#profitable business ideas 2024

Text

10 Most Profitable Manufacturing Business Ideas Under 10 Lakhs

🌟 Dreaming of becoming your own boss? 💼 Discover these Top 10 Profitable Manufacturing Business Ideas Under 10 Lakhs! 💡 Let's turn your business dreams into reality! #SmallBusiness #BusinessOpportunity #FinancialFreedom #StartupIdeas

Manufacturing businesses produce goods using equipment, machines, and labour. This sector is vital to the economy and offers many opportunities for entrepreneurs to start their own companies. Manufacturing businesses can be established in various industries, including food, appliances, electronics, vehicles, clothing, power tools, and more. Today, many people dream of becoming entrepreneurs, but…

View On WordPress

#best business ideas#best manufacturing business#business#business ideas#business ideas under 15 lakhs#entrepreneurship#low investment business ideas#low investment high profit business ideas#manufacturing business ideas#manufacturing business ideas in india#manufacturing business ideas under 10 lakhs#manufacturing business under 5 lakhs#new business ideas#profitable business ideas 2024#profitable manufacturing business ideas#small business ideas#start manufacturing business#startup ideas#top 10 manufacturing business ideas

0 notes

Text

Buy Bike Garage Franchise in India | Garage Franchise Businesses to Start | Pikpart Smart Garage Franchise

#Garage Franchise in India#Garage Business Opportunities#Buy Bike Garage Franchise in India#Car Franchise India#Profitable Garage Franchise in India#Best Car Garage in India#Garage Business in India#Garage Franchise Businesses to Start#Best Businesses to Start In 2024#Most Profitable Good Business Ideas#Good Entrepreneur Ideas#Top Garage Franchise Idea in 2024

0 notes

Text

#rental business ideas#rental business ideas 2024#start rental business#start profitable rental business#car rental script#rental marketplace script#marketplace#marketplace script#bike rental#boat rental#blog

0 notes

Text

Business Ideas 2024: Unveiling the Future of Profitable Ventures Beyond 2024

Explore a groundbreaking guide that unveils the most lucrative and innovative business ideas for 2024 and beyond. Gain insights into the trends shaping the future of entrepreneurship and discover strategic opportunities to ensure your success in the ever-evolving business landscape. Don't miss out on this comprehensive exploration of Profitable Business Ideas for 2024, designed to empower and inspire aspiring entrepreneurs and seasoned professionals alike.

Visit: https://fortunescrown.com/unveiling-the-future-profitable-business-ideas-for-2024-and-beyond/

0 notes

Text

Google is (still) losing the spam wars to zombie news-brands

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TONIGHT (May 3) in CALGARY, then TOMORROW (May 4) in VANCOUVER, then onto Tartu, Estonia, and beyond!

Even Google admits – grudgingly – that it is losing the spam wars. The explosive proliferation of botshit has supercharged the sleazy "search engine optimization" business, such that results to common queries are 50% Google ads to spam sites, and 50% links to spam sites that tricked Google into a high rank (without paying for an ad):

https://developers.google.com/search/blog/2024/03/core-update-spam-policies#site-reputation

It's nice that Google has finally stopped gaslighting the rest of us with claims that its search was still the same bedrock utility that so many of us relied upon as a key piece of internet infrastructure. This not only feels wildly wrong, it is empirically, provably false:

https://downloads.webis.de/publications/papers/bevendorff_2024a.pdf

Not only that, but we know why Google search sucks. Memos released as part of the DOJ's antitrust case against Google reveal that the company deliberately chose to worsen search quality to increase the number of queries you'd have to make (and the number of ads you'd have to see) to find a decent result:

https://pluralistic.net/2024/04/24/naming-names/#prabhakar-raghavan

Google's antitrust case turns on the idea that the company bought its way to dominance, spending the some of the billions it extracted from advertisers and publishers to buy the default position on every platform, so that no one ever tried another search engine, which meant that no one would invest in another search engine, either.

Google's tacit defense is that its monopoly billions only incidentally fund these kind of anticompetitive deals. Mostly, Google says, it uses its billions to build the greatest search engine, ad platform, mobile OS, etc that the public could dream of. Only a company as big as Google (says Google) can afford to fund the R&D and security to keep its platform useful for the rest of us.

That's the "monopolistic bargain" – let the monopolist become a dictator, and they will be a benevolent dictator. Shriven of "wasteful competition," the monopolist can split their profits with the public by funding public goods and the public interest.

Google has clearly reneged on that bargain. A company experiencing the dramatic security failures and declining quality should be pouring everything it has to righting the ship. Instead, Google repeatedly blew tens of billions of dollars on stock buybacks while doing mass layoffs:

https://pluralistic.net/2024/02/21/im-feeling-unlucky/#not-up-to-the-task

Those layoffs have now reached the company's "core" teams, even as its core services continue to decay:

https://qz.com/google-is-laying-off-hundreds-as-it-moves-core-jobs-abr-1851449528

(Google's antitrust trial was shrouded in secrecy, thanks to the judge's deference to the company's insistence on confidentiality. The case is moving along though, and warrants your continued attention:)

https://www.thebignewsletter.com/p/the-2-trillion-secret-trial-against

Google wormed its way into so many corners of our lives that its enshittification keeps erupting in odd places, like ordering takeout food:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

Back in February, Housefresh – a rigorous review site for home air purifiers – published a viral, damning account of how Google had allowed itself to be overrun by spammers who purport to provide reviews of air purifiers, but who do little to no testing and often employ AI chatbots to write automated garbage:

https://housefresh.com/david-vs-digital-goliaths/

In the months since, Housefresh's Gisele Navarro has continued to fight for the survival of her high-quality air purifier review site, and has received many tips from insiders at the spam-farms and Google, all of which she recounts in a followup essay:

https://housefresh.com/how-google-decimated-housefresh/

One of the worst offenders in spam wars is Dotdash Meredith, a content-farm that "publishes" multiple websites that recycle parts of each others' content in order to climb to the top search slots for lucrative product review spots, which can be monetized via affiliate links.

A Dotdash Meredith insider told Navarro that the company uses a tactic called "keyword swarming" to push high-quality independent sites off the top of Google and replace them with its own garbage reviews. When Dotdash Meredith finds an independent site that occupies the top results for a lucrative Google result, they "swarm a smaller site’s foothold on one or two articles by essentially publishing 10 articles [on the topic] and beefing up [Dotdash Meredith sites’] authority."

Dotdash Meredith has keyword swarmed a large number of topics. from air purifiers to slow cookers to posture correctors for back-pain:

https://housefresh.com/wp-content/uploads/2024/05/keyword-swarming-dotdash.jpg

The company isn't shy about this. Its own shareholder communications boast about it. What's more, it has competition.

