#incometaxrefund

Text

Income Tax Return Filing has been enabled for A.Y. 2024-25, Dont wait for Due Date! File Your ITR for Last 2 year. Contact Us +91 9818209246

#incometaxrefund#incometaxreturn#incometaxfiling#incometax#AdvanceTax#taxplanning#taxfilingservices#income tax return filing and other

0 notes

Text

𝐈𝐧𝐜𝐨𝐦𝐞 𝐓𝐚𝐱 𝐑𝐞𝐟𝐮𝐧𝐝: 𝐇𝐨𝐰 𝐭𝐨 𝐂𝐥𝐚𝐢𝐦

For further information, refer to this Article By SoOLEGAL

#incometax#incometaxrefund#claimrefund#howtoclaim#itrfilling#ITR#LegalHelp#lawupdates#SoOLEGAL#legalupdates

0 notes

Text

A Comprehensive Guide: How to File Income Tax in India

In India, filing income tax returns is a critical financial obligation for both individuals and corporations. Seeking the advice of a trained professional, such as a chartered accounting business like CAnest, can be very beneficial in ensuring a smooth and correct filing procedure. We'll outline the procedures, required paperwork, and internet tools in this article's step-by-step guide to filing income taxes in India.

Step 1: Gather Essential Documents

Before proceeding with the filing process, it is essential to gather the necessary documents. These typically include:

1. PAN Card: Your Permanent Account Number (PAN) card is a unique identification number required for income tax filing.

2. Form 16: If you are a salaried individual, your employer will issue Form 16, which contains details of your salary, tax deductions, and TDS (Tax Deducted at Source).

3. Bank Statements: Collect your bank statements, as they will help you verify your income and transactions during the financial year.

4. Investment Proofs: Keep records of investments made under various tax-saving schemes, such as life insurance policies, provident fund contributions, and equity-linked savings schemes.

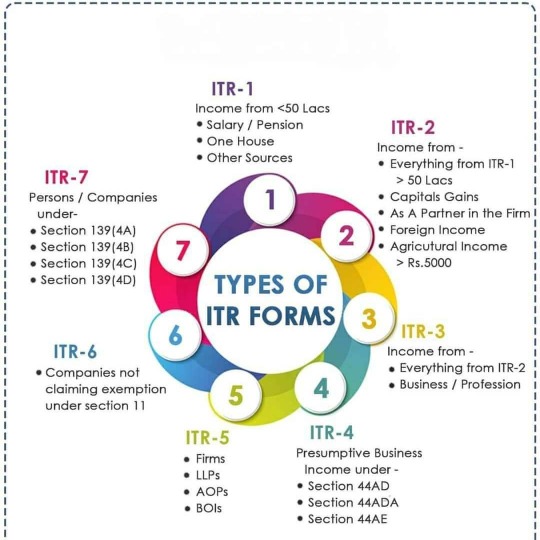

Step 2: Choose the Appropriate ITR Form

Next, determine the correct Income Tax Return (ITR) form to use. The appropriate form depends on your income sources and category. The different ITR forms cater to individuals, businesses, and specific income types. Seek professional advice from a chartered accountant to select the correct form based on your circumstances.

Step 3: Online or Offline Filing

India's income tax filing process offers two options: online and offline filing.

1. Online Filing: This is the most convenient and popular method. Visit the official income tax e-filing portal (incometaxindiaefiling.gov.in) and register yourself as a taxpayer. Complete the relevant ITR form, upload the required documents, and submit your return online.

2. Offline Filing: If you opt for offline filing, download the applicable ITR form from the official portal. Fill in the form manually, and submit it at the nearest Income Tax Office or authorized centers.

Step 4: Verify and Submit Returns

Regardless of the filing method, ensure you verify your returns. The most common methods of verification include:

1. Digital Signature Certificate (DSC): Obtain a DSC and sign your returns electronically. This is mandatory for certain categories of taxpayers.

2. Aadhaar OTP or EVC: Use your Aadhaar-linked mobile number to generate a One-Time Password (OTP) or EVC (Electronic Verification Code) for verification purposes.

Step 5: E-Verification or Physical Verification

After submitting your returns, you can choose either e-verification or physical verification.

1. E-Verification: Use any of the electronic verification methods mentioned in Step 4 to complete the verification process online.

2. Physical Verification: In case you choose physical verification, print your ITR-V (Income Tax Return - Verification) form generated after filing your returns. Sign the form and send it via regular or speed post to the Centralized Processing Center (CPC) within 120 days of e-filing.

Although submitting income tax returns in India may seem difficult, it can be made simple and trouble-free with the correct advice and assistance from a reputable chartered accounting business like CAnest. Do not forget to gather all required paperwork, select the appropriate ITR form, and decide whether to file electronically or manually. Verify your returns using digital signatures or OTP/EVC, then carry out the necessary steps for physical or electronic verification. You can efficiently complete your tax duties and ensure compliance with Indian tax rules by following these steps.

