#spg custom cards

Text

@big-mothy-man these are a few drafts from the custom SPG set

3 notes

·

View notes

Text

30 days of Autism Acceptance: Day 3!

April 3: Talk about special interests. Do you have any? What are they? How long have you had them? What does it feel like to have special interests? What does having special interests mean to you? Talk about your past special interests

HOO BOY! Ok, I’ll try not to go on too long about my special interests, but I have a lot to say about them! Also, some of my special interests are in this weird grey area of “are they a SpIn or a hyperfixation?”, so I’ll cover those as well, and make it noted when that’s the case for one. Also, this will be VERY LONG, so I’ll put it under a cut.

SpIn #1 - Pokemon

Pokemon has been my main special interest since I was 9, I believe! Black was my first game that I got for my birthday, and I was super happy to get it since all of my friends at the time would talk about it! I’ve gotten (almost?) every major release since then, thought I usually only get one out of the two versions.

The Pokemon games that I have are *inhales*: Black, Black 2, HeartGold (got a few years after it came out), X (I have the limited edition 3DS), Alpha Sapphire, Moon (first completed Pokedex!), Ultra Moon (haven’t beat and probably never will), Let’s Go, Eevee!, Sword (still trying to beat), Conquest, Art Academy, PMD: Gates to Infinity, Picross, Rumble World, Battle Trozei, Pokemon Quest, Pokemon Playhouse (for when I’m regressed), Poke Park 1 & 2, My Pokemon Ranch, and Battle Revolution!

I also used to play the TCG competitively, and in my first competition, I placed 9th in my division! I stopped playing about a year after that though because the cards I used in my strategy when I would practice with my Dad were too old to be viable.

I have a growing stuffie and merch collection as well! I have a lot of Unova stuffies, and a print of the Unova map that I got at a ren faire when I was younger (it currently hangs above my dresser)! My two favorite stuffies at this time are Baby my Eevee Build-A-Bear (named after my Eevee in Let’s Go, Eevee!), and Lily my Wooloo! I have a couple of Pokemon sketch cards that friends of my Dad’s drew, and some prints and figure-y things I’ve gotten in Artist Alleys over the years!

I also own a couple of different Pokemon books (not the manga, though), and 2 of the movies, along with the OSTs for B/W, X/Y, and ORAS! I don’t have much as far as clothing goes though, except for my “Gotta Catch ‘Em All” scarf and a Pikachu hat I got at an old anime store at the mall that has since closed. That’s probably all I can remember right now!

SpIn #2 - Steam Powered Giraffe

SPG has been a special interest for about 4 years now? Anyway, they’re my #1 favorite band and have literally saved my life. Watching Bunny Bennett’s (who plays Rabbit) vlogs about her transition, along with listening to the song Transform that she wrote (waaay before they just made it a single) really helped me accept myself and come out.

They also came at a time where I was struggling emotionally a lot, and I remember being stuck in the ER hooked up to an IV, and my mom played some of their albums for me to keep me calm and grounded. More recently, I saw them perform at Anime Midwest last year, and when they performed Transform (which neither me or my friends expected), we were all hugging each other and crying tears of joy (my friends are trans as well, and have also been touched by Bunny’s vlogs).

Their songs (not including the sad ones) make me really happy as well, and Make Believe makes me stim a lot in particular! I also got to sing Honeybee as part of a voice coaching summer camp I took last year, and it felt really good to do it! I really recommend listening to them, especially if you like steampunk and/or you’re looking for trans artists to support!

SpIn #3 - Little Shop of Horrors

So this is more of a fairly recent one, compared to the first two. This special interest mostly applies to the 1986 movie, but I’ve seen the stage musical as well! The music, the cast, the plot, it’s all *chef’s kiss*. But for real though, my two favorite things about the movie are the practical effects and the endings.

With the CGI fresh hell we got with CATS, you may thing, “wow, special effects were so much better back then”. Except here’s the thing, they were practical effects. Audrey II is (I believe) entirely puppetry, not CGI. The same applies for the musical as well! It really culminated at the end of the film during “Mean Green Mother from Outer Space”, when Audrey II is at it’s biggest and most elaborate. Speaking of that scene, I much prefer the director’s cut over the theatrical cut. I know that the happy ending is much better for Audrey and Seymour, but “Don’t Feed The Plants” is an absolute banger, and I get a good cry out of it too.

I heard they might be making a remake of the movie, which I’m hesitant about, again, seeing how CATS turned out. We can only hope that they listen to the fans, and make the right decisions when it comes to making it.

SpIn #4 - Jojo’s Bizarre Adventure

Ok, so this is one of those aformentioned “is it a SpIn or a hyperfixation” moments. I’ve been hyperfixated on JJBA for the past 6 months and I’m physically unable to shut up about it XD

I’m about to start watching part 4 of the anime, I just need to set aside time to do it. I watched it a tad out of order, my ex told me to skip part 1 and watch a synopsis of it, so I started with part 2 (I’m a huge part 2 stan btw), got to part 3, was confused by everything going on with DIO, so I went back, watched part 1, and then resumed part 3.

As I mentioned, I’m a huge part 2 stan, so I currently have several part 2 character cosplays in the works. This includes (but isn’t limited to) Caesar, Suzi Q, Playboy Bunny Caesar (inspired by a piece of art that @tinypalettes drew), Tequila Joseph (but like,, actually decent drag), and Cleric Suzi Q from the JJBA D&D session me and my friends are having. I also want to do a drag/latex DIO look, along with maid DIO inspired by an old JUMP cover and a fanfic I read the other day.

I get a little nervous about doing/going to JJBA events at conventions because I’m worried about running into my ex, but knowing that I have supportive people with me helps a lot.

SpIn #5 - Homestuck/Hiveswap

So this is another one of those “SpIn or hyperfixation” moments as well. I’ve been into Homestuck since late 2016, but I’ve never been super involved in the fandom. Like, yes, I have a moirail and I’ve been in and hosted panels at conventions, but I’ve encountered some toxic people in it, so I try to distance myself.

I will say, however, that Homestucks are loyal to their fandom, and will buy merch if they like it. When I say that, yes, I mean myself, but it’s mostly about my Etsy customers. If you look at my sales history, the majority of it is quadrant necklaces, almost always the moirail ones. I get some orders for horns and pillows too, but not as often as the necklaces. When it comes to exhibiting at conventions, it depends. I normally don’t put Homestuck stuff out on the table because it’s such a niche, but when I do, people will usually buy a lot at once. For example, at Wizard World Madison in 2018, one guy bought $50-60 worth of Homestuck sprites from me. That weekend was the best I’ve ever done, and I haven’t come close since. My Etsy store started out as just me making Homestuck sprites for me and my friends too, so I’m glad that I was able to expand and give others what I like as well.

I’m also involved in a Hiveswap YouTube musical, and I’ve made a lot of good friends through it! We’re on hiatus right now, but we should be starting up again soon! I also have a lot of Homestuck cosplays! I’ve done Karkat, John, Jade, Nepeta, Trickster Nepeta, Karkat Peixes (a bloodswap), and I have a lot more that I want to do!

SpIn #6 - Danganronpa

So Danganronpa is (probably) one of those last “SpIn or hyperfixation” things. I’ve been into Danganronpa since 2018 (I think?), and DR:AE is my favorite (mostly because I’m a Kotoko and Toko kinnie oof-)!

Right now, my only Danganronpa cosplay is Toko/Syo, but I’m working on a couple of j-fashion (particularly menhera and fairy kei) inspired looks to do with my moirail (who was the one who got me into j-fashion), and just some Amazon/eBay cosplays as well! I’m also working on a Future Foundation Toko cosplay to do with my moirail so we can do Tokomaru together (though most of it is thrifting and clothes I already have)!

I own DR1, SDR2, and DR:AE on my computer, but I don’t play them much. The second trial in DR1 gives me panic attacks because of the whole breaking of trust thing (I’ve heard the audios and I just,,, break down), I haven’t touched SDR2 yet, and I’m sucky at the controls for DR:AE. However, I’ve watched the anime and I’ve seen let’s plays, so I have a feel for what’s going on, though I may not remember it all correctly since I haven’t watched them in a while.

———————————–

So that’s most (if not all) of my special interests! I probably forgot some, but it’s getting late and I need to pack for my Mom’s and go to bed. I hope you all have a good night!

#30daysofautismacceptance#2020#autism#autistic#actually autistic#autistic characters#autistic character of the day

12 notes

·

View notes

Note

Hi Mr. ENTJ. I think I remember you wrote you were a frequent traveler for work. I'm in the same position (but auditing), not a keen traveler, but wondering if you had anything to share to make life on the road easier. Thanks!

A few tips below made the road warrior life bearable.

