#partnership firm registration services

Text

Get the best GST basic course! Master the fundamentals of GST with our comprehensive GST Basic Course. Designed for beginners, this course covers the essentials of Goods and Services Tax, including its principles, registration process, filing procedures, and compliance requirements. For more information, you can call us at 7530813450.

#gst registration service#partnership firm registration services#income tax certification course#best income tax course#gst filing training#best income tax course online#basic gst course online#best income tax preparation courses#basic gst course#gst basic course

0 notes

Text

"Setting the Foundation for Success: Trusted Partnership Firm Registration Services for Indian Entrepreneurs"

Introduction:

Establishing a partnership firm in India requires meticulous attention to legal formalities and regulatory requirements. Aspiring entrepreneurs often find themselves navigating through a maze of paperwork and regulations, which can be daunting and time-consuming. However, with the right guidance and support, this process can be streamlined, allowing entrepreneurs to focus on their core business objectives.

At , we understand the challenges that entrepreneurs face when starting a partnership firm. Our mission is to provide comprehensive Partnership Firm registration services that empower entrepreneurs to embark on their business journey with confidence. With our expertise and commitment to excellence, we aim to set the foundation for success for Indian entrepreneurs.

Why Choose Us:

Expert Guidance: Our team of experienced professionals possesses in-depth knowledge of partnership firm registration procedures. We provide personalized guidance tailored to the specific needs of each client, ensuring a smooth and hassle-free registration process.

Timely Assistance: Time is of the essence taxation consultancy services for entrepreneurs, and delays in registration can impede business progress. We prioritize efficiency and strive to expedite the registration process, enabling entrepreneurs to kickstart their ventures without unnecessary delays.

Compliance Assurance: Navigating the legal framework surrounding partnership firm registration can be complex. We ensure that all regulatory requirements are met, minimizing the risk of non-compliance and legal complications in the future.

Transparency and Integrity: We believe in fostering trust and transparency in our client relationships. Our commitment to integrity means that entrepreneurs can rely on us to provide honest advice and transparent communication throughout the registration process.

Our Services:

Pre-Registration Consultation: We offer comprehensive consultations to assess the specific requirements of each client and provide guidance on the necessary steps to initiate the registration process.

Document Preparation: Our team assists in the preparation and compilation of all required documents, including partnership deeds, identity proofs, and address proofs, ensuring accuracy and compliance with regulatory standards.

Application Submission: We handle the entire application submission process, including interactions with regulatory authorities and government agencies, to ensure swift processing and approval.

Post-Registration Support: Our support doesn't end with registration. We provide ongoing assistance with compliance obligations, such as filing annual returns and maintaining statutory records, to help entrepreneurs stay on the right track.

Conclusion:

At, we recognize that partnership firm registration is a critical milestone in the entrepreneurial journey. By offering trusted and reliable registration services, we aim to empower Indian entrepreneurs to realize their business aspirations and achieve sustainable growth. With our expertise and support, entrepreneurs can embark on their entrepreneurial endeavors with confidence, knowing that they have a solid foundation for success.

Contact us today to learn more about our partnership firm registration services and take the first step towards building a successful business venture in India.

#Top Partnership Firm Registration#Services in India#taxation consultancy services#Partnership Firm Registration

1 note

·

View note

Text

A partnership firm is a form of business where two or more individuals come together to carry out a business for profit. This kind of business form is governed by the Indian Partnership Act of 1932. Key characteristics include a mutual agreement, joint ownership, profit-sharing, and unlimited liability of the partners.

This type of partnership firm involves the distribution of profits and liabilities among its members, making it a typical choice for small businesses and entrepreneurs.

How to Register a Partnership Firm Online

Step 1: Fill out an application for a Register Partnership Firm.

Step 2: Selecting the Partnership Firm’s Name

Step 3: Registration Certificate

#partnership firm registration#eazybahi solutions#bookkeeping services#bookkeeping#accounting#finance#partnership firm

0 notes

Text

Business Tax Filing Services in Delhi

Vishal Madan CA offers expert Business Tax Filing Services in Delhi. As a Chartered Accountant, Vishal Madan specializes in facilitating seamless and accurate tax filing for businesses in the capital city. His services encompass comprehensive tax planning, meticulous documentation, and timely submission of business tax returns. With a focus on compliance and maximizing tax efficiency, Vishal Madan CA ensures that businesses in Delhi navigate the complex tax landscape effectively, minimizing liabilities and optimizing financial outcomes. Entrust your business tax filings to Vishal Madan CA for professional expertise and reliable assistance in meeting all regulatory requirements.

Read more:-

#GST Registration Services in Delhi#Business Tax Filing Services in Delhi#Personal Tax Filing Service in Delhi#Partnership Firm Registration Service in Delhi#Best Chartered Account in Janakpuri#Chartered Account in Janakpuri#Best Chartered Account in West Delhi#Best CA Firm in West Delhi#CA in west Delhi#CA in janakpuri#accountants in west delhi

0 notes

Text

#itr filing#ca services#online ngo registration#trust registration#partnership firm#trust registration services

0 notes

Text

The Indian Partnership Act of 1932 is a piece of legislation that controls how partnerships are formed and run in India. It offers a framework for the legal rights, obligations, and liabilities of people running partnership businesses. The purpose of the act was to establish and codify Indian partnership law.

Key features of the Indian Partnership Act of 1932

Definition of Partnership:

According to the legislation, a partnership is a relationship between individuals who have decided to split the earnings of a firm that is run by all of them together or by any one of them acting alone.

Formation of Partnership:

It describes the steps involved in creating a partnership, such as the need for an agreement, the minimum and maximum number of members, and the significance of splitting gains and losses.

Rights and Duties of Partners:

The legislation outlines the responsibilities and rights of partners, including their obligations to act loyally and in good faith as well as their rights to take part in the company's management and split profits and losses.

Registration of Firms:

The act emphasizes the importance of registering a partnership firm. While registration is not mandatory, it provides certain legal benefits, including the ability to sue third parties and fellow partners.

Dissolution of Partnership:

The act details the various circumstances under which a partnership may be dissolved, such as by mutual agreement, on the death of a partner, or by court order.

Liabilities of Partners: It talks about how partners in a partnership have unlimited responsibility, meaning that the firm's obligations and liabilities can be settled with the partners' personal assets.

Minor's Position in Partnership:

The act deals with the capacity of a minor to become a partner, specifying the limitations on a minor's rights and liabilities in the partnership.

Over time, changes have been made to the Indian Partnership Act of 1932 to ensure that it remains compliant with evolving legal requirements and commercial practices. It is essential to give India's partnerships a legal foundation and give direction to people and organizations working together on economic projects.

Pros and cons of partnership Firm Registration

Pros:

1. Legal Recognition:

Prospective Rights: The partnership gains legal status through registration, enabling it to bring lawsuits against other partners and third parties in the event of a disagreement.

Evidence of Existence: A registered firm has a legal document (the partnership deed) that serves as evidence of its existence and the terms of the partnership.

2. Credibility and Trust:

Business Credibility: Getting registered can help the partnership seem more credible to suppliers, consumers, and financial institutions.

Building Trust: It may instill confidence in clients and partners, as they can verify the legal status and authenticity of the partnership.

3. Access to Legal Remedies: Unregistered partnerships might not be able to access certain legal remedies and benefits that are available to registered partnerships.

4. Tax Benefits: Registered firms may be entitled to specific exemptions or deductions, as well as particular tax benefits.

5. Continuity: Registration can ensure continuity, especially in cases of changes in partners or other structural modifications.

Cons:

1. Cost and Formalities:

There are costs associated with the registration process, including fees and expenses related to drafting and notarizing the partnership deed. The registration process involves formalities and paperwork, which can be time-consuming and may require professional assistance.

2. Public Disclosure:

The relationship details become public information after they are registered, which may not be ideal for people who value their privacy.

3. Limited Liability Concerns:

Partners in an unregistered firm also have unlimited liability, but registration doesn't provide protection against personal liability.

4. Flexibility and Informality:

Registration may impose certain obligations and restrictions, limiting the flexibility that unregistered partnerships may enjoy. Unregistered partnerships can be less formal in their operations, which may be an advantage for some businesses.

5. Limited Legal Advantages:

Unregistered partnerships still have some legal status and rights, although the benefits of registration may be limited.

The choice to register a partnership firm is ultimately based on several variables, such as the type of business, the partners' preferences, and the financial and legal ramifications of doing so. It is advisable to get advice from financial and legal experts to make an informed decision that takes into account the unique conditions of the partnership.

Key Elements of Partnership Registration In India

1. Partnership Deed:

Creation: The first step is to draft a partnership deed, which is a written agreement outlining the terms and conditions of the partnership.

Contents: Information including the company name, partner names and addresses, the type of business, capital contributions, profit-sharing percentages, and other pertinent clauses are usually included in the partnership deed.

Stamp Duty: The non-judicial stamp paper on which the partnership deed is executed is required, and the stamp duty payable is determined by the capital contribution of the partners.

2. Application for Registration:

Form: Form 1, the application for the registration of the partnership firm, must be completed by partners and submitted.

Information Required: The application contains information on the firm, including its name, address, and any duration, as well as the partners' names and contact information.

Attachment of Documents: Along with the application, a copy of the partnership deed and an affidavit stating that all the information provided is true and genuine must be submitted.

3. Payment of Fees:

Registration Fee: Partners need to pay the prescribed registration fee based on the state in which the firm is registered.

Stamp Duty: There can be additional stamp duty required for the registration procedure on top of the stamp duty on the partnership deed.

4. Submission to the Registrar of Firms:

Regional Registrar: The completed application, along with the necessary documents and fees, is submitted to the Registrar of Firms in the region where the business is located.

Verification: The Registrar may verify the documents and, if satisfied, enter the details in the Register of Firms.

5. Certificate of Registration:

Issuance: The Registrar issues a Certificate of Registration following a successful registration. This certificate is evidence of the partnership's existence.

Validity: In general, the certificate is valid for the time frame specified in the partnership agreement.

6. Public Notice:

Optional Public Notice: Although it is not required, partners may decide to notify the public and prospective stakeholders about the partnership's creation by placing an announcement in the local newspaper.

7. PAN and TAN Application:

PAN and TAN: For taxation purposes, partnerships must get a Permanent Account Number or PAN. The partnership needs to obtain a TAN (Tax Deduction and Collection Account Number) if it is required to deduct taxes at source.

8. Bank Account:

Bank Account Opening: Partners should use the Certificate of Registration and other required paperwork to open a bank account in the partnership's name.

9. Compliance and Renewal:

Annual Filing: As long as the partners keep correct financial records and follow tax requirements, there is no need for an annual file.

Renewal: Generally speaking, the partnership registration is good for the time frame given in the partnership agreement. Partners may need to renew the registration if there are any modifications or if the collaboration lasts longer than expected.

#company registration in kochi#tax consultancy#partnership firm registration#accounting consultancy#financial consultancy#GST registration#auditing company#cost accounting services#ISO registration#UAE Vat Registration in kochi#legal advisory services

0 notes

Text

Registration Tips by Private Limited Company Registration in Bangalore - Kros-chek

Registering a private limited firm is an essential step for anyone planning to start a marketing business in Bangalore. The process of private limited company registration in Bangalore can be a bit overwhelming, but with the right guidance and preparation, it can be a straightforward process. In this article, we will discuss the steps involved in registering a private limited firm for marketing, along with some useful tips by Kros Chek, a leading Private Limited Company Registration in Bangalore.

Step 1: Choose a suitable name for your private limited firm The first step in registering a private limited firm is to choose a suitable name. The name of your firm should be unique, easy to remember, and easy to pronounce. It is also important to ensure that the name you choose is not already registered by another company. Once you have decided on a name, you can check its availability on the Ministry of Corporate Affairs (MCA) website.

Step 2: Obtain a Digital Signature Certificate (DSC) The next step is to obtain a Digital Signature Certificate (DSC) for the directors of your company. A DSC is required to sign the electronic documents required for company registration. You can obtain a DSC from government-approved agencies or directly from the Certifying Authority (CA).

Step 3: Obtain Director Identification Number (DIN) The next step is to obtain a Director Identification Number (DIN) for the directors of your company. The DIN is a unique identification number issued by the MCA. You can apply for a DIN online through the MCA website.

Step 4: Drafting of Memorandum of Association (MOA) and Articles of Association (AOA) The Memorandum of Association (MOA) and Articles of Association (AOA) are the two important documents that must be prepared for private limited company registration in Bangalore. The MOA outlines the main objectives of your company, while the AOA specifies the rules and regulations governing your company's internal affairs. It is recommended to seek the assistance of a legal expert in drafting these documents.

Step 5: File an application for company registration Once you have obtained the DSC, DIN, and drafted the MOA and AOA, the next step is to file an application for company registration with the MCA. The application should include all the necessary documents, including the MOA and AOA, along with the prescribed fees.

Step 6: Obtain the Certificate of Incorporation Once the MCA receives your application, they will review it and issue a Certificate of Incorporation if everything is in order. The Certificate of Incorporation is proof that your company has been registered with the MCA.

Private Limited Company Registration in Bangalore Cost The cost of registering a private limited company in Bangalore depends on various factors, including the authorized capital, stamp duty, and professional fees. The authorized capital refers to the amount of capital that your company is authorized to issue to its shareholders. The stamp duty is a tax levied on the documents required for company registration. The professional fees refer to the charges of the professionals you hire to help with the registration process. The cost of registering a private limited company in Bangalore can range from a few thousand to lakhs of rupees.

Tax Consultants in Bangalore It is recommended to seek the assistance of a tax consultant in Bangalore when registering a private limited company. A tax consultant can help you understand the various tax laws and regulations that apply to your company and ensure that you comply with them. Kros Chek is a leading tax consultant in Bangalore that can help you with all your tax-related needs.

Partnership Firm Registration in HSR Layout Apart from private limited company registration in Bangalore, you can also consider partnership firm registration in HSR Layout. A partnership firm is a type of business entity in which two or more persons join together to carry

More information:

365 Shared Space, 2nd Floor,#153, Sector 5, 1st Block

Koramangala, HSR Layout,

Bengaluru,Karnataka 560102

Call:+91 9880706841

#llp company registration services in bangalore#llp registration in bangalore#partnership firm registration in bangalore#pvt ltd company registration in bangalore cost

0 notes

Text

Get Professional Accounting Service - IndianSalahkar

Well, you have reached the right place; welcome to Indian Salahkar, one of the leading business consultancy firms in India that provide quality Professional Accounting Service. A globally acknowledged certification or a private limited company registration for any company is an essential and primary requirement to stabilize its credibility.

#Professional accounting service#Business accounting firm in india#best accounting firm in India#Trademark Registration Services#Brand Registration#GST registration service provider#partnership firm registration online#company registration in India#Income tax return filing service

0 notes

Text

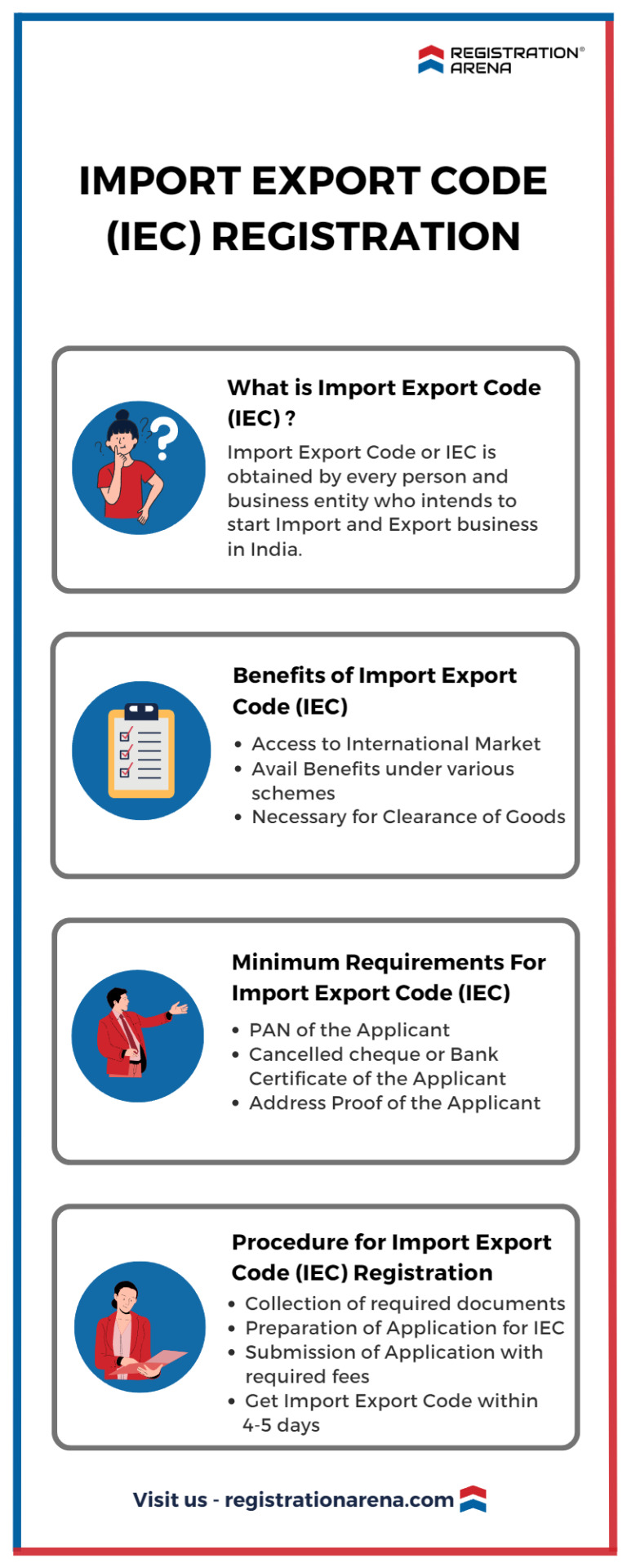

To engage in importing or exporting goods, all business entities are required to obtain a 10-digit identification number known as the Importer-Exporter Code (IEC). Without a valid IEC number, a person or entity is not permitted to conduct any import or export activities. In India, the Director General of Foreign Trade (DGFT) is responsible for granting IECs. IEC registration is a completely online process and can be finished within 4-5 days. IEC once issued shall be valid for a lifetime.

#legal advisers#legal consultation#legal services#llp registration#private limited company registration#sole proprietorship#public limited company#annual compliances of llp#annual compliance of private limited company#startup india registration#trademark registration#partnership firm registration#tds return filing#itr filing#Import-export code#opc registration

0 notes

Text

Are you in search of chartered accountant services? Our professionals can help you. Our team of seasoned professionals offers comprehensive financial solutions tailored to your specific needs. From tax planning and compliance to auditing, financial reporting, and business advisory, we provide strategic insights to optimize your financial performance and compliance. For more information, you can call us at 7530813450.

#gst registration service#income tax certification course#partnership firm registration services#best income tax course#best income tax preparation courses#basic gst course online#gst filing training#best income tax course online#basic gst course#gst basic course

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

Business Tax Filing Services in Delhi

Vishal Madan CA offers expert Business Tax Filing Services in Delhi. As a seasoned Chartered Accountant, Vishal Madan specializes in navigating the complexities of tax regulations for businesses. His services include meticulous organization of financial records, strategic tax planning, and ensuring compliance with local tax laws. With a focus on efficiency and accuracy, Vishal Madan CA provides businesses in Delhi with the expertise needed for seamless tax filing, enabling clients to optimize their financial processes and meet their tax obligations with confidence.

Read more:-

#GST Registration Services in Delhi#Business Tax Filing Services in Delhi#Personal Tax Filing Service in Delhi#Partnership Firm Registration Service in Delhi#Best Chartered Account in Janakpuri#Chartered Account in Janakpuri#Best Chartered Account in West Delhi#Best CA Firm in West Delhi#CA in west Delhi#CA in janakpuri#accountants in west delhi#accountants in janakpuri#best accountant in janakpuri#accountant firm in west delhi#accountant firm in janakpuri

0 notes

Text

#LLP registration in Surat#llp registration services#llp registration#llp company registration#llp registration online#llp registration cost#limited liability partnership registration#llp firm registration#llp company registration online#llp registration finaccle

0 notes

Text

Black History Facts!!!

#Happy90th

#NAACP

Born Myrlie Louise Beasley on March 17, 1933, in her maternal grandmother’s home in Vicksburg, Mississippi. She was the daughter of James Van Dyke Beasley, a delivery man, and Mildred Washington Beasley, who was 16 years old. Myrlie’s parents separated when she was just a year old; her mother left Vicksburg but decided that Myrlie was too young to travel with her. Since her maternal grandmother worked all day in service, with no time to raise a child, Myrlie was raised by her paternal grandmother, Annie McCain Beasley, and an aunt, Myrlie Beasley Polk. Both women were respected school teachers and they inspired her to follow in their footsteps. Myrlie attended the Magnolia school, took piano lessons, and performed songs, piano pieces or recited poetry at school, in church, and at local clubs.

Myrlie graduated from Magnolia High School (Bowman High School) in 1950. During her years in high school, Myrlie was also a member of the Chansonettes, a girls’ vocal group from Mount Heroden Baptist Church in Vicksburg. In 1950, Myrlie enrolled at Alcorn A&M College, one of the few colleges in the state that accepted African American students, as an education major intending to minor in music. Myrlie is also a member of Delta Sigma Theta sorority. On her first day of school Myrlie met and fell in love with Medgar Evers, a World War II veteran eight years her senior. The meeting changed her college plans, and the couple later married on Christmas Eve of 1951. They later moved to Mound Bayou, and had three children, Darrell Kenyatta, Reena Denise, and James Van Dyke. In Mound Bayou, Myrlie worked as a secretary at the Magnolia Mutual Life Insurance Company.

When Medgar Evers became the Mississippi field secretary for the National Association for the Advancement of Colored People (NAACP) in 1954, Myrlie worked alongside him. Myrlie became his secretary and together they organized voter registration drives and civil rights demonstrations. She assisted him as he struggled to end the practice of racial segregation in schools and other public facilities and as he campaigned for voting rights many African Americans were denied this right in the South. For more than a decade, the Everses fought for voting rights, equal access to public accommodations, the desegregation of the University of Mississippi, and for equal rights in general for Mississippi's African American population. As prominent civil rights leaders in Mississippi, the Everses became high-profile targets for pro-segregationist violence and terrorism.

In 1962, their home in Jackson, Mississippi, was firebombed in reaction to an organized boycott of downtown Jackson’s white merchants. The family had been threatened, and Evers targeted by the Ku Klux Klan.

In 1967, after Byron De La Beckwith's release in 1965, she moved with her children to Claremont, California, and emerged as a civil rights activist in her own right. She earned her Bachelor of Arts in sociology from Pomona College. She spoke on behalf of the NAACP and in 1967 she co-wrote For Us, the Living, which chronicled her late husband's life and work. She also made two unsuccessful bids for U.S. Congress. From 1968 to 1970, Evers was the director of planning at the center for Educational Opportunity for the Claremont Colleges.

From 1973 to 1975, Evers was the vice-president for advertising and publicity at the New York-based advertising firm, Seligman and Lapz. In 1975, she moved to Los Angeles to become the national director for community affairs for the Atlantic Richfield Company (ARCO). At ARCO she was responsible for developing and managing all the corporate programs. This included overseeing funding for community projects, outreach programs, public and private partnership programs and staff development. She helped secure money for many organizations such as the National Woman’s Educational Fund, and worked with a group that provided meals to the poor and homeless.

Myrlie Evers-Williams continued to explore ways to serve her community and to work with the NAACP. Los Angeles mayor Tom Bradley appointed her to the Board of Public Works as a commissioner in 1987. Evers-Williams was the first black woman to serve as a commissioner on the board, a position she held for 8 years. Evers-Williams also joined the board of the NAACP. By the mid-1990s, the prestigious organization was going through a difficult period marked by scandal and economic problems. Evers-Williams decided that the best way to help the organization was to run for chairperson of the board of directors. She won the position in 1995, just after her second husband’s death due to prostate cancer. As chairperson of the NAACP, Evers-Williams worked to restore the tarnished image of the organization. She also helped improve its financial status, raising enough funds to eliminate its debt. Evers-Williams received many honors for her work, including being named Woman of the Year by Ms. Magazine. With the organization financially stable, she decided to not seek re-election as chairperson in 1998. In that same year, she was awarded the NAACP's Spingarn Medal.

Sources:

Padgett, John. "MWP: Myrlie Evers-Williams". University of Mississippi. Retrieved October 20, 2011

Goldsworthy, Joan. "Gale - Free Resources - Black History - Biographies - Myrlie Evers-Williams". Gale. Retrieved November 22, 2011.

Myrlie Evers-Williams Biography - Facts, Birthday, Life Story - Biography.com". Famous Biographies & TV Shows - Biography.com. A&E Television Networks. Retrieved November 22, 2011.

Davis, Merlene. "Merlene Davis: Myrlie Evers-Williams doesn't want us to forget". Kentucky.com. Retrieved November 22, 2011.

Jessie Carney Smith; VNR Verlag für die Deutsche Wirtschaft (1996). Notable Black American Women: book II. p. 208.

University of Virginia (June 24, 2013). "Speakers and Guests Bios". virginia.edu. Archived from the original on June 2, 2013.

28 notes

·

View notes

Text

Unlock the Secrets of Udyam Registration for Partnership Firms

The Udyam Registration, previously known as Udyog Aadhaar Memorandum (UAM), has been a transformative initiative by the Indian government to support and empower micro, small, and medium-sized enterprises (MSMEs). For partnership firms, this registration offers a host of benefits and opportunities.

Update Udyam Certificate: One of the key advantages of Udyam Registration is the ability to Update Udyam Registration online. Business details may change over time, and this feature allows you to keep your registration accurate and up-to-date, reflecting the current state of your partnership firm.

Apply Online for Udyam Partnership Firm: The online application process for partnership firms is user-friendly and efficient. You can easily submit the necessary documents and information online, reducing the time and effort required for registration.

Online Enquiry for Udyam: The digital platform has simplified the process of making inquiries related to Udyam Registration. You can get information, clarification, and assistance regarding the registration process, making it easier to navigate.

Print UAM Registration Online: Once your partnership firm's Udyam Registration is approved, you can conveniently print your Udyam Certificate online. This certificate is not just a document; it's your ticket to a plethora of benefits and opportunities reserved for MSMEs.

Print Udyam Certificate: After successfully obtaining your Udyam Registration, you can print the Udyam Certificate, which serves as proof of your registration. Displaying this certificate can build trust among clients and partners, enhancing your firm's credibility.

Access to Government Schemes: Udyam Registration opens the door to various government schemes and incentives specifically designed for MSMEs. These schemes can provide financial assistance, subsidies, and priority in procurement, giving your partnership firm a competitive edge.

Financial Benefits: Banks and financial institutions often offer preferential treatment to Udyam-registered businesses. This includes easier access to credit facilities and lower interest rates, which can be advantageous for managing finances and expansion.

Global Opportunities: Udyam Registration can also pave the way for international collaborations and exports. Many foreign companies prefer to engage with Udyam-registered Indian businesses, offering the potential for global growth.

Simplified Compliance: Udyam Registration streamlines the compliance process by consolidating various government-related registrations into one. This reduces the administrative burden on your partnership firm.

Competitive Advantage: Displaying your Udyam Certificate on your website and marketing materials can enhance your firm's reputation and attract clients who prefer working with registered MSMEs.

Conclusion

Udyam Registration is a game-changer for partnership firms in India. It offers numerous benefits, ranging from financial advantages to global opportunities. By utilizing online services such as updating your Udyam Certificate, applying online, making online inquiries, and printing your Udyam Certificate, you can unlock the full potential of this registration and take your partnership firm to new heights of success. Don't miss out on the secrets of Udyam Registration; embrace them and witness the transformation in your business.

2 notes

·

View notes

Text

How to start a business in Vietnam as a foreign investor?

Vietnam is one of the fastest-growing economies in Southeast Asia, with a young and dynamic population, a favorable business environment, and a strategic location. Additionally, Vietnam's government has been increasingly enacting more preferential policies to facilitate foreign investors' entry into the country to do business in Vietnam. If you are interested in starting a business in Vietnam, here are some steps you need to follow:

Step 1: Choose a business entity type

There are different types of business entities in Vietnam, such as limited liability company joint-stock company partnership, branch office, representative office, etc. Each type has its own advantages and disadvantages, depending on your business goals, capital, and legal requirements. You should consult a local law firm in Vietnam to help you decide which entity type suits your needs best.

Step 2: Register your business in Vietnam

After chosing your business entity type, you need to register your business with the relevant authorities in Vietnam. This involves submitting various documents, such as: business name, address, charter capital, shareholders, directors, tax code, etc. Depending on the type and scope of your business, you may also need to obtain additional licenses or permits from other agencies, such as the Ministry of Industry and Trade, the Ministry of Health, the Ministry of Planning and Investment, etc.

Step 3: Open a bank account in Vietnam

You need to open company’s bank account after registering your business. You will need to provide your business registration certificate, tax code certificate, and other documents to the bank. You can choose from various local or foreign banks operating in Vietnam, depending on your preferences and needs.

Step 4: Hire staff and set up your office in Vietnam

The next step is to hire staff and set up your office in Vietnam. You will need to comply with the labor laws and regulations in Vietnam, such as: minimum wage, social insurance, health insurance, working hours, etc. You will also need to find a suitable location for your office and equip it with the necessary facilities and equipment.

Step 5: Start your operations and marketing

You will need to develop a business plan and strategy that suits the local market and culture in Vietnam. You will also need to build relationships with customers, suppliers, partners, and authorities in Vietnam. You can use various channels and methods to promote your products or services, such as: social media,online platforms, events, etc.

Starting a business in Vietnam can be challenging but rewarding. By following these steps and seeking professional advice from the law firm in Vietnam when needed, you can successfully establish and grow your business in Vietnam.

ANT Lawyers is the reliable law firm in Vietnam that will always contact the authorities to obtain legal updates on issues pertaining to do business in Vietnam.

2 notes

·

View notes