#Small Business Owners

Text

Hi, I have some experts at website designing and would like to help a few business owners in designing or redesigning their websites.

Guess what? They are affordable.

If interested, inbox me now, I can link you up.

Regards,

Tobby.

#small business#wix#shopify#ecommerce#business growth#small business owners#photography#jewelry#clothing store#notary services#lawn care#lawn & garden#realestate#realtor#authors#author#interior design#kajabi#thinkific#wordpress#elementor

6 notes

·

View notes

Text

If you care about artists… don’t post AI, don’t post artists work without credit. If you love an artist, buy stuff from them on Etsy, Shopify… or tip them on kofi etc. Support them on Instagram, TikTok by reposting their posts. Most of us are working hard to have time to create anything we love in the face of… all this.

1 note

·

View note

Text

Why Outsourcing Content Writing for Your Small Business is A Great Idea

It’s not uncommon for businesses to start small. In fact, there are many cases where it is a one-man shop who handles every single aspect of the business operations for years, if not indefinitely. As a result, business owners will tackle daunting tasks like accounting, finance, marketing, product development, and lead generation.

The good thing is that with enough perseverance and a quality…

View On WordPress

#blog#blog writing#business ghostwriting#business operations#business outsourcing#business tips#content marketing#content marketing strategy#content writing#content writing tips#ghostwriting#marketing#outsourcing#small business#small business owners#small business tips#social media content

4 notes

·

View notes

Link

I just published on FractalMax Blog

#entreprenuerlife#entrepreneurship#onlinebusiness#online business#Online Business Success#business#Small business#start a business#Small Business Owners#business owner#business owners#small business owner#affiliate marketing#affiliate marketer

15 notes

·

View notes

Text

Business coaching,Graphic designing

2 notes

·

View notes

Text

এডিটর ইন চিফ রাজা গুহ 087774 71298

www.tollymag.com

International Group of Institutes

for Management & Studies

State Bank of India

A/C No. 42792705121

IFSC. SBIN0006145

MICR. 700002066

MSME REGD. UDYAM-WB-10-0114223

সব ধরণের রেজিস্ট্রেশন, রিনিউ ও অডিট করা হয়।

এখানে পাত্র/পাত্রী অনুসন্ধান, প্রতারণা, ক্রেডিট কার্ড/

লোন সেটলমেন্ট, জমি সমস্যা, ভাড়াটে উচ্ছেদ, বাড়ি/ফ্ল্যাটের সার্চিং, ট্যাক্স, মিউটেশন, রেজিস্ট্রি, ডিভোর্স, ট্রেড লাইসেন্স, ফুড লাইসেন্স, ITR, GST, TDS, E Filling, Co Reg, P Tax, Payroll, NGO, ট্রাস্ট,সোসাইটি, লোনের পেপার, জমি, ফ্ল্যাট, বাড়ি ,ভাড়া/ক্রয়/ বিক্রয় সংক্রান্ত, KMC Related Matter এবং সমস্ত সিভিল/ক্রিমিনাল C.D.F/D.R.T কেসের কাজ করা হয়।

স্যার রাজা গুহ : 087774 71298

Other Services - NGO, ট্রাস্ট, ক্লাব, সোসাইটি, সমিতি, ইউনিয়ন , বৃদ্ধাশ্রম, মন্দির, পূজা কমিটি, শিক্ষাকেন্দ্র, কম্পু কেন্দ্র , 80G, 12AA, FCRA, MSJE, MSME প্রজেক্ট রিপোর্ট, Company (Partnership/LLP/Pvt. Ltd/OPC), Micro-Finance, Nidhi Company, Import & Export Code, #trademark, Patent, Copyright, #ISO Certificate, Food License, Trade License, Drug License, #GST, #TDS, P.Tax, ROC Compliance.

