#best statutory audit services in bangalore

Text

Statutory Audit Requirements for Small and Medium-sized Enterprises (SMEs) with Expert Insights from CAnest CA Firm

Small and medium-sized enterprises (SMEs) are the backbone of many economies around the world. In their pursuit of growth and financial stability, SMEs often navigate a complex web of regulations and financial responsibilities. One such responsibility is the statutory audit, a critical process that ensures financial transparency and accountability. In this article, we'll explore the statutory audit requirements for SMEs, with expert insights from the experienced professionals at CAnest CA Firm.

Understanding Statutory Audits for SMEs

A statutory audit is an independent examination of a company's financial statements and accounts. Its primary goal is to provide assurance to stakeholders that the financial information is accurate and reliable. While statutory audits are commonly associated with large corporations, SMEs are not exempt from these requirements.

CAnest CA Firm, a renowned name in the world of auditing, explains that the need for statutory audits in SMEs stems from various factors:

1. Legal Mandate: In many countries, the law mandates that SMEs conduct an annual statutory audit if they meet specific criteria, such as meeting certain revenue or asset thresholds.

2. Stakeholder Assurance: Statutory audits provide confidence to stakeholders, including investors, creditors, and even potential partners, about the financial health of the SME.

3. Tax Compliance: An audited financial statement can simplify the tax filing process and help SMEs avoid potential tax-related issues.

4. Access to Finance: Many financial institutions require audited financial statements as a prerequisite for loans or credit lines.

Criteria for Statutory Audits in SMEs

The specific criteria for statutory audits in SMEs can vary from one jurisdiction to another, but common thresholds include:

- Revenue: Typically, SMEs with revenues exceeding a certain amount (e.g., $1 million) are required to undergo a statutory audit.

- Total Assets: In some cases, the value of a company's assets may trigger the need for an audit.

- Number of Employees: The size of the workforce can also influence audit requirements.

CAnest CA Firm emphasizes that it's crucial for SMEs to understand the legal and regulatory requirements in their specific jurisdiction, as non-compliance can result in fines and penalties.

The Role of CAnest CA Firm in SME Statutory Audits

CAnest CA Firm has a strong track record of assisting SMEs in meeting their statutory audit requirements efficiently. The firm's team of experienced auditors and financial experts provides several key services to SMEs:

1. Audit Planning: CAnest CA Firm customizes audit plans based on the unique needs and risks of each SME, ensuring a cost-effective and thorough process.

2. Risk Assessment: Their experts assess the financial risks that SMEs face and develop strategies to mitigate them.

3. Compliance Guidance: CAnest CA Firm stays up to date with changing regulations, ensuring SMEs remain compliant with all statutory audit requirements.

4. Business Insights: Beyond compliance, CAnest CA Firm leverages audit data to provide valuable insights that can help SMEs make informed financial decisions.

For SMEs, statutory audits are not just a regulatory burden; they are an opportunity to demonstrate financial integrity and gain the trust of stakeholders. CAnest CA Firm, with its expertise and commitment to serving SMEs, is a valuable ally in navigating the complex landscape of statutory audit requirements. SMEs should proactively engage with professionals like CAnest CA Firm to ensure compliance, foster growth, and secure their financial future.

As a business owner or financial professional, understanding these requirements is essential to thrive in a competitive market. Consult with experts like those at CAnest CA Firm to ensure your SME meets its statutory audit obligations while reaping the benefits of financial transparency and accountability.

#incometax#incometaxballer#incometaxballers#incometaxballin#incometaxclapback#incometaxes#incometaxeffect#incometaxloans#incometaxmiami#incometaxmoney#top statutory audit services#best statutory audit services in bangalore#statutory audit services#statutory compliance#statutor

0 notes

Text

How can you get ISO 14001 Certification

All you need to know about ISO 14001 Certification in Hyderabad

ISO 14001 Certification in Hyderabad, If you are looking for a way to get ISO 14001 Certification in Hyderabad, you then have reached the proper carrier company. Factocert lets you in achieving this certification in a problem-loose approach. ISO is the International Standard that specifies the necessities for a pleasant management machine (QMS). Meeting the necessities of this standard will provide great management systems with a purpose to be of real benefit for your business enterprise to assist manipulate your business effectively and put in vicinity great exercise technique.

