#vyper posting

Text

(vyper as well as the vyper doodle at the bottom belongs to @ratscrap !!!)

oh also adding onto the au from earlier, we have very toxic yaoi up in this club too lol there’s a cult and everything it’s great and also oracle and vyper are kissing their ship name is killing machine ISNT THAT FUN ^_^

#the yaoi is beyond toxic#it’s radioactive and you will die if you stare at it for too long#obsessed with them HELP ME!!!!!!#pathfinder wotr#pathfinder#pf wotr#dnd#dnd oc#dnd oc art#oc art#dnd art#oracle posting#vyper posting#killing machine posting#<- they get their own tag now too ^_^#bob the artist

76 notes

·

View notes

Text

i love how astarion can be as much as a bitch as he wants and be as snarky as he wants towards other companions but as soon as one is jokingly snarky towards him in return suddenly they're the actual worst character in the game. like okay.

#(sarcasm. obviously.)#ive seen this with wyll and then there were those tags in my own post like. come on guys#for the record i do like astarion. if that wasnt clear. vyper is literally romancing him#but goddddd his FANS dog. HIS FANS.#rev txt

44 notes

·

View notes

Text

16 Examples of Social Media Strategies That You Can Use for Your Clients

As a social media strategist, you never want to be at a loss to help your clients. Should they want to try something new or expand their reach to new audiences, you need to have new ideas ready to brainstorm.

And social media marketing is about so much more than just posting interesting content or nice-looking pictures. You need to have solid strategies in place so you can know how to accomplish specific results that your brand or your client is looking for.

Let’s take a look at 16 tried-and-true examples of social media strategies that can help you drive real results.

Why You Should Never Take a Single Strategy Approach

It’s nearly impossible at this stage of the social media game to focus on a single strategy and stay successful. Some brands remain entirely focused on growth or engagement to the point that they fail to recognise how these can all be interconnected, never mind that businesses rarely need to achieve just one metric. They want a larger engaged audience that buys more, not just a bigger audience that does nothing or only succeeds in getting their existing audience to comment more. You need all the rungs.

Here we’ll outline a few different ideas you can keep on hand so that you can create a diverse, expansive, and increasingly effective social media marketing strategy . Note that there will be plenty of overlap between the strategies, so some may serve more than one purpose.

4 Examples of Growth Strategies for Social Media

Growth strategies are a must for any social media campaign, but not in isolation. How can you grow your following and help them along to the next stage of the sales funnel?

These four examples of social media strategies for growth are a solid start.

1. Social Media Contests

Social media contests are obviously great for engagement and growth, but they also go a long way towards attracting new followers and motivating them to not just follow but engage.

You have a number of software options for running your contest, like Shortstack, Wishpond, or Vyper. They can help you not only capture user engagement with things like photo submissions, but you can get their email addresses, too. It’s an effective social growth and lead generation strategies.

You can require people to follow your accounts in order to enter the contest, which can help growth.

You can also encourage users to submit their own photo or caption a picture and share it on their social media, tagging your accounts. This method ensures that even more people see it through their friend’s socials, which can also help your accounts grow further.

2. Partnering With Other Brands

Partnerships with beloved brands often make for the most engaging growth strategies because it forces both brands to get creative for an eye catching contest.

Read more

0 notes

Text

In an effort to spice up safety, the BNB Chain has lately launched a safe multi-signature pockets service generally known as BNB ProtectedPockets.

This service is constructed upon the Gnosis Protected protocol and is now accessible on each the Binance Sensible Chain (BSC) and opBNB networks.

The Gnosis Protected Multisig Pockets

The BNB Chain has lately launched a multi-signature pockets service referred to as BNB ProtectedPockets, constructed on the Gnosis Protected protocol. The latter is a great contract pockets recognized for its high-level safety features, strong entry management, and complicated execution logic.

One among its standout options is the flexibility to permit a number of wallets to be managed by a number of homeowners, including an additional layer of safety.

