#find investors

Text

How to attract investors in difficult times

Opinions expressed by Entrepreneur contributors are their own.

Whether the economy is doing well or you are in a phase of uncertainty, the fundamentals for building an investable startup remain the same. You don’t need to be a mind reader to determine what investors want to know.

Here are five tips to help convince potential investors that your solution solves a big problem for a big market and…

View On WordPress

#angel investors#Business ideas#Business models#business processes#Economic conditions#Employee Experience and Recruitment#find investors#fundraising#grow a business#growth strategies#investors#Launch Investors#Operations and Logistics#Pitching#Recession

0 notes

Text

This is your periodic reminder that I have a Dreamwidth account, you can follow me there, and if you are concerned about online privacy, don't want your data sold to advertisers or AI companies, and want to be safe from capricious banning and deletion, you should consider making a Dreamwidth account too.

#lace's personal stuff#no advertisers no ai no investors no corporate overlords#they've been keeping their budget in the black for 15 years on user donations#and no censorship or siloing of 'adult content'#if it is legal under US law you can post it#even if all you want is a place to link to for#'if we lose touch on other sites come find me here'#this is one place you can trust will still be there#dreamwidth

5 notes

·

View notes

Note

niku! for the fanfic trope ask game i'm so curious about flower shop aus!

HI BEEEEEE.

so flower shop aus. i think that. yes, yeah i would. but at the same time i would want to make sure i'd be leaning into flower language and such a lot so the thought of the research for that is.... cries. i hate research!!

as for who, hm... i'm not sure, and maybe it was looking at your name but... suguru as a flower shop owner... yes, i think that would be very nice, a nice existence for him.

[put a fanfic trope in my ask box and i'll tell you how likely i am to write it]

#ask games#bee tag#he finds the twins when he's sourcing suppliers#no one in the town wanted to take them in so he comes back with many flowers#gojo is there too because of course he is#maybe he's an investor LMAOOO#i cannot imagine gojo running any kind of adjacent store or anything#suguru's landlord#that would be the worst#i say that but i'm laughin

3 notes

·

View notes

Text

i’m gonna be real ya’ll: Life is not seeming to great rn and i’m really struggling to see the good things

#abc shut it#everything is bad all i hear is bad news#all the websites i use are switching to shitty paid models or just destroying their site from the inside out bc of investors#i feel so alone and out of the loop#it’s hard to see a point in being a live with everything#idk it’s hard trying to find a reason to stay alive when the world feels likes it’s on fire and i have to deal with it all alone

2 notes

·

View notes

Text

Well comrades, I think we all knew that something was going on since the news about making a deal with Capitalist poster child Amazon and now we know

What is there left to be said that most of us probably don't think already?

While I've no interest to wish ill upon the remaining workers of ZA/UM company, anything and especially everything Disco Elysium related from them is from now on is just investors whiping on the cash cow a little bit further and I've no interest in supporting them

It's also a bit sad to see so many people hoping Kurvitz & Co. found another studio to continue the journey. With the cultural association aka the creative minds going their (apparently) seperate ways? And ZA/UM as a company only having been possibly due to the investement (that backstabbed them), with the question of how they should find this second investement that does not want to exploit them? And with talent probably now being stuck with the old company?

I'm pessimistic that they will capture the lightening in the bottle a second time, but I wish Kurvitz still owns the rights to his story and do something, anything, with it and find other ways to gain a living out of it

Overall, F in the chat

#my ramblings#its a true fuckery this right here#and this is probably a situation that one can find in thousand variations across the game or even creative industries#also now I am conflicted in recommending the game#because the money now flows in the investors pocket probably#this is so depressing#disco elysium

18 notes

·

View notes

Text

people only now realizing mclaren doesn't treat their employees well trust me they've been like this for a while. having askew drive in indycar while he was concussed and then dropping him out of nowhere. paying their engineers a single freddo frog chocolate instead of actual pay when they implemented upgrades. everything that happened with stoffel and their lack of support for him.

