Text

Seamless Protocol: Transforming DeFi with Innovative Features on Base Network

In the fast-paced world of decentralized finance (DeFi), innovation is the name of the game. Recently, a groundbreaking project called Seamless Protocol emerged, revolutionizing the DeFi landscape. In this article, we'll delve into the details of this exciting venture and explore how it is changing the game.

Unlocking DeFi Innovation: Seamless Protocol's Journey

In a groundbreaking collaboration, the Seashell team joined forces with several prominent DeFi projects, including RNG Labs, STIG, and Loreum Labs. This collaboration also welcomed advisors and collaborators from Ampleforth and Uniswap. Together, they embarked on a mission to redefine decentralized finance by introducing Seamless Protocol, a cutting-edge initiative within the Base network.

Exploring Seamless Protocol

Seamless Protocol, the brainchild of this collective effort, emerges as a decentralized liquidity market poised to reshape the DeFi landscape. It represents a full-fledged fork of the Aave v3 platform, incorporating similar smart contract functionalities. However, Seamless Protocol aims to stand out by focusing primarily on enabling undercollateralized borrowing—a game-changing feature in the world of decentralized finance.

Revolutionizing Borrowing Dynamics

At the core of Seamless Protocol's innovation lies its strategic use of smart contracts. These contracts are meticulously designed to offer a level of transparency and control that has been lacking in traditional DeFi platforms. With Seamless Protocol, liquidity providers gain comprehensive insights into the utilization of their funds, empowering them with unparalleled information.

Key Features of Seamless Protocol

To understand the transformative power of Seamless Protocol, let's delve into some of its key features:

- Undercollateralized Borrowing: Seamless Protocol breaks down barriers by allowing users to access loans with reduced collateral requirements. This innovation opens doors for a broader audience, enhancing financial inclusion within the DeFi ecosystem.

- Transparent Fund Utilization: Through smart contracts, users can track precisely how their funds are utilized within the platform. This transparency fosters trust and confidence among liquidity providers, ultimately driving higher participation.

- Enhanced Security Measures: Security is a paramount concern in the world of DeFi. Seamless Protocol integrates state-of-the-art security protocols to safeguard user assets and data, setting new standards for safety in the industry.

- Community-Driven Governance: The governance model of Seamless Protocol is community-oriented, ensuring that the platform evolves in alignment with the needs and aspirations of its users. Decisions are made collectively, fostering a sense of ownership among stakeholders.

The Path Forward

As Seamless Protocol continues to evolve, it has the potential to disrupt the DeFi sector significantly. Its innovative approach to undercollateralized borrowing and transparent fund utilization is a testament to the forward-thinking nature of the DeFi community.

Conclusion

In conclusion, Seamless Protocol, born from a collaborative effort between Seashell, RNG Labs, STIG, and Loreum Labs, stands at the forefront of DeFi innovation. With its unique features and community-driven ethos, it is poised to make a lasting impact on the world of decentralized finance. Stay tuned as Seamless Protocol paves the way for a more inclusive and transparent financial future.

Image: Coin68

For more articles visit: Cryptotechnews24

Source: Cryptonetnews

Related Posts

Read the full article

0 notes

Text

MicroStrategy's Remarkable Rise with Bitcoin

MicroStrategy, a renowned business intelligence company, saw its shares surge by 3% during premarket trading on Tuesday. This upturn came as Bitcoin made a significant recovery, crossing the $26,000 mark after a period of lackluster performance. With 158,800 BTC in its possession, valued at over four billion dollars, MicroStrategy holds the distinction of being the largest publicly-listed corporate holder of the flagship cryptocurrency.

MicroStrategy's Stock Boosted by Bitcoin Resurgence

In a noteworthy turn of events, MicroStrategy's shares experienced a 3% increase in premarket trading as Bitcoin staged an impressive comeback, surpassing the $26,000 threshold for the first time since Friday. As of the time of writing, MicroStrategy's stock was trading at approximately $353 per share during the market's pre-open, while Bitcoin's price was hovering around $26,144. This surge in Bitcoin's value had a ripple effect on various altcoins, including Ethereum, Binance Coin, XRP, Dogecoin, and Cardano, which all saw gains ranging from 1.5% to 2.5%.

The Unbreakable Link Between MicroStrategy and Bitcoin

The strong correlation between MicroStrategy's share price and Bitcoin's performance comes as no surprise. MicroStrategy, under the leadership of CEO Michael Saylor, holds the title of being the largest corporate holder of Bitcoin. In essence, the company acts as a Bitcoin proxy, resembling a de facto Bitcoin exchange-traded fund (ETF).

As of August 1, 2023, MicroStrategy's Bitcoin holdings stand at an impressive 158,800. The total purchase price for this significant crypto asset exceeds $4.5 billion, with an average acquisition cost of approximately $29,672 per coin. Remarkably, this positions MicroStrategy as the custodian of nearly 0.7% of the entire Bitcoin supply, considering that Bitcoin's maximum supply is capped at 21 million.

Corporate Crypto Investors Embrace New Accounting Rules

MicroStrategy's bold and proactive approach to Bitcoin investment has undeniably contributed to the company's business success and its soaring stock performance. This week, MicroStrategy and other prominent corporate Bitcoin holders received a considerable boost.

A pivotal development came in the form of long-awaited accounting rules, which were unanimously approved by US accounting policymakers. These rules require companies that hold or invest in cryptocurrencies to report their holdings at fair value. This ensures that the most current asset values, including recoveries following price declines, are accurately reflected in financial reporting.

While the new guidelines are expected to introduce some level of volatility to the earnings of companies heavily invested in crypto, they offer the crucial advantage of capturing price recoveries. This improvement in accounting practices is anticipated to bring substantial benefits, as companies gain the ability to present a more accurate financial picture of their cryptocurrency investments.

Conclusion

In conclusion, MicroStrategy's strategic alliance with Bitcoin and its proactive approach to investment have not only bolstered the company's standing but have also played a pivotal role in shaping the evolving landscape of corporate crypto investments. As accounting rules catch up with the crypto revolution, we can expect continued growth and innovation in this dynamic space.

For more articles visit: Cryptotechnews24

Source: tokenist.com

Related Posts

Read the full article

0 notes

Text

PayPal On and Off Ramps: Cryptocurrency Revolution in the US

In a significant development for the world of online payments, PayPal, the global industry giant, has unveiled a game-changing feature known as "PayPal On and Off Ramps." This innovative integration with PayPal's existing services opens up new horizons for Web3 merchants, allowing them to readily accept cryptocurrency payments from their customers in the United States. Let's delve deeper into this groundbreaking offering and explore how it can transform the landscape of digital transactions.

The Power of PayPal On and Off Ramps

PayPal On and Off Ramps serve as a bridge between the world of traditional finance and the burgeoning Web3 ecosystem. This integration extends the capability of PayPal's existing service, which already permits US consumers to purchase and sell cryptocurrencies backed by PayPal. Now, it empowers wallets, decentralized applications (dApps), and NFT marketplaces to seamlessly integrate with PayPal's robust payment platform.

Enhancing the Customer Experience

One of the key advantages of PayPal On and Off Ramps is the unparalleled convenience it offers to users. Customers can now swiftly buy and sell cryptocurrencies within the United States, all while benefiting from PayPal's robust fraud management, chargeback protections, and dispute resolution tools. This added layer of security ensures a safe and worry-free transaction experience for both buyers and sellers.