An ISO certification in Hyderabad may be carried out through any commercial enterprise of any length and in any given zone. We provide our services in all fundamental cities in India, like Bangalore, Chennai, Mumbai, Kerala, Hyderabad, Pune, Coimbatore and so on.

Cost of ISO 14001 Certification in Hyderabad

ISO 14001 Certification Cost in Hyderabad for an agency varies primarily based on its worker size and the complexity of the business nature. Also, suppose the employer is already running at a selected widespread with a maximum of the best techniques and practices already set in place. In that case, the certification fee should considerably come down and make it very easy to gain ISO Certification.

In a few eventualities wherein a particular corporation is running in all 3 three running shifts, the ISO 14001 Certification Cost may additionally grow for the reason that the representative, as well as the auditor, will want to engage employees in education and discussions in all three running shifts.

Also, assume an employer is running in more than one place. In that case, the certification value is sure to boom because the consultant and auditor will want to go to most of these working places to make certain implementation and auditing are performed in those places.

Factocert conducts a loose hole analysis for the agencies to make sure ISO 14001 Certification Cost in Hyderabad is very low-priced to the customers.

Requirements of ISO 14001 Certification in Hyderabad

By complying with the ISO 14001 Certification Requirements, an organization can beautify its credibility by showing customers that its products and services meet expectations. To achieve the ISO 14001 certification method, an organization has established the following:

Follows the recommendations of the ISO 14001 Standard

Fulfills its necessities

Meets purchaser necessities and statutory and regulatory necessities

Maintains documentation

ISO 14001 Certification in Hyderabad and benefits

The blessings of ISO 14001 Certification in Hyderabad are multi-fold. There is absolutely no doubt that clients are far more likely to touch an enterprise if it uses an ISO logo within the advertising of its products or services. Following are a number of the blessings of ISO Certification

Increased earnings ability and market percentage.

The agency can growth its logo visibility by way of showing clients that its products and services meet expectancies.

To grow to be eligible to use for Government and International Tenders.

It facilitates increasing the operational efficiency in a manufacturing environment.

It lets you take your products and services to overseas markets.

ISO 14001 Certification Process in Hyderabad

The ISO 14001 Certification Process in Hyderabad is less difficult, faster, and inexpensive. Factocert will make sure that the certification is finished with a totally simplified procedure, other ISO 14001 Certification bodies in India is ISO 14001 Certification in India.

Our Mission is to offer cost-effective, competitive, and practical commercial enterprise answers to assist companies in achieving ISO 14001 Certification in Hyderabad in a quick time. Our method is easy and easy to understand. We are one of the handful of professional consulting businesses with an international consumer base and carrier portfolio that covers all of the International Quality Certifications, other ISO 14001 Certification bodies in India is ISO 14001 Certification in Mumbai.

ISO 14001 Auditors in Hyderabad

Seek recommendations from other organizations or colleagues in your industry who have undergone ISO 14001 auditors in Hyderabad. Personal recommendations can be valuable in finding auditors with a proven track record.

When selecting an ISO 14001 auditors in Hyderabad, ensure that they are accredited by a recognized accreditation body. Look for 14001 Auditors in Hyderabad with relevant experience in your industry and a good understanding of environmental management systems. Verify their credentials and inquire about their auditing process.

Remember to request quotes or proposals from multiple auditors to compare their offerings and make an informed decision based on your organization’s needs.

ISO 14001 Consultants in Hyderabad

When selecting a consultant, consider their experience, track record, and expertise in ISO 14001. It’s also essential to verify their credentials and inquire about their past successful projects. Additionally, check if they have experience working with organizations in your industry.

Always request proposals or quotes from multiple consultants to compare their offerings and ensure that their services align with your organization’s needs.

Why Factocert for ISO 14001 Certification in Hyderabad

We provide the best ISO consultants in Hyderabad, Who are very knowledgeable and provide the best solution. And to know how to get ISO certification in the . Kindly reach us at [email protected]. ISO 14001 Certification consultants work according to ISO 14001 standards and help organizations implement ISO 14001 certification in with proper documentation.

