you will lose everything.

Back when the pandemic started, your shares in movie theater chains were in the toilet, while your stock in tech companies shot through the roof. If you sold the tech stocks then and held onto your movie stocks and sold them now, you'd have cleaned up - today, tech stocks are down and movie theater stocks are up. But if you sold the cinema shares when they bottomed out, and held onto your tech stocks when they were peaking, you'd be busted today.

So selling your loser stocks to offset the gains from your winners is a bad idea. That's where loss-farming comes in: what if you sold your tech stocks at their peak, and sold your bottomed-out cinema stocks at the same time, but then bought the cinema stocks again, right away? That way you'd have the "loss" from selling the cinema stocks, but you'd still have the stocks.

That's called "wash trading," and Congress promptly banned it. If you've heard of wash-trading, it's probably something you picked up during the NFT bubble, which was a cesspit of illegal wash-trading. Remember all those eye-popping NFT sales? It was just grifters with multiple wallets, buying NFTs from themselves, making it seem like there was this huge, white-hot market for monkey JPEGs. Wash-trading.

Turns out that crypto really did democratize finance...fraud.

Wash-trading has been illegal for a century, but brokerages have invented modern variations on the theme that are legal-ish, and the most lucrative versions of these scams are only available to billionaires, through companies like Goldman Sachs.

There are a bunch of these variations, but they all boil down to this: there are lots of ways to sell an asset and buy it again, while making it look like you bought a different asset. Like, say you're invested in Chinese tech companies through an exchange-traded fund (ETF) that bundles together "all the Top Chinese tech stocks."

Maybe you bought this fund through Vanguard, the giant brokerage. Now, say Chinese stocks are way down, because the Chinese government is doing these waves of lockdowns on the factory cities. If you could sell those Chinese stocks now, you'd get a massive loss, enough to wipe out all the profits from all your good stocks.

But of course, China's going to figure out the lockdown situation eventually, so you don't want to actually get rid of those stocks right now, especially since they're worth so much less than you paid for them. So right after you sell your Vanguard Chinese tech ETF shares, you buy the same amount of Schwab's Chinese tech-stock ETF.

An ETF of "leading Chinese tech companies" is going to have basically the same companies' stock in it, no matter whether it's sold by Vanguard, State Street or Schwab. But as far as the IRS is concerned, this isn't a wash-trade, because you sold a thing called "Vanguard ETF" and bought a thing called "Schwab ETF" and these are different things (even if the main difference is the name on the wrapper, and not what's inside).

There's other ways to do this. For example, lots of companies have different "classes" of stock. Under Armour sells both Class A (voting) and Class C (nonvoting) stocks. Though voting stock is worth a little more than nonvoting stock, they both rise and fall together - if the Class A shares are up 10%, so are the Class C shares. So you can dump your Under Armour Class A's, buy Under Armour Class C's and own essentially the same amount of Under Armour stock - but as far as the IRS is concerned, you just sold your interest in one company and bought an interest in a different company, and you can take a big loss and write down your profits from other stock trades.

The IRS does prohibit wash-trading, but only in the narrowest sense. Brokerages are obliged to report trades in which a customer buys and sells exactly the same security, with the same unique ID (the CUSIP number), within 60 days. Beyond that, IRS guidance is extraordinarily wishy-washy, calling on filers to "consider all the facts and circumstances" of their transactions. Sure, that'll work.

Propublica found zero instances of the IRS targeting any of these trades, ever, for enforcement. That's especially true of the most egregious version of loss-harvesting, a special version that only the ultra-rich can take advantage of, called "direct indexing." You might know about "index funds," where a brokerage sells a single fund that tracks a broad index of stocks - for example, you can buy an S&P 500 index that goes up and down with the total value of the top 500 stocks in America.

Direct indexing is something that giant banks like Goldman Sachs offer to their very richest clients. The brokerage buys a mix of stocks that are likely to track the whole index, and puts those shares directly into the client's account. Rather than owning shares in a fund that owns the stocks, you own the stocks directly. That means that when you want to harvest some losses, you can sell just a few of the stocks in the index, rather than your shares in the whole fund.