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation

1 note

·

View note

Text

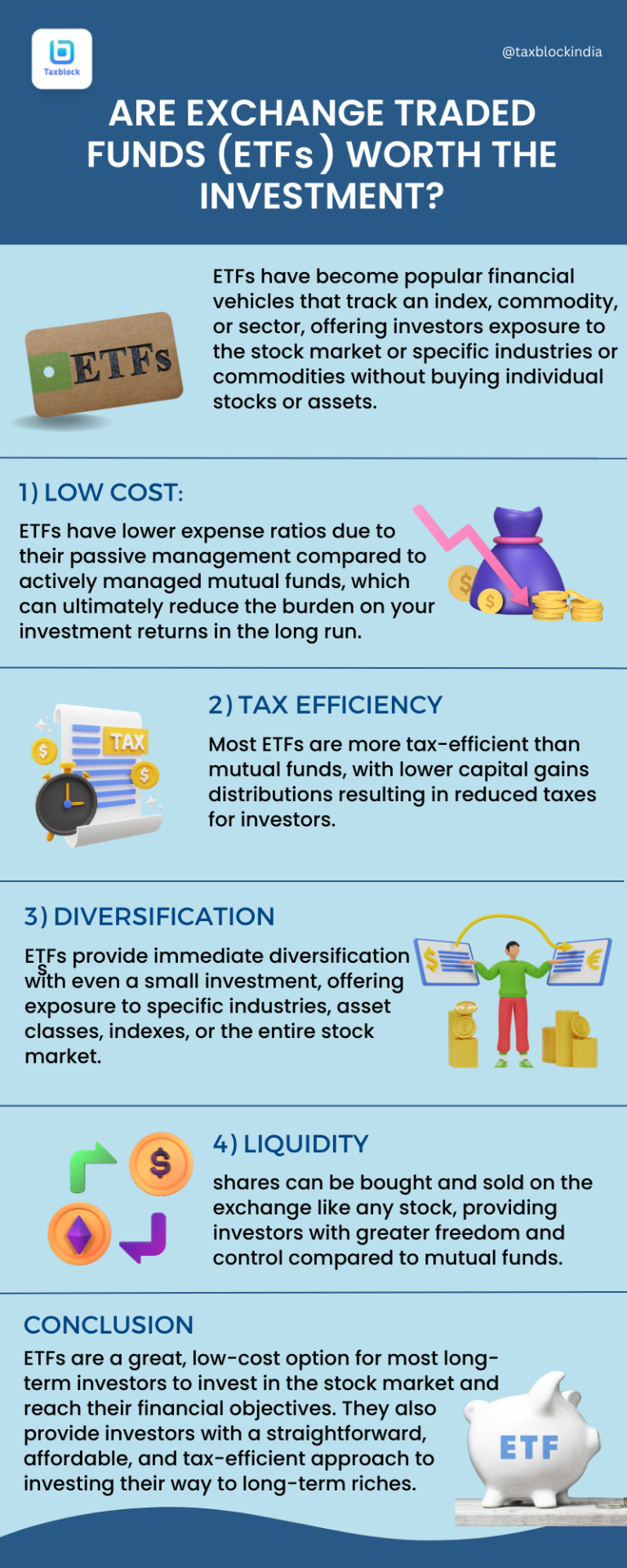

Follow us for more.....

Visit Our Website: taxblock.in

#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxswag#IncomeTaxPrep#IncomeTaxPreparation#investment#investments#investmentproperty#investmentbanking#investmentproperties#InvestmentBanker#investmentopportunity#investmentrealestate#investmentph#investmentart#investmentgold#investmentadvisor#investmentbank#investmentmanagement#investmentclub#investmentadvice

0 notes

Text

In Budget 2023-24, the central government has shown pity for the common man. Only those earning more than 7 lakhs per annum are now liable to pay income tax. Those with an annual income of less than 7 lakhs have been exempted from income tax. It must be said that this is a huge burden for the average wage earner. The biggest mistake in the Indian taxation system is that the middle class people who are paying double the taxes than before due to the increase in the prices of petrol, diesel, gas.. have to pay income tax even on the little income they earn. Now this government has amended it. At least this time the income tax slab has been greatly increased.