#ITreturns#auditt#bookkeeping#incometax#GST#TDS#TallyERP9#msexceltips#society#trust#loanservices#tradelicence#FSSAI#loans#BusinessLoans#LoanSettlement#qrcodes#legalsupport#taxconsultant#lawfirm#LegalSolutions#DSC#realestateagent#RealEstate#taxresolution#TaxConsultation #financialwellness #ExpertGuidance #accounting #incometaxreturn #tdsrefund #smarttaxplanning #ClaimYourBenefits #consultationhub #taxreturn #project #gstreturn #taxiservice #taxaudit

#Overwhelmed by Debt#Unemployment or Underemployment#Unexpected Expenses#Recent Graduates#First-time credit card Borrowers#Middle Income Families#Parents with College-aged Children#Fixed Income Retirees#Business-related Debt#Poor Credit History#High Debt-to-Income Ratio#frequent late payments#high credit card utilization#Small Business Owners#Individual Taxpayers#Freelancers and Independent Contractors#Real Estate Professionals#High Net Worth Individuals#Expatriates#Financial Advisors#Corporate Clients#Customers Researching Mortgages#Administrative Services#Sales and Management professionals#Army#Govt employees#Entrepreneurs#Startups#Business#Business Professionals

0 notes

Text

Top Small Business Grants in Arizona 2024: Access Funding Now

Arizona small business owner! Running a business is tough, and sometimes you just need a little boost to get things going. The great news is there are grants out there specifically designed to help Arizona businesses like yours. This post will walk you through some of these grants, how to apply, and even what to do if you don’t snag the funding this time around. So whether you’re just starting…

View On WordPress

#500 employees#arizona business startup grants#arizona grants for small business#arizona small business grants#business development#business grants arizona#city of phoenix#economic development#financial assistance#funding sources#grant application#grant program#grants for small business in arizona#grants in arizona#local first arizona#maricopa county#minority owned businesses#minority small business grants arizona#small and micro businesses#small business administration sba#small business grants#small business grants az#small business grants in arizona#small business grants phoenix#small business loans#small business owners#small business start up grants arizona#small businesses in arizona#start up business grants arizona#state government

0 notes

Text

How Online Auctions Are Empowering Small Business Owners?

Online auctions in MN are empowering small business owners by providing access to a global marketplace where they can purchase equipment, inventory, and supplies at competitive prices. These auctions offer convenience, flexibility, and cost-effective solutions for acquiring essential assets without the need for extensive travel or physical presence. By leveraging online auctions, small business owners can access a diverse range of products, expand their capabilities, and remain competitive in their respective industries.

#online auctions#empowering#small business owners#auctions#auction company#online liquidation auctions

0 notes

Text

Navigating the Complexities of Health Insurance: Expert Advice for Small Business Owners

For small business owners, navigating the complexities of health insurance can be a daunting task. Balancing the well-being of employees with the financial constraints of a small business requires strategic decision-making. This article provides expert advice to help small business owners make informed choices when it comes to health insurance, ensuring both the health of their workforce and the sustainability of their enterprises.

Understand the Basics of Health Insurance: Before diving into specific plans, business owners must grasp the basics of health insurance. Familiarize yourself with key terms such as premiums, deductibles, co-pays, and coinsurance. Understanding the fundamentals lays the groundwork for making informed decisions and effectively communicating with insurance providers and employees.

Assess the Needs of Your Workforce: Every small business has a unique workforce with varying healthcare needs. Conduct a thorough assessment to understand the health requirements of your employees. Consider demographics, potential health risks, and the preferences of your workforce. This insight will guide you in selecting a health insurance plan that aligns with the specific needs of your team.

Explore Different Plan Options: Health insurance plans come in various forms, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs). Each has its advantages and limitations. Consult with experts offering health insurance companies in PA to explore different options and find a plan that suits both your budget and the healthcare needs of your employees.

Consider Cost-Sharing Strategies: Small businesses often face budget constraints when it comes to offering health insurance. Explore cost-sharing strategies to strike a balance between providing valuable coverage and managing expenses. Options such as sharing costs with employees through premium contributions, co-pays, and deductibles can help distribute the financial burden effectively.

