#incometaxswag

Text

A Comprehensive Guide: How to File Income Tax in India

In India, filing income tax returns is a critical financial obligation for both individuals and corporations. Seeking the advice of a trained professional, such as a chartered accounting business like CAnest, can be very beneficial in ensuring a smooth and correct filing procedure. We'll outline the procedures, required paperwork, and internet tools in this article's step-by-step guide to filing income taxes in India.

Step 1: Gather Essential Documents

Before proceeding with the filing process, it is essential to gather the necessary documents. These typically include:

1. PAN Card: Your Permanent Account Number (PAN) card is a unique identification number required for income tax filing.

2. Form 16: If you are a salaried individual, your employer will issue Form 16, which contains details of your salary, tax deductions, and TDS (Tax Deducted at Source).

3. Bank Statements: Collect your bank statements, as they will help you verify your income and transactions during the financial year.

4. Investment Proofs: Keep records of investments made under various tax-saving schemes, such as life insurance policies, provident fund contributions, and equity-linked savings schemes.

Step 2: Choose the Appropriate ITR Form

Next, determine the correct Income Tax Return (ITR) form to use. The appropriate form depends on your income sources and category. The different ITR forms cater to individuals, businesses, and specific income types. Seek professional advice from a chartered accountant to select the correct form based on your circumstances.

Step 3: Online or Offline Filing

India's income tax filing process offers two options: online and offline filing.

1. Online Filing: This is the most convenient and popular method. Visit the official income tax e-filing portal (incometaxindiaefiling.gov.in) and register yourself as a taxpayer. Complete the relevant ITR form, upload the required documents, and submit your return online.

2. Offline Filing: If you opt for offline filing, download the applicable ITR form from the official portal. Fill in the form manually, and submit it at the nearest Income Tax Office or authorized centers.

Step 4: Verify and Submit Returns

Regardless of the filing method, ensure you verify your returns. The most common methods of verification include:

1. Digital Signature Certificate (DSC): Obtain a DSC and sign your returns electronically. This is mandatory for certain categories of taxpayers.

2. Aadhaar OTP or EVC: Use your Aadhaar-linked mobile number to generate a One-Time Password (OTP) or EVC (Electronic Verification Code) for verification purposes.

Step 5: E-Verification or Physical Verification

After submitting your returns, you can choose either e-verification or physical verification.

1. E-Verification: Use any of the electronic verification methods mentioned in Step 4 to complete the verification process online.

2. Physical Verification: In case you choose physical verification, print your ITR-V (Income Tax Return - Verification) form generated after filing your returns. Sign the form and send it via regular or speed post to the Centralized Processing Center (CPC) within 120 days of e-filing.

Although submitting income tax returns in India may seem difficult, it can be made simple and trouble-free with the correct advice and assistance from a reputable chartered accounting business like CAnest. Do not forget to gather all required paperwork, select the appropriate ITR form, and decide whether to file electronically or manually. Verify your returns using digital signatures or OTP/EVC, then carry out the necessary steps for physical or electronic verification. You can efficiently complete your tax duties and ensure compliance with Indian tax rules by following these steps.