Here's how that works. In 2017, the US index was up 20%; global indexes were up even more. Steve Ballmer made a bundle. But Goldman Sachs, acting on Ballmer's behalf, sold s few of the stocks in the portfolio and harvested a $100,000,000 loss, that Ballmer could use to trick the IRS into treating his massive profits as though he'd made very little taxable income.

Goldman uses a whole range of tricks to keep billionaires like Ballmer in a lower tax-bracket than the janitors who clean the floors after his team's games. They not only buy and sell different classes of stock in companies like Discovery and Fox; they also buy and sell the same company's stock in different countries. For example, they sold Ballmer's shares in Shell in one country, and then immediately bought the same amount of shares in another country. The IRS doesn't treat this as a wash-trade, despite the fact that the shares have the same value, and, indeed, companies like Shell routinely merge their overseas and domestic shares with no change in valuation.

Thanks to Goldman's ruses - and the IRS's willingness to accept them - Ballmer's wealth has swollen to grotesque proportions. He generated $579 million in losses from 2014-18, and as a result, got to keep at least $138m that he'd have otherwise had to pay to the IRS.

Goldman's not the only one in on this game: Iconiq Captial - a firm that also offers marriage partner scouting for its richest clients - has $13.2 billion under management on behalf of just 337 people. Among those high-rollers: Mark Zuckerberg, whose $88m in gains from Iconiq investments were offset by $34m in imaginary losses that the company manufactured with wash-trades.

In theory, the simplest form of wash-trading - selling your Vanguard China fund and buying a Schwab China fund - is available to any investor. Leaving aside the fact that the top 1% of Americans own most of the stock, this is still a deceptive proposition. This kind of wash-trading only benefits investors who hold their shares outside of a sheltered retirement account, which is a vanishing minority indeed.

Instead, the primary beneficiaries of this activity are the usual suspects: convicted monopolists like Ballmer, or useless scions of wealthy families, like the kids of Walmart founder Sam Walton, who emerged into this world through very lucky orifices and are thus effectively exempt from the need to work or pay tax for life.

Jim Walton is Sam Walton's youngest orifice-lottery-winner. Young Jim saw a $10 billion increase in his wealth from 2014-18, making him the tenth richest person in America. Thanks to wash-trading, he declared only $111 million of that $10 billion on his taxes, and paid $0.00 in tax on that $10 billion gains.

One way that the rich are especially well-situated to exploit loss-harvesting is in converting short-term gains - which are taxed at 40% - into long-term gains, which are taxed at 20%. For people who make a lot of money buying and selling shares as pure speculation, flipping them in less than a year, wash-trading can create the appearance of long-term holdings. Analyzing their trove of leaked IRS files, Propublica showed that Americans who report over $10 million in income almost never report short-term gains. Instead, two-thirds of the richest Americans report short-term losses.

One fascinating wrinkle is that rich people may not even know this is going on. Whatsapp co-founder Brian Acton, managed to "lose" $2.9 million when he sold $17 million in shares - the same day he bought $17 million in shares in nearly the same companies from another brokerage. Then, a few months later, he reversed those transactions, selling his new fund and buying the old one and harvesting another $600,000 in losses.

When Propublica asked Acton about this, he told them he was "not really aware of any events like that...Broadly my wealth is managed by a wealth management firm and they manage all the day to day transactions."

This is completely believable and consistent with the extraordinarily frank account of how elite money-management works that Abigail Disney described in 2021, where the ultra-rich are insulated from the scams, tricks and wheezes that lawyers and accountants dream up to keep their fortunes steadily mounting with no action needed on their part:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Could the IRS block this kind of wash-trading? Yes, but they'd need action from Congress. The most effective way to do this would be to force shareholders to "mark to market" the value of their holdings, taxing them each year on the fluctuations in their portfolio.

Propublica notes that this is incredibly unlikely to happen, though. As an alternative, Congress could change the rule that blocks investors from claiming losses when they buy and sell "substantially identical" shares with a rule that applies to "substantially similar" stocks. This proposal comes from Columbia Law's David Schizer, who says the law "ought to be updated to reflect how people invest today instead of how they invested 100 years ago."

But for any of that to have an effect, the IRS would have to change its auditing and enforcement practices, which currently see low-income earners (who can't afford fancy tax-lawyers who'll tie up the IRS for months or years) being disproportionately targeted, while America's super-rich, ultra-rich, and stupid-rich are allowed to submit the most hilariously, obviously fictional returns and get away with it.

