#Anti-financial Advisor

Text

I’ve seen a few people, mostly non-American, who don’t know who Henry Kissinger is or what he did. So your local history student and nerd is going to try to give a quick summary of the main atrocities he committed.

-Role in the Vietnam War: this is the first and biggest reason most people have for hating Kissinger. He unnecessarily extended and expanded the war prolonging the already frivolous conflict. He purposefully delayed negotiations. He approved large scale carpet bombings done with the use of B-52 bombs killed thousands to millions of innocent civilians. The Christmas Bombing was an intense, focused bombing that caused large civilian deaths in a short period of time. He engaged in negotiations with the North Vietnamese often without permission or knowledge from the US government. He was the National Security Advisor and overall had much knowledge about 1) how useless the war was 2) the travesties happening to both the North Vietnamese and South, as well as America’s own soldiers.

-Secret Bombing and Invasion in Cambodia: Kissinger (and Nixon) lead secret bombing campaigns in Cambodia aimed to destroy North Vietnamese trails and routes that ran through the country. Cambodia originally pursued neutrality in the war. Its citizens were not involved.

-Invasion and Bombing of Laos: Laos also held North Vietnamese routes, so Kissinger led Operation Lam Son which was a full scale invasion supplied with American air power and weapons. Not that it would matter, but this invasion did little to interrupt the trade routes. The North Vietnamese, made up of people who lived and knew the landscape of Vietnam, were able to adapt and find new routes. There was also secret bombings carried out in Laos, authorized by Kissinger, aimed to destroy the Ho Chi Minh trail, which, once again, wasn’t disrupted and just took innocent civilian lives in Laos. Laos also remained neutral in the Vietnam War. They were not involved, yet they were punished.

-Involvement in the Bangladesh Liberation War: this was a war between Bangladesh and Pakistan. Kissinger remained in a close relationship with Pakistan which, by now, was known to be committing horrendous human rights abuses, including large scale killings of the Bangladeshis. In fact, Kissinger and America provided funding for them. America was aligned in the first place because of bullshit Cold War alliances.

-Supporting and funding a dictator over an elected president: Chile had elected a *gasp* socialist president that really made Kissinger piss his pants. Project FUBELT, directly under Kissinger’s guidance, initiated covert actions to undermine and prevent the socialist President, Salvador Allende, from rising to power. Financial support was provided to anti-Allende groups and would eventually provided support to a military coup who would kill Allende. The leader of the coup, Augusto Pinochet, would then assume power and take rule an authoritarian government and become a dictator for 17 years. Under his rule, torture and executions were carried out against political dissidents and others. This wasn’t a secret.

-Supported the brutal invasion of East Timor: Indonesia would invade and occupy East Timor in 1975. Kissinger and Nixon had knowledge of the invasion beforehand and provided military support despite the knowledge of human rights abuses already taking place in East Timor by the Indonesians, abuses often using US weapons. Massacres, forced displacement, suppression of political dissents, torture, sexual abuse, restrictions of religious and cultural practices, and scorched earth policies are just some examples.

To my knowledge, these are usually the largest reasons cited, but please add more if I’m wrong. There are also lesser known atrocities either supported or funded by Kissinger, many taking place in Africa, that I thoroughly implore you to read about. Please correct any inaccurate things I said.

556 notes

·

View notes

Text

If money is not just a medium of economic exchange but also a political institution, then how does fiscal policy contribute to the politics of a nation? In an essay first published by Meduza in Russian, Ekaterina Pravilova, a Princeton University professor and author of “The Ruble: A Political History,” explains how the Russian imperial and Soviet governments’ refusal to outsource money supply to private banks unmoored the national currency, eroded the population’s political agency, and put the ruble at the service of the state’s autocratic and imperial ambitions.

Paper money as the monarch’s word

The history of the Russian ruble is a perfect example of the two-way relationship between national currency and political order. The first appearance of the silver ruble in the 18th century marked a Westward turn whose underlying ideology was defined and promoted by the reformist Tsar Peter I. The Petrovian reform equated the Russian ruble with the thaler (then in circulation around Europe), thereby linking the Russian monetary system with the European one.

The most significant change in Russia’s currency system was the introduction of paper assignations by Catherine II. Instead of silver and gold coins, inherently valuable because made of precious metals, the new paper money derived its value from sheer trust in the state’s promise that paper assignations could, if needed, be redeemed for “real money.”

But several years later the state reneged on that promise. Because Russia was constantly embroiled in wars, covering its expenses by printing more paper money, the value of its currency plummeted. In the late 1770s and early 1780s, a group of anonymous writers proposed to reform the Russian Assignations Bank, claiming that its capital was the imperial subjects’ common property, and that the government had no right to interfere in the balance between the national economy and currency supply — which, the writers, argued, had to correspond to the country’s volume of production. Thus Russia arrived at the idea of limiting the state’s control over money even before the French Revolution proclaimed the principle of the people’s sovereignty, rooting the legitimacy of state power in the people as its sole sanctioning source.

The constitutional ruble

In Russian history, heterodox political thought is commonly equated with opposition to state absolutism and with constitutional and parliamentary initiatives. In reality, the ideas of civil liberties and people’s sovereignty were capable of springing up outside of government and legislative contexts. The idea of a “constitutional” or “lawful” ruble, which emerged between the late-18th and early-19th centuries, was one such idea: it emerged in financial context but implied major limitations on the powers of the monarch and the state, if adopted.

What would have been the difference, then, between the constitutional and the monarchist ruble? Proponents of this reform wanted money issuance to be handled by an independent bank, rather than the state itself. They also wanted to restore the policy of freely exchanging assignations for silver. In 1809, the statesman Mikhail Speransky, the closest of advisors to Russia’s Emperor Alexander I, argued these ideas in his own fiscal reform proposal. A conservative court then denounced it as anti-national and, above all, incommensurate with autocracy.

With respect to the latter accusation, Speransky’s critics had been right. Just like any other liberal fiscal proposal of that era, Speransky’s sought to limit the state’s and the sovereign’s right to print money. In the ensuing political struggle, Speransky was pilloried and exiled, but his idea of a constitutional ruble lodged itself firmly in the minds of Russia’s liberal elites, who viewed independent banking and limiting the state’s control over money supply as a financial equivalent of constitutional rule.

From ‘liberté, égalité, fraternité’ to ‘autocracy, Orthodoxy, community’

Russia’s conservatives were themselves trying to develop a political philosophy of money, hoping to oppose it to the Westernizers’ economic ideas they considered to be alien for Russia. The conservatives’ main thesis was the imperative to trust the monarch: “If the sovereign gave us branded wood-chips and ordered them to circulate instead of rubles,” wrote the historian Nikolay Karamzin, “we would have used wood-chips.”

This ardent faith did little to remedy the fiscal situation. Towards the end of the Napoleonic Wars, the paper ruble had lost 75 percent of its original value. Awkward attempts to boost it without substantial reforms only made the problem worse. By the late 1830s, the government conducted a belated reform, devaluing the ruble to less than a third of its original value and ultimately replacing the assignations with a credit-based currency.

Outwardly, Russia’s fiscal system now resembled its European counterparts. The ruble was once again convertible to silver and might have seemed stable. In reality, the new system was a reflection of the statesman Sergey Uvarov’s famous triad, “Autocracy, Orthodoxy, Community,” formulated in opposition to the French Revolution’s motto, “Liberté, égalité, fraternité.” In contrast with the French revolutionary principles, Uvarov’s maxim encapsulated the reactionary political philosophy of Nicholas I. Unlike the bank-controlled European money supply, the credit-based Russian ruble was issued by the Finance Ministry. For the emperor, money issuance was an extension of his power. The ruble, therefore, was used to straitjacket the empire’s rebellious periphery (for instance, the Russian-controlled part of Poland, where the ruble displaced the Polish zloty).

The state’s fiscal policy was wrapped in secrecy. No one knew either the volume of the nation’s currency supply or the size of its gold and silver reserves. Unsurprisingly, after only a short time the silver standard toppled. When the Crimean War started in 1853, the ruble was once again fully de-coupled from silver.