Take Forbes, an actual news-site, which has a whole shadow-empire of web-pages reviewing products for puppies, dogs, kittens and cats, all of which link to high affiliate-fee-generating pet insurance products. These reviews are not good, but they are treasured by Google's algorithm, which views them as a part of Forbes's legitimate news-publishing operation and lets them draft on Forbes's authority.

This side-hustle for Forbes comes at a cost for the rest of us, though. The reviewers who actually put in the hard work to figure out which pet products are worth your money (and which ones are bad, defective or dangerous) are crowded off the front page of Google and eventually disappear, leaving behind nothing but semi-automated SEO garbage from Forbes:

https://twitter.com/ichbinGisele/status/1642481590524583936

There's a name for this: "site reputation abuse." That's when a site perverts its current – or past – practice of publishing high-quality materials to trick Google into giving the site a high ranking. Think of how Deadspin's private equity grifter owners turned it into a site full of casino affiliate spam:

https://www.404media.co/who-owns-deadspin-now-lineup-publishing/

The same thing happened to the venerable Money magazine:

https://moneygroup.pr/

Money is one of the many sites whose air purifier reviews Google gives preference to, despite the fact that they do no testing. According to Google, Money is also a reliable source of information on reprogramming your garage-door opener, buying a paint-sprayer, etc:

https://money.com/best-paint-sprayer/

All of this is made ten million times worse by AI, which can spray out superficially plausible botshit in superhuman quantities, letting spammers produce thousands of variations on their shitty reviews, flooding the zone with bullshit in classic Steve Bannon style:

https://escapecollective.com/commerce-content-is-breaking-product-reviews/

As Gizmodo, Sports Illustrated and USA Today have learned the hard way, AI can't write factual news pieces. But it can pump out bullshit written for the express purpose of drafting on the good work human journalists have done and tricking Google – the search engine 90% of us rely on – into upranking bullshit at the expense of high-quality information.

A variety of AI service bureaux have popped up to provide AI botshit as a service to news brands. While Navarro doesn't say so, I'm willing to bet that for news bosses, outsourcing your botshit scams to a third party is considered an excellent way of avoiding your journalists' wrath. The biggest botshit-as-a-service company is ASR Group (which also uses the alias Advon Commerce).

Advon claims that its botshit is, in fact, written by humans. But Advon's employees' Linkedin profiles tell a different story, boasting of their mastery of AI tools in the industrial-scale production of botshit:

https://housefresh.com/wp-content/uploads/2024/05/Advon-AI-LinkedIn.jpg

Now, none of this is particularly sophisticated. It doesn't take much discernment to spot when a site is engaged in "site reputation abuse." Presumably, the 12,000 googlers the company fired last year could have been employed to check the top review keyword results manually every couple of days and permaban any site caught cheating this way.

Instead, Google is has announced a change in policy: starting May 5, the company will downrank any site caught engaged in site reputation abuse. However, the company takes a very narrow view of site reputation abuse, limiting punishments to sites that employ third parties to generate or uprank their botshit. Companies that produce their botshit in-house are seemingly not covered by this policy.

As Navarro writes, some sites – like Forbes – have prepared for May 5 by blocking their botshit sections from Google's crawler. This can't be their permanent strategy, though – either they'll have to kill the section or bring it in-house to comply with Google's rules. Bringing things in house isn't that hard: US News and World Report is advertising for an SEO editor who will publish 70-80 posts per month, doubtless each one a masterpiece of high-quality, carefully researched material of great value to Google's users:

https://twitter.com/dannyashton/status/1777408051357585425

As Navarro points out, Google is palpably reluctant to target the largest, best-funded spammers. Its March 2024 update kicked many garbage AI sites out of the index – but only small bottom-feeders, not large, once-respected publications that have been colonized by private equity spam-farmers.

All of this comes at a price, and it's only incidentally paid by legitimate sites like Housefresh. The real price is borne by all of us, who are funneled by the 90%-market-share search engine into "review" sites that push low quality, high-price products. Housefresh's top budget air purifier costs $79. That's hundreds of dollars cheaper than the "budget" pick at other sites, who largely perform no original research.

Google search has a problem. AI botshit is dominating Google's search results, and it's not just in product reviews. Searches for infrastructure code samples are dominated by botshit code generated by Pulumi AI, whose chatbot hallucinates nonexistence AWS features:

https://www.theregister.com/2024/05/01/pulumi_ai_pollution_of_search/

This is hugely consequential: when these "hallucinations" slip through into production code, they create huge vulnerabilities for widespread malicious exploitation:

https://www.theregister.com/2024/03/28/ai_bots_hallucinate_software_packages/

We've put all our eggs in Google's basket, and Google's dropped the basket – but it doesn't matter because they can spend $20b/year bribing Apple to make sure no one ever tries a rival search engine on Ios or Safari:

https://finance.yahoo.com/news/google-payments-apple-reached-20-220947331.html

Google's response – laying off core developers, outsourcing to low-waged territories with weak labor protections and spending billions on stock buybacks – presents a picture of a company that is too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Google promised us a quid-pro-quo: let them be the single, authoritative portal ("organize the world’s information and make it universally accessible and useful"), and they will earn that spot by being the best search there is:

https://www.ft.com/content/b9eb3180-2a6e-41eb-91fe-2ab5942d4150

But – like the spammers at the top of its search result pages – Google didn't earn its spot at the center of our digital lives.

It cheated.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/03/keyword-swarming/#site-reputation-abuse

Image:

freezelight (modified)

https://commons.wikimedia.org/wiki/File:Spam_wall_-_Flickr_-_freezelight.jpg

CC BY-SA 2.0

https://creativecommons.org/licenses/by-sa/2.0/deed.en

#pluralistic#google#monopoly#housefresh#content mills#sponcon#seo#dotdash meredith#keyword swarming#iac#forbes#forbes advisor#deadspin#money magazine#ad practicioners llc#asr group holdings#sports illustrated#advon#site reputation abuse#the algorithm tm#core update#kagi#ai#botshit

870 notes

·

View notes

Text

Butch Fairy Zine: Answering questions

What art style are we looking for? What is the estimated timeline? Will you get paid? we answer them here!

We will be answering more questions and posting them in the days leading up to the artist application form opening. So if you have questions, use our inbox, or you can fill in our interest form and leave them at the bottom. And if you have queries for the frog, you can leave them there too. He is very busy, so keep that in mind.

Find the interest form here.

Our Artist Application form will open on the 12th of January 2024.

text version under the cut

What type of artists are you looking for? And are you after a specific style or a range of styles?

We are looking for artists who can create pieces with fully rendered fairies and a background within the specified schedule. These can be digital artworks that are flat colour artworks, paintings, a mixture, or another style entirely.

We will also accept mixed media and traditional artworks, but they will need to be scanned at a minimum of 300dpi.

~

When you sign up for an artist position, are there any requirements to be a part of the team?

