#private equity firms

Text

#private equity firms#capitalism#capitalism ruins everything#capitalism in medicine#late stage capitalism#healthcare#veteran emergency room doctor#ming lin#peacehealth st. joseph medical center#bellingham washington#coronavirus pandemic#hospital preparedness#social media criticism#teamhealth#blackstone group#private equity#healthcare industry#physician staffing#peer review process#due process rights#patient safety#financial entity#acquisitions#rural hospitals#physicians' practices#nursing homes#hospice centers#air ambulance companies#healthcare billing management#debt collection systems

3 notes

·

View notes

Text

Decoding Strategies: India's Private Equity Market Landscape

Uncover the pivotal role played by private equity firms in India's economic development, navigating challenges and capitalizing on growth opportunities.

#Private Equity#private equity firms#private equity firms in india#private equity vs venture capital#private equity and venture capital#private equity venture capital#difference between private equity and venture capital

0 notes

Text

Navigating Investments: The World of Private Equity Firms

Examine the symbiotic relationship between private equity and venture capital, showcasing how these financial partners collaborate to fuel entrepreneurial ventures.

#Private Equity#private equity firms#private equity firms in india#private equity vs venture capital#private equity and venture capital#private equity venture capital

0 notes

Text

A really good article from Ars Technica

on how American hospitals being bought out by private equity firms cause harm. It comes as no surprise really, especially when you introduce corporate mentality to healthcare.

#articles#hospitals#health care#private equity firms#malpractice#medical malpractice#private healthcare#American healthcare#US healthcare

0 notes

Text

Private Equity: Fueling Growth and Innovation in Malaysia's Healthcare Landscape

Private equity in Malaysia has played a pivotal role in revolutionizing Malaysia's healthcare industry by injecting capital, expertise, and strategic guidance into various healthcare entities. The infusion of private equity funds has facilitated the expansion of healthcare infrastructure, the adoption of advanced technologies, and the enhancement of service quality across the sector. Innovation remains a cornerstone of progress within the healthcare sector. Private equity firms, with their keen focus on driving growth, have actively fostered innovation by backing research and development initiatives,

expertise, and innovation, private equity firms have contributed significantly to the evolution of the healthcare sector, making it more robust, technologically advanced, and accessible to the population. As these partnerships continue to flourish, Malaysia's healthcare industry is poised to embrace transformative changes that prioritize excellence, innovation, and inclusivity for all.

0 notes

Text

Kavan Choksi: What Does Private Equity Really Mean?

Kavan Choksi: How Private Equity Firms Make Money

Private equity is an alternative investment strategy that is not available to most individual investors. Kavan Choksi says that most private equity funds are only open to institutional investors, including sovereign wealth funds, pension funds, insurance companies, and investors, typically high-net-worth individuals or high earners. Many private equity investments are either in privately held companies or in public companies they take private, explains Kavan Choksi.

Investing in a company can be a risky move, but taking an equity stake in that company can be even riskier. The firm that takes this step is typically looking for a controlling stake that will give it the power to make changes to increase the company's value. This kind of investment requires a lot of trust and confidence in the potential of the company, as well as a thorough understanding of the market and the competition. It's a bold move, but if it pays off, it can be incredibly rewarding.

How do private equity firms make money?

Private equity firms are also investment advisors, notes Kavan Choksi. They typically earn multiple revenue streams from investors in their funds, including management fees, a promotion (also known as performance revenues or carried interest), and other related fees such as a disposition fee or acquisition.

Private equity investors pay sponsors a recurring advisory or management fee to manage their investments. The fee is typically 2% (or less) per year, based on the assets under management (AUM), notes Kavan Choksi.

Private equity fund sponsors also receive a share of the profits generated by the investments in the fund after reaching a specific return. Its carried interest often involves splitting a share of profits. The most common split is 80/20, with fund investors getting 80% of the profits above a specific return while sponsors receive the remaining 20% share, explains Kavan Choksi. In addition, many private equity sponsors will charge their investors other fees, such as bonuses, when they close an acquisition deal.

Kavan Choksi is a business management consultant. He has always shared his business, finance, and economics insights with his readers. Nowadays, he works on his series of blogs, which can be accessed by clicking this link.

0 notes

Photo

Find the Right Private Equity Firm for Your Business Goals

Searching for a private equity firm? Michael K. Lorelli provide comprehensive profiles of the leading private equity firms in the US. See reviews and ratings, investment strategies, and contact information for each firm. Get an overview of each firm, compare different investment strategies, and find out which firm is the right fit for you. For more info visit:- https://www.lorelli.net/blog/accelerating-growth-coaching-strategies-for-private-equity-firms/

0 notes

Link

USPEC partnership programs give you access to a wellspring of expertise in private equity professional education fitting to your unique environment, education objectives, and learning needs.