Unlocking Opportunities for Web3 Merchants

Web3 merchants are poised to reap substantial benefits from this innovative feature. By integrating with PayPal, they gain access to a reliable payment ecosystem that has garnered trust among millions of users worldwide. This partnership opens the doors to an expanded user base, as customers can seamlessly use their PayPal accounts to engage with Web3 platforms.

Seamless Crypto-to-USD Conversion

In addition to empowering Web3 merchants, PayPal On and Off Ramps also cater to crypto wallet users in the United States. These users can now convert their cryptocurrency holdings into US dollars directly from their wallet to their PayPal balance. This flexibility enables them to shop, send money, save, or transfer funds to their bank or debit card with ease.

PayPal's Perspective

PayPal has expressed its enthusiasm for this groundbreaking feature, emphasizing its commitment to facilitating cryptocurrency adoption and usage:

"By adding Off Ramps, crypto wallet users in the US can convert their crypto into USD directly from their wallet to their PayPal balance so they can shop, send money, save, or transfer to their debit or debit card."

Accessible on MetaMask

To make this feature readily available to users, PayPal On and Off Ramps can be accessed through MetaMask, one of the most popular crypto wallets and browser extensions. This integration with MetaMask enhances accessibility and ensures that a broad user base can leverage the benefits of cryptocurrency transactions with ease.

Conclusion

In conclusion, PayPal On and Off Ramps represents a significant milestone in the evolution of digital payments and the adoption of cryptocurrencies. It empowers Web3 merchants, crypto wallet users, and the broader online community to embrace the potential of digital assets securely and conveniently. As this feature continues to gain traction, it paves the way for a future where cryptocurrency payments become as commonplace as traditional methods.

Please note that this article provides information and does not constitute investment advice.

For more articles visit: Cryptotechnews24

Source: en.bitcoinsistemi.com

Related Posts

Read the full article

0 notes

Text

Is Bitcoin a Superior Investment Choice Compared to Gold?

In the world of investments, Bitcoin (BTC) has emerged as a contender against the traditional store of value, gold. While these two assets belong to different categories, the ongoing maturation of Bitcoin has sparked intriguing debates within financial circles. In this article, we'll delve into the compelling reasons why Bitcoin might outshine gold as an investment choice.

Liquidity and Accessibility

One significant advantage that Bitcoin boasts over gold is its exceptional liquidity and round-the-clock availability for trading. Unlike gold, which necessitates physical possession, Bitcoin can be effortlessly traded and transferred 24/7. This flexibility enables investors to access their funds swiftly and conveniently, making Bitcoin an appealing option for those who value agility in their investments.

Digital Simplicity

In contrast to gold, which requires secure vault storage or physical possession, Bitcoin exists purely in the digital realm. This unique characteristic makes it incredibly straightforward to store and transfer. All you need is a digital wallet, which can take the form of software, hardware, or even a paper wallet, to securely hold your Bitcoins. Investors can conveniently store wallet information digitally or memorize a passphrase, ensuring portability and easy access.

Freedom from Government Regulation

Another compelling point in favor of Bitcoin is its autonomy from government regulation. Historically, gold has been subject to government oversight and regulations, which can influence its value and trade. On the flip side, Bitcoin operates on a decentralized blockchain technology, rendering it resistant to government interference. This feature is particularly attractive to individuals seeking a financial asset that operates outside the confines of traditional systems. It's important to note that global efforts to regulate Bitcoin are ongoing, but completely outlawing this digital currency has proven to be a formidable challenge.

Potential for Remarkable Returns

Since its inception, Bitcoin's meteoric rise in value has enticed investors in search of substantial returns. While gold has a well-established track record of wealth preservation, Bitcoin's price trajectory hints at the potential for significant gains over a relatively short period. However, the allure of high returns comes hand in hand with cryptocurrency volatility. It's crucial for investors to acknowledge the risks associated with this potential for remarkable returns, including price fluctuations and market unpredictability.

On the flip side, the AI tool also identified some of Bitcoin's drawbacks, including its volatility, its status as a new asset class, and the risks of hacking and theft that come with the territory of the first cryptocurrency.

It's worth emphasizing that Bitcoin represents a relatively uncharted asset class compared to gold. Nevertheless, its underlying blockchain technology holds the potential to revolutionize industries beyond finance. As blockchain continues to advance, Bitcoin's utility and value may expand, making it an even more enticing investment opportunity.

Conclusion

In summary, the choice between Bitcoin and gold as an investment ultimately boils down to individual preferences and risk tolerance. Both assets have their unique advantages and disadvantages, and it's essential for investors to conduct thorough research and make informed decisions based on their financial goals and circumstances.

For more articles visit: Cryptotechnews24

Source: finbold.com

Related Posts

Read the full article

0 notes

Text

Ethereum Smartphone: A Game-Changer in the Web3 World

In the fast-evolving realm of Web3 technology, the Ethereum smartphone has emerged as a true game-changer. Within a mere 24 hours, this innovative device, based on the Google Pixel 7a and fueled by the unique open-source operating system known as ethOS, managed to completely sell out its initial 50 units. Let's delve deeper into what makes this Ethereum smartphone a standout in the ever-competitive market.

The EthOS Operating System: Redefining Mobile Experiences

The "Ethereum Phone" derives its name from the Ethereum operating system, which goes by the abbreviation ethOS. Interestingly, 'ethOS' not only represents Ethereum but also carries the Greek connotation of 'character.' This double meaning encapsulates the uniqueness of this device, boasting an ethOS operating system designed to redefine mobile experiences.

One of the standout features of this smartphone is its built-in Ethereum light client. This specialized functionality transforms the device into a "light node" on the Ethereum network, enabling independent block validation. This unique capability sets it apart from other Web3 smartphones and enhances its performance in handling Ethereum-based transactions and smart contracts.

Seamless Integration: Payments, Messaging, and Ethereum Name Services

The Ethereum smartphone doesn't stop at Ethereum integration; it goes a step further by providing an array of built-in tools for effortless payment processing and seamless messaging. What sets it apart is its native integration with Ethereum Name Services (ENS), simplifying payment procedures for users. Additionally, it offers support for Ethereum Virtual Machines (EVM) and Layer 2 scaling networks, ensuring compatibility with a wide range of decentralized applications (DApps).

Exclusive Access Through NFTs

ethOS NFT. Source: OpenSea

Securing one of these coveted Ethereum smartphones required prospective buyers to obtain an ethOS non-fungible token (NFT) during the pre-sale period. Owning this NFT acted as a ticket to reserve their Ethereum smartphone. However, the process was not without its challenges, as fake NFTs flooded the market on OpenSea, the largest NFT trading platform.

For some enthusiasts, the cost of entry was steep, with ethOS NFTs commanding prices of up to three Ethereum (ETH), equating to nearly $5,000. This stands in stark contrast to the standard Google Pixel 7a, priced at a modest $499 in the US. The exclusivity and blockchain integration of these smartphones have driven their value skyward, with the price differential being a notable 10x.

Competition Heats Up in the Web3 Space

While the Ethereum smartphone made waves with its successful pre-sale, the Solana (SOL) smartphone faced a more challenging market entry. Records show that just over 2,000 units were sold since its release, according to Flipside records. To combat this, Solana Labs took drastic measures, reducing the price from $1,000 to $599, aiming to boost the appeal of their user-friendly crypto phone. This price adjustment came in response to the impending launch of the Ethereum smartphone, scheduled for the fall of 2023.