E-mail communication is required (discord is optional).

You must have a PayPal account to receive payment.

You must be able to communicate comfortably in English.

You must be 18 or older at the time of signing the contract by the 16th of February.

~

For artists accepted into the zine what would be the timeline for completing and submitting artwork?

Our current schedule for the artists requires concept ideas to be submitted by Feb 16th, and the final version by May 16th! Progress check-ins will be on Feb 29th, March 21st, and April 11th.

(In the image there is also a table including this information as well as the final submissions date being May 16th)

~

When the zine is for sale, where would the profits go to (charity, zine admin, etc.)?

We are aiming to hold pre-orders in June/July of 2024, with a flat fee paid to all contributors and additional proceeds split between contributors and mods.

Our priority is to make sure each contributor is paid fairly for their work. If sales do well enough, 20% will be used for future books and projects, and 80% split between taxes and fees, production costs, contributors and shipping costs.

~

Is this physical or digital and will there be prints of the art available? Got any merch ideas planned to go along with the zine?

Both physical and digital! Our goal is to make a 210 x 148 mm (A5) perfect-bound soft cover book.

We also plan to add some paper merch, including prints of some of the art from the book. Additional merch ideas include stickers, sticker sheets and bookmarks.

1K notes

·

View notes

Text

01 - Taylor Swift

No one in the music industry wielded more power over the past year than Taylor Swift, who made history at stadiums, movie theaters and on the Billboard charts, leaving even the most seasoned executives speechless. While they’d long celebrated her staggering popularity as a singer, songwriter and performer, her force as a strategic business leader suddenly came into sharper focus — and industry veterans took notes as they watched some of her bravest and most innovative business risks reap remarkable rewards.

At 34, she is one of the music industry’s most charismatic and influential leaders — and she rewrites the rules.

“The piece of advice I would give to the other executives on this list is that the best ideas are usually ones without industry precedent,” Swift tells Billboard. “The biggest crossroads moments of my career came down to sticking to my instincts when my ideas were looked at with skepticism. When someone says to me, ‘But that has never been done successfully before,’ it fires me up. We have to take strategic risks every day in this industry, but every once in a while, you have to really trust your gut and take a flying leap. My rerecordings are my favorite example of this, and I’m extremely grateful to my team and fans for taking that leap with me because it absolutely changed my life.”

Sage advice for an industry in which instinct has largely been supplanted by metrics and data analysis.

In December, Time named Swift its 2023 Person of the Year. In September, after encouraging her 279 million Instagram followers to vote and linking to vote.org, the nonpartisan nonprofit said it received over 35,000 registrations. She appears on the cover of this issue of Billboard and in the No. 1 spot of our annual Power 100 issue because her force across the business of music is now unparalleled — and because she models commitment to innovation that the rest of the business will need in order to tackle the big challenges ahead.

Swift’s gambles have paid off handsomely over the past year.

Her massive The Eras stadium tour, which began in March after she controversially put all the tickets on sale at once, crashing Ticketmaster and sparking mass hysteria, grossed an estimated $906.1 million in 2023 and is poised to become the highest-grossing global tour of all time before it wraps in December, according to Billboard.

The Golden Globe-nominated Taylor Swift: The Eras Tour film, taped during her six-show run at SoFi Stadium in Inglewood, Calif., in August, has grossed over $261.6 million worldwide since its October opening, according to AMC Theatres Entertainment. In January, the publicly traded movie-house chain announced that the film’s box-office take made it the highest-grossing concert/documentary picture ever released, surpassing Michael Jackson’s 2009 This Is It. Once again blazing a new path, Swift made a groundbreaking distribution deal directly with AMC Theaters instead of linking with a film studio.

Swift has shaken up the catalog market, too. When Scooter Braun infuriated her by acquiring the master recordings of her first six albums through his Ithaca Holdings and then sold them to investment firm Shamrock Capital at a profit, Swift rerecorded the albums with loving precision and added bonus tracks to the new releases. They performed phenomenally well, as she deftly used her tour to promote them. When her latest rerecording (and 14th studio album overall), 1989 (Taylor’s Version), spent its fifth week at atop the Billboard 200 at the end of 2023, Swift beat Elvis Presley’s record for the most weeks at No. 1 by a solo artist. Her industry market share last year was 1.72%. If she were her own genre, she’d rank ninth for 2023 — bigger than jazz.

“She’s the smartest artist I’ve ever worked with,” says Messina Touring Group’s Louis Messina, who promotes Swift’s tours and has worked with her since 2005. “She outworks everybody and she has always had this vision. If you’re around her, you can’t help but believe in her.” —Melinda Newman

53 notes

·

View notes

Note

Celebrity blockout 2024

After the tone deaf met gala, a lot of people are starting a movement where we block and unfollow all celebrities and influencers on social media.

These celebrities become irrelevant without our following and blocking prevents them from gaining any ad revenue from us.

This is the start of the awakening process where celebrities are exposed and class consciousness arises. Celebrity worship and the gap between the rich and the poor is being brought to light.

Kim Kardashian has already lost 3 million followers on insta. It's working.

TLDR:

1. Block all celebrities and influencers on social media, including their products and companies. (Taylor Swift, the Kardashians, Haley Baylee, Bill Gates, JLo)

To go even further: 2. Block all news & media sites that promote celebrities like SNL, Vogue, TMZ, Enews, etc.

3. Block major corporations like Amazon and especially the fast food corporations that profit off of making us sick. No more Taco Bell or Chick-fil-A ads. We can't let them advertise to us anymore. Enough is enough.

4. Find ways to support your local businesses (like farmer's markets) and promote platforms that are doing good for people. Start a garden this summer, boycott processed food and corrupt food brands like Kelloggs. Find ways to be more self-sufficient.

If you have any more ideas to add about how we can continue making change please comment them! This just the start

YES! All of this is crucial, but I want to put emphasis on blocking.

It's so important. I've been saying this since Andrew Tate.

It didn't matter if he meant what he was saying, it didn't matter if it was all real or a persona, your attention served his pockets.

Stop giving these ridiculous people your attention when it's so clearly what they want.

Your attention is how they profit. It's the new currency.

Your attention means views means likes means reposts means engagement means money.

Even when you comment to criticize, even when you share a video to discuss their problematic behaviour with friends, you're boosting them.

Influencers and celebrities need people's eyes on their platforms, this is how they make their cash and how they ensure that their presence reaches new audiences with every minute.

Your very gaze drawn to them through the screen is what allows them to remain so comfortable in their position that they're tone deaf.

Block them.