As we speak, we’re launching the BNB ProtectedPockets 🔒

Our multi-sig pockets relies on the Gnosis Protected protocol and now dwell on BSC + opBNB. It affords a safe solution to handle digital belongings!

Create BNB Protected Account:https://t.co/7nJiV3vcqD

Documentation:https://t.co/yFzeupHeb2 pic.twitter.com/6h6gGyA2ZX

— BNB Chain (@BNBCHAIN) October 28, 2023

BNBChain’s Protected multi-signature pockets service affords digital asset storage with user-centric safety measures. Customers can customise their safety preferences, deciding on proprietor accounts and specifying the minimal variety of confirmations required for transactions.

To get began with the BNB Chain multi-signature wallet service, customers are required to create a Protected. Gnosis Protected is a protocol and platform that allows decentralized custody and administration of belongings throughout a number of networks, together with Ethereum (ETH), zkSync, Arbitrum, BNB Sensible Chain, EVM, and Ethereum Mainnet.

Its web3-enabled device, generally known as Protected Pockets, simplifies interplay with the DeFi and web3 ecosystem, thereby enhancing the security of belongings and selling cooperative asset administration.

Safety Breaches on the BNB Chain

Current years have witnessed quite a few safety breaches and assaults focusing on the BNBChain community, elevating considerations in regards to the security of customers’ belongings. Notable incidents embrace the July 2023 Vyper Copycat Exploit on BSC, the place vulnerabilities within the Vyper programming language resulted in cryptocurrency theft.

Moreover, a significant assault in October 2022 on Binance (BNB) noticed hackers exploiting weaknesses within the BNB community, resulting in substantial monetary losses.

In September 2023, hackers who beforehand focused the Stake on line casino for $41 million made off with roughly $328,000 million value of BNB (BNB) and Polygon (MATIC) tokens, additional highlighting the necessity for strong safety measures inside the ecosystem.

In response to a weblog post by BNB Chain, the introduction of the BNB ProtectedPockets, BNB Chain goals to offer customers with a safe and reliable answer for managing their digital belongings, providing peace of thoughts in an more and more complicated and difficult crypto panorama.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).PrimeXBT Particular Provide: Use this link to register & enter CRYPTOPOTATO50 code to obtain as much as $7,000 in your deposits.

0 notes

Note

Hello Malkuth, i know this may seem completely random, and you dont have to answer this ask or delete it if you please, but before/if you do, please let me make myself clear.

1. When i asked to join the rp, it was because i was genuinely curious and wanted to see how things were going on with you and eve (not in a malicious way, it was also because i genuinely thought you forgot about us, and i just wanted to check on how you two were doing because it's been so long.)

2. i havent been trying to be malicious to you as much as the others. i'm usually a man of second chances, and despite everything that happened between us, i would still be glad to give you another chance because i genuinely think you've gotten better mentally.

you'll most likely be blocking my tumblr and banning me from fuck it we ball after you find this ask in your askbox, but i want you to know that im not here to insult you, judge you, or do anything negatively impactful to you, your server, or your friends.

(this was made because of one of your recent tumblr posts talking about me asking for an invite for the server, which, you told me the server name and i got curious.)

you're completely fine! I'm just been extremely paranoid after Ego tried to raid the server once (hence why the invite function is off for @/everyone) and the fact that London, Id, and Vyper all act as sort of a group? And they feel familiar, really familiar, which scares me a bit.

I've forgotten a lot tbh.

(but I remembered some recently due to certain circumstances.)

I won't block or ban you, why would I? I thank you for the second chance. I've gotten a lot better mentally since then, I think.

(Also, sorry about the post. I was just nervous and I felt the need to share with someone.)

0 notes

Text

Unraveling the Curve Finance Attack: How DeFi Survived the Contagion

The recent Curve Finance attack sent shockwaves through the DeFi ecosystem, prompting concerns about its stability and resilience. However, JPMorgan analysts offer a glimmer of hope, stating that the contagion has been contained. In this article, we explore the aftermath of the exploit, collaborative efforts to save Curve Finance, and the overall state of the DeFi landscape amidst the challenges it faces. Join us on this journey as we navigate the complexities and potential impact on the future of decentralized finance.