Business Travel 101

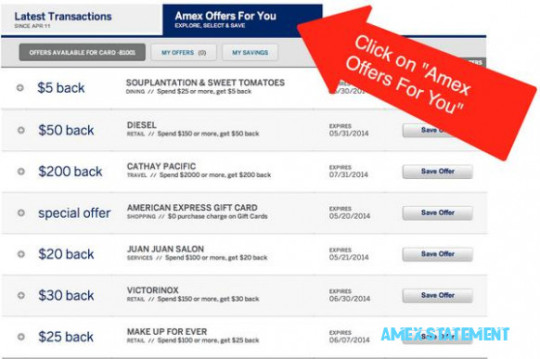

1. Sign up for a travel credit card and airline/hotel/rental car loyalty programs. If you want to be treated like a human being by these giant airlines while traveling and want to avoid becoming a YouTube celebrity from being tased and dragged off a plane then loyalty programs are the way to go. Frequent flyers with status travel like kings– priority boarding, priority seating, seat upgrades to first class, immunity from being bumped, personal concierge, airport lounges, etc. You’ll accumulate points and status quickly from business trips which can be redeemed for personal vacations later. Competing companies will often status match so invest in one specific airline/hotel/rental car chain and request this if you’re looking to make a loyalty switch.

Airline Loyalty Programs

For airlines, pick the one with a major airport hub in your city (ex: American Airlines is in Dallas Fort Worth, United in Chicago, and Delta in Atlanta, etc.). I avoid carriers like Southwest because they’re domestic and points can’t be redeemed for international travel.

United Airlines: MileagePlus Program

American Airlines: AAdvantage Program

Delta Airlines: SkyMiles Loyalty Program

Hotel Loyalty Programs

Marriott/SPG: SPG and Marriott Rewards

Hilton: Honors Rewards Program

Hyatt: World of Hyatt

Rental Car Loyalty Programs

Avis: Avis Preferred

Hertz: Hertz Rewards

Enterprise: Enterprise

2. Apply for the TSA Precheck or Global Entry Program (for U.S. citizens or U.S. permanent residents/green card holders). The amount of time and insanity I’ve been spared at airports with Global Entry is worth 10x its membership fee. For $85 or $100, these two programs allow for expedited security screening and processing when traveling domestically and/or internationally. TSA Precheck is for domestic travel in the United States, Global Entry includes all the benefits of TSA Precheck plus international travel to/from the United States. Go for Global Entry, it only costs $15 more than TSA Precheck for a 5 year membership, and it’ll spare you the unpleasant experience of dealing with United States Customs and Border Protection.

Global Entry: $100 for 5 years

TSA Precheck: $85 for 5 years

If you get one of the luxury travel cards (the Chase Sapphire Reserve, American Express Platinum, Citi Prestige), they’ll pay for 1 TSA Precheck/Global Entry membership fee.

3. Invest in a quality piece of carryon luggage. The 2 most important qualities to look for in luggage are the zippers and the wheels. If the wheels give out, your luggage will become useless and if it happens in the middle of a business trip then you’ll get to experience the joy of carrying a 20-30 pound bag across a crowded airport like a pack mule. I have a Tumi Alpha 2 now but when I first started my career I had a solid Travelpro bag that I got for 60% off MSRP. You can find heavily discounted luggage at off-price department stores like Ross, Marshalls, TJ Maxx, etc.

Color-wise, go for black or neutral colored bags because there will be times you’ll need to haul your luggage to the client site and showing up with a sparkly rainbow unicorn bag may give them the wrong impression.

4. Travel accessories will make your life easier. My top 3 essentials:

Cocoon Grid-It: Travel organizer that makes cables, chargers, and accessories manageable in your briefcase or backpack.

Anker Travel Powerstrip: In cramped conference rooms, outlets are at a premium and this little device will come in handy for charging all your devices.

Portable power bank: I have this one but any will do.

5. All seats are not created equal, use SeatGuru to get tips on the best seats on the plane. SeatGuru has layouts for every plane model and it’ll let you know which ones have funky features like cramped leg space, limited seat recline, etc.

6. Take direct flights. This is especially important during winter when the weather can get unpredictable and flight delays pile up across the country. If you must book a flight with a connection, pick a city that isn’t prone to snow.

7. Uber/Lyft/Taxi to the airport, don’t drive and park at the airport parking lot. Depending on the airport, you’ll save 30-45 minutes each way.

8. Don’t check in your luggage for domestic flights because airlines often lose bags and it’ll slow you down an additional 20-30 minutes; use the overhead compartment. Don’t be that guy/girl that your team has to wait on because your luggage hasn’t come out on the conveyor belt.

9. To get through the security checkpoint blazing fast, avoid lining up behind these 3 groups of people: senior citizens (slow), families with small children (slow + stressed out parents + cumbersome strollers/baby equipment), and fashionably dressed people (slow because they tend to have a ton of metal on them from jewelry, metal belts, heels, etc. and will repeatedly set off the metal detectors).

10. There’s no #10 but I like whole numbers so here we are.

129 notes

·

View notes

Text

Tali Pegawai Id Card Batik Wanita Surabaya & Sidoarjo. Online di Tokopedia

Tali Pegawai Id Card Batik Wanita Surabaya & Sidoarjo. Online di Tokopedia. Link produk di Tokopedia Indonesia => SILAHKAN KLIK

Tanda pengenal pegawai area Asemrowo, Benowo, Lakarsantri, Pakal, Sambikerep, Suko Manunggal, Tandes, Dukuh Pakis

Tali id card staf SPG atau conter HP Gayungan, Jambangan, Karang Pilang, Sawahan, Wiyung, Wonocolo, Wonokromo, Gubeng, Gunung Anyar, Mulyorejo, Rungkut, Sukolilo, Tambaksari, Tenggilis Mejoyo, Bulak, Kenjeran, Krembangan, Pabean , Cantikan, Semampir, Bubutan, Genteng, Simokerto, Tegalsari

Kalung tanda pengenal staf kantoran, ASN & BUMN Pakuwon City, Perumahan Gading Pantai, Pantai Mentari, Jl. Abdul Latif, Bulak, Galaxy Bumi Permai, Jl. Arif Rahman Hakim, Sukolilo, Pantai Mentari, Perumahan Gubeng, Citraland, Pakuwon Indah

📷

id card, id card murah, id card custom, id card holder, name tag, kartu nama, id card kulit, cetak id card, id card kulit asli,id card Jakarta, id card Surabaya, id card kantor, souvenir, lanyard, idcardtag, Lanyard, lanyard murah , tali id Card , id card , hand made , tali id card murah, lanyards, lanyard custom, tali lanyard, para cord, id card murah, lanyard Jakarta, tali id card makassar, lanyard surij, id card holder, name tag,

Lanyard Malang

0 notes

Text

Best Credit Card Points for Travel

Doing our purchases and getting to travel the world using the points we earned from the things we wanted to purchase is just an amazing feeling. You are traveling for free because of the things you bought with the card. There are couple of things as charming as the guarantee of free travel to intriguing goals. The banks know this, and have since a long time ago offered go points to clients for utilizing their charge cards. Thus, insightful Visa clients boost their rewards to travel in solace and style well past their methods.

As of late, I was disclosing this to an European official sitting beside me in Lufthansa's Airbus A380 business class while returning home from a get-away in Italy. I revealed to him that my family and I couldn't in any way, shape or form have paid for our three $7,000 tickets for this flight. Be that as it may, on account of my movement rewards charge cards, my voyage was everything except free after some expenses and expenses. Through watchful determination and utilization of points, these sorts of treks have turned into a yearly event for my family. While there are countless thoughts, tips, and traps to be gathered from unlimited long periods of research, my central goal is to take every necessary step for you and convey just the most profitable counsel to occupied individuals who do not have the time and tolerance to find and interpret these arrangements.

Picking The Best Credit Card Points for Travel

It is decent to pick the best travel compensate cards in a simply experimental way, the way one would pick a card with the most minimal loan fee. Tragically, each movement rewards card offers an exceptional blend of advantages and disadvantages, and infrequently is one card in a perfect world suited for everybody's movement yearnings. I have perused a large number of blog and discussion posts, composed many Visa audits, and by and by held many diverse travel rewards cards in the course of the most recent twenty years. At last, I judge these cards in light of three criteria:

Esteem: The arrival in pennies per dollar spent

Adaptability: Cards that offer the most open doors for reclamations — no power outage dates, an assortment of accomplices, and so forth.

Expenses And Fees: If charges are advocated by its rewards and advantages

Of all the movement rewards cards as of now offered, these are the ones I find generally fulfilling.

Chase Sapphire Preferred® Card

Cardholders of the Chase Sapphire Preferred® Card can exchange their focuses to Chase travel accomplices at full esteem — 1,000 Chase focuses rise to 1,000 accomplice miles/focuses. For most cards, some esteem gets lost amid the exchange. Or on the other hand get 25% off movement booked through Chase's site. Procure 2X focuses on movement and feasting at eateries and 1 point for each dollar spent on every single other buy around the world. There are no remote exchange charges. The introduction yearly expense is $0 the principal year, at that point $95.

Reward offer: Earn 50,000 extra focuses after you burn through $4,000 on buys in the initial 3 months from account opening. That is $625 in movement when you reclaim through Chase Ultimate Rewards®. Win 5,000 extra focuses after you include the main approved client and make a buy in the initial 3 months from account opening.

Bank of America® Travel Rewards Credit Card

The Bank of America® Travel Rewards Credit Card offers 1.5 focuses per $1 spent on each buy, with no restriction to the focuses you can acquire and no lapse date on the focuses. In case you're a Bank of America® client, you get an extra 10% client focuses reward on each buy when you have a functioning checking or investment account with Bank of America. Focuses can be recovered as an announcement credit to pay for flights, lodgings, get-away bundles, and more with no power outage dates and confinements. This card has no yearly charge and no outside exchange expenses.

