#post office kisan vikas patra

Text

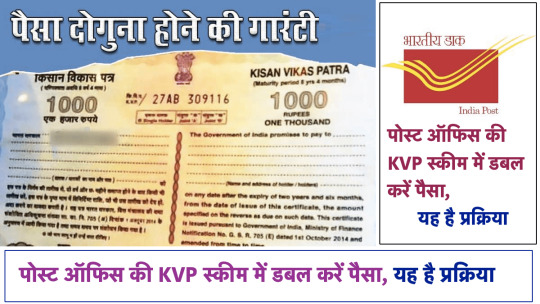

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra : डाकघर किसान विकास पत्र: डाकघर की योजनाएं निश्चित रूप से एक दीर्घकालिक निवेश हैं, लेकिन इसमें कोई जोखिम कारक नहीं है क्योंकि इसमें सरकारी गारंटी उपलब्ध है। ये योजनाएं उन लोगों के लिए हैं जो पारंपरिक निवेश पसंद करते हैं और लंबी अवधि का नजरिया रखते हैं।

Post Office Kisan Vikas Patra

डाकघर किसान विकास पत्र: डाकघर योजनाएं उनके लिए हैं जो पारंपरिक निवेश पसंद करते हैं…

View On WordPress

#how to invest in kisan vikas patra#Kisan Vikas Patra#kisan vikas patra in hindi#kisan vikas patra interest rate#kisan vikas patra kya hai#kisan vikas patra post office#kisan vikas patra post office scheme#kisan vikas patra post office scheme 2022#kisan vikas patra scheme#kisan vikas patra tax benefit#kisan vikas patra yojana#post office kisan vikas patra#Post Office Kisan Vikas Patra Scheme#Post Office KVP Scheme#post office scheme kisan vikas patra

0 notes

Text

Small Saving Schemes: A setback for those investing in PPF, Sukanya Samriddhi Yojana

Small Saving Schemes: A setback for those investing in PPF, Sukanya Samriddhi Yojana

Small Saving Schemes News: Investors in small government savings schemes have suffered a major setback. Despite the increase in the repo rate by the RBI and the increase in the yield of government bonds, the government decided not to increase the interest rates on savings schemes like NSC, PPF and Sukanya Samriddhi Yojna in the month of July to September. has done. The Department of Economic…

View On WordPress

#Government Saving Schemes#Kisan Vikas Patra#Ministry of Finance#NSC#Post Office Deposit Scheme#PPF#RBI#small saving schemes#small savings scheme#Sukanya samriddhi yojana

0 notes

Text

PPF, सुकन्या समृद्धि और NSC जैसी स्कीम्स के निवेशकों के लिए अच्छी खबर, 30 जून को सरकार देगी बड़ी खुशखबरी!

PPF, सुकन्या समृद्धि और NSC जैसी स्कीम्स के निवेशकों के लिए अच्छी खबर, 30 जून को सरकार देगी बड़ी खुशखबरी!

Photo:INDIA TV

Small Saving

Highlights

छोटी बचत पर वित्त मंत्रालय तय करता है ब्याज दर

पिछले दो साल के छोटी बचत पर ब्याज दरों में कोई बदलाव नहीं हुआ

सरकार अब महंगाई देखते हुए ब्याज दरों में बढ़ोतरी कर सकती है

PPF, सुकन्या समृद्धि और NSC समेत तमाम स्मॉल सेविंग स्कीम्स में निवेश करने वालों निवेशकों को जल्द अच्छी खबर मिल सकती है। करीब दो साल बाद सरकार 30 जून को स्मॉल सेविंग स्कीम्स पर ब्याज दरों…

View On WordPress

#Government Saving Schemes#interest rate hike#Kisan Vikas Patra#ministry of finance#Modi Government likely to change Small savings scheme interest rate#National Saving certificate interest rate#NSC#Post Office Deposit Schemes#post office inter#PPF#PPF Interest rate#rbi#small savings scheme#Small savings Scheme interest rate#sukanya samriddhi yojana#छोटी बचत योजना#छोटी बचत योजनाओं का ब्याज#पीपीएफ#पोस्टल डिपॉजिट स्कीम्स#रेपो रेट#लघु बचत योजना#सुकन्या समृद्धि योजना#स्मॉल सेविंग्स स्कीम