Conclusion

In conclusion, the Ethereum smartphone, powered by ethOS, is undeniably a trailblazer in the Web3 arena. Its innovative features, seamless integration with Ethereum's ecosystem, and exclusivity via NFTs have positioned it as a frontrunner in the competitive market. As the Web3 landscape continues to evolve, it will be fascinating to witness how this groundbreaking device shapes the future of mobile blockchain technology.

For more articles visit: Cryptotechnews24

Source: beincrypto.com

Related Posts

Read the full article

#blockchainintegration#CryptoNews#Ethereum#Ethereumintegration#EthereumNameServices#Ethereumsmartphone#EthereumVirtualMachines#ethOSoperatingsystem#NFTs#non-fungibletoken#OpenSea#Web3technology

0 notes

Text

GMX V2 Launches on Arbitrum: A Decentralized Exchange with Enhanced Trading Features

GMX, a decentralized exchange, has recently launched its Version 2 (V2) platform, marking a significant achievement in the trading industry. The V2 platform went live on Thursday and has already gathered over $1.2 million in liquidity pools during its initial phase. GMX's popularity has increased due to its availability on the Ethereum-based Arbitrum network, allowing traders to leverage major tokens for betting on price movements. This article will delve into the improvements V2 has introduced, its advantages for traders, and its potential impact on GMX's growth and revenue.

The Growth of GMX on the Arbitrum Network

GMX has firmly established itself as the leading decentralized exchange on the Arbitrum layer-2 network. The platform offers users a seamless on-chain interface to trade spot and perpetual futures at considerably low fees. One of the reasons behind GMX's recent surge in popularity is the rise of Arbitrum, which allowed the exchange to provide traders with leveraged trading services for major tokens like Bitcoin (BTC) and Ether (ETH).

V2: Introduction and Advantages

GMX's V2 platform has been introduced alongside its current version, expanding the range of tradable assets to include alternative currencies such as Dogecoin (DOGE) while offering significantly lower fees compared to V1. The move aims to attract more trading activity and foster revenue growth for the platform.

Enhanced Liquidity with GMX Market (GM) Pools

V2 introduces liquidity through individual GMX Market (GM) pools. These pools reward liquidity providers, who lock their tokens on GMX, with a share of the fees earned from services like leverage trading, borrowing, and swaps. With the expansion of assets in V2, liquidity providers have the opportunity to participate in a wider range of markets, increasing the overall liquidity on the platform.

Diverse GM Pools

The initial GM pools on V2 comprise an array of tokens from different networks. These include Solana (SOL), XRP, Litecoin (LTC), Dogecoin (DOGE), and Arbitrum (ARB) on the Arbitrum network, alongside SOL, XRP, LTC, and DOGE on the Avalanche network. Each GM pool consists of long tokens for positions betting on higher prices, short tokens for positions betting on lower prices, and an index pool token.

Lucrative Returns for Traders

Traders on GMX's V2 platform can benefit from highly attractive annualized payouts on specific GM pools. For instance, as of Friday, DOGE pools are paying out as much as 45%, while the SOL pool offers a 47% annualized payout. However, it's essential to note that these rates are subject to change as market conditions fluctuate.

Fostering GMX's Growth and Revenue Prospects

The introduction of V2 holds great promise for GMX, especially in the fiercely competitive trading market. The platform's commitment to offering attractive rewards and enhanced trading options could drive significant value to its governance token, GMX (GMX). The influx of liquidity, along with the substantial trading volume, will contribute to the overall growth and sustainability of the platform.

GMX's Impressive Performance

GMX's impact on the decentralized finance (DeFi) landscape is evident from the substantial amounts locked on both the Arbitrum and Avalanche networks. According to DeFiLlama data, GMX has locked up over $447 million on Arbitrum and $74 million on Avalanche. Furthermore, the platform has facilitated trades worth over $117 billion and generated $184 million in fees for its Arbitrum users alone, underscoring its significance in the market.

Conclusion

The launch of GMX's Version 2 (V2) is a significant achievement in the decentralized exchange field. V2 aims to attract more traders by offering a wider range of assets, lower fees, and more profitable liquidity opportunities, leading to increased revenue growth for the platform. GMX's success on the Arbitrum network and its impressive trading volumes confirm its position as a prominent player in the DeFi industry. As the platform continues to develop and flourish, traders and liquidity providers can look forward to exciting opportunities and rewards in the decentralized trading ecosystem.

For more articles visit: Cryptotechnews24

Source: coindesk.com

Related Posts

Read the full article

0 notes

Text

The Impact of Non-Farm Employment and Unemployment Data on Bitcoin and Altcoins

In today's dynamic financial landscape, economic data from influential economies like the USA can significantly affect cryptocurrency prices, especially for Bitcoin and altcoins. Understanding the impact of non-farm employment and unemployment data on the crypto market is crucial for informed decision-making by traders and investors. Let's explore this intriguing relationship between traditional economic indicators and the world of cryptocurrencies.

The Impact of Non-Farm Employment and Unemployment Data on Bitcoin and Altcoins

Bitcoin's battle to maintain its position at $29,000 has attracted attention, but the focus of investors and interested parties has turned towards the economic data released by the USA today.

Understanding the State of the Economy: Key Data Disclosed

On the first Friday of every month, the release of economic data is closely monitored to gauge the state of the economy. The data unveiled today is as follows:

- Non-Farm Employment Data

- Expected: 200k

- Previous: 185k

- Disclosed: 187k

- Unemployment Data

- Expected: 3.6%

- Previous: 3.6%

- Disclosed: 3.5%

How Non-Farm Employment Data Affects the Market

The non-farm employment data exceeding expectations signals a potential economic recovery, and this positive effect ripples through the currency market.

The Federal Reserve (FED) closely monitors changes in the labor market as it plays a crucial role in determining the central bank's monetary policy. The FED believes that the labor market, along with falling inflation, needs to stabilize. Therefore, it keeps a watchful eye on employment data.

Considering the impact of the banking crisis, any indication of slowing down interest rate hikes may favor risky assets, particularly with lower inflation and employment data.

The Ripple Effect on Bitcoin and the Dollar Index (DXY)

When the announced data surpasses expectations, the dollar index (DXY) tends to rise while Bitcoin experiences a minor pullback. Conversely, if the data falls below expectations, DXY may see a pullback.

A rise in the unemployment rate can lead to a sharp pullback in DXY, which, in turn, becomes a positive factor for Bitcoin.

During the minutes when the data is released, both scenarios result in high volatility in the market.

Key Takeaways for Investors

For investors and traders, closely monitoring these economic indicators is essential. Non-farm employment data, as well as unemployment figures, can significantly sway the market sentiment. Understanding these trends can help make informed decisions.

As the market reacts to economic data, investors should keep in mind that Bitcoin and altcoins are influenced by a variety of factors, including macroeconomic trends.

Conclusion

The economic data coming from the USA has a significant impact on the prices of Bitcoin and altcoins. The non-farm employment data is a vital indication of possible economic recovery, which affects the currency market and, in turn, affects Bitcoin's performance. Furthermore, fluctuations in the unemployment rate have consequences for both the dollar index and Bitcoin. Investors and traders must thoroughly analyze these indicators to navigate the market successfully, especially during data releases when there is high volatility.