Online elite reward offer: Get 20,000 online extra focuses in the event that you make at any rate $1,000 in buys in the initial 90 long periods of record opening - that can be a $200 explanation credit toward movement buys.

Discover it® Miles

Voyagers can win 1.5x Miles for every dollar you go through on all buys with the Discover it® Miles, without any tops or restrictions. Discover will likewise coordinate the Miles that new cardmembers acquire toward the finish of the main year. There is no yearly expense or remote exchange charge. See rates and expenses.

Capital One® Venture® Rewards Credit Card

The Capital One® Venture® Rewards Credit Card is a straightforward travel rewards card that offers two miles for every dollar spent on all buys and boundless 10x miles on lodgings when you pay with your card at hotels.com/Venture. Gain boundless miles and recover them for explanation credit on movement buys, enabling you to pick any carrier or lodging, and win miles on your movement rewards. Additionally, get up to $100 application charge credit for Global Entry or TSA Pre✓®. There is no yearly expense for the main year. It's $95 from that point.

Reward offer: Get a one-time reward of 50,000 miles once you burn through $3,000 on buys inside 3 months from account opening, equivalent to $500 in movement.

Barclaycard Arrival Plus® World Elite Mastercard®

The Barclaycard Arrival Plus® World Elite Mastercard® offers a clear 2x miles for every dollar spent on all buys. You can recover your miles for movement or money back explanation credits, gift vouchers, and stock. Miles never lapse, and when you recover, you generally get 5 percent of your miles back toward your next recovery. There is a $89 yearly charge for this card. You'll pay no remote exchange charges when utilizing the card abroad.

Reward offer: Earn 60,000 miles when you utilize the card to burn through $5,000 on buys in the initial 90 long periods of record opening and paying the yearly expense. See Terms.

The Platinum Card® from American Express

The Platinum Card® from American Express is best for the long standing customer who can value free access to more than 1,000 air terminal parlors in the American Express Global Lounge CollectionSM. Different advantages of this excellent card incorporate up to $200 aircraft charge credit yearly, $75 inn credit, expense credit towards an application for the Global Entry program or TSA PreCheck, complimentary Hilton Honors and SPG Gold Status upon enlistment, and up to $200 reserve funds on Uber every year. Cardholders win focuses in the American Express Membership Rewards program with their buys — 5X focuses for flights booked straightforwardly with carriers or with American Express Travel, 5X focuses on qualified lodgings set up for amextravel.com, and 1X point on other qualified buys. There are no remote exchange expenses. There is a $550 yearly expense for this charge card. Terms apply. See rates and charges.

Reward: Earn 60,000 Membership Rewards® focuses after you utilize your new Card to make $5,000 in buys in your initial 3 months.

Conclusions

No discourse of rewards Mastercards is finished without the notice that these items are best for the individuals who dependably pony up all required funds and never cause intrigue. Every other person should utilize the card with the most minimal APR. All things considered, on the off chance that you do pay your adjust off each month, and you want to movement, at that point you have much to pick up by applying for and utilizing one of these best travel rewards cards. Go along with me in the energizing universe of the individuals who frequently travel for nothing.

1 note

·

View note

Text

Disney Princess sale

Strut is also announcing the collection through advertising in high-end media such as Report, DuPont Registry, Riviera and Ocean Drive. However, the preview does not start and end with technology but it includes innovations in fashion, watches, hotels, marinas and residences. The brand is also looking to participate in exclusive events that deliver an audience of , per Grooms. The brand has sent out multiple emails to drive ecommerce and keep the brand top of mind for late shoppers. most popular disney channel shows is a compilation of user-generated images of the brand watches and stackable bracelets called Arm Parties. After all, the reports are not only markers of performance, Disney Mug sale but also repositories of successful tactics and important patterns.

looking pensive while on the set of. This year campaign also contains radio, print and online components through Jan. seen in the content of the January issue included apartments at the in Chelsea neighborhood and another residential property located at 182 West 82nd Street in. The automaker offered the Ferrari Mania at a special launch price of $0. carmakers try to reclaim marketAlong 11th Avenue, on the west side of Manhattan, two showrooms illustrate the challenge facing the upmarket car brands, per the Financial Times. Whether drawing upon the figures gathered by other researchers, Disney Ornament sale tallying social media residue with a microscope or determining the participation rates of trends such as sending out follow-up emails after a sales cart is abandoned, Disney seems to employ a cat-scan for examining digital activities.

The collection is meant to cater to affluent drivers in that it is highly-customized. An abundance of health tips pervade the issue as well, such as 10 questions to ask health care providers and yet another reason to drink red wine. A executive at the Holiday Focus 2016 Sep. With the role of sales associates changing, bringing mobile technology into stores may help re-establish trust while creating an enhanced experience for. Applications, optimized sites, augmented reality Disney jewelry and interactive mobile ads seemed to play a key role in the most-savvy marketers’ strategies in 2012. Starwood SPG Member Card for PassbookStarwood Hotels Resorts enabled its preferred guests to upload their member card to the Passbook for the iPhone iOS 6 for instant access to account information and reservations at all nine of its brands including the St.

www.disnco-outlet.com/

0 notes

Text

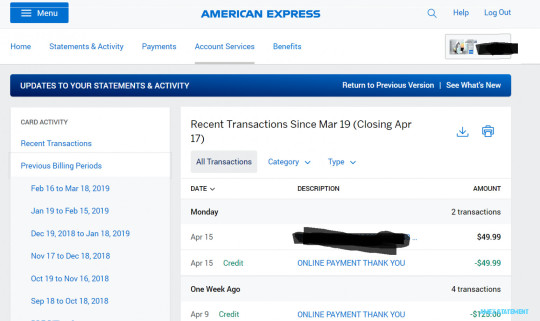

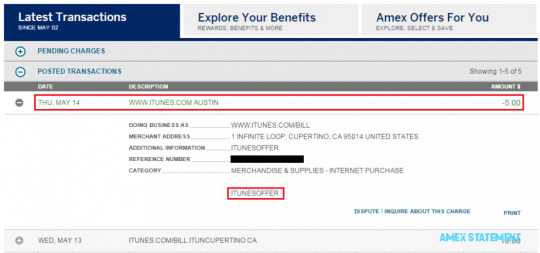

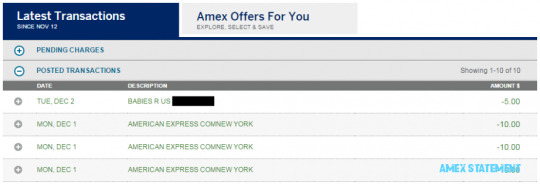

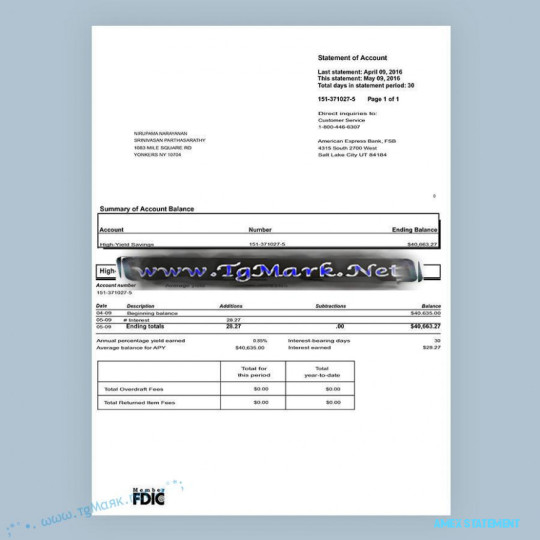

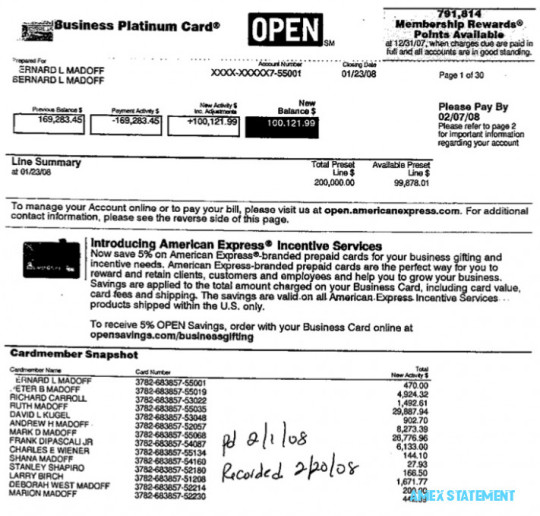

15 Precautions You Must Take Before Attending Amex Statement | amex statement

Image source: Getty Images

What can an Amex authorized user see online? – myFICO® Forums .. | amex statement

American Express wants to animate cardholders to boutique at baby businesses. Now, it’s alms you a banking allurement to do so. Through its Let’s All Boutique Small® Offer, you can get up to $50 aback on some baby business purchases through Sept. 20, 2020.

Here are all the capacity on this promotion, including how it works, how to booty part, and breadth you can acquisition accommodating baby businesses.

Here’s how the Boutique Small® Action works:

Eligible cards accommodate U.S.-issued American Express customer and business cards, as able-bodied as registered American Express Serve® and Bluebird cards. New agenda associates can get this bonus, too, so there’s still an befalling to accessible an American Express agenda and accept it afore the deadline.

