#post office mis scheme

Text

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office : पिछले कुछ दिनों से हम सभी देख रहे हैं कि शेयर बाजार में काफी उतार-चढ़ाव देखने को मिल रहा है। ऐसे में कई लोग जोखिम भरे इक्विटी मार्केट में निवेश करना पसंद नहीं कर रहे हैं। ऐसे लोगों के लिए डाकघर निवेश के बेहतरीन विकल्प लेकर आता रहता है। पोस्ट ऑफिस स्मॉल सेविंग्स स्कीम में निवेश करने से आपको लंबी अवधि में ज्यादा रिटर्न पाने में मदद मिलती है।

Post office : इन तीन योजनाओं में मिलेगा…

View On WordPress

#monthly income scheme post office#nsc details post office#office#Post Office#post office best investment plan 2022#post office best plan 2022#post office best scheme 2022#post office fd#post office fixed deposit scheme#post office interest rate#post office interest rate 2022#post office job#post office kisan vikas patra#post office latest interest rate#post office latest interest rate 2022#post office mis#post office mis interest rate 2022#post office mis scheme#post office monthly income scheme#post office nsc#post office nsc calculator#post office nsc interest rate#post office nsc rules#post office nsc sceme 2020#post office nsc scheme#post office rd#post office rd plan#post office rd scheme#post office recruitment 2022#Post Office Scheme

0 notes

Text

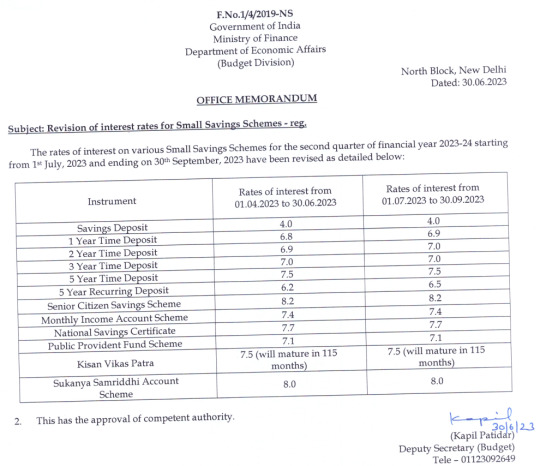

Post office and small savings schemes Interest rates from 1st July 2023

Today's Govt. circular on 'small savings schemes' Interest rates for July to Sep 2023. Interest rates of some schemes have been increased.

#SSY, #KVP, #NSC, #SCSS, #POFD, #MIS, #PPF

The interest rates for the period from 1st July 2023 to 30th September 2023 of ‘Post office and small savings schemes’ like PPF, KVP, SSY, SCSS, NSC, MIS, post office savings deposit, Time deposit, Recurring deposits has been declared on 30th June 2023 (Friday) by the Finance Ministry.

(more…)

View On WordPress

#dEPOSIT#Finance#Fixed deposit#income tax#KVP#MIS#NSC#post office#PPF#SAVINGS#SCSS#small savings schemes#ssy#sukanya samriddhi yojana

0 notes

Text

POMIS SCHEME - Post Office Monthly Income Scheme 2022

#pomisscheme #pomis_scheme #pomis #postofficesavings #savingscheme #bestsavingscheme #post_office_savings #saving_scheme #best_saving_scheme postoffice #pomisscheme #monthlyincomescheme #pomis #postofficescheme #சேமிப்புதிட்டம் #சேமிப்பு_திட்டம்

pomis scheme, pomis saving scheme, pomis scheme full details, pomis scheme latest update, pomis scheme interest, pomis scheme eligibility, pomis online account opening, best post office pomis scheme,pomis scheme 2022, pomis saving scheme 2022, pomis scheme full details 2022, pomis scheme 2022 latest update, pomis scheme 2022 interest, pomis scheme 2022 eligibility, 2022 pomis online account…

View On WordPress

#2022 pomis online account opening#best post office pomis scheme#best post office pomis scheme 2022#how post office monthly income scheme works#how to apply for post office monthly income scheme#mis in post office in tamil#money saving tips#monthly income post office schemes#Monthly income scheme#monthly income scheme at post office#onthly income scheme post office in tamil#p o m i s schemepost office scheme to double the money#pomis 2022#pomis online account opening#pomis saving scheme#pomis saving scheme 2022#pomis scheme#pomis scheme 2022#pomis scheme 2022 eligibility#pomis scheme 2022 interest#pomis scheme 2022 latest update#pomis scheme eligibility#pomis scheme full details#pomis scheme full details 2022#pomis scheme interest#pomis scheme interest rates#pomis scheme latest update#pomis scheme post office#post office fixed deposit scheme#post office mis interest rates in tamil

0 notes

Text

Ukrainian operation prevents sale of stolen parts of MiG-29 fighters to Russia 🇷🇺

The Ukrainian Security Service (SSU) detained a criminal network that sold stolen MiG-29 components valued at more than $200,000.