Stay Informed about Regulatory Changes: Health insurance regulations are subject to change, and staying informed is crucial for compliance and optimal decision-making. Keep abreast of updates to healthcare laws, tax incentives, and any changes that may impact the offering and administration of health insurance for small businesses.

Engage with Insurance Brokers and Agents: Utilize the expertise of insurance brokers and agents who specialize in small business health insurance. These professionals can provide valuable insights, help navigate the complexities of different plans, and assist in negotiating the best possible terms. Establishing a collaborative relationship with insurance experts ensures that you have access to the most up-to-date information and personalized advice.

Communicate Effectively with Employees: Clear communication is key when introducing or updating health insurance plans. Ensure that employees fully understand the details of their coverage, including premiums, deductibles, and any changes to the plan. Transparent communication fosters trust and helps employees make informed decisions about their healthcare.

Explore Employee Wellness Programs: Investing in employee wellness programs can complement your health insurance offerings. These programs promote preventive care, encourage healthy lifestyles, and contribute to overall workforce well-being. Some insurance plans may offer discounts or incentives for participating in wellness initiatives, providing a holistic approach to employee health.

Evaluate Telehealth Options: Especially in the current landscape, telehealth has become a valuable component of healthcare delivery. Evaluate health insurance plans that offer robust telehealth options, providing employees with convenient access to medical consultations and reducing the need for in-person visits.

Regularly Review and Adjust Plans: The healthcare landscape is dynamic, and the needs of your workforce may evolve. Regularly review your health insurance plans and be prepared to make adjustments. This could involve renegotiating terms with providers, exploring new plan options, or incorporating additional benefits based on feedback and changing healthcare trends.

Navigating the complexities of health insurance requires a strategic and well-informed approach. Small business owners can leverage expert advice, stay informed about regulatory changes, and tailor health insurance offerings to the unique needs of their workforce. By carefully assessing options, communicating effectively with employees, and staying adaptable in the face of evolving healthcare landscapes, small business owners can provide valuable health coverage while ensuring the financial sustainability of their enterprises.

0 notes

Text

E-commerce Solutions for Small Businesses

Nowadays, small enterprises are increasingly turning to e-commerce solutions as a means to not only survive but thrive. These tailored digital platforms offer small businesses a competitive edge by providing a cost-effective and efficient way to reach a broader audience and conduct transactions. By harnessing the power of e-commerce, small startups can transcend geographical limitations, reduce operational costs, and amplify their brand presence.

Moreover, e-commerce solutions empower entrepreneurs to embrace sustainability initiatives by reducing paper usage, minimizing waste, and optimizing logistics, thus contributing to a greener future. In this article, we explore the landscape of e-commerce solutions tailored for small enterprises, highlighting their significance, benefits, and key considerations.

The Significance of E-commerce for Small Businesses

E-commerce has transformed business operations, enabling small enterprises to rival larger ones. By erasing geographical constraints, e-commerce empowers businesses to reach customers worldwide, fostering inclusivity and diversity within the marketplace. This shift has profound implications, as it breaks down longstanding barriers to entry and opens doors for ambitious entrepreneurs to realize their dreams on a global scale.

Additionally, the onset of the COVID-19 pandemic has catalyzed a seismic shift toward online shopping, further underscoring the critical importance of establishing a robust e-commerce presence. In the face of unprecedented challenges, small businesses that swiftly embraced this digital transformation not only weathered the storm but emerged stronger than ever before. Their ability to adapt and thrive amidst adversity serves as a testament to the resilience and agility inherent in e-commerce solutions.

Therefore, e-commerce has become more than just a tool for conducting transactions; it has emerged as a lifeline for small startups, offering them the means to not only survive but also thrive in an ever-evolving marketplace.

Advantages of E-commerce Solutions for Small Enterprises

Discover the myriad benefits that e-commerce solutions offer to small businesses, revolutionizing their operations and enhancing their competitive edge in the digital marketplace.

1) Extended Reach: E-commerce platforms grant small businesses unprecedented access to a wide array of potential customers, surpassing physical constraints and unlocking opportunities in new markets.

