Text

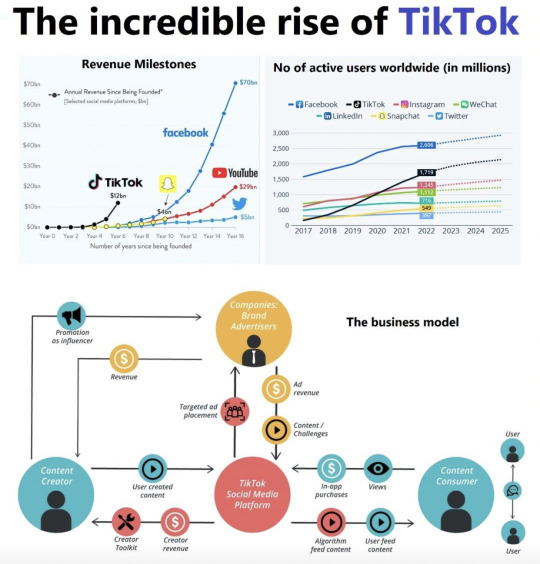

"Unveiling the Unstoppable Surge of TikTok: How This Global Phenomenon is Revolutionizing Social Media, Commerce, and Beyond!"

Diving Deep into TikTok's Unstoppable Revolution: Witnessing the Phenomenon That's Reshaping Social Media, Commerce, and More - A Must-Read Journey! TikTok's meteoric rise is not only reshaping the landscape of social media, but it's also ushering in profound cross-industry effects that extend into e-commerce, digital advertising, and payments, among other areas. Let's delve into this transformative phenomenon.

Initially introduced as Douyin by ByteDance in 2016, TikTok made its global debut in 2018 and has since established a presence in 154 countries, reaching a remarkable milestone of 1 billion users faster than any other social platform.

At its core, TikTok's success is rooted in simplicity: a video-sharing app that empowers users to effortlessly create and share short videos. Its standout feature, however, lies in its algorithmic prowess, which rapidly curates videos from its expansive database based on user preferences. Unlike conventional platforms, TikTok doesn't rely on established networks for virality, allowing anyone to achieve global recognition without an extensive follower count.

Statistics underscore TikTok's influence, with users dedicating an average of over 1.5 hours to the platform, primarily comprising Generation Z (individuals born between the late 1990s and early 2000s). In the #US, TikTok has become the premier video destination, outshining its social media counterparts. The emulation of TikTok's model by industry giants such as #Meta, #YouTube, #Pinterest, and Netflix is a testament to its disruptive impact.

Expanding beyond its humorous video content, TikTok is instigating paradigm shifts in various sectors. Notably, within digital advertising, projections indicate a substantial leap in TikTok's ad revenues, soaring from $13 billion in 2022 to $44 billion by 2027. Concurrently, TikTok Douyin's revenue in China is predicted to rise from $28 billion to $76 billion. By 2027, global online video advertising is set to generate over $331 billion, with TikTok commanding 37% of these earnings, equivalent to $120 billion. In comparison, the combined presence of YouTube and Meta is estimated at 24% or $77 billion.

On the e-commerce frontier, TikTok's foray into live shops embedded within user profiles (deployed in regions like the #UK, Southeast #Asia, and the US) enables in-app purchases, potentially paving the way for live-stream shopping to become a pivotal e-commerce trend. In #China, TikTok's direct in-app sales are substantially challenging established e-commerce titans like JD and Alibaba. Douyin's strategic focus on "interest e-commerce," driven by users' passions, signifies a multidimensional approach to consumer engagement encompassing short videos, livestreams, and searches.

This seismic shift reminds us that the world is evolving rapidly, surpassing some in its velocity of change.

Join me in uncovering the seismic shifts powered by socialmedia- from reshaping social landscapes to igniting a commerce evolution. Let’s ride this wave of transformation together! Don’t miss out – hit that follow button for more captivating insights. 🚀🔥

#TikTokRevolution #StayInformed #TikTokTransforms #SocialShiftsUnveiled #CommerceEvolution #TrendingTikTok #InnovationUnleashed #rtumovs #tumovs

2 notes

·

View notes

Text

🔥 Unveiling China's Economic Challenges: Dive into the Upheaval of the World's Second-Largest Economy! Don't Miss Out! 🌐

Beneath the bustling surface of the world's second-largest economy, China, lies a landscape of turbulence that has caught global attention. Let's delve into the riveting developments that have sent shockwaves through international markets:

• Amidst efforts to revive economic vigor, the People's Bank of China enacted a dramatic emergency rate cut on its MLF, descending to its lowest level since 2020. A bold move, but equities responded with a surprise sell-off.