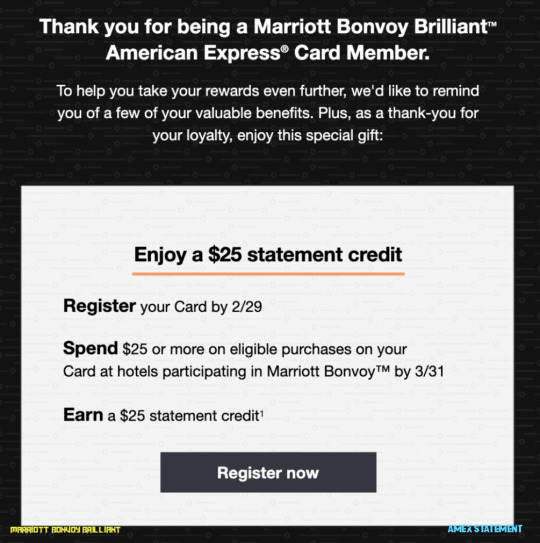

Marriott Bonvoy Brilliant Amex $15 anniversary statement credit .. | amex statement

This action alone applies to one agenda per American Express agenda member. If you accept assorted American Express cards, you’ll alone be able to accept one of them. You allegation use the agenda you accept for anniversary acquirement to accept the $5 annual credit.

Additional agenda associates are additionally eligible. If you’ve added added bodies to your American Express annual and they accept their own acclaim cards (or allegation cards), they can accept and get money aback on their baby business purchases.

To accept an American Express agenda for this offer:

You can additionally acquisition the Boutique Small® Action by activity anon to your online account. Aback you log in, the action will be listed beneath the Amex Offers & Benefits breadth of any acceptable card.

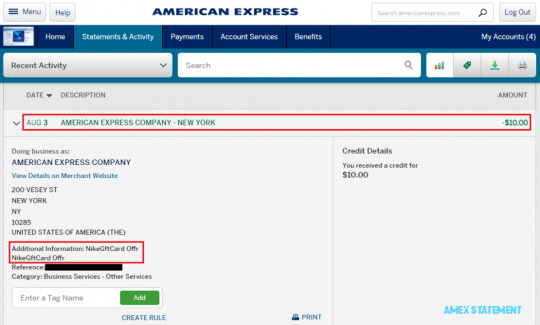

$10 Statement Credits Just Posted for Jifiti Nike Promo .. | amex statement

The best way to see breadth you can save money with this advance is by application the Boutique Small® Map.

You can either allotment your breadth aback you accessible the map or blazon in a breadth to accomplish a search. The map apparatus will again accommodate a account of accommodating baby businesses in the area. There are additionally chase filters accessible to attenuated bottomward the results.

The Boutique Small® Map allotment 100 businesses for anniversary search. As a result, if you’re in a big city, you may not see every accommodating business. That’s breadth filters can appear in handy: You can chase for a specific business category, such as arcade or dining.

If you appetite to see whether a specific business is allotment of the Boutique Small® Offer, blazon the name into the chase bar followed by the location.

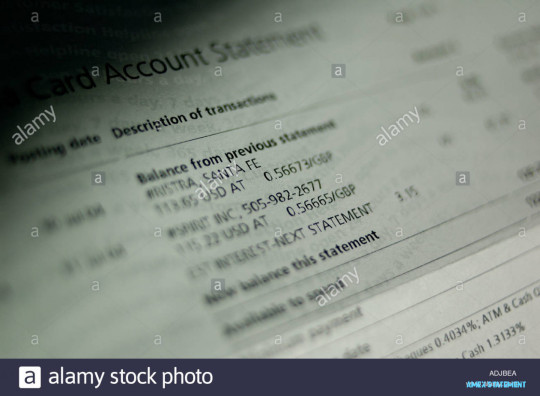

American Express Credit Card Statement High Resolution Stock .. | amex statement

Most purchases will authorize for this deal, but there are some exceptions. The best notable archetype is any acquirement fabricated through a third affair (because American Express may not be able to actuate whether it is eligible). This can accommodate purchases fabricated through a agenda clairvoyant absorbed to a adaptable phone, purchases fabricated through online marketplaces, and purchases fabricated through aliment commitment apps or platforms. Etsy and Resy are the exceptions here–both are acceptable for the baby business promotion.

Any acquirement of a banknote agnate won’t qualify, either. You can’t get the $5 aback if you’re affairs a prepaid agenda or a traveler’s check.

You can apprentice absolutely which purchases will and won’t authorize in the offer’s agreement and conditions.

American Express’s Boutique Small® Action makes it accessible to save money while additionally allowance bounded businesses. All you charge to do is accept an American Express card. There are affluence of accommodating baby businesses, and back the acquirement minimum is aloof $10, you shouldn’t accept any agitation demography advantage of this promotion.

Expired] [Targeted] AmEx Offer: SPG, Spend $15+ & Receive $15 .. | amex statement

The Ascent aloof appear a chargeless acclaim agenda adviser that could advice you pay off acclaim agenda debt already and for all. Inside, you’ll bare a simple debt-cutting action that could save you $1,863 in absorption accuse advantageous off $10,000 of debt. Best yet, you can get started in aloof three minutes!

15 Precautions You Must Take Before Attending Amex Statement | amex statement – amex statement

| Delightful to my personal website, within this time We’ll teach you concerning keyword. And after this, this is actually the 1st impression:

Credit card statements – All About Credit Cards – amex statement | amex statement

Why don’t you consider impression above? is actually of which remarkable???. if you feel so, I’l l provide you with a number of image all over again beneath:

So, if you want to obtain all of these outstanding photos related to (15 Precautions You Must Take Before Attending Amex Statement | amex statement), click save button to download these photos in your personal pc. They are available for transfer, if you want and wish to have it, simply click save symbol on the web page, and it’ll be immediately saved in your laptop computer.} At last if you wish to find new and the recent photo related with (15 Precautions You Must Take Before Attending Amex Statement | amex statement), please follow us on google plus or save this website, we try our best to give you daily update with fresh and new images. We do hope you enjoy keeping here. For many upgrades and latest information about (15 Precautions You Must Take Before Attending Amex Statement | amex statement) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to present you update periodically with fresh and new graphics, enjoy your browsing, and find the ideal for you.

Here you are at our site, contentabove (15 Precautions You Must Take Before Attending Amex Statement | amex statement) published . At this time we are delighted to announce we have discovered an awfullyinteresting topicto be discussed, that is (15 Precautions You Must Take Before Attending Amex Statement | amex statement) Some people searching for information about(15 Precautions You Must Take Before Attending Amex Statement | amex statement) and certainly one of them is you, is not it?

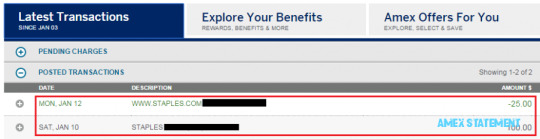

AMEX Offers: Staples $25 Statement Credit Update and 4 New .. | amex statement

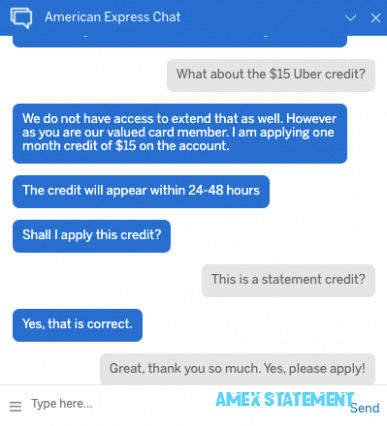

Guide: 15 Ways To Still Use Your Amex Platinum Uber Credit From Home – amex statement | amex statement

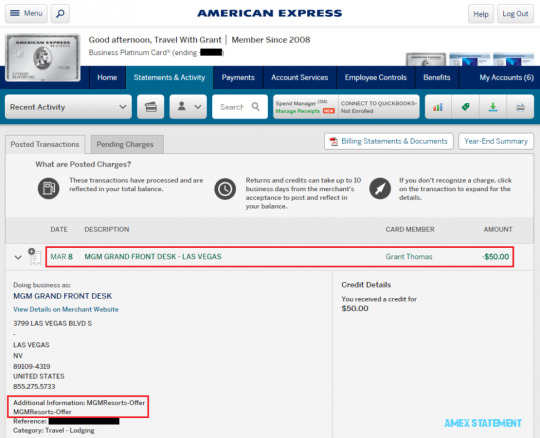

PSA: Follow up on Missing AMEX Offer Statement Credits .. | amex statement

$15 AMEX Statement Credit for Buying a Cathay Pacific Ticket .. | amex statement

iTunes AMEX Offer Update: Statement Credits and Shopping .. | amex statement

My Small Business Saturday Statement Credits Posted and .. | amex statement

Get $15 In Statement Credits With Amex Shop Small | creditcardGenius – amex statement | amex statement

American Express Bank Statement Template – amex statement | amex statement

Madoff’s Expensive Credit Card Bill – amex statement | amex statement

from WordPress https://www.cardsvista.com/15-precautions-you-must-take-before-attending-amex-statement-amex-statement/

via IFTTT

0 notes

Text

some sort of spg or maybe summer months marriage plus size white wedding dress)(*&yhd