For more information visit: ISO 14001 Certification in Hyderabad

Related Article : ISO Consultants in Hyderabad

0 notes

Text

Private Limited Company in Bangalore

Bangalore is a hub for new business registration and the start of the latest companies, including LLP registration in Bangalore.

LLP is a complete form of Limited Liability partnership firm, which the LLP Act, 2008, has governed. The plus point of LLP is that it has the dual benefit of partnership firm and private company benefits.

LLP business is best for risk-oriented services, where the partner's responsibility is limited to the associated decision taken by the firm.

LLP Registration procedure in Bangalore

LLP is a corporate type of business, just similar to a private limited company.

It has a minimum of two designated partners to manage the LLP firm.

Steps in LLP Registration in Bangalore

· Select the unique Business name for the reservation

· Obtain the documents from each partner

· Get the DSC to designated partners

· Registration of the LLP

Documents required under LLP Registration

Before proceeding with LLP Registration, we must make sure the below.

Get the unique business name by a suffix of LLP, and get it reserved.

Once the LLP name reservation is approved, we can proceed with the Registration of the LLP.

Steps involved in LLP Registration in Bangalore

There are three main steps in the LLP registration

· Name Reservation of the LLP in Bangalore

· Registration of the LLP in Bangalore

· Filing the LLP Agreement with MCA in Bangalore

Below are the essential documents must for LLP registration.

· Pan and aadhar of each partner

· DIN number of each designated partner or allotment of new DPIN

· Get the business rental agreement in LLP’s name

· Utility bills like electric bills or phone bill

LLP Subscriber

consent letter

LLP Features

As the LLP is a mixed version of the partnership firm and Private company, many features are mainly added from both.

· It’s a hybrid business from a Firm and a Company

· LLP is a corporate body; it has been separately recognized as a body corp

· LLP has continuity of the business even partner's death or resignation

· LLP partner has limited exposure to the risk of the company upto their capital investment

· LLP can use its common seal to represent its business

LLP partner's responsibility in Bangalore

LLP’s unique character is its partner's limited liability to the business.

The LLP law protects the partners from unforeseen risks, where their assets are safe from any 3rd party recovery notice.

Also, LLP law protects any partner from misuse without the consent of all the partners.

If any unforeseen vent happens and the business gets lost, the partners are not liable for the risk to the company.

LLP form 8 & Form LLP 11

LLP is a corporate entity; it must comply with the Mca rules and regulations for compliance.

There are two types of returns with LLP.

Form 8 filing with Mca

Form 8 is a year-end for accounting and solvency report filing with MCA; the due date is 30th October of each year.

Non-filing of LLP form 8 attracts a late fee every day.

Form 11 filing with Mca

Form 11 is a year-end annual report filing with MCA; the due date is 30th May each year. It has the details of management affairs, several partners' details, declaration of the partner's investment, payables, etc.

Benefits from LLP business

· No capital required for LLP Registration

· No limit to the number of owners in business

· Significantly lower cost to register the LLP

· No statutory audit is directed to your LLP

· Dividend distribution tax does not apply to your LLP

LLP ITR tax filings

You must file LLP’s ITR irrespective of the business income, loss, or nil return.

Every year, LLP ITR is filed before 31st July.

Form ITR 5 to report the business's net profit or loss, capital, liability, assets, etc.

LLP Income tax rate is 30% of the net taxable income after adjusting partners' remuneration interest payment etc.

Benefits from our LLP in-house consultants

· Professionally qualified consultants

· Expert in the LLP Act and filings

· Error-free LLP tax filings from the last ten years

Apart from tax return filing, they handle tax department notices, advise clients about resolving tax disputes, etc.

LLP Registration fee in Bangalore

LLP registration fee is relatively lesser compared to other Companies.

· LLP Registration fee: Rs.5000 plus govt. fee

· Time required: 15 days from the date of receipt

Difference between LLP and partnership Firm

The main difference is given below

· LLP has a separate legal business, but the partnership has no such independent legal status

· Under LLP, the partner has limited risk, whereas in partnership partner has unlimited risk

· In LLP, there is no limit for the number of partners, but in partnership, it has 100 only

· LLP can hold property in its name, but a partnership cant hold property in its name

· You can form LLP with foreign nationals, but in a partnership firm, no such option

· Law creates LLP, but the partnership is created by Contract with partners.