• China's 10-year government bond yield echoes the hushed reverberations of the pandemic era, now resting at the lowest point since the 2020 outbreak.

• A stern government advisory to investment funds, warning them against adopting the role of net sellers in the Chinese stock market, reflects a desperate attempt to curb potential aftershocks.

• The dreaded specter of deflation looms; consumer prices, a cornerstone of economic vitality, experienced a staggering -0.3% year-on-year plunge. An alarming hint at possible global repercussions.

• The towering quandary of China's real estate domain remains unresolved, magnifying its significance as arguably the world's largest asset class.

• A harbinger of peril, China's second-largest real estate giant, Country Garden, teeters at the precipice of a potential onshore bond default. An eerie resonance with the Evergrande fiasco

• Chinese shadow bank, Zhongrong International Trust Co which manages $140 billion has missed payments on products because of liquidity problems, they are part of a $2.9 trillion shadow banking system.

• Pervasive skepticism takes root as a slew of investment banks downgrade their economic growth forecasts for China, casting a shadow over its economic trajectory.

• A stark and chilling portrait of China's economic health, as new loans for July skid to a gloomy low, reminiscent of the bleak days of 2009.

• The echoes of contraction resound through both exports and imports, painting a grim outlook for China's international trade landscape.

• The housing market crumbles, with July witnessing a remorseless tumble in home prices, amplifying concerns about the real estate quandary.

• A strategic shift unfolds as China's U.S. Treasury holdings plunge to their lowest ebb since 2009, replaced by the glint of gold and a newfound embrace of agricultural staples such as rice, wheat, maize, and soybeans.

• In an enigmatic twist, China's government retreats from revealing youth unemployment statistics, a decision that raises eyebrows and triggers whispers of concern.

As the giant grapples with internal fissures, its impact resonates far beyond its borders, leaving the world to watch with bated breath, pondering the ripple effects of China's convulsions on the global stage.

#ChinaEconomy #tumovs #rtumovs #reinistumovs #wkwgroup #wkw_group #GlobalMarketTurbulence #EconomicInsights #ChinaTroubles #EconomicShifts

Join the conversation and gain valuable insights! Share your thoughts and be part of the transformation. 🗣️🤝"

1 note

·

View note

Text

"Living the dream: Pomeranian style! 🐾 Napping in a stroller with legs out, mastering the art of relaxation. "

1 note

·

View note

Text

Exciting News in Open Banking! 🌐📊

Discover the Ultimate Strategy to Revolutionize the Financial Landscape! 📈🏦

Are you ready to unlock the power of Open Data Ecosystem Strategy? Dive into our latest article that deciphers key decisions in the world of #OpenBanking, #FinTech, and #Banking. 🌐💡

🔗 Read more: [m.facebook.com/story.php?stor…]

🔑 Partnerships 🌟 | 📊 Diversified Models 🌍 | 🕊️ Regulatory Harmony | 💰 Incentive Alignment

🏛️ Standardization & Governance | 🚀 Transition to Open Data | 📈 Regulatory Growth Catalysts

Join the conversation and gain valuable insights! Share your thoughts and be part of the transformation. 🗣️🤝

2 notes

·

View notes

Text

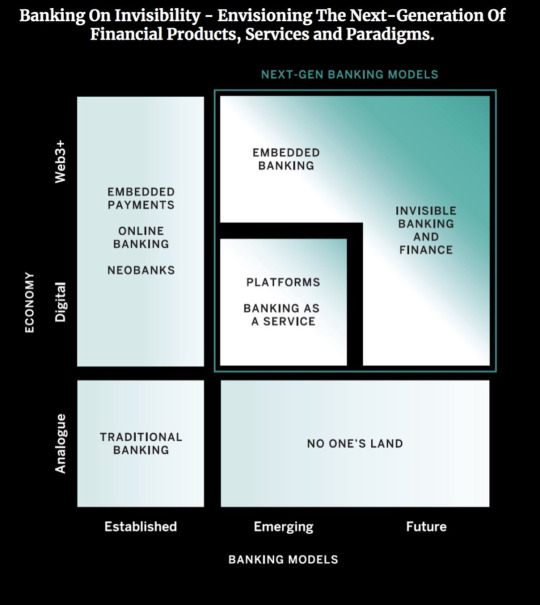

"Unlocking the Invisible: Pioneering the Future of Banking and FinTech"

Banking On Invisibility - Envisioning The Next-Generation Of Financial Products, Services and Paradigms

In the not-so-distant past, banks adorned prime locations along bustling streets. Today, their prominence is wavering, and a future looms where they might vanish even from our phone screens. Financial services are seamlessly intertwining with technology and various industries, almost fading into invisibility.