Summer months wedding mementos thoughts on your summer months marriage -------------------- Summer months marriage benefit thoughts intended for summer months marriage usually are rich in enjoyable in addition to completely new stuff like sandals, bridal flowers cardboard boxes crafted from a glass. This benefit really should fit the wedding ceremony coloration program in addition to topic. It must be great for this family and friends so as to work with it whenever they head out property as soon as the marriage. obtains enjoyable with the summer season, seeing that is it doesn't very best time period on the season to search outrageous despite this shiny colorings in addition to dynamic marriage interior decoration. Marriage customer likes usually are a crucial component of almost any marriage bash. Summer months lalapromdihsk_dsu wedding mementos are classified as the almost all enjoyment to go intended for. Not like additional times, winter weather in addition to slip, you will discover many content likes you possibly can decide on. Primary it is advisable to number in addition to opt for the just one you choose. Since you start out looking for wedding mementos, it is advisable to come to a decision this topic in addition to coloration program; in order that you really know what likes will probably accommodate this special occasion. Would like to sensible employ a nautical, hawaiian or maybe beachfront model marriage subsequently figuring out likes will likely be simple and fast. Understand what opt for a hawaiian topic nonetheless hope this likes to help lighten ones designs you may opt for a lot of the underneath likes. Bridal flowers pattern luminous made of wax holders and cases: This label explains what exactly this benefit is usually and it also bursts having the sun's rays, including daisy types. Environment friendly type grass with distinct violet a glass appears to be incredibly energetic black gown with sleeves. They might be displayed within a lawn gazebo pack and maybe they are simply just ideal for some sort of spg or maybe summer months marriage plus size white wedding dress. Daisy excite, Gerbera daisy cardboard boxes: You possibly can provide the wedding ceremony likes from the rather daisy lead cardboard boxes which might be still dripping wet having shiny colorings in addition to content demonstrations. Most of these likes is usually whatever by mouth watering truffles to help typical Light Walnuts. Populate this cardboard boxes with the information you need to in addition to area these individuals near to your house location. Blossoming rose bottle of wine stoppers with windows treat pack: This bottle of wine stoppers usually are one of a kind in addition to guaranteed to help multiply happiness over the party. Finish these individuals having "for you" tag cloud in addition to rather organza bows. Sandals: Required marriage family and friends a couple sandals during which they will fall in a relaxed manner over the party in addition to which might take property make use of over the summer months. Opt for sandals of which fit the wedding ceremony coloration program in addition to customise these individuals while using the star of the wedding in addition to grooms initials in addition to date for your wedding. Beachfront rest room towels: Beachfront rest room towels is usually tailored that has a price with appreciate along with the time frame connected with party presenting these individuals seeing that likes to help family and friends. Decide on colours of which fit the wedding ceremony coloration topic. Family and friends can get that as a practical treat simply incorporate the use of that whenever they select a beachfront excursion.

Take in clubhouse: Address ones family and friends that has a icy take in clubhouse bankruptcy lawyer las vegas marriage is determined from the outdoor and in addition they delight in alcohol in addition to not for alcohol-based drinks elegant lingerie. Maintain family and friends trendy having vino, fruits smoothies, in addition to margaritas. Garnish these individuals having fruits and veggies, cherries, a melon, strawberries in addition to whipped treatment burgundy mermaid dress. Area greeting cards: Work with plantable report for making area greeting cards for every single customer. Family and friends might take most of these greeting cards property in addition to vegetable these individuals from the home gardens watching these individuals mature. It is a environmentally friendly summer months marriage benefit strategy and is particularly made for newlyweds exactly who approach "green" events. Summer months would be the almost all shiny in addition to enjoyable the perfect time to include ones marriage and will also be seeing that enthusiastic to find the wedding mementos for the reason that family and friends is to be given these individuals.

Related recommendations:

they are stable enough(*&%P_()&9 to serve their clients well simple wedding dresses under 200

them a stunning look and at the same time)(*^_)*080 suit their pocket cheap plus size wedding dresses under 200

An ideal wedding ceremony is actually exactly what every single bride-to-be goals purple cocktail dressesJGHO(Ygs

that she has a long streaming train on her dress short vintage wedding gowns(*&……——(7

that create ()&……()OYg provided option of its purchasers over the internet popular pageant dresses

0 notes

Text

addition to dynamic marriage interior decoration strapless mermaid wedding dress)(*&TYhd

Summer months wedding mementos thoughts on your summer months marriage -------------------- Summer months marriage benefit thoughts intended for summer months marriage usually are rich in enjoyable in addition to completely new stuff like sandals mermaid wedding dresses with bling, bridal flowers cardboard boxes crafted from a glass. This benefit really should fit the wedding ceremony coloration program in addition to topic. It must be great for this family and friends so as to work with it whenever they head out property as soon as the marriage. obtains enjoyable with the summer season, seeing that is it doesn't very best time period on the season to search outrageous despite this shiny colorings in addition to dynamic marriage interior decoration strapless mermaid wedding dress. Marriage customer likes usually are a crucial component of almost any marriage bash. Summer months lalapromdihsk_dsu wedding mementos are classified as the almost all enjoyment to go intended for. Not like additional times, winter weather in addition to slip, you will discover many content likes you possibly can decide on. Primary it is advisable to number in addition to opt for the just one you choose. Since you start out looking for wedding mementos, it is advisable to come to a decision this topic in addition to coloration program; in order that you really know what likes will probably accommodate this special occasion. Would like to sensible employ a nautical, hawaiian or maybe beachfront model marriage subsequently figuring out likes will likely be simple and fast. Understand what opt for a hawaiian topic nonetheless hope this likes to help lighten ones designs you may opt for a lot of the underneath likes. Bridal flowers pattern luminous made of wax holders and cases: This label explains what exactly this benefit is usually and it also bursts having the sun's rays, including daisy types. Environment friendly type grass with distinct violet a glass appears to be incredibly energetic. They might be displayed within a lawn gazebo pack and maybe they are simply just ideal for some sort of spg or maybe summer months marriage. Daisy excite, Gerbera daisy cardboard boxes: You possibly can provide the wedding ceremony likes from the rather daisy lead cardboard boxes which might be still dripping wet having shiny colorings in addition to content demonstrations. Most of these likes is usually whatever by mouth watering truffles to help typical Light Walnuts. Populate this cardboard boxes with the information you need to in addition to area these individuals near to your house location. Blossoming rose bottle of wine stoppers with windows treat pack: This bottle of wine stoppers usually are one of a kind in addition to guaranteed to help multiply happiness over the party. Finish these individuals having "for you" tag cloud in addition to rather organza bows. Sandals: Required marriage family and friends a couple sandals during which they will fall in a relaxed manner over the party in addition to which might take property make use of over the summer months. Opt for sandals of which fit the wedding ceremony coloration program in addition to customise these individuals while using the star of the wedding in addition to grooms initials in addition to date for your wedding. Beachfront rest room towels: Beachfront rest room towels is usually tailored that has a price with appreciate along with the time frame connected with party presenting these individuals seeing that likes to help family and friends burgundy evening gown. Decide on colours of which fit the wedding ceremony coloration topic. Family and friends can get that as a practical treat simply incorporate the use of that whenever they select a beachfront excursion.

Take in clubhouse: Address ones family and friends that has a icy take in clubhouse bankruptcy lawyer las vegas marriage is determined from the outdoor and in addition they delight in alcohol in addition to not for alcohol-based drinks. Maintain family and friends trendy having vino, fruits smoothies, in addition to margaritas. Garnish these individuals having fruits and veggies, cherries, a melon, strawberries in addition to whipped treatment. Area greeting cards: Work with plantable report for making area greeting cards for every single customer. Family and friends might take most of these greeting cards property in addition to vegetable these individuals from the home gardens watching these individuals mature. It is a environmentally friendly summer months marriage benefit strategy and is particularly made for newlyweds exactly who approach "green" events. Summer months would be the almost all shiny in addition to enjoyable the perfect time to include ones marriage and will also be seeing that enthusiastic to find the wedding mementos for the reason that family and friends is to be given these individuals 34cm to inches.

Related recommendations:

that uses very mild_)(*&^_+)( electrical current to exercise your muscles cheap lace wedding dresses under 200

effortless by means of on the web bridal dress retailers 2 piece homecoming dresses()*&gTIk

them a stunning look and at the same time)(*^_)*080 suit their pocket cheap plus size wedding dresses under 200

with marriage wedding planning garments including lehenga nordstrom bridesmaid dresses*&……TIg

0 notes

Text

Analytics Experience 2019: making analytics real

ANALYTICS EXPERIENCE — There is a lot of hype and jargon surrounding analytics and artificial intelligence (AI). Yet put simply data holds the key: when used properly, your data can set your organisation up for success for years to come. So why not find out how to make analytics a reality delivering tangible results at Analytics Experience 2019 in Milan on Oct. 21-23?

Join us at the event that gathers more than 1,500 data scientists and business leaders who are passionate about analytics. The theme of this year’s conference is “Together we make analytics real” with a focus on how organizations get value from analytics in day-to-day operations.