Curve Finance Attack: Vulnerability and Consequences

The exploit that struck Curve Finance was due to a vulnerability in Vyper, a widely-used programming language in DeFi applications. As a result, the price of the native CRV token plummeted, putting over $100 million worth of loans at risk of being liquidated, including those of its founder, Michael Egorov. Egorov had taken multiple loans on different DeFi lending platforms, with CRV as collateral, mostly receiving stablecoins in return. The potential liquidation of these loans raised concerns about the impact on other DeFi protocols, given CRV's role as a trading pair in various liquidity pools.

Egorov's Response and Ongoing Status

In the aftermath of the attack, Michael Egorov acted swiftly to protect his loan position and prevent liquidation. He sold a total of 72 million CRV to 15 institutions/investors through over-the-counter deals at a price of $0.4 per token, receiving $28.8 million in total to repay the debts, according to on-chain analyst Lookonchain. Presently, Egorov still holds 374.18 million CRV ($220.4 million) in collateral and owes $79 million on five DeFi platforms.

Collaborative Efforts to Save Curve Finance

Several prominent investors, including Tron founder Justin Sun, Huobi co-founder Jun Du, crypto trader DCFGod, and Mechanism Capital co-founder Andrew Kang, have united their efforts to salvage Curve Finance. Their coordinated response has played a crucial role in limiting the contagion effect, as stated by JPMorgan analysts.

DeFi Ecosystem: Stalling Growth and Bright Spots

Beyond the immediate impact of the Curve Finance attack, the overall DeFi ecosystem has experienced challenges over the past year. Collapse of projects like Terra and FTX, the U.S. regulatory crackdown and uncertainty, hacks, and higher transaction fees have collectively eroded investor confidence, leading to fund outflows and user exits from DeFi platforms, according to the analysts.

Despite these challenges, some parts of DeFi continue to thrive. Notably, the Tron ecosystem and Ethereum Layer 2 networks, including Arbitrum and Optimism, have seen a rise in their total value locked (TVL) over recent months. This growth can be attributed to their ability to offer faster and more cost-effective transactions compared to the congested Ethereum network.

Conclusion

While the Curve Finance attack shook the DeFi ecosystem, the prompt containment efforts by stakeholders have mitigated its impact on a larger scale. However, the sector still faces challenges that demand careful attention and innovative solutions. As investors and users remain cautious, projects that can offer improved efficiency and lower costs will likely lead the way in driving the DeFi ecosystem towards its next phase of growth and stability.

For more articles visit: Cryptotechnews24

Source: theblock.co

Related Posts

Read the full article

#CRVtokenprice#CryptoNews#CurveFinanceattack#decentralizedfinance(DeFi)#DeFilendingplatforms#liquiditypools#MichaelEgorov#Vyperprogramminglanguage

0 notes

Text

Hackers stole around $62 million from Curve Finance on Sunday, causing a ripple effect throughout the crypto sector and raising questions about the strength of the decentralized finance ecosystem.

Curve is one of the largest decentralized exchanges (DEX) in the crypto market today, with about $1.67 billion in total value locked (TVL), according to data on DeFi TVL aggregator DeFiLlama.

A handful of DeFi projects’ pools were also hacked, including PEGd’s pETH/ETH: $11 million; Metronome’s msETH/ETH: $3.4 million; Alchemix’s alETH/ETH: $22.6 million; and Curve DAO: around $24.7 million, according to Llama Risk’s post-exploit assessment.

A bug found in older versions of the Vyper compiler contract programming language caused a failure in a security feature used by a handful of Curve liquidity pools. An admin in Curve Finance’s Telegram group declined to comment further to TechCrunch+ and referred us back to the post-exploit assessment.

By crypto standards, this wasn’t considered a “big” hack; Curve is a massive DEX, and this hack makes up about 4% of its TVL. A portion of the exploit was done by white hat hacker user c0ffeebabe.eth, who returned 2,879 ether, roughly $5.4 million, to Curve, according to on chain data.

