#sukanya samriddhi yojana

Text

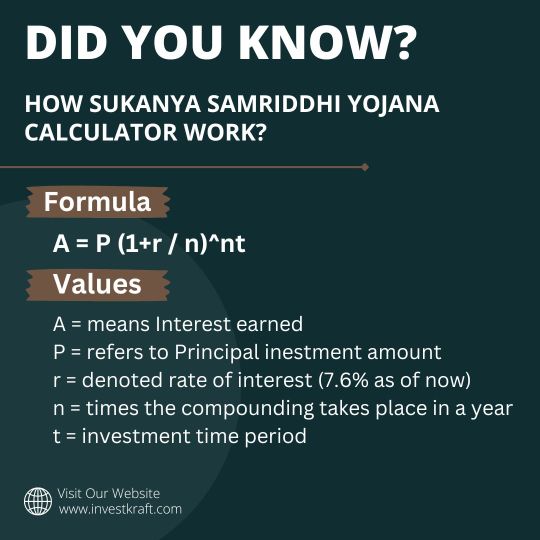

Curious About Sukanya Samriddhi Yojana Calculator?

Are you interested in planning for your daughter's future education and marriage expenses? The Sukanya Samriddhi Yojana Calculator can help you estimate potential returns on your investments. This handy tool allows you to input your investment amount and duration to calculate the future value of your savings under the Sukanya Samriddhi Yojana scheme. Whether you're considering starting a new investment or already have one, this calculator provides valuable insights into your financial planning. For a user-friendly experience, you can access the Sukanya Samriddhi Yojana Calculator on the Investkraft website. Investkraft offers a range of financial tools and resources to assist you in making informed investment decisions. Take advantage of this easy-to-use calculator to plan effectively for your daughter's financial needs.

#investkraft#finance#calculators#financial calculators#Sukanya Samriddhi Yojana#Sukanya Samriddhi Yojana Calculator

2 notes

·

View notes

Text

Sukanya Samriddhi Yojana 2023 Benefits & Interest Rates

Sukanya Samriddhi Yojana (SSY) is a savings scheme launched by the Government of India in 2015 as part of the "Beti Bachao Beti Padhao" campaign. The scheme is designed to encourage parents to save for the future education and marriage expenses of their girl child.

Here are some of the benefits and interest rates associated with Sukanya Samriddhi Yojana:

High Interest Rates: The current interest rate for Sukanya Samriddhi Yojana is 7.6% per annum (as of January 2022), which is higher than most other government-backed savings schemes.

Tax Benefits: Contributions to Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. The interest earned and the final maturity amount are also tax-free.

Flexible Investment Options: Parents or guardians can open an SSY account for their girl child with a minimum initial deposit of Rs. 250. They can make contributions in multiples of Rs. 100, up to a maximum of Rs. 1.5 lakh per annum. The account can be opened until the girl child attains the age of 10 years.

Long Maturity Period: The maturity period for Sukanya Samriddhi Yojana is 21 years from the date of opening the account. This makes it an ideal savings scheme for long-term financial planning.

Partial Withdrawals Allowed: Partial withdrawals of up to 50% of the balance in the account are allowed once the girl child attains the age of 18 years, for the purpose of higher education or marriage.

Account Transferable: In case of a change in residence of the account holder, the account can be transferred anywhere in India.

Overall, Sukanya Samriddhi Yojana is a great savings scheme for parents who want to secure their daughter's future education and marriage expenses. It offers high interest rates, tax benefits, and flexible investment options, making it a popular choice among investors.

#Sukanya Samriddhi Yojana#Girl Child Education#Beti Bachao Beti Padhao#Savings Scheme#Financial Planning#Tax Benefits#High Interest Rates#Long-term Investment#Account Transfer#Government-backed Scheme

3 notes

·

View notes

Text

To open a Sukanya Samriddhi Account, follow these steps: 1. Visit a post office or authorized bank branch. 2. Fill out the account opening form with essential details. 3. Submit required documents, including the birth certificate of the girl child and proof of identity/address of the guardian. 4. Deposit the minimum initial amount specified by the institution. 5. Receive the passbook containing the account details. Note: The account is designed for the financial benefit of the girl child, offering long-term savings with attractive interest rates.