#there's so much more i can analyze when it comes to celebrities and influencers#i get it you want to live vicariously through them#i get it they share things about themselves that you can't help but develop a parasocial relationship#but i swear. i swear they're not special. they're not one of a kind. they're average people.#they're just average people that you get to know through interviews and quirky grwm's.#they're. not. special.#celebrities#influencers#social media#gaza#rafah#free palestine 🇵🇸#all eyes on rafah#all eyes on gaza#all eyes on palestine

29 notes

·

View notes

Text

manifesting chaos in the 2024 f1 season (wiz edition)

kudos to @keepthedelta for starting this idea way back when, theirs were hilarious

- jos verstappen and carlos sainz snr have an actual fistfight, but agree to do it on pay per view TV for maximal profit and impact. carlos snr wins only because he still has good core strength from driving endurance races and also he definitely does yogilates

- forced to get more sponsorship money, kick stake sauber drivers have to do an embarrassingly slutty ad for vitamin water. turns out valtteri and guan yu is very game for it and it actually goes super viral, but only in china

- FIA announces seoul gp 2026 and do an embarrassing eGames tie up as well as get nct's most junior division (most of them are 10 years old) to promote it for some reason. 2025 Charles leclerc finally makes his debut on MDC singing an slow-fi hip hop song with lots of air horns. it’s the one he co-wrote with lewis hamilton as an anthem for the ferrari team

- no more grill the grid. liberty media takes things to the next level and makes all the drivers do elimination games from squid game. drivers may be injured or perish. however as per FIA regs they are still expected to recover well enough to drive by the following sunday

- seb vettel returns but only for one race to drive a literal tractor across a field in austria to promote saving the bees

- alex albon is told he gets to move to red bull again except alex albon was busy taking some proper off time with his girlfriend during the summer so he misses the email and the tweets. by the time he catches up with the rumours, red bull have already musical chaired first liam lawson and then daniel ricciardo in the seat only to immediately take it back and give it to a fifteen year old who’s currently taking a nap in the rb junior academy room somewhere

- zak brown starts a new tie up with an aerospace company and andrea accidentally builds a rocket ship that blasts the papaya boys into space. lando and oscar do a livestream in the MCL38 parked on the side of an asteroid

- nico rosberg appears on a sky broadcast in a t-shirt that people swear lewis hamilton once wore, and it in fact may be the exact same one. neither of them comments on it at all

- otmar somehow returns and spends half his time instructing his drivers to try and chase / destroy that orange twink… i mean, car. somehow he will manage to run a team more embarrassingly than haas.

#f1#f1 predictions#f1 memes#f1blr#the way i wrote this pre-bahrain and forgot about it in the drafts#the Liberty Media one is shockingly accurate tho lmao#in light of the announcement that teams are supposed to lessen their marketing content so Liberty can push their own#anyway i found this while searching for something else so like-- enjoy#still fully believe jos and carlos snr might fight each other cus we're only in april rn#what i did not anticipate pre-bahrain was how much Alpine truly would be in the trenches#one one hand: poor them#one the other: kind of incredible that haas is not the laggard rn

24 notes

·

View notes

Text

1) Taylor Swift

No one in the music industry wielded more power over the past year than Taylor Swift, who made history at stadiums, movie theaters and on the Billboard charts, leaving even the most seasoned executives speechless. While they’d long celebrated her staggering popularity as a singer, songwriter and performer, her force as a strategic business leader suddenly came into sharper focus — and industry veterans took notes as they watched some of her bravest and most innovative business risks reap remarkable rewards.

At 34, she is one of the music industry’s most charismatic and influential leaders — and she rewrites the rules.

“The piece of advice I would give to the other executives on this list is that the best ideas are usually ones without industry precedent,” Swift tells Billboard. “The biggest crossroads moments of my career came down to sticking to my instincts when my ideas were looked at with skepticism. When someone says to me, ‘But that has never been done successfully before,’ it fires me up. We have to take strategic risks every day in this industry, but every once in a while, you have to really trust your gut and take a flying leap. My rerecordings are my favorite example of this, and I’m extremely grateful to my team and fans for taking that leap with me because it absolutely changed my life.”

Sage advice for an industry in which instinct has largely been supplanted by metrics and data analysis.

In December, Time named Swift its 2023 Person of the Year. In September, after encouraging her 279 million Instagram followers to vote and linking to vote.org, the nonpartisan nonprofit said it received over 35,000 registrations. She appears on the cover of this issue of Billboard and in the No. 1 spot of our annual Power 100 issue because her force across the business of music is now unparalleled — and because she models commitment to innovation that the rest of the business will need in order to tackle the big challenges ahead.

Swift’s gambles have paid off handsomely over the past year.

Her massive The Eras stadium tour, which began in March after she controversially put all the tickets on sale at once, crashing Ticketmaster and sparking mass hysteria, grossed an estimated $906.1 million in 2023 and is poised to become the highest-grossing global tour of all time before it wraps in December, according to Billboard.

The Golden Globe-nominated Taylor Swift: The Eras Tour film, taped during her six-show run at SoFi Stadium in Inglewood, Calif., in August, has grossed over $261.6 million worldwide since its October opening, according to AMC Theatres Entertainment. In January, the publicly traded movie-house chain announced that the film’s box-office take made it the highest-grossing concert/documentary picture ever released, surpassing Michael Jackson’s 2009 This Is It. Once again blazing a new path, Swift made a groundbreaking distribution deal directly with AMC Theaters instead of linking with a film studio.

Swift has shaken up the catalog market, too. When Scooter Braun infuriated her by acquiring the master recordings of her first six albums through his Ithaca Holdings and then sold them to investment firm Shamrock Capital at a profit, Swift rerecorded the albums with loving precision and added bonus tracks to the new releases. They performed phenomenally well, as she deftly used her tour to promote them. When her latest rerecording (and 14th studio album overall), 1989 (Taylor’s Version), spent its fifth week at atop the Billboard 200 at the end of 2023, Swift beat Elvis Presley’s record for the most weeks at No. 1 by a solo artist. Her industry market share last year was 1.72%. If she were her own genre, she’d rank ninth for 2023 — bigger than jazz.

“She’s the smartest artist I’ve ever worked with,” says Messina Touring Group’s Louis Messina, who promotes Swift’s tours and has worked with her since 2005. “She outworks everybody and she has always had this vision. If you’re around her, you can’t help but believe in her.” —Melinda Newman

23 notes

·

View notes

Text

Top 10 Best Machines for Small Business with Low Investment

🎬 Want to be your own boss? 🚀 Discover the Top 10 Profitable Small Business Machines with Low Investment! 💼 Turn your passion into profit with these game-changing ideas. 💰 #businessmachines #smallbusinessideas #newbusinessideas #businessopportunity

Small business owners in today’s dynamic landscape of entrepreneurship are always seeking innovative solutions to maximize their efficiency and profitability. Investing in the right machinery can catalyze success, enabling businesses to streamline operations, meet market demands, and generate significant returns on investment. And, small business machines play a pivotal role in improving…

View On WordPress

#Best Machines for Small Business#Business Innovation#business machinery#business machines in 2024#Entrepreneurial Ventures#entrepreneurship#Low Investment#Low Risk High Reward#machines for my business#machines for small business#Manufacturing Machines for Small Business#Money Making Machines#new business ideas#profitable business ideas#Small Business Innovation#Small Business Machines#Startup Tips

0 notes

Text

https://www.pikpartsmartgarage.com/new-franchise

Buy Bike Garage Franchise in India | Garage Franchise Businesses to Start | Pikpart Smart Garage Franchise

Explore lucrative opportunities in India's booming automotive industry by investing in a Bike Garage Franchise. Start your entrepreneurial journey with Pikpart Smart Garage Franchise – a trusted brand for aspiring business owners. Discover the potential of Garage Franchise Businesses and buy into a thriving market today.