Why are Team LLP consultants different?

Our expert team of LLP consultant is worked with Big MNCs in the Registration, taxation, and Accounting department for more than ten years; they hold LLP Act, tax, and financial management degrees from reputed institutes, including ICAI and ICSI, etc.

They are giving benchmark advisory services at affordable fees across Bangalore.

They properly review the LLP agreement, accounting, invoicing, purchase, etc., before taking a call on the tax planning and filings.

They have a good network with MCA, Roc, and the Tax office to minimize the litigations to clients.

We have an LLP registration and filing process with a benchmark fee.

Our Llp experts do quick checks.

· Review the required documents and advise accordingly

· Internal assessment and update to management

· Advise on the best option for management

· Handover the finalized report for finalization of LLP books

The Team In filings Bangalore basedconsultants firm comprised team members from CA and CS professionals practicing from last 15+ years in Bangalore,

providing host of services includingLLP advise, LLP tax advisory services, Company Registration, Trademark registration, Trademark objection filing, Trademark hearing, Company Registration, GST services, Tax return filing as well as Gst advice Service, Tax consultancy, and Management have been providing various tax planning, business setup filing-related services from the 15 years in India.

Find your Team IN FilingsLLP management consultant to get the assured LLP Registration, LLP tax filing service on time with best tax plansfast and efficiently with our Team member and get an expert advice to help you with minimized riskadvise, Trademark renewal update.

This includes LLP law periodical update, Trademark status report,LLPtax compliance, GST support invoicing software and filing software that is free. GST invoicing, cloud-based filing software, as well as Accountants Assistance.LLP Registration 5K+ is processed. Rapid and reliable Companytax filing service provider in Bangalore. Karnataka

Contact Team IN Filings

Trust our dedicated Team of professionals to get your LLP Registered service today.

Get in touch with our Team today and get a FREE consultation!

Reach us to manage your Accounting, Gst, Tax services, and Trademark.

Call at +91-7019827351 [email protected] to get your LLP service done!

0 notes

Link

OUR PRIMARY FOCUS IS GROWING BUSINESS OPPORTUNITIES FOR OUR CLIENTS.

Kros-Chek Consultancy Services established in 2014, is a young firm of Chartered Accountants, Company Secretaries and Corporate Lawyers providing finance, accounting, taxation, audit, corporate secretarial and legal services to Start-ups, Corporates and other legal entities.

We have a vibrant and experienced team with a wealth of experience in the areas of service that we provide. At Kros-Chek we provide end to end services right from the inception of the business to ongoing compliances to final exit from the business.

Rely on us for effortless completion of tasks such as preparation of digital signature certificate and company incorporation certificate.

Moreover, we offer post-incorporation services such as legal compliance, preparation of legal documents, and management of accounts and taxes. We can also help you understand the procedure to easily obtain funds by way of bank loans, as well as from angel investors and venture capitalists.

We provide an all-inclusive suite of company registration services in Bangalore that are fully customized to perfectly match your needs and help you save on tax filing, legal, and varied bookkeeping expenditures.

Kros-Chek we provide end to end services from the inception of the business to ongoing compliances to final exit from the business. In the current era of globalization, having the best corporate governance practices, information security processes and strong compliance culture are considered as the USP of any organization. We assist our clients in accomplishing their goals of building an organization with bespoke industry practices based on their regulatory, statutory and industry-specific requirements.

We can help our clients with

Consultancy Services - for their business like analyzing their account payable, the examination of a business and checking the accounting services that you need.

Problem Solving - We are a team of experts that identify opportunities when the conventional approach fails & find a fresh perspective to deliver a solution.

End to End Services - With a holistic approach we offer service consisting of book-keeping, payroll management, taxation, compliance management, etc.