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Catch me on tour with Red Team Blues in San Diego, Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

[Image ID: A dilapidated shack. A sign reading 'Internal Revenue Service Building' stands next to it. From its eaves depends another sign, reading 'Internal Revenue Service' and bearing the IRS logo. From the window of the shack beams the grinning face of billionaire Steve Ballmer. Behind the shack is a DC avenue terminating in the Capitol Dome.]

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Image:

Matthew Bisanz (modified)

https://commons.wikimedia.org/wiki/File:NYC_IRS_office_by_Matthew_Bisanz.JPG

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Ted Eytan (modified)

https://commons.wikimedia.org/wiki/File:2021.02.07_DC_Street,_Washington,_DC_USA_038_13205-Edit_%2850920473547%29.jpg

CC BY-SA 2.0

https://creativecommons.org/licenses/by-sa/2.0/deed.en

--

Bart Everson (modified)

https://www.flickr.com/photos/editor/1287341637

Eric Garcetti (modified)

https://commons.wikimedia.org/wiki/File:Steve_Ballmer_2014.jpg

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#paper losses#direct indexing#tax-loss harvesting#steve ballmer#propublica#irs files#the rich are different from you and me#mego#wash trading#tax evasion#goldman sachs#vampire squid#mark zuckerberg

88 notes

·

View notes

Text

#crime pays#hedge funds#goldman sachs#John Paulson#donald trump#crisis of legitimacy#american exceptionalism

4 notes

·

View notes

Text

George Santos made history when he unexpectedly became the first non-incumbent out gay Republican to be elected to Congress in a "red wave" that swept New York state in the November midterm elections.

And according to a New York Times investigation, he may have a historically large amount of questions to answer about his resume.

The investigation found that Santos, who was elected to represent a Long Island district currently held by Democratic Rep. Tom Suozzi, may have made numerous misrepresentations of key aspects of his background.

FIRST, HIS DESCRIPTION OF HIS EMPLOYMENT DOESN'T ADD UP:

• His biography says he's worked at Goldman Sachs, but spokeswoman Abbey Collins told the Times there's no record of his employment at the company.

• He's also said he was a "associate asset manager" at Citigroup, but spokeswoman Danielle Romero-Apsilos said it also couldn't confirm that he worked there, and said that the company sold off its asset management operations in 2005, which is five years before he claims to have graduated college.

• The Times found no IRS record of his a charity he says he owns, Friends of Pets United, and the beneficiary of a 2017 fundraiser by the group told the Times that they'd never received any of the money that was raised.

SECOND, HE'S REPORTEDLY FACED NUMEROUS EVICTIONS, CLAIMED TO BE A LANDLORD HIMSELF, AND MAY NOT LIVE AT HIS CURRENT ADDRESS:

• He was evicted in 2015 from a residence in Whitestone, Queens, after owing $2,250 in unpaid rent, per the Times. The landlord, Maria Tulumba, told the paper he was a "nice guy" and "respectful" tenant.

• He was evicted in 2017 from a residence in Sunnyside, Queens, after owing more than $10,000 in unpaid rent. Santos received a $12,208 fine.

• He claimed to be a landlord in 2021, but did not list any properties in New York on financial disclosure forms from either his 2020 or 2022 campaigns.

• The Times tried to interview him on Sunday at an address where he's registered to vote, but a person there said they weren't familiar with him.

THIRD, HIS HIGHER EDUCATION HISTORY APPEARS TO BE A LIE AS WELL:

• He's said he graduated with a degree in economics and finance from Baruch College, a public 4-year college in New York City, in 2010. But representatives from the school told the Times they had no record of his enrollment, despite searching multiple variations of his name.

• A biography on the National Republican Campaign Committee website says he went to New York University as well, but a spokesman for the university told the Times they had no attendance records that matched his name and birth date.

FOURTH, THERE'S STILL A MYSTERY AS TO WHERE HIS MONEY IN COMING FROM:

• He's reported a $750,000 salary and $1 million from a now-dissolved entity called the "Devolder Organization."

• The firm had been described in numerous ways, including as his "family's firm" that manages $80 million in assets and as a capital introduction consulting company. He did not list any clients.