#i also find it unsurprising that they value norris over ricciardo#his father has stakes in mclaren which is why they picked him up as a junior and zak brown gets money from his out of sport quadrant stuff#bcos of a deal. hes a decent driver with the money and connections to put him in a placement above another driver. hes loyal to the team#as one of his juniors and as the son of one of their investors and he stands as a profitable product even when he isnt racing#and drivers are products to these businesses. the same way an influencer turns themself into something sellable online#the companies who advertize them as personalities as well as drivers do the same#thats why they do the whole ''we're a family'' thing its another way to sell a product#any business tells you theyre like a family treats their workers like shit and expects way too much of them

13 notes

·

View notes

Note

u kno after the force awakens when they talked about how many chewbacca costumes they had to make because everyone wanted to hug him so much he just disintegrated? that would be a life size ludo with me.

so true we would single handedly disintegrate that puppet !! the fact that nobody has made giant ludo plushes is insane like those giant stuffed bears y’know. This would make millions I don’t understand how it’s been 35 years and it hasn’t been done

2 notes

·

View notes

Text

.

#I remember this theory going around that fatin's parents were investors in the experiment#and you know what--i don't like that#not saying that it couldn't be true but like#the way i hc the family -- I don't think they'd do that to fatin#I think fandom...esp western fandom...has this fantasy of just burning the bridges of the family that hurt you#and i think that's what people want to do with fatin and her family#and to do that they want to make fatin's parents do something irredeemable#but i don't think fatin's mom would do that to her#Fatin's dad I'm not sure--because we saw him through the eyes of fatin so we both have no idea how deep his darkness may be#but I don't think her mom would do that#she's the typical Asian dragon mom--she almost breaks her daughter in her effort to perfect her#but it's from a place of love#and im not saying that Fatin has to make peace with her for how hard she drove her; or for not defending her after daddygate#but I think her mom would be horrified to find out what her daughter had to go through on that island#i just can't get over how tenderly fatin looked at her when she saw how broken she was--how her heart sung out to her#i can't get over how when Leah broke down and cried about missing her mom... fatin cried too and thought about hers

2 notes

·

View notes

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

34K notes

·

View notes

Text

Project Serenity - 33% Life-time Commissions

Digital - membership area

#Finding Financial Peace with Project Serenity: A Membership Worth Exploring#Financial planning can be a daunting task#especially in today's ever-changing economic landscape. For years#I felt overwhelmed by investment options and unsure of how to navigate the complexities of the financial world. This is where Project Sere#A Curated Approach to Financial Education#Project Serenity is a digital membership area designed to empower individuals to take control of their financial futures. The platform pro#including insightful articles#informative webinars#and interactive workshops. These resources cover a wide range of topics#from investment fundamentals and portfolio diversification to wealth-building strategies and navigating the ever-evolving world of finance.#Expert Guidance for Informed Decisions#What truly sets Project Serenity apart is its focus on expert guidance. The platform offers insights from seasoned financial professionals#wealth managers#and experienced investors. Their knowledge and experience provide members with a valuable framework to make informed financial decisions#A Supportive Community for Shared Growth#Project Serenity fosters a supportive and collaborative environment. Members can connect with each other through online forums and discuss#ask questions#and learn from one another's financial journeys. The sense of community is valuable#especially for those who might feel lost in the world of finance.#Building a Brighter Financial Future#Since joining Project Serenity#I've gained a newfound confidence in managing my finances. The platform's educational resources have equipped me with the knowledge and too#Important Disclaimer: This review is for informational purposes only and should not be considered financial advice. It's crucial to condu#Overall#Project Serenity offers a valuable resource for anyone seeking to improve their financial literacy and build a secure financial future. I#expert guidance#and a supportive community make it an excellent choice for individuals at any stage of their financial journey.