Fernando Valduga

The Ukrainian Security Service (SSU) successfully prevented the illegal sale of components of military aircraft stolen from a Ukrainian company to Russian military interests in a bold operation.

The stolen parts, including starter generators and aircraft pumps for MiG-29 multifunctional fighters, were valued at more than $268,000.

SSU's efforts have led to the prevention of a potentially harmful transaction involving stolen military equipment. The investigation revealed that a criminal from Dnipro, who stole components from a manufacturer's warehouse in 2019, played a key role in trying to sell these items.

The stolen goods were entrusted to a local businessman for “storage” and subsequent sale. Hiding the components of the aircraft in his post for a long time, the businessman disclosed them on a specialized website when he decided to dispose of the illicit merchandise.

The crisis in Ukraine has significantly paralyzed the Russian supply chain, whether in commercial aviation or defense. The interest of representatives of the Russian military-industrial complex, in search of spare parts for their combat aircraft, intensified the urgency of the situation. SSU documented the illegal activity, preventing the sale of the equipment to potential opponents.

During the searches of the suspect's service station, SSU seized a set of military equipment, including ten airplane bombs, two starter generators and 1,000 additional components. Criminal proceedings were initiated under Article 209.3 of the CCU, focused on money laundering by a group organized on a particularly large scale. Offenors can get up to 12 years in prison pending the ongoing investigation.

The examination of the aircraft's equipment by SSU confirmed its suitability for combat conditions, which led to a court decision to deliver the seized items to the Armed Forces of Ukraine. The entire investigation was conducted under the procedural supervision of the Attorney General's Office, demonstrating a collaborative effort to safeguard Ukraine's military assets.

Last month, the Security Service of Ukraine dismantled two transnational smuggling networks that tried to export components of military aircraft, preventing the illicit transfer of equipment.

In a multi-regional operation, SSU thwarted the illegal export of MiG-29 fighter components, detaining three dealers who tried to sell stolen spare parts to Asian customers. Simultaneously, another smuggling scheme involving components for Mi-8 helicopters was exposed in the Kirovohrad region.

Fernando Valduga

Aviation photographer and pilot since 1992, has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work in the world of aviation.

Related news

Related news

BRAZILIAN AIR FORCE

FAB: Squadrons conduct training to validate the launch of personnel in the KC-390

3 notes

·

View notes

Text

Revolutionizing Financial Processes with Winsoft Technologies

When it comes to financial technology, Winsoft Technologies stands at the forefront, offering cutting-edge solutions to optimize various aspects of financial operations. Two standout offerings, SmartASBA and SmartPayout are crafted to deliver precision in primary market operations and brokerage payout reconciliation.

SmartASBA: Enhancing Primary Market Operations

Optimizing the Primary Market Workflow:

With its all-inclusive web-based platform, SmartASBA, primary market operations are revolutionized by digitizing the processing of applications for IPOs, FPOs, DEBT/NCD, NFOs, and rights issues. IPO application processing systems are made easy and efficient this way. Financial distributors gain from an automated and smooth system that guarantees correctness throughout the whole allocation process.

Integrated SmartASBA Suite

- Back Office: Manages primary market schemes, integrates with Core Banking Systems, and supports bulk uploads.

- Branch Office: Supports bidding and fixed-price issues, offering a dashboard for monitoring the entire application process.

- ASBA On-Net: Features scheme and application dashboards, beneficiary registration, and seamless integration with retail banking portals.

- Business Reports: Generates a variety of reports, including MIS, audit, posting, SEBI, and compliance reports.

Benefits of SmartASBA:

- Supports bulk imports for efficient handling of application requests.

- Fully automated web-based architecture ensures scalability and accessibility.

- API-based architecture facilitates integration with various channels for seamless application processing.

- Granular level user access control enhances security and data confidentiality.

- Web-responsive user interface for a seamless and user-friendly experience.

- Supports both SMS and email alerts to keep stakeholders informed.