A major cause of the ruble’s instability were wars, since they required constant outlays and undermined the economy. Even more fundamentally, the whole monetary system was geared towards servicing the autocracy rather than market demand for a medium of exchange. While liberal economists argued that only independent banks could maintain the fiscal balance, the Russian state printed money as it saw fit. After the Crimean War, some economic thinkers tried to revive Speransky’s ideas, calling to establish a money-issuing bank that would make the ruble a genuine credit currency. Yet even the so-called “great reforms” of Alexander II failed to realize this idea. In 1860, Russia established a State Bank. The ruble remained an autocratic currency.

Autocracy and war remained Russia’s main impediments to financial stability. Until 1897, the ruble remained convertible, and its unstable exchange rate only encouraged the speculators. On the eve of the Russo-Turkish war of 1877–1878, conservative elites preached patriotism over financial pragmatism, insisting that the empire’s honor depended upon the successes of its army, not the stability of its national currency. Any attempts to limit the supply of paper rubles was bound to be viewed as an attack on the Czar’s prerogative to wage war.

Gold and gold standards

By the 1880s, the gold standard had been adopted in nearly all of Europe as a system that prevents the state from printing money uncontrollably. This system also established a fixed exchange rate for national currencies when used for payments between gold-standard countries.

In this setting, the Russian Minister of Finance Sergey Vitte pushed through a fiscal reform in 1897, setting the ruble on a gold standard. This sparked immediate protest, not only from political elites, but even in business circles: the gold standard, they feared, would compromise Russia’a financial sovereignty. Liberals, meanwhile, criticized Vitte for distorting the political principles underlying the gold standard. Instead of placing an independent money-issuing bank in control of the gold reserve, Vitte’s reform increased the Czar’s and the government’s power over fiscal policy.

Unlike the European and American gold standard systems, the Russian gold standard proved to be a tool of the autocracy. With fiscal policy still in the hands of the finance minister, the emperor was free to issue credit from the State Bank’s reserves without any guarantee of repayment. This contributed to the erosion of the ruble. Countries with either private or parliament-managed central banks did not permit this kind of profligacy.

The expenditures that hit Russia during the First World War plunged the country into a financial crisis. The government proved to have been so blinded by its gold reserve that it paid no attention to the economy or the country’s financial limitations. Because Russia was buying essential goods abroad, the gold reserve was shrinking. The country was flooded with paper money of negligible buying power.

The government responded to the crisis with a campaign to replenish the gold reserves with donations from the population, calling on the Czar’s subjects to turn in their medals and wedding rings to help bolster the ruble. These calls to financial patriotism only encouraged the people to start hoarding gold, melting it down to make trinkets that could be taken out of the country. The campaign failed spectacularly, baring not only the country’s destitution but also the population’s lack of trust in the government.

The population knew full well that the “common ruble” belonged to the Czar and the government, and therefore instantly recognized “supporting the ruble” as empty rhetoric, which covered up the state’s eagerness to guard its fiscal prerogatives from encroachment by people’s representatives in the State Duma.

The Soviet legacy

Russia’s February Revolution gave rise to a strange political system that had no parliament, no constitution, and no constitutional ruble. Inflation accelerated, instantly negating the workers’ wage increases and contributing to revolutionary ferment. When they came to power, Bolsheviks did nothing to rein in the financial chaos. The money-printing press once again turned into the state’s main source of income, leading to hyperinflation. The Bolsheviks, meanwhile, weaponized money supply to undermine the moneyed classes.

In reality, the state itself had lost control over the monetary system, overrun by surrogate currencies and local financial instruments competing with the devalued ruble. When Lenin launched his New Economic Policy in 1922, it was only “new” if compared to the Civil War period. Having brought back the pre-revolutionary gold ruble and centralized money issuance, Lenin also reinstated the state-owned central bank.

That 1920s-style “gold standard” resembled the autocratic gold standard of Vitte’s era, distinguished from Western fiscal models by the government’s centrality to the monetary system. By the decade’s end, the gold standard had essentially dissolved, and the industrial credit reforms of the 1930s voided the economic value of money.

This, however, only increased the ruble’s political significance, by turning the currency into the main financial instrument of social and political control over the population. What the government termed the “monetary reform” of 1947 came down to exchanging old rubles for new money at the rate of 10 to one. At the same time, the government capped the sums it would accept for exchange at 3,000 rubles, deposited at the state savings bank. In addition, rations cards, food allowances, and commercial and farm pricing were also disposed with, in favor of a fixed pricing system that favored the government by making goods more expensive for the people. The reform robbed the population of its savings, once again highlighting that, instead of offering them power, Soviet money turned the people into hostages of the state.

Rumors of upcoming savings confiscations plagued the 1950s and 1960s, triggering panics that emptied store shelves as people sank their money into valuables from fur coats to grand pianos.

After the reforms of the late 1980s, the absolutist Soviet philosophy of money, which robbed the citizens of political agency, seemed destined for oblivion. In practice, though, the reforms of 1991 and 1993 reproduced the Soviet and imperial models: the state once again shifted the costs of inflation and economic chaos to the population. It was the money reform of 1993 that occasioned the famous phrase of Russia’s Prime Minister Viktor Chernomyrdin: “We wanted what’s best, but it turned out as always.”

The Soviet and imperial past are still inherent in the monetary system Russia has today. The Bank of Russia — heir to the state banks of the USSR and the Russian Empire — has, of course, a lot more autonomy than its predecessors did. Still, despite its nominal independence, it must contend with the so-called “power vertical” whose subjects are fully integrated into a system of total control.

Although the central banks of other countries also depend on governments to some extent, their decades (sometimes centuries) of experience in bargaining with the state let them resist such pressures much more effectively. In Russia, on the other hand, it is the state that has centuries of experience in controlling money, which makes the Russian ruble but flesh of the regime’s flesh.

10 notes

·

View notes

Text

This day in history

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

#20yrsago Lego Pantone values https://memex.craphound.com/2004/03/04/lego-pantone-values/

#20yrsago Mojo Nixon retiring https://web.archive.org/web/20040402054153/http://www.mojonixon.com/

#20yrsago Jay-Z construction set http://www.jayzconstructionset.com

#20yrsago Anthropomorphic Mars Rover LiveJournal https://opportunitygrrl.livejournal.com

#15yrsago Child in wet bathing suit made to stand in -5F weather because school policy forbade her from waiting in teacher’s car https://www.cbsnews.com/minnesota/news/teen-teachers-made-me-stand-outside-in-wet-bathing-suit-barefoot/

#10yrsago Data-compression with playing cards https://www.timwarriner.com/carddata/index.html

#10yrsago David Cameron’s porn-filter advisor arrested for possession of images of sexual abuse of children https://www.independent.co.uk/news/uk/crime/senior-tory-adviser-patrick-rock-arrested-on-child-pornography-allegations-9166837.html

#10yrsago Free download of danah boyd’s must-read book “It’s Complicated” https://www.zephoria.org/thoughts/archives/2014/03/03/its-complicated-open-access.html

#10yrsago Podcast: Cold Equations and Moral Hazard https://ia800202.us.archive.org/17/items/CoryDoctorowPodcast267ColdEquationsAndMoralHazard/Cory_Doctorow_Podcast_267_Cold_Equations_and_Moral_Hazard.mp3

#10yrsago Guy who “fixed” women’s computers spied through their webcams https://www.wired.co.uk/article/cyber-voyeur

#10yrsago Barrett Brown legal motion: linking is protected by the First Amendment https://web.archive.org/web/20140307111151/http://freebarrettbrown.org/right-to-link/

#5yrsago Fox News was always partisan, but now it is rudderless and “anti-democratic” https://www.newyorker.com/magazine/2019/03/11/the-making-of-the-fox-news-white-house

#5yrsago How the patent office’s lax standards gave Elizabeth Holmes the BS patents she needed to defraud investors and patients https://arstechnica.com/tech-policy/2019/03/theranos-how-a-broken-patent-system-sustained-its-decade-long-deception/