Services What We Offer

Startup Support Services in HSR Layout Bangalore

Incorporation Formation & Setting up Services

Registration Services

Digital Signatures

Ongoing Support Services in HSR Layout Bangalore

Company Law Services in Bangalore

Accounting Services

Auditing and Assurance Services

Financial Services

Service Tax Matters Consultancy

Management & Industrial Consultancy

Income Tax Returns

Income Tax Services

GST Registration

GST Registration Services

Legal Support Services

Company Law Related Contracts and Agreements

HR Related Contracts & Agreements

Business Related Contracts & Agreements

Chartered Accountancy Services

#company registration consultants in bangalore#startup registration in hsr layout bangalore#Tax auditors in HSR Layout#accounting services in hsr layout#financial consultants in HSR Layout#company law consultancy services hsr layout#GST registration consultant in HSR Layout#Income Tax Filing Services in HSR Layout

1 note

·

View note

Text

Top Reasons to Choose a Chartered Accountancy Firm

When looking for an accounting company, it is important to choose a chartered accountancy firm with an excellent reputation. The quality of service offered by a chartered accountancy firm should be the first consideration, especially if you're looking to save money. The accountants at top-rated companies have specialized in many areas of accounting, from cost accounts to management and financial accounts. The firm should be able to handle complex accounting services, consistently get 'A' grades, and maintain the highest professional rapport with all customers.

Experienced chartered accountants are essential to running a successful organization. They can help business owners, directors, and top management with all aspects of their financial statements. The top accounting firms in Bangalore have handled the accounts of many fortune companies. They will provide a comprehensive audit and file the income taxes on time. Moreover, experienced accountants in top firms have high morale and integrity. They are honest and will give you unbiased opinions.

A good accounting firm will also keep rules and regulations in mind. This includes income tax laws, commercial tax laws, and other statutory law. Not following these laws can result in show-cause notices, and even cancellation of your business' registration. While minor problems are not likely to attract penalties, any violations will prolong your time-frame for collecting taxes and fines. It's vital to know the rules and regulations of your industry before engaging a chartered accountancy firm.

A qualified chartered accountant can provide advice regarding tax compliance and implementation. Whether you're a small business owner or a multi-national corporation, a top accounting firm in Bangalore can provide you with valuable financial services. They will provide you with valuable tax services, and will be a trusted partner for your business. There are many reasons to hire a chartered accountancy firm in Bangalore, but a good one will always be worth your while.

A successful organization should follow all rules and regulations. These include income tax laws and other statutory law. If they do not, they risk being penalized. The penalties can be severe. If your company does not follow these laws, it will be subject to fines and penalties. Having a reputable accounting firm can help you avoid this. It also ensures compliance with the government's rules and regulations. This means that it will be more reliable and trustworthy.

It is important to seek an accounting firm with a long list of awards and certifications. The best firms have won awards for their services. They should be highly qualified and provide excellent service. Those with an exceptional track record will provide you with a competitive advantage in the industry. So, look for the best accounting firms in Bangalore and get the most value for your money. You will be glad you did! If you're looking for a trusted company, check out these reviews.

The best accounting firms in Bangalore offer an extensive range of services. These services are essential for a successful organization. The tax law is a major component of any organization, and an accounting firm should have experience in this area. They will have a comprehensive understanding of the legal requirements and be familiar with the latest laws that govern business. They will also be able to help you manage your finances. If you're looking for an accounting firm in Bangalore, you'll find that these professionals are the best fit for your business.

In addition to tax compliance, the top accounting companies in Bangalore should also be able to help you with other business needs. These firms are the perfect choice for a wide variety of businesses, and can provide a range of accountancy services to both large and small organizations. For more information, visit their website at www.top-accounting-company-in-bangalore. If you're looking for an accountant in Bangalore, it's best to contact a few and learn what they offer.

Apart from supplying professional accounting services, the top-rated companies in Bangalore also provide business consulting and IT services. They can assist you with the entire accounting process, including tax preparation, and prepare a tax-ready financial statement for your company. The top-notch firms are a good choice for any business, so choosing the right firm is crucial. If you want to engage an accountant in Bengaluru, make sure you do a comprehensive search.

0 notes

Text

What is ISO 13485 Certification, what are the Steps and Benefits of it?

ISO 13485 Certification in Bahrain is Quality Management System requirements for regulatory functions represent the necessities that medical device manufacturers should incorporate into their management systems. this document supersedes its 1996 incarnation still as nut 46001, nut 46002, and ISO 13488. though supported by ISO 9001, ISO 13485 removes 9001's stress on continual improvement and client satisfaction. In its place, stress is on meeting regulatory still as client requirements, risk management, and maintaining effective processes. ISO 13485 customary is partly designed to produce a management system that facilitates compliance to the necessities of consumers and, pre-eminently, numerous world regulators.