SmartPayout: Streamlining Brokerage Payout Reconciliation

Automated Brokerage Payout Reconciliation:

SmartPayout, Winsoft's advanced solution, revolutionizes brokerage payout reconciliation for Asset Management Companies. This automated system ensures reconciliation at the transaction level for distributors, handling different broker categories and commission types.

Key Features of SmartPayout:

- Transaction-level brokerage payout calculation and reconciliation.

- AUM calculation and reconciliation of folio scheme-level across distributors.

- Reconciliation based on regulatory, statutory, and business rules.

- Calculations performed directly on RTA Data, ensuring customer-sensitive data is not shared.

- Customized reports and dashboards as per business requirements.

Benefits of SmartPayout:

- Controls excess payout with meticulous reconciliation of all transactions across brokers.

- Improves operational efficiency with adaptability to handle all types of brokerages.

- Offers an intuitive user interface for ease of navigation.

These innovative tools empower financial institutions to navigate intricate financial landscapes with unparalleled efficiency, providing precise solutions for the complexities of primary market applications and brokerage payout processes. With a commitment to transparency and operational excellence, Winsoft's SmartASBA and SmartPayout stand as benchmarks for the evolution of financial technology, promising a future where institutions can navigate intricate financial terrains with confidence and ease.

Winsoft's SmartASBA and SmartPayout redefine the efficiency, accuracy, and adaptability of financial processes in the primary market and brokerage payout reconciliation, respectively. These innovative solutions empower financial institutions to navigate complex financial landscapes with precision, transparency, and unparalleled operational efficiency.

Winsoft Technologies' groundbreaking solutions, SmartASBA and SmartPayout, herald a new era in financial efficiency and precision. SmartASBA transforms primary market operations, streamlining the processing of IPOs, FPOs, and more with unprecedented accuracy. Meanwhile, SmartPayout revolutionizes brokerage payout reconciliation, ensuring transaction-level precision and adaptability for Asset Management Companies.

#IPO application processing systems#winsoft tehnologies#wealth managment software#brokerage payout reconciliation

0 notes

Text

Safe Investment Options in India: Securing Your Financial Future

In the ever-changing environment of financial markets, everyone prioritizes ensuring their financial future. For risk-averse investors, navigating the maze of financial possibilities can be difficult. In this tutorial, we'll look at secure investing possibilities in India, specifically for individuals who value stability and security.

Safe Investment Opportunities in India for Risk-Averse Investors

Fixed Deposits

Fixed deposits (FDs) are a traditional option for risk-averse investors. These are low-risk investments in which you deposit a lump sum with a bank or financial institution for a specified period of time and get a predetermined interest rate. FDs offer capital protection and consistent returns, making them a popular alternative for investors seeking a safe haven for their funds.

Mutual Funds

Mutual funds provide a diversified investing approach, making them ideal for risk-averse clients who want their assets managed professionally. With many types of mutual funds accessible, such as debt funds and hybrid funds, investors may select solutions that are appropriate for their risk level. Systematic Investment Plans (SIPs) reduce risks by spreading investments across time.

Post Office Savings Scheme

The Post Office Savings Scheme is a government-backed project that offers a variety of savings and investing opportunities. These programs include the Senior Citizens Savings Scheme (SCSS), Monthly Income Scheme (MIS), and Public Provident Fund (PPF). These programs are appealing to risk-averse investors because of the safety and reliability that comes with government support.

The National Pension Scheme (NPS)

NPS is a long-term retirement-focused investment scheme that encourages systematic savings. NPS offers a well-diversified portfolio that includes equity, term deposits, corporate bonds, liquid funds, and government funds. It provides not just financial stability in retirement but also tax breaks, making it an excellent alternative for risk-averse individuals.

Unit-Linked Insurance Plans (ULIPs)

ULIPs combine insurance coverage with investing potential. These plans provide flexibility by allowing investors to select among equities and debt funds based on their risk tolerance. ULIPs are becoming increasingly popular as a comprehensive financial product due to their ability to generate wealth and provide life insurance.

Public Provident Fund (PPF).

PPF is a long-term investment option that requires a 15-year lock-in period. This government-backed program offers competitive interest rates and tax breaks, making it a popular choice among conservative investors. The rigorous practice of paying yearly to the PPF assures consistent wealth building during the investing period.

Senior Citizens Saving Scheme (SCSS)

SCSS is a low-risk investment option for seniors that delivers regular income in the form of quarterly interest payments. With a five-year tenure, SCSS provides a consistent stream of income for retirees, making it a good choice for risk-averse persons in their golden years.

7.75% Government of India bonds.