#5yrsago Open dataset of 1.78b links from the public web, 2016-2019 https://blog.gdeltproject.org/who-links-to-whom-the-30m-edge-gkg-outlink-domain-graph-april-2016-to-jan-2019/

#5yrsago Automated reception kiosks are a security dumpster fire https://securityintelligence.com/stranger-danger-x-force-red-finds-19-vulnerabilities-in-visitor-management-systems/

#5yrsago Alias: a smart-speaker “parasite” that blocks your speaker’s sensors until you activate it https://web.archive.org/web/20190321085518/https://bjoernkarmann.dk/project_alias

#5yrsago Financialization is wearing out its welcome https://www.ft.com/content/a9f13afc-3c3d-11e9-b856-5404d3811663

#5yrsago German data privacy commissioner says Article 13 inevitably leads to filters, which inevitably lead to internet “oligopoly” https://www.eff.org/deeplinks/2019/03/german-data-privacy-commissioner-says-article-13-inevitably-leads-filters-which

#5yrsago Tim Maughan’s Infinite Detail: a debut sf novel about counterculture, resistance, and the post-internet apocalypse https://memex.craphound.com/2019/03/04/tim-maughans-infinite-detail-a-debut-sf-novel-about-counterculture-resistance-and-the-post-internet-apocalypse/

#5yrsago Terra Nullius: Grifters, settler colonialism and “intellectual property” https://locusmag.com/2019/03/cory-doctorow-terra-nullius/

#5yrsago Leaked memo suggests that Google has not really canceled its censored, spying Chinese search tool https://theintercept.com/2019/03/04/google-ongoing-project-dragonfly/

#1yrago Solving the Moderator's Trilemma with Federation https://pluralistic.net/2023/03/04/pick-all-three/#agonism

2 notes

·

View notes

Text

As Free as the United States is, our Foreign Interactions Suck (Specifically, US involvement in Ukraine Russia War)

If Ukraine joins NATO before the war with Russia is resolved, WW3 between the US, NATO countries, and Russia appears to be inevitable.

In the scenario in which this happens, I am leaving this country (the United States) for a country that is neutral and/or against the shit the United States pulls on the rest of the world.

I will not serve as collateral damage for whatever insanity our corrupt and demented leaders try and put us through

I want to have nothing to do with this shit.

I'm an American and I literally hate the fact that we are being emotionally and financially coerced by Ukraine to give them more and more of our hard-earned money to continue a war that does not benefit the American people, and a fight that neither Ukraine nor the United States HAS NO EXIT PLAN for.

I am starting to side with Russia in a certain way.

The United States is trying to impose their will on Russia by 1. Trying to turn a country that borders Russia into a NATO country, and 2. Portraying Russia as an unjustified aggressor.

Honestly, I hate the tragedy of war, but it just seems to be an inevitable part of life, in that, for example, if you see that your country is getting pushed around by the United States, a global superpower, you are of course going to want to push back.

The strength a country shows, and the respect they receive for that acknowledgement of their strength is the key to peace.

The United States does not respect the strength and political autonomy of Russia and many other countries.

As much as I appreciate the freedoms and opportunities I have in the United States, I am not proud of the foreign interactions the US has had with other countries.

The United States is always trying to convince foreign countries that our way of life is going to "elevate" their society, notably, in 2014 when Obama tried to convince Uganda that they shouldn't pass an anti-homosexuality bill (1).

I'm sorry, but does our society look like its thriving with gay and bisexual men representing over half of all AIDS and HIV victims(2) ?

We also have about about forty to fifty percent divorce rate amongst the general population(3), and sixty seven percent of black children being born into single parent homes(4), so tell me United States, who claims to be so anti-racist and accepting, why are you trying to ruin black-African societies?

I am in no way saying that African, or any foreign countries are perfect, or lacking problems of their own, but their problems are exactly that, their own!

Why does the western world feel the need to try and "fix" other's problems!

Especially with the inflation that the people of the United States are experiencing, apparently now is the time to devote our time, money and resources into other countries problems with governments that are, at the very least not free of political corruption.

https://www.pbs.org/newshour/world/obama-issues-warning-uganda-anti-gay-legislation

2. https://www.cdc.gov/nchhstp/newsroom/fact-sheets/hiv/HIV-gay-bisexual-men.html

3. https://www.forbes.com/advisor/legal/divorce/divorce-statistics/

4. https://afro.com/census-bureau-higher-percentage-black-children-live-single-mothers/

*Bonus Content*

On a sort of related note, here is a savage video of the Uganda president unashamedly declaring his opinion about homosexuals. This man appears to be more honest than most US politicians.

youtube

#politics#nato expansion#ukraine#russia#ukraine russia war#united states#foreign affairs#uganda#gay pride#lgbtq#conservative#liberal#republican#democrats#cnn politics#media analysis#lgbtqia#queer#war#vladimir zelensky#vladimir putin#Youtube

5 notes

·

View notes

Note

D&D au, lalexie 👀

Thank you, darling!! <3 This got a bit longer so I put the rest under a cut. Low-key dedicating this to @lexxlikes too, for reasons ;D

Willie had been excited when he'd been invited to the Sunset Phantoms D&D session, not only looking forward to spending more time with the band (and especially with certain members of the band) but also because he looked forward to an opportunity of dusting off his half-elf thief that had been sadly mouldering in his closet since his own group had dispersed a few years ago.

He knew that bringing a new player into a group was never easy and so he made sure to thank not only the band for having him as soon as he arrived but Bobby especially, as the DM who now had to keep track of one more character, bringing the total number of characters up to five.

Reggie being a 6,5 foot tall half-orc tank was a bit of a surprise but became a little easier to accept when Willie found out that Zogar had a habit of adopting any stray wildlife the party encountered and wanted to pet all the monsters.

Julie played a female human mercenary that took on the role of financial advisor to the group and made sure that every corner in every dungeon was duly inspected for valuables that might be sold off later. Shondri also had a talking sword she had named Flynn, which made everyone giggle, especially since Julie was remarkably good at making it sound like the real world Flynn (who was on vacation and therefore not playing with them).

Alex's Tezlan was a harengon, which was not a race Willie was familiar with but turned out to be a large humanoid hare that was very good at running away from danger and possessed a lot of luck. Willie just thought it was adorable and that his own Falfinas would have a hard time staying away from those large, fluffy ears that just begged to be petted.

And Luke was a bard.

Willie laughed out loud at that and thought Luke getting all red in the face and defensive was way too cute to bear. Apparently, Luke had been the most difficult to persuade to play D&D at all (they could be doing so much better things with their time, like playing music!) but when they had finally convinced him ("think of the songs you can write about our adventures!"), he'd been adamant to invest as little time as possible in his character and had immediately opted for a human bard name Lucas and demanded that his character had created at least one hit song à la 'that guy in the Witcher.'

(Everyone immediately chanted 'Toss a coin to your witcher, oh valley of plenty' under their breath.)

But Willie had to admit that Lucas was a very charming companion who frequently amused them with songs (and then had to be dragged away from his guitar/lute so they could continue to actually quest) and he certainly didn't mind that Falfinas was getting serenaded by the bard around the evening camp fire.

He also appreciated Tezlan cosying up to him when he innocently mentioned how he was still feeling cold. The harengon's fur was soft and warm after all.

Bobby kept shooting him glances and rolling his eyes as Falfinas continued to gleefully flirt with Lucas and Tezlan but Julie kept giggling and Shondri often dragged Zogar a little away from the others by promises of cute birds and monsters, which meant Bobby had to create some impromptu Flumphs (anti-gravity jellyfish) or Almiraj (bunnies with unicorn horns) on the fly to satisfy the half-orc.

But Willie didn't think Bobby really minded all that much because there were enough grins scattered throughout his more annoyed expressions that Willie still felt safe enough to continue with his mission to fluster Luke and Alex by flirting with Lucas and Tezlan without fear of not being invited back.

Because he very much wanted to be invited back.