While being certified to ISO 13485 doesn't fulfill the necessities of either the office or other foreign regulators, the certification aligns associate degree organization's management system to of the FDA's Quality System Regulation (QSR) necessities still as several alternative regulative requirements found throughout the globe. Therefore, ISO 13485:2016 certification serves to make a management system that can be thought of as a framework on that compliance to varied regulatory and client necessities got to be built.

ISO 13485 Certification

ISO 13485 Registration in Dubai is issued by Certifying body, which is licensed to supply certificate beneath the ISO 13485:2016. The certificate is issued for the amount of three years when successful completion of pre-assessment and registration (final) assessment. The certificate is valid until 3 years from the date of issue. police investigation audits are conducted by the Certifying body among the amount of three years at the interval of nine Months or twelve Months relying upon the character and size of the organization. Upon completion of three years, a renewal audit is completed for the new 3-year cycle.

Steps in ISO 13485 practice

is a leading ISO 13485 adviser in an Asian country, having huge industrial expertise in ISO 13485 practice and implementation of ISO 13485 system for all kinds of the medical device producing industries, like surgical instruments, orthopedic implants, etc producing firms.

follows the below-mentioned steps to develop the ISO 13485:2016 Medical devices - Quality management system for its customers

· small level survey for each activity of the organization and preparation of detailed gap analysis report;

· Preparation of applicable documents needed by ISO 13485:2016, based on an elaborate study of all activities of the organizations, such as:

1. ISO 13485 Quality Manual;

2. ISO 13485 Quality Procedures (mandatory procedures needed by the standard);

3. ISO 13485 Services in Saudi Arabia Identification of applicable regulative requirements and guarantee compliance with the regulative requirements;

4. Standard operational Procedures (SOPs) to manage known activities having risk potential to the human during the utilization of such medical devices;

5. Formats to determine the target proof of implementation and to confirm management over all the activities;

· ISO 13485 coaching to all or any levels of staff among the organization,

· facilitate ineffective implementation of ISO 13485 system by periodic visit until ISO 13485:2016 certification,

· Conduct an internal audit to visualize readiness for the certification.

· Conduct management review meeting in presence of high Management to guide the organization for effective implementation on all the issues related to Quality management systems necessities for regulative functions,

7. Conduct mock drill for traceability of product still as product recall, etc.

Benefits of ISO 13485 Certification

• ISO 13485 consultant in Bangalore satisfy through delivery of products that consistently meeting client necessities still as quality, safety, and legal necessities.

• Reduced operational prices through continual improvement of processes and ensuring operational efficiencies.

• Improved neutral relationships together with employees, customers, and suppliers.

• Legal compliance by understanding however statutory and regulative necessities impact the organization and its customers.

• Improved risk management through larger consistency and traceability of products and use of risk management techniques.

• Proven business credentials through freelance verification against recognized standards.

• Ability to win a lot of business notably wherever procure specifications need certification as a condition to supply in a very highly regulated sector.

How to get ISO 13485 Consulting services in Dubai?

If you are wondering how to get ISO 13485 Consultants in Dubai never give it a second thought approaching Certvalue with a 100% track record of success without any fail in the certification process. ISO 13485 in Dubai are easy and simple with Certvalue. You can easily reach Certvalue by simply visiting www.certvalue.com where you can chat with an expert or you can also write an enquiry to [email protected] so that one of our experts shall contact you at the earliest to provide the best possible solution available in the market.

0 notes

Text

What are the career options for commerce students in India?

Are you pursuing a degree in commerce? Want to know the career options available? This article explores the popular jobs in India for a commerce student.

In this article, we’ll discuss the most lucrative career choices for commerce students in India. It will help you to understand the various work roles and help you make an informed decision as you step into the professional world.

1. Chartered Accountant

This is the most popular course to pursue in the commerce stream. The course is offered by ICAI (Institute of Chartered Accountants of India) and consists of 3 levels and an articleship. CA is a professional who has a thorough knowledge of accounting, taxation, filing returns and financial statements of individuals and companies. It also consists of various other specializations like Tax auditing, Internal Auditor, Corporate Finance etc. A Chartered Accountant is a highly qualified and respectable professional who is regarded as an expert in his field of specialization.

