#incometaxmoney

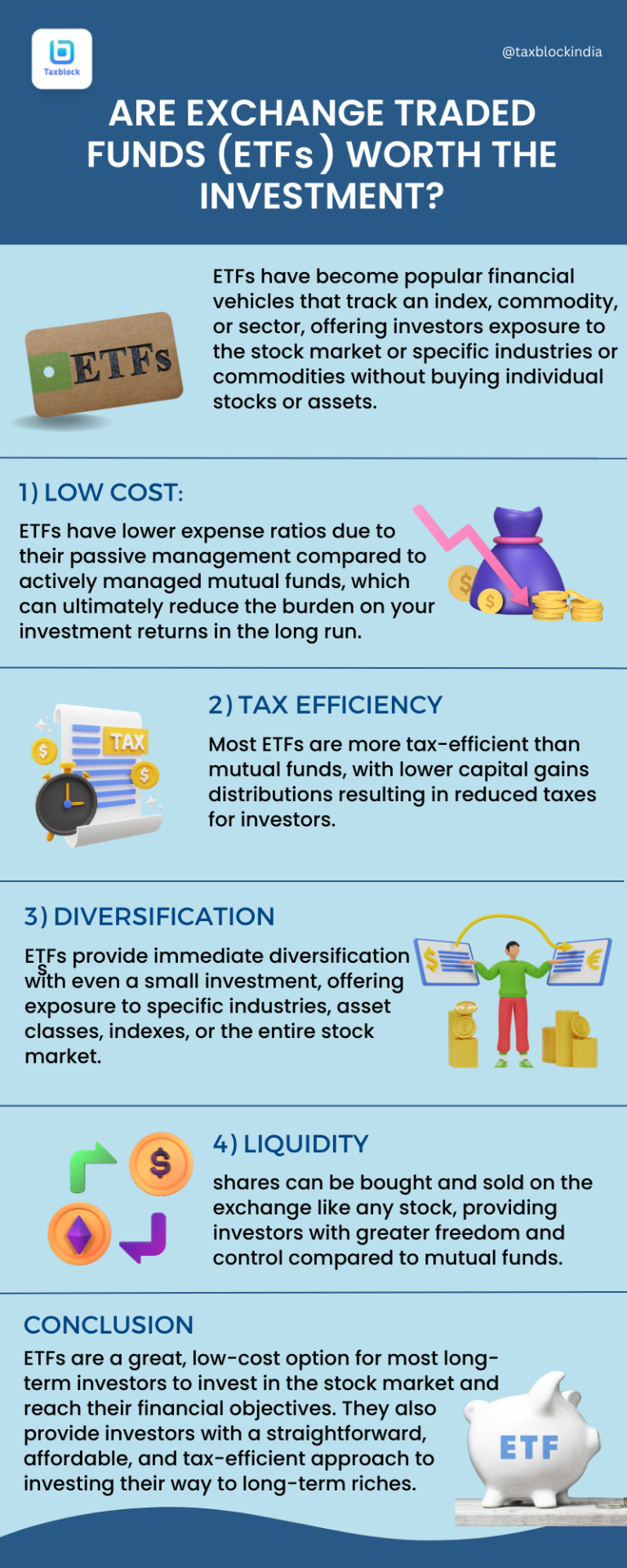

Text

#incometax#incometaxballer#incometaxballers#incometaxballin#incometaxclapback#incometaxeffect#incometaxes#incometaxloans#incometaxmiami#incometaxmoney

0 notes

Text

Follow us for more.....

Visit Our Website: taxblock.in

#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxswag#IncomeTaxPrep#IncomeTaxPreparation#investment#investments#investmentproperty#investmentbanking#investmentproperties#InvestmentBanker#investmentopportunity#investmentrealestate#investmentph#investmentart#investmentgold#investmentadvisor#investmentbank#investmentmanagement#investmentclub#investmentadvice