• He was also the regional director of Harbor City Capital, a Florida-based company, when it was accused of running a more than $17 million Ponzi scheme. He's publicly denied knowledge of the scheme, according to the Times.

FIFTH, HE CLAIMED TO HAVE LOST FOUR EMPLOYEES IN THE 2016 PULSE NIGHTCLUB SHOOTING:

• He made the claim during an interview after his election, but the Times review found that none of the 49 victims of the Orlando shooting appeared to be associated with any of his firms.

Neither Santos nor the office of House Minority Leader Kevin McCarthy immediately responded to Insider's request for comment.

#us politics#news#business insider#2022#gop#Republicans#conservatives#rep. George Santos#new york#us house of representatives#rep. kevin mccarthy#the new york times#Rep. Tom Suozzi#Goldman Sachs#Citigroup#Friends of Pets United#Baruch College#National Republican Campaign Committee#New York University#republican lies#Devolder Organization#Harbor City Capital#ponzi scheme#pulse nightclub shooting

36 notes

·

View notes

Photo

’Black Chapel,’ 21st Serpentine Pavilion, Kensington Gardens, London,

Designed by Theaster Gates,

Realized with the architectural support of Adjaye Associates,

Photography is by Iwan Baan

#art#design#sculpture#pavilion#black#chapel#serpentine pavilion#london#kensington gardens#goldman sachs#theaster gates#adjaye associates#minimal#cylinder#iwan baan#meditation

66 notes

·

View notes

Text

I'd be such a good data analyst I would open Excel spreadsheets with all the data and stuff and be like "Wow! This one takes the cake!"

4 notes

·

View notes

Text

Goldman Sachs Wants To Cut Ties w/ Apple...

Users have deposited more than $10 billion into Apple savings accounts launched in partnership with Goldman Sachs.

But Goldman Sachs wants to sever ties with Apple as it scales back on its consumer business.

https://www.entrepreneur.com/business-news/apple-savings-accounts-hit-10b-goldman-sachs-wants-out/456916

View On WordPress

2 notes

·

View notes

Text

Margin Call Free Movie

One of my favorite movies because it accurately depicts the behind the scenes shenanigans of the 2007/2008 global financial meltdown.

How did a low budget film manage to attract such an all star cast? A phenomenal script (minus all the Fbombs) written by the son of an investment banker. JC Chandor's dad has described taking a young JC with him to the NYC trading floor to play while he worked. He always felt JC had a good sense of the business, but JC chose creative writing & film.

The entire film was shot in under a week. Most of the actors were in the middle of other projects but offered 1 day, and in some cases a few hours (Jeremy Irons, Mary McDonald) to film their scene(s).

Tells you everything you need to know about how Goldman Sachs managed to emerge from the 2007/2008 meltdown relatively unscathed.

Easter Egg Alert- Tuld played by Jeremy Irons picks up a tiny lion while speaking with actress Demi Moore. 🦁

Follow the YouTube link to view the film for free.

"When an entry-level analyst unlocks information that could prove to be the downfall of the firm, employees must weigh whether to save their own company (and their jobs) at the risk of fleecing millions of investors."

youtube

Some clips from Margin Call¹ can be viewed without YT like the "Senior Partners Mtg." Academy Award winner Jeremy Irons arrived in NYC, drove to set and nailed his performance without a rehearsal!

youtube

youtube

youtube

youtube

¹an investor must increase the securities or other assets used as collateral for a loan when their value falls below a certain threshold.

"Margin Call (2011) is an entangling thriller starring Kevin Spacey, Paul Bettany, Jeremy Irons and Zachary Quinto that follows the key people at an investment bank over a 24-hour period during the early stages of the 2008 financial crisis." (IMDb)

#Youtube#banking crisis#sussex#goldman sachs#frauds#deceivers#deception#margin call#jeremy irons#paul bettany#demi moore#zachary quinto