For more articles visit: Cryptotechnews24

Source: en.bitcoinsistemi.com

Related Posts

Read the full article

#Altcoins#Bitcoin#CryptoNews#CurrencyMarket#DollarIndex#EconomicData#FederalReserve#investors#MonetaryPolicy#Non-FarmEmployment#UnemploymentRate#USA#volatility

0 notes

Text

Revolutionary Blockchain-Based SCEMS: Driving a Greener Future

In a groundbreaking move to combat climate change, Hyundai Motor and Kia Corporation have successfully deployed their revolutionary blockchain-based Supplier CO2 Emission Monitoring System (SCEMS) on the Hedera mainnet. This pioneering system is designed to preemptively address local and global environmental regulations while fostering sustainable supply chains within both companies and their cooperative partners.

Calculating Carbon Emissions Across the Entire Supply Chain

The core objective behind the creation of SCEMS is to accurately calculate carbon emissions throughout the entire supply chain. By gaining access to reliable data from their suppliers' operations, Kia and Hyundai Motor can now monitor the sources of raw materials, the production process, and the transportation of products in real-time. This heightened transparency enables the companies to take proactive steps in reducing their carbon footprint and promoting eco-friendly practices across the automotive industry.

Empowering Suppliers with Efficiency and Accuracy

One of the most significant advantages of the SCEMS is the relief it brings to suppliers from time-consuming and costly carbon emission management. Leveraging the power of artificial intelligence (AI) and high-performance blockchain technology, this system empowers business partners to efficiently monitor and manage carbon emissions at their respective workplaces. By streamlining data collection and analysis, suppliers can now ensure compliance with environmental standards while optimizing their operations for a greener future.

Sustainable Practices for a Greener Tomorrow

Hyundai Motor and Kia Corporation's adoption of the SCEMS aligns perfectly with their vision for a sustainable future. As leaders in the automotive industry, both companies are committed to reducing their ecological impact and promoting responsible practices across their supply chains. By harnessing the potential of blockchain technology, they have taken a giant leap towards building a more sustainable and eco-conscious tomorrow.

Unlocking New Avenues of Innovation

The deployment of SCEMS on the Hedera mainnet opens up exciting possibilities for further innovation. As the system continues to gather invaluable data on carbon emissions and sustainability metrics, it lays the groundwork for future advancements in environmental management and clean technologies. This data-driven approach empowers researchers, policymakers, and automotive enthusiasts to collaborate on finding solutions to the most pressing environmental challenges.

Conclusion

Hyundai Motor and Kia Corporation's blockchain-based Supplier CO2 Emission Monitoring System (SCEMS) represents a monumental leap forward in the automotive industry's fight against climate change. By utilizing cutting-edge technology, they are leading the way in proactive carbon emission management and sustainable supply chain practices. As this revolutionary system continues to evolve and drive positive change, it brings us one step closer to a greener, cleaner, and more sustainable world.

For more articles visit: Cryptotechnews24

Source: Cryptonews.net

Image: The Coin Republic

Read the full article

0 notes

Text

Sui Blockchain Daily Transaction Volume Drops by 98%: What Caused the Plunge?

In 2023, the Sui blockchain surged to prominence, attracting widespread attention with its unique digital asset ownership approach. Daily transaction blocks soared, but just as quickly, the network experienced an unprecedented 98% plunge in volume, leaving experts and enthusiasts puzzled. In this article, we explore the reasons behind this sudden decline, analyzing market sentiments, network scalability, and the impact of recent events. As the crypto world grapples with the aftermath, understanding the implications is crucial in this ever-evolving landscap

The Rise and Fall of Sui Network's Daily Transaction Volume

Sui Network, one of the most promising blockchains of 2023, garnered immense attention from the crypto community with its innovative approach to digital asset ownership. The platform witnessed widespread adoption, resulting in millions of daily transaction blocks and total transaction blocks on its network.

Unveiling the Decline

Unfortunately, the euphoria was short-lived as the Sui blockchain recently encountered a significant setback. The daily transaction volume on the network plummeted by a staggering 98%, leaving industry experts and enthusiasts baffled.

Noted Observations

Chinese reporter Colin Wu was among the first to notice the sudden drop in transaction activity on the Sui blockchain. On August 2, just seven days after the blockchain's historic peak with 65.84 million transaction blocks on July 27, the number of transactions drastically decreased to approximately 1.479 million.

Wu tweeted about the startling decline, capturing the attention of the crypto community worldwide.

Understanding Daily and Total Transaction Blocks

To comprehend the impact fully, it's essential to distinguish between daily transaction blocks and total transaction blocks. Daily transaction blocks encompass both successful and unsuccessful transactions performed by SUI accounts within a 24-hour period. In contrast, total transaction blocks represent the cumulative count of transactions authenticated by validators since the Sui mainnet's inception.

The Historic High

As per the latest data on the Sui Network's explorer, the platform recorded a historical high of 65.84 million transaction blocks on July 27. This record coincided with MystenLab's Bullshark event, a groundbreaking initiative promoting 8,192 games developed on the L1 blockchain.

The Plunge

The decline that followed the peak was unexpected and swift. On August 2, the number of transactions on the Sui network dramatically dropped to 1,478,983. The situation worsened further, with a meager 902,780 transactions on August 3, marking a jaw-dropping 98.6% decline from its all-time high. Notably, this plunge occurred soon after the conclusion of MystenLabs' first Bullshark event on July 28.

Timing and Mainnet Launch

Curiously, this record decline happened exactly three months after the Suit network's mainnet launch on May 3. The crypto market had witnessed a 30% drop in the Sui token's value following the launch, even with the backing of major players like Binance.

Analyzing the Reasons

The sudden decline in daily transaction volume on the Sui blockchain has spurred a wave of analysis and speculation within the crypto community. Several factors could have contributed to this downturn:

1. Bullshark Event Conclusion

The conclusion of MystenLab's Bullshark event might have led to decreased activity on the Sui network. The hype around the event could have caused a temporary surge, followed by a slump once the event was over.

2. Market Sentiment

Crypto markets are highly sensitive to market sentiment. Any negative news or market turbulence can trigger investors to withdraw or pause their activities, affecting transaction volumes.

3. Network Scalability

As the Sui Network gained rapid adoption, its scalability might have been tested. If the network faced congestion or performance issues, it could have hindered smooth transaction processing.

4. Regulatory Concerns

Cryptocurrencies often face regulatory uncertainties. Any sudden regulatory announcement or changes in the crypto landscape can lead to caution among traders and investors, impacting transaction numbers.

Conclusion

The Sui blockchain's unprecedented decline in daily transaction volume serves as a reminder of the volatility and unpredictability of the crypto market. While the exact reasons behind the plunge remain speculative, it underscores the importance of thorough analysis and understanding before making investment decisions in the ever-evolving crypto space. As the industry adapts and evolves, it is crucial for blockchain networks to address scalability and regulatory concerns to maintain sustainable growth and stability in the long run.