2. Company Secretary

This is the second most popular course and is offered by ICSI (Institute of company secretaries of India). A company secretary ensures that the company follows all mandatory and statutory requirements of operating a business. This course is also done by passing through 3 levels of exams: Foundation, Executive and Professional. One can also hold positions like Legal advisor and Compliance Officer in companies. This is a job that holds great repute and comes with a lot of dedication and responsibility.

3. Financial Management

The role of a Financial Management professional is focused on an in-depth study of finances and its management, budget, capital management & structuring and so on. This professional field offers various certifications like CFA (Chartered financial analyst), CPA (Certified public accountant), CFP (certified financial Planner). One can become a Financial Officer, Advisor, Financial Auditor, Investment Analyst etc. As you can sense from the titles and designations, all these roles require extensive knowledge and expertise in the field of Commerce.

4. Cost & Management Accounting

It is a part of a managerial study of accounting that focuses on budgeting, analysing and reducing various costs in the company. Its main aim is the optimization of resources to get maximum returns. Preparation of financial reports is also one of the responsibilities in this job. If budgeting and accounting are your strong areas in commerce, then give this career path a serious thought.

5. Banking

Banking is the backbone of a nation’s economic growth. It is a field with diverse types of subjects such as loans, investments, financial services, insurance, currency, foreign exchange, wealth management etc. If you want to deep dive into the world of banking, be prepared to ace your college-level examinations in Commerce. Bankers are highly sought after professionals with a safe and stable career.

6. Statistician

Students who have a keen interest in economics and data analysis can explore this field for higher studies. Statisticians are in great demand in almost every industry which makes this field very lucrative and rewarding. You get to learn about data & risk analysis, statistical tools, research methods, maths, predictive science and scientific decision making through this course.

7. Actuarial Science

Do you like mathematics? Then Actuarial Science can be your calling. It is the field for maths enthusiasts and deals with rigorous study of risks analysis, uncertainty, trend analysis etc. to help the big companies, corporates and business organizations make the right decisions by solving complex problems.

8. Business Management

Managers are required in almost every industry and this makes the study of Business Management one of the most commonly chosen fields by students. MBA is one of the most popular courses taken up by commerce students. You can choose a specialization based on your interests such as finance, marketing, HR, operations, international business, hotel management, hospitality, etc.

9. Entrepreneurship

Want to be your own boss? Entrepreneurship is a career option for those who want to work independently by setting up their own business. Students of B.Com, M.Com, MBA often have more exposure to the world of business. You can gain an insight into the various complex aspects of operating a business with the help of business courses that teach you about management, costs, marketing, sales, customer satisfaction etc. Alternatively, you can gain some experience by working in an industry of your choice to learn the practical ropes of the business before setting up your own enterprise!

10. Law

Lawyers and legal advisers are one of the most influential and powerful people in the professional market. With the rise of new business houses and startups, law graduates are getting lucrative and diverse career opportunities such as corporate lawyer, lecturers, civil services, legal advisors etc. To build a career in law you need to pursue a 5 year-integrated LLB course and LLM for specialization.

Now that you know about the top options in commerce, choose the field that you are passionate about. Alongside, if you are looking for comprehensive career development, explore the apna app. The app offers jobs in over 70 categories across Delhi NCR, Bangalore, Mumbai, Pune, Ahmedabad, Jaipur, Ranchi, Kolkata, Hyderabad, Surat, Lucknow, Ludhiana, Kanpur & Chandigarh. Apart from this, the app facilitates professional networking and skill development for continuous learning and the best opportunities.

Join apna app now!

0 notes

Text

Why cdp is important

Those on Social Security as their only supply of earnings are in dire need. There's a clear need for a citizen to know the purposeful differences between these statutory agencies to deal with issues pragmatically. We offer high-high-quality professional growth to keep schooling agencies knowledgeable about immigration requirements, course entry standards, and scholar assist expectations all over the world.

Along with the town company and the assorted parastatals liable for planning, improvement, and service supply features, there are also the State Government Departments that perform service delivery and regulatory functions in Bangalore.

The most recent para-statal that has come into existence