0 notes

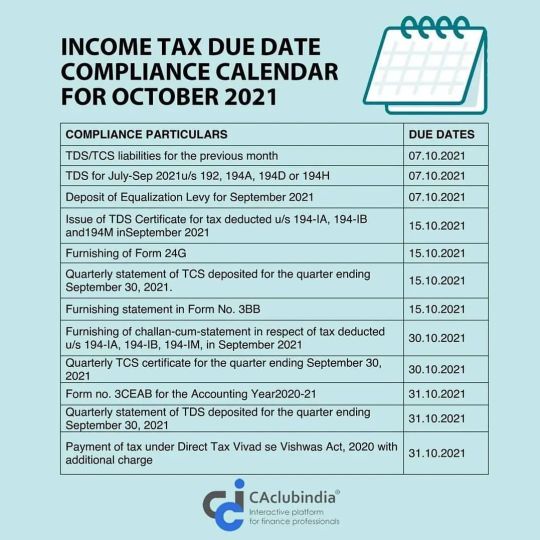

Photo

Pay your Income tax ..! And help in India development..! #incometaxhouston #incometaxoffice #incometaxcheck #incometaxballers #incometaxballin #incometaxation #incometaxreturns #incometaxseason #incometaxtime #incometaxindia #incometaxsale #intags #incometaxact #incometaxrefund #incometaxmoney #incometaxreturn #incometaxreturnfiling #incometaxprep #incometaxes #incometaxdepartment #incometaxeffect #incometaxpreparation #incometaxballer #incometaxfiling #incometax (at Uttar Pradesh) https://www.instagram.com/p/CT1QU4dpDex/?utm_medium=tumblr

#incometaxhouston#incometaxoffice#incometaxcheck#incometaxballers#incometaxballin#incometaxation#incometaxreturns#incometaxseason#incometaxtime#incometaxindia#incometaxsale#intags#incometaxact#incometaxrefund#incometaxmoney#incometaxreturn#incometaxreturnfiling#incometaxprep#incometaxes#incometaxdepartment#incometaxeffect#incometaxpreparation#incometaxballer#incometaxfiling#incometax

0 notes

Photo

#incomestreams #income #itrindia #incometaxfiling #incometaxrefund #incometaxreturnfiling #incometaxoffice #incometaxseason #incometips #incometaxofficer #incometax #incometaxact #incometaxpreparation #itr #incometaxdepartment #incometaxreturns #incometaxtime #incometaxpreparer #incometaxprep #incometaxcheck #incometaxes #incometaxreturn #incometaxmoney #incometaxinspector #incometaxballers #incometaxupdate #incometaxindia #incometaxupdates (at India : इंडिया) https://www.instagram.com/p/CW3tefyBgST/?utm_medium=tumblr

#incomestreams#income#itrindia#incometaxfiling#incometaxrefund#incometaxreturnfiling#incometaxoffice#incometaxseason#incometips#incometaxofficer#incometax#incometaxact#incometaxpreparation#itr#incometaxdepartment#incometaxreturns#incometaxtime#incometaxpreparer#incometaxprep#incometaxcheck#incometaxes#incometaxreturn#incometaxmoney#incometaxinspector#incometaxballers#incometaxupdate#incometaxindia#incometaxupdates

0 notes

Photo

#dailyincome #kissimmeeincometax #7figureincome #incomestreams #singleincome #FulltimeIncome #automatedincome #incomeharihari #incometaxtime #makeextraincome #pasiveincome #basicincome #supplementalincome #incometaxmiami #withpaincomesstrength #lowincome #fixedincome #IncomeTaxMoney #earnedincome #incometaxballers #EarnAnExtraIncome #USDPASSIVEINCOME #incomestatement #ProofOfIncome #passiveincomeinvesting #PORTFOLIOINCOME #incomeopportunities #unlimitedincome #premierincomeplan #IncomeTaxRefund

0 notes

Text

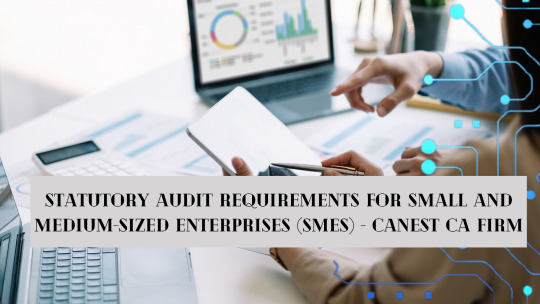

The Role of Statutory Audits in Detecting and Preventing Financial Fraud

In the intricate world of business, where financial transactions form the backbone of operations, the Specter of financial fraud looms large. Small and large enterprises alike face the constant threat of fraudulent activities that can jeopardize not only their financial health but also their reputation. This is where statutory audits, conducted by trusted firms like CAnest CA Firm in India, emerge as a critical line of defence.

