#payment gateways

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world.

Introduction:

Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

0 notes

Text

The Role of Payment Gateways in Middle East E-Commerce Expansion

UAE’s ecommerce market is poised to generate sales worth USD 8 billion by 2025, as per the Dubai Chamber of Commerce and Industry.

0 notes

Text

Bulk Payout API & its role in simplifying finances

Bulk Payout API is a kind of an API that provides a convenient way to disburse payment to multiple recipients in a single transaction. Here we are going to throw some light on the structure and benefits of bulk payout APIs & how they can revolutionize your financial operations.

Understanding Bulk Payout APIs:

Bulk Payout APIs are software interfaces that enable businesses to send payments to multiple recipients in a single transaction in just one minute. These APIs work by integrating with the company's existing systems, allowing for seamless transfer of funds to multiple accounts at once. Key components of Bulk Payout APIs include authentication mechanisms, transaction processing engines, and reporting tools to track payment statuses.

Benefits of Bulk Payout APIs:

One of the primary advantages of Bulk Payout APIs is their time-saving potential. By automating the payment process, businesses can significantly reduce the manual efforts. This automation not only saves time but also minimizes the risk of errors.

Additionally, Bulk Payout APIs offer cost-effective solutions by consolidating multiple payments into a single transaction. This consolidation results in lower transaction fees and reduced administrative expenses, leading to significant cost savings for businesses.

In the age of digital commerce, efficiency is the currency of success. Embracing Bulk Payout APIs not only streamlines financial transactions but also unlocks the potential for businesses to focus on growth and innovation, leaving behind the constraints of manual payment processing.

Your Gateway to Efficient Financial Management in India

Discover the top providers of Bulk Payout APIs in India, including industry leaders like Razorpay, Cashfree, Waayupay and more. Unlock the potential of streamlined financial transactions and find the perfect solution to meet your business needs.

Use Cases:

Bulk Payout APIs find applications across various industries and business models. E-commerce platforms, for instance, leverage these APIs to streamline vendor payments, affiliate commissions, and supplier transactions. By automating the payout process, e-commerce businesses can enhance efficiency and build trust with their partners.

Implementation Considerations:

When implementing Bulk Payout APIs, businesses must consider several factors to ensure successful integration and operation. Integration ease, for example, is crucial, as businesses seek APIs that seamlessly integrate with their existing systems and infrastructure. Additionally, compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is paramount.

Furthermore, customization options play a vital role in tailoring Bulk Payout APIs to specific business needs and branding requirements. Businesses should seek APIs that offer flexibility and customization capabilities to align with their unique preferences and workflows.

Case Studies:

To illustrate the effectiveness of Bulk Payout APIs in real-world scenarios, let's consider a few case studies. Company A, an e-commerce platform, implemented a Bulk Payout API to automate its vendor payments. By consolidating multiple payments into a single transaction, Company A reduced its administrative workload by 50% and achieved significant cost savings on transaction fees.

In both cases, the implementation of Bulk Payout APIs resulted in tangible benefits, including increased efficiency, cost savings, and improved user experience.

Conclusion:

Bulk Payout APIs offer a powerful solution for businesses seeking to streamline their financial operations. By automating the process of disbursing payments to multiple recipients, these APIs save time, reduce costs, and enhance security. With applications across various industries, Bulk Payout APIs have become indispensable tools for optimizing financial workflows and driving business growth. As businesses continue to embrace digital transformation, Bulk Payout APIs will play a central role in shaping the future of financial transactions.

#payout api#instant payment#instant payout api#bulk payout#payment gateways#bulk payment api#bulk payout api

0 notes

Text

Explore the advantages and disadvantages of using Shopify for dropshipping in 2024. Learn about Shopify's user-friendly interface, customization options, and scalability, along with considerations such as cost, transaction fees, and competition. Consider hiring Webgarh Solutions for expert Shopify dropshipping store development services to maximize your e-commerce success.

#shopify#dropshipping#ecommerce#shopify store#customization#shopify apps#payment gateways#ecommerce platforms#web development#shopify development#webgarh solutions

0 notes

Text

Unleashing Success: The Power of Ecommerce Development Companies

In the rapidly evolving digital landscape, ecommerce has become the driving force behind countless successful businesses. Behind the seamless online shopping experiences and robust digital storefronts are the unsung heroes – ecommerce development companies. In this blog post, we’ll delve into the pivotal role these companies play in unleashing success for businesses in the digital…

View On WordPress

#Brand Identity Online#Business Growth#Custom Ecommerce#Digital Commerce#Digital Storefront#Ecommerce Development#Ecommerce Features#Ecommerce Maintenance#Ecommerce Platforms#Ecommerce Security#Ecommerce Solutions#Ecommerce Success#Ecommerce Website#Mobile Ecommerce#Online Store Development#Payment Gateways#Scalable Ecommerce#User Experience Design#Web Development Services#Website Customization

0 notes

Text

Casino Merchant Account

#Casino Merchant Account#payment gateway#online payment gateway#best payment gateway in india#payment gateways#top payment gateways in india#payment gateway by digitain#best payment gateway in 2022#payment gateway for website#singapore#singapore news#gambling#singapore online casino#singapore current affairs#online payment#payment#digital payments#ecommerce payments

1 note

·

View note

Text

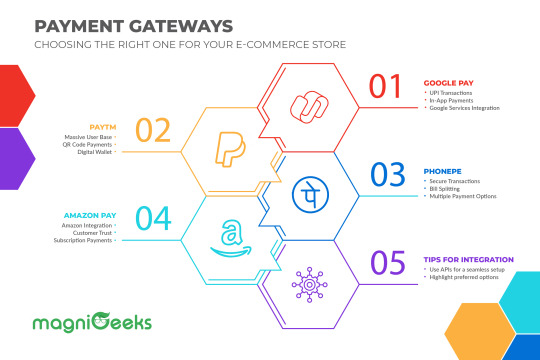

Choosing the right payment gateway is akin to selecting a trustworthy partner for your e-commerce journey. It should align with your business goals, provide a secure environment, and offer the flexibility needed to cater to your unique customer base. By carefully weighing the factors mentioned above, you can make an informed decision that propels your e-commerce store to new heights of success. The right payment gateway is not just a transaction facilitator; it's a cornerstone of customer trust and satisfaction in the digital realm. To know more visit us at https://shorturl.at/elnCQ

0 notes

Text

Role of Modern Payment Gateways in the Ecommerce Industry

Technology has become ubiquitous across the industries. In any business, the role of technology is not confined to performing a particular function. It is responsible for making all the business operations efficient and streamlined.

One of the industries where the role of technology has been crucial is the ecommerce industry. From placing orders by the customer to performing the delivery by the agent, the technology has a role to play.

The payment transaction is considered to be an essential part of any business. The role of payment transactions increases manifold when the transactions are done online as it contributes an important part to the shopping journey of a buyer.

Any ecommerce marketplace platform not providing smooth transactions to the customers is going to negatively impact the sales of the business. Payment transaction methods should be business-friendly.

Buyers should be able to find the payment method of their choice and complete the purchase in a few clicks or touches of a smartphone. Similarly, the vendors and the aggregator should be able to receive their part of the amount smoothly and instantly.

The developers are leaving no stone unturned in making the ecommerce marketplace software efficient and business-friendly.

Businesses have got the luxury of integrating the ecommerce platform with the payment method of their choice.

Not just the ecommerce websites but the mobile ordering apps also provide the facility of online payment through the gateway of consumers’ choice.

The advancements in technology have led to the introduction of automatic settlement of payments between the aggregator and the vendors. As soon as the buyer makes the payment, the amount is instantly split between the aggregator and the vendor. This indicates that the multi vendor marketplace software not only keeps consumer convenience at the forefront but also boosts the experience of the sellers as well.

According to the Market Statsville Group (MSG), the global payment gateway market size is expected to grow from USD 39,118.86 million in 2022 to USD 204,011.03 million by 2033, growing at a CAGR of 16.2% from 2023 to 2033. The payment gateway market has witnessed significant growth in recent years, driven by the rapid expansion of e-commerce and digital payment solutions.

#ecommerce marketplace#hyperlocal ecommerce platform#multi vendor ecommerce#multi vendor marketplace#multi vendor marketplace platform#multi vendor ecommerce software#payment gateways

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Building Better Payment Experiences Helps Companies Navigate The “Great Reshuffle”

Building a company for where the world is going requires organizations to align with how their customers and workforces want to be paid: through experiences that are immediate, personalized, and inclusive of each recipient’s preferred payment modality and spend channel.

0 notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world.

Introduction:

Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

1 note

·

View note

Text

A Complete Guide to WooCommerce – Everything You Need to Know

WooCommerce is one of the leading eCommerce solutions that is exclusively designed for WordPress websites. It has more than 4 million active installs and a huge number of satisfied online store owners.

As per research, almost 28% of all eCommerce stores are based on WooCommerce. If you too are planning to take your business online through your WordPress site, you must read this article entirely to find out why WooCommerce can be a great solution for it.

Before exploring the complete guide to WooCommerce for beginners, let us first introduce you to WooCommerce in detail.

What is WooCommerce?

If you have a WordPress based business website to sell your products and services, you must be aware of the term WooCommerce. WooCommerce is nothing but an eCommerce software that simplifies the process of selling products and services online for business owners. It is one of the most popularly used eCommerce platforms that is preferred by businesses of all sizes.

WooCommerce is created as a WordPress extension which is currently holding the position of the most popularly used website builder in the market. It is used to build a full-fledged eCommerce website with the shopping cart functionality.

Being an open-source platform, it is absolutely free to download but you do need to pay for the domain name and hosting service to create your WooCommerce based ecommerce website. In this WooCommerce tutorial you will find out how you can set up your own WooCommerce based website and some of the popular WooCommerce based plugins that you can use.

Here are some of the main reasons why WooCommerce can be the best solution for your WordPress website.

Why WooCommerce is the best choice for your eCommerce Website?

WooCommerce has empowered almost 28% of total online shops which is huge. The best part about WooCommerce is that it helps you create a basic eCommerce shop without any cost and also lets you add any additional feature or functionality on your website.

WooCommerce is not only a free platform which anyone can use but it also gives the entire control of a website to its owner.

WooCommerce does not include the licensing fees in its pricing structure which signifies that you can create an unlimited number of eCommerce sites.

As it is an extension of WordPress, you can utilize the advantages of all the powerful features that WordPress offers.

Besides WooCommerce based addons, thousands of other WordPress plugins can also be added to your eCommerce site for additional features.

One of the biggest advantages of WooCommerce is that it supports multiple payment gateways which makes transactions easy for eCommerce site owners. By default it comes with Stripe and PayPal.

It offers a huge array of designs and layouts for your eCommerce sites.

It is so easy to use that even a person with little technical knowledge can also use it.

SEO friendly.

Quality support from the community.

It also ensures payment security.

For all these advantageous features, WooCommerce has become one of the most desired platforms for eCommerce website owners.

WooCommerce Payment Gateways

A payment gateway refers to a platform that helps you receive payments from your buyers. You can simply avoid the financial and legal trouble that it takes to process the money yourself by relying on a third party payment that will do everything on your behalf.

When it comes to an online store, having an efficient payment solution is crucial. Such payment solutions need to be convenient, secure and trustworthy for the customers.

WooCommerce fulfills all these criteria and offers a huge list of payment gateways to make the payment process easy for both sellers and buyers. Here we have mentioned 7 best payment gateways in 2023 that WooCommerce supports.

We have found almost 80 WooCommerce extensions in payments and handpicked 6 amongst them.

Stripe: It is one of the most popular payment gateways that supports both credit and debit cards. Stripe can be accessed by more than 45 countries and it allows transactions in 135+ currencies. Users can take the advantage of Stripe with any WordPress subscription or membership plugin.

Amazon pay: It is mainly known for its security measures. Buyers can easily make payments with the data that is already saved on their Amazon account.

PayPal: The third in our list is paypal that supports more than 100 currencies. It also offers fraud detection facility along with instant access to funds.

Square: Just like other WooCommerce payment gateways Square is suitable for all types of businesses. It supports online as well as in-person transactions and offers many other payment facilities.

Authorize.netIt offers a smooth checkout process for customers using credit cards. It can be accessed in countries that include the United States, Canada, United Kingdom, Europe or Australia.

Alipay: It is one of the best options for those sellers who deal with international customers. Though it is mainly used by Chinese buyers, the payment gateway is available in more than 200 countries.

The above mentioned payment gateways are very popularly used but to know which is the best among them, you need to consider a few facts that include the transaction fees, user experience, recurring payments, other charges and also availability in different regions.

Taking all of these facts into account, we would tag Stripe as the best among them for woocommerce.

Now that you know about WooCommerce payment gateways, let us introduce you to the WooCommerce plugins.

WooCommerce and WP Event Manager

WP Event Manager is a WordPress event management plugin that has more than 35 premium extensions to help event business owners conduct and manage their events online with ease. It supports WooCommerce for all its transactions. In addition to that it offers plugins like:

Sell Tickets: The plugin transforms an ordinary event website into a ticket selling platform where users can receive their payments through WooCommerce from their customers.

WooCommerce paid listing: The plugin helps users by monetizing their events website.

Stripe Split Payment: The plugin helps an events website owner by distributing the event ticket revenue between the event organizer and the website owner automatically through Stripe which is one of the most popular payment gateway supported by WooCommerce.

We hope that this article will help you know WooCommerce better and why it is trusted by so many business owners for their eCommerce websites.

Frequently asked questions about WooCommerce

1. Is WooCommerce free?

Technically WooCommerce is a free WordPress plugin. However to create a WooCommerce based eCommerce website, you need to pay for your website host, domain name, WooCommerce theme, designs SSL certificate and additional plugins.

2. How many products can I sell with WooCommerce?

The answer to this question is unlimited. WooCommer allows users to sell unlimited products but users need to be careful about their website speed and overall performance in case of a huge number of products.

3. How many WooCommerce plugins are there?

WooCommerce offers almost 60000 plugins but when it is about growing your eCommerce store WooCommerce, you have an endless number of opportunities.

4. Can I use multiple payment gateways on WooCommerce?

The answer is yes. WooCommerce offers the facility to use multiple gateways. It is also a healthy option for your eCommerce website because all your buyers might be using only Stripe or Paypal and that is why it is better to give them options.

5. Does WooCommerce have a default payment gateway?

Yes, WooCommerce has a default payment gateway which is named WooCommerce payments. However, it is a premium extension of WooCommerce which means you need to pay for it and it is not covered in the core plugin.

#WooCommerce#events#eventmanagement#virtual event#event#WordPress websites#eCommerce solutions#eCommerce Website#payment gateways#Stripe#Amazon pay#PayPal#Alipay#plugins#events plugins#sell ticket plugins#strip e split payment#woocommerce paid listing#hybrid event#wp event manager#WooCommerce plugins#core plugin#registration

0 notes

Text

Top 3 E-commerce Payment Gateways In 2023

The world of e-commerce has become so popular in recent times, and the improvement of payment gateways are crucial to maintain its growth. This is because e-commerce businesses use them to secure and process online customer payments.

In this article, we’ll be discussing what payment gateway is, the top 3 best payment gateway plugin in 2023, why they’re important, and how do they work.

What is a…

View On WordPress

1 note

·

View note

Text

Optimize your Shopify Plus store with expert-recommended payment gateways for a seamless checkout. Explore Stripe, Braintree, Adyen, and Authorize.Net. Partner with Webgarh Solutions, a leading Shopify Plus development agency, for tailored solutions and a high-performance e-commerce experience.

#shopify plus#ecommerce solutions#payment gateways#web development#customer experience#webgarh solutions#smooth checkout#shopify experts#tech innovation#digital payments#secure transactions#shopify plus developers#shopify plus development company#shopify plus development agency

0 notes