Government bonds are regarded one of the most secure investment alternatives. The 7.75% Government of India Bonds, which have a fixed interest rate, provide both capital protection and regular returns. These bonds are a reliable option for risk-averse individuals looking for a safe haven for their assets.

Conclusion

In the search of financial security, selecting the correct investment option is critical. For risk-averse investors, the stated solutions offer a variety of possibilities, each with its own set of features and benefits. Whether you like the stability of fixed deposits, the diversification of mutual funds, or the broad coverage of ULIPs, there is an investing opportunity for everyone. Understanding your financial goals and risk tolerance allows you to develop a well-rounded investing strategy that protects your financial future. Explore the world of safe investments in India and begin your road to financial prosperity and peace of mind.

0 notes

Text

Exploring the Best Post Office Schemes for Students in India

I've been delving into the world of savings and investments recently, and I'm amazed at the plethora of options we have right at our doorstep - the Indian Post Office Schemes! 😊 From the Recurring Deposit (RD) that lets you save a little every month, to the Time Deposit Account (TD) that works like a fixed deposit, there's something for everyone. 💰

What caught my eye is the Monthly Income Scheme Account (MIS) - perfect for those who want a consistent cashflow. 💵 And let's not forget the Public Provident Fund Account (PPF) and National Savings Certificate (NSC) that offer tax savings and a nice return. 🙌

https://fresherblog.com/post-office-schemes/

For my friends with a rural connection or interest in agriculture, the Kisan Vikas Patra (KVP) is a gem. Your investment doubles in less than 10 years. 🚜

The best part? Even students can apply! Just fill out the form and submit it with your ID, address proof, and a snap. Oh, and you'll need some cash or a cheque for the first deposit. 📝

But remember, always read the fine print and make sure the scheme suits your needs and risk tolerance. Happy investing! 😊

#Investing101#PostOfficeSchemes#Savings#PersonalFinance#StudentLife#InvestmentTips#MoneyMatters#India#FinancialFreedom#students#fresherblog#college#college life#desiblr

0 notes

Text

Post Office MIS: Earn every month from Post Office Scheme (POMIS)? These rules of Income Tax have to be kept in mind while filing ITR

Post Office MIS: Earn every month from Post Office Scheme (POMIS)? These rules of Income Tax have to be kept in mind while filing ITR

0 notes

Text

Post Office Monthly Income Scheme|डाकघर मासिक आय योजना

How to Open MIS Post Office Monthly Income Scheme | MIS | Monthly Income Scheme | POMIS | Post Office Income Scheme | How to open Post office MIS account

अपने भविष्य को सुरक्षित करने के लिए सुरक्षित स्थान पर निवेश करना महत्वपूर्ण है। अगर आप ऐसा नहीं करते हैं तो जमा किया हुआ पैसा डूब सकता है। आज हम आपको एक ऐसी स्कीम के बारे में बताएंगे जहां निवेश करने से आपको अन्य विकल्पों के मुकाबले ज्यादा…

View On WordPress

0 notes

Text

Post Office New Service: Big update! Now online investment facility is also available in these post office schemes, just follow these steps. - informalnewz

Small Saving Schemes: Post Office has started online investment facility in MIS, SCSS and MSSC. You can easily invest online by following the steps given in this article.

The Post Office has recently started the facility to open Monthly Income Scheme (MIS), Senior Citizen Saving Scheme (SCSS) and Mahila Samman Saving Certificate (MSSC) accounts online. The objective behind this is to provide…

View On WordPress

0 notes

Text

Post Office Monthly Income Scheme

0 notes

Text

Post Office Scheme: पोस्ट ऑफिस की नई योजनाओं में दोगुने हो आजएंगे पैसे.

Post Office Scheme: पोस्ट ऑफिस की नई योजनाओं में दोगुने हो आजएंगे पैसे.

Post Office Scheme: अगर आप भी अपने जीवन में पैसे की बचत कर उसे एक अच्छी जगह निवेश करने की योजना बना रहे हैं। तो आप पोस्ट ऑफिस की तीन नई निवेश योजनाओं में अपना पैसा निवेश कर इस पर मोटे ब्याज की कमाई कर सकते हैं। पोस्ट ऑफिस द्वारा जारी 3 स्कीम: वरिष्ठ नागरिक बचत योजना, पीपीएफ योजना एवं सुकन्या समृद्धि योजना के माध्यम से आप 7% से अधिक ब्याज आसानी से प्राप्त कर सकते हैं। इसके साथ ही आपका पैसा भी…