Understanding Financial Fraud:

Financial fraud is a pervasive issue that encompasses various deceptive practices aimed at manipulating financial records, misrepresenting financial health, and siphoning off funds for personal gain. From embezzlement and asset misappropriation to financial statement fraud, the methods employed by fraudsters are diverse and evolving.

The Vital Role of Statutory Audits:

Statutory audits, mandated by regulatory authorities, are not mere formalities but robust mechanisms designed to scrutinize financial records meticulously. CAnest CA Firm, with its team of seasoned auditors, recognizes the pivotal role these audits play in identifying, addressing, and preventing financial fraud.

1. Uncovering Irregularities:

Statutory audits involve a comprehensive examination of financial statements, transactions, and internal controls. This scrutiny often reveals irregularities or inconsistencies that could be indicative of fraudulent activities.

2. Verification of Transactions:

Through a systematic review, auditors verify the authenticity of transactions. This helps in detecting fictitious transactions, a common tactic in financial fraud, where funds are funnelled out of the organization under the guise of legitimate activities.

3. Assessment of Internal Controls:

A crucial aspect of statutory audits is evaluating the effectiveness of internal controls. Weak internal controls create opportunities for fraud. CAnest's auditors meticulously assess these controls, recommending enhancements where necessary.

4. Forensic Auditing Techniques:

In cases where fraud is suspected, CAnest CA Firm employs forensic auditing techniques. This involves a deeper, more specialized examination aimed at uncovering fraudulent activities and gathering evidence for legal proceedings.

5. Educating and Advising Clients:

Beyond detection, statutory audits are proactive in preventing fraud. CAnest CA Firm goes beyond the numbers, educating clients on fraud risks and providing advisory services to strengthen internal controls, reducing vulnerabilities.

Case Studies:

CAnest's Intervention in a Case of Embezzlement:

In a recent engagement, CAnest CA Firm uncovered a case of embezzlement within a client's organization. Through a rigorous statutory audit, irregularities in financial transactions were identified, leading to the exposure of an elaborate embezzlement scheme. Prompt action was taken, preventing further financial losses.

As financial fraud becomes more sophisticated, the role of statutory audits, exemplified by the diligent efforts of CAnest CA Firm, becomes increasingly vital. Beyond meeting regulatory requirements, statutory audits are a strategic investment in the financial integrity and longevity of businesses. By partnering with CAnest CA Firm, businesses in India can fortify their defences against financial fraud, ensuring not only compliance but also sustainable growth.

In the complex dance between transparency and deception, statutory audits orchestrated by firms like CAnest CA Firm emerge as a powerful force for accountability and trust in the realm of finance.

#incometax#incometaxballer#incometaxballers#incometaxballin#incometaxclapback#incometaxeffect#incometaxes#incometaxloans#incometaxmiami#incometaxmoney

0 notes

Text

Statutory Audit Requirements for Small and Medium-sized Enterprises (SMEs) with Expert Insights from CAnest CA Firm

Small and medium-sized enterprises (SMEs) are the backbone of many economies around the world. In their pursuit of growth and financial stability, SMEs often navigate a complex web of regulations and financial responsibilities. One such responsibility is the statutory audit, a critical process that ensures financial transparency and accountability. In this article, we'll explore the statutory audit requirements for SMEs, with expert insights from the experienced professionals at CAnest CA Firm.

Understanding Statutory Audits for SMEs

A statutory audit is an independent examination of a company's financial statements and accounts. Its primary goal is to provide assurance to stakeholders that the financial information is accurate and reliable. While statutory audits are commonly associated with large corporations, SMEs are not exempt from these requirements.

CAnest CA Firm, a renowned name in the world of auditing, explains that the need for statutory audits in SMEs stems from various factors:

1. Legal Mandate: In many countries, the law mandates that SMEs conduct an annual statutory audit if they meet specific criteria, such as meeting certain revenue or asset thresholds.