2) Cost Efficiency: Establishing an online storefront entails notably lower operational expenses compared to traditional brick-and-mortar establishments, encompassing reduced costs such as rent, utilities, and staffing.

3) Improved Customer Experience: E-commerce solutions provide seamless shopping experiences, enabling customers to effortlessly browse products, complete purchases, and monitor orders, thereby nurturing loyalty and satisfaction.

4) Insights Informed by Data: Through the utilization of analytics tools seamlessly integrated into e-commerce platforms, small businesses can acquire valuable insights into customer behavior, preferences, and trends, empowering them to make informed decisions and execute targeted marketing strategies.

5) Flexibility in Growth: Furthermore, these solutions inherently possess scalability, allowing businesses to accommodate expansion without extensive investments in infrastructure, thereby fostering agility and adaptability in ever-changing market landscapes.

“With a vast array of courses tailored to the needs of entrepreneurs, Study24hr.com offers unparalleled access to expertise in digital marketing areas. Empower yourself with the tools you need to thrive in the digital age by exploring Study24hr.com's comprehensive catalog of courses, ensuring that your business remains agile, adaptable, and primed for success in the competitive online marketplace.”

Key Considerations When Choosing E-commerce Solutions

When choosing an e-commerce platform, it's essential to contemplate the key components that are instrumental in guaranteeing a smooth and prosperous online shopping journey for both merchants and consumers. These are:

1) User-Friendly Interface: Opt for e-commerce platforms that prioritize intuitive user interfaces, ensuring a seamless shopping experience for both customers and administrators.

2) Customization Options: Look for solutions that offer flexibility and customization capabilities to tailor the online storefront to reflect the brand identity and unique offerings of the business.

3) Payment Gateways and Security: Prioritize e-commerce platforms that support multiple payment options and adhere to stringent security protocols to safeguard sensitive customer information and instill trust.

4) Mobile Compatibility: With the proliferation of mobile devices, ensure that the chosen e-commerce solution is optimized for mobile responsiveness, enabling customers to shop conveniently on the go.

5) Customer Support and Training: Select vendors that provide comprehensive customer support and training resources to assist small businesses in navigating the implementation and maintenance of the e-commerce platform effectively.

Wrap-up

In closing, as small startups navigate the ever-evolving landscape of commerce, embracing these solutions isn't just a choice—it's a strategic imperative. From unlocking new avenues of growth to fostering unparalleled customer engagement, these digital tools serve as the cornerstone of success in today's competitive market.

So, whether you're a budding entrepreneur or a seasoned business owner, harnessing the power of e-commerce isn't just about adapting; it's about thriving in a world where innovation reigns supreme. Embrace the future, empower your business, and watch as your dreams transform into reality with the boundless possibilities of e-commerce at your fingertips.

0 notes

Text

Tax Tips For Small Business Owners For This Year’s Taxes

Navigating the complexities of tax planning is essential for small business owners, and staying informed about the latest tips and strategies can lead to significant savings. As you prepare for this year’s taxes, consider the following tax tips tailored for small business owners:

Understand Tax Deductions: Familiarize yourself with eligible tax deductions for small businesses. Deductible expenses may include business-related travel, office supplies, equipment, and certain startup costs. Keep meticulous records of your expenses throughout the year, ensuring you can claim all legitimate deductions and reduce your taxable income.

Take Advantage of Section 179: Utilize Section 179 of the tax code, which allows small businesses to deduct the full purchase price of qualifying equipment and software during the tax year. This can provide immediate tax relief and incentivize investments in necessary business assets. Be aware of any changes to Section 179 limits, and plan your equipment purchases accordingly.

Explore Qualified Business Income Deduction: For pass-through entities like sole proprietorships, partnerships, and S corporations, the Qualified Business Income (QBI) deduction can be valuable. This deduction allows eligible businesses to deduct up to 20% of their qualified business income. Understand the eligibility criteria and limitations to ensure you maximize this deduction.