But this exploit isn’t the only problem Curve — and the broader crypto space — is facing.

Curve founder Michael Egorov has a $100 million loan backed by 427.5 million of the DEX’s token, CRV. That’s around 47% of the entire circulating supply of CRV, according to Delphi Digital, a research and data platform. The token’s price dropping could spell bad news for the health of Curve, and could create even more volatility in the broader DeFi ecosystem.

Egorov borrowed about 63.2 million tether from Aave, against collateral of 305 million CRV which will be liquidated if the CRV/USDT pair drops to 37 cents, Delphi wrote. As it stands, CRV is down 19% to 59 cents from 73 cents before the Sunday attack, according to CoinMarketCap data.

Next in store

0 notes

Text

𝐚𝐥𝐥 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐛𝐥𝐨𝐠

main account

this account is vy/vyper's spam account. i will post rants and updates about my work here. follow me to keep up with my work !

tags

rants / random - #vypersrants

updates - #vyperiaup

1 note

·

View note

Text

Analyzing Solidity and Vyper for Smart Contracts Programming

Which smart contract programming, Solidity vs. Vyper, is superior? The answer will be revealed in this post. After the Ethereum network introduced smart contracts in 2014, it was only a matter of time before a language other than Solidity for smart contract development services was developed. Vyper is one such language that aims to increase the readability and comprehension of the source code for smart contracts. We’ll look at the advantages and disadvantages of the programming languages Solidity and Vyper separately.

Understanding Solidity

Solidity is a high-level, Turing-complete programming language that supports smart contract development for several use cases, including decentralized finance (DeFi), NFTs, and wallets, on the Ethereum Virtual Machine.

Influenced by JavaScript and C++, Solidity uses the same multiple inheritance techniques as Python. Solidity is supported by several blockchain systems, including Polkadot and Avalanche while being most closely related to Ethereum.

Ethereum CTO Gavin Wood presented Solidity as a solution to the requirement for a flexible smart contract-based developer environment. The vibrant decentralized ecosystem of applications currently operating on Ethereum was made possible by Solidity. It gave programmers the ability to write smart contracts for a variety of use cases.

Advantages of using Solidity

Educational resources and online courses are widely available.

Remix, an online editor for building smart contracts, is one of the many developer tools available.

Development suites like Hardhat and Truffle for building, testing, and deploying smart contracts are available.

Aave and UniSwap, two important providers of blockchain technology, have used Solidity.

It supports strings and dynamic size arrays.

Recently, exception handling was added to the repository for Solidity.

Disadvantages of using Solidity

There is a chance of overflow circumstances or the storage of overly large numbers.

Numerous contracts that were created using this technology turned out to have significant flaws that were not found during testing and development.

Understanding Vyper

Vyper, which is a high-level programming language similar to Solidity, was developed specially to increase the security of smart contracts used on blockchains that are EVM-compatible.

Pythonic syntax is used in Vyper programming, hence the serpentine name, to emphasize readability so that developers may quickly identify bugs and weaknesses in their code before sharing contracts.

The security of Vyper’s smart contracts is greatly enhanced by the use of strong typing and computational decidability. Because Vyper variables must all have specified types, developers may estimate the maximum gas usage before deploying a contract thanks to the decidability of contracts.

Advantages of using Vyper

It is easier to start coding for Python coders.

It attempts to be transparent for readability and security.

Development tools like Etherscan and Brownie have become more popular recently.

It is used by DeFi protocols like Curve to generate their contracts.

It is less susceptible to assaults because of the restrictions on arrays and strings.

A precise upper bound may be calculated for the gas consumption of any function call.

Disadvantages of using Vyper

Community support is lacking.

Modifiers, recursive calls, class inheritance, and dynamic data types are not included in the functionality.

Many Solidity features are still in development and are not yet accessible in Vyper.

What Compromises do Vyper and Solidity make?