#private equity professionals#private equity firms#certified private equity professionals#united states private equity council#uspec#private equity exit strategies#certified equity professional

0 notes

Link

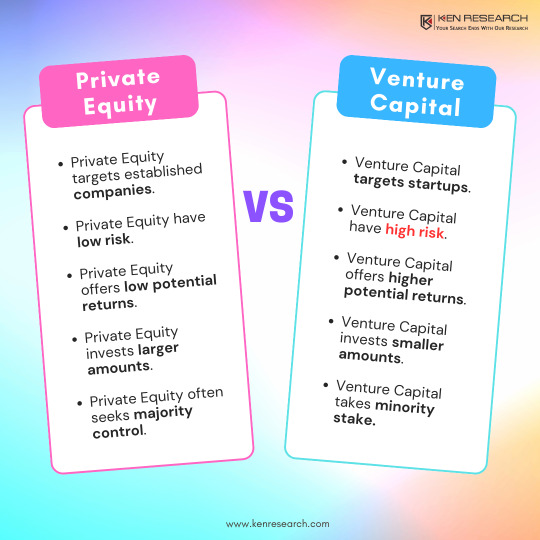

Private Equity vs. Venture Capital: 4 Ways To Tell The Difference

Most of the time Private Equity is considered synonymous with Venture Capital. But, there is a huge difference between the two. Private Equity is a bigger concept while Venture Capital is a subset of Private Equity.

Private Equity

Private Equity firms invest in businesses that have promising growth potential and exit the company at a higher valuation multiple. They generally invest in businesses through Leveraged Buyout strategy. According to this, a major investment is made by the private equity through debt and the rest is funded through PE’s own funds. The debt is taken by keeping the assets of the investee company as collateral. The future cash flows generated will be used to reduce the proportion of debt eventually. This will automatically increase the value of the equity stake held. Most PE firms follow this strategy for investment. Apart from this, another method is growth equity and Venture Capital.

Venture Capital

Venture Capital firms also invest in businesses that have huge growth potential. They mostly invest in startups that have a promising business idea or an established target market. There are various rounds of VC funding depending on the business stage of the startup. Most of the VCs aim to either exit from the company through IPO or by Mergers and acquisitions.

Here Are the Key Differences Between PE and VC

Type of Investment

There is a huge difference between the type of companies that a PE and a VC firm choose. For investment. PE firms invest in already successful companies that already have a well-established brand name in the market and it is looking to launch another segment of product or services. Some PEs also invest in companies which are facing thunder due to operational inefficiencies or any other structural challenge. Since PE firms are involved in aggressively managing the company, they believe to overcome these efficiencies to make the company highly profitable.

On the other hand, VCs mostly invest in startups that have innovative business ideas and business models. These companies need to develop a product or want to expand their market.

Also, PE firms buy companies across industries whereas Venture capitalists do theme-based investing.

Capital Structure

PEs generally hold more than 50% stake in the company while VCs hold a minority stake in the investee company. Private Equity firms use a combination of Equity and Debt which is called Leveraged Buyout whereas VCs only invest through equity.

Risk Appetite

Venture Capital firms invest on the assumption that only the handful of companies that they are investing in will earn returns and the rest will fail. The goal here is not to target the company rather it is to target the industry. They invest in some promising startups in a booming industry so even if one or two startups become industry leaders, they will generate huge profits. This explains their theme-based investing. So, they take more risk than a private equity firm. Therefore, they buy a minority stake in the company to balance the risk.

0 notes

Link

Chartered Private Equity Professional (CPEP™) Program - USPEC

Become a qualified Chartered Private Equity Professional (CPEP™) to accelerate your career growth in Private Equity. Apply for CPEP™ Program today! CPEP™ elevates your knowledge and employer-appeal and brings you up to the same high level that top PE and VC firms expect.

#Private Equity Professionals#Private Equity Certifications#Private Equity Firms#Private Equity Career#Private Equity#Best Private Equity Certifications#Private Equity Program#United States Of Private Equity

0 notes

Text

VCs predict dark days ahead for the private markets

VCs predict dark days ahead for the private markets

VCs predict dark days ahead for the private markets | Fortune

You need to enable JavaScript to view this site.