0 notes

Text

Exploring the Best Post Office Schemes for Students in India

I've been delving into the world of savings and investments recently, and I'm amazed at the plethora of options we have right at our doorstep - the Indian Post Office Schemes! 😊 From the Recurring Deposit (RD) that lets you save a little every month, to the Time Deposit Account (TD) that works like a fixed deposit, there's something for everyone. 💰

What caught my eye is the Monthly Income Scheme Account (MIS) - perfect for those who want a consistent cashflow. 💵 And let's not forget the Public Provident Fund Account (PPF) and National Savings Certificate (NSC) that offer tax savings and a nice return. 🙌

https://fresherblog.com/post-office-schemes/

For my friends with a rural connection or interest in agriculture, the Kisan Vikas Patra (KVP) is a gem. Your investment doubles in less than 10 years. 🚜

The best part? Even students can apply! Just fill out the form and submit it with your ID, address proof, and a snap. Oh, and you'll need some cash or a cheque for the first deposit. 📝

But remember, always read the fine print and make sure the scheme suits your needs and risk tolerance. Happy investing! 😊

#Investing101#PostOfficeSchemes#Savings#PersonalFinance#StudentLife#InvestmentTips#MoneyMatters#India#FinancialFreedom#students#fresherblog#college#college life#desiblr

0 notes

Text

Post Office KVP : Superhit scheme of post office, money will be doubled in just so many months with guarantee, know - Business League---Information for 🇮🇳

Post Office KVP Account: Your investment amount in KVP i.e. Kisan Vikas Patra can double in 115 months. Know full details here. Know benefits and eligibility kisan vikas patra post office schemes.

More details in the 🔗

https://www.businessleague.in/post-office-kvp-account-money-will-be-doubled-in-just-so-many-months-with-guarantee/

View On WordPress

0 notes

Link

The Ministry of Finance made the aadhaar card compulsory for enjoying the benefits under various national savings schemes which are government based. The new notification stated that aadhaar card is mandated for opening a small savings account by children or any account opened in the name of minors.

0 notes

Text

Senior citizens: Government hikes Senior #Citizen #savings Scheme (#scss), National Saving Certificate (#NSC), Post Office Monthly Income Scheme (#POMIS), Post Office Time Deposit (#potd) interest rates for the January–March quarter of FY 2022–23 - Lawyer2CA®️

Senior Citizen Savings Scheme (SCSS) has an interest rate of 8.0% per annum for the fourth quarter of FY 2022–23. Anyone over the age of 60 and who is over 55 but under 60, is eligible for this programme. An SCSS account can be opened with as minimum as Rs 1,000 and a maximum of Rs 15 Lakh. The account has a five-year maturity period that can be extended by an additional three years. A penalty equal to 1.5% of the deposit is imposed for early withdrawals made after one year. Section 80C of the Income Tax Act allows for the deduction of investments up to Rs 1.5 lakh. Additionally, the interest income is wholly taxable.

The Post Office Monthly Income Scheme (POMIS) interest rate has gone up from 6.7% to 7.1%. This account may be opened with a minimum deposit of Rs. 1,000 and a maximum deposit of Rs 4.5 Lakh (single account) and Rs 9 Lakh (joint account).

Post Office Time Deposit Account (POTD) can be opened for one, two, three, and five-years tenure. A minimum investment of Rs 1,000 is needed to open an account and there is no maximum investment amount. POTD now earns an interest rate of 6.6%, 6.8%, and 6.9% for periods of one year, two years, and three years, respectively. Under Section 80 C of the Income Tax Act of 1961, a senior citizen may be qualified for a tax deduction for a 5-year Post Office Time Deposit Account.

For the January-March quarter, the interest rate on National Savings Certificates (NSCs) is now, 7%. A minimum of Rs. 1,000 should be invested, in multiples of Rs. 100. There is no upper limit. The account will have 5 Years of maturity.