#Garage Franchise in India#Garage Business Opportunities#Buy Bike Garage Franchise in India#Car Franchise India#Profitable Garage Franchise in India#Best Car Garage in India#Garage Business in India#Garage Franchise Businesses to Start#Best Businesses to Start In 2024#Most Profitable Good Business Ideas#Good Entrepreneur Ideas#Top Garage Franchise Idea in 2024

0 notes

Text

LETTERS FROM AN AMERICAN

April 7, 2024 (Sunday)

HEATHER COX RICHARDSON

APR 08, 2024

In August 1870 a U.S. exploring expedition headed out from Montana toward the Yellowstone River into land the U.S. government had recognized as belonging to different Indigenous tribes.

By October the men had reached the Yellowstone, where they reported they had “found abundance of game and trout, hot springs of five or six different kinds…basaltic columns of enormous size” and a waterfall that must, they wrote, “be in form, color and surroundings one of the most glorious objects on the American Continent.” On the strength of their widely reprinted reports, the secretary of the interior sent out an official surveying team under geologist Ferdinand V. Hayden. With it went photographer William Henry Jackson and fine artist Thomas Moran.

Banker and railroad baron Jay Cooke had arranged for Moran to join the expedition. In 1871 the popular Scribner’s Monthly published the surveyor’s report along with Moran’s drawings and a promise that Cooke’s Northern Pacific Railroad would soon lay tracks to enable tourists to see the great natural wonders of the West.

But by 1871, Americans had begun to turn against the railroads, seeing them as big businesses monopolizing American resources at the expense of ordinary Americans. When Hayden called on Congress to pass a law setting the area around Yellowstone aside as a public park, two Republicans—Senator Samuel Pomeroy of Kansas and Delegate William H. Clagett of Montana—introduced bills to protect Yellowstone in a natural state and provide against “wanton destruction of the fish and game…or destruction for the purposes of merchandise or profit.”

The House Committee on Public Lands praised Yellowstone Valley’s beauty and warned that “persons are now waiting for the spring…to enter in and take possession of these remarkable curiosities, to make merchandise of these bountiful specimens, to fence in these rare wonders so as to charge visitors a fee, as is now done at Niagara Falls, for the sight of that which ought to be as free as the air or water.” It warned that “the vandals who are now waiting to enter into this wonderland will, in a single season, despoil, beyond recovery, these remarkable curiosities which have required all the cunning skill of nature thousands of years to prepare.”

The New York Times got behind the idea that saving Yellowstone for the people was the responsibility of the federal government, saying that if businesses “should be strictly shut out, it will remain a place which we can proudly show to the benighted European as a proof of what nature—under a republican form of government—can accomplish in the great West.”

On March 1, 1872, President U. S. Grant, a Republican, signed the bill making Yellowstone a national park.

The impulse to protect natural resources from those who would plunder them for profit expanded 18 years later, when the federal government stepped in to protect Yosemite. In June 1864, Congress had passed and President Abraham Lincoln signed a law giving to the state of California the Yosemite Valley and nearby Mariposa Big Tree Grove “upon the express conditions that the premises shall be held for public use, resort and recreation.”

But by 1890 it was clear that under state management the property had been largely turned over to timber companies, sheep-herding enterprises, and tourist businesses with state contracts. Naturalist John Muir warned in the Century magazine: “Ax and plow, hogs and horses, have long been and are still busy in Yosemite’s gardens and groves. All that is accessible and destructible is rapidly being destroyed.” Congress passed a law making the land around the state property in Yosemite a national park area, and the United States military began to manage the area.

The next year, in March 1891, Congress gave the president power to “set apart and reserve…as public reservations” land that bore at least some timber, whether or not that timber was of any commercial value. Under this General Revision Act, also known as the Forest Reserve Act, Republican president Benjamin Harrison set aside timber land adjacent to Yellowstone National Park and south of Yosemite National Park. By September 1893, about 17 million acres of land had been put into forest reserves. Those who objected to this policy, according to Century, were “men [who] wish to get at it and make it earn something for them.”

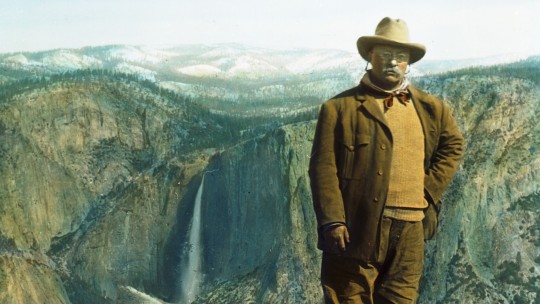

Presidents of both parties continued to protect American lands, but in the late nineteenth century it was New York Republican politician Theodore Roosevelt who most dramatically expanded the effort to keep western lands from the hands of those who wanted only their timber and minerals.

Roosevelt was concerned that moneygrubbing was eroding the character of the nation, and he believed that western land nurtured the independence and community that he worried was disappearing in the East. During his presidency, which stretched from 1901 to 1909, Roosevelt protected 141 million acres of forest and established five new national parks.

More powerfully, he used the 1906 Antiquities Act, which Congress had passed to stop the looting and sale of Indigenous objects and sites, to protect land. The Antiquities Act allowed presidents to protect areas of historic, cultural, or scientific interest. Before the law was a year old, Roosevelt had created four national monuments: Devils Tower in Wyoming, El Morro in New Mexico, and Montezuma Castle and Petrified Forest in Arizona.

In 1908, Roosevelt used the Antiquities Act to protect the Grand Canyon.

Since then, presidents of both parties have protected American lands. President Jimmy Carter rivaled Roosevelt’s protection of land when he protected more than 100 million acres in Alaska from oil development. Carter’s secretary of the interior, Cecil D. Andrus, saw himself as a practical man trying to balance the needs of business and environmental needs but seemed to think business interests had become too powerful: “The domination of the department by mining, oil, timber, grazing and other interests is over.”