10 notes

·

View notes

Link

9 notes

·

View notes

Text

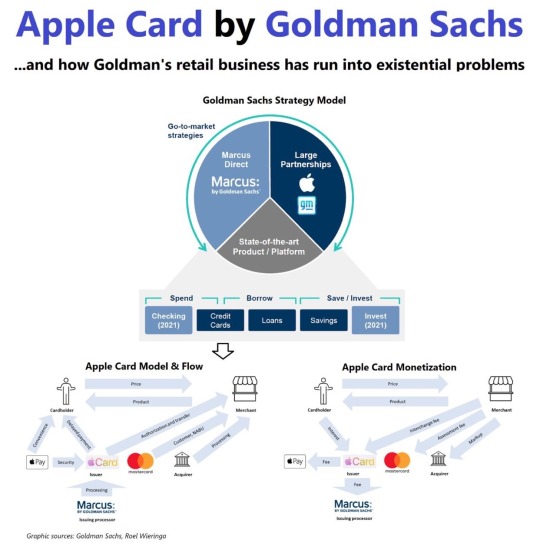

Goldman Sachs’ foray into consumer #banking in 2016 was quickly heralded as (and seemed to be) a great success. A few days ago, the bank announced an almost $3 billion loss from that business. Let’s take a look.

Despite the initial skepticism, Marcus proved a huge success: by 2020, Marcus was one of the fastest-growing #digital #banks in the US with more than $80 billion in deposits and $5 billion in loans.

Aggressive pricing, state-of-the-art #technology, reliable customer service and a well-known brand name count among the reasons for the rise. Markus’ success was twice important because - on top of commercial reasons - it exemplified one thing: how traditional financial institutions (Goldman was founded in 1869) can adapt to the #digital age and compete with #fintech players.

Several things have gone wrong:

1) Goldman’s overly aggressive pricing (to gain market share) during the boom years

2) Poor risk #management with more than 25% of card loans going to financially weak customers and a provision rate at subprime levels

3) Expanding defaults as a result of the deteriorating macro environment

4) Bad management decisions such as the one to merge (previously independent) Marcus with the wealth management segment

5) Service quality (i.e. disputes over chargebacks) not being able to keep up with an increasing customer base.

The credit card business is traditionally a hard one to crack, more so for newcomers even if they are called #Goldman_Sachs. And there seems to be no way back for what was once hailed as one the company’s biggest successes. Timing and bad management decisions have proven – once more – an unbeatable combination.

Reawd more, the full article at: 👉

Opinions: my own, Graphic sources: #Goldman Sachs, Roel Wieringa

____________________________

Please leave comments, subscribe and follow my news on my official social media pages: Telegram, LinkedIn, Facebook, Twitter, Gettr, Reddit, and Tumblr.

🤝 𝐑𝐞𝐢𝐧𝐢𝐬 𝐓𝐔𝐌𝐎𝐕𝐒. @reinis_tumovs

#tumovs #reinis #reinis_tumovs #rtumovs #rtgroup #тумовс #banker #neobanker #тумовс_банкир #tumovs_banker

#tumovs#wkwgroup#тумовс#fintech#defi#rtumovs#reinis tumovs#neobankers#goldman#goldman sachs#apple inc#apple news#apple card#bankers#bank#digital currency#digital#digital banking

7 notes

·

View notes

Link

Rishi took Goldman Sachs off of his CV on LinkedIn, can’t imagine why! Or maybe it’s to put people off the scent of another WEF(WTF?) stooge!

13 notes

·

View notes

Text

2 notes

·

View notes

Quote

Artificial intelligence (AI) could replace the equivalent of 300 million full-time jobs, a report by investment bank Goldman Sachs says. It could replace a quarter of work tasks in the US and Europe but may also mean new jobs and a productivity boom. Generative AI, able to create content indistinguishable from human work, is "a major advancement", the report says. The report notes AI's impact will vary across different sectors - 46% of tasks in administrative and 44% in legal professions could be automated but only 6% in construction 4% in maintenance, it says. According to research cited by the report, 60% of workers are in occupations that did not exist in 1940. But other research suggests technological change since the 1980s has displaced workers faster than it has created jobs. And if generative AI is like previous information-technology advances, the report concludes, it could reduce employment in the near term.

Chris Vallance, ‘AI could replace equivalent of 300 million jobs - report’, BBC

2 notes

·

View notes

Text

That's probably fine, right?

9 notes

·

View notes

Text

Embattled Rep.-elect George Santos (R-N.Y.) advertised that donors could pay between $100 and $500 to attend his swearing-in ceremony on Tuesday, according to several outlets.