It should also be said that the central government has taken huge decisions in the new budget. As the reputation of India increases internationally, the number of people who want to visit India will increase. So it is a great thing that the central government has come up with the idea of bringing new plans for India tourism. The Center has introduced a new scheme called “Dekho Apna Desh”. And when the world is facing recession, the new reforms will strengthen Indian banking. As any transaction in the country is ultimately tied to the bank, this will lead to changes in other sectors. Allocations to agriculture sector have increased. Special provisions were made for women. At a time when the world is chasing electric vehicles, the reduction in taxes on lithium-ion batteries will give relief to the sector. However, it can be said that in this budget only decisions have been taken that benefit the common man. For More information http://bhalamedia.com/ncome-tax-exemption-limit-2023/

#incometaxseason#incometaxreturn#incometaxindia#incometaxes#incometaxrefund#incometaxreturnfiling#incometaxfiling#incometaxupdate#incometaxdepartment#incometaxreturns#incometaxballers#incometaxtime#incometaxupdates#incometaxpreparation#incometaxact#.#Created by Inflact Hashtags Generator

0 notes

Text

Still, awaiting your GST or Tax refund? Get it earlier than your family and friends like over 1 million other Canadians. The Secret?

https://web.koho.ca/referral/RV2TV073

Get your FREE ACCOUNT HERE. Canadian Accounts with cash back, high-interest rates and free over-draft protection to name a few benefits. #directdeposit #GST #incometax #familybonus #childtaxcredit #workingbenefit Refunds #credit #deposit #banking #finaince #overdraft #freeaccounts #badcreditok #mastercarddebitcard #rewards #incometaxrefund #CRAdirectdeposit #GSTcredit #GSTcreditpayment #childtaxpayment #earlydeposit #mastercarddebitcard

#youtube#canada#vancouver#business#abbotsford#news#music#ontario#GST#GST Credit#GSt payment#banking#direct deposit#early payment#family#child tax#child tax benefit#carbon tax credit#tax refund#tax refund deposit#GST Credit deposit#cash back#high interest#mastercard#interac#free#accounts#overdraft#free overdraft#credit rebuilding

4 notes

·

View notes

Text

QUESTION OF THE DAY: (1) Does your income tax refund decrease if you file a year late? (2) How can I check my GST compliance rating?

(1) Income tax returns cannot be filed beyond the time permitted for belated filing which normally 31st march of the assessment year. However, in a hypothetical situation, if the ITR is filed with a delay of 1 year, then late fees shall be applicable resulting in the reduced refund or increased tax liability.

(2) As of now, the GST compliance rating has not been introduced it's still in the planning stage. However, you can get the details of GST filing by your vendor by visiting the link https://services.gst.gov.in/services/searchtp give the GSTIN and clicking show filing table in the inside window

For information on Company Registration, visit https://www.parpella.com/one-person-company-registration

#gst #incometaxreturn #incometax #tax #incometaxindia #incometaxseason #taxes #taxseason #business #itr #accountant #taxreturn #taxpreparer #incometaxes #gstindia #gstupdates #finance #taxation #accounting #taxconsultant #taxrefund #gstregistration #incometaxreturnfiling #gstreturns #incometaxrefund #taxprofessional #taxplanning #incometax

0 notes

Text

Goodness of Filing IT Return

Most people don’t file their IT returns in India. As per the latest information from the Income tax department, Only 6,01,46,901 crore tax returns have been successfully filed for the Assessment year 2020-21, which is 6% over the previous year. The total number of ... visit : https://zerotaxes.in

#incometax#it returns#zerotax#incometaxrefund#finance#taxes#personaltaxes#directtax#india#income tax department

1 note

·

View note

Photo

Celebrating @APPSMOBILETAX Assertively Robinson 6th Tax Season - Mon, Jan 28th is the First Day to begin to e-file your tax return with your Certified Tax Preparer. APPS, LLC has a 92% Success Rate with the IRS and my staff has already started receiving w2’s and preparing tax returns for past year clients. $500 - 5 new clients #ReferralMarketing relies on Trust & Personal Relationships to drive sales!!! 🎯 http://bit.ly/APPSMOBILETAXAuthorizedIRSefileProvider - 2019 -- HTML Newsletter, Checklist and IRS Self Help Options #taxdeductions #payoffdebt #maxrefund #incometaxrefund #appsmobiletax #facebook #youtube #hbcualumni 🔶🔷 #entrepreneurlife #100kKings #health #wellness #education #MillennialCapitalInvestmentGroup #AssertivelyPromotingPhilanthropicServices #APPSLLC #tax #realestate #fixnflip #advertisement #thegrind #love #referafriend #incomeopportunity #customerservice #Marketing #getlost #positivevibes #mindset philanthropy https://www.instagram.com/p/B7SCi5tJyyy1WoIeGpBAR9BA-wFn889VZUfcHE0/?igshid=pvfnyz2qsphg