In fact, the fight over the public lands was not ending; it was entering a new phase. Since the 1980s, Republicans have pushed to reopen public lands to resource development, maintaining even today that Democrats have hampered oil production although it is currently, under President Joe Biden, at an all-time high.

The push to return public lands to private hands got stronger under former president Donald Trump. On April 26, 2017, Trump signed an executive order—Executive Order 13792—directing his secretary of the interior, Ryan Zinke, to review designations of 22 national monuments greater than 100,000 acres, made since 1996. He then ordered the largest national monument reduction in U.S. history, slashing the size of Utah’s Bears Ears National Monument by 85%—a goal of uranium-mining interests—and that of Utah’s Escalante–Grand Staircase by about half, favoring coal interests.

“No one better values the splendor of Utah more than you do,” Trump told cheering supporters. “And no one knows better how to use it.”

In March 2021, shortly after he took office, President Biden announced a new initiative to protect 30% of U.S. land, fresh water, and oceans areas by 2030, a plan popularly known as 30 by 30. Also in March 2021, Supreme Court chief justice John Roberts urged opponents of land protection to push back against the Antiquities Act, saying the broad protection of lands presidents have established under it is an abuse of power.

In October 2021, President Biden restored Bears Ears and Escalante–Grand Staircase to their original size. “Today’s announcement is not just about national monuments,” Interior Secretary Deb Haaland, a member of the Laguna Pueblo in New Mexico, said at the ceremony. “It’s about this administration centering the voices of Indigenous people and affirming the shared stewardship of this landscape with tribal nations.”

In 2022, nearly 312 million people visited the country’s national parks and monuments, supporting 378,400 jobs and spending $23.9 billion in communities within 60 miles of a park. This amounted to a $50.3 billion benefit to the nation’s economy.

But the struggle over the use of public lands continues, and now the Republicans are standing on the opposite side from their position of a century ago. Project 2025, the blueprint for a second Trump presidency, demands significant increases in drilling for oil and gas. That will require removing land from federal protection and opening it to private development. As Roberts urged, Project 2025 promises to seek a Supreme Court ruling to permit the president to reduce the size of national monuments. But it takes that advice even further.

It says a second Trump administration “must seek repeal of the Antiquities Act of 1906.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#public lands#the Antiquities Act of 1906#history#Department of the interior#tribal nations#Teddy Roosevelt#conservation#conservatism#preservation

10 notes

·

View notes

Text

Uranus Awakens: How the Rebellious Bull Shakes Up Business and Finance in 2024

Prepare for disruption, fellow stargazers! As the revolutionary planet Uranus stations direct in the grounded sign of Taurus on January 27, 2024, a cosmic earthquake ripples through the world of business and finance. Get ready for unexpected twists, innovative breakthroughs, and a complete reshaping of the economic landscape. Buckle up, entrepreneurs, investors, and everyone in between — Uranus is here to shake things up!

The Cosmic Cocktail:

Imagine the stoic, earth-loving Taurus as a well-established bank, steeped in tradition and conservative practices. Now, picture the rebellious Uranus, bursting in with a briefcase full of digital currency and blockchain ideas. That’s the essence of this transit — a clash between old and new, stability and revolution, practicality and radical transformation.

Impacts to Expect:

Technological Disruption: Brace yourself for a wave of innovation in finance and business. Cryptocurrency, blockchain, and decentralized finance (DeFi) will take center stage, challenging traditional banking systems and pushing the boundaries of what’s possible.

Prepare for a digital gold rush as Uranus throws open the vault of financial innovation! Cryptocurrency will erupt into mainstream commerce, blockchain will become the new ledger, and DeFi will democratize finance like never before. Traditional banks better dust off their abacus and learn to code, because digital cowboys are charging onto the financial frontier, redefining how we value, exchange, and invest. From peer-to-peer microloans to fractionalized real estate ownership, the possibilities are as limitless as your imagination. Buckle up, because the tectonic plates of finance are shifting, and the digital revolution is rewriting the rules of the game!

Shifting Market Dynamics: Expect volatility and unexpected shifts in established industries. Old guard companies might scramble to adapt, while nimble startups with innovative ideas flourish. Think green energy disrupting fossil fuels, or AI revolutionizing the service industry.

Be prepared for market earthquakes! Uranus, the cosmic trickster, will send shockwaves through established industries, causing titans to tremble and upstarts to dance. Picture fossil fuels choking on the dust of solar panels, brick-and-mortar stores gasping as virtual bazaars boom, and customer service bots replacing flustered clerks. AI will infiltrate every corner, from crafting personalized shopping experiences to streamlining logistics, while sustainable solutions crack open resource-hungry giants. It’s a Darwinian playground for businesses — adapt or face extinction. This isn’t just a market shuffle, it’s a complete reshuffle of the deck, and the cards are dealt anew. Get ready for the thrill of the unexpected, because the only constant in this dynamic landscape is change itself!

Evolving Values: Sustainability, ethical practices, and social responsibility will become increasingly important for consumers and investors alike. Businesses that prioritize these values will thrive, while those stuck in outdated models might struggle.

Get ready for a values revolution! Consumers and investors will turn from price tags to purpose tags, demanding businesses that go beyond profit and prioritize sustainability, ethical sourcing, and social responsibility. Imagine carbon-neutral factories replacing smog-belching behemoths, fair-trade coffee beans eclipsing exploitative practices, and employee well-being becoming a non-negotiable bottom line. Businesses that cling to outdated models will find themselves gasping for air as ethical alternatives steal the oxygen. It’s not just a trend, it’s a tidal wave of conscious consumerism sweeping away the tide of greed. So, businesses, listen up: embrace responsible practices, champion inclusivity, and weave sustainability into your very fabric, or risk being swept away by the rising tide of conscious capitalism. The future belongs to those who do good, not just those who do well!

Collaborative Entrepreneurship: Collaboration and community-driven ventures will rise in prominence. Shared workspaces, cooperatives, and peer-to-peer platforms will gain traction, challenging the traditional top-down corporate structure.

Picture the corporate pyramid crumbling as the cosmic crane hoists the collaborative flag! Uranus, the revolutionary, encourages a seismic shift: from isolated silos to thriving beehives. Shared workspaces buzz with creative collisions, cooperatives blossom out of shared passions, and peer-to-peer platforms become the new marketplace, fueled by trust and mutual aid. The top-down hierarchy shivers as horizontal networks rise, blurring the lines between boss and worker, replacing command with consensus. Collaboration takes center stage, not competition, as communities band together to tackle challenges and build innovative solutions. So, entrepreneurs, shed your solopreneur capes and embrace the power of the collective! In this new social business ecosystem, where synergy triumphs over supremacy, the future belongs to those who share, empower, and co-create a brighter tomorrow. Let the collaborative revolution begin!