While the demise of traditional banking has been a recurring topic among pundits, the ascent of digital finance has unquestionably chipped away at the once-familiar brick-and-mortar bank. Yet, could digital finance merely serve as a transient bridge to a truly revolutionary era?

Open Banking has empowered diverse brands to embody financial institutions, seamlessly integrating loans, payments, payroll, and more into their existing offerings. The ongoing surge of consumer tech innovation merges the physical and digital realms in our daily lives, enabling us to transact effortlessly without fixating on the financial dimension. Departing a store, our purchases are automatically tallied and deducted; our smart devices autonomously place orders and process payments. Our bank accounts evolve into intelligent, automated allies, optimizing our savings journey.

Financial services, a traditionally conservative industry, are subject to rigorous regulation. While change may be gradual, its impact ripples across sectors, given money's fundamental role. This metamorphosis heralds fresh revenue avenues beyond finance's confines, catalyzing transformative repercussions.

Alternative operational models and revenue streams are sprouting across the financial landscape. Next-gen banking paradigms foretell an array of innovative products and services tailored for a world where industry boundaries blur or fade away.

The automotive industry's evolution from "car" to "mobility" exemplifies this shift, extending value chains beyond physical products and fostering broader interpretation. As financial and non-financial sectors intermingle, banking gains the ability to subtly infiltrate the subconscious, steering evolving customer expectations and novel competitive dynamics.

To thrive in this invisible landscape, banks must fathom customer needs, habits, and aspirations. Financial professionals must conjure the dual magic of becoming both unseen and all-seeing. An entirely novel form of finance beckons on the horizon—one abstract, seamless, and intrinsically interconnected.

#InvisibleFinance #FutureBanking #TechInnovation #FinancialEvolution #CustomerCentric #SeamlessTransactions #InnovationFrontiers #Innovation #Fintech #Banking #OpenBanking #OpenFinance #EmbeddedFinance #OpenAPIs #BaaS #BaaP #FinancialServices #CoreBanking #Payments #SaaS

1 note

·

View note

Text

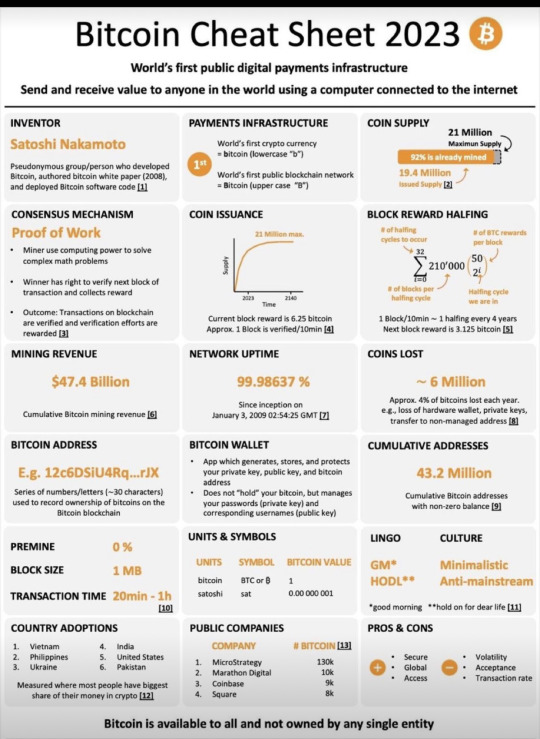

Bitcoin Cheat Sheet 2023

#tumovs#blockchain#тумовс#reinis tumovs#neobankers#crypto#defi#bitcoin#fintech#rtumovs#wkwgroup#crypto market