2. Stakeholder Assurance: Statutory audits provide confidence to stakeholders, including investors, creditors, and even potential partners, about the financial health of the SME.

3. Tax Compliance: An audited financial statement can simplify the tax filing process and help SMEs avoid potential tax-related issues.

4. Access to Finance: Many financial institutions require audited financial statements as a prerequisite for loans or credit lines.

Criteria for Statutory Audits in SMEs

The specific criteria for statutory audits in SMEs can vary from one jurisdiction to another, but common thresholds include:

- Revenue: Typically, SMEs with revenues exceeding a certain amount (e.g., $1 million) are required to undergo a statutory audit.

- Total Assets: In some cases, the value of a company's assets may trigger the need for an audit.

- Number of Employees: The size of the workforce can also influence audit requirements.

CAnest CA Firm emphasizes that it's crucial for SMEs to understand the legal and regulatory requirements in their specific jurisdiction, as non-compliance can result in fines and penalties.

The Role of CAnest CA Firm in SME Statutory Audits

CAnest CA Firm has a strong track record of assisting SMEs in meeting their statutory audit requirements efficiently. The firm's team of experienced auditors and financial experts provides several key services to SMEs:

1. Audit Planning: CAnest CA Firm customizes audit plans based on the unique needs and risks of each SME, ensuring a cost-effective and thorough process.

2. Risk Assessment: Their experts assess the financial risks that SMEs face and develop strategies to mitigate them.

3. Compliance Guidance: CAnest CA Firm stays up to date with changing regulations, ensuring SMEs remain compliant with all statutory audit requirements.

4. Business Insights: Beyond compliance, CAnest CA Firm leverages audit data to provide valuable insights that can help SMEs make informed financial decisions.

For SMEs, statutory audits are not just a regulatory burden; they are an opportunity to demonstrate financial integrity and gain the trust of stakeholders. CAnest CA Firm, with its expertise and commitment to serving SMEs, is a valuable ally in navigating the complex landscape of statutory audit requirements. SMEs should proactively engage with professionals like CAnest CA Firm to ensure compliance, foster growth, and secure their financial future.

As a business owner or financial professional, understanding these requirements is essential to thrive in a competitive market. Consult with experts like those at CAnest CA Firm to ensure your SME meets its statutory audit obligations while reaping the benefits of financial transparency and accountability.

#incometax#incometaxballer#incometaxballers#incometaxballin#incometaxclapback#incometaxes#incometaxeffect#incometaxloans#incometaxmiami#incometaxmoney#top statutory audit services#best statutory audit services in bangalore#statutory audit services#statutory compliance#statutor

0 notes

Text

#incometax#incometaxballer#incometaxballers#incometaxclapback#incometaxballin#incometaxes#incometaxeffect#incometaxloans#incometaxmiami#incometaxmoney#top statutory audit services#best accounting firm in bangalore#best statutory audit services in bangalore#statutory audit services#statutory compliance#statutor

0 notes

Text

Navigating Complexities: Challenges Faced By Auditors In Conducting Statutory Audits For Multinational Corporation in India

#best statutory audit services in bangalore#statutory audit services#incometaxclapback#incometaxballin#incometaxballer#incometaxeffect#incometaxmiami#incometaxloans#incometaxballers#incometax#incometaxes#incometaxmoney

0 notes

Text

Navigating Complexities: Challenges Faced by Auditors in Conducting Statutory Audits for Multinational Corporations in India

Statutory audits play a crucial role in ensuring the accuracy and reliability of financial statements for multinational corporations (MNCs) operating in India. However, the process of conducting statutory audits services for MNCs presents auditors with a unique set of challenges. This article delves into these challenges and envisions the role of a hypothetical professional, the "CAnest," in overcoming these complexities.

Challenges Faced by Auditors:

1. Cross-Border Regulations and Standards: MNCs frequently have to comply with numerous sets of accounting and reporting requirements across multiple jurisdictions. To maintain consistency and compliance, auditors must traverse these complicated regulations.

2. Language and Cultural Diversity: MNCs with operations in India may have subsidiaries in several regions with varied languages and cultures. It is difficult to maintain accurate financial readings while communicating effectively with varied stakeholders.