Kisan Vikas Patra's (#kvp) interest rate was hiked from 6.8% to 7%.

#Lawyer2CA #interestrates

https://economictimes.indiatimes.com/wealth/invest/senior-citizens-govt-hikes-senior-citizen-savings-scheme-nsc-post-office-time-deposit-interest-rates/post-office-time-deposit-account-potd/slideshow/96737707.cms

1 note

·

View note

Text

Post office double money scheme: Big news! Deposit Rs 5 lakh in Kisan Vikas Patra and Get Rs 10 lakh on Maturity, know complete details

Post office double money scheme: Big news! Deposit Rs 5 lakh in Kisan Vikas Patra and Get Rs 10 lakh on Maturity, know complete details

0 notes

Text

Post Office Saving Schemes, Saving Plans for Boy Child in India 2022

Below are the 6 best Post Office Schemes for Boy Child in India-

National Savings Certificate (NSC)

Ponmagan Podhuvaippu Nidhi Scheme

Post Office Monthly Income Scheme (POMIS)

Kisan Vikas Patra (KVP)

Post Office Recurring Deposit

Public Provident Fund (PPF)

0 notes

Text

Get your money doubled with these POST OFFICE schemes; Check interest rate, return calculator, maturity time

Get your money doubled with these POST OFFICE schemes; Check interest rate, return calculator, maturity time

Post Office Investment Scheme Return Calculator: If you don’t want to take any risk with your money, you can put your money into these schemes including National Savings Certificate (NSC), Sukanya Samriddhi Yojana, Senior Citizen Saving Scheme (SCSS), Kisan Vikas Patra (KVP) and Senior Citizens Savings Scheme among others.

source…

View On WordPress

0 notes

Text

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office : पिछले कुछ दिनों से हम सभी देख रहे हैं कि शेयर बाजार में काफी उतार-चढ़ाव देखने को मिल रहा है। ऐसे में कई लोग जोखिम भरे इक्विटी मार्केट में निवेश करना पसंद नहीं कर रहे हैं। ऐसे लोगों के लिए डाकघर निवेश के बेहतरीन विकल्प लेकर आता रहता है। पोस्ट ऑफिस स्मॉल सेविंग्स स्कीम में निवेश करने से आपको लंबी अवधि में ज्यादा रिटर्न पाने में मदद मिलती है।

Post office : इन तीन योजनाओं में मिलेगा…

View On WordPress

#monthly income scheme post office#nsc details post office#office#Post Office#post office best investment plan 2022#post office best plan 2022#post office best scheme 2022#post office fd#post office fixed deposit scheme#post office interest rate#post office interest rate 2022#post office job#post office kisan vikas patra#post office latest interest rate#post office latest interest rate 2022#post office mis#post office mis interest rate 2022#post office mis scheme#post office monthly income scheme#post office nsc#post office nsc calculator#post office nsc interest rate#post office nsc rules#post office nsc sceme 2020#post office nsc scheme#post office rd#post office rd plan#post office rd scheme#post office recruitment 2022#Post Office Scheme

0 notes

Text

Here are top 6 post office investment plans :

National Savings Certificate (NSC)**This is a low-risk with fixed income scheme offered by the government and is available with the post-offices across India. This post office saving scheme for boy child is loaded with best features and benefits to aptly suit your child’s needs. It facilitates a fixed income and definite returns to generate best revenues. This plan is currently available at 6.8% rate of interest per annum.

Features:

Minimum investment – Rs.1000

Maximum investment – no max. limit

Interest Rate – 6.8%

Lock in tenure – 5 years

Tax Benefits – Up to Rs.1.5 lakh (as per Section 80C of Income Tax)

Benefits

The plan offers fixed return on investment higher as compared to FDs.

Offer Tax benefits under section 80C.

Available at an initial investment of Rs 1,000, which is very less.

The Plan is available with a maturity period of 5 years.

No TDS allowed so the insured can obtain full value at maturity.