1 note

·

View note

Text

youtube

i'm so glad this hasn't been deleted, it's one of the best and funniest things on the internet. every line of this is pure gold and an instant quote. and THAT ending? *mwah* masterclass

EDIT: HOW COULD I NOT NOTICE THE FRAMED PICTURES BEHIND HIM FROM HIS BOXING VICTORIES AGAINST HIS CRITICS

#'my movie's 10 times better'#'goodbye investor fuck yourself i will find another retarded chinese alibaba'#'i'm one of you i'm jenny from the block'#best thing he's done hands down#uwe boll

0 notes

Text

Top Tips for Working with Venture Capital Firms in India

The Indian startup ecosystem is booming. With a young, tech-savvy population and a rapidly growing economy, India presents a goldmine of opportunities for entrepreneurs. However, securing funding remains a crucial hurdle for many startups. This is where venture capital firms in India come in, acting as investment partners and providing the fuel to propel your venture forward. But how do you navigate the world of VC and build a successful partnership with these firms?

Here are some top tips to help you work effectively with venture capital firms in India:

1. Do Your Homework: Before approaching any VC firm, it's vital to understand their investment thesis. Every firm has specific sectors, stages of growth, and deal sizes they focus on. Researching their portfolio companies and past investments will give you valuable insights into their preferences. This targeted approach demonstrates respect for their expertise and increases your chances of securing a meeting.

2. Craft a Compelling Story: Investors are not just funding a business; they're backing a vision. Your pitch deck and presentations should tell a compelling story about your startup. Clearly articulate the problem you're solving, the unique value proposition you offer, and the market opportunity you're addressing. Focus on the "why" behind your business and how it will disrupt the existing landscape.

3. Know Your Numbers: Investors are looking for solid financial projections and a clear understanding of your revenue model. Prepare a well-defined financial plan that showcases your projected growth trajectory, burn rate, and potential for profitability. Be prepared to answer questions about your unit economics, customer acquisition costs, and funding requirements with confidence.

4. Build a Strong Team: A strong founding team is paramount for any startup. Investors want to see a passionate, experienced, and complementary team with the skills necessary to navigate the challenges and opportunities ahead. Highlight the diverse skillsets and domain expertise each team member brings to the table.

5. Demonstrate Traction, But Be Realistic: While early-stage startups might not have massive revenue figures, demonstrating traction through user growth, pilot projects, or other early validation metrics is crucial. This shows investors you're not just an idea on paper, but a venture with a proven concept and the potential to scale. However, be realistic about your stage of development and avoid overpromising on metrics you haven't achieved.

6. Network Like Crazy: Building relationships within the startup ecosystem is vital. Attend industry events, conferences, and workshops to connect with other entrepreneurs and potential investors. Network with mentors, advisors, and industry professionals who can provide valuable guidance and introductions to relevant VC firms.

7. Be Prepared for Due Diligence: Once you secure an initial meeting, be prepared for a thorough due diligence process. This may involve a deep dive into your financial records, legal documents, and market research. VC firms will want to assess the feasibility of your business model and identify any potential risks. Transparency and open communication are key during this stage.

8. Negotiate with Confidence: Terms are negotiable, so be prepared to discuss the investment details with confidence. This includes aspects like valuation, deal structure, board representation, and liquidation preferences. Research industry benchmarks and consult with advisors to ensure a fair and mutually beneficial agreement.

9. Build a Long-Term Partnership: The relationship with a VC firm doesn't end after the money is secured. View them as strategic partners who can offer valuable mentorship, industry connections, and support throughout your growth journey. Keep them informed of your progress, milestones achieved, and any upcoming challenges.

10. Find the Right Fit: Choosing the right venture capital firm is as important as securing funding itself. Look for firms that not only align with your investment needs but also share your vision and values. An ideal VC firm should be a value-added partner, providing guidance and support beyond just capital.

How to Find Investors for Startups in India - How to find investors for startups in India, can be a daunting task. Numerous firms operate across various sectors and investment stages. Platforms like Krystal Ventures Studio can be instrumental in connecting startups with relevant investment partners. Krystal Ventures Studio acts as a bridge, fostering meaningful connections between startups seeking funding and venture capital firms looking for promising ventures to support.