View On WordPress

#Austin#Esquire#fund closes#Hulu#Michelle Carter#private equity#private equity deals#private equity firms#private equity funding#private equity funds#SXSW#The Girl From Plainville#VC#VC deals#VC firms#VC funding#VC funds#VC investors#Venture Capital#venture capital deals#venture capital exits#venture capital firms#venture capital funding#venture capital funds#venture capital investors#venture deals#venture firms#venture funding#venture funds#venture investors

0 notes

Text

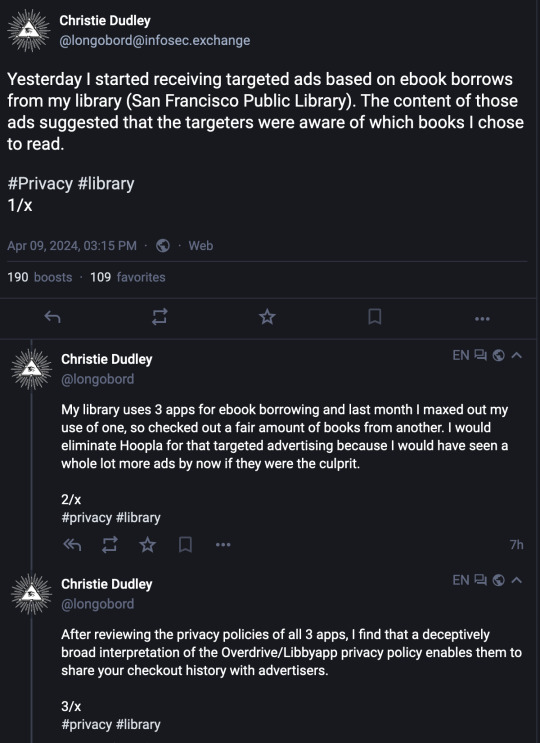

#libby#library#libraries#books#reading#privacy#source linked in reblog#idk if this has escaped mastodon yet#remember when people were afraid of enshitification because Overdrive was bought by one of those terrible private equity firms?#afaik the app itself hasn't gotten worse but this is in fact bad!

49 notes

·

View notes

Photo

(via Music Licensing Powerhouse BMI Is Being Sold to a Private Equity Firm | Pitchfork)

BMI, the music licensing agency that represents thousands of songwriters, has announced that it will sell to the private equity firm New Mountain Capital, The New York Times reports. Terms of the deal have yet to be disclosed; in August, Billboard cited sources claiming the deal could be worth $1.7 billion. The sale needs to be approved by shareholders and undergo “customary regulatory approvals.” The two sides expect the deal to close by the end of 2024’s first quarter.

After announcing that it would change over to a for-profit model before considering a sale of the company, BMI faced scrutiny over the change from songwriter groups. BMI and ASCAP are the two major licensing agencies which distribute royalties to songwriters and publishers from songs being played via the radio, online streaming, and in retail settings.

24 notes

·

View notes

Note

do you think stewy is old money rich?

yes i doooooo i think stewy’s family (and im sure this is the assumption we’re supposed to make) comes from a long line of very wealthy generational wealth. still not at the level of the roys considering the roys are supposed to be one of the richest families in the world, but very wealthy. im sure they lost a chunk of it in the revolution and after they immigrated, but again, remained very wealthy. i do however think that stewy now is the richest he’s ever been

#i was debating on whether its plausible for stewy to be an actual billionaire or not#but a some google research uncovered a jordanian immigrant private equity ceo who’s worth almost 8 billion largely self made#and according to his profile in forbes he became ceo of his firm when the former ceo killed himself.#and he stepped in to seize the opportunity to ensure continued and improved success for their clients#which is the most stewy thing i’ve ever fucking read so yes stewy is a self made immigrant billionaire#ask#anon#m

28 notes

·

View notes

Text

How Private Equity Can Help Malaysia Bridge the Healthcare Gap?

Private equity has emerged as a viable solution to bridge the healthcare gap in Malaysia. Private equity (PE) firms can help to finance the expansion of private healthcare providers in Malaysia. The involvement of private equity firms in the Malaysian healthcare sector has the potential to improve access to healthcare for all Malaysians. Private equity in Malaysia can play a significant role in helping bridge the healthcare gap. By investing in private hospitals, PE firms can help to expand the capacity of the healthcare system and improve the quality of care. PE firms can also invest in medical technology and research, support the development of new healthcare delivery models, and promote public-private partnerships. All of these initiatives have the potential to improve access to healthcare for all Malaysians.

1 note

·

View note