Ponmagan Podhuvaippu Nidhi Scheme

The department of post, Tamil Nadu introduced the Ponmagan Podhuvaippu Nidhi Scheme in the year 2015,especially meant for the male child. The account for this post office saving scheme for boy child can be opened through a parent/guardian for a minor boy below 10 years of age, while minor boys above 10 years can open the account on their own name. This special plan is limited to the residents of Tamil Nadu only, and can be availed by parents before their son attains 10 years of age.

Features:

Minimum investment – Rs.500

Maximum investment – 1.5 lakhs

Interest Rate – 9.70%

Maturity period – 15 years

Tax Benefits – available under Section 80C of Income Tax

Benefits

The plan offers ways to increase your income.

Offer Tax benefits under section 80C.

Nomination facility available.

Payments can be made in lump sum or in 12 small installments.

Parents can avail loan facility from fourth year of the account.

Post Office Monthly Income Scheme (POMIS)

Post office monthly income scheme or POMIS is a saving scheme for boy child where you can earn a fixed monthly interest by investing a certain amount. This scheme is easy to open in any post office across the country and is packed with features and benefits. For this scheme, the one key requirement is to have a post office savings account.

Features:

Minimum investment – Rs. 1000

Maximum investment – 4.5 lakhs

Interest Rate – 6.6%

Maturity period – 5 years

Tax Benefits – TDS is not applicable but sum invested is not covered under Section 80C

Benefits

The plan offers capital protection until the plan matures

This is a low risk plan and safe.

It offers affordable deposit amount facility.

The scheme offers guaranteed returns.

Multiple ownership is also available under this scheme.

Kisan Vikas Patra (KVP)

Kisan Vikas Patra or KVP is an apt plan that suits perfectly to the low income as well as the middle-class income families in India. This is a short-term post office saving scheme for boy child in India that permit parents to invest on a particular lump-sum money per year.

Features

Interest Rate – 6.9%

Minimum amount – Rs.1,00

Maximum amount – No Upper Limit

Maturity period – 10 years and 4 months

Lock-in period – 30 months

Benefits

The plan offers guaranteed returns with zero risks.

It helps accumulate savings for future your child.

Allow parents to get loans with low interest rates.

Nomination facility is available.

Post Office Recurring Deposit (RD)

This another good saving post office schemes for boy child in India. This is a recurring deposit plan that offer high rate of interest as compared to regular saving account in a bank. Under this scheme, parents can save a particular amount in the account every month for 5 years.

Features

Interest Rate – 5.8%

Minimum amount – Rs.100

Maximum amount – No Upper Limit

Maturity period – 5 years

Benefits

The plan offers limited restrictions.

Nomination facility is available.

Transfer of funds is available from RD to savings account.

Allow parents to save enough for their male child’s future.

Public Provident Fund (PPF)

Public Provident Fund or PPF is a post office scheme for male child in India that help parents to save on taxes as well. PPF is a long term plan of investment available at an attractive rate of interest and offers god returns on investment.

Features

Interest Rate – 7.1%

Minimum Amount – Rs.500

Maximum Amount – Rs 1.5 lakh

Tenure/Lock-in period – 15 years

Tax Benefit – available up to Rs.1.5 lakh under Section 80C

Benefits

The plan offers low risk.

Nomination facility is available.

Allow parents to take loans against the invested amount from 3rd of scheme.

Transfer of funds is available under this savings scheme.

Long term savings with attractive interest rate.

0 notes

Text

किसान विकास पत्र योजना 2022: Kisan Vikas Patra, ब्याज दर, कैलकुलेटर, टैक्स बेनिफिट्स

किसान विकास पत्र योजना 2022: Kisan Vikas Patra, ब्याज दर, कैलकुलेटर, टैक्स बेनिफिट्स

Kisan Vikas Patra | किसान विकास पत्र योजना 2022 | पोस्ट ऑफिस स्कीम | इन्वेस्टमेंट स्कीम | Post Office Government Scheme | ब्याज दर, कैलकुलेटर, टैक्स बेनिफिट्स | KVS, पोस्ट ऑफिस नई योजना, इन्वेस्टमेंट योजना, Kisan Vikas Patra Yojana

Kisan Vikas Patra एक ऐसी स्कीम है, जो 124 महीने में पैसा डबल कर के देती है। ये योजना पोस्ट ऑफिस द्वारा चलाई गई योजना है जिसे हम KVP-kisan Vikas Patra योजना कहते है।…

View On WordPress

0 notes

Text

Fixed Income Bonds

What Are Bond Funds?