For more articles visit: Cryptotechnews24

Source: thecryptobasic.com

Related Posts

Read the full article

#24-hourtransactionblocks#Bullsharkevent#cryptocommunity#cryptoindustry#CryptoNews#dailytransactionvolume#MystenLab#Suiblockchain#SuiNetwork

0 notes

Text

Unraveling the Curve Finance Attack: How DeFi Survived the Contagion

The recent Curve Finance attack sent shockwaves through the DeFi ecosystem, prompting concerns about its stability and resilience. However, JPMorgan analysts offer a glimmer of hope, stating that the contagion has been contained. In this article, we explore the aftermath of the exploit, collaborative efforts to save Curve Finance, and the overall state of the DeFi landscape amidst the challenges it faces. Join us on this journey as we navigate the complexities and potential impact on the future of decentralized finance.

Curve Finance Attack: Vulnerability and Consequences

The exploit that struck Curve Finance was due to a vulnerability in Vyper, a widely-used programming language in DeFi applications. As a result, the price of the native CRV token plummeted, putting over $100 million worth of loans at risk of being liquidated, including those of its founder, Michael Egorov. Egorov had taken multiple loans on different DeFi lending platforms, with CRV as collateral, mostly receiving stablecoins in return. The potential liquidation of these loans raised concerns about the impact on other DeFi protocols, given CRV's role as a trading pair in various liquidity pools.

Egorov's Response and Ongoing Status

In the aftermath of the attack, Michael Egorov acted swiftly to protect his loan position and prevent liquidation. He sold a total of 72 million CRV to 15 institutions/investors through over-the-counter deals at a price of $0.4 per token, receiving $28.8 million in total to repay the debts, according to on-chain analyst Lookonchain. Presently, Egorov still holds 374.18 million CRV ($220.4 million) in collateral and owes $79 million on five DeFi platforms.

Collaborative Efforts to Save Curve Finance

Several prominent investors, including Tron founder Justin Sun, Huobi co-founder Jun Du, crypto trader DCFGod, and Mechanism Capital co-founder Andrew Kang, have united their efforts to salvage Curve Finance. Their coordinated response has played a crucial role in limiting the contagion effect, as stated by JPMorgan analysts.

DeFi Ecosystem: Stalling Growth and Bright Spots

Beyond the immediate impact of the Curve Finance attack, the overall DeFi ecosystem has experienced challenges over the past year. Collapse of projects like Terra and FTX, the U.S. regulatory crackdown and uncertainty, hacks, and higher transaction fees have collectively eroded investor confidence, leading to fund outflows and user exits from DeFi platforms, according to the analysts.

Despite these challenges, some parts of DeFi continue to thrive. Notably, the Tron ecosystem and Ethereum Layer 2 networks, including Arbitrum and Optimism, have seen a rise in their total value locked (TVL) over recent months. This growth can be attributed to their ability to offer faster and more cost-effective transactions compared to the congested Ethereum network.

Conclusion

While the Curve Finance attack shook the DeFi ecosystem, the prompt containment efforts by stakeholders have mitigated its impact on a larger scale. However, the sector still faces challenges that demand careful attention and innovative solutions. As investors and users remain cautious, projects that can offer improved efficiency and lower costs will likely lead the way in driving the DeFi ecosystem towards its next phase of growth and stability.

For more articles visit: Cryptotechnews24

Source: theblock.co

Related Posts

Read the full article

#CRVtokenprice#CryptoNews#CurveFinanceattack#decentralizedfinance(DeFi)#DeFilendingplatforms#liquiditypools#MichaelEgorov#Vyperprogramminglanguage

0 notes

Text

Will Bitcoin Reach $1 Million?

Bitcoin, the vanguard of cryptocurrencies and decentralized finance (DeFi), has captivated investors and observers with its sideways moves. Yet, whispers of a potential surge to $1 million abound. Delve into the crucial drivers of this possibility – halvings, institutional adoption, wider acceptance, favorable regulations, and its safe-haven appeal during economic crises. Together, they paint a compelling picture of Bitcoin's journey towards an extraordinary milestone. Join us as we explore the elements shaping Bitcoin's future price trajectory and the boundless possibilities they hold.

Halvings: A Key Driver of Bitcoin's Price

Bitcoin's price movements have long been influenced by its halving events. These algorithmic events cut the mining reward in half, reducing the circulating supply of BTC and driving up demand, ultimately pushing the price higher. In May 2023, Bitcoin entered the final phase before its fourth halving, and the crypto community expects the next halving to occur in May 2024. Prominent analysts, like PlanB, have discussed pricing models that suggest Bitcoin could potentially reach $1 million during that time.

Increased Institutional Adoption Boosts Confidence

The landscape of institutional interest in Bitcoin has shifted dramatically, with major players like BlackRock expressing newfound support for the cryptocurrency. BlackRock's application for a spot Bitcoin exchange-traded fund (ETF) in June sparked a wave of similar filings with the United States Securities and Exchange Commission (SEC). Billionaire Mike Novogratz identified this as a turning point, indicating that increased institutional adoption could further drive Bitcoin's price upward.

Bitcoin as a Widely Accepted Payment Method

As Bitcoin gains acceptance as a legitimate payment option across various businesses worldwide, the demand for the cryptocurrency is expected to increase. Numerous e-commerce and brick-and-mortar establishments now allow customers to pay using cryptocurrencies, and the proliferation of Bitcoin ATMs globally further facilitates its use. Statistics from Coin ATM Radar indicate a continuous increase in installations, with over 36,000 crypto ATMs and 236,000 Bitcoin service providers in 71 countries.

Favorable Regulatory Climate Supports Bitcoin's Growth

Governments and regulators around the world are becoming more open and receptive to cryptocurrencies. The United Kingdom's financial services minister, Andrew Griffith, rejected the idea of regulating retail trading and investing in crypto as gambling. Additionally, countries like Malta have established crypto-friendly regulations, making them attractive hubs for crypto businesses. Binance, one of the world's largest crypto exchanges, chose Malta over Japan due to its favorable regulatory environment.

Bitcoin as a Safe-Haven Asset in Economic Crisis

During times of economic uncertainty, many individuals turn to safe-haven assets like gold and silver. Bitcoin has also emerged as a popular choice, with renowned investor Robert Kiyosaki advocating its inclusion in one's portfolio. Kiyosaki has criticized the Wall Street Journal's claims about the strength of the US economy and suggested investing in Bitcoin as a hedge against a potential financial crisis and stock market crash. He predicts Bitcoin's price could reach $120,000 in the near future.

Current Bitcoin Price Analysis

As of August 2, Bitcoin is trading at $29,467, showing a daily increase of 1.76% and a weekly gain of 0.88%. However, on its monthly chart, it has experienced a decline of 3.83%. While predicting if and when Bitcoin will reach $1 million remains uncertain, the factors discussed above, whether acting independently or in combination, will undoubtedly shape the future price of this leading digital asset. Ultimately, supply and demand will dictate Bitcoin's actual value.

Conclusion

In conclusion, Bitcoin's potential to reach $1 million is influenced by several significant factors. Halvings play a crucial role in driving its price upwards, while increased institutional adoption and wider acceptance as a payment method boost confidence in the cryptocurrency. A favorable regulatory environment and Bitcoin's appeal as a safe-haven asset during economic crises further contribute to its potential growth. As investors and enthusiasts closely monitor these developments, only time will reveal the true extent of Bitcoin's ascent to unprecedented heights.