Contribute to Retirement Accounts: Contributions to retirement accounts, such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k), can provide current tax benefits and long-term financial security. Not only do these contributions reduce your taxable income, but they also help you build a nest egg for retirement. Explore the options available and contribute as much as your business allows.

Employ Tax Credits: Investigate available tax credits that can directly reduce your tax liability. Common business credits include the Small Business Health Care Tax Credit, Research and Development Tax Credit, and Work Opportunity Tax Credit. Determine your eligibility for these credits and take advantage of the opportunities they provide to lower your overall tax bill.

Stay Informed About Tax Law Changes: Tax laws are subject to change, and staying informed about updates is crucial. Regularly check for changes in tax regulations that may impact your business. Understanding the latest laws and leveraging any new provisions can help you make informed decisions that optimize your tax position.

Organize Financial Records: Maintain well-organized financial records throughout the year. Accurate and detailed records not only simplify the tax preparation process but also serve as documentation in case of an audit. Use accounting software to track income and expenses, and systematically keep receipts and invoices.

Consider Hiring a Professional: Engage the services of a tax professional offering tax planning for business owners in Mayfield Heights OH to get personalized guidance, ensure compliance with tax regulations, and help you identify additional opportunities for savings that may be overlooked without professional assistance.

As a small business owner, proactive tax planning is a key component of financial success. By understanding available deductions, exploring tax credits, staying abreast of law changes, and maintaining meticulous records, you can optimize your tax position, minimize liabilities, and contribute to the overall financial health of your business.

0 notes

Text

Unlocking New Revenue Streams: The Power of Affiliate Marketing for Small Businesses

As a small business owner, finding innovative ways to increase revenue without significant investment can be a game-changer. One such strategy is affiliate marketing, a concept that might be new to many but has proven effective across various industries. Here’s how it works and how you can integrate it into your existing business model.

What is Affiliate Marketing?

At its core, affiliate…

View On WordPress

#Business Growth#small business growth#small business ideas#small business owner#small business owners#sole traders

0 notes

Link

#online business#Small business#Small Business Owners#small business owner#affiliate marketing#success mindset#mindset#mindsetmatters#positive thinking

3 notes

·

View notes

Text

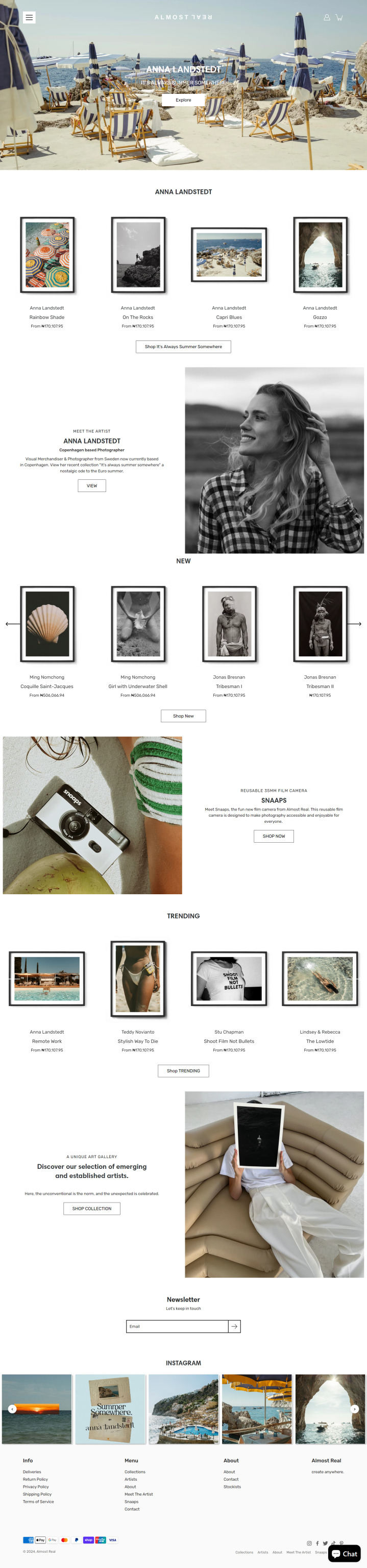

😊Would you like to have a website of this for your business?