By following these tips and leveraging resources like Krystal Ventures Studio, you can significantly improve your chances of successfully working with venture capital firms in India and securing the funding your startup needs to thrive. Remember, building a successful startup is a marathon, not a sprint. With dedication, perseverance, and the right investment partners by your side, you can turn your innovative idea into a flourishing business that makes a real impact.

#how to invest in startups for equity#tech startups to invest in#how to find investors for startups in india

0 notes

Text

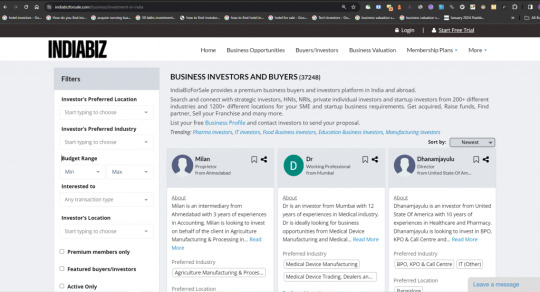

How To Find Investors For Business? - Here's the ultimate list

Over 11 years, we’ve cultivated a network of over 37,700 active business investors. Thousands of business owners/startup founders to connecting with potential investors/buyers or partners by their own to get funded/exit in the fastest and easiest way possible.

Locations Based Business Investors in India

We know how crucial your time is. So, we made location based business investors list below to help you find the right matches instantly.

So with less effort, you can click in only that fits your preferences and initiate the connection with the right potential investor matches;

1653 business investors in Andhra Pradesh Andhra-Pradesh

303 business investors in Arunachal Pradesh

350 business investors in Assam

502 business investors in Bihar

437 business investors in Chhattisgarh

905 business investors in Goa

2731 business investors in Gujarat

1486 business investors in Haryana

757 business investors in Himachal Pradesh

464 business investors in Jharkhand

2832 business investors in Karnataka

1130 business investors in Kerala

1021 business investors in Madhya Pradesh

3638 business investors in Maharashtra

273 business investors in Manipur

275 business investors in Meghalaya

274 business investors in Mizoram

272 business investors in Nagaland

456 business investors in Orissa

885 business investors in Punjab

1105 business investors in Rajasthan

300 business investors in Sikkim

2404 business investors in Tamil Nadu

1366 business investors in Telangana

283 business investors in Tripura

1425 business investors in Uttar Pradesh

813 business investors in Uttarakhand

970 business investors in West Bengal

Business Investors Based on Union Territories

972 business investors in Chandigarh

3894 business investors in Delhi

290 business investors in Diu

517 business investors in Pondicherry

281 business investors in Andaman Nicobar

335 business investors in Jammu and Kashmir

100 business investors in Dadra-and-Nagar-Haveli

1539 other business investors in India

Industry Based Business Investors in India

During our 11 years of journey, we came to know that, for business owners (like those like you who are looking for right partner/investor) are more focusing on specific business based matches.

So here, we make a list based on major industry based investors for you to get stated with;

2738 Agriculture business investors in India

1230 entertainment business investors in India

3877 automobile business investors in India

4376 services-based business investors in India

2241 real estate and construction business investors in India

2136 finance business investors in India

6852 healthcare and pharmaceutical business investors in India

11676 hotel and restaurant business investors in India

5220 IT/Tech business investors in India

9281 manufacturing business investors in India

3501 personal care business investors in India

5875 retail/wholesale business investors in India

1613 travel business investors in India

3141 utilities & energy business investors in India

4517 education business investors in India

5864 startup investors in India

480 media and broadcasting business investors in India

5244 franchise business investors in India

Above all industry-based investors list may go beyond the total of 37,700 networks as many investors have multiple industry preferences. For example one of our Investor (Saurabh) from Indore, is open to investing in IT, Food, Agriculture, and Pharmaceutical businesses.

So, you can find your potential matches and close your fundraising or M&A deal straight away.

Best of luck!

Source: https://indiabizforsale.com/blog/37700-investors-to-contact-for-your-business-in-india

#how to find investors#how to find investors for business#how to find investors for startups#business investors network#37700 private investors#indiabizforsale#fundraising opportunities

0 notes

Text

OS RESIDENTIAL PROPERTIES

OS Residential Properties specializes in bespoke property sourcing for busy professionals and investors in UK and overseas. We work to your requirements to help you acquire the best properties with the best returns legally, professionally and compliantly.