29 notes

·

View notes

Text

June 5th - SEC sues #Binance

June 6th - SEC sues #Coinbase

Who's next in line today? Tell us below 👇

1 note

·

View note

Text

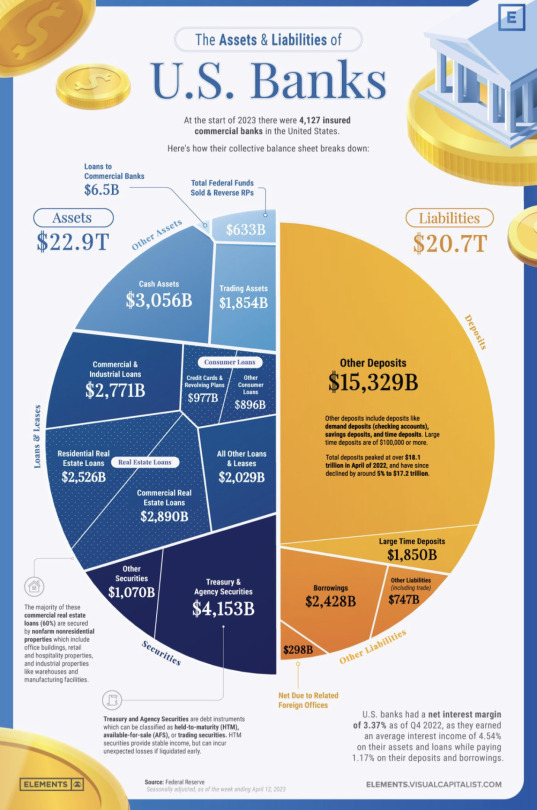

Visualizing the Assets and Liabilities of U.S. Banks

The U.S. banking sector has more than 4,000 #FDIC-insured banks that play a crucial role in the country’s #economy by securely storing deposits and providing credit in the form of loans.

This infographic visualizes all of the deposits, loans, and other assets and liabilities that make up the collective balance sheet of U.S banks using data from the Federal Reserve.

With the spotlight on the #banking sector after the collapses of Signature Bank, Silicon Valley Bank, and First Republic bank, understanding the assets and liabilities that make up banks’ balance sheets can give insight in how they operate and why they sometimes fail…

10 notes

·

View notes

Text

2 notes

·

View notes

Text

Bank-fintech partnerships have exploded in recent years! Instead of viewing each other solely as competitors, banks and fintechs are choosing to collaborate, working together to build and bring more innovative products to customers. The benefits of these partnerships are clear 🤝

⚡For banks: being able to adopt new technologies faster and cheaper than building them in-house.

⚡For fintechs: banks offer greater resources and the opportunity to reach thousands - perhaps millions - more customers around the world.

And for those customers, bank-fintech partnerships unlock more innovative ways for them to send, spend, and manage their money 💰💳However, these partnerships supported by BaaS providers could be under threat, as examples of companies falling down on compliance have inspired fresh regulatory scrutiny across the #US, UK and #Europe 🚫 Most recently in the #UK, BaaS provider Railsr is being monitored by the Financial Conduct Authority (#FCA) following concerns about the business’ health. Following emergency M&A talks, #Railsr now looks like it will be sold through pre-pack administration. This follows an investigation by Lithuania’s central bank over Railsr’s #AML failures. Regulators may increase oversight of partnerships facilitated by #BaaS providers, but there is a risk that what is in reality isolated incidents could lead to a backlash that makes bank-fintech partnerships appear far riskier than they are, and put banks and fintechs off of them for good ⚠️ Let's not forget that BaaS providers and early-stage fintechs already have limited and often stretched resources. Even for big banks with strong #compliance arms, partnerships may start to look like regulatory quagmires that suck up resources and nullify the biggest benefit of working with a fintech, which is making innovation faster and cheaper 💸💻 The truth is that regulation in its current form should prevent compliance failures and keep customers safe. 📌Regulators can help by providing specific lessons from incidents that allow all banks, fintechs and BaaS providers to revisit their compliance procedures with fresh eyes and make sure they have the tools in place to meet demands. This will give banks and fintechs the confidence to move forward with partnerships, and ensure that the industry and customers around the world continue to benefit from the products and services made possible by cross-industry collaboration in the years to come 🌎🌍🌏 Let's work together to make sure that bank-fintech partnerships continue to drive innovation and provide the best possible services to customers 🙌 _🤝 Dr. 𝐑𝐞𝐢𝐧𝐢𝐬 𝐓𝐔𝐌𝐎𝐕𝐒.

𝘗𝘭𝘦𝘢𝘴𝘦 𝘭𝘦𝘢𝘷𝘦 𝘤𝘰𝘮𝘮𝘦𝘯𝘵𝘴, 𝘴𝘶𝘣𝘴𝘤𝘳𝘪𝘣𝘦 𝘢𝘯𝘥 𝘧𝘰𝘭𝘭𝘰𝘸 𝘮𝘺 𝘯𝘦𝘸𝘴 𝘰𝘯 𝘮𝘺 𝘰𝘧𝘧𝘪𝘤𝘪𝘢𝘭 𝘴𝘰𝘤𝘪𝘢𝘭 𝘮𝘦𝘥𝘪𝘢 𝘱𝘢𝘨𝘦𝘴.