#referralmarketing#taxdeductions#payoffdebt#maxrefund#incometaxrefund#appsmobiletax#facebook#youtube#hbcualumni#entrepreneurlife#100kkings#health#wellness#education#millennialcapitalinvestmentgroup#assertivelypromotingphilanthropicservices#appsllc#tax#realestate#fixnflip#advertisement#thegrind#love#referafriend#incomeopportunity#customerservice#marketing#getlost#positivevibes#mindset

1 note

·

View note

Text

Income Tax Return Filing for AY 2024-25

0 notes

Photo

#incomestreams #income #itrindia #incometaxfiling #incometaxrefund #incometaxreturnfiling #incometaxoffice #incometaxseason #incometips #incometaxofficer #incometax #incometaxact #incometaxpreparation #itr #incometaxdepartment #incometaxreturns #incometaxtime #incometaxpreparer #incometaxprep #incometaxcheck #incometaxes #incometaxreturn #incometaxmoney #incometaxinspector #incometaxballers #incometaxupdate #incometaxindia #incometaxupdates (at India : इंडिया) https://www.instagram.com/p/CW3tefyBgST/?utm_medium=tumblr

#incomestreams#income#itrindia#incometaxfiling#incometaxrefund#incometaxreturnfiling#incometaxoffice#incometaxseason#incometips#incometaxofficer#incometax#incometaxact#incometaxpreparation#itr#incometaxdepartment#incometaxreturns#incometaxtime#incometaxpreparer#incometaxprep#incometaxcheck#incometaxes#incometaxreturn#incometaxmoney#incometaxinspector#incometaxballers#incometaxupdate#incometaxindia#incometaxupdates

0 notes

Text

How to file the Income Tax In India

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation#standard chartered#charteredaccountant

1 note

·

View note

Photo

It's not easy, but it's simple. Check out ways for you to make a passive income.💰 Like ❤️ Comment 💬 Share ⏩ Save 📩 For more amazing posts Follow @billion_worship👈 Follow @billion_worship👈 Follow @billion_worship👈 #incometaxrefund #startupideas #startupindia #moneyslave #startupmarketing #incometax #moneycake #moneycoach #startupsuccess #incomeshifting #startuptips #incomegoals #rentalincome #moneysaver #incomeinequality #startupkdrama #startupbusinessess #startupindonesia #incomereplacement #moneytree #moneybox #moneyfast #startupadvice #startupfounder #expensespaid #incometaxindia #janaincome #startupnews #startupbrasil #moneypit (at Hyderabad) https://www.instagram.com/p/CUsS2AyPAei/?utm_medium=tumblr

#incometaxrefund#startupideas#startupindia#moneyslave#startupmarketing#incometax#moneycake#moneycoach#startupsuccess#incomeshifting#startuptips#incomegoals#rentalincome#moneysaver#incomeinequality#startupkdrama#startupbusinessess#startupindonesia#incomereplacement#moneytree#moneybox#moneyfast#startupadvice#startupfounder#expensespaid#incometaxindia#janaincome#startupnews#startupbrasil#moneypit

0 notes

Photo

Pay your Income tax ..! And help in India development..! #incometaxhouston #incometaxoffice #incometaxcheck #incometaxballers #incometaxballin #incometaxation #incometaxreturns #incometaxseason #incometaxtime #incometaxindia #incometaxsale #intags #incometaxact #incometaxrefund #incometaxmoney #incometaxreturn #incometaxreturnfiling #incometaxprep #incometaxes #incometaxdepartment #incometaxeffect #incometaxpreparation #incometaxballer #incometaxfiling #incometax (at Uttar Pradesh) https://www.instagram.com/p/CT1QU4dpDex/?utm_medium=tumblr

#incometaxhouston#incometaxoffice#incometaxcheck#incometaxballers#incometaxballin#incometaxation#incometaxreturns#incometaxseason#incometaxtime#incometaxindia#incometaxsale#intags#incometaxact#incometaxrefund#incometaxmoney#incometaxreturn#incometaxreturnfiling#incometaxprep#incometaxes#incometaxdepartment#incometaxeffect#incometaxpreparation#incometaxballer#incometaxfiling#incometax

0 notes

Text

Still, awaiting your GST or Tax refund? Get it earlier than your family and friends like over 1 million other Canadians. The Secret?

https://web.koho.ca/referral/RV2TV073

Get your FREE ACCOUNT HERE. Canadian Accounts with cash back, high-interest rates and free over-draft protection to name a few benefits. #directdeposit #GST #incometax #familybonus #childtaxcredit #workingbenefit Refunds #credit #deposit #banking #finaince #overdraft #freeaccounts #badcreditok #mastercarddebitcard #rewards #incometaxrefund #CRAdirectdeposit #GSTcredit #GSTcreditpayment #childtaxpayment #earlydeposit #mastercarddebitcard

0 notes

Link

0 notes