“There is a lot of talk about AI and what this technology can do,” said Randy Guard, Executive Vice President and Chief Marketing Officer at SAS. “But the reality is that technology alone won’t make a difference unless it’s properly deployed to help organizations benefit from analytically-driven decisions every single day. That’s why we want to share real-life examples from our customers, about how analytics and AI can detect credit-card fraud, manage banking risk, drive personalized customer relationships, identify promising drug therapies and a lot more besides.”

Participants can also look forward to keynotes from:

Daniel Newman, Principal Analyst of Futurum Research and CEO of Broadsuite Media Group, who works with the world’s largest technology brands exploring digital transformation and how it is influencing the enterprise.

Matteo Motterlini, philosopher and neuroeconomist, looks at how humans make (or are made to make) decisions with a view to helping us make better decisions and avoid mental traps.

Dr. Youssef Al Hammadi, Chief Intelligence Officer of the Special Olympics World Games Abu Dhabi 2019, who is also an Advisor within the Office of Strategic Affairs at the Abu Dhabi Executive office, looking at how advanced analytics is applied across various industry sectors.

Matt Ledding, a Juggling Management Artist, looks at using juggling to hack the learning process, and challenges people to rewire their minds and overcome false assumptions that they never suspected they had.

Stefano Quintarelli, Serial entrepreneur and member of the High-Level Expert Group on Artificial Intelligence of the European Commission, who is interested in the intersection between technology, regulation and markets.

There will be a rich variety of engagement opportunities, including 56 breakout sessions, 48 super demos, escape room challenges, networking events and six industry executive workshops, a new offering for 2019.

More than 60 media and influencers are already registered to attend, with SAS sharing announcements about helping organizations operationalize analytics, and showcasing customers who have obtained real returns through analytics and AI.

Jim Goodnight, SAS CEO and Founder, and Oliver Schabenberger, Chief Operating Officer and Chief Technology Officer at SAS, will open the conference on October 22 at the MiCo – Milano Congressi, the largest convention center in Europe.

During the two-day event, executives from numerous companies and organisations will share their experiences including: UBI, Banking (Italy), Inland Revenue Department, Government (New Zealand) Asian Paints, Manufacturing (India), Hanwha Galleria Co Ltd., Retail (Korea), Société Générale, Banking (France), Topdanmark, Insurance (Denmark), SPG Dry Cooling, Manufacturing (Belgium), Ergo Direct Versicherung AG, Insurance (Germany), National Bank of Greece, Banking (Greece), Stoloto (S8 Capital), Retail (Russia), Ørsted, Energy (Denmark), OP Bank, Banking (Finland), Amsterdam University Medical Center, Health Care (The Netherlands), Sky, Media (UK), Department of IT and Communication, Government of Rajasthan (India), Pegasus Airlines, (Turkey), Permanent TSB, Banking (Ireland), Nets, Financial Services (Denmark), Yolo Group, Insurance (Italy), First National Bank (South Africa).

Reduced admission is available for participants from educational institutions. Register today at the Analytics Experience 2019 website.

0 notes

Text

Finest Hotel Credit Cards

Comparing Credit Cards for Hotel Points

A great hotel card can help you log free hotel nights, add a touch of luxury to your hotel stays and even take the stress out of travel with convenient perks and upgrades. Many hotel cards combine generous rewards programs with ample perks for loyal guests.

Hotel credit cards, like airline cards, pair a travel brand with a bank, encouraging loyalty. They are a great way to build points on a specific loyalty brand. But, it's important to make sure you are going to spend enough to benefit from the card.

We researched more than 40 co-branded hotel cards and more than 300 general travel rewards cards, using a lot of the criteria outlined in this guide, to get down to our list of the best hotel cards. Strong rewards values, sign-up bonuses, and flexible redemption options were a big factor in our choices. Here, we look at:

Whether you are wondering how hotel cards work or you want to know who should get one, we can help.

What are hotel credit cards and how do they work?

What are hotel credit cards?

Hotel credit cards are often co-branded cards (but not always). That means they are issued by a bank, such as Chase or American Express, and partner with a specific hotel brand. As you can imagine, the hotel card will reward you for loyalty to that brand, as well as reward you for loyalty to airline and car rental partners. In some cases, you are rewarded for using the card on general-purpose purchases, such as grocery stores, gas stations and restaurants.

Other cards, such as the Capital One Venture cards, also reward for hotels. However, they are not associated with a specific brand. Instead, in the case of the Venture cards, cardholders earn 10X miles when booking and paying through hotels.com/venture.

How hotel cards work

Typically, hotel credit cards come with sign-up bonuses, ongoing rewards and special benefits, depending on the category of membership that you qualify for. Then, the rewards programs usually offer a different redemption amount depending on the category of hotel property you choose. For example, a Category 1 Marriott property requires 7,500 points for a one-night stay, while a Category 7 property runs 35,000 points.

There are 2 types of hotel credit cards, co-branded cards and general-purpose cards. Each has its advantage.

Co-branded cards. Most hotel cards, called co-branded products, are aligned with specific hotel companies, such as IHG. These cards reward you for loyalty to specific brands, giving bonus points for spending at properties and sign-up bonuses in the hundreds of dollars. In many cases, the brand will have partnerships with airlines or other companies that you can benefit from.

General-purpose cards. Some travel cards reward you for a variety of spending that you can use on a number of airline and hotel brands. In some cases, your points are boosted for using a travel portal operated by the card issuer, such as the Chase Ultimate Rewards portal. For example, with the Chase Sapphire Preferred, you get an increase of 25% and with the Reserve, you get an increase of 50% on your points when you book through the portal, which makes it worth a look.

What are the best hotel credit cards?

After analyzing over 40 different hotel rewards credit card offers (and even more general travel cards), here is our list of the 10 best hotel credit cards of 2018. The Capital One® Venture® Rewards Credit Card tops our list because of its generous 10x miles when you book and pay at hotels.com/venture. For a co-branded hotel credit card, the Hilton Honors American Express Ascend Card is our top choice.

Credit CardBest For:CreditCards.com RatingAnnual FeeHotel Rewards RateCapital One® Venture® Rewards Credit CardWinner in rewards value4.3 / 5$0 first year, then $9510 miles per dollar spent at hotels.com/ventureCiti PremierSM CardRunner-up in rewards value3.8 / 5$95, waived first year3x points on travel, including hotelsHilton Honors American Express Ascend CardBest in hotel rewards value4.3 / 5$9512x points at Hilton propertiesMarriott Rewards® Premier Plus Credit CardRunner-up in hotel rewards value3.9 / 5$956 points per dollar at Marriott and SPG hotelsChase Sapphire Preferred® CardBest in rewards flexibility4.1 / 5$0 first year, then $952x points on travel, including hotelsCapital One® VentureOne® Rewards Credit CardRunner-up in rewards flexibility3.4 / 5$010 miles per dollar spent at hotels.com/ventureWells Fargo Propel American Express® CardWinner in travel features3.9 / 5$03x points on travel, including hotelsBank of America® Travel Rewards credit cardRunner-up in travel features3.5 / 5$01.5 points per dollar on all purchasesIHG® Rewards Club Premier Credit CardWinner in hotel options & features4.1 / 5$8910 points per $1 spent when you stay at an IHG hotelHilton Honors American Express CardRunner-up in hotel options & features4.1 / 5$07x points at Hilton properties

Research methodology: how we chose the best cards

Hotel credit cards analyzed: 42

Criteria used: Rewards rates, rewards categories, sign-up bonuses, size of hotel network, transfer partners, point values, other travel benefits, annual fee, other rates and fees, redemption options and flexibility, customer service, credit needed, elite status, ability to upgrade and downgrade

Details on our top picks for the best hotel cards

Best in rewards value

Capital One® Venture® Rewards Credit Card

Earn 50,000 miles after a $3,000 spend within the first 3 months, equal to $500 in travel, and enjoy the flexibility of staying at any hotel at any time.

CategoryRatingHotel rewards rating4.3 / 5Rewards value4.3Annual percentage rate2.7Rewards flexibility4.8Features3.0

Runner-up in rewards value

Citi PremierSM Card

Earn 50,000 points after a $4,000 spend within the first 3 months; 3X points for travel and gas; and 2X points for restaurants and entertainment. One thing to note: Those 50,000 points become $625 when booked through the ThankYou Travel Center.

Bottom line – While the Citi Premier Card is second to the Venture Rewards in annual rewards value due to the latter's hotel.com/venture feature, the Citi card's value is still strong with its generous tiered points system.

CategoryRatingHotel rewards rating3.8 / 5Rewards value4.1Annual percentage rate1.8Rewards flexibility3.8Features3.0

Best in hotel rewards value

Hilton Honors American Express Ascend Card

You might think earning 125,000 points after a $2,000 spend within the first 3 months of card membership will be as good as it gets, but there's so much more. Earn 12X points at participating hotels and resorts in the Hilton portfolio; 6X points at U.S. restaurants, U.S. gas stations and U.S. supermarkets; and 3X points on everything else.

Bottom line – The Hilton Honors American Express Ascend Card is just full of surprises, including a weekend night reward after spending $15,000 in a calendar year, and upgrade to Diamond status after a $40,000 spend in a calendar year. And unique to this card – your non-hotel spending is mightily rewarded.