A Community of Developers

Solidity is a web3 programming language that is far more popular than Vyper only based on numbers. We can estimate the number of developers using each language by quickly searching GitHub for all files written in Vyper (.vy) and all files written in Solidity (.sol). In comparison to the 8.3 million Solidity files on GitHub, there were about 10,300 files created in Vyper at the time this article was produced.

Flexibility

Security

Auditability

Which language to choose between Solidity and Vyper?

The decision to choose a single language is not either/or because Vyper and Solidity are compatible. However, Vyper should be used for applications that require strong security guarantees while Solidity should be used for more basic smart contracts that require flexibility.

Because each language has a variety of applications, neither is expressly superior to the other. Vyper is best for applications requiring the highest level of security because of its rigidity and lack of a robust developer community, and novice web3 developers should begin by studying Solidity.

0 notes

Text

why is this shit always happening with me and astarion

#from a few days ago but i forgot to post it.#bg3#astarion#baldurs gate 3#rev txt#also vyper cameo hiii vyper.

16 notes

·

View notes

Text

5 tips to DeFi smart contract development

In the world of Decentralized Finance (DeFi), smart contracts play a vital role in enabling various financial transactions and applications. As such, it is important for developers to create robust and secure smart contracts to ensure the safety of users’ funds. In this blog post, we will share 5 tips to help you develop DeFi smart contracts that are safe and secure. From using verified libraries to testing your code, following these tips will help you create contracts that can stand up to the rigors of the DeFi world.

What is a smart contract? What isDeFi smart contract development?

A smart contract is a programmable agreement that is stored on a blockchain. Smart contracts automatically execute the terms of an agreement when certain conditions are met.

DeFi smart contracts are smart contracts that are developed for the purpose of providing financial services on a decentralized network. DeFi smart contract development involves creating smart contracts that can provide these services in a secure and trustless manner.

What are the benefits of smart contracts? What are the benefits ofDeFi smart contract development?

When it comes to developing DeFi smart contracts, there are a number of benefits that should be considered. First and foremost, smart contracts can help to automate a number of processes and tasks related to the DeFi ecosystem, which can save time and resources. Additionally, smart contracts can help to ensure the security of transactions and reduce the risk of fraud or theft. Finally, smart contracts can also help to promote transparency and trust within the DeFi ecosystem by providing clear and concise terms and conditions for all parties involved.

How to develop a smart contract? How to achieveDeFi smart contract development?

To develop a DeFi smart contract, you’ll first need to have a clear understanding of what your contract is supposed to do. Only then can you start coding it and testing it on a blockchain.

To make sure your contract works as intended, you must first write code that meets all the requirements specified in the DeFi smart contract development guide. After that, you should test your code on a blockchain platform like Ethereum.

If everything goes well and your contract works as expected, you can finally deploy it on the main Ethereum network. Now, other users can interact with it and use it to trade or borrow money.

What programming languages can be used forDeFi smart contract development?

There are a few languages that can be used for DeFi smart contract development, but the most popular ones are Solidity and Vyper.

Solidity is a contract-oriented, high-level language for implementing smart contracts. It was influenced by C++, Python and JavaScript and is designed to target the Ethereum Virtual Machine (EVM).

Vyper is also a contract-oriented, high-level language but with a syntax that is more expressive and easier to read and write than Solidity. Vyper is also meant to be compiled to EVM bytecode.

Conclusion

We hope that these tips have helped you when it comes to developing smart contracts for DeFi applications. If you follow these tips, you’ll be well on your way to creating contracts that are secure, efficient, and user-friendly. Keep up the good work!