3. Currency Exchange and Transfer Pricing: Auditors must handle complex currency conversion difficulties and evaluate transfer pricing arrangements within the MNC group to ensure that transactions between businesses are at arm's length and in accordance with Indian regulations.

4. Data Consolidation and Validation: MNCs frequently keep financial data on multiple platforms. Auditors must aggregate and validate this data in order to provide accurate financial accounts, which necessitates strong data analytics abilities.

5. Complex Organizational Structures: MNCs frequently have complex organizational structures that include several subsidiaries, joint ventures, and associates. Auditors must guarantee that financial statements accurately reflect the organization's financial situation and performance.

6. Taxation and Regulatory Compliance: MNCs must comply with a variety of tax laws and regulatory obligations. Auditors must evaluate tax situations, provisions, and disclosures in order to verify compliance with Indian tax rules.

7. Risks of Fraud and Corruption: The intricacy of MNC operations raises the possibility of financial wrongdoing. Auditors must be forensically skilled in order to detect and handle possible fraud and corruption within the organization.

The Role of the CAnest:

Consider a "CAnest" (Cross-Border Audit Specialist) who specializes in conducting statutory audits Services for multinational corporations in India. The CAnest possesses a specific skill set to meet auditing challenges:

1. In-Depth Regulatory Knowledge: CAnest is well-versed in both Indian and international accounting and auditing standards, allowing them to easily manage complex laws.

2. Cultural and Language Proficiency: The CAnest is bilingual and culturally sensitive, allowing for successful financial information sharing and interpretation among varied stakeholders.

3. Advanced Data Analytics Expertise: The CAnest employs cutting-edge data analytics techniques to combine, evaluate, and analyse financial data from several sources, thereby improving audit accuracy and efficiency.

4. Transfer Pricing and Taxation Acumen: The CAnest assures compliance and optimal tax positions throughout the MNC group by having a thorough awareness of transfer pricing restrictions and taxation laws.

5. Forensic and Fraud Detection Skills: The CAnest has superior forensic capabilities that allow him to spot probable fraud, corruption, and anomalies within complex MNC organizations.

Conducting statutory audits Services for global firms in India presents distinct problems that necessitate specialized knowledge and skills. The fictitious CAnest envisioned in this paper symbolizes a professional capable of confronting these issues front on. The CAnest contributes to the integrity and transparency of financial reporting for MNCs with their in-depth understanding, cultural sensitivity, and superior technical abilities, consequently increasing investor trust and regulatory compliance.

#incometax#incometaxballer#incometaxballers#incometaxeffect#incometaxballin#incometaxes#incometaxclapback#incometaxloans#incometaxmiami#incometaxmoney#statutory compliance#statutory Audit#statutory audit

0 notes

Text

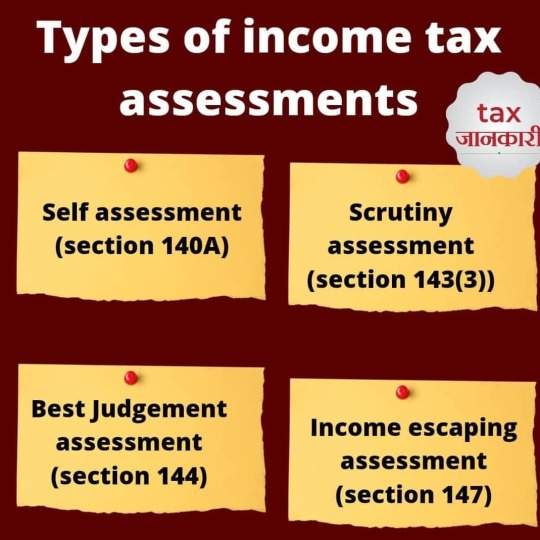

A Comprehensive Guide: How to File Income Tax in India

In India, filing income tax returns is a critical financial obligation for both individuals and corporations. Seeking the advice of a trained professional, such as a chartered accounting business like CAnest, can be very beneficial in ensuring a smooth and correct filing procedure. We'll outline the procedures, required paperwork, and internet tools in this article's step-by-step guide to filing income taxes in India.