7 notes

·

View notes

Text

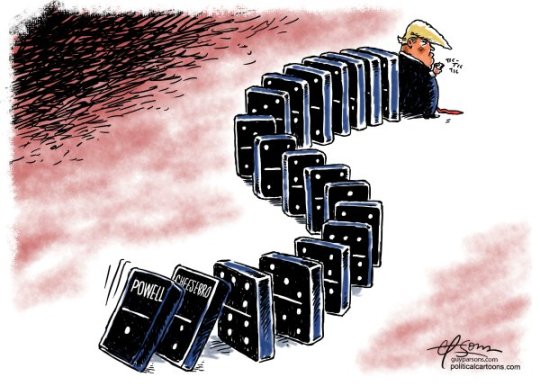

Guy Parsons :: @ParsonsGuy

* * * *

LETTERS FROM AN AMERICAN

October 24, 2023

HEATHER COX RICHARDSON

OCT 25, 2023

Another of Trump’s lawyers has pleaded guilty to charges as part of a cooperation agreement with the Fulton County, Georgia, district attorney’s office. This morning, Jenna Ellis pleaded guilty to aiding and abetting false statements and writings as part of the plan to overturn the results of the 2020 presidential election. She is the fourth of the 19 people charged in the Georgia racketeering case to plead guilty.

In late September, bail bondsman Scott Hall, who helped to breach voting equipment and data in Coffee County, Georgia, pleaded guilty; lawyers Sidney Powell and Kenneth Chesebro pleaded guilty last week.

Ellis opposed Trump’s 2016 nomination but supported him after his election in frequent television appearances as a “constitutional law attorney” although she had not worked on election law. After Trump saw her on the Fox News Channel, Ellis became a “senior legal advisor” to Trump’s reelection campaign.

After he lost, she was a very visible television spokesperson for the Big Lie that the election was stolen. On November 19, 2020, she joined Trump lawyers Rudy Giuliani and Sidney Powell at the headquarters of the Republican National Committee to insist that Democrats had rigged the voting in majority-Black cities and that communist forces in Venezuela had tampered with U.S. voting machines. She also peppered her social media feed with MAGA statements, mixing it up with anti-Trump figures, making her a more public figure than the other lawyers.

Nonetheless, Trump declined to cover her legal fees after her indictment as a co-defendant in the Georgia racketeering case, possibly because she had supported Florida governor Ron DeSantis’s presidential bid. While Ellis said she had stopped supporting the former president because of his “narcissistic” tendencies, she continued to echo Trump’s rhetoric. In September she raised more than $216,000 for her legal defense fund from crowdfunding, claiming she was fighting “a weaponized government and the criminalization of the practice of law.”

Today, in a court of law rather than in front of the television cameras, she sounded quite different.

“As an attorney who is also a Christian, I take my responsibilities as a lawyer very seriously, and I endeavor to be a person of sound moral and ethical character in all of my dealings,” a tearful Ellis told the court. “I relied on others, including lawyers with many more years experience than I, to provide me with true and reliable information.” (Ellis worked closely with older Trump lawyer Giuliani; she will be 39 on November 1.)

“If I knew then what I know now, I would have declined to represent Donald Trump in these post-election challenges,” Ellis said in court. “I look back on this whole experience with deep remorse. For those failures of mine, your honor, I have taken responsibility already before the Colorado bar, who censured me, and I now take responsibility before this court and apologize to the people of Georgia.”

Ellis’s plea agreement spelled out the statements she made that were lies. As legal analyst Joyce White Vance explained in Civil Discourse, this means the court has identified the specific lies that made up the Big Lie that the 2020 presidential election was stolen, and that Ellis will testify that they are lies. Those claims include the lie that there were 96,000 fraudulent mail-in ballots, that 2,506 felons voted illegally, that 66,248 underage people illegally registered to vote, that 2,423 unregistered people voted, that more than 10,000 dead people voted, that Fulton County election workers counted ballots with no oversight.

In the civil case in New York in which Trump, his older sons, two employees, and the Trump Organization are on trial for fraud, Trump’s former lawyer and fixer Michael Cohen testified today that he and the former chief financial officer of the Trump Organization, Allen Weisselberg, would reverse engineer Trump’s financial statements to meet whatever number Trump wanted.

His testimony suggested that the alleged massive fortune on which Trump based his identity, as well as his presidential bid, was an illusion.

In a series of motions filed overnight, Trump’s defense team appears to be throwing anything it can at the wall to challenge the election conspiracy case in Washington, D.C.

But as Trump’s legal peril escalates, Republicans in the House of Representatives continue to reject any House speaker who does not embrace Trump. Representative Marjorie Taylor Greene (R-GA) today said, “We need a speaker of the House that reflects the values and the views of Republican voters across the country, and they support President Trump and they support his agenda.” Representative Troy Nehls (R-TX) suggested nominating Trump himself for the job.

CNN’s Jake Tapper has had enough. “I'm covering life and death issues, serious tragedies, serious momentous occurrences here in Israel and of course in Gaza,” he said today. But, he said, “We have to interrupt this for one moment to cover the complete and utter clown car that is the House Republicans' Speaker's race.”

House Republicans today selected Representative Tom Emmer (R-MN) as their choice for the post, only to have him drop out of the race after Trump, apparently angry that Emmer had dodged a question about whether he supported Trump’s nomination for president, turned on him.

Trump went on social media to call Emmer, whose work in Congress has earned him a 79% lifetime approval rating from the right-wing Heritage Action for America, a “Globalist RINO,” meaning “Republican In Name Only.” Trump warned that Emmer “never respected the Power of a Trump Endorsement, or the breadth and scope of MAGA…. I believe he has now learned his lesson, because he is saying that he is Pro-Trump all the way, but who can ever be sure? Has he only changed because that’s what it takes to win?”

Trump ally Ohio Representative Jim Jordan’s failure to win the speakership even after threatening his colleagues showed that Trump cannot put his chosen candidate into the chair, but Emmer’s failure to win the speakership suggests Trump’s opposition can keep a candidate out of it.

Just hours after Emmer dropped out, the House Republican conference threw up a fourth candidate for speaker: Representative Mike Johnson of Louisiana. Johnson is a self-described Christian and staunch Trump ally. He defended the former president during both of his impeachment trials and fought for Texas v. Pennsylvania, the key lawsuit contesting the results of the 2020 presidential election (the Supreme Court decided that Texas did not have standing to sue). He voted against certifying the 2020 election results.

Johnson won the conference’s nomination with 128 votes to 29 votes for Representative Byron Donalds of Florida, who only entered Congress in 2021. In an interesting sign that Republicans might be reconsidering their rejection of former speaker Kevin McCarthy (R-CA) three weeks ago, 43 Republicans voted for him even though he was not standing for the position. Johnson told reporters he expects a floor vote at noon tomorrow.

House minority leader Hakeem Jeffries (D-NY) has offered a bipartisan deal in which Democrats would help Republicans elect a speaker. In exchange for their help, Democrats have said they want a candidate who is not an election denier and who agrees to hold up-or-down votes for bills that have broad support across the parties. Such a deal would mean some security for future elections. It would also mean that a measure funding Ukraine, which is popular across Congress but which the extremists oppose, would get a hearing.