0 notes

Text

Cryptocurrencies Disclosure: This is a sponsored post. Readers ought to perform additional research study prior to taking any actions. Learn more ' Over the last numerous days, an extensive examination was released into a confidential white hat tipster who unbelievely conserved numerous leading crypto procedures from significant losses to the tune of $350 M and still counting. The neighborhood ultimately found that the hero of the story was blockchain security auditing company Statemind The business is reasonably brand-new, yet its effect on the cryptocurrency market is currently being acknowledged and valued in a considerable method. The current scenario is likewise the ideal example of why blockchain auditing companies are so essential and can possibly conserve organizations millions in damages. Here is whatever you require to learn about the current blockchain vulnerability in Avalanche, SushiSwap, Abracadabra, and other procedures. We will likewise shed some extra light on Statemind itself.Cryptocurrencies All About The $350 M Vulnerability And White Hat Tipster All throughout the crypto area, the most popular procedures are routinely bombarded with hackers who look for bugs and other backdoors into the underlying code that can be made use of for individual gain. These innovative hackers understand there are millions, even billions, at stake with these blockchain networks throughout all properties, that makes them a high-value target at all times. Source code should be spotless of any vulnerabilities, otherwise somebody will discover it. In the current case with Statemind and a handful of leading procedures, the cryptocurrency neighborhood was fortunate that the blockchain security auditing company discovered the vital precompile vulnerability prior to a dubious star did. Otherwise, the approximated damages would have been over half a billion dollars, or at minimum, $350 million. Overall price quotes of damages are still climbing up as the circumstance is totally examined. Not just did Statemind avoid massive losses throughout the crypto neighborhood, however they likewise weren't even looking for credit for it and provided a suggestion anonymously to ImmuneFi.Cryptocurrencies Statemind Steps Forward After Lengthy Crypto Community Investigation Not pleased with not understanding who the tipster was, designers required to the crypto Twitter neighborhood and started looking for responses For the sake of openness, those affected started sharing their findings associated with the vulnerability on social networks and released post-mortems speaking about what failed. Eventually, Statemind stepped forward, and the affected blockchain designers revealed their inmost thankfulness. It has actually likewise put Statemind in the spotlight throughout the crypto market as both a hero and as a brand-new auditing company that is plainly worth focusing on. @statemindio stepped forward as the confidential whitehat who tipped off the groups included: https://t.co/MmG4hkkad7 Thanks once again for all your work to signal the neighborhood of the problem!-- Patrick "The Faucet" O'Grady (@_patrickogrady) September 8, 2022 Blockchain auditing companies are ending up being progressively essential as blockchain procedures end up being more complex and there is this much cash at stake. Routine auditing and code evaluation may feature an expense upfront however can conserve crypto business and their users a fortune if and when something goes badly incorrect.Cryptocurrencies Learn More About Statemind Blockchain Security Auditing Statemind.io is a leading blockchain security auditing business with over 100,000 LoC worth of Solidity and Vyper experience. The business just recently can be found in 14 th location in the Paradigm CFT2022 Customers consist of LIDO, 1INCH, and Yearn.Finance, and it is simple to see why, after the business had the ability to conserve other blockchains and users from loss of funds. To discover more about Statemind.

io or demand an audit, see the main site Disclaimer: This is a sponsored post gave you by Statemine. Disclaimer: Our authors' viewpoints are exclusively their own and do not show the viewpoint of CryptoSlate. None of the details you keep reading CryptoSlate ought to be taken as financial investment suggestions, nor does CryptoSlate back any job that might be pointed out or connected to in this short article. Purchasing and trading cryptocurrencies must be thought about a high-risk activity. Please do your own due diligence prior to taking any action associated to material within this short article. CryptoSlate takes no obligation must you lose cash trading cryptocurrencies. Read More

0 notes

Text

Потенциальный аирдроп: Основная сеть zkSync готова к запуску в октябре

New Post has been published on https://cripta.today/airdrop/spisok-novyh-razdach/potencialnyj-airdrop-osnovnaja-set-zksync-gotova-k-zapusku-v-oktjabre/

Потенциальный аирдроп: Основная сеть zkSync готова к запуску в октябре

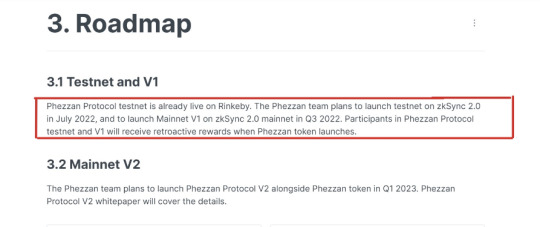

Запуск zkSync 2.0 запланирован на 28 октября, и в объявлении команда также представила общедоступную дорожную карту.