Bond funds are mutual funds, which provide investors with a diverse portfolio of fixed-income investments such as bills and bonds issued by different entities. They make the process of holding bonds issued by different issuers easier by providing access to a variety of bonds in one fund instead of investors having to buy individual securities. Bond funds are also a type of debt funds.

When it comes to fixed income products in India, investors tend to look at bank or post office fixed deposits, and other small savings schemes like the public provident fund, Kisan Vikas Patra, recurring deposits, Senior Citizen Savings Scheme, Sukanya Samriddhi Scheme, among others. Savvier investors may invest in RBI bonds, fixed deposits issued by corporates and non-convertible debentures (NCDs). One option of investing in bonds, which does not stand out, is bond funds. Fixed income bonds are ideal for individuals looking for the safest tools to invest.

How Bond Funds Work?

Bond funds invest in debt issued by the government or by companies, the latter being known as corporate debt. The government or corporates issue bills and bonds of different maturities in order to raise money for carrying out their operations and projects. In return of investors parting with their money, the government or corporates pay out an interest, which is mentioned on the offer document of the bill or bond and is paid out periodically.

Buying shares entitle one to proportional ownership of the company given the proportion they own. In a similar manner, buying bonds makes one a loaning entity; while stock owners get returns based on the performance of the company in the market, (which can be either profit or loss), bondholders are paid a set interest for their contributions, regardless of the performance of the company on the stock market.

Before investing in fixed income bonds in India, there are several things you should keep in mind.

Capital gains under fixed income securities are subject to taxation as per the Income Tax Act of India, 1963. 20% deduction (after adjustments made for indexation) is made in case of long term gains, while short term capital gains are taxable as per the income of the investor.

Mutual Funds investing in fixed income bonds tend to be actively managed to ensure highest returns for investors with guaranteed stability.

The investment strategies of such Mutual Funds differ according to their respective maturity period. In case of a short-term investment scheme, money market instruments and debt funds are targeted from the list of fixed income securities. ETF are optimal for a longer tenure.

These funds are generally highly liquid, thereby satisfying the cash requirements of the investor as and when demanded.

0 notes

Text

New Rules: अगर आपने लगाया है इस स्कीम में पैसा तो अगले 8 दिन में सरकार लेने वाली है बड़ा फैसला - CNBC आवाज़

Small Savings Scheme:

पोस्ट ऑफिस की योजनाओं (Post Office Schemes) में लोगों का काफी भरोसा होता है क्योंकि इनमें उन्हें गारंटीड रिटर्न मिलता है. ये पोस्ट ऑफिस स्कीम सरकार की ओर से पेश की जाती हैं. किसान विकास पत्र (Kisan Vikas Patra) सरकार की सबसे सफल योजना में से एक है. अगर आपने भी इस स्कीम में निवेश किया है तो ये खबर आपके लिए बहुत जरूरी है. इस महीने के अंत में यानी अगले महीने से सरकार इसमें…

View On WordPress

0 notes

Text

In how many days does the Kisan Vikas Patra Scheme of the Post Office double the money? people like a lot

In how many days does the Kisan Vikas Patra Scheme of the Post Office double the money? people like a lot

New Delhi. In today’s time, investing money in a safe place is a very difficult task. People want that the place where the money is kept, should be safe as well as good returns from investment point of view. If you are also looking for such a safe investment place, then you can consider the Kisan Vikas Patra (KVP) scheme of your post office.

Kisan Vikas Patra is a special scheme of Indian Post…

View On WordPress

0 notes