For more articles visit: Cryptotechnews24

Source: finbold.com

Related Posts

Read the full article

#anditsappealasasafe-havenasset.#Bitcoin#CryptoNews#DiscoverthefactorsthatcoulddriveBitcoin'spriceto$1million#favorableregulations#includinghalvings#institutionaladoption#wideracceptanceasapaymentmethod

1 note

·

View note

Text

Unlocking the Power of Kaspa (KAS): A Deep Dive into the Altcoin's Impressive Performance and Growth Potential

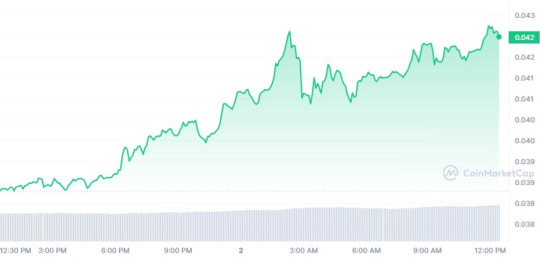

Kaspa (KAS) has been on an impressive bullish run, maintaining an upward trajectory for three consecutive days, positioning itself as one of the top-performing altcoins in July. At the time of this writing, Kaspa is trading at $0.04223, representing a notable 13.01% increase in the past 24 hours. This impressive uptrend has led to an astounding surge of over 80.52% in the trailing 30-day period.

Kaspa's Enigmatic Power in the Blockchain World

Kaspa stands out in the blockchain landscape as it operates on a Directed Acyclic Graph (DAG)-powered proof-of-work (PoW) platform. Its emergence coincided with the need for an Ethereum (ETH) alternative after the transition of Ethereum from PoW to proof-of-stake (PoS) last year.

Growth Drivers for Kaspa

- Diverse Community and Increased Adoption: Kaspa's native community has been a driving force behind its growth, accumulating and supporting the project consistently. Furthermore, the entry of buyers from other protocols, like Ethereum, has contributed to bolstering Kaspa's appeal across the entire crypto space.

- Utility and Performance Focus: Unlike many competitors in the market, Kaspa is prioritizing utility and performance over mere hype. The platform boasts an impressive throughput rate, capable of processing up to 100 blocks per second, making it exceptionally suitable for enterprise adoption.

- Developer Team and Functionality Upgrades: The dedicated team of developers working on Kaspa has been instrumental in continuously enhancing its functionalities. Recently, they introduced a new update, further fortifying the platform's capabilities.

Climbing the Ranks

Kaspa's recent impressive growth has propelled it up the rankings, currently standing at the 208th position. However, there is a prevailing perception that the coin is still undervalued. With a series of upgrades and dApps in the pipeline, Kaspa holds the potential for further uptrend before the end of Q3.

Conclusion

Kaspa (KAS) has exhibited remarkable bullish momentum, making it one of the standout performers among altcoins in July. Its Directed Acyclic Graph (DAG)-powered proof-of-work (PoW) platform sets it apart in the blockchain world, and with the support of a dedicated community and growing adoption, its appeal continues to expand. Focusing on utility and performance, Kaspa stands out as a strong contender for enterprise adoption. As the team of developers keeps upgrading the platform, the potential for further uptrend remains high, positioning Kaspa for a promising future in the crypto market.

For more articles visit: Cryptotechnews24

Source: u.today

Related Posts

Read the full article

#altcoin#Blockchain#CryptoNews#DAG#DirectedAcyclicGraph#ETH#Ethereum#growthdrivers#KAS#kaspa#performance#PoW#proof-of-work#protocol#utility

2 notes

·

View notes

Text

Introducing BakerySwap: A Game-Changing Multi-Chain DeFi and NFT Platform

Discover the revolutionary world of BakerySwap, a cutting-edge multi-chain platform that is set to transform the DeFi and NFT landscape. With its strategic incorporation with Base Chain, BakerySwap is poised to unleash a wave of innovative services, including an advanced AMM exchange, a Launchpad for budding projects, and a groundbreaking NFTSwap platform. Join us on this exciting journey as we explore the seamless trading experience, liquidity provision, and unparalleled opportunities that BakerySwap brings to the crypto community. Embrace the future of DeFi and NFTs with BakerySwap today!

BakerySwap Expands Horizons with Base Chain Incorporation

BakerySwap, a prominent player in the cryptocurrency space, is gearing up for a major milestone in its journey by incorporating with multiple chains. Their first strategic move involves backing the Base Chain, a secure and cost-effective Ethereum Layer 2 solution created by Coinbase, designed to onboard a large number of users on-chain.

The Base Chain Advantage for BakerySwap

Integrating with the Base Chain opens up new horizons for BakerySwap, enabling the expansion of its services and community outreach. The upcoming launch will feature a cutting-edge AMM exchange, a dynamic Launchpad, and a groundbreaking NFTSwap platform, all built on the Base Chain.

BakerySwap AMM Exchange: Empowering Seamless Trading

The BakerySwap AMM exchange on Base Chain promises users a seamless and reliable trading experience. With a strong focus on liquidity provision, users will have the opportunity to earn a share of trading fees, fostering the growth of DeFi within the platform.

Base Chain Launchpad: Nurturing Innovation

As part of the incorporation, BakerySwap's Launchpad on Base Chain will serve as an innovation hub for aspiring projects. Developers and innovators will find a secure and conducive platform to launch their projects, allowing users to invest in them at an early stage.

Bakery NFTSwap: A Paradigm Shift in NFT Trading

Bakery NFTSwap, an innovative platform, is poised to revolutionize NFT trading. Simplifying the process, NFTs will be mapped with tokens, and trading can take place seamlessly on the AMM exchange.

Unwavering Enthusiasm for Innovation

BakerySwap's commitment to innovation doesn't stop here. The team is dedicated to introducing additional cutting-edge services and functionalities to the Base Chain. This effort will significantly enhance the NFT and DeFi landscape, providing users with exciting new opportunities.

Conclusion

BakerySwap's decision to incorporate with the Base Chain is a testament to its vision and ambition. The upcoming AMM exchange, Launchpad, and NFTSwap platform are set to redefine DeFi and NFT trading, making it more accessible and user-friendly than ever before. With BakerySwap's commitment to continuous innovation, the future looks promising for both the platform and its community.

For more articles visit: Cryptotechnews24

Source: cryptonewsz.com

Related Posts

Read the full article

#AMMexchange#BakerySwap#BaseChain#CryptoNews#Defi#Launchpad#liquidity#multi-chainincorporation#NFTtrading#NFTSwap

0 notes

Text

Open Ordinals Institute: Advancing the Bitcoin Ordinals Protocol

The Open Ordinals Institute, led by visionary creator Casey Rodarmor, is a non-profit organization dedicated to advancing the Bitcoin Ordinals protocol and its reference implementation, Ord. Through collaboration, community engagement, and financial support for core developers, the institute is driving sustainable growth and high-quality contributions. With transparency and a focus on preserving neutrality, the Open Ordinals Institute invites enthusiasts to contribute and be a part of the transformative future of cryptocurrencies. In this article, we explore the impact and mission of this institute in shaping the future of the Bitcoin Ordinals protocol.

Advancing the Bitcoin Ordinals Protocol

The Open Ordinals Institute, founded by the renowned creator Casey Rodarmor, has emerged as a pivotal force in the world of cryptocurrencies. This non-profit organization is dedicated to pushing the boundaries of the Bitcoin Ordinals protocol and its reference implementation, Ord, with a clear vision of fostering long-term growth and promoting high-quality contributions.