The invitation — which reportedly noted that donors would also receive a round-trip bus ride from New York to Washington, D.C., a luncheon and a tour of the Capitol grounds — has once again drawn scrutiny to the representative-elect, who has recently faced intense backlash over his false claims about his background.

Santos did not respond to NBC New York or other outlets about the most recent controversy. The Hill reached out for comment as well.

After a New York Times article called into question much of his résumé, Santos admitted last week that he lied about his educational and professional background on the campaign trail.

Despite claiming to have graduated from Baruch College and worked for Goldman Sachs and Citigroup, Santos told the New York Post in an interview that he did not graduate from any college or university and never worked directly for the two firms.

Santos also made misleading statements about his heritage, previously claiming he was Jewish and that his grandparents fled Nazi persecution in Europe during World War II. He later walked back these claims when speaking with the Post.

“I never claimed to be Jewish,” Santos said. “I am Catholic. Because I learned my maternal family had a Jewish background I said I was ‘Jew-ish.’”

Fellow New York congressman Rep. Ritchie Torres (D) suggested in a tweet on Thursday that Santos’s invitations to his swearing-in could represent an ethics violation.

“George Santos, who never misses an opportunity to violate Congressional Ethics, is charging people for touring the US Capitol and attending his Congressional swearing-in,” he said. “Is the US Capitol one of the 13 properties in the imaginary Santos real estate empire?”

However, Santos and other representatives-elect did not end up being in sworn on Tuesday as the battle for Speaker of the House dragged on and delayed the event.

#us politics#news#the hill#2023#Rep. Ritchie Torres#118th congress#rep. george santos#new york#brazil#Judaism#Holocaust#citigroup inc#goldman sachs#Baruch College#fraud#congressional ethics rules#congressional ethics violations#us capitol#us house of representatives#the new york times#new york post#nbc news

7 notes

·

View notes

Text

Antoni Trencsev, a Nexo társalapítója a CNBC-nek azt mondta, év közepére 100 ezer dolláros bitcoint vár, és arra is emlékeztetett, hogy míg a Dow, és a NASDAQ tőzsdeindexek 18 százaléknyit, az S&P 500 27 százalékot erősödött, addig a bitcoin árfolyama lekörözte a mutatókat, és 60 százalékot ment fel a járvány időszaka alatt. Trencsev szerint intézményi befektetők is felfigyeltek a kriptopiacra, ami nagy tőkebeáramlást hoz magával. Emellett véleménye szerint továbbra is megmarad az „olcsó pénz”, a likviditásbőség időszaka, ami szintén hajthatja a bitcoin árfolyamát.

(...)

A vélemények azonban messze nem egységesek, például a Sussexi Egyetem pénzügyprofesszora rendkívül pesszimista. Carol Alexander 10 ezer dolláros bitcoinnal számol az idén, ami azt jelentené, hogy a digitális eszköz esése nagyobb lenne, mint amennyit az elmúlt években összesen drágult. Úgy érvelt, hogy a kriptopiac szabályozásának elhúzódása és az extrém ármozgások miatt egyre kevesebben veszik majd a digitális eszközöket.

(...)

A Goldman Sachs sem zárja ki a 100 ezer dolláros bitcoint. Úgy vélik, ha a legnagyobb kriptoeszköz meg tudja őrizni értéktároló – menekülőeszköz – jellegét, akkor nagy tér nyílik a további emelkedésre.

Becslésük szerint a mostani árfolyamokon 700 milliárd dollár körüli a btc piaci kapitalizációja, azaz az értéktároló piac ötödét birtokolhatja, ugyanis a befektetésre rendelkezésre álló arany mennyiségét 2,6 milliárd dollárra becsülik. Ha ez az arány a feltevésük szerint 50 százalékra nőne az elkövetkező öt évben, akkor a 100 ezer dolláros árat is elérheti a bitcoin egysége.

via vg

A bitcoin 16500 $ áron zárta az évet, a piaci kapitalizációja per pillanat 326 mrd$. Még leginkább Carol Alexander találta el az árat, de azt ő is rosszul látta, hogy vissza fog esni az ár a 2021-22-es mánia előtti szintre.

2 notes

·

View notes