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation

1 note

·

View note

Text

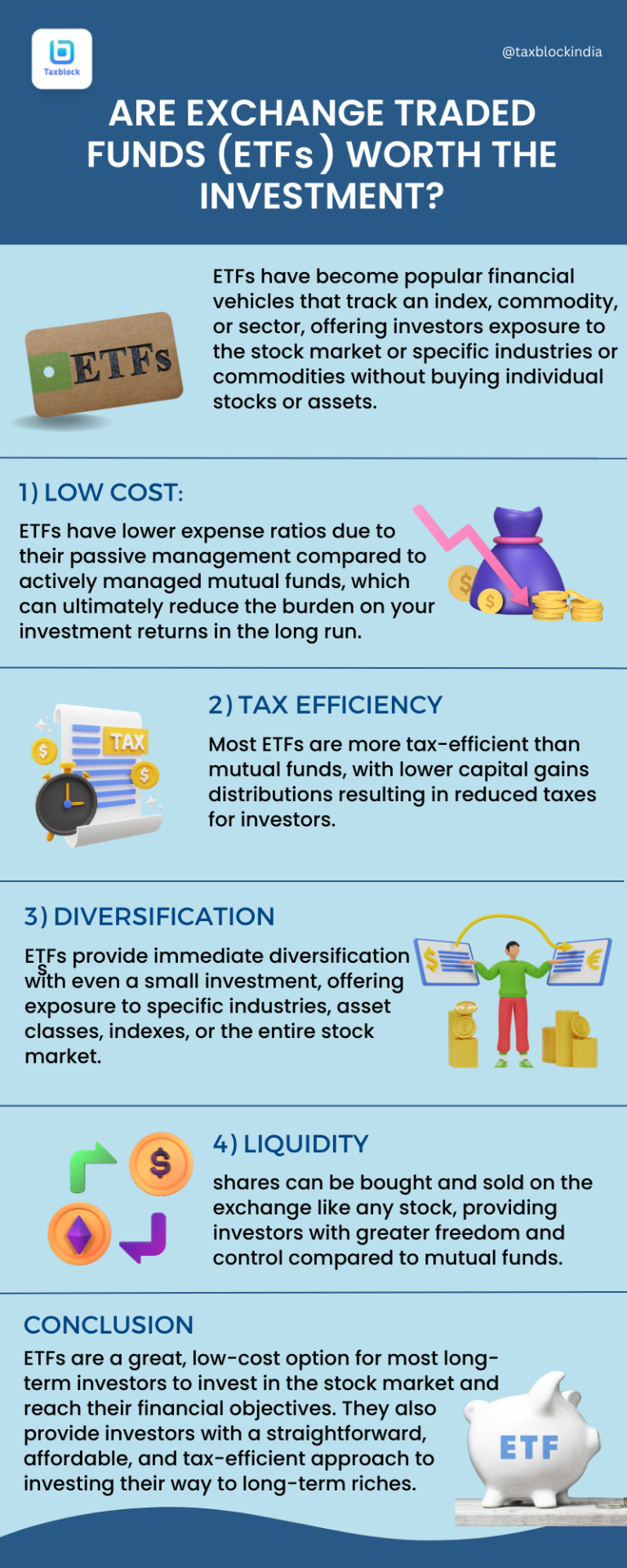

Follow us for more.....

Visit Our Website: taxblock.in

#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxswag#IncomeTaxPrep#IncomeTaxPreparation#investment#investments#investmentproperty#investmentbanking#investmentproperties#InvestmentBanker#investmentopportunity#investmentrealestate#investmentph#investmentart#investmentgold#investmentadvisor#investmentbank#investmentmanagement#investmentclub#investmentadvice

0 notes

Photo

It’s time for a change. #Income #incomesystem #incomegeligeli #incometaxswag #incomeph #incomeoptions #incomestrategist #incomepassive #incometaxtime #incometaxseason #incomecetar #incometaxes #incomeaccelerationconference #IncomeTax #incomesurirumah #incomestatement #income400k #incomefromhome #incomegedhe #incomeverification #incomebesar #INCOMEUSD #incomeia #incomeonline #incomegoals #incomeideas #incometaxmiami #incomebunda #incomepadu #incomegenerator (at Los Angeles, California) https://www.instagram.com/p/B_ZGJE3FMJe/?igshid=1xlb21zvmedig

#income#incomesystem#incomegeligeli#incometaxswag#incomeph#incomeoptions#incomestrategist#incomepassive#incometaxtime#incometaxseason#incomecetar#incometaxes#incomeaccelerationconference#incometax#incomesurirumah#incomestatement#income400k#incomefromhome#incomegedhe#incomeverification#incomebesar#incomeusd#incomeia#incomeonline#incomegoals#incomeideas#incometaxmiami#incomebunda#incomepadu#incomegenerator

0 notes

Text

...all dem monees

When dat freelance check you forgot about come in the day before you skip town to Paris.

23 notes

·

View notes

Photo

Me when I cash my income tax check and/or financial aid check

1 note

·

View note

Text

How to file the Income Tax In India

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation#standard chartered#charteredaccountant

1 note

·

View note