Focus on Personal Values: Individuals will increasingly prioritize work that aligns with their personal values and passions. Entrepreneurship fueled by purpose and authenticity will flourish, shaping a more diverse and fulfilling business landscape.

Prepare for a workplace metamorphosis! Uranus, the cosmic butterfly, flutters wings of purpose, urging individuals to shed the career chrysalis and soar towards fulfilling their true potential. Gone are the days of soul-sucking jobs; now, personal values take center stage as the compass guiding career choices. Imagine passionate bakers opening community cafes, eco-conscious designers launching upcycled fashion lines, and tech whizzes crafting apps that tackle social issues. Authenticity becomes the new currency, with entrepreneurs weaving their passions into the fabric of their ventures, creating a mosaic of purpose-driven businesses that cater to every corner of the human experience. This isn’t just a career shift, it’s a heart shift, transforming the business landscape into a vibrant tapestry of diverse talents and fulfilled souls. So, listen to your inner compass, embrace your unique spark, and let your passion ignite the world — the future of work belongs to those who dare to be true to themselves!

Tips for Navigating the Cosmic Chaos:

Embrace innovation: Don’t cling to the old ways. Stay open to new technologies, trends, and business models. Be curious, explore, and experiment.

Adapt and evolve: Be prepared to change course quickly. Agility and responsiveness will be key to success in this dynamic environment.

Prioritize sustainability and ethics: Integrate environmental and social responsibility into your business practices. Consumers and investors are increasingly drawn to values-driven companies.

Collaborate and connect: Build partnerships, join communities, and leverage the power of collective action. Collaboration will be crucial for navigating the changing landscape.

Follow your passion: Don’t be afraid to pursue your entrepreneurial dreams. Uranus encourages authenticity and purpose-driven ventures.

Remember, Uranus isn’t about chaos for chaos’ sake. It’s about dismantling outdated structures and paving the way for a more progressive, sustainable, and fulfilling economic future. By embracing the change, staying adaptable, and aligning your business with your values, you can not only survive this cosmic revolution but thrive in the exciting new world it creates. So, let your inner rebel loose, embrace the disruption, and ride the wave of innovation — the economic future is bright for those who dare to dream big!

#uranus in taurus#taurus uranus#business astrology#astrology business#astrology finance#finance astrology#astrology updates#astro#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology community#astrology observations#astropost#astro community#astrology notes

14 notes

·

View notes

Text

Amazon’s financial shell game let it create an “impossible” monopoly

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

For the pro-monopoly crowd that absolutely dominated antitrust law from the Carter administration until 2020, Amazon presents a genuinely puzzling paradox: the company's monopoly power was never supposed to emerge, and if it did, it should have crumbled immediately.

Pro-monopoly economists embody Ely Devons's famous aphorism that "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’":

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

Rather than using the way the world actually works as their starting point for how to think about it, they build elaborate models out of abstract principles like "rational actors." The resulting mathematical models are so abstractly elegant that it's easy to forget that they're just imaginative exercises, disconnected from reality:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

These models predicted that it would be impossible for Amazon to attain monopoly power. Even if they became a monopoly – in the sense of dominating sales of various kinds of goods – the company still wouldn't get monopoly power.

For example, if Amazon tried to take over a category by selling goods below cost ("predatory pricing"), then rivals could just wait until the company got tired of losing money and put prices back up, and then those rivals could go back to competing. And if Amazon tried to keep the loss-leader going indefinitely by "cross-subsidizing" the losses with high-margin profits from some other part of its business, rivals could sell those high margin goods at a lower margin, which would lure away Amazon customers and cut the supply lines for the price war it was fighting with its discounted products.

That's what the model predicted, but it's not what happened in the real world. In the real world, Amazon was able use its access to the capital markets to embark on scorched-earth predatory pricing campaigns. When diapers.com refused to sell out to Amazon, the company casually committed $100m to selling diapers below cost. Diapers.com went bust, Amazon bought it for pennies on the dollar and shut it down:

https://www.theverge.com/2019/5/13/18563379/amazon-predatory-pricing-antitrust-law

Investors got the message: don't compete with Amazon. They can remain predatory longer than you can remain solvent.

Now, not everyone shared the antitrust establishment's confidence that Amazon couldn't create a durable monopoly with market power. In 2017, Lina Khan – then a third year law student – published "Amazon's Antitrust Paradox," a landmark paper arguing that Amazon had all the tools it needed to amass monopoly power:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

Today, Khan is chair of the FTC, and has brought a case against Amazon that builds on some of the theories from that paper. One outcome of that suit is an unprecedented look at Amazon's internal operations. But, as the Institute for Local Self-Reliance's Stacy Mitchell describes in a piece for The Atlantic, key pieces of information have been totally redacted in the court exhibits:

https://www.theatlantic.com/ideas/archive/2024/02/amazon-profits-antitrust-ftc/677580/

The most important missing datum: how much money Amazon makes from each of its lines of business. Amazon's own story is that it basically breaks even on its retail operation, and keeps the whole business afloat with profits from its AWS cloud computing division. This is an important narrative, because if it's true, then Amazon can't be forcing up retail prices, which is the crux of the FTC's case against the company.

Here's what we know for sure about Amazon's retail business. First: merchants can't live without Amazon. The majority of US households have Prime, and 90% of Prime households start their ecommerce searches on Amazon; if they find what they're looking for, they buy it and stop. Thus, merchants who don't sell on Amazon just don't sell. This is called "monopsony power" and it's a lot easier to maintain than monopoly power. For most manufacturers, a 10% overnight drop in sales is a catastrophe, so a retailer that commands even a 10% market-share can extract huge concessions from its suppliers. Amazon's share of most categories of goods is a lot higher than 10%!

What kind of monopsony power does Amazon wield? Well, for one thing, it is able to levy a huge tax on its sellers. Add up all the junk-fees Amazon charges its platform sellers and it comes out to 45-51%:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Competitive businesses just don't have 45% margins! No one can afford to kick that much back to Amazon. What is a merchant to do? Sell on Amazon and you lose money on every sale. Don't sell on Amazon and you don't get any business.

The only answer: raise prices on Amazon. After all, Prime customers – the majority of Amazon's retail business – don't shop for competitive prices. If Amazon wants a 45% vig, you can raise your Amazon prices by a third and just about break even.

But Amazon is wise to that: they have a "most favored nation" rule that punishes suppliers who sell goods more cheaply in rival stores, or even on their own site. The punishments vary, from banishing your products to page ten million of search-results to simply kicking you off the platform. With publishers, Amazon reserves the right to lower the prices they set when listing their books, to match the lowest price on the web, and paying publishers less for each sale.

That means that suppliers who sell on Amazon (which is anyone who wants to stay in business) have to dramatically hike their prices on Amazon, and when they do, they also have to hike their prices everywhere else (no wonder Prime customers don't bother to search elsewhere for a better deal!).