Step 1: Gather Essential Documents

Before proceeding with the filing process, it is essential to gather the necessary documents. These typically include:

1. PAN Card: Your Permanent Account Number (PAN) card is a unique identification number required for income tax filing.

2. Form 16: If you are a salaried individual, your employer will issue Form 16, which contains details of your salary, tax deductions, and TDS (Tax Deducted at Source).

3. Bank Statements: Collect your bank statements, as they will help you verify your income and transactions during the financial year.

4. Investment Proofs: Keep records of investments made under various tax-saving schemes, such as life insurance policies, provident fund contributions, and equity-linked savings schemes.

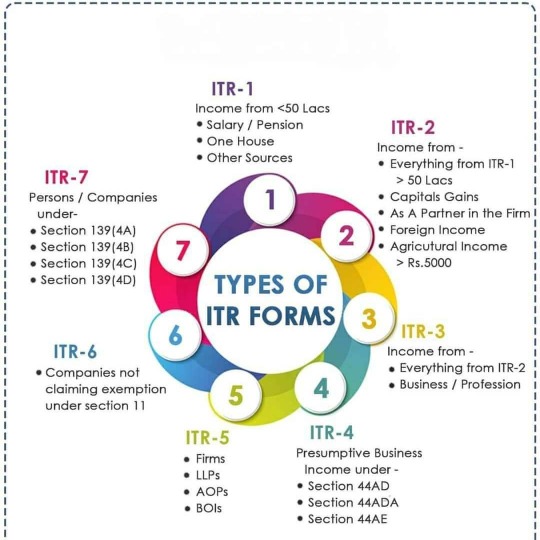

Step 2: Choose the Appropriate ITR Form

Next, determine the correct Income Tax Return (ITR) form to use. The appropriate form depends on your income sources and category. The different ITR forms cater to individuals, businesses, and specific income types. Seek professional advice from a chartered accountant to select the correct form based on your circumstances.

Step 3: Online or Offline Filing

India's income tax filing process offers two options: online and offline filing.

1. Online Filing: This is the most convenient and popular method. Visit the official income tax e-filing portal (incometaxindiaefiling.gov.in) and register yourself as a taxpayer. Complete the relevant ITR form, upload the required documents, and submit your return online.

2. Offline Filing: If you opt for offline filing, download the applicable ITR form from the official portal. Fill in the form manually, and submit it at the nearest Income Tax Office or authorized centers.

Step 4: Verify and Submit Returns

Regardless of the filing method, ensure you verify your returns. The most common methods of verification include:

1. Digital Signature Certificate (DSC): Obtain a DSC and sign your returns electronically. This is mandatory for certain categories of taxpayers.

2. Aadhaar OTP or EVC: Use your Aadhaar-linked mobile number to generate a One-Time Password (OTP) or EVC (Electronic Verification Code) for verification purposes.

Step 5: E-Verification or Physical Verification

After submitting your returns, you can choose either e-verification or physical verification.

1. E-Verification: Use any of the electronic verification methods mentioned in Step 4 to complete the verification process online.

2. Physical Verification: In case you choose physical verification, print your ITR-V (Income Tax Return - Verification) form generated after filing your returns. Sign the form and send it via regular or speed post to the Centralized Processing Center (CPC) within 120 days of e-filing.

Although submitting income tax returns in India may seem difficult, it can be made simple and trouble-free with the correct advice and assistance from a reputable chartered accounting business like CAnest. Do not forget to gather all required paperwork, select the appropriate ITR form, and decide whether to file electronically or manually. Verify your returns using digital signatures or OTP/EVC, then carry out the necessary steps for physical or electronic verification. You can efficiently complete your tax duties and ensure compliance with Indian tax rules by following these steps.

