#kisan vikas patra tax benefit

Text

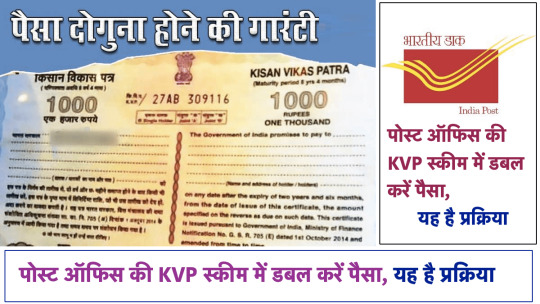

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra : डाकघर किसान विकास पत्र: डाकघर की योजनाएं निश्चित रूप से एक दीर्घकालिक निवेश हैं, लेकिन इसमें कोई जोखिम कारक नहीं है क्योंकि इसमें सरकारी गारंटी उपलब्ध है। ये योजनाएं उन लोगों के लिए हैं जो पारंपरिक निवेश पसंद करते हैं और लंबी अवधि का नजरिया रखते हैं।

Post Office Kisan Vikas Patra

डाकघर किसान विकास पत्र: डाकघर योजनाएं उनके लिए हैं जो पारंपरिक निवेश पसंद करते हैं…

View On WordPress

#how to invest in kisan vikas patra#Kisan Vikas Patra#kisan vikas patra in hindi#kisan vikas patra interest rate#kisan vikas patra kya hai#kisan vikas patra post office#kisan vikas patra post office scheme#kisan vikas patra post office scheme 2022#kisan vikas patra scheme#kisan vikas patra tax benefit#kisan vikas patra yojana#post office kisan vikas patra#Post Office Kisan Vikas Patra Scheme#Post Office KVP Scheme#post office scheme kisan vikas patra

0 notes

Text

Here are top 6 post office investment plans :

National Savings Certificate (NSC)**This is a low-risk with fixed income scheme offered by the government and is available with the post-offices across India. This post office saving scheme for boy child is loaded with best features and benefits to aptly suit your child’s needs. It facilitates a fixed income and definite returns to generate best revenues. This plan is currently available at 6.8% rate of interest per annum.

Features:

Minimum investment – Rs.1000

Maximum investment – no max. limit

Interest Rate – 6.8%

Lock in tenure – 5 years

Tax Benefits – Up to Rs.1.5 lakh (as per Section 80C of Income Tax)

Benefits

The plan offers fixed return on investment higher as compared to FDs.

Offer Tax benefits under section 80C.

Available at an initial investment of Rs 1,000, which is very less.

The Plan is available with a maturity period of 5 years.

No TDS allowed so the insured can obtain full value at maturity.

Ponmagan Podhuvaippu Nidhi Scheme

The department of post, Tamil Nadu introduced the Ponmagan Podhuvaippu Nidhi Scheme in the year 2015,especially meant for the male child. The account for this post office saving scheme for boy child can be opened through a parent/guardian for a minor boy below 10 years of age, while minor boys above 10 years can open the account on their own name. This special plan is limited to the residents of Tamil Nadu only, and can be availed by parents before their son attains 10 years of age.

Features:

Minimum investment – Rs.500

Maximum investment – 1.5 lakhs

Interest Rate – 9.70%

Maturity period – 15 years

Tax Benefits – available under Section 80C of Income Tax

Benefits

The plan offers ways to increase your income.

Offer Tax benefits under section 80C.

Nomination facility available.

Payments can be made in lump sum or in 12 small installments.

Parents can avail loan facility from fourth year of the account.

Post Office Monthly Income Scheme (POMIS)

Post office monthly income scheme or POMIS is a saving scheme for boy child where you can earn a fixed monthly interest by investing a certain amount. This scheme is easy to open in any post office across the country and is packed with features and benefits. For this scheme, the one key requirement is to have a post office savings account.

Features:

Minimum investment – Rs. 1000

Maximum investment – 4.5 lakhs

Interest Rate – 6.6%

Maturity period – 5 years

Tax Benefits – TDS is not applicable but sum invested is not covered under Section 80C

Benefits

The plan offers capital protection until the plan matures

This is a low risk plan and safe.

It offers affordable deposit amount facility.

The scheme offers guaranteed returns.

Multiple ownership is also available under this scheme.

Kisan Vikas Patra (KVP)

Kisan Vikas Patra or KVP is an apt plan that suits perfectly to the low income as well as the middle-class income families in India. This is a short-term post office saving scheme for boy child in India that permit parents to invest on a particular lump-sum money per year.

Features

Interest Rate – 6.9%

Minimum amount – Rs.1,00

Maximum amount – No Upper Limit

Maturity period – 10 years and 4 months

Lock-in period – 30 months

Benefits

The plan offers guaranteed returns with zero risks.

It helps accumulate savings for future your child.

Allow parents to get loans with low interest rates.

Nomination facility is available.

Post Office Recurring Deposit (RD)

This another good saving post office schemes for boy child in India. This is a recurring deposit plan that offer high rate of interest as compared to regular saving account in a bank. Under this scheme, parents can save a particular amount in the account every month for 5 years.

Features

Interest Rate – 5.8%

Minimum amount – Rs.100

Maximum amount – No Upper Limit

Maturity period – 5 years

Benefits

The plan offers limited restrictions.

Nomination facility is available.

Transfer of funds is available from RD to savings account.

Allow parents to save enough for their male child’s future.

Public Provident Fund (PPF)

Public Provident Fund or PPF is a post office scheme for male child in India that help parents to save on taxes as well. PPF is a long term plan of investment available at an attractive rate of interest and offers god returns on investment.

Features

Interest Rate – 7.1%

Minimum Amount – Rs.500

Maximum Amount – Rs 1.5 lakh

Tenure/Lock-in period – 15 years

Tax Benefit – available up to Rs.1.5 lakh under Section 80C

Benefits

The plan offers low risk.

Nomination facility is available.

Allow parents to take loans against the invested amount from 3rd of scheme.

Transfer of funds is available under this savings scheme.

Long term savings with attractive interest rate.

0 notes

Photo

(via Kisan Vikas Patra Yojana 2020 - Online Apply KVP, Calculator, Tax Benefits)

3 notes

·

View notes

Text

Kisan Vikas Patra - Eligibility, Interest Rate, Benefits

Kisan Vikas Patra - Eligibility, Interest Rate, Benefits

https://askqueries.com/kisan-vikas-patra-eligibility-interest-rate-benefits/

The Government of India first introduced the Kisan Vikas Patra saving scheme in 1988. It was found that the original scheme could be misused for money laundering. So they then re-introduced it in 2014 with some changes. In this article, the different features as well as benefits of this scheme...

For More : https://askqueries.com/kisan-vikas-patra-eligibility-interest-rate-benefits/

#kisan vikas patra#kisan vikas patra 2017#kisan vikas patra benefits#kisan vikas patra interest rate 2017#kisan vikas patra tax benefit#KVP certificate

0 notes

Text

Kisan Vikas Patra Scheme 2021: Kisan Vikas Patra, Interest Rate, Tax Benefits

Kisan Vikas Patra Scheme 2021: Kisan Vikas Patra, Interest Rate, Tax Benefits

Kisan Vikas Patra: You all know that the government keeps on launching various schemes to promote the habit of saving towards the citizens of the country. One such scheme is the Kisan Vikas Patra Yojana. To take advantage of this scheme, gender term investment has to be made. This scheme has been started for those people who do not want to take risks. Today we are going to provide you all the…

View On WordPress

#kisan vikas patra#kisan vikas patra calculator#Kisan Vikas Patra interest rate#kisan vikas patra scheme

0 notes

Link

Know well about ITR forms

Who can file Income Tax Returns?

Individuals, HUFs, AOPs, BOIs, firms and companies are mandated to file the income tax return (ITR) if the income earned is taxable. Each of these taxpayers is taxed differently under the Income Tax laws of India wherein the domestic companies and firm have fixed a 22 per cent tax rate but the individuals are taxed as per the tax slabs.

Advantages of filing income tax returns (ITRS)

It has often seen that many individuals believe that if their salaries fall below the taxable bracket then they don’t need to file an income tax return (ITR). However, that is not true! Even if your earned income is not taxable, you should file ITR as it will benefit you in different ways.

Listed out the following advantages of filing income tax returns:

Avoid Penalties:

Easy Loan Approval:

Address Proof:

Compensate for Losses in the next Financial Year:

Hassle-free Visa Processing:

Filing ITR timely can help you avoid penalties imposed by the Income Tax Department for belated return that could cost you extra interest.

In India, ITR is one of the important documents asked by banks in sanctioning a loan to an individual. Many banks and NBFCs ask for ITR receipts of the latest 3 years when applying for the loan such as home loan, car loan etc. Such lenders consider ITR as the most authentic document of verifying an individual’s income. Hence, an individual who is filing ITR on time can benefit from hassle-free loan approval.

Income Tax Return (ITR) receipts can serve as a residential proof as it is sent directly to your registered address.

If you are eligible to file ITR but didn’t then you would not be able to carry forward the losses of the current financial year to the next financial year. Hence, it is vital to file the ITR to claim the losses in the future years.

At the time of applying for Visa, the embassies generally ask for past ITR receipts to process the Visa application of an individual. So, filing ITR before the due date can help you in quick Visa processing at the time of Visa application.

Things to remember before filing an Income Tax Return

Income tax return filing is very important and if you have not filed your return yet, it’s a good idea to get going and try to do it as early as possible. Tax filing involves a lot of paperwork, confusion and queries. To ensure a seamless process, give yourself enough lead-time for a smooth and timely return filing. Unfortunately, there are penalties to be paid, if the deadlines are missed. These fines range between Rs. 5,000 to 10,000, depending on the delay.

You can get help from professionals to file your tax return who can advise you on how to save tax, the available deductions and exemptions under 80C and assist you with investment planning. But, if you are planning to file returns yourself, here are a few important things you could keep in mind.

First of all, make sure to collect all the required documents that you will need to file your ITR Form such as Form 16, Form 26AS, investment documents, premium payments, loan statements, salary slips, bank statements, and proof of capital gains (if any) that will help you in providing the details of tax deducted at source (TDS) and to compute the gross taxable income of yours in that financial year.

Similar to this, if you have redeemed mutual fund units within that year, you can reach out to your mutual fund house to provide you with the transaction statements and capital gain statements. Remember, if the gains exceed Rs. 1 lakh, you will be required to pay tax on LTCG. Once you finished computing your total income, the next thing is to calculate your tax liability by applying the tax rates as per your income slab.

Important Things To Remember While Filing Income Tax Returns

Know Your ITR Forms Well

The Central Board of Direct Taxes (CBDT) has made few amendments in the ITR forms to ease the process of filing Income Tax returns. The number of forms to be used by taxpayers has been reduced from 9 to 7. For individuals with annual taxable income (from salary, interest, one house property) of up to Rs. 50 lakh, ITR 1 is required to be filed. Whereas, for individuals with annual taxable income of more than Rs. 50 lakh, ITR 2 is required to be filed.

Mandatory Disclosure

Following up on the Central Government's efforts on demonetisation, the Income Tax department has made it mandatory to disclose cash deposits of Rs. 2 lakh and more in bank accounts. This was first initiated during the demonetisation period and continues to this day. The Income Tax department requires a declaration in a separate column giving details of money deposited along with bank details in the income tax returns. To prevent being taxed at 60% plus surcharge and cess, tax payers need to explain all sources or forms of income or investment.

Carefully Select the Assessment Year and Financial Year

Assessment Year and Financial Year are not the same and you need to be familiar with them in order to correctly file your taxes. Financial Year is the period or year within which you earn the income, whereas Assessment Year is the period or year that follows Financial Year and it is in this year that you file your tax return. Every Financial Year and Assessment Year begins on the 1st of April and ends on 31st of March. Assessment Year always comes after Financial Year.

Since your income is taxed in the Assessment Year, you have to select Assessment Year while filing your income tax return.

Check For Deductions Under 80C

Section 80C entitles you to certain deductions from the gross total income, up to a maximum limit of Rs. 1.5 lakh. It is the most widely used option to save income tax. The investments and expenditures that qualify for deduction under section 80C are investments in National Savings Certificates (NSC), Kisan Vikas Patra (KVP), notified Equity Linked Saving Scheme (ELSS) of a mutual fund, five-year post office term deposits, five-year bank fixed deposits, contribution to Employee Provident Fund (EPF), Public Provident Fund (PPF), Superannuation Funds and premiums paid for life insurance, annuity plan and Unit-Linked Insurance Plans (ULIP), etc.

These investments can not only be claimed as deduction while calculating your total taxable income but can also generate good returns. Moreover, investment in PPF, superannuation funds, etc. also help in accumulating funds for retirement planning.

Check TDS on Form 26A

Form 26A is an important document for tax filing. It provides details of the income paid to you, the tax deducted on that income and the amount of TDS deposited by the payer with the Government. The form also contains details of any refund applicable to you. To check your tax deduction on Form 26A, you have to go to https://incometaxindiaefiling.gov.in and login to your account. Next, you have to go to ‘My Account’ and click on ‘View Form 26AS’ in the drop down.

Conclusion

While filing your income tax return, ensure that you know the relevant ITR forms well, make the necessary disclosures, select appropriate assessment year, take advantage of 80C deductions and verify your TDS from Form 26A. This will ensure a smooth and hassle-free tax filing process.

For reference: http://www.incometaxindiaefiling.gov.in/main/ListOfITRsAndOtherForms

0 notes

Text

KISAN VIKAS PATRA (KVP)

Kisan Vikas Patra (KVP) is a government saving scheme, was specifically designed for the benefit of farmers. Now, it is welcoming to all the citizens.

This scheme was one of the most popular among farmers, intending to help farmers by offering them to double their investment in 124 months.

The KVP was first originated in 1988 as a saving certificate for farmers. It was, but, suspended in 2011, as people were misusing it for money laundering purposes.

To avoid misuse of the scheme, the Government made a few modifications to the guidelines of KVP in 2014. If you need to invest more than Rs. 50,000, your PAN Card is mandatory. If you desire to invest Rs10 Lakh or more further, then presenting all income proofs related documents is compulsory.

Types of KVP certificate options available:

Single holder type- you can avail of this type of certificate if investing individually for yourself or on behalf of a minor.

Joint A type - This type of certificate is available to those investing jointly (two individuals). Both investors would get the return. But in case of death of any holder, the only survivor will be eligible to receive the same.

Joint B type - This type of certificate be given jointly to two individuals. Unlike Joint A type, at maturity, either of the two holders or the survivor would get the amount.

Here are the key highlights and benefits of the KVP scheme:

1. Eligibility criteria:

A person must be an adult and a resident of India.

Hindu Undivided Family and Non-residential Indian are not eligible to invest in KVP.

2. Easy purchasing of the certificate

You can acquire the certificate from any post office around the country.

3. The interest rate on the scheme

For the current financial year, investment in KVP carries interest at the charge of 6.9 percent. For instance, the amount invests in KVP certificates get double in 124 months.

4. Limits of Investment

A person needs to invest a minimum of Rs1, 000 in the scheme. There is no maximum limit for investment in the scheme.

5. Easy Withdrawal procedure:

One can withdraw the total amount after the maturity time. In case you withdraw the funds prematurely, you will not get any interest and will bear a penalty for the same.

If you withdraw the amount after a year, prior to the maturity date, will not suffer from any penalty but earn less interest. Withdrawal after 2.5years will not ask for any fines or penalties. You will receive the whole principal amount with the guaranteed interest.

6. Turning certificate into cash:

One can encash the KVP certificate at the bank branch or post office from where you bought the certificate. However, In case of urgency, can easily encash it at another post office or bank branch, with the consent of the post head or manager of the branch.

7. Taxability of the Scheme

KVP is not meant for investors looking to avoid tax. The principal sum and interest do not have any tax discounts. Yet, it still extends many advantages to investors.

8. Loan against a certificate

People can easily get a loan against their stake in the Kisan Vikas Patra. The KVP certificate will act as a guarantee while applying for a loan.

Easy steps to invest in KVP:

1. Get the application form, and fill the form with the basic information.

2. Submit the form to the post office or bank.

3. If you are investing in KVP through an agency then, the agent will help you in filling up the form. You can arrange these forms from the internet. ·

4. The Know Your Customer, also known as KYC, evaluation is compulsory and, you need to submit the ID and address proof.

5. After the verification of documents, you need to deposit the money.

6. You will receive a KVP certificate promptly unless you make the payment by cheque or demand draft.

7. Keep this certificate safe as you will require submitting this at the time of maturity. You can also get your certificate by email.

0 notes

Text

Ways to start small savings for your Dream Home

Everyone dreams for his/her own home, where they can cherish their good to bad to exciting to sad moments. A home is a place where you shed all your stress and feel relaxed and happy. If we talk about today’s scenario where even basic necessities are so damn costly or beyond one's expectation, it’s hard to even dream for a home. But as they say, even impossible has possible hidden in it. Similarly, dreaming for your own home might be challenging but not impossible even in today’s world.

Our elders often tell us about doing small savings. Whether you are a new bee in the professional world or an expert saving is an important and mandatory part of one’s life. Even if you own home well in advance you need to save some part of your money for uncertain situations. Let’s talk about small saving schemes so that you can apply for Home Loan.

Recurring Deposit is the best way to start your saving, as there are best interest rates on RD (Recurring Deposit). In recurring deposit, you are supposed to deposit a fixed amount every month without any fail. You can start your account with a minimum balance of Rs. 100 every month.

Public Provident Fund or PPF is another fabulous government scheme. It allows one to save tax up to 1.5 Lakh under section 80C ITR. The account holds a lock-in period of 15 years. One can apply for PPF account in a bank, post office or NBFC’s. It also offers a good interest rate as compared to other saving schemes.

Saving Account, although these are the one that offers minimum interest rate i.e. 4% approx (vary from bank to bank), still is a preferable option for many. You can operate this saving account from anywhere and share whatever part of the amount you want to save every month.

Fixed Deposit is a scheme with a tremendous benefit, i.e. once you fixed a part of your saving you are not supposed to use it until it gets matured. Those who are interested in this scheme must make sure that once they sign in for this scheme they won’t be able to use their amount before maturity.

Similar to these there are various other government schemes available like Kisan Vikas Patra, Sukanya Samriddhi Yojana, National Saving Certificate etc where you can save you money for fulfilling your dream.

All these days, banks and other NBFC’s are very particular about documentation and so apply for Aadhar card online as it’s a mandatory document for such documentation.

0 notes

Text

Must you keep off debt mutual funds?

New Post has been published on https://apzweb.com/must-you-keep-off-debt-mutual-funds/

Must you keep off debt mutual funds?

The Franklin Templeton crisis has brought to light many instances of mis-selling and mis-buying in debt mutual funds (MFs), where many folks seem to have signed up for these products without understanding their true nature.

Here are specific situations in which you should avoid investing in debt funds.

Securing the principal

If the top attribute you look for in a debt investment is your principal remaining intact, then debt MFs aren’t for you. Unlike deposits or small savings schemes, debt MFs are market-linked vehicles that pass on not just interest receipts, but also capital gains or losses on the bonds they own, to you.

Some categories of debt funds are highly prone to capital losses. Funds which invest in longer-dated government securities or bonds fall in this category.

Gilt funds made 12-13% NAV losses between January 2009 and 2010 as interest rates rose. Funds that invest in lower- rated corporate bonds (credit risk funds) can hit you with substantial losses, if the issuers, whose bonds they hold, default or get downgraded.

In the recent past, we’ve seen some credit risk funds taking 20-30% NAV knocks on such write-offs. Even safer categories of debt funds such as ultra-short, short, low-duration or liquid funds are not wholly loss-proof. In the past, liquid, short and low duration funds have taken NAV hits on commercial paper from issuers who got downgraded.

Liquid funds, deemed the safest, experienced a brief period of negative returns in March after big pullouts from the money market-battered bond prices.

So, if you have zero tolerance for capital losses, it is best to steer clear of debt funds and stick to bank deposits or post office schemes instead.

Predictable income

With a bank deposit or a Sundaram Finance FD it is possible to know exactly at the time of investing, the interest income you’re likely to receive every year. Such planning is impossible with debt funds because of the high variability in returns.

Some debt fund categories are more volatile than others. For instance, gilt funds, which delivered a 11% return in 2019, earned just 2% in 2017. Credit risk funds, which surprised investors with 9-11% returns between 2011 and 2016, have averaged a nil return in 2019 after a bunch of debt write-offs.

But even debt fund categories that don’t take on very high credit or duration risks tend to deliver volatile returns. In the last ten years, corporate bond funds have seen their annual returns swing from 5.5% to 11% and banking/PSU funds from 5.9% to 10%. Short duration and liquid funds have delivered between 5% and 10%. Knowing which category of debt fund will deliver a good return in the year ahead needs one to make accurate forecasts on interest rate movements and the ability of companies to service their debt. Even star fund managers haven’t been great at this, so it’s a tall task for the retail investor.

Yes, setting up Systematic Withdrawal Plans (SWPs) to receive regular cash flows from debt funds can help you deal with this problem.

But while SWPs smoothen out your cash flows, they don’t change the underlying nature of returns from a debt fund that remain volatile. So, if you are a pensioner, senior citizen or self-employed person looking for high predictability of income, then debt funds aren’t for you.

Preserving wealth

Received a big windfall from an employer/relative that you simply want to protect? Are you a high net worth investor who is looking to preserve the wealth you’ve created for posterity?

If preserving wealth takes priority over growing it, then you have no need to take on the risk of capital losses or bond market volatility with debt MFs.

Such investors have the choice of alternative debt investments that offer reasonable returns with a capital guarantee such as GOI 7.75% taxable bonds, National Savings Certificates (6.8%) or Kisan Vikas Patra (6.9%) which lock in your money for 5-9 years but promise to keep your capital intact. The returns are comparable to debt funds too.

No tax considerations

Tax-efficiency is one of the main arguments offered for signing up for debt funds.

Your interest receipts from bank FDs, GOI bonds and post office schemes are treated as income and taxed at your income tax slab rate. But returns on the growth options of debt funds are treated as capital gains. This leads to two tax advantages.

One, when you hold a debt fund for less than 3 years and set up cash flows via SWP, you pay tax only on the ‘return’ part of your withdrawals and not on the entire withdrawal amount.

Two, if you hold debt funds for over 3 years, the capital gains are taxed at a flat 20% after adjusting for indexed costs, effectively allowing you to pay tax only on the returns earned over inflation.

This leads to substantially better post-tax returns on debt funds compared to safer alternatives such as bank or post office deposits.

However, this tax arbitrage matters mainly to folks in the 20-30% tax brackets. For those in the 10% bracket or with no tax liability, the tax efficiency may not be incentive enough to take on higher risks.

You have reached your limit for free articles this month.

Register to The Hindu for free and get unlimited access for 30 days.

Subscription Benefits Include

Today’s Paper

Find mobile-friendly version of articles from the day’s newspaper in one easy-to-read list.

Unlimited Access

Enjoy reading as many articles as you wish without any limitations.

Personalised recommendations

A select list of articles that match your interests and tastes.

Faster pages

Move smoothly between articles as our pages load instantly.

Dashboard

A one-stop-shop for seeing the latest updates, and managing your preferences.

Briefing

We brief you on the latest and most important developments, three times a day.

Not convinced? Know why you should pay for news.

*Our Digital Subscription plans do not currently include the e-paper ,crossword, iPhone, iPad mobile applications and print. Our plans enhance your reading experience.

Source link

0 notes

Text

Types of Saving Schemes in India

Saving schemes are introduced by the Indian Government or by financial institutions or banks of the public sector. Their interest rates, investment horizons and tax treatments differ. A saving scheme makes us prepared financially for unexpected personal and medical emergencies. This helps you fulfill your personal goals and those of your family-additional education courses to complement your current credentials, further education and marriage for children, etc. In others, money from saving schemes often acts as an additional source of income. Everything else? This instills a disciplined habit of saving regularly.

The advantage of saving schemes is that they are supported by Government, thereby providing full protection and security of your invested money. Furthermore, they are low in risk but have decent returns at the same time. In general, interest rates on saving schemes are updated every 3-6 months.

Types of saving schemes in India can be broadly categorized into 2 types based on their popularity, financial security and returns:

National Savings Certificate (NSC)

National Savings Scheme (NSS)

National Savings Certificate (NSC)

The National Savings Certificate is a fixed income savings scheme offered by the Government of India which can be opened with any post office. This requires a savings bond which is proving tax-efficient for the borrower. It is ideally suited primarily for investors with a low risk tolerance from small to medium incomes. It is ideally suited primarily for investors with a low risk tolerance from small to medium incomes. It is comparable to other fixed income savings such as PPF (Public Provident Fund) and Fixed Deposits from Post Office. Being a safe and low-risk investment, however, also implies not guaranteeing high returns, especially when the stock market is volatile. In your name, you can buy an NSC, or hold a joint account with another person, or buy it for a minor. The government, however, only makes this scheme available to citizens of Indian nationality. HUFs (Hindu Undivided Families) and NRIs (Non-Resident Indians) are also not liable for an investment in NSCs.

Salient features and benefits of NSC Savings Scheme:

They are of two types based on their maturity periods of 5 years and 10 years.

NSCs do not have any maximum limits of purchase. However, investments of only up to INR 1.5 lakhs attracts tax benefits under Section 80C of the Income Tax Act, 1961.

The current rate of interest applicable on NSCs is 7.6% per annum. This interest rate is added to the investment and then compounded annually and serves as a stable source of regular income.

You can start with an investment as small as INR 100 and increase the amount as per your convenience.

Acceptable as collateral by banks and financial institutions as well as security for secured loans.

Acts as financial security and support for the nominee on the unforeseen demise of the investor.

The entire maturity value is payable to the investor when the investment completes its maturity tenure. However, since TDS on NSC pay-outs are applicable, NSC is not completely tax-free.

Investors are not eligible for premature withdrawal unless under exceptional circumstances like sudden death of the investor or legal order from the court.

National Savings Scheme (NSS)

The National Savings Scheme (NSS), backed by the Government of India, provides the maximum amount guaranteed after its maturity period is complete. Yearly, the relevant interest rate is multiplied. This also offers you the flexibility to prolong the time according to your investment goals. It is also tax deductible according to Section 80 C of the 1961 Income Tax Act.

Salient features and benefits of NSS Savings Scheme:

Offers fixed assured returns after it completes the maturity term. However, they are not market-linked like some other government schemes.

The rates on small saving schemes are revised and updated every quarter every quarter. This implies that you will be eligible for higher interest rates.

NSS schemes like PPF, Sukanya Samriddhi Yojana, NSC etc., attract tax exemptions of up to INR 1.5 lakhs under Section 80C of Income Tax Act, 1961. Besides, interest on Sukanya Samriddhi Yojana and PPF and Sukanya Samriddhi Yojana is also tax-free.

Investors are not eligible for premature withdrawal unless under exceptional circumstances like sudden death of the investor.

Public Provident Fund (PPF)

This scheme was introduced by the National Savings Institute, under the Finance Ministry of India, in 1968. It is an effective savings instrument, specifically for tax savings.

Salient features and benefits of PPF Savings Scheme:

Attracts an interest rate of 7.6% per year, which is then compounded annually.

Applicable on a minimum annual investment of INR 500 and a maximum of INR 1,50,000.

Payable in lump sum or through a maximum of 12 deposits in one financial year.

Maturity period varies from a minimum tenure of 15 years and can be extended up to a maximum of 5 more years, as per the discretion of the investor.

Offers further flexibility as it can be moved from one post office or bank to another.

Not applicable on joint accounts.

Investors are eligible for tax deductions under Sec. 80C of the IT Act, 1961. Besides, accumulated interest is completely tax-free.

The accumulated savings is accepted by banks and financial institutions as security and collateral during loan application from the third financial year.

Post Office Savings Scheme

Being one of the saving schemes that are most safe and efficient, it is the most suitable for investors with a low risk appetite. In addition to ensuring high returns for investors, the process is automated, fast and trouble-free. The inherent characteristics of high-end investment and saving schemes in India are followed by this.

Senior Citizens Savings Scheme (SCSS)

In particular, the Senior Citizens Savings Scheme was planned, keeping in mind the special needs of senior citizens in India, that is, people at least 60 years old. Nevertheless, people between the ages of 55 and 60 who have retired or opted for the Voluntary Retirement Scheme (VRS) are still entitled to qualify for the Senior Citizens Savings Scheme, but only if the savings plan account has been released within one month of obtaining their pension benefits.

Kisan Vikas Patra (KVP)

The Kisan Vikas Patra (KVP), initiated in 1988, is one of the Indian Postal Department's most favoured saving schemes. Postponing its initial phenomenal performance, this savings scheme was discontinued as a result of its abuse in 2011. Amid high demand it was re-introduced in 2014.

Sukanya Samriddhi Yojana (SSY)

The Sukanya Samriddhi Yojana (SSY) savings scheme, initiated by the Indian Ministry of Finance, was launched by India's Honorable Prime Minister, Mr. Narendra Modi, to secure the girl's future financially and to help her potential aspirations.

Source: https://hardejayant.blogspot.com/2020/03/types-of-saving-schemes-in-india.html

0 notes

Text

Government Savings Promotion Act

About Small Saving Schemes (SSSs)

They are important source of household savings for providing social benefit.

These can be classified under three heads;

(i) Postal deposits: Savings account, recurring deposits, time deposits of varying maturities and monthly income scheme(MIS)];

(ii) Savings certificates: (National Small Savings Certificate and Kisan Vikas Patra (KVP).

(iii) Social security schemes: Public Provident Fund (PPF), Senior Citizens Savings Scheme(SCSS), and Sukanya Samridhi Account Scheme.

Features of Small Saving Scheme

They offer slightly higher interest rates compared to bank deposits. Some of the small savings schemes also have income tax benefits, assure return and government’s guarantee.

All the money pooled form different SSSs goes to National Small Savings Fund (NSSF) which was established in 1999 within the Public Account of India.

More on News

The Act would be a merger of Government Savings Certificates Act, 1959 and Public Provident Fund (PPF) Act, 1968 with the Government Savings Banks Act, 1873.

No existing benefits to depositors are proposed to be taken away through this process, while certain new benefits have been proposed.

Moreover, no change in interest rate or tax policy on small savings scheme is being made through these amendments.

The proposed amendments intend to remove the various existing ambiguities due to multiple Acts and rules for Small Saving Schemes and also introduce certain flexibilities for the investors.

Present Scenario

There has been a sharp rise in government borrowings from small savings scheme in the past five years.

Small savings schemes accounted for a little over a fifth (20.9 per cent, in FY18) of all central government borrowing, up from 17.2 per cent a year before and 2.4 per cent in FY14.

Interest rates for small savings schemes are to be notified on a quarterly basis.

Proposed Amendments

Provision of premature closure of Small Savings Schemes may now be introduced to deal with medical emergencies, higher education needs, etc. -through specific scheme notification. Presently this provision is absent in PPF act.

Investment in small saving scheme can be made by a guardian on behalf of minor(s). The guardian may also be given associated rights and responsibilities- such as, provisions for nominations etc. Thus, the move will promote culture of savings among children.

Provisions of accounts for differently abled persons have now been made, which was not clear in aforesaid acts.

The amended Act place a mechanism for redressal of grievances and for amicable and expeditious settlement of disputes relating to Small Savings.

Other Issues and suggested Reforms

The sharp rise in central borrowing from small saving schemes distorts the interest rate structure, which hampers the cost of funds economy-wide. Thus, it is imperative to align the government borrowing with fiscal prudence.

Government needs to create a more conducive environment for monetary transmission, (process through which the policy action of the central bank is transmitted for stable inflation and growth) by aligning the rates on small savings schemes with market rates or to align SSSs to the benchmark Government Security yield, as suggested by the Urjit Patel committee report (2014).

The tax administration for the small savings instruments need to be made more efficient to ensure tax compliance (Shyamala Gopinath 2011).

#Government Savings Promotion Act#indianeconomy#upsccoaching#upscexam#chennai#annanagar#best ias coaching in chennai#INKARIASACADEMY

0 notes

Text

POST OFFICE SAVING SCHEMES INTEREST RATE 2019 – 20

The Post Office Small Saving Schemes is regulated by the Ministry of Finance. They have complete security of investment combined with attractive returns.

Some of the very popular schemes are given below,

PPF or Public Provident Fund

NSC or National Savings Certificate

Sukanya Samriddhi Scheme

Senior Citizen Savings Scheme

Kisan Vikas Patra or KVP

Time Deposits

Recurring Deposits

Monthly Income Scheme or MIS

Latest Post Office Small Saving Schemes Interest rates July – Sep 2019

– 20 -Highlights

The Government of India has reduced the interest rate on small savings schemes by 0.1 per cent for the July-September quarter of FY 2019-20.

But the interest rate on Savings Deposit account remains @ 4% as earlier.

The RBI cuts key Interest rates on June 2019

Earlier the interest rates announced once in a year. But, now from 2016-17, the rate of interest calculated on a quarterly basis.

Latest Post Office Small Saving Schemes Interest rates July – Sep 2019 – 20 Quarter 2

Sukanya Samriddhi Scheme(SSA ) -8.4%.

PPF(Public Provident Fund) -7.9%.

Senior Citizen Savings Scheme(SCSS) – 8.6%.

Kisan Vikas Patra(KVP) -7.6%.

National Savings Certificate(NSC) -7.9%.

MIS(Monthly Income Scheme) -7.6%.

Latest Post Office Saving Schemes – details

Savings Account Post Office

The post office departments provide a deposit scheme named savings account post office is a deposit scheme. It is a helpful scheme for rural customers. Post offices nationwide reach is much greater than banks. A large number of underserved people can get access to their accounts through post offices. It is a better option for the people who are looking for a regular income without exposure to risk.

An Indian citizen can open this account.

In case of a minor, he/she should be at least 10 years old.

Two or three persons can open a joint account.

A person who is not of sound mind can also open this account.

It just requires a minimum balance of Rs. 20 to open the account.

Customers can withdraw their cash either completely or partially if needed.

Customers can avail an assured return on all the investments so the risk exposure is very less.

Account holders can transfer their account to one post office to another.

Some of the post offices also provide the facility of debit cards.

Parent or guardian of a minor can open the account in the name of minor and operate that account.

In case of any demise to the account holder, they can nominate a person to whom the funds will be transferred.

Account opening process is quick and hassle-free because savings account post office does not have any maturity period.

Customers can convert their individual account to a joint account.

Rural area people can also open a savings account.

Steps To Open A Savings Account In Post Office

Fill the application form and submit it to the nearest post office with the required documents.

Pay the amount that you wanted to save in your savings account not less than Rs. 20.

If you want to open a savings account without a chequebook, then you have to deposit Rs. 50 as a minimum balance.

For senior citizens, separate forms are available.

After paying that minimum amount, your savings account will be generated.

Public

Provident

Fund or PPF

The safest small saving scheme among theTop Small Saving Schemes.

From 01.07.2019 the interest rate is 7.9% per annum (compounded yearly).

An individual can open an account with Rs 100/-

The minimum contribution is Rs 500/- in a financial year.

The maximum contribution is Rs 1,50,000/- in a financial year.

It is a 15 years plan and extended further 5 years several times.

Premature closure is not possible before 15 years.

A joint account not exist.

You can open an account by cash/cheque.

Nomination facility is available in this scheme.

It comes under EEE category.

Interest is completely Tax-free.

Withdrawal is permissible from the 7thfinancial year every year.

Loan facility available from the 3rdfinancial year.

PPF is not attached under court decree order.

National Saving Certificate or NSC

– Post Office Saving Schemes

From 01.07.2019 the interest rate is 7.9% per annum (compounded yearly but payable at maturity).

An individual can open an account with Rs 100/-

Maximum has no limit.

It is a 05 years plan.

Premature closure is not permitted.

You can open an account by cash/cheque.

Nomination facility is available in this scheme.

It comes under EET category.

Interest is not Tax-free.

NSC Certificate is valid for availing loan from a bank.

Must Read-

E INSURANCE ACCOUNT – HOW TO OPEN, BENEFITS AND USE

Sukanya Samriddhi Yojna – Post Office Saving Schemes

From 01.07.2019 the interest rate is 8.4% per annum (compounded yearly).

An individual can open an account with Rs 1,000/-

A legal guardian can open this account in the name of girl child up to 10 years.

Minimum contribution is Rs 1,000/- & maximum contribution is Rs1,50,000/- in a financial year.

It is a 21 years plan.

Premature closure is possible in some special situations only.

You can open an account by cash/cheque.

Nomination facility is available in this scheme.

It comes under EEE category.

Interest is Tax-free.

50% of withdrawal is allowable for higher education or marriage after attaining 18 years.

Senior Citizen Savings Scheme or SCSS

– Post Office Saving Schemes

An individual of age 60 or more may open this account.

An individual of age 55 or less than 60 years under VRS may open this account.

From 01.07.2019 the interest rate is 8.6% per annum (compounded yearly).

It is a 05 years plan.

An individual can open an account with Rs 1,000/-

Maximum deposit limit is 15 lakhs.

An account can be opened by cash if the amount is below 1 lakh and for 1 lakh and above by cheque.

Nomination facility is available in this scheme.

Premature closure is permissible after one year with a penalty of 1.5 % and after 2 years with 1% penalty.

The joined account can open with spouse only.

TDS is deductible if interest is more than Rs.10,000/- per annum.

Read More –

SMALL FINANCE BANK IN INDIA

Kishan Vikas Patra or KVP

– Post Office Saving Schemes

It is a safe investment not related to market risk.

From 01.07.2019 the interest rate is 7.6% per annum (compounded yearly).

An individual can open an account with Rs 1,000/-

Maximum has no limit.

The maturity period of this scheme is 118 months.

Nomination facility is available in this scheme.

A certificate can be transferred from one person to another person.

A certificate can be encashed after 2.5 years or 30 months from the date of issue.

Interest earned is Taxable.

KVP Certificate is valid to avail loan as collateral security.

Post Office Monthly Income Scheme

– Post Office Saving Schemes

From 01.07.2019 interest rate is 7.6% per annum payable monthly.

Minimum amount is in multiples of INR 1500/-

Maximum investment limit is INR 4.5 lakh in a single account and INR 9 lakh in the joint account

You can invest maximum INR 4.5 lakh in MIS including his share in joint accounts

For calculation of the share of an individual in a joint account, each joint holder have an equal share in each joint account

Any individual can open this account.

You can open it by cash/Cheque and in case of Cheque the date of realization of Cheque in Govt. account is the date of opening of an account.

Also, nomination facility is available at the time of opening and also after opening of an account.

An account is transferrable from one post office to another.

Additional Features of –

Post Office Monthly Income Scheme

Any number of the account you can open in any post office subject to a maximum investment limit by adding balance in all accounts.

You can open an account in the name of a minor.

Also, a minor age 10 years and above can open and operate the account

Two or three adults can open Joint Account.

Further, all joint account holders have an equal share in each joint account.

You can convert a single account into Joint and Vice Versa.

The Minor after attaining majority has to apply for conversion of the account in his name.

The Maturity period is 5 years from 1.12.2011.

Interest can be drawn by auto credit into savings account standing at the same post office, through PDCs or ECS.

But in case of MIS accounts standing at CBS Post offices. The monthly interest will credit into savings account standing at any CBS Post offices.

Prematurecloser after one year but before 3 years at the discount of 2% of the deposit and after 3 years at the discount of 1% of the deposit. (Discount means deduction from the deposit.)

Must Read –

SAVINGS ACCOUNT POST OFFICE – DETAILS AND BENEFITS

5-Year Post Office Recurring Deposit Account (RD)

From 01.07.2019, the interest rate is 2 % per annum (quarterly compounded)

On maturity INR 10/- account fetches INR 725.05. You can continue for another 5 years on year to year basis

Minimum INR 10/- per month or any amount in multiples of INR 5/-. No maximum limit.

You can open an account by cash/cheque and in case of Cheque the date of deposit shall be the date of presentation of Cheque

The nomination facility is available at the time of opening and also after opening of account

The account is transferrable from one post office to another

You can open an account in the name of a minor.

Also, a minor of age10 years and above can open and operate the account

Two adults can open Joint account.

Additional Features of 5-Year Post Office Recurring Deposit Account (RD)

The subsequent deposit is acceptable up to the 15th day of next month if the account is opened before 15th of a calendar month.

Deposit is possible up to the last working day of next month if the account opening is between the 16th day and last working day of a calendar month.

If a subsequent deposit is not made up to the prescribed day, a default fee is chargeable for each default, default fee @ 0.05 rs for every 5 rupees.

After 4 regular defaults, the account becomes discontinued. But it can be revived in two months but if the same is not revived within this period, no further deposit can be made.

If in any RD account, there is a monthly default amount, then the depositor has to first pay the defaulted monthly deposit with a default fee. Then pay the current month deposit. This is applicable for both CBS and non-CBS Post offices.

There is a rebate on advance deposit of at least 6 instalments

A single account is convertible into Joint and Vice Versa

Minor after attaining majority can apply for conversion of the account in his name

One withdrawal up to 50% of the balance is only allowed after one year.

Post Office Time Deposit Account

–

Post Office Saving Schemes

Interest payable annually but calculated quarterly

The minimum amount for account opening Rs200/-. Maximum no limit.

An individual can open this account.

The account can be opened by cash /Cheque and in case of Cheque the date of realization of Cheque in Govt. account is the date of the opening of account

The Nomination facility is available at the time of opening and also after opening of account

An account is transferable from one post office to another

Any number of accounts you can open in any post office

You can open an account in the name of a minor.

Also, a minor of age 10 years and above can open and operate the account

Two adults can open a Joint Account.

Also, a Single account is convertible into Joint and Vice Versa

The Minor after attaining majority has to apply for conversion of the account in his name

In CBS Post offices, when any TD account is matured, the same TD account will be automatically renewed for the period for which the account was initially opened.

0 notes

Text

5 Safe Investment Options with High Returns for FY 2017-18

Investors looking at growing wealth in a low risk manner have quite a few options. Based on their objectives and individual risk profiles, they can choose from these best investment plans and options in India,preferably by diversifying money across investments.

While investors are specific in their quest for safe investment options and plans in India, it’s important to understand that safe investment options don’t really exist in India or any part of the world. As they say – the only safe investment option is the savings bank account. And even then, your money won’t earn a return. In fact, it won’t even survive the eroding effects of inflation. So you may actually lose money in a savings account in terms of purchasing power.

So what investors should really gun for are low risk investments that offer a reasonable return. While there are quite a few of them in the market, we shortlist the five options that are worth considering:

i. Fixed deposits

Fixed deposits (FDs) are a low risk investment that can help grow money over time. Investors can choose from bank FDs or company FDs. Certain FDs also offer income tax benefits.

While investing in FDs may seem simple, investors must consider a few points while selecting the FD most suited to their needs:

Credit profile – this helps determine whether the company will honour all capital and interest payments – higher rated FDs (AAA/FAAA) should be preferred

Interest rate – this is the rate of return on the FD, so a higher rate is obviously preferable. However, make sure you do not compromise on the credit rating for a higher return.

Interest payout frequency - FDs are known to offer interest payouts at varying frequencies - monthly, quarterly, annually or a one-time payment on maturity. You must opt for the one that meets your needs. The one-time payment or ‘on maturity’ option generates the highest return, thanks to the effect of compounding.

ii. Post-office schemes

Favoured by conservative investors, they include:

The schemes are ideal for individuals with long term investment. They have varying tenures, interest rates and tax implications. Your choice best investment option/plan in India depends on your specific needs and financial goals.

NSC (National Saving Certificate)

PPF (Public Provident Fund)

POMIS (Post office monthly income scheme)

POTD (Post-office time deposit)

KVP (Kisan Vikas Patra)

iii. Endowment plans

Insurance companies launch endowment plans to offer life cover combined with savings. In insurance parlance, they are ‘with profits’ plans. Endowment plans assure a payout regardless of whether the policyholder survives the tenure or not.

iv. Bonds

Bonds work in much the same way as FDs, with the exception that certain bonds are traded in the secondary market which makes them liquid. Given the similarities between the two, bonds must be analysed in the same manner as FDs. So if you want to invest in them, it’s a good idea to consider parameters like credit rating of the bond, rate of interest and the frequency of compounding. Certain bonds, like infrastructure bonds, also offer tax benefits.

v. Bond funds

As the name suggests, debt funds or bond funds invest in fixed income securities like corporate bonds, government securities (gsecs/gilts), money market instruments, among the best investment plans in India. They are offered by mutual funds as also life insurers. Bond funds have more variety, greater flexibility, higher liquidity and superior tax benefits compared to bonds.

0 notes

Link

KisanVikaspatrayojna is a small long-term saving scheme launched back in the year 1988.

0 notes

Text

7 Investment Avenues for Your Post-Retirement Portfolio

Shekhar, a computer engineer by profession, was planning to retire soon.

He had been setting aside all his monthly savings in bank FDs, and was having EPF and gratuity accounts too, which he thought would suffice to take care of his post-retirement needs.

But, as he was getting closer to his retirement, there were three questions on his mind that somehow disturbed him.

‘How long will I survive?’

‘Will my savings last long enough to support me during retirement?’

‘Will it sustain me till the end of my life and support my family after I’m gone?’

Walking home one evening, he was deeply engrossed with his thoughts on life post-retirement and meets his friend Rahul on his way.

Rahul, a financial planner, retired a year ago and is enjoying his retirement life.

So Shekhar decided to discuss his concerns with him.

Unfortunately, most of us begin to worry about our post-retirement life at the brink of retirement phase.

Rahul explained that when retirement begins, income stops, and expenses continue. The years from the start of retirement till demise are unpredictable, however financially preparing for this time of our lives is imperative for our survival. He concluded that our investments/savings act as a steady source of income during our retirement phase.

With the old conservative saving strategy, the money cannot last long as it cannot beat the rising cost of inflation. It will be over before you take your last breath and that you missed the train of the power of compounding because you did not invest in equities in your youth.

But now that Shekhar had completely missed planning for his retirement, should he go overboard and invest all his money in equities? Maybe he will be putting his entire savings at risk, as he is a couple of years away from his retirement.

The solution Rahul gave Shekhar was to diversify his investments across avenues suitable for retirees, once he attains his retirement year.

Rahul continued that most of the investment schemes for retirees are government backed. So, the risk involved is very less and to invest one must comply with the KYC norms.

But one needs to be cautious, as not all small saving schemes are able to beat the inflation and may hamper one's retirement.

Pick your post-retirement schemes carefully, so that it takes care of not only the regular source of income but also provides decent growth in the capital on your retirement corpus.

Here is the list of investment avenues one may consider for a blissful retired life.

Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Saving Scheme allows you to invest your hard-earned retirement corpus in a safe product and offers the benefit of quarterly interest payment (payable on the first working day of April, July, October and January). You can invest a one-time fixed sum in the SCSS, for a steady source of income.

It is a suitable investment that can be held by any retiree (single or joint with spouse) aged 60 years and above for a term of 5 years. An individual of the age between 55 years and 60 years who have retired on superannuation or under VRS can also open an SCSS account.

The scheme currently earns a decent interest of 8.3% per annum.

The total investment in the SCSS shouldn’t exceed Rs 15 lakhs and not below Rs 1,000.

The principal amount invested is eligible for a benefit under Sec. 80C of the Income Tax Act, but up to Rs 1.5 lakhs p.a. However, on premature withdrawal, a deduction charge is levied.

Under the SCSS, the interest earned is taxable as per the prevailing slab rates. However, TDS is applicable only if the interest income exceeds Rs 10,000 in a financial year.

On maturity of the SCSS account, you have the option to extend the account for another three years. But you need to apply within one year of maturity by applying in the prescribed format.

Post Office Time Deposits (POTD)

Post office Time Deposits work similar to fixed deposits. You can invest your money in these deposits for a pre-specified time horizon; i.e. 1-year, 2-year, 3-year, or 5-year tenure.

You can open the account either in a single name, or jointly, or even in the name of a minor (through a guardian) who has attained the age of 10 years.

The minimum investment amount is Rs 200, with no upper limit. However, the investment amount over Rs 1.50 lakh will not be eligible for any tax benefit.

A 5-Yr POTD currently earns an interest of 7.4% p.a., which is calculated quarterly but paid annually. The premature withdrawals are permitted only after a year from the date of deposit, subject to a penalty in the form of reduced interest rate.

The investment in a 5-year POTD qualifies for a tax deduction of up to Rs 1.50 lakh p.a. under Section 80C. But the interest earned on your investments is taxable under Section 80C.

Recurring Deposit (RD)

Recurring Deposit, a facility offered by Post Office and Banks, can help you gradually save for your future goals by allocating a small sum regularly.

5-Year Post Office Recurring Deposit Account offers you an interest of 6.9% per annum, compounded quarterly. Although the interest is calculated quarterly you will receive it only at maturity.

It is very convenient to invest in RD by cash or through cheque with a minimum sum of Rs 10 or in multiples of Rs 5 with no maximum limit of investment.

While the investment period in RD offered by banks varies from 6 months to 10 years the ones offered by post office come with a tenure of 5 years, with an option to continue for another 5 years on maturity.

You can open the account either in a single name, or jointly, or even in the name of a minor (through a guardian) who has attained the age of 10 years.

In case of 5-Year Post Office RD, one withdrawal up to 50% of the balance is allowed after completion of one year. It may be repaid in one lump sum along with interest at the prescribed rate. Nowadays most banks allow premature withdrawals on RD with a penal rate of interest charge.

Post Office Monthly Income Scheme (POMIS)

Post Office MIS is considered a preferred monthly investment avenue for individuals who seek to earn a regular income, especially after retirement. Any person in his individual capacity or jointly (by two or three adults) can invest in this scheme. However, post office MIS comes with a maturity period of 5 years.

You can invest in a multiple of Rs 1,500/- with a maximum amount of Rs 4.5 lakh for a single account holder, while joint account holders can hold up to Rs 9 lakhs in an account.

At present, the interest earned on a POMIS is at 7.30% p.a. which is compounded annually but paid monthly to take care of your monthly income.

While you can hold any number of MIS accounts in any number of branches of the post office, it does have a few restrictions. The total investment by an individual in an MIS account cannot exceed Rs 4.5 lakhs, including his share in joint accounts. This restricts the number of accounts an individual can open, either individually or jointly.

National Savings Certificates (NSC)

Issued by the Post Offices in India, the NSC is optimum for post-retirement earnings as there is minimal risk involved. NSCs have a fixed lock-in period of 5 years and offer tax benefits too.

The minimum investment amount required is in denominations of Rs 100 to Rs 10,000 with no maximum limit to investment.

While you may not be able to invest in NSC just like SIP in a mutual fund, you need to make a separate purchase of NSC’s every month, if you wish.

Currently, the interest rate on a 5-year NSC is 7.60% p.a. compounded annually, but payable at maturity; i.e. you will receive accrued interest along with principal on maturity.

Premature withdrawal is not possible in case of NSC unless there is an occurrence of an unfortunate event like the death of the holder, holder of certificate forfeiting them through a pledge, a court of law ordering the pre-mature withdrawal of NSC, etc.

The interest on NSC accrues annually but is deemed to be reinvested under Section 80C of IT Act. The deposits along with the accrued interest on NSC qualify for deduction u/s. 80C, subject to a maximum limit of Rs 1.50 Lakhs in a financial year. There is no TDS on the interest earned on an NSC.

Kisan Vikas Patra (KVP)

It is a small savings scheme which doubles the invested amount in approx. 118 months (9 years and 10 months), at the current rate of 7.3% p.a.

The interest income earned on KVP is taxable as per the tax slab of the investor and TDS at 10% will also be deducted. Moreover, the amount invested in KVP is not eligible for a benefit under Sec. 80C.

While one needs to invest a minimum of Rs. 1,000 in KVP and in multiples of Rs. 1,000 thereafter, there is no limit to the maximum amount of investment. KVP is issued in various denominations of Rs 1,000; Rs 5,000; Rs 10,000 & Rs 50,000.

You can prematurely withdraw from NSC, after 2 and ½ years from the date of issue. The amount you receive on such premature withdrawal depends on the period of your holding. This feature makes KVP liquid vis-à-vis PPF and NSC.

Mutual Funds (MFs)

Investment in mutual funds are linked to the market and are a little riskier as compared to the ones mentioned above. However, the impact of near-term volatility can fade over time and offer you a decent growth on invested capital.

If you are prudent, choose stable large-cap or hybrid funds with a suitable time horizon in mind. The investments in mutual funds can be later used as a monthly source of income through Systematic Withdrawals Plans offered by them. The returns from such funds may help you cope with the inflation during your retirement years so that the value of your retirement corpus does not diminish in value.

[Read: What Is A Mutual Fund? – A Guide to Mutual Fund Basics]

Sometimes, it is difficult to decide which funds to choose, but premium research services like PersonalFN’s FundSelect Plus.You can choose from 7 High-Performing, Time-Tested Readymade Portfolios offered under FundSelect Plus. These portfolios are backed by decade-long market-beating track record.

Our recommended portfolios have outperformed the markets by as much as over 80%! The best part is, these portfolios are crafted as per your risk profile and investment time horizon.

To conclude…

Shekhar regretted not investing earlier in life but learnt about various post-retirement schemes to erase some of his worries.

Although Shekhar missed the benefit of planning his retirement early, you can still manage a peaceful retirement by taking guidance from a certified financial planner.

I hope you too wouldn’t want to repeat the same mistake as Shekhar did and do plan your retirement earlyfor a blissful retired life. Reach out to PersonalFN’s Financial Guardians, on 022-61361200 or write to [email protected]. You may also fill in this form, and soon our experienced financial planners will reach out to you.

Author: Aditi Murkute

This post on " 7 Investment Avenues for Your Post-Retirement Portfolio " appeared first on "PersonalFN"

#Retirement#Postretirement#Financialplanning#financialdiscipline#personalfinance#financialinvestment

0 notes

Photo

New Post has been published on https://diginewspoint.com/best-saving-schemes-in-post-office-retirement-girl-marriage-to-millennials-the-risk-free-investment-caters-everyone/

Best Saving Schemes in Post Office: Retirement, girl marriage to millennials, the risk-free investment caters everyone

Saving Schemes in Post Office are issued and managed by the Government of India. These are risk-free investment avenues which are ideal for tax-saving too. If you are looking for a long-term guaranteed way of generating wealth then post office saving schemes is ideal as it carries a sovereign guarantee. Moreover, different types of schemes […]

Saving schemes in post office offers flexibility and risk-free return

Saving Schemes in Post Office are issued and managed by the Government of India. These are risk-free investment avenues which are ideal for tax-saving too. If you are looking for a long-term guaranteed way of generating wealth then post office saving schemes is ideal as it carries a sovereign guarantee. Moreover, different types of schemes are relevant for different purposes. The legislative has ensured that your hard earned money is not only invested with a risk-free return but also practical needs of the wage earning class can also be taken into account.

Retirement can be practically very sensitive. Hence, it becomes important to be aware about the investment plans at our disposals. These plans not only provide compounded interest but also, tax advantages.

1 .National Saving Certificate

Return- 7.6% compounded annually and payable at maturity

The minimum investment amount is Rs. 100 and in multiples of Rs. 100 and there is no maximum limit. The deposit amount qualifies for tax deduction under section 80C of the IT act. The interest accrued annually and deemed to be reinvested is allowed deduction under section 80C of the Income tax act.

2. 15 year Public provident fund

Return- 7.6% per annum compounded yearly.

Maximum investment allowed is Rs. 150,000 in a financial year. Depositors can invest in lump-sum or in twelve installments. Joint account is allowed. Nomination and transfer facility is available. The maturity period of 15 years can be extended for further 5 years and so on. Premature closure is not allowed before 15 years. Deposits are qualified for deduction under section 80C of the IT act. Also, the interest is completely tax free.

3. Senior Citizen Saving Scheme

Return- 8.3% per annum and interest payable on 31st March, 30th June, 30th Sept and 31st December in individual or joint capacity

Maximum limit is Rs. 15 lakhs. An individual of age 60years or more may open the account. The depositor has an option of opening the account below Rs.1 lakh by cash and for Rs. 1 lakh and above by cheque only. Nomination and transfer facility is available. Tax will be deducted at source if the interest amount is more than Rs. 10000. This investment qualifies for the tax benefit under section 80C of the income tax act, 1961.

Millenials who wish to park their early earned income in safe hands but not for a very long period of time have following options

1. 5-year post office Recurring Deposit Account

Return- 6.9% per annum compounded quarterly on individual/joint account

Account can be opened by cash or cheque. Nomination and transfer facility is available. Account can be opened in the name of a minor and a minor of years and above can open and operate the account. One withdrawal up to 50% is allowed after one year. Premature closure is permissible after 3 years

2. Post Office Time Deposit Account

Return- 6.6% for one year a/c, 6.7% for two year a/c, three year a/c and 5 year a/c 7.4% for an individual

Nomination and transfer facility is available. Account can be opened in the name of a minor and a minor of 10 years and above can open and operate the account. However, on attaining majority minor has to apply for conversion of account. This investment qualifies for the benefit of section 80C of the Income Tax Act, 1961. Minimum of Rs.200 is required for opening of an account.

3. Post office Monthly Income Scheme Account

Return- 7.3% per annum payable monthly to individual/joint

Minimum amount required for opening the account is Rs.1500 and maximum investment limit is INR 4.5 lakhs in single account and INR 9 lakhs in joint account. Nomination and transfer facility is available. Maturity period of 5 years. Account can be opened in the name of a minor and a minor of 10 years and above can open and operate the account. It can be prematurely en-cashed after one year but before 3 years at a deduction of 2% of the deposit and after 3 years at a deduction of 1% of the deposit. A bonus of 5% on principal amount is admissible on maturity.

Worrying about your gild children education and marriage? Post office saving scheme includes a specific investment plan for your girl children. You can start planning for your daughters big events in life from the time she is born. Also, the return is slightly more as compared to other plans.

1. Sukanya Samriddhi Account

Return- 8.1% per annum compounded yearly.

Minimum contribution is Rs 1000 and a maximum amount is Rs 150,000 in a financial year. There is no limit on number of deposits either in a month or in a financial year. Account can be closed after the attainment of 21 years of age by a girl child. Partial withdrawal is allowed for education and marriage expenses after the girl child attains the age of 18 years. The account can be opened up-to age of 10 years only from the date of birth. A guardian can open only one account in the name of one girl child and maximum two accounts in the two girl children.

Saving Schemes in Post Office also cater to farmers progress. The amount invested doubles till the maturity amount.

1. Kisan Vikas Patra

Return- 7.3% compounded annually.

Minimum investment required is Rs.1000 and there is no maximum limit. Certificate can be purchased by an adult for himself or on behalf of a minor. The maturity period is of 9 years and 10 months. Facility of nomination and transfer is available. The Lock in period is of 2.5 years.

0 notes