Now, Amazon says this is all wrong. That 45-51% vig they claim from business customers is barely enough to break even. The company's profits – they insist – come from selling AWS cloud service. The retail operation is just a public service they provide to us with cross-subsidy from those fat AWS margins.

This is a hell of a claim. Last year, Amazon raked in $130 billion in seller fees. In other words: they booked more revenue from junk fees than Bank of America made through its whole operation. Amazon's junk fees add up to more than all of Meta's revenues:

https://s2.q4cdn.com/299287126/files/doc_financials/2023/q4/AMZN-Q4-2023-Earnings-Release.pdf

Amazon claims that none of this is profit – it's just covering their operating expenses. According to Amazon, its non-AWS units combined have a one percent profit margin.

Now, this is an eye-popping claim indeed. Amazon is a public company, which means that it has to make thorough quarterly and annual financial disclosures breaking down its profit and loss. You'd think that somewhere in those disclosures, we'd find some details.

You'd think so, but you'd be wrong. Amazon's disclosures do not break out profits and losses by segment. SEC rules actually require the company to make these per-segment disclosures:

https://scholarship.law.stjohns.edu/cgi/viewcontent.cgi?article=3524&context=lawreview#:~:text=If%20a%20company%20has%20more,income%20taxes%20and%20extraordinary%20items.

That rule was enacted in 1966, out of concern that companies could use cross-subsidies to fund predatory pricing and other anticompetitive practices. But over the years, the SEC just…stopped enforcing the rule. Companies have "near total managerial discretion" to lump business units together and group their profits and losses in bloated, undifferentiated balance-sheet items:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2021/dec/crouching-tiger-hidden-dragons

As Mitchell points you, it's not just Amazon that flouts this rule. We don't know how much money Google makes on Youtube, or how much Apple makes from the App Store (Apple told a federal judge that this number doesn't exist). Warren Buffett – with significant interest in hundreds of companies across dozens of markets – only breaks out seven segments of profit-and-loss for Berkshire Hathaway.

Recall that there is one category of data from the FTC's antitrust case against Amazon that has been completely redacted. One guess which category that is! Yup, the profit-and-loss for its retail operation and other lines of business.

These redactions are the judge's fault, but the real fault lies with the SEC. Amazon is a public company. In exchange for access to the capital markets, it owes the public certain disclosures, which are set out in the SEC's rulebook. The SEC lets Amazon – and other gigantic companies – get away with a degree of secrecy that should disqualify it from offering stock to the public. As Mitchell says, SEC chairman Gary Gensler should adopt "new rules that more concretely define what qualifies as a segment and remove the discretion given to executives."

Amazon is the poster-child for monopoly run amok. As Yanis Varoufakis writes in Technofeudalism, Amazon has actually become a post-capitalist enterprise. Amazon doesn't make profits (money derived from selling goods); it makes rents (money charged to people who are seeking to make a profit):

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Profits are the defining characteristic of a capitalist economy; rents are the defining characteristic of feudalism. Amazon looks like a bazaar where thousands of merchants offer goods for sale to the public, but look harder and you discover that all those stallholders are totally controlled by Amazon. Amazon decides what goods they can sell, how much they cost, and whether a customer ever sees them. And then Amazon takes $0.45-51 out of every dollar. Amazon's "marketplace" isn't like a flea market, it's more like the interconnected shops on Disneyland's Main Street, USA: the sign over the door might say "20th Century Music Company" or "Emporium," but they're all just one store, run by one company.

And because Amazon has so much control over its sellers, it is able to exercise power over its buyers. Amazon's search results push down the best deals on the platform and promote results from more expensive, lower-quality items whose sellers have paid a fortune for an "ad" (not really an ad, but rather the top spot in search listings):

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

This is "Amazon's pricing paradox." Amazon can claim that it offers low-priced, high-quality goods on the platform, but it makes $38b/year pushing those good deals way, way down in its search results. The top result for your Amazon search averages 29% more expensive than the best deal Amazon offers. Buy something from those first four spots and you'll pay a 25% premium. On average, you need to pick the seventeenth item on the search results page to get the best deal:

https://scholarship.law.bu.edu/faculty_scholarship/3645/

For 40 years, pro-monopoly economists claimed that it would be impossible for Amazon to attain monopoly power over buyers and sellers. Today, Amazon exercises that power so thoroughly that its junk-fee revenues alone exceed the total revenues of Bank of America. Amazon's story – that these fees barely stretch to covering its costs – assumes a nearly inconceivable level of credulity in its audience. Regrettably – for the human race – there is a cohort of senior, highly respected economists who possess this degree of credulity and more.

Of course, there's an easy way to settle the argument: Amazon could just comply with SEC regs and break out its P&L for its e-commerce operation. I assure you, they're not hiding this data because they think you'll be pleasantly surprised when they do and they don't want to spoil the moment.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

Image:

Doc Searls (modified)

https://www.flickr.com/photos/docsearls/4863121221/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#amazon#ilsr#institute for local self-reliance#amazon's antitrust paradox#antitrust#trustbusting#ftc#lina khan#aws#cross-subsidization#stacy mitchell#junk fees#most favored nation#sec#securities and exchange commission#segmenting#managerial discretion#ecommerce#technofeudalism

602 notes

·

View notes

Text

QUESTION: You have not commented on Trump’s NY case. What do you think of this case?

EK

ANSWER: It is a typical New York rigged trial. NOBODY ever gets a fair trial in New York. It is a cesspool of legal corruption. Judge Arthur Engoron is a national disgrace. When Trump’s lawyer Habba stood up to defend Trump, stating that the Engoron needed to “hear what he has to say.” The judge quickly scolded Habba, telling her, “I’m not here to hear what he has to say. He’s here to answer questions.”

He has already determined that everyone is guilty. This is about how much he can take from Trump and his family. They claim Trump should have paid $168 million more in interest. This is so absurd; it is just unimaginable.

In Securities Law, this applies between a professional and a member of the public. If I managed money for a major public corporation and said I wanted 50% of the profits, and they agreed, that is not fraud because, between two professionals, it is presumed they knew what they were doing.

This is not bank fraud, where the loans are paid off. The bank has its own assessors. They would have looked at the collateral listed and lent money on that and must have done their own diligence. For this case to even proceed is outrageous, for you could then scrutinize every loan ever made in New York City and claim that someone overvalued their house when they borrowed.

The ENTIRE world knows this is to interfere in the 2024 election. Both Argentina and Brazil said that a great idea and are doing the same to their opponents. As I have said, the computer is projecting massive civil unrest post-2024. It does not matter who wins the election; NEITHER side will accept the conclusion. I would NOT want to be in New York City post-election. This judge may have sealed the fate of New York City once and for all.

Any rational businessman should now avoid New York City for doing any business whatsoever.

21 notes

·

View notes