Supporting Core Developers

One of the primary objectives of the Open Ordinals Institute is to provide financial support to Ordinals core developers. As a testament to their commitment, they have appointed Raph as the lead maintainer. This strategic move aims to create an open-source contributor environment that encourages sustained growth and high-quality contributions from developers worldwide.

In a recent statement shared with Bitcoin Magazine, Raph emphasized the significance of collaboration and community engagement in driving the Ordinals protocol's development forward. The institute aspires to build an ecosystem where long-term commitments and exceptional contributions are not only possible but encouraged and supported.

A Transparent Funding Model

To ensure transparency and sustainability in funding, the Open Ordinals Institute operates as a 501(c)(3) non-profit organization. This designation allows them to accept tax-deductible donations, offering donors the assurance that their contributions are used to enhance the protocol and support its dedicated developers. Previously funded through private sources and personal gifts, this shift to a non-profit structure further strengthens the protocol's neutrality and independence.

Preserving Neutrality: The Cleanest Way to Compensate Developers

Ordinally, a core developer of Ordinals, echoed the sentiment of the Open Ordinals Institute. In a statement, they emphasized that this non-profit organization provides the cleanest and most ethical means to compensate developers without compromising the protocol's neutrality. This assurance is essential for a protocol that strives to maintain its integrity and decentralization.

Community Updates and Resource Sharing

The official website of Ordinals.org plays a pivotal role in facilitating community updates and resource sharing related to the development of the Ordinals protocol. Through this platform, developers, enthusiasts, and stakeholders can stay informed about the latest advancements and actively engage in discussions that shape the future of Ordinals.

Supporting the Open Ordinals Institute

If you share the vision of advancing the Bitcoin Ordinals protocol and supporting its dedicated team of developers, you can contribute to the Open Ordinals Institute's mission. By visiting Ordinals.org, you can make tax-deductible donations, thereby ensuring a promising future for the transformative Ordinals protocol. Although IRS approval for tax-deductible status is anticipated in 2023, the organization is currently accepting Bitcoin donations.

Conclusion: A Promising Future for Bitcoin Ordinals

The establishment of the Open Ordinals Institute signifies a remarkable step forward for the Bitcoin Ordinals protocol. With a steadfast commitment to collaboration, community engagement, and developer support, this non-profit organization serves as a driving force behind the protocol's continuous growth and development. Together, we can build a brighter future for the world of cryptocurrencies, one that is powered by the transformative potential of the Ordinals protocol.

For more articles visit: Cryptotechnews24

Source: bitcoinmagazine.com

Related Posts

Read the full article

0 notes

Text

Worldcoin: Revolutionizing Digital Identity with World ID and WLD Token

Worldcoin, an exceptional digital identification platform, revolutionizes online identity verification, empowering individuals worldwide to distinguish themselves from bots and AI algorithms. Co-founded by Sam Altman, the mastermind behind ChatGPT and OpenAI CEO, this innovative project seeks to address the very AI gold rush that Altman contributed to. By leveraging cryptographic and blockchain tools, Worldcoin introduces a robust digital passport system utilizing the WLD token, enabling secure and efficient transactions.

World ID: Pioneering Proof of Personhood

The cornerstone of the Worldcoin platform is the World ID, a revolutionary concept that facilitates online human identity verification while ensuring user privacy. Central to this groundbreaking system is the Orb, an advanced iris-scanning device.

The Orb captures the unique iris pattern of each individual, creating a distinct identification code called the IrisCode. Importantly, this code does not contain any personal information, effectively preventing multiple World IDs from being acquired by a single individual.

Once the Orb completes the iris scan and stores the anonymous IrisCode securely, it issues a unique World ID to the user. The iris images are permanently deleted, eliminating the need for repeated iris scanning for identity verification.

To enhance the security and reliability of the World ID system, each generated World ID is added to the Worldcoin blockchain. Users can then utilize a cryptographically secure application for seamless authentication, fortifying the platform's digital identification process.

World App: Accessible and Secure

The World App is the gateway to obtaining a World ID and is currently operating on the Polygon blockchain during its beta phase, with plans for migration to Optimism's Superchain.

Worldcoin Token (WLD): Empowering Transactions

During the beta program, Worldcoin distributed WLD tokens to participating users, and on July 24, 2023, the token went live, listing on various trading platforms and exchanges, including the Crypto.com App and Exchange. In celebration of its official launch, a significant number of WLD tokens were airdropped to users.

According to the Worldcoin white paper, the platform plans to issue a total of 10 billion WLD tokens over 15 years. Presently, approximately 143 million WLD tokens are in circulation. Among them, 43 million WLD tokens were allocated to verified World App users, while 100 million were provided to market makers to facilitate trading activities.

Acquiring WLD on Crypto.com: A Step-by-Step Guide

- Download and install the Crypto.com App from the App Store or Google Play Store.

- Complete the KYC verification process within the App.

- Deposit funds into the account wallet using bank transfer, credit card, or another crypto wallet.

- Navigate to the 'Buy' section, search for Worldcoin (WLD), and initiate the trade for WLD using the deposited funds.

Criticism and Future Implications

Despite its promising potential, Worldcoin has encountered criticism, especially concerning its use of biometric data, such as eye scans, for identity verification. Privacy concerns and data security issues have led to skepticism among some users and critics.

Nevertheless, Worldcoin's novel approach to digital identity verification and its dedication to fostering a global financial and identity network present a compelling vision for the future of the digital landscape. By creating an accessible and secure system, Worldcoin opens doors to increased economic opportunities for individuals worldwide.

Conclusion

Worldcoin, a groundbreaking digital identification platform co-founded by Sam Altman, endeavors to redefine how individuals verify their human identity in the digital world. With its innovative World ID, World App, and the Worldcoin token (WLD), the platform paves the way for a more secure and accessible global financial landscape. As Worldcoin continues to evolve, addressing concerns and building on its strengths, it stands at the forefront of shaping the future of digital identity and financial accessibility, ultimately contributing to a more inclusive and connected world.

For more articles visit: Cryptotechnews24

Source: crypto.com

Related Posts

Read the full article

#AIdifferentiation#Altcoins#blockchaintechnology#CryptoNews#Optimism#Polygonblockchain#WLDtoken#WorldApp#Worldcoin

0 notes

Text

Bitcoin Halving 2024: How Miners Are Preparing for the Event

As the Bitcoin halving date of April 16, 2024, draws near, miners are leaving no stone unturned in their extensive research and planning. Learning from the past halvings' effects on the Bitcoin network and analyzing the market's reaction during those times, they are gearing up to tackle potential challenges and seize opportunities in the cryptocurrency world.

Efficient Mining Fleet: Upgrading Hardware and Software

One of the foremost areas miners are focusing on is upgrading their mining fleet. Many North American Bitcoin miners have made substantial investments in acquiring the most efficient machines available on the market, gearing up for the forthcoming halving.

- Marathon Digital's Acquisition: In a significant move, Marathon Digital (MARA) acquired 78,000 units of Antminer S19 XP mining machines, known for their exceptional efficiency, delivering close to 11 EH/s in hash rate. Most of these machines were successfully installed and energized in 2022, with a plan to achieve an operational hash rate of 23 EH/s in North America by mid-2023.

- CleanSpark's Expansion: In April 2023, CleanSpark (CLSK) announced the purchase of 45,000 Antminer S19 XP mining machines, which will provide an additional 6.3 EH/s of hash rate upon deployment in Q3 2022. This expansion will increase their total hash rate to 16 EH/s by the end of the year.