0 notes

Text

Sukanya Samriddhi Yojana: नए साल से पहले सरकार ने दिया बड़ा तोहफा, सुकन्या समृद्धि योजना के लिए बढ़ाई इतनी ब्याज दरें

Sukanya Samriddhi Yojana(सुकन्या समृद्धि योजना): नए साल के आगाज से पहले, सरकार ने सुकन्या समृद्धि योजना में निवेश करने वालों के लिए एक रोचक समाचार घोषित किया है। इस योजना के तहत, वित्त वर्ष 2023–24 की चौथी तिमाही के लिए ब्याज दर को 8.2 प्रतिशत बढ़ा दिया गया है। पहले, इस योजना में निवेश करने वालों को 8 फीसदी ब्याज प्रदान किया जाता था। हालांकि, इस योजना के अलावा अन्य योजनाओं की ब्याज दरों में कोई परिवर्तन नहीं किया गया है। Read more…

1 note

·

View note

Text

Sukanya Samriddhi Yojana: नए साल 2024 से पहले सरकार का तोहफा, सुकन्या समृद्धि योजना के लिए बढ़ाई ब्याज दरें

Sukanya Samriddhi Yojana (SSY) is a government-backed small savings scheme in India that aims to ensure the financial well-being of girl children and encourage parents to save for their education and marriage expenses. This scheme falls under the Beti Bachao, Beti Padhao Yojana, and provides numerous benefits to both parents and the girl child.

नए साल से पहले सरकार ने Sukanya Samriddhi Yojana…

View On WordPress

0 notes

Text

Sukanya Samriddhi Yojana : 21 साल में बेटी के शादी के लिए मिलेंगे 64 लाख, जानें क्या है सरकारी स्कीम

Sukanya Samriddhi Yojana: यदि आप अपनी बेटी की शादी के खर्च को लेकर चिंतित हैं, तो आप सुकन्या समृद्धि योजना के तहत 8% ऋण शुल्क पर इतने वर्षों तक वित्तीय योजना बनाकर उसकी शादी के समय 64 लाख रुपये जुटा सकते हैं। इस योजना के बारे में बताएं?

Sukanya Samriddhi Yojana

सुकन्या समृद्धि योजना:आज के समय में महंगाई इतनी हो गया है कि एक लड़की की शादी के लिए माता-पिता को 18 से 20 लाख रुपये खर्च करने पड़ते हैं।…

View On WordPress

0 notes

Text

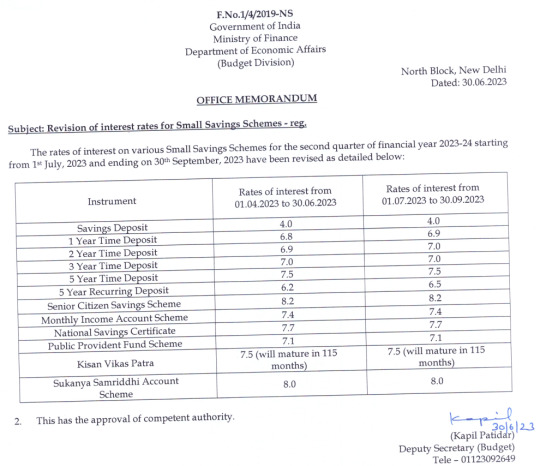

Post office and small savings schemes Interest rates from 1st July 2023

Today's Govt. circular on 'small savings schemes' Interest rates for July to Sep 2023. Interest rates of some schemes have been increased.

#SSY, #KVP, #NSC, #SCSS, #POFD, #MIS, #PPF

The interest rates for the period from 1st July 2023 to 30th September 2023 of ‘Post office and small savings schemes’ like PPF, KVP, SSY, SCSS, NSC, MIS, post office savings deposit, Time deposit, Recurring deposits has been declared on 30th June 2023 (Friday) by the Finance Ministry.

(more…)

View On WordPress

#dEPOSIT#Finance#Fixed deposit#income tax#KVP#MIS#NSC#post office#PPF#SAVINGS#SCSS#small savings schemes#ssy#sukanya samriddhi yojana

0 notes

Text

Sukanya Samriddhi Yojana : SBI સુકન્યા સમૃદ્ધિ યોજના દ્વારા મેળવો રૂપિયા 15 લાખ

સ્ટેટ બેંક ઓફ ઈન્ડિયા (SBI) હવે આવી ઘણી યોજનાઓ ચલાવી રહી છે, જેના દ્વારા દીકરીઓ અમીર બનવાનું તેમનું સપનું સાકાર કરી રહી છે. જો હવે તમારા ઘરે એક નહીં પરંતુ બે દીકરીઓએ જન્મ લીધો છે તો ટેન્શન લેવાની જરૂર નથી. SBI હવે દીકરીઓને એટલા લાખો રૂપિયા આપી રહી છે કે તમે ગણીને થાકી જશો, જે જાણવું ખૂબ જ જરૂરી છે.