CategoryRatingHotel rewards rating4.3 / 5Rewards value4.8Annual percentage rate0.8Rewards flexibility4.3Features3.0

Runner-up in hotel rewards value

Marriott Rewards® Premier Plus Credit Card

The 2 Free Night Awards points earned after a $3,000 spend within the first 3 months are valued up to 35,000 points each. There's also the free night every year after your account anniversary; 6X points at participating Marriott and SPG hotels; and 2X points on all other purchases.

Bottom line – While the Marriott Rewards Premier Plus has a lower annual reward value ($453) than the Ascend ($699), it still offers excellent rewards for the Marriott enthusiast.

CategoryRatingHotel rewards rating3.9 / 5Rewards value3.9Annual percentage rate1.6Rewards flexibility4.2Features3.0

Best in rewards flexibility

Chase Sapphire Preferred® Card

Earn 50,000 points after a $4,000 spend within the first 3 months, and 2X points on worldwide travel and restaurants. But it's the flexibility in rewards that makes it stand out from its competition.

Bottom line – The Chase Sapphire Preferred is at the top in flexibility, with a 25% bonus on bookings through the Chase Ultimate Rewards portal, and 1:1 redemption on many travel partners.

CategoryRatingHotel rewards rating4.1 / 5Rewards value4.0Annual percentage rate1.3Rewards flexibility4.9Features3.0

Runner-up in rewards flexibility

Capital One® VentureOne® Rewards Credit Card

While you can earn 20,000 miles after a $1,000 spend within the first 3 months, and earn 1.25X miles on all eligible purchases, it's the hotel rewards that are the most impressive. When you book and pay through hotels.com/Venture, you can earn 10X points on bookings at thousands of hotels.

Bottom line – The Capital One VentureOne Rewards comes in close behind the Sapphire Preferred in rewards flexibility, with travel without blackout dates and stays at any hotel at any time. With the outrageous 10X points offer on hotels, this card is a keeper.

CategoryRatingHotel rewards rating3.4 / 5Rewards value2.4Annual percentage rate4.2Rewards flexibility4.8Features2.0

Best in travel features

Wells Fargo Propel American Express® Card

CategoryRatingHotel rewards rating3.9 / 5Rewards value3.8Annual percentage rate3.2Rewards flexibility4.3Features3.0

Runner-up in travel features

Bank of America® Travel Rewards Credit Card

This card offers 25,000 points after a $1,000 spend within the first 90 days and 1.5X points on all eligible purchases. You can also earn a 10% points bonus on every purchase when you have an active Bank of America checking or savings account.

Bottom line – The Bank of America Travel Rewards' no annual fee, straightforward redemption and easy earnings make it a smart addition to your wallet.

CategoryRatingHotel rewards rating3.5 / 5Rewards value3.0Annual percentage rate2.9Rewards flexibility4.6Features2.0

Best in hotel options & features

IHG® Rewards Club Premier Credit Card

Earn 80,000 points after a $2,000 spend within the first 3 months; 10X points at IHG hotels; and 2X points at gas stations, grocery stores and restaurants. Also get a free night every anniversary.

Bottom line – The IHG Rewards Club Premier offers bountiful points and is a standout in hotel options and features, with more than 5,200 properties, room upgrades, vast types of travel insurance and the famous free night after a stay of 4 or more nights.

CategoryRatingHotel rewards rating4.1 / 5Rewards value4.5Annual percentage rate1.8Rewards flexibility4.1Features3.0

Runner-up in hotel options & features

Hilton Honors American Express Card

Earn 75,000 points after a low $1,000 spend within the first 3 months; 7X points at the Hilton brand; 5X points at U.S. restaurants, U.S. supermarkets and U.S. gas stations; and 3X points on all other purchases. While its points are not as rich as the Ascend, there is no annual fee.

Bottom line – With the 5th night free for every consecutive stay, a 15% bonus on Honors points, and express and late check-out, the Hilton Honors American Express offers hotel options and features second only to the IHG Rewards Club Premier card.

CategoryRatingHotel rewards rating4.1 / 5Rewards value4.3Annual percentage rate0.8Rewards flexibility4.3Features3.0

Pros and cons of hotel credit cards

Hotel credit cards are great for loyalty, whether with a specific brand or its partners. Depending on your category of membership, hotel cards and loyalty programs often offer benefits such as early check-in, late check-out, breakfast and more. There are a number of advantages to these cards, including generous sign-up bonuses, but there can be some downsides as well.

Pros and cons of hotel cards...

ProsConsBuild creditCan impact credit if pay lateGreat for loyaltyMay be limited in how use pointsGenerous sign-up rewardsPoints may not be as rewarding as other card typesNice benefitsMay require high annual spendBenefit from other brandsWill likely pay an annual feePoint valuations vary

When hotel cards are a good choice:

Here, we take a deeper dive into the advantages of hotel credit cards:

Getting rewarding benefits. David Bakke of Money Crashers points out that the big advantage of hotel credit cards is the rewards program. You can earn everything from points good for purchases and statement credits to free nights and room upgrades.

Finding a strong sign-up bonus. Many of the available hotel cards offer sign-up bonuses in which you spend a certain minimum within a specific amount of time, usually 3 months or 90 days, and in return, you earn thousands of points, which can be worth hundreds of dollars.

Enjoying credits for other brands. As Bakke points out, some hotel cards allow you to convert points into credits for flights as well.

Great for loyalty. If you have a favorite hotel brand, it's worth your while to look at hotel cards, because with them, you can earn excellent bonus points toward the brand, as well as the benefits we mentioned.

When hotel cards may not work for you:

There are a number of reasons, however, why a hotel card may not be the best choice:

Paying an annual fee. Most hotel cards have an annual fee, which you need to be aware of, because if you don't pay full attention to your spending and earning, you can actually end up spending more than you save.

Finding that the card is of limited use. Bakke points out that some cards' rewards are only good at the brand's hotels, limiting how you use the card's points. A hotel card may not be the best choice if you aren't supremely loyal to a single brand, in this case.

Carrying a balance. If you carry a balance, you defeat the purpose of a rewards card. Plan to not pay in full each month? Don't get a hotel card. Also, it can impact your credit score if you carry too high of a balance.

Who should get a hotel credit card?

An incredible 40% of cardholders have always used the same card or haven't changed cards in at least 10 years, our March 2018 survey shows. That's a lot of points, miles and cash we are leaving on the table, including those from hotel cards.

When consumers did switch, it looks like it was for the right reason, with people on the hunt for rewards at the top of the list.

Reasons cardholders switched cards...

27%

Points, miles or cash

12%

Low interest rate

9%

Easy to get

8%

Card brand

If you make the choice to transition to a rewards card, keep in mind that with the right hotel card, you can maximize points through business and personal travel alike. Also, they are worth your while if you like to play the points game.

Wondering if a hotel credit card is right for you? If you are one of these 4 types of people, they might be a good choice.

If you travel often for business. With the right hotel card, you can maximize your savings by pulling the card out whenever you travel on business.

If you have a favorite hotel brand. If you are loyal to say, Hilton, then look at the Hilton cards that are available to see which one suits your travel habits best, such as the Hilton Honors suite through American Express.

If you enjoy playing the points game. Hotel cards are great for people who like to take full advantage of rewards programs.

If you'll enjoy the finer benefits. With the right hotel card, you can get, for example:

Early check-in

Late check-out

Complimentary breakfast

Free bottles of water

How to compare two hotel credit cards

Hotel cards come in a choice of flavors, with widely varying benefits, different point valuations and differing expiration rules. Curious how to make it work for you? Here, we look at the different factors to consider, then we compare hotel cards as an example. Here are top factors to consider when choosing a hotel credit card.

Which has fewer restrictions? Wesley notes that you need to be mindful of restrictions on usage as well as points redemption.

What are the expiration rules? Hotel rewards programs vary in their expiration rules, starting with 12 months and going even to 4 years. Make sure they are requirements that suit your lifestyle.

What about benefits? Hotel cards often offer features that are not apparent at first glance. For example, you might be able to get free breakfast for two or free late check-out.

Do the annual fees outweigh the potential perks? If so, don't get the card.

How useful are the rewards, really? Look at whether you are really going to have an opportunity to redeem the points, says Wesley. Be sure to compare the sign-up bonus, as well as the ongoing rewards.

Am I familiar and comfortable enough with one hotel chain over the other? Look at which brand you are most loyal to, says Wesley.

Comparing 2 hotel credit cards...

CardThe World of Hyatt Credit CardHilton Honors American Express Ascend CardTPG Aug point valuation$0.018$0.006Welcome40,000 pts / $3,000 spend in 3 mths = $720

20,000 pts / $6,000 spend in 6 mths = $360125,000 pts / $2,000 spend in 3 mths = $750Spending at properties$2,000 * 9X pts * $0.018 = $324$2,000 * 12X pts * $0.006 = $144Various spending$500 * 12 mths * 2X pts * $0.018 = $216$500 * 12 mths * 6X pts * $0.006 = $216Annual fee$95$95Total net value at end of first year$1,525$1,015

As you can see, the Hyatt card is the clear winner because of a superior point valuation – that's even with the Hilton card's special intro offer. Bottom line: Make sure you look at all of the moving parts of the cards you are eyeing before making a decision.