A website that engages your clients...

A website that converts your clients...

A website that increases your ROI...

Let's do this....

Inbox me for FREE consultation.😉

#painting#oil painting#art painting#acrylic painting#small business owners#small business#business growth#business coach#entrepreneur#black lives matter#blacklivesmatter#black and white

1 note

·

View note

Text

এডিটর ইন চিফ রাজা গুহ 087774 71298

www.tollymag.com

International Group of Institutes

for Management & Studies

State Bank of India

A/C No. 42792705121

IFSC. SBIN0006145

MICR. 700002066

MSME REGD. UDYAM-WB-10-0114223

সব ধরণের রেজিস্ট্রেশন, রিনিউ ও অডিট করা হয়।

এখানে পাত্র/পাত্রী অনুসন্ধান, প্রতারণা, ক্রেডিট কার্ড/

লোন সেটলমেন্ট, জমি সমস্যা, ভাড়াটে উচ্ছেদ, বাড়ি/ফ্ল্যাটের সার্চিং, ট্যাক্স, মিউটেশন, রেজিস্ট্রি, ডিভোর্স, ট্রেড লাইসেন্স, ফুড লাইসেন্স, ITR, GST, TDS, E Filling, Co Reg, P Tax, Payroll, NGO, ট্রাস্ট,সোসাইটি, লোনের পেপার, জমি, ফ্ল্যাট, বাড়ি ,ভাড়া/ক্রয়/ বিক্রয় সংক্রান্ত, KMC Related Matter এবং সমস্ত সিভিল/ক্রিমিনাল C.D.F/D.R.T কেসের কাজ করা হয়।

স্যার রাজা গুহ : 087774 71298

Other Services - NGO, ট্রাস্ট, ক্লাব, সোসাইটি, সমিতি, ইউনিয়ন , বৃদ্ধাশ্রম, মন্দির, পূজা কমিটি, শিক্ষাকেন্দ্র, কম্পু কেন্দ্র , 80G, 12AA, FCRA, MSJE, MSME প্রজেক্ট রিপোর্ট, Company (Partnership/LLP/Pvt. Ltd/OPC), Micro-Finance, Nidhi Company, Import & Export Code#trademark, Patent, Copyright, hashtag#ISO Certificate, Food License, Trade License, Drug License, hashtag#GST, hashtag#TDS, P.Tax, ROC Compliance.

hashtag#ITreturns hashtag#auditt hashtag#bookkeeping hashtag#incometax hashtag#GST hashtag#TDS hashtag#TallyERP9 hashtag#msexceltips hashtag#society hashtag#trust hashtag#loanservices hashtag#tradelicence hashtag#FSSAI hashtag#loans hashtag#BusinessLoans hashtag#LoanSettlement hashtag#qrcodes hashtag#legalsupport hashtag#taxconsultant hashtag#lawfirm hashtag#LegalSolutions hashtag#DSC hashtag#realestateagent hashtag#RealEstate hashtag#taxresolution hashtag#TaxConsultation hashtag#financialwellness hashtag#ExpertGuidance hashtag#accounting hashtag#incometaxreturn hashtag#tdsrefund hashtag#smarttaxplanning hashtag#ClaimYourBenefits hashtag#consultationhub hashtag#taxreturn hashtag#project hashtag#gstreturn hashtag#taxiservice hashtag#taxaudit

#Small Business Owners#Individual Taxpayers#Freelancers and Independent Contractors#Real Estate Professionals#High Net Worth Individuals#Expatriates#Financial Advisors#Corporate Clients#Customers Researching Mortgages#Administrative Services#Sales and Management professionals#Army#Govt employees#Entrepreneurs#Startups#Business#Business Professionals#Financial#Young Families#First-time Home Buyers#Healthcare Employees#Loan Defaulters#Credit Card defaulters

0 notes