#companies that buy houses in london#find a buyer for my house london#find an investor to buy my house in london#guarantee property management london#guaranteed rent for landlords london.

0 notes

Text

How to Get the Right Investor for Your Startup

Today, in this blog, we will concentrate on finding investors and the best way to determine the investors you want to spend your time with. In this series, we started by figuring out the amount of capital your startup needs by making a calculation of the runway for your startup. We then looked at the advantages and disadvantages of the various sources of financing. Then, we took an examination of the venture capital market and startups' funding rounds. We also discussed properly dividing your equity among advisors, employees, and co-founders. Suppose you've made the decision to get venture capitalist (VC) funds and are considering raising VC funds. In that case, it's time to be practical and determine how to locate the most suitable investors on the proper terms.

Visit us:

#Right Investor#find Right investor#ios app development#app development#best iphone app development#blockchain application development#ui and ux design service#iot development services#web development

0 notes

Text

CEO Bucky takes his anger out on his secretary (ft smut)

Imagine CEO!Bucky accidently taking his anger out on his already stressed out secretary. He gets mean and you will deal with it because I wanted this angst turned smut to go from chest itching to stomach fluttering.

-

Your stomach twisted in knots looking at the pile of papers you had stacked on your desk, the phone still ringing while new messages popped up in your email inbox every 5 minutes. The files had to be organized by the next meeting and the number on the phone display was one you couldn’t ignore. The back to back messages were from various investors, each person insisting they were a priority over the others. You kept the receiver between your ear and shoulder, your hands flying around your desk madly between papers and tapping your keyboard.

You quickly added a few more meetings to the calendar before hurrying to your bosses office to remind him of one he had later that afternoon. You hesitated before knocking at the door, the closed doors indicating he was busy, but you knew he’d want a heads up about the meeting.

“Mr. Barnes, you have a meeting with Stark Enterprises at 3:30-

“Didn’t I tell you to move this meeting to next week?” Bucky snapped, blue eyes glaring at you while you blinked in confusion. “Well?”

“N-no” You shook your head, you’d never missed an email before and you’d always been on top of scheduling changes on time. Bucky mumbled something under his breath before waving you off, the shrill sound of his phone going off.

“Barnes” Bucky grunted, answering the phone without looking back at you, leaving to you scramble away and figure out if you could rearrange the date with Tony Stark.

Which was a mess in itself.

You had to argue back and forth, pleading to no end for a different day with Starks assistant only reluctantly agreeing after nearly half an hour.

“You really should be more responsible, can’t believe Barnes has the likes of you working under him” the woman on the phone clicked her tongue before slamming down the receiver, cutting the call. You sighed, taking in a deep breath to calm the tightness you felt in your throat, you didn’t have time to break down now.

You printed the up coming contracts for Bucky to sign, organizing them by name and highlighting the places he had to sign so he didn’t have to bother finding the space for signatures. You scurried back into his office, dreading the tense click of his jaw, your nerves increasing even more.

“Sir, these are your papers-” You stumbled over the corner of the rug, scattering the papers onto the floor, your heart hammering out of your chest when you saw Bucky irritatedly run his fingers through his hair.

“For fucks sake, y/n, I’m already stressed, don’t screw more shit up!” He growled, eyes hardening at the sight of the papers strewn across the floor of his office while you stayed frozen on the spot. Your eyes glossed over, quickly scrambling to the floor to grab the documents, mumbling apologies over and over again, hoping none of your tears stained the paper. The sight of tears streaking down your face broke Bucky out of his frustrated state, instantly regretting the tone he’d used with you.

“Fuck” Bucky cursed under his breath, getting out of his chair to help you but you’d already managed to pick everything up, immediately trying to scramble away.

“Y/n”

You didn’t stop, unable to take more of Bucky’s wrath, continuing to hurry towards the door, desperately trying to hold down your sniffles and aggressively wiping your cheeks.