So would funding the government.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#US House of Representatives#Republican radicals#government shutdown#Middle East#Israel#TFG#Trump indictments

4 notes

·

View notes

Text

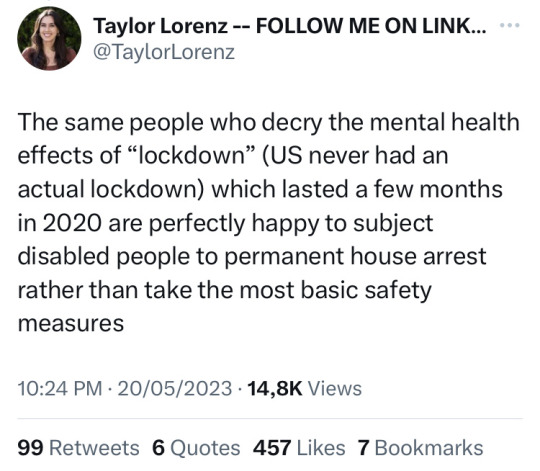

yeah my thoughts summed up.

the way so many dumbfucks somehow concluded that the massive amount of worldwide labour shortages since this pandemic started, are due to "people not wanting to work anymore" is mindblowing. you absolute fucking IDIOT?? there are millions upon millions of people with Long Covid, consecutive other illnesses and disabilities, or are dead. i hate work too but how do you conclude that people just happen to simultaneously quit their jobs for fun en masse as if that's even financially possible to do.

we're still in a fucking pandemic and it's only easier to get infected now than before.

the way covid-19 and migitation strategies are rarely even being named by leftists is infuriating. do you know how fucked up it is i had to follow more liberals for info on the pandemic bc way too few so-called leftists stopped caring ab covid within a few months?

and don't get me started on this shithole the Netherlands bc the lack of safety measures and the amount of disinformation has from the start been worse than the most conservative US states, or Alberta in Canada, which i saw often being brought up. i'll never be over when a lot of people from the arts and culture field protested en masse in 2020 against covid measures.

we were told here by our lovely supposedly "expert" (anti-mask and anti-vax) healthcare policy advisors that getting infected is good, especially for kids, that we can't get covid when sitting on a CHAIR, that xyz things without any measures is safe, that you are immune if you got it in the past, that masks don't work, and that if they do it's not the FFP2 (N95) ones somehow.

RIVM kept changing the standards for what are 'safe' levels even though it would've been code red or black if non-adjusted. also various hospitals were forbidden from using face masks and since over a year (for future readers: it's may 2023 rn), infected staff was allowed to work. i was actually jealous in some ways of the US bc i read how medical professionals and shop staff etc actually asked people to keep their mask ON. i've only been asked or pressured by therapists, doctors, nurses, etc to take my mask OFF and they even got pissed bc i asked them to wear one.

also if i get infected i'm really screwed bc there is no paxlovid and there are no long covid clinics in the country. they plan on opening only ONE next year, while in germany there's dozens with each still 9 months of waiting lists bc the demand is high.

my immunocompromised and disabled mom doesn't fucking get it even though she clearly got covid several times with horrible lasting side effects, and my sad doesn't fucking get how testing works and they both believe they're always being safe even though they dont wear masks or she does but takes it off inside somehow.

i went off topic but im just fucking TIRED of how few fucking leftists and people as a whole actually give a fuck abt the pandemic. there is still a 1/5-1/10 chance of getting Long Covid with every infection and there are whole generations growing up with more disability and death than before. you can't fucking go anywhere safely bc ventilation and masking wasn't made a common thing to demand. me and others who advocate for safety measures are being painted off by other leftists as delusional or as liberals or even as "calvinist" which is hilariously false bc my country's culture is the prime example of that and does absolutely nothing ab the pandemic. like YEAH i would love to go to more protests again but it's just not fucking safe with public transport and huge crowds and no one masking up. you can say all you want ab eugenics and capitalism and whatnot but if you don't wear masks and pretend the pandemic is over (strange also bc you know governments ignore every other crisis) and just want the disabled ppl who do stay aware, to stay inside and rot while you can keep making society more unsafe, you're part of the problem.

god and same w LGBT activism. i don't fucking care what you say, if you're anti-mask and carelessly contribute to maskless superspreader events and don't include disabled people, you are just as uncaring as people were about the AIDS crisis.

i'll end my rant here. feel free to share but if anyone argues back youre getting blocked. im fucking tired and i don't know who to trust anymore besides like 3 friends and a few kpop fan mutuals online who also still care ab the pandemic.

5 notes

·

View notes

Text

8/22/22

A Russian journalist named Darya Dugina died when the car she was driving exploded from a bomb. Her father, Aleksandr Dugin, is an ultra-nationalist philosopher and very strong supporter of Putin. Because they were supposed to be driving together but the father decided to take another car at the last minute, it's assumed the bomb was intended for him. Russia is blaming the Ukrainian government, which is denying responsibility. The Ukraine is pursuing a strategy of attacking Crimea, which it lost to a Russian invasion back in 2014. Several military targets were bombed last week and into the weekend.

Anti-terrorism charges have been levied against former Pakistani Prime Minister Imran Khan after he gave a speech at a rally. Khan was ousted last April after a decline in popularity, and since then one of his aides was arrested. In the speech Khan said he would sue the judge and officers after he alleged the aide was tortured. This is what got him into trouble, with the claim that he was intimidating the judge and police.

The presidential election in Kenya was very close with William Ruto winning 50.5%. His opponent Raila Odinga is claiming fraud and has taken it to the supreme court.

Senator Lindsey Graham (R-SC) was ordered to testify as part of an investigation into Trump's efforts to reverse election results in his state, but another court put a temporary halt to that in order to see if his position as senator gave him protection against some of the questions.

The UK's GDP shrank by 11% in 2020, much worse than people previously thought.

Fauci said he would be stepping down in December as director of the National Institute of Allergy and Infectious Diseases and chief medical advisor to the president. Fauci was often seen as the governmental spokesperson during the pandemic and the vaccine rollout.

Singapore repealed its law banning gay sex.

al-Shabab fighters stormed a hotel in Mogadishu, which lead to a thirty-hour battle. It's unknown how many fighters and others were killed, but the total seems to be over 20.

1) NYT, Washington Post 2) Al Jazeera 3) BBC 4) Washington Post 5) Financial Times 6) Politico 7) Reuters 8) Al Jazeera

Sorry for the long absence. I’ll try my hardest to maintain a schedule from now on.

9 notes

·

View notes

Text

GONE LIKE A GUST OF WIND, HER PERFUME A VEIL.

SOPHIE DUMOND of 2019'S JOKER, written by Abigail, 25+, gmt. low-key, private, low-activity. influence solely from that film and my own work post-canon. single-story. anti-anti-anti 2024 musical, seriously do not come anywhere near me, I do bite.

independent sophie dumond of 2019's joker. this blog is part-time, exceedingly picky, and likely slow. exclusive to @jokethur's arthur and our own plot-driven canon we've built with my main muse, nix degraves, found at @banschivs. some influences from 2022's the batman. full pages here are unlikely.

currently sophie is not only a mother, and working in gotham square at gotham national bank, she is also putting herself through night school as a means to become a financial advisor some time in the future. she's aiming for a better life for her and her daughter, and like most in gotham, is pursuing some sense of freedom among the rubble. she is, however, due to her tenuous ties to one arthur fleck in the past, currently being surveilled by the court of owls. further information on the court and their reach can be found here.

number one banned fc is gaga, and essentially any other character from that upcoming musical. in an ideal world i'm allowed to forget it even exists, i don't want to so much as catch a whiff of its scent. for that reason i can be exceedingly picky when it comes to following back dc blogs. sophie, and the universe within which jessie and i have built that she exists, works perfectly for me.

though it's unlikely i'll be working off my dash much, i do ask all those i follow to please tag 'terminal illness cw' or 'cancer cw' where applicable. in turn i'll do my best to tag anything needed.

if your muse has anything to say to Soph, i.e you wanna interact, just lob a starter at me. as mentioned above i won't be using the dash here much at all, so that's your best bet for interaction.

general rules and etiquette expectations apply.

2 notes

·

View notes

Text

i’m also just not sure how much the managerial / finance people of a corporation and those involved in the artistic side overlap…. corporate media entities aren’t necessarily homogeneous and aren’t necessarily going to use the art side of things to pursue their corporate interests beyond producing things audiences will buy. like these entities have giant teams of lawyers and financial advisors snd what-have-you working on that side of things that almost certainly are not conferring with scriptwriters on a daily basis, and honestly probably aren’t terribly concerned if the scriptwriters include an anti-capitalist message in their movie. especially if it means the movie will sell.

6 notes

·

View notes

Text

U.S. President Joe Biden has defined the fight against global corruption as a “core United States national security interest” and made it an official priority for his administration. Now, he is turning Paraguay into a test case for his policy.