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation

1 note

·

View note

Text

How to file the Income Tax In India

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation#standard chartered#charteredaccountant

1 note

·

View note

Photo

#taxation #incomestreams #income #itrindia #incometaxfiling #incometaxrefund #incometaxreturnfiling #incometaxoffice #incometaxseason #incometips #incometaxofficer #incometax #incometaxact #incometaxpreparation #itr #incometaxdepartment #incometaxreturns #incometaxtime #incometaxpreparer #incometaxprep #incometaxcheck #incometaxes #incometaxreturn #incometaxmoney #incometaxinspector #incometaxballers #incometaxupdate #incometaxindia #incometaxupdates (at India) https://www.instagram.com/p/CW2RkUxJeg3/?utm_medium=tumblr

#taxation#incomestreams#income#itrindia#incometaxfiling#incometaxrefund#incometaxreturnfiling#incometaxoffice#incometaxseason#incometips#incometaxofficer#incometax#incometaxact#incometaxpreparation#itr#incometaxdepartment#incometaxreturns#incometaxtime#incometaxpreparer#incometaxprep#incometaxcheck#incometaxes#incometaxreturn#incometaxmoney#incometaxinspector#incometaxballers#incometaxupdate#incometaxindia#incometaxupdates

0 notes

Photo

#incomestreams #income #itrindia #incometaxfiling #incometaxrefund #incometaxreturnfiling #incometaxoffice #incometaxseason #incometaxofficer #incometips #incometax #incometaxact #incometaxpreparation #itr #incometaxdepartment #incometaxreturns #incometaxreturns #incometaxtime #incometaxpreparer #incometaxprep #incometaxcheck #incometaxes #incometaxreturn #incometaxmoney #incometaxinspector #incometaxballers #incometaxupdate #incometaxindia #incometaxupdates (at India) https://www.instagram.com/p/CUxdg2LoZmr/?utm_medium=tumblr

#incomestreams#income#itrindia#incometaxfiling#incometaxrefund#incometaxreturnfiling#incometaxoffice#incometaxseason#incometaxofficer#incometips#incometax#incometaxact#incometaxpreparation#itr#incometaxdepartment#incometaxreturns#incometaxtime#incometaxpreparer#incometaxprep#incometaxcheck#incometaxes#incometaxreturn#incometaxmoney#incometaxinspector#incometaxballers#incometaxupdate#incometaxindia#incometaxupdates

0 notes

Photo

#income #incomestreams #itrindia #incometaxfiling #incometaxrefund #incometaxreturnfiling #incometaxoffice #incometaxseason #incometaxofficer #incometips #incometax #incometaxact #incometaxpreparation #itr #incometaxdepartment #incometaxreturns #incometaxtime #incometaxpreparer #incometaxprep #incometaxcheck #incometaxes #incometaxreturn #incometaxmoney #incometaxinspector #incometaxballers #incometaxupdate #incometaxindia #incometaxupdates (at India) https://www.instagram.com/p/CT_cBWqo7ld/?utm_medium=tumblr

#income#incomestreams#itrindia#incometaxfiling#incometaxrefund#incometaxreturnfiling#incometaxoffice#incometaxseason#incometaxofficer#incometips#incometax#incometaxact#incometaxpreparation#itr#incometaxdepartment#incometaxreturns#incometaxtime#incometaxpreparer#incometaxprep#incometaxcheck#incometaxes#incometaxreturn#incometaxmoney#incometaxinspector#incometaxballers#incometaxupdate#incometaxindia#incometaxupdates

0 notes

Photo

#income #incometax #incometaxindia #incometaxreturn #incometips #incomestreams #incometaxseason #incometaxes #itr #itrindia #incometaxinspector #incometaxofficer #incometaxdepartment #incometaxupdate #incometaxupdates #incometaxrefund #incometaxreturnfiling #incometaxreturns #incometaxact #incometaxballers #incometaxfiling #incometaxtime #incometaxpreparation #incometaxprep #incometaxpreparer #incometaxoffice #incometaxcheck #incometaxmoney https://www.instagram.com/p/CTcVrTloX-c/?utm_medium=tumblr

#income#incometax#incometaxindia#incometaxreturn#incometips#incomestreams#incometaxseason#incometaxes#itr#itrindia#incometaxinspector#incometaxofficer#incometaxdepartment#incometaxupdate#incometaxupdates#incometaxrefund#incometaxreturnfiling#incometaxreturns#incometaxact#incometaxballers#incometaxfiling#incometaxtime#incometaxpreparation#incometaxprep#incometaxpreparer#incometaxoffice#incometaxcheck#incometaxmoney

0 notes