- Riot Platforms' Growth: In June 2023, Riot Platforms (RIOT) revealed its acquisition of 33,280 next-generation Bitcoin miners from MicroBT, adding an impressive 7.6 EH/s miners to their self-mining capacity. This move will boost their mining capacity to 20.1 EH/s upon full deployment in 2024.

Moreover, maintaining control over the sites where these mining machines are installed is crucial, as it allows miners to have better control over when machines need to be switched on or off.

Cheap Sustainable Renewable Energy: Lowering Energy Costs

Energy costs constitute a significant expense in Bitcoin mining. As these costs continuously rise after each halving, it is crucial for miners to find ways to utilize the cheapest sustainable and renewable energy options available. Having access to fixed-price energy contracts or the flexibility to curtail energy usage during price spikes becomes essential to maintaining profitability in mining operations.

- CleanSpark's Automation: CleanSpark (CLSK) is actively developing automation systems that maximize uptime and firmware enabling them to underclock and overclock their machines based on the situation. Additionally, they are strategically managing their power consumption in Georgia (GA), positioning themselves favorably for the upcoming halving.

- Texas-based Miners' Strategies: Several Texas-based miners have been implementing innovative energy strategies to boost their revenues. Riot Platforms, for instance, actively participates in the Electric Reliability Council of Texas (ERCOT) market. By supplying power when needed and strategically switching off their systems to help balance the grid, they have secured long-term power purchase agreements, effectively reducing the cost of mining Bitcoin. In June 2023 alone, Riot Platforms generated $8.4 million in power sales and $1.6 million in demand response revenue through these initiatives.

Build Cash Reserves: Preparing for Price Volatility

History has shown that after each halving, there is a period of increased scarcity of Bitcoin, but the immediate price surge may not occur as anticipated. For miners, this means it is crucial to build cash reserves and have sufficient funds ready to cover immediate revenue losses.

Diversification: Incorporating Additional Revenue Streams

In light of the potential price volatility post-halving, some Bitcoin miners have been diversifying their businesses to include additional revenue streams.

- Hut 8's Expansion: Hut 8 (HUT) made a significant move by acquiring the cloud and colocation data center business from TeraGo Inc., establishing itself as a leading high-performance computing platform. This strategic positioning within the digital asset ecosystem enhances Hut 8's resilience in the face of market fluctuations.

- Partnership with Interior Health Authority: In June 2023, Hut 8 also announced a five-year partnership with Interior Health Authority, British Columbia. This partnership enables Hut 8 to provide safe, secure, and reliable colocation services from their flagship Kelowna data center.

- Hive Digital Technologies and Iris Energy: Other players, such as Hive Digital Technologies (HIVE) and Iris Energy (IREN), are also diversifying into high-performance computing, cloud, and artificial intelligence services, further expanding their revenue streams.

Hedging Techniques: Minimizing Risk Exposure

With the halving event approaching, specialized companies now offer services to help mining companies hedge their risk, particularly in terms of electricity costs and hash rate fluctuations. Miners are actively considering these hedging options to protect themselves from potential financial risks associated with mining operations.

As Bitcoin's halving draws nearer, miners are taking proactive steps to optimize their mining operations, making strategic investments in efficient hardware, securing cost-effective energy sources, diversifying revenue streams, and hedging their risks. By employing these tactics, miners are positioning themselves for success amidst the evolving dynamics of the cryptocurrency market.

Conclusion

In conclusion, miners are diligently preparing for Bitcoin's fourth halving by optimizing efficiency, securing sustainable energy, building cash reserves, diversifying revenue streams, and employing hedging techniques. Their proactive approach ensures they are well-positioned to navigate challenges and capitalize on opportunities in the evolving cryptocurrency market. As the halving date approaches, the mining community stands united and ready to embrace the potential that lies ahead.

For more articles visit: Cryptotechnews24

Source: coindesk.com

Related Posts

Read the full article

0 notes

Text

The Debut of Worldcoin (WLD): A Stellar Rise in the World of Cryptocurrency

The entry of Worldcoin (WLD) into the crypto market was remarkable. On its debut day, the token saw a substantial surge in price, as investors eagerly latched onto the excitement surrounding artificial intelligence (AI). What started at $1.70 quickly escalated to an impressive $3.58, before eventually settling at $2.25 at press time.

The Rise of Worldcoin: Unveiling the Numbers

As we write this, Worldcoin continues to impress with a staggering 55% increase in value over the last 24 hours. The project's white paper reveals that the initial supply of the WLD token is capped at 10 billion, and currently, there are 104,872,616 WLD tokens circulating, according to CoinMarketCap data.

A Futuristic Vision: Worldcoin's Innovative Approach

The Worldcoin crypto project has been in the works for three years, and it has recently unveiled its ground-breaking initiative. Centered around AI and biometrics, Worldcoin introduces a unique identification system through the use of an innovative device known as the "orb." By scanning individuals' eyeballs, the orb creates a distinct digital identity, aptly named the "World ID." This identification process grants its owner what Worldcoin calls "proof of personhood."

Changing the Game: Worldcoin's Mission

Co-founded by Sam Altman, the CEO of OpenAI, Worldcoin aims to distribute 1,500 orbs to address the global demand for the World ID. The successful implementation of this system could revolutionize economic opportunities and provide a robust means of differentiating real individuals from AI entities online.

Major Exchanges Embrace Worldcoin (WLD)

The resounding success of Worldcoin's launch has garnered support from various cryptocurrency exchanges. Prominent platforms like Binance, Gate.io, and KuCoin have already listed the WLD token, further cementing its position in the market.

Binance Takes the Lead

One of the leading exchanges in the crypto space, Binance, has wasted no time in listing the WLD token. Traders on Binance can now access WLD through two trading pairs: WLD/BTC and WLD/USDT. The exchange also announced that withdrawals for the WLD token will commence on July 25, 2023.

Gate.io: A Gateway to WLD Trading

Gate.io is another prominent exchange that has joined the Worldcoin wagon. By listing WLD, Gate.io is providing its users with access to this burgeoning asset, allowing them to be part of the revolution.

KuCoin: A Key Player in WLD Adoption

KuCoin, a trailblazer in the crypto exchange sphere, has also extended its support to Worldcoin by listing the token on its platform. This move further solidifies Worldcoin's presence and accessibility in the market.

Bitmex Joins the Bandwagon

Bitmex, a renowned crypto exchange, has announced its plans to list a WLD/USD perpetual swap pair on July 25, 2023, at 4:00 a.m. UTC. This move is expected to provide even more trading options and liquidity for Worldcoin enthusiasts.

Conclusion

Worldcoin's debut has been nothing short of impressive, with its WLD token capturing the attention of investors and the crypto community alike. With its innovative approach to AI-driven identification and substantial support from major exchanges, Worldcoin has set a promising trajectory for the future. As the project continues to unfold, the world watches with anticipation to see how it will revolutionize the landscape of cryptocurrency and artificial intelligence.

For more articles visit: Cryptotechnews24

Source: u.today

Related Posts

Read the full article

#Altcoins#ArtificialIntelligence#Binance#Bitmex#CryptoNews#cryptocurrency#eye-scanningtechnology#Gate.io#globaldemand#KuCoin#majorcryptocurrencyexchanges#orbs#SamAltman#WLDtoken#WorldID#Worldcoin

0 notes