Sukanya Samriddhi Yojana

યોજનાનું નામસુકન્યા સમૃદ્ધિ યોજનાઆર્ટિકલની ભાષાગુજરાતી અને…

View On WordPress

0 notes

Link

PPF or Public Provident Public and SSY or Sukanya Samriddhi Yojana are two Government-backed savings schemes to help you secure your financial future. Both these schemes are best to have a large corpus of funds at the time of retirement. However, SSY offers more interest rates than PPF. So, if you have any problem choosing any one between these two schemes, we are here to help.

0 notes

Text

सुकन्या समृद्धि योजना नियम,पात्रता पूरी जानकारी

सुकन्या समृद्धि योजना नियम,पात्रता पूरी जानकारी #chhattisgarhnews #govtscheme #sarkariyojna #narendramodi

सुकन्या योजना: आपके घर में एक नन्ही बिटिया ने जन्म लिया है, क्या आप बेटी के भबिष्य के लिए जैसे – पढाई, उच्च शिक्षा एवं शादी आदि के लिए चिंतित है। केंद्र सरकार द्वारा सुकन्या समृद्धि योजना को इसी उदेश्य से बनाया गया है। यह स्कीम केवल बेटियों के लिए ही बनायीं गयी है। Sukanya Samriddhi Yojana केंद्र सरकार की बालिकाओं के लिए एक छोटी बचत योजना है। जो बेटियों भविष्य में होने वाले खर्च की पूर्ति…

View On WordPress

0 notes

Text

0 notes

Text

Sukanya Samriddhi Account Scheme

Minimum deposit ₹ 250/- Maximum deposit ₹ 1.5 Lakh in a financial year.

The account can be opened in the name of a girl child till she attains the age of 10 years.

Only one account can be opened in the name of a girl child.

Accounts can be opened in Post offices and in authorized banks.

Withdrawal shall be allowed for the purpose of higher education of the Account holder to meet education expenses.

The account can be prematurely closed in case of marriage of a girl child after her attaining the age of 18 years.

The account can be transferred anywhere in India from one Post office/Bank to another.

The account shall mature on completion of a period of 21 years from the date of opening of the account.

Deposit qualifies for deduction under Sec.80-C of I.T.Act.

Interest earned in the account is free from Income Tax under Section -10 of I.T.Act.

0 notes

Text

Sukanya Samriddhi Yojana | Money Making Tips | save money | Small Savings Schemes | Sukanya samriddhi scheme

11 lakh accounts opened in 2 days, people are very fond of this government scheme, a huge amount of money invested, and benefits are amazing

In Sukanya Samriddhi Yojana, about 11 lakh accounts were opened within just 2 days. PM Modi tweeted and congratulated the Indian Post Office for this achievement. About 33 lakh accounts are opened every year in this popular scheme.

The post office has opened…

View On WordPress

#Money Making Tips#save money#Small Savings Schemes#Sukanya Samriddhi#Sukanya samriddhi scheme#Sukanya Samriddhi Yojana

0 notes

Text

How To Use Sukanya Samriddhi Yojana 250 Per Month Calculator

#Sarkariyojana#pmsarkariyojana#sukanya samriddhi scheme#calculator#sukanya samriddhi yojana#bjpindia#government#gujarat#pm#up#pmv#pmu#pmyojana

1 note

·

View note

Photo

Sukanya Samriddhi Yojana is one of the best savings sche0me targeted for girl child.

One of the most attractive benefits is tax exempt and even very low premium of Rs. 250 per FY is also accepted.

Let's know more about Sukanya Samriddhi Yojana benefits and interest rate

0 notes

Link

Sukanya Samriddhi Yojana or SSY account offers a lucrative interest rate of 8.6 per cent, tax-free accumulated and interest amount after maturity, and tax reliefs under Section 80C of the Income Tax Act, 1961. This small savings scheme backed by the Government itself provides lucrative financial benefits to the girl child of a parent or … The post How to Open Sukanya Samriddhi Yojana or SSY Account in Simple Steps? appeared first on Viral Bake.

0 notes