How to maximize rewards on your hotel credit card

Choosing a hotel card is a deeply personal experience, because where you travel and which brands you favor informs your decision about which card to get. But no matter which card you use, there are a few basic ground rules for how to maximize your rewards, such as:

Look at your travel habits. Do you have a favorite brand? How often do you use it? If you love the Hilton Portfolio, then go with that. If you are open to options, look at which brand is prevalent in the areas where you tend to travel.

What are the benefits? When choosing a hotel card, look at the different membership tiers, what they offer and ascertain which one you can realistically meet based on your travel habits. This will help you decide whether you prefer the complimentary lounge access of SPG or the 48-hour room guarantee of Hilton Honors.

Take a look at the annual fee. Many hotel cards have an annual fee. You'll want to make sure that you will surpass that fee each year with your rewards. Keep in mind that some cards waive the charge the first year.

Make sure you comply with the sign-up rules. Hotel cards typically offer a one-time sign-up bonus in exchange for a required spend. Don't let that deadline pass you by.

Put big purchases on it. Planning to get some work done on your car? Pull out that plastic and enjoy such rewards as 3X Hilton Honors points with the Hilton Honors Ascend from American Express. Keep in mind that you may get a better deal with a different card in your wallet that has a flat rate, such as the Barclaycard Arrival Plus World Elite Mastercard.

Pay monthly bills with the card. Look at which card is best for such recurring purchases as cellphone charges and utilities.

Do hotel points expire?

Typically, points for hotel-brand loyalty programs can expire if you don't keep the account active, but there are a number of ways to make sure that doesn't happen.

For example, you can use a co-branded credit card that earns hotel points, you can transfer points from the American Express' Membership Rewards program for Best Western, Choice, or Hilton, or do the same from Marriott, Ritz-Carlton or Priority Club.

By keeping your accounts active, the points won't just go away. Here are top brands and their expiration policies:

Hotel loyalty programs' points expiration policies...

Hotel brandPoints expiration policyWyndham RewardsEnd of calendar year following calendar year when obtainedHilton Honors12 monthsMarriott/SPG/Ritz-Carlton2 yearsWorld of Hyatt24 months

Source: CreditCards.com research

Can hotel credit card points be used for flying?

By transferring your hotel card points to an airline partner, you can fly with those points. But do your homework, because the transfer may not be the best you can get. That said, there are advantages to marrying airlines with hotel cards, such as bonuses for points transferred and points earned for airline tickets purchased. Ideally, check the hotel brand's partnerships if that's a deal-breaker for you.

Popular hotel loyalty programs

With many hotel loyalty programs out there, it can be hard to decide which is the best. Well, The Points Guy does the heavy lifting for you by establishing criteria on which to assess programs, and ranking them. Here, we reveal popular hotel loyalty programs and what they can offer members:

Favorite hotel loyalty programs...

Hotel loyalty programNumber of propertiesStrongest criteriaValuationSelect featuresWyndham Rewards8,000Ease and value of redemption1.2 cents/per point10 pts/dollar; free internet; rental upgrade; late check-out; early check-inHilton HonorsStrong co-branded cards0.6 cents/per point48-hour room guarantee; 5th night free; free internet; late check-outMarriott Rewards5,300Geographic spread0.9 cents/per point48-hour room guarantee; late check-out; free internet; breakfast for twoWorld of HyattPercentage of luxury properties1.8 cents/per pointWaives resort fees on award stays; suite upgrades; guaranteed late checkout

Recently, Marriott International's acquisition of Starwood Hotels & Resorts formed the largest hotel company. With it, Marriott began matching member status across Marriott Rewards and Starwood Preferred Guest, as well as The Ritz-Carlton Rewards.

This means you can spend and redeem at 6,700 hotels across 29 brands. Marriott has made it easy, allowing you to have one account, one login, one profile and one points balance. And when you are an Elite member, you will be able to see your Elite status and all the benefits you get in a single account.

To achieve this, you'll want to combine your accounts into a single account and profile. With this action, you might achieve a higher tier. Your nights dating back to Jan. 1, 2018, will be counted. Also, when your SPG and Marriott are combined, your lifetime activity will be also combined.

There will be new redemption opportunities, including Marriott's new free night award chart. You'll be able to transfer points to more than 40 airlines, and starting in August, Marriott will add 15,000 points for every 60,000 points transferred to airline miles.

Detailed card reviews

Laura is an editor and writer at CreditCards.com. She has written extensively on all things credit cards and works to bring you the most up-to-date analysis and advice. Laura's work has been cited in such publications as the New York Times and Associated Press. You can reach her by e-mail at [email protected] and on Twitter @creditcards_lm.

We encourage an active and insightful conversation among our users. Please help us keep our community civil and respectful. For your safety, we ask that you do not disclose confidential or personal information such as your bank account number, phone number, or email address. Keep in mind that anything you post may be disclosed, published, transmitted or reused.

The comments posted below are not provided, reviewed or approved by the card issuers or advertisers. Additionally, the card issuer or advertiser does not assume responsibility to ensure that all posts and/or questions are answered.

0 notes

Text

This Is the Most Riotously Insane Thing About the Massive Marriott Data Breach You're Likely to Hear

New Post has been published on https://rwamztech.com/this-is-the-most-riotously-insane-thing-about-the-massive-marriott-data-breach-youre-likely-to-hear/

This Is the Most Riotously Insane Thing About the Massive Marriott Data Breach You're Likely to Hear

Not to worry, Yahoo, you still had the largest data breach in corporate history, at 3 billion records. But at 500 million, Marriott is a strong second, and maybe should be first.

That’s because of the nature of the data that went out the door for about 327 million of the people who had stayed at a Starwood property on or before September 10, 2018. (And starting in 2014, because that’s how long it’s been since someone first broke into the system.)

The data included some combination of name, mailing address, phone number, email address, Starwood Preferred Guest (“SPG”) account information, birth date, gender, arrival and departure information, reservation date, communication preferences, and passport number.

Passport number? Yup. They kept them on file. And an undisclosed number of encrypted payment card numbers, expirations dates, and maybe–Marriott’s really not quite sure–enough information to let someone crack the encryption.

Yes, this is really, really bad.

Oh, and TechCrunch also noted the the claim that Russian cybercriminals got into the Starwood servers. It can’t keep getting worse, right?

You know the answer.

Marriott’s promised email notifications to affected customers will come from a fake-ish looking email address, as TechCrunch noted, and one that could be easily spoofed by people who want to cause even more damage. In other words, beware of phishing hacks that stand on the back of Marriott’s efforts to address the terrible position it’s put so many customers into.

And now we come around to the latest insanity. As part of its response, Marriott set up a website that ultimately points you to a third party service that “monitors internet sites where personal information is shared and generates an alert to the consumer if evidence of the consumer’s personal information is found.”

The third party running the service, corporate investigations and risk management firm Kroll, of course is going to need information from you to see if it pops up on the dark web. Here is what they might want, directly from their website:

name, address, phone number, and e-mail address

date of birth, driver’s license number, social security number, passport number, and other similar information

copies of government-issued photo identification, Social Security card and/or utility bill(s), where applicable

credit card number and other financial account data, including your consumer credit file(s), as applicable

your responses to security questions; the information you provide in customer service correspondence; and general feedback

You’re going to have to cough up enough information to see if they can match it to anything on the dark web. You’ll have to trust that everything will be fine. Which is what you did with Marriott in the first place.

Fat lot of good that did almost half the country.

How does this keep happening? As I explained in a piece over at Vice Motherboard, it all comes down to economics. The ultimate penalties big companies pay are so infrequent and small in comparison to their revenues that it becomes something just as easy to ignore. The millions of dollars you may hear about as the cost of a data breach is significantly smaller than a rounding error in accounting to them.

Not that I’m suggesting Marriott is ignoring this. Just a comment on the general treatment of customer data security by large corporations.

The only hope is that government officials take enough heat from voters that they put significant fiscal punishment into place. I’d settle, at least in this case, for Marriott to pay the cost for all the people who might now need to obtain a new passport. That at least would be a start.

But there’s the other factor: consolidation. Marriott is the largest hotel operator in the world. If you’re traveling, there’s a good chance you’ll land in one of its properties. Unless, of course, you remember all this nonsense and intentionally stay elsewhere.

Even if you don’t get more points, you might at least keep your data secure.

0 notes

Text

This Is the Most Riotously Insane Thing About the Massive Marriott Data Breach You're Likely to Hear

New Post has been published on https://rwamztech.com/this-is-the-most-riotously-insane-thing-about-the-massive-marriott-data-breach-youre-likely-to-hear/

This Is the Most Riotously Insane Thing About the Massive Marriott Data Breach You're Likely to Hear

Not to worry, Yahoo, you still had the largest data breach in corporate history, at 3 billion records. But at 500 million, Marriott is a strong second, and maybe should be first.

That’s because of the nature of the data that went out the door for about 327 million of the people who had stayed at a Starwood property on or before September 10, 2018. (And starting in 2014, because that’s how long it’s been since someone first broke into the system.)

The data included some combination of name, mailing address, phone number, email address, Starwood Preferred Guest (“SPG”) account information, birth date, gender, arrival and departure information, reservation date, communication preferences, and passport number.

Passport number? Yup. They kept them on file. And an undisclosed number of encrypted payment card numbers, expirations dates, and maybe–Marriott’s really not quite sure–enough information to let someone crack the encryption.

Yes, this is really, really bad.