View On WordPress

#mis scheme post office#monthly income scheme post office#Post Office#post office fd scheme#post office fixed deposit scheme#post office mis scheme#post office mis scheme in hindi#post office monthly income scheme#post office nsc scheme#post office nsc scheme in hindi#post office rd scheme#post office saving schemes#Post Office Scheme#post office scheme for retirement#post office schemes#post office schemes in telugu#अप्रैल माह की नई ब्याज दरें पोस्ट ऑफिस की#जाने पोस्ट ऑफिस के नए ब्याज दरों के वारे मे#पोस्ट ऑफिस#पोस्ट ऑफिस की 5 बेहतरीन योजनाएं के बारे में जानकारी#पोस्ट ऑफिस की अप्रैल से जून 2022 की नई ब्याज दरें#पोस्ट ऑफिस की नई ब्याज दरें#पोस्ट ऑफिस की बेस्ट स्कीम्स के बारे में बताएं#पोस्ट ऑफिस की सभी बचत योजनाओ की अपडेट ब्याज दरें#पोस्ट ऑफिस के 2022 के सभी बचत योजनाओं की नई ब्याज दरें#पोस्ट ऑफिस बचत योजनाओं की नई ब्याज दरें अप्रैल से जून 2022#सुकन्या योजना#सुकन्या समृद्धि खाता से कितने रूपये मिलेंगे#सुकन्या समृद्धि में कितने रूपये मिलेंगे#सुकन्या समृद्धि योजना

0 notes

Text

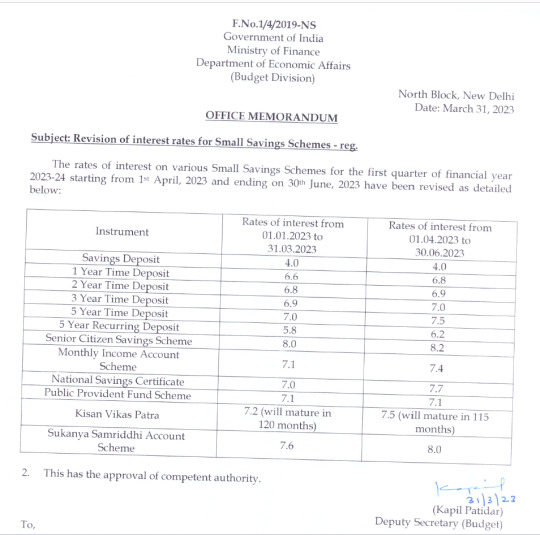

Post office and small savings schemes Interest rates from 1st April 2023

Govt. circular on small savings schemes Interest rates from 1st April 2023 to 30th June 2023. Except PPF, all schemes' rate have been increased.

#SSY, #KVP, #NSC, #SCSS, #POFD, #MIS, #PPF

The interest rates for the period from 1st April 2023 to 30th June 2023 of ‘Post office and small savings schemes’ like PPF, KVP, SSY, SCSS, NSC, MIS, post office savings deposit, Time deposit, Recurring deposits has been declared on 31st March 2023 (Friday) by the Finance Ministry.

(more…)

View On WordPress

#dEPOSIT#Finance#Fixed deposit#income tax#KVP#MIS#NSC#post office#PPF#SAVINGS#SCSS#small savings schemes#ssy#sukanya samriddhi yojana

0 notes

Text

Best books for the all competition exam at best price

Sure, here is some information on the Revenue officers grade II Exam, UPSC Exam, Food Safety Officer Exam, and some popular publishers of competitive exam books, including RBD Publications and Lakshya Publications.

Revenue officers grade II Exam Books:

Revenue Officer Grade II is a state-level exam conducted by the Rajasthan Public Service Commission (RPSC) for the recruitment of revenue officers in Rajasthan. The exam consists of two papers - Paper I and Paper II, each with 200 marks. Here are some recommended books for Revenue Officer Grade II exam preparation:

RPSC Revenue Officer Grade-II Exam Guide by RPH Editorial Board

Rajasthan Revenue Officer Exam Guide by Disha Experts

RPSC Revenue Officer Grade-II Exam Guide by Arihant Experts

UPSC Exam Books:

UPSC (Union Public Service Commission) conducts various competitive exams for recruitment to various government services and posts. Some popular UPSC exams include Civil Services Exam, Indian Forest Service Exam, Engineering Services Exam, and Combined Medical Services Exam. Here are some recommended UPSC exam books for exam preparation:

Indian Polity by M. Laxmikanth

Indian Economy by Ramesh Singh

History of Modern India by Bipan Chandra

Environmental Studies: From Crisis to Cure by Rajagopalan

Food Safety Officer Books:

Food Safety Officer (FSO) is a state-level exam conducted by various state governments for the recruitment of food safety officers. The exam consists of multiple-choice questions on various topics such as food science and technology, food safety laws and regulations, and microbiology. Here are some recommended books for FSO exam preparation:

Food Safety Officer (FSO) Exam Guide by RPH Editorial Board

Food Safety Officer (FSO) Exam Guide by Arihant Experts

Food Safety Officer (FSO) Exam Guide by S. Chands Publications

Buy Competitive Exam books in Jaipur:

Jaipur is a city in Rajasthan that is known for its bookstores and publishers. Here are some popular bookstores in Jaipur where you can buy competitive exam books:

Book Palace, MI Road

Bookzone, Tonk Road

KoolSkool, C Scheme

Rachna Sagar Private Limited, Adarsh Nagar

Big Book Bazaar, Malviya Nagar

Rajasthan Exam Books:

Rajasthan Public Service Commission (RPSC) conducts various state-level exams for recruitment to various government services and posts in Rajasthan. Here are some recommended books for Rajasthan exam preparation:

Rajasthan General Knowledge by RPH Editorial Board

Rajasthan Civil Services Exam Guide by Arihant Experts

Rajasthan Patwari Exam Guide by RPH Editorial Board

RBD Publication Books:

RBD Publications is a well-known publisher of competitive exam books in India. They have a wide range of books on various subjects such as general knowledge, current affairs, and government job exams. Here are some popular RBD Publication books:

Current Affairs Yearly 2021 by RBD Editorial Board

Rajasthan General Knowledge by RBD Editorial Board

Railway Group D Exam Guide by RBD Editorial Board

Lakshya Publication Books:

Lakshya Publication is another popular publisher of competitive exam books in India. They have a wide range of books on various subjects such as general knowledge, mathematics, and reasoning. Here are some popular Lakshya Publication books:

Quantitative Aptitude for Competitive Exams by R.S. Aggarwal

Verbal and Non-Verbal Reasoning by R.S. Aggarwal

General Knowledge 2022 by Manohar Pandey

In conclusion, preparing for competitive exams requires a lot

For info: CET Exam Books

0 notes

Text

Post Office Monthly Income Scheme Interest Rate And Investment All You Need To Know - Mis: पोस्ट ऑफिस की इस स्कीम में करें निवेश, हर महीने मिलेंगे 4,950 रुपये

Post Office Monthly Income Scheme Interest Rate And Investment All You Need To Know – Mis: पोस्ट ऑफिस की इस स्कीम में करें निवेश, हर महीने मिलेंगे 4,950 रुपये

Post Office Monthly Income Scheme: आज हम आपको पोस्ट ऑफिस की एक बेहद ही शानदार स्कीम के बारे में बताने जा रहे हैं। पोस्ट ऑफिस की इस योजना का नाम मंथली इनकम स्कीम है। देश में ऐसे लोगों की संख्या काफी अधिक है, जो ऐसी निवेश योजनाओं की तलाश करते हैं, जहां पर उनको बिना जोखिम के अच्छा रिटर्न मिलता रहे। अगर आप भी किसी ऐसी स्कीम की तलाश कर रहे हैं, जहां पर आपको गारंटीड रिटर्न मिले।

ऐसे में आप पोस्ट ऑफिस…

View On WordPress

0 notes

Text

পোস্ট অফিস স্কিম।Indian Post Office। Interest Rates of Post Office 2022 -takapoysanews - TAKAPOYSANEWS

In this particular post you learn details about Indian post office schemes and their lastest interest rates.

There are 9 types of schemes activated by Indian government are popular very much. Among them 1.Post office savings account 2. Post office time deposit / fixed deposit 3.Post office monthly income scheme (MIS) 4.Post office recurring deposit (RD) 5. Post office senior citizen savings scheme (SCSS) 6. Sukanya samriddhi Yojana 7.Kishan Vikas Patra (KVP) 8.Public Provident Fund (PPF) 9. NSC National Savings Scheme .

In this post you learn all the details for this popular schemes in Bengali.

#post office schemes with high returns#post office small savings schemes#post office#Indian Post Office#পোস্ট অফিস ইন্টারেস্ট রেট টেবিল#পোস্ট অফিস#takapoysanews#POMIS#SCSS#KVP#NSC#SSY

0 notes