Запуск принесет несколько обновлений, в том числе совместимость с Web3, поддержку Solidity и Vyper, более оптимизированный перенос и более низкую плату за газ.

Члены криптосообщества предполагают, что будет раздача нативного токена, хотя это еще не подтверждено.

В настоящее время работа находится на завершающей стадии тестовой сети с динамическими сборами среди задач, которые необходимо выполнить. Некоторые из функций zkSync 2.0 включают, среди прочего, совместимость с EVM и Web3, поддержку Solidity и Vyper, более оптимизированный перенос и более низкую плату за газ. В настоящее время пользователи могут торговать на zkSync в альфа-тестовой сети.

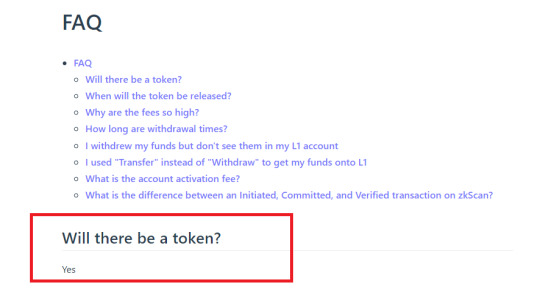

В социальных сетях велись дискуссии о том, будет ли раздача нативного токена. На странице токеномики zkSynch в Интернете говорится, что будет собственный токен, поэтому ясно, что будет актив, которым пользователи смогут торговать.

Команда, подтверждающая токен на странице часто задаваемых вопросов: zkSync

Однако неясно, будет ли аирдроп сопровождать эти разработки. Криптовалютные аналитики и энтузиасты размышляли об этом утвердительно, говоря, что кошельки, которые оставались активными на предыдущих этапах zkSynch, имеют право на раздачу.

Тем не менее, это остается предположением, хотя оно не выходит за рамки возможного. Токен, безусловно, привлечет внимание крипторынка и может быть очень успешным.

Как пользователи будут иметь право на zkSync Airdrops?

Существует несколько протоколов, созданных поверх zkSync, которые могут дать пользователям право на участие в потенциальной раздаче. Сообщество предполагает, что можно сделать моментальный снимок, который будет хранить записи обо всех пользователях, которые были активны в сети.

Есть также несколько протоколов, построенных поверх zkSynch, которые могут проводить аирдропы. Одним из них является Orbiter Finance , который представляет собой перекрестный мост, который можно использовать для соединения различных блокчейнов. Еще одна платформа — Phezzan Protocol , вечный DEX на zkSync 2.0. Все эти протоколы проводят аирдропы, которыми пользователи могут воспользоваться, если они активны.

Дорожная карта Phezzan Protocol намекает на возможный сброс: Phezzan

В последнее время в заголовки новостей попали аирдропы, в первую очередь токен ETHW и токен Optimism . Эти бесплатные токены для активных пользователей также были популярны, и даже крупные DEX, такие как Uniswap, проводили аирдропы. Это популярный способ вознаграждать активных пользователей и одновременно расширять сеть.