t.me/reinis_tumovs

facebook.com/TUMOVS

linkedin.com/in/tumovs

#tumovs #reinis_tumovs #rtumovs #rtgroup #тумовс #рейнис_тумовс

5 notes

·

View notes

Text

1 note

·

View note

Text

2 notes

·

View notes

Text

1 note

·

View note

Text

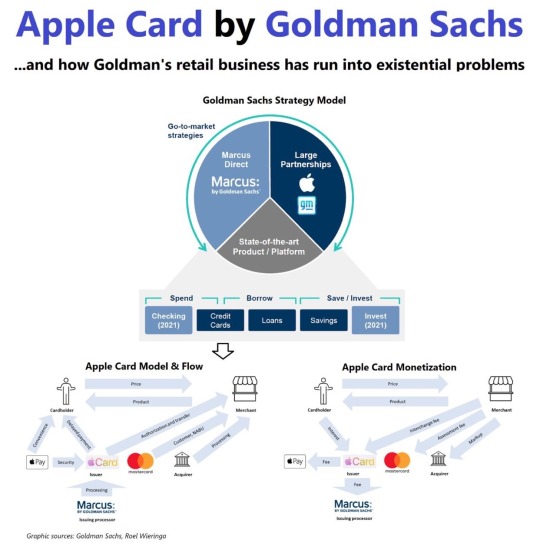

Goldman Sachs’ foray into consumer #banking in 2016 was quickly heralded as (and seemed to be) a great success. A few days ago, the bank announced an almost $3 billion loss from that business. Let’s take a look.

Despite the initial skepticism, Marcus proved a huge success: by 2020, Marcus was one of the fastest-growing #digital #banks in the US with more than $80 billion in deposits and $5 billion in loans.

Aggressive pricing, state-of-the-art #technology, reliable customer service and a well-known brand name count among the reasons for the rise. Markus’ success was twice important because - on top of commercial reasons - it exemplified one thing: how traditional financial institutions (Goldman was founded in 1869) can adapt to the #digital age and compete with #fintech players.

Several things have gone wrong:

1) Goldman’s overly aggressive pricing (to gain market share) during the boom years

2) Poor risk #management with more than 25% of card loans going to financially weak customers and a provision rate at subprime levels

3) Expanding defaults as a result of the deteriorating macro environment

4) Bad management decisions such as the one to merge (previously independent) Marcus with the wealth management segment

5) Service quality (i.e. disputes over chargebacks) not being able to keep up with an increasing customer base.

The credit card business is traditionally a hard one to crack, more so for newcomers even if they are called #Goldman_Sachs. And there seems to be no way back for what was once hailed as one the company’s biggest successes. Timing and bad management decisions have proven – once more – an unbeatable combination.

Reawd more, the full article at: 👉

Opinions: my own, Graphic sources: #Goldman Sachs, Roel Wieringa

____________________________

Please leave comments, subscribe and follow my news on my official social media pages: Telegram, LinkedIn, Facebook, Twitter, Gettr, Reddit, and Tumblr.

🤝 𝐑𝐞𝐢𝐧𝐢𝐬 𝐓𝐔𝐌𝐎𝐕𝐒. @reinis_tumovs

#tumovs #reinis #reinis_tumovs #rtumovs #rtgroup #тумовс #banker #neobanker #тумовс_банкир #tumovs_banker

#tumovs#wkwgroup#тумовс#fintech#defi#rtumovs#reinis tumovs#neobankers#goldman#goldman sachs#apple inc#apple news#apple card#bankers#bank#digital currency#digital#digital banking

7 notes

·

View notes

Text

Apple Card responsible for more than $1 billion in losses for Goldman Sachs.

Goldman Sachs submitted a regulatory filing today for its “Platform Solutions” group of businesses that includes Apple Card.

The collection of consumer offerings from Goldman is on track for a loss of $4 billion since 2020 with Apple Card making up more than $1 billion of that.

Reported by Bloomberg, the new performance details from Goldman’s Platform Solutions division paint a grim picture.

In just the first nine months of 2022, the businesses including Apple Card saw a pretax loss of over $1.2 billion.

Looking back to 2020 through the end of September 2022, those losses amounted to $3 billion. But when Q4 results of 2022 are included soon, the number is expected to be close to $4 billion.

The main cause of the losses is said to be from loan-loss provisions (when a bank sets aside money as an expense for future loans it expects won’t be repaid)

____________________________

Please leave comments, subscribe and follow my news on my official social media pages: Telegram, LinkedIn, Facebook, Twitter, Gettr, Reddit, and Tumblr.

🤝 𝐑𝐞𝐢𝐧𝐢𝐬 𝐓𝐔𝐌𝐎𝐕𝐒.

9 notes

·

View notes