“Y/n”

Bucky sighed, gently reaching out to grab your arm and pulling you to face him, his feeling even worse when you kept your eyes trained on the floor, your arms wrapped around yourself.

“I’m sorry, p-please d-on’t yell” You choked out, still trying to hold your composure together, fighting the way your body wanted to break down into sobs

“It’s okay. I’m sorry, I’m sorry” his heart broke seeing the tears collecting in your lash line, his thumb swiping away the ones that spilled out. “M’sorry baby” he wasn’t sure where the pet name came from but he couldn’t help it, letting it naturally roll off his tongue. You were still rigid, refusing to look at him, nearly flinching when he pulled you closer, tilting your chin up to meet his steel blues.

“Look at me” He spoke softly now, as if he were trying to coax a small animal out of hiding, his touch gentle, “I’m sorry, I shouldn’t have yelled at you”

“It’s okay” you shrugged, slipping out of his hold, quickly wiping your face and going back to work as if nothing had happened. Even though he’d apologized, his words rang through your mind for the rest of the day.

In fact, they stuck with you through the entire week.

Bucky hated the way you didn’t even look at him anymore. He missed your soft good mornings and shy smile whenever he walked into his office. Now all you did was keep your head down, freezing in fear as soon as you heard his footsteps. And it was all his fault.

He despised that he made you feel scared of him, his own anger being the cause of upsetting you when you had been nothing but sweet from the day he’d met you. You were also the best he’d ever had; no one else had ever come close to how brilliantly you worked; you never missed anything. He nearly spat out the coffee that was placed on his table, missing the perfect cup you made for him every morning.

You only spoke 1-2 words, retreating from his office as soon as you got what you needed, your eyes always trained on the floor, looking away from him. He couldn’t take it anymore, feeling more guilty each day; he couldn’t go on any longer without your sweetness.

You blinked at the baby pink roses that sat in a basket on your desk along with a little bear placed on top, a small hand made I’m Sorry heart sitting in its furry hands, clearly in Bucky’s handwriting. You traced over the soft teddy holding it in your hands before going to his office. Before you could say anything, Bucky was up and out of his seat, desperately hoping you’d hear him out.

“M’sorry y/n” His soft eyes were filled with sadness and regret as he reached out to hold your hands in his, not wanting you to run off again, “I’m so sorry angel, there’s no excuse, I shouldn’t have yelled at you”

“It’s fine” You whispered, still avoiding his gaze.

“Hey, it’s not fine” Bucky shook his head, cupping your face to make you look at him, “It’s not baby, I shouldn’t have ever treated you that way. You do everything for me, I shouldn’t have taken out my anger on you”

“I shouldn’t have messed u-

“Don’t, absolutely not. You never do sweets, it was me who messed up. Never you. Will you forgive me, doll?” Bucky nervously bit his lip while you gave him a small nod, that adorable shy smile he loved so much making its way to your lips.

“God, I missed this” He whispered, his thumb tracing over your lips, chuckling at the tiny confused pout you gave him after.

“What did you miss”

“This little smile you always have whenever you’re around me” Bucky smirked at the way you grew more bashful, doe eyes darting about, “Do you have any idea how much I love when you look at me like that?”

“Mr-Mr. Barnes” Your breath hitched in your throat as his hands slowly moved to hold your waist, pulling you closer. Your hands made their way to his chest to ground yourself, forgetting how to breathe as he pressed his lips against yours. It started off soft and slow; his sweet tongue turning sinful as he walked over to his chair, pulling you to straddle him without breaking apart once. You let out a needy whimper feeling him harden under you though Bucky was still focused on kissing your soft skin, his lips fluttering across every inch.

You’d never been this close to Bucky before, the intoxicating scent of his cologne making your heart race, his calloused large hands roaming your body. You hadn’t even realized you were grinding down on his thick bulge until he let out a groan, stilling your hips.

“Keep that up bunny and you’ll make me cum in my pants like a little boy” Bucky let out a strained chuckle, using every bit of his self restraint not to tear your clothes off.

“Please?” You wiggled against him again, needing to be closer, Bucky’s resolve slowly crumbling. How could he hold back when you were practically humping your soaked needy cunt right on his erection.

“Please what, sweets”

“Need you Sir” your voice had melted in a whine and that was all it took. The sound of his belt buckle hitting the floor caused more arousal to dampen your panties, nearly drooling at the sight of his cock as he pulled it out.

“Are-are you sure?” He checked with you once more, not wasting a second ripping your blouse off as soon as you nodded. He threw your bra off next before lifting your skirt up and pulling your panties to the, rubbing his fingers through your folds.

“Sir, pleasee”

“I got you, I got you baby. Wanted to make love for our first time angel, give you a bed with rose petals n’ champagne over ice” He whispered, recounting every fantasy he’d thought of from the day he’d met you, “Wanted to make you feel good baby, throw your legs over my shoulders and nurse off this little clit”

He rubbed your sensitive bundle of nerves, continuing.

“N’ then you’d be my sweet pillow princess. I’d let you lie down all night while I fuck your soul angel. I’d give you my cum all night, pump you full of my cream”

“Need you now” You whimpered, clutching onto the lapels of his blazer, not that you didn’t want everything he was telling you but you couldn't wait.

“Alright baby, c’mere” He pulled you closer, your bare chest pressed against his as he rubbed his swollen cockhead to gather your slick before breeching your tight hole, his hips gently pushing up till he was buried to the hilt, “That’s it, shhh take all of me”

Bucky gave you a second to adjust to his size, his wide hands splayed across your body to hold you in place as he began to thrust up. You gasped in pleasure, your voice melting into a moan as he picked you up and placed you on his desk, pushing your thighs to hit your chest, hitting an even deeper angel.

“OH GOD-MR-BARNES” You wailed as he fucked you harder, his heard thrown back, tie loosened, tightening the grip he had on your legs, keeping you spread out wide open. He groaned at the sight of his thick cock disappearing in and out of you while you moaned and sobbed on his desk, taking everything he gave you.

“That’s right baby, say my name, let everyone know who makes you feel this good” He grunted through gritted teeth, holding off his orgasm while bringing his thumb to rub your clit again.

“I-I’m gonna-OH-GOD-PLEASEE

“Fuck you sound perfect” Bucky moaned feeling you choke his length, fluttering and pulling him deeper as your orgasm washed over you, his own release dangerously close. “God you feel so fuckin’ good when you cum baby. One more angel, just one more” Bucky practically pleaded with you, speeding up his fingers till he saw your eyes roll back, silent screams leaving your mouth as your juices soaked his balls.

“Fuck m’cumming so hard for you baby” He groaned, giving you a few more sloppy thrusts before stilling and spilling ropes of cum into you. He kept his cock inside while bending down to pick you up and sit back in his chair again. He sat with you for a while, petting your hair and kissing you, whispering sweet nothings.

“Ready to go?” He whispered, looking down to see if you’d fallen asleep while you snuggled into him with your eyes closed.

“Too tired sir” You pouted, nuzzling into his chest, refusing to move, your body too fucked out to even stand.

“I got you baby” Bucky smiled, shrugging off his blazer and wrapping you up before carrying you away in his arms, ready to take you home, right where you belonged “Gonna make love to my pretty girl”

#bucky barnes angst#bucky barnes#bucky barnes smut#bucky barnes x reader#bucky barnes x you#bucky barnes x reader smut#bucky x you#bucky x smut#bucky x y/n#bucky x reader#bucky x Female Reader#bucky x f!reader#bucky x fluff#James Buchanan Bucky Barnes#james bucky buchanan barnes#james bucky barnes#james buchanan barnes#ceo bucky#ceo!bucky#ceo bucky barnes#ceo bucky smut#ceo bucky barnes smut#ceo bucky x secretary reader#bucky x secretary#bucky barnes imagine#bucky imagine#bucky fanfic#bucky fan fiction#bucky fan fic#bucky barnes fanfiction

10K notes

·

View notes