0 notes

Text

Suunto x lander mode d'emploi

SUUNTO X LANDER MODE D'EMPLOI >> DOWNLOAD LINK

vk.cc/c7jKeU

SUUNTO X LANDER MODE D'EMPLOI >> READ ONLINE

bit.do/fSmfG

Tirez le meilleur parti de votre produit Suunto en consultant le manuel d'utilisation, en regardant les vidéos explicatives et en lisant Suunto X-Lander. GRATUIT ! Ce site permet de télécharger le mode d'emploi SUUNTO X-LANDER en Français. Télécharger mode d'emploi, notice, manuel quelque soit la marque. Il reste affiché en permanence dans tous les modes, permettant ainsi d'analyser d'un Indicateur De Tendance Barométrique - Suunto X-LANDER Mode D'emploi. montres et objets connectés Suunto 3, 5, 7, 9, Advizor, Altimax, Ambit, Stinger, T, Traverse, Vector, Vyper, Vytec, X, X-Lander, Yachtsman, Zoop. Mode d'emploi. Consultez gratuitement le manuel de la marque Suunto X-Lander Military ici. Ce manuel appartient à la catégorie Montres de sport et a été Manuel pour Suunto X-Lander Montre sport. Consultez et téléchargez le PDF, trouvez des réponses aux questions fréquemment posées et lisez les commentaires Manuel, et notice d'utilisation SUUNTO X-LANDER - SUUNTO. Votre guide et mode d'emploi pour vous servir de votre appareil.

https://fowacaqadoma.tumblr.com/post/694495530679664640/mode-emploi-nokia-3310-2017, https://cukobeconim.tumblr.com/post/694494840415764480/mecanicien-competition-emploi, https://lemotipan.tumblr.com/post/694495179663654912/mode-demploi-ther, https://cukobeconim.tumblr.com/post/694494545890721792/machine-sous-vide-silvercrest-mode-d-emploi, https://cukobeconim.tumblr.com/post/694495205973442560/notice-ecostar-plus.

0 notes

Audio

To prove I'm still active, a song I made before the recent global changes that seemingly fit the times so I had to release it. I was thinking of saving it for an album but I'm way too slow making it so share a single instead? Anyhow, a picture I took of a downtown building. As it is 4:50 AM and I'm tired, that is all I will write on this before retiring to sleep. Oh and the lyrics are a pun..

#SoundCloud#music#Vyper#Electronic#Alternative#Indie#Rock#darkwave#coldwave#post-punk#punk#dark#covid

3 notes

·

View notes

Text

hi! been quite some time since I’ve been active, so a little update:

pronouns and identity—

I use all pronouns except for she but primarily I use they/them/theirs and ze/zem/zyr, and the best way to label my gender would be genderfluid, although I never fluctuate between genders feeling-wise; I just have masculine and feminine feelings. I’m a big fan of the terms non-binary, queer, and gendervoid, though

I now identify as a neurodivergent trans/non-binary person loving over neurodivergent trans and/or non-binary people, however my strong affinity towards women (especially masculine ones) remains, often despite gender identity (although I do tend to attract and be attracted to fellow transgender/non-binary people… sooo…) and I’m still a demisexual, and slighty demiromantic

I use the names Vyper and Ashton interchangeably, so feel free to use whichever!

mental health—

I have been formally diagnosed with ADHD for quite a while now, I’m getting tested for autism, and I feel as though it’s quite possible I have a personality disorder, i.e. BPD (borderline, not bipolar), however I’m working very hard on getting to a healthy place with myself as I also have severe anxiety and severe suicidal depression

yes, I do often get professionally diagnosed—this is more for myself than anyone else. I believe in self-diagnosis however because I wouldn’t be where I am today without it, and not everyone else has the same privilege to get diagnosed as I do. you know what your body needs better than anyone else.

I don’t believe in labels such as low-functioning and high-functioning for anything mental-health related, especially autism. Please don’t label me as such or try to.

Recently—

I just got my wisdom teeth removed this morning! The numbing it wearing off but it’s not fun to say the least.

I have feelings for someone, and he’s the reason my identity has fluctuated to vastly. No relationship, just feelings.

I am fully vaccinated and I recommend for others to get vaccinated too. Complain all you want about having to wear a mask, but if you didn’t get fully vaccinated and had the ability to? You’re part of the problem. Very few of us like wearing masks. If possible, get vaccinated.

I like to say I’m goth punk. Just throwing that out there. I’m an alternative person 😂

anyways, thanks for reading my catch-up post! stay healthy yall 🖤🦷👁☠️🐍🐉🥀⛓

#suicide tw#personal#🐍#pronouns#trans#nonbinary#t4t#demisexual#demiromantic#catchup#lgbtq#alternative#punk#goth#actually autistic#actually adhd

36 notes

·

View notes