On July 22, the U.S. ambassador to Paraguay shocked the country’s political establishment by announcing at a live, televised press conference that the U.S. State Department was sanctioning former Paraguayan President Horacio Cartes, along with his adult children, for their involvement in “significant corruption.” Less than a month later, the Biden administration doubled down by imposing sanctions for corruption on Paraguay’s sitting vice president, Hugo Velázquez, along with his close advisor and associate, Juan Carlos Duarte, and their spouses and children. Cartes, Velázquez, Duarte, and their families will no longer be able to obtain a visa and travel to the United States. A stunned Velázquez—who, until then, was arguably Paraguay’s power behind the throne and a serious contender in next year’s presidential elections—quit the race that same day.

U.S. authorities have targeted former leaders on corruption grounds before, not to mention a plethora of lower-ranking figures. This February, for example, the State Department designated former Honduran President Juan Orlando Hernández. But for the United States to go after the sitting vice president of a friendly country is unprecedented. It is a clear message to Paraguay’s leaders as well as their regional counterparts: Washington will no longer take a passive approach to corruption.

Although the country’s elites have formally embraced democracy since the 1989 overthrow of then-fascist dictator Alfredo Stroessner, they have nonetheless benefited from Stroessner’s legacy: a corrupt power structure complicit with a gargantuan shadow economy estimated to be worth almost half the country’s GDP as well as trafficking in every sort of contraband. Cross-border cigarette smuggling is big business in Paraguay, and brands owned by Tabacalera del Este—known as Tabesa, a manufacturer controlled by the Cartes family—are frequently seized in Brazil. Off-the-books contraband also extends to consumer goods, agricultural products, alcohol, tires, and even pesticides. In an operation last month, Brazilian police seized $190 million worth of goods. All told, the estimated value of goods smuggled from Paraguay is $5 billion annually.

More than 30 years after Stroessner’s departure, Paraguay still ranks among the most corrupt countries in the world. Organized crime and terrorism organizations have converged on its territory, turning its porous borderlands into key hubs for money laundering, drug trafficking, and terrorism finance. Paraguayan businesses and the front companies they establish in the United States engage in commodities trading to launder proceeds from these criminal activities. The financial flows frequently go through U.S. banks.

Washington’s action on Paraguay is a warning to corrupt leaders everywhere. Biden’s anti-corruption message is a strong and welcome step—and his administration should follow up with further U.S. action. The most hotly debated question in Paraguay now is whether sanctions, like those on Honduras’ former president, will be followed by U.S. criminal indictments and extradition requests. Paraguay’s public response to the designations after the initial shock has also been focused on whether the United States will stop with the current sanctioned politicians or go after even more. The administration should leave no room for doubt: Corruption in Paraguay goes deep and wide, and Cartes, Duarte, and Velázquez should not be the only people on Washington’s list.

In the past, Paraguay’s leaders had impunity as long as they were politically aligned with the United States. Biden’s predecessors, whether Democrats or Republicans, were well aware of Paraguay’s corruption pandemic yet treaded carefully with its leaders amid mounting evidence of corruption in the highest reaches of the country’s power structure. U.S. investigations into Cartes’s suspected role in smuggling predate his 2013 election as president, but they were likely cast aside as part of a diplomatic deal, according to conversations FP had with a former Paraguayan official close to Cartes and a former U.S. official familiar with the U.S. investigation.

In Paraguay, political meddling to protect the culprits has stalled the investigation of the so-called megalavado case, the largest-ever money laundering case in the country, allegedly worth $1.2 billion. For six years now, the investigation has been hampered with periodic changes of prosecutors, sometimes ordered by Paraguay’s attorney general’s office. Each time, the investigation is set back—and there is no end in sight. Other large investigations into money laundering schemes have also failed to yield indictments or convictions. That was the case with Liz Paola Doldán González, whom the U.S. Treasury Department eventually sanctioned in 2021 for corruption. Doldán was implicated in a tax evasion and money laundering scheme worth more than $500 million. Paraguayan authorities slapped her on the wrist with a tax fine despite the staggering losses Paraguay’s treasury incurred. Of the two other businesspeople also sanctioned in the case, cousins Kassem and Khalil Hijazi, only the former has been extradited to the United States, while no legal action is pending against the latter.

For years, Washington buried any acknowledgement of Paraguay’s corruption in annual State Department reports, diligently flagging Paraguay’s deficient anti-money laundering controls and weak judicial system. The department’s annual International Narcotics Control Strategy Report routinely described Paraguay’s corruption as “pervasive.” Yet nothing of consequence happened despite periodic alarms about criminal organizations laundering proceeds from smuggling with the complicity of corrupt officials. U.S. investments in anti-corruption training, capacity-building, mutual assistance, and gentle pressure contributed to much legislative reform as well as to successful investigations, raids, arrests, and extraditions. But the bottom line remained the same: Despite “results in terms of arrests and modest progress toward implementation of new legislation … convictions remain rare.”

Observing corruption was not enough as long as Paraguayan politicians believed their loyalty to Washington insulated them from the duty to govern honestly and transparently. U.S. policy still seemed to reflect the old Cold War-era practice of aligning with unsavory regimes as long as they supported U.S. foreign-policy goals. In September 2019, merely three years before facing sanctions, Velázquez received the red carpet treatment in Washington, where he met members of Congress and visited the U.S. Justice, State, and Treasury departments as well as the CIA. Washington threw its weight behind Cartes when he ran for president in 2013 despite having earlier investigated his alleged criminal activities, including by infiltrating his business with an eye toward prosecuting him.

Given how extensive corruption is across the political spectrum among Latin America’s ruling classes, doing business with criminals seemed to be the only way to get things done with those in power. Their opponents, so this logic goes, are just as bad. Paraguay’s pervasive corruption has shown that this approach has not worked.

After Biden took office, there were clues that patience in the White House was running thin. In April 2021, the Biden administration slapped sanctions on a Paraguayan politician and his wife, and in August 2021, it issued sanctions on three businesspeople, Doldán and the Hijazis, for their corrupt practices. Kassem was even arrested and recently extradited to the United States. But despite this progress, corruption remains rampant, and government efforts to combat it continue to be underwhelming. Investigations have suffered setbacks; judicial processes have languished; transnational criminal activities in Paraguay have spiked; and, most dramatically, there was the recent assassination of a top prosecutor spearheading cases against criminal networks, corrupt politicians, and financiers of terrorism.

Even as the Biden administration has now homed in on Paraguay to showcase its fight against global corruption, the country’s ruling elites are likely still hoping the worst that can happen to them is losing their visas to the United States. The White House needs to show them they’re wrong.

The Biden administration, which clearly aims to tackle corruption well beyond the confines of Paraguay or even Latin America, should not lose sight of the shock-and-awe impact of its summer measures. Relentless, continued focus on Paraguay is therefore essential. Too often in the past, U.S. sanctions, once promulgated, gradually lost their grit as sanctioned foreign nationals were able to adjust and resume their activities as soon as the United States’ Eye of Sauron moved its gaze elsewhere. Velázquez presumably banks on that: After announcing he would end his electoral campaign and resign as vice president, he retracted the latter decision and now plans to serve his full term, which ends in August 2023. Even as a diminished leader, he can hunker down and, for the remaining months of his term, leverage his patronage network to his own benefit. The White House needs to disabuse him of his complacency.

The designations of Cartes, Velázquez, and Duarte offer a clue on where to start. According to the State Department, Cartes “obstructed a major international investigation into transnational crime in order to protect himself and his criminal associate from potential prosecution and political damage.” Duarte, Velázquez’s close associate, “offered a bribe to a Paraguayan public official in order to obstruct an investigation that threatened the Vice President and his financial interests.” Washington needs to ensure that authorities in Asunción pursue serious investigations of these alleged crimes. At the moment, there are still no pending Paraguayan indictments against Cartes, Duarte, or Velázquez.

If the Justice Department can assert jurisdiction, it should. If the evidence for sanctions is sufficient to prosecute Cartes, Velázquez, and Duarte in U.S. courts, indictments should be drafted and extradition requests filed. Sanctions should also target the bribers, not just those on the receiving end. The former’s impunity is equally responsible for systemic corruption, and it is their crimes the politicians seek to conceal.

For far too long, Paraguay’s corruption has sabotaged the course of justice—not least because of Washington’s indifference to its consequences. The Biden administration’s commitment to combat corruption may have just changed that. Let’s hope it stay the course.

6 notes

·

View notes

Text

The Ultimate Guide to Investing in Foreign Stocks from Bangladesh

In a globalized world, investing in foreign stocks presents lucrative opportunities for diversification and potentially higher returns. For Bangladeshi investors, venturing into international markets can be a rewarding strategy to maximize their investment portfolio's growth. In this comprehensive guide, we delve into the intricacies of investing in foreign stocks from Bangladesh, exploring the benefits, challenges, strategies, and essential considerations to empower investors with the knowledge needed to make informed decisions.

Understanding the Benefits of Investing in Foreign Stocks

Diversification: Expanding Investment Horizons

Diversification is a cornerstone principle of sound investment strategy. By spreading investments across different asset classes and geographic regions, investors can mitigate risk and optimize returns. Investing in foreign stocks offers Bangladeshi investors exposure to a broader range of industries, currencies, and economic cycles, reducing their portfolio's vulnerability to local market fluctuations.

Access to Growth Opportunities

Emerging markets often present compelling growth prospects that may outpace those available domestically. Investing in foreign stocks allows Bangladeshi investors to capitalize on the growth potential of dynamic economies and industries that may not be fully represented in their home market. From technology startups in Silicon Valley to established multinational corporations in Europe, international markets offer a diverse array of investment opportunities for astute investors.

Currency Diversification and Hedge Against Inflation

Investing in foreign stocks denominated in different currencies provides Bangladeshi investors with an additional layer of diversification. In times of currency depreciation or inflationary pressures, foreign investments can act as a hedge, preserving the value of their investment portfolio. Moreover, exposure to foreign currencies can offer opportunities for capital appreciation, further enhancing overall returns.

Overcoming Challenges: Navigating Legal and Regulatory Frameworks

Compliance with Regulatory Requirements

Before venturing into foreign stock markets, Bangladeshi investors must familiarize themselves with the legal and regulatory frameworks governing cross-border investments. This includes understanding foreign exchange regulations, tax implications, and compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. Seeking guidance from reputable financial advisors or consulting legal experts can help investors navigate these complexities and ensure compliance with applicable laws.

Currency Risks and Volatility

Investing in foreign stocks exposes Bangladeshi investors to currency risks and exchange rate fluctuations. Fluctuations in exchange rates can impact the value of foreign investments when converted back into Bangladeshi Taka (BDT). To mitigate currency risk, investors can employ hedging strategies such as forward contracts or currency options. Additionally, diversifying investments across multiple currencies can help spread risk and minimize the impact of adverse exchange rate movements.

Political and Economic Stability

Political instability, economic downturns, and geopolitical tensions can significantly affect foreign stock markets' performance. Bangladeshi investors must conduct thorough research and analysis of the political and economic landscape of target countries before making investment decisions. Assessing factors such as government stability, fiscal policies, and regulatory environment can help investors gauge the risk profile of foreign markets and make informed investment choices.

Strategies for Investing in Foreign Stocks

Research and Due Diligence

Before investing in foreign stocks, thorough research and due diligence are paramount. Bangladeshi investors should analyze macroeconomic trends, industry dynamics, and company fundamentals to identify promising investment opportunities. Utilizing research tools, financial publications, and reputable online platforms can provide valuable insights into foreign markets and help investors make well-informed decisions.

Diversified Portfolio Allocation

Maintaining a well-diversified portfolio is essential for managing risk and optimizing returns. Bangladeshi investors should allocate a portion of their investment portfolio to foreign stocks based on their risk tolerance, investment objectives, and time horizon. By diversifying across different geographic regions, industries, and asset classes, investors can enhance portfolio resilience and capture growth opportunities in global markets.

Long-Term Perspective

Investing in foreign stocks requires a long-term perspective and disciplined approach. While short-term market fluctuations and volatility are inevitable, focusing on the fundamental strengths of selected companies and holding investments for the long term can yield attractive returns. Adopting a patient and strategic mindset, rather than succumbing to short-term market noise, is key to successful foreign stock investing.

Conclusion

Investing in foreign stocks from Bangladesh offers investors access to diversified opportunities, growth potential, and currency diversification. By understanding the benefits, overcoming challenges, and implementing sound investment strategies, Bangladeshi investors can harness the power of global markets to build wealth and achieve their financial goals. With careful research, prudent risk management, and a long-term perspective, investing in foreign stocks can be a rewarding endeavor for savvy investors seeking to expand their investment horizons.

0 notes

Text

Cryptocurrency Regulations Around the World

Various governments, including those in the United States, China, and other regions, struggle to regulate the rapidly expanding cryptocurrency market. This thorough guide can help us better understand how various countries address the complicated world of digital currencies by navigating their present regulatory frameworks and developments.

Understanding the regulatory environment is essential for anyone keen to study bitcoin trading and advance to the cryptocurrency expert or advisor position. Blockchain Council's cryptocurrency trading courses shine like a beacon, providing unmatched insights into digital assets and cryptocurrency trading as the need for knowledge in this industry rises.

United States

The United States, a prominent actor in the bitcoin market, has recently seen considerable regulatory changes. In 2022, a new framework that opened the door to more stringent regulation surfaced. Market authorities like the CFTC and the Securities and Exchange Commission (SEC) have acquired power in this changing environment.

Under Chairman Gary Gensler's direction, the SEC has moved aggressively toward regulation, as seen by the well-known legal action brought against Ripple. Gensler has highlighted the importance of safeguarding investors, characterizing the cryptocurrency markets as "a Wild West." The White House has also stated that it intends to deal with illicit cryptocurrency activity. It considers changing current laws and assessing the dangers of decentralized finance and non-fungible coins.

With the Biden administration acknowledging "significant benefits" in investigating a central bank digital currency (CBDC), the possibility of a digital dollar appears to be approaching. Chairman of the Federal Reserve Jerome Powell views a CBDC as a way to prevent the nation from using alternative currency.

China

For inheritance purposes, bitcoins are categorized as property in China. The People's Bank of China (PBOC) has banned Bitcoin mining and cryptocurrency exchanges due to worries about government funding and regulatory permission. Despite these constraints, China has been busily creating its digital yuan (e-CNY), and in 2022, it will formally launch the next stage of its CBDC pilot test program.

Canada

Canada proactively approaches cryptocurrency legislation. Even though they're not regarded as legal money, cryptocurrencies are liable to capital gains tax. The first Bitcoin exchange-traded fund (ETF) was authorized nationwide, and cryptocurrency trading platforms must register with regulatory bodies. As money service enterprises, all cryptocurrency investment firms must register with Canada's Financial Transactions and Reports Analysis Centre (FINTRAC).

United Kingdom

Trading cryptocurrencies are considered property in the UK, and exchanges must register with the Financial Conduct Authority (FCA). After the British Parliament's lower house recognized cryptocurrencies as regulated financial instruments and expanded the scope of existing legislation to include stablecoins, the regulatory environment became even more apparent.

Japan

Japan is progressive, recognizing cryptocurrency as legitimate property through the Payment Services Act (PSA). Cryptocurrency exchanges are required for anti-money laundering (AML), countering the financing of terrorism (CFT) regulations, and registering with the Financial Services Agency (FSA). The nation has been actively addressing regulatory issues, including taxation, and treats profits from cryptocurrency trading as supplemental income.

Australia

Australia taxes capital gains on cryptocurrencies because it considers them legal property. Exchanges must adhere to AML/CTF regulations and register with the Australian Transaction Reports and Analysis Centre (AUSTRAC). Prohibited trading of private coins and imposed restrictions on initial coin offerings (ICOs).

Singapore

Similar to the UK, Singapore considers cryptocurrencies to be property. Exchanges are licensed and governed by the Monetary Authority of Singapore (MAS) by the Payment Services Act (PSA). Because long-term capital gains are tax-free, Singapore is an excellent place for cryptocurrency-related business.

Korea

Exchanges of cryptocurrencies and suppliers of virtual asset services in South Korea must register with the Korea Financial Intelligence Unit (KFIU). The nation imposed a 20% tax on digital assets; it was initially scheduled to go into effect in 2022 but was postponed until 2025. A law known as the Digital Asset Basic Act is being worked on to control the learn crypto trading industry.

India

India's regulations regarding cryptocurrency still need to be clarified. Although a measure to prohibit private cryptocurrency is being circulated, it has yet to be approved. India levies a 1% tax deduction at source (TDS) on cryptocurrency trades and a 30% tax on cryptocurrency investments. In late 2022, the nation started a test program using tokenized rupees.

Brazil

Although Brazil has not declared Bitcoin legal cash, it did enact legislation acknowledging cryptocurrencies as legitimate means of payment. The regulatory framework, the "Legal Framework for Virtual Assets," assigns responsibility for overseeing cryptocurrency exchanges to the Brazilian Central Bank.

European Union

Most of the European Union allows cryptocurrency, while the individual member states govern exchanges. Taxation varies by country, ranging from 0% to 50%. New regulations like the Markets in Crypto-Assets Regulation (MiCA) seek to strengthen consumer safeguards and implement licensing specifications.

Current Worldwide Developments

Around the world, laws are still being developed as the bitcoin business develops. Many nations are working hard to create rules and regulations to deal with the particular difficulties that come with virtual currencies. Crypto exchanges are subject to restrictions in the United States, and legislation requiring crypto service providers to obtain an operating license will soon be introduced in the European Union. Regulating cryptocurrency is happening, but it's still complex and contentious.

In summary

Finally, crypto advisor classes are essential for individuals keen to learn about cryptocurrency trading, as cryptocurrencies require a detailed grasp of regulatory nuances. People who want to become cryptocurrency specialists or consultants must keep up with the latest developments as governments worldwide try to find a balance between regulation and innovation.

The cryptocurrency trading courses offered by Blockchain Council are a great approach to becoming an expert in this ever-evolving industry. They convey a comprehensive understanding of cryptocurrency trading and the leading cryptocurrencies. Blockchain Council's cryptocurrency trading courses offer the necessary resources to confidently and competently navigate the complex world of cryptocurrencies, regardless of your experience level.

1 note

·

View note

Text

Regulatory Challenges and Opportunities for Corporate Law Firms in Mumbai

In the bustling economic environment of Mumbai, corporate law firms face a complex web of regulatory challenges and opportunities. As the commercial and financial hub of India, Mumbai’s legal landscape is continually evolving, compelling corporate law firms in Mumbai to adapt swiftly to remain effective and competitive. This adaptation is not just about overcoming challenges but also leveraging opportunities that come with regulatory changes.

Navigating through a Dynamic Regulatory Environment

The Indian regulatory environment is known for its dynamic nature, with frequent changes that can significantly impact business operations. Corporate law firms in Mumbai play a crucial role in helping businesses understand and navigate these changes. The introduction of new regulations, such as those concerning data protection, corporate governance, and environmental compliance, presents a continuous learning curve for these firms.

For instance, the implementation of the Goods and Services Tax (GST) was a major regulatory shift that required businesses to overhaul their existing tax compliance frameworks. Corporate law firms in Mumbai were instrumental in assisting businesses through this transition, providing guidance on the new tax regime’s implications and helping to restructure business processes to ensure compliance.

Adapting to Technological Advancements

As technology continues to advance, so does the regulatory framework that governs it. Areas such as data privacy, cybersecurity, and financial technology are under intense scrutiny by regulators, creating a demand for specialized legal services. Corporate law firms in Mumbai have the opportunity to position themselves as leaders in these fields by developing expertise and offering up-to-date legal advice that addresses the latest regulatory requirements.

For example, the expected introduction of a comprehensive data protection law in India similar to the GDPR in Europe means that businesses will need to significantly adjust their data handling and privacy policies. Corporate law firms in Mumbai are gearing up to offer consultancy services in this area, helping clients implement robust data protection frameworks that comply with new laws.

Leveraging Regulatory Changes for Business Growth

While regulatory changes can pose challenges, they also provide opportunities for business growth. Corporate law firms in Mumbai have the unique advantage of guiding businesses through these changes not just for compliance but also for strategic advantage. For example, changes in foreign direct investment (FDI) policies or the easing of norms in certain sectors can open new avenues for businesses to expand or diversify.

Corporate law firms in Mumbai are well-placed to analyze these regulatory changes and advise clients on how to capitalize on them. By doing so, they not only aid their clients in leveraging these opportunities but also enhance their own market standing as strategic partners rather than just legal advisors.

Ethical and Compliance Considerations

Amidst the rush to stay ahead of regulatory changes, corporate law firms in Mumbai must also uphold the highest ethical standards. The legal profession is fundamentally based on trust and integrity, and any deviation from these principles can tarnish a firm’s reputation permanently. Moreover, with the increasing focus on anti-corruption laws and corporate ethics, firms need to ensure that they are not just advising clients on compliance but also practicing what they preach.

Conclusion

The regulatory landscape for corporate law firms in Mumbai is both challenging and rich with opportunities. By staying informed about regulatory changes, investing in specialized knowledge, and maintaining a steadfast commitment to ethical practices, these firms can not only navigate these challenges successfully but also help their clients thrive in an increasingly complex business world.

In doing so, corporate law firms in Mumbai will continue to be pivotal players in India's economic growth, steering businesses through the regulatory hurdles and towards sustainable success.

0 notes

Text

Setting Up a Financial Consultancy in Dubai

Setting up a financial consultancy in Dubai involves careful planning and adherence to regulatory requirements. Here's a comprehensive guide to assist you in establishing your financial consultancy:

Market Research and Specialization

Market Analysis:

Conduct thorough research to understand the financial consultancy landscape in Dubai, including the demand for financial services, competition, and emerging trends in the local market.

Identify potential clients, key industries, and the regulatory environment governing financial advisory services.

Specialization:

Define the niche and specialization of your financial consultancy, such as wealth management, corporate finance, investment advisory, or Islamic finance, to tailor your services to the specific needs of clients in Dubai.

Legal Considerations and Business Setup

Legal Structure:

Choose the appropriate legal structure for your consultancy, considering factors such as ownership, liability, and compliance with financial regulations in Dubai.

Ensure compliance with licensing and regulatory frameworks for financial services companies in Dubai, including registration with relevant authorities.

Obtain Necessary Licenses and Permits:

Acquire the required licenses and permits for offering financial consultancy services, including professional licenses for financial advisors, compliance with the regulations of the Dubai Financial Services Authority (DFSA) if it's a financial free zone, and adherence to the laws and regulations of the UAE Central Bank.

Location Selection and Office Setup

Strategic Location:

Select a strategic location for your consultancy office, considering proximity to financial institutions, potential clients, and networking opportunities within Dubai's business districts or financial free zones.

Evaluate lease agreements, zoning regulations, and workspace layout to ensure a professional and accessible location.

Office Infrastructure and Compliance:

Design and equip your office to meet the infrastructure requirements for a financial consultancy, including IT systems for data security, client confidentiality, and necessary compliance with financial regulations.

Establish internal controls, policies, and procedures to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

Service Offerings and Expertise

Service Portfolio:

Define the range of financial services to be offered, such as financial planning, investment advisory, risk management, and corporate finance, aligning them with the needs of businesses and individuals in Dubai.

Showcase expertise in the specific areas of financial consultancy, ensuring a comprehensive and tailored offering for clients.

Adherence to Regulatory Standards:

Stay abreast of regulatory changes and ensure that the services and advice provided by your consultancy comply with the regulations set forth by the relevant financial authorities in Dubai and the UAE.

Talent Acquisition and Professional Development

Recruitment:

Recruit experienced financial professionals with expertise in areas such as financial planning, investment analysis, and regulatory compliance, ensuring that they possess the necessary certifications and qualifications recognized in Dubai.

Continuous Professional Development:

Foster a culture of ongoing learning and skill development among your team, encouraging participation in professional certifications, training programs, and industry seminars to stay updated with the evolving financial landscape in Dubai.

Marketing and Client Engagement

Brand Positioning:

Develop a strong brand identity that conveys expertise, trustworthiness, and professionalism in financial consultancy, reflecting the values and vision of your firm.

Client Engagement: