#junk bonds

Text

The long, bloody lineage of private equity's looting

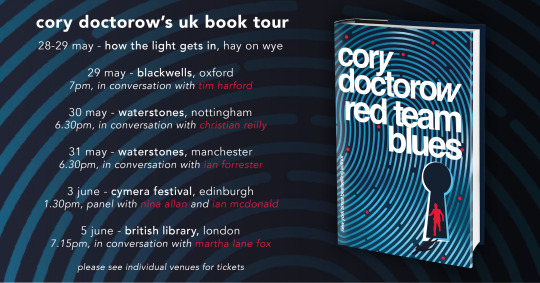

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

Junk bonds are behaving very strangely

Money has been flooding into bonds all year, as the market looks for a recession that stubbornly refuses to happen. Through May nearly $113 billion net flowed into taxable bond funds according to Morningstar, with market-leading institutions including JPMorgan, Pimco, Charles Schwab, Fidelity Investments, and Amundi, declaring that “bonds are back” after 2022’s historic 16% loss.

High yield bonds, however, should be a different story. Non-investment grade debt typically does well in a strengthening economy, as even poorly capitalized companies benefit from widespread growth. If the market really does anticipate slowing growth and lower rates, junk should be under pressure. It’s not.

Indeed spreads to Treasuries have tightened measurably this year, with non-investment grades yielding only about 4.15% more than the risk-free benchmark. That differential has shrunk by nearly half since a peak in late March when junk bonds yielded 9.2%, compared to 0.7% for Treasuries.

Do high yield investors just have a more positive take on the economy than others? Seems unlikely. And indeed, the issue may be a simple case of supply and demand. Issuance of less-than-investment grade debt is down dramatically, and that supports prices.

High yield issuance peaked in 2020, at $450 billion, and remained near record levels in 2021 ($410 billion), as below-investment grade borrowers rushed to lock in historically low rates. That has allowed many high yield issuers to sit out current, less receptive conditions and wait for potentially lower rates and cheaper financing to come. Issuers that are seeking financing are taking on shorter-term obligations. Indeed, the Wall Street Journal reports that junk debt’s average maturity has shrunk to 6.1 years, down from a historic norm of 7.4 years.

Issuers that can’t wait for financing are also using another strategy to reduce costs—offering secured loans that provide investors with additional protection in case of default. So far in 2023, around 62% of total non-investment grade issuance has been secured, nearly double the levels in 2022 and 2021.

Fewer junk bonds, better investor terms and a recession that remains elusive. It’s all supporting the non-investment grade market for now. But for how long?

0 notes

Photo

The “Experts” again. The same experts that brought us sub-prime mortgages and junk bonds, I’d wager.

0 notes

Text

do you think leon's a 'snorrrrk... mimimimiii' . or a 'honnk shooo' kinda guy.........

(just some progress pics under read more-)

#pokemon swsh#pokemon sword and shield#pkmn swsh#pkmn sword and shield#champion leon#grooky#scorbunny#sobble#art#poke's doodles#uhhhhhhhhhhhhhhh im not happy with the colours lol but#this was a wip for SO long and i decided to just like. 'finish' it lol#anyways i think a lot about the starters...... i like to think he bonded with them before gifting two to hop and the protag........#oh yea if you couldnt tell - i havent. drawn the starters in a GOOD while--------------#anyways - heres hoping i can sort out irl junk so i can draw pkmn more :']

90 notes

·

View notes

Text

modern day Derrick would keep Penelope and Reynold on toddler harnesses and tie them to a street light when he has to go somewhere important. he once forgot to pick them up and when he returned in the evening he found Penelope chewing on Reynold's arm because she was hungry

#Derrick leaves her alone for five hours without a meal and Penelope bites into Reynold's arm like it's an apple#the duke would always want him to take Penelope and Reynold with him and insert them into his activities#Derrick always bribes himself out of it and buys them things so they'll lie about having spend a wonderful sibling bonding time together#when in reality he just left them in front of the tv/private cinema with junk food#obv Derrick can't let himself be embarrassed in front of his 'friends' by his stupid siblings#death is the only ending for the villainess#derrick eckart#penelope eckart

42 notes

·

View notes

Text

Sketches: A Huntlow Fic📜✍🏽

Rating: T

Content Warnings: None

“Actually,” Gus drawled. “Sometimes people post fanart of real life people too. Like celebrities.”

For some reason his eyes slid to Hunter, and he started laughing, low and mischievous.

Hunter looked up and narrowed his eyes suspiciously.

“Real…people?”

“No, Gus-” Amity started, but she was too late.

Gus was already holding out his scroll for a bewildered Hunter to squint at.

“What-“ Hunter said. “What…is this.”

Amity scooted next to them and leaned in to look too, wincing disapprovingly.

Gus was scrolling through a folder full of sketches, and digital paintings, and even a hilarious meme or two.

…of the Golden Guard.

Read the rest here!

#Huntlow#The Owl House#toh hunter#Willow Park#Offers some Huntlow fluff (with a side dish of hexsquad bonding) in this trying time of discourse and season three anxiety#Take this humble offering and be at peace#my scribbles#Wintery junk

53 notes

·

View notes

Note

have you read gormenghast. Also top five hottest guitar solos

I have not but just at a glance it looks pretty compelling. Love that the protagonists name is titus groan, that’s a magnificent thing to be named..ill look into it

Also LOVELY question solo focused guitar stuff is kinda not my main fascination of course partly cause of the recent johnny obsession where he does more jangle/rhythm-as-lead work. But im a normal human being and I still enjoy a good solo. Though i think? The ones i enjoy tend to verge between riff/solo with repeated phrases

Im convinced that less is more even wrt guitar so its not surprising tbh i think a good solo should focus on 1) communication 2) brevity. I feel like overdoing a solo can quickly empty it of any feeling you intended to put in it - and esp like classic rock style soloing can quickly get cliche or tacky (see: oasis. No hate i like them fine but very little of their guitar work speaks to me)

Quick “typical” picks for hottest include staples like hotel california - works with the narrative they made, anticipation built throughout song deliberately FOR the solo (can ANY lyric or vocals adequately follow from ‘you can check out any time you like but can never leave’?? There must be a solo. Its imperative), the kind of smooth growl sound of it that makes you think of ‘The Beast’ that they talk about in the prev verses, length of it justifiable in my eyes by the sense of twists and turns in a maze, the gradual segue into a pattern and fadeout very wickedly suggesting the ‘can never leave’ endless hallways fading into more hallways vibe. You get the idea that the pattern could just keep going on and on.

And then my own subjective picks for hottest. the solo from stop me if you think you’ve heard this one before, partly because of how rare it is and the very concise communication of exactly the emotion of the rest of the song, didnt ever read this quote before today but johnny marr said he wanted it to sound like a solo by a punk guitarist whos trash at guitar so he did it on one string. For the poignancy. Which is bonkers because hes completely right and it works so well. That whine, that slight bitter taste, perfect late Smiths instrumentation. THE solo from a band that doesnt do solos. Saying: Stop me if you think that youve heard this one before. but you obviously havent. Kill yourself

In the same realm of “bad good” the one graham coxon does in coffee & tv which is rightfully one of blurs best songs its just so. And he attests he was just messing around but its a perfect fit with the mildly sardonic/fully earnest rest of the song. It feels tongue in cheek but simultaneously deeply sincere. I feel very much in the space of those foul distorted wails. Which is why blur will always be on top of oasis. (Honorary nod to classic of discordant solos while my guitar gently weeps by the beatles which is great but not making it into my top 5 because i like the guitar work in the rest of the song more than the solo bit). I think blur just understands the deep inherent value of getting a bit sillay (Woo hoo!) But also its completely serious and you need to take it completely seriously its so good. Just speaks to my personal tightrope of serious/not/serious/not

Okay and in terms of objectively technically jaw dropping solos i prefer the classic metal over rock so im gonna put. Can I play with madness by iron maiden here. Out of their many many blisteringly hot solos because when i tried to conjure up ‘hot solo’ in my mind i came up with that particular solo and had to work backwards to remember where it was from. It’s funny to call heavy metal guitar ‘lovely’ but thats exactly what the riffs on this song are. Theyve got that freezing hot mystique of the whole concept album. And then the solo itself moves everything up into teeth chattering sexiness. Cause the song is structured as an exchange - speaker to prophet, antagonising each other, the solo is the perfect climax - goes into that quick run of shrieks, then distinct phrases like a person speaking, drawing breaths, speaking again - and is the perfect length to get that idea across. Idk whether its adrian smith or dave murray but it’s brilliance

Ok thats four and i still feel like i have a lot more but you said “hottest” so right now the most fuckable in my opinion is actually another graham coxon one and its the one in my terracotta heart. Which i understand may subjectively only be rrreeally really really hot to me but 1) perfect anguished leadup to it. perfect continuation of the little riff he does during the verse/chorus before it. 2) subdued in tone, introspective almost, but has that flair..that groove….that hint of acerbic….You might say “ITS JUST THE SAME PHRASE SIX OR SO TIMES” YES IT IS and i need it INSIDE MEEEE

#more honorary mentions is the bit of lead in elliott smith’s junk bond trader that just forces your face to scrunch. but its more#‘devastating gasp for air inducing’ than ‘hot’ imo#and other maiden solos like in hallowed be thy name where the guitar and drums are in CRAZY conversation#and the stuff in afraid to shoot strangers where maiden got janick gers and he put down the filthiest maddest finger shredders.#jackson pollock of lead guitar#spray that solo in my face. Im a thirsty little flower#ok sorry thats really long. You got me monologuing about guitar solos there#promise ill address the first half of the ask (read gormenghast) as thanks#let me know what about it is cool though Im interested

5 notes

·

View notes

Text

"I'm your Super Friend! Super Friend! If you need a compliment, I can rattle off a dozen!"

Super Friend, from CW's The Flash episode "Duet"

"I can't say it, so I'll sing it!"

Pitch Perfect RarePair Week Prompt #7

And that's the end! I can't believe we've already made it to the end of RarePair Week 🥺 and with a full year to wait until the next one! I hope everyone has enjoyed the absolutely STUNNING entries that everyone's been putting out, seriously everybody is so TALENTED!! I can't wait to see how everyone ends their week with this prompt tbh, I know it's gonna be a lot of fun!

As for second of my two final entries, I figured since I started with something fun and lighthearted, I'd end with something fun too! And what better way to do that than with a redraw of one of my favorite Musical Episode™ scenes ever: Super Friends, from The Flash! And once I decided that this was the route I was gonna go with, I knew there was no better pair for it than Benji and Emily! I don't know if y'all have noticed from my... everything, but I have some Ideas™ about the sexualities (and genders but that's not super relevant right here) about some of these characters, and one of them... is that you can pull Queerplatonic duo Benji and Emily from my cold, dead, ace hands. 😂 I know PP2 tried to sell them as a romantic ship, and while I don't necessarily mind that, tbh I feel like, while they might have, like, a nice solid life long bond, I don't really see it as a romantic one ya know? So I headcanon both of them as some kind of ace and maybe aro, and in the Big Damn Fic™ they're hanging out in the background in LA as platonic roomies!

And if you missed it, check out today's other post here!

Links to the rest of my Pitch Perfect RarePair Week posts can be found below the cut, and the Image ID is in the alt text!

Days I'm participating in (and the Entries I've posted):

Day 1 (this is me trying): Link

Day 2 (I've missed you): Link

Day 5 (if honesty means telling the truth... Then the truth is I'm still in love with you): Link

Day 6 (there's no way that it's not going to happen with you looking at me like that): Link

Day 7.1 (I can't say it, so I'll sing it): Link

Day 7.2 (part 2): You Are Here!

#pitch perfect#pitch perfect rare pair week#pprpw22#pprpw22.7#benji applebaum#emily junk#queerplatonic benji/emily#yes they dated in college. yes they broke up cause of the distance. yes they reunited in LA. no they didn't get back together romantically.#they are simply Best Friends™ and also maybe roommates rn cause LA is expensive and Emily only just moved out there#and she needed a place to stay for a while and benji had the room--it just made sense!#that excuse only really worked for the first 6 months but after a year everyone just kinda got used to their bond#they are simply Vibing™ and living their best ace (aro?) lives together and we respect that#myposts#myart#(real talk tho they are intentionally like this as a narrative foil to Jesse and Beca as well as on their own merit)#(the fact that they have nearly the same beat-for-beat relationship progression up thru LA and the reunion is explicitly intentional)#(something something yes Jesse and Beca broke up for good reasons after being together for good reasons)#(then when they reunited at a time where both were single and emotionally available they rekindled their relationship)#(but this is far from the only option for a relationship track like this; and in fact this track maybe shouldnt be expected)#(couples can just as easily reunite and yet not get back together in a romantic sense. and thats what benji and emily represent)#(...that and ill take any excuse to make characters queer if it can make sense. ESPECIALLY if that queerness is ace or aro-spec)#(hence why stacie and fat amy are both also aro-spec: stacie is fully aro while fat amy is grey or demiro)#(...that comes with some big 'i am Ace™ i have Reasons For This™ caveats but these tags are getting long enough as is)#pitch perfect rare pair week 22

9 notes

·

View notes

Text

Here’s Paradox’s dialogue with Yusei, which, you guessed it, recaps another Bonds Beyond Time turn! He has the most dialogue with characters from the 5Ds era.

Paradox: I'll send Cyber End Dragon from my Extra Deck to the Graveyard. Which means Malefic Cyber End Dragon now appears!

Yusei: You sent a monster from the Extra Deck directly to your Graveyard?

Paradox: Yes - that’s how I’m allowed to Special Summon my Malefic monsters.

Yami Yugi: In other words, by destroying a monster’s good version, he can give life to its bad. It seems Paradox only sees the dark side in Duel Monsters.

Paradox: It’s your turn.

Yusei: Jaden...Yugi...We know what’s at stake here. Our friends, our family our very future - it all hangs in the balance in this Duel. We may have all just met and may not know each other's duel styles and strategies. But even so, we have to fight as one. Let's focus our skills to this one common cause!

Jaden/Yubel: You said it!

Yami Yugi: Agreed, Yusei. And I think you should be the one to start us off!

Yusei: Right! Here we go! Just as Yugi, Jaden, and I are combining our might, these monsters are combining theirs! I Synchro Summon! Junk Gardna!

Yami Yugi: Synchro what?

Jaden: I dunno, but I like it! Too cool!

Paradox: If that's the best you can do, you might as well just give up here and now. Your decks are no match for mine - not since I snatched Yusei's Stardust Dragon!

#yu gi oh#duel links#yu gi oh gx#yu gi oh 5ds#bonds beyond time#paradox#yusei fudo#yami yugi#jaden yuki#yubel#malefic cyber end dragon#Junk Gardna#stardust dragon

17 notes

·

View notes

Text

I'm just sayin; if Stolkien happened what else would that mean? Superhero game AU Tuperware / Toolshed baby. Tuppershed nation rise.

#stolkien#tolkien black#stan marsh#south park#it'd be like way cute#Toolshed's like *hey man there's a crack on the side of your suit! here i got duct tape for it let me patch it for you*#*and here i'm gonna add a stripe on the other side so it looks like part of your costume!*#Tolkien like *hey i know the white shirt is your biz but my dad ordered these slick looking athletic shirts in my size by mistake -#- at online checkout and i think it suits your look better*#they'd bond over making gadgets and improving their weapons/armor together like the torque dorks they are#listen its 2:30am and i haven't been able to sleep because of period junk lol this is what i got

8 notes

·

View notes

Note

Sasunaru for the bingo 🙏

This is gonna be controversial but... sasunaru is one of those pairs where i genuinely believe they were in love in canon but i dislike them together as a ship. I preferred Naruto and Sasuke as characters when they weren't together (Sasuke especially) and I think they're better off apart

#asks#ask game#i joke a lot abt sns and it's a good ship but i just don't vibe with it#(which is ironic given the dynamic of most of my otps)#i really dislike the way naruto (the show) butchered sasuke's character and ig that sentiment permeated my view of the ship as well#plus i think their bond was overrated af & i think that's why kishi introduced the soulmate junk to rationalize their obsession w each othe#*other#ask game : duo bingo

5 notes

·

View notes

Text

my dad and i bond over what really matters: hurling 500lbs of drywall chunks into a giant pit together

#we both had fun :)#bond by taking your daughter to the county dump and hurling junk into a BIG ASS PIT

0 notes

Text

the love and care that Elize shows for Elle in both wanting to be a good big sis for Elle and wanting to protect her is too much for my little heart to handle 😭😭 her disappointment at not being able to win a real Bunnykins for Elle broke my heart!!! Elize you are too sweet and good for this world 😭😭❤️❤️❤️

#tales of xillia 2#tox2#tales of#these side chapters are so goooood I love these characters and they do such a good job at making ludger form a bigger bond with the#original cast!! 🥰#junk

1 note

·

View note

Text

im so excited w the neji time travel au guys, i decided to actually cover shippuden after all 😌 let’s see how many chapters i can finish before i start classes again

#morty stuff#writing ch 12 out of the planned 16 of the first arc#but mm. they can be more tbh#chapter 11**#theres gonna be some filler bc this is a naruto fic#(the character of the filler will appear later on + its more about developing bonds rather than useless junk LOL)

1 note

·

View note

Text

Basically its my firm belief that humans made musical instruments so as to communicate incommunicable primal sounds and the height of guitarship to me is making noises that closely resemble human ones like full on WAILS and complains and cries of pain so hearing trem or bends with killer vibrato and like slides too will always thrill me its like YES that is exactly how I feel just what I was thinking let me shake your hand so profusely

#prime examples: that bit in Junk bond trader by elliott smith#hotel california solo 🕺🏻🕺🏻🕺🏻🕺🏻🕺🏻#and how soon is now of course#Like i love a riff that can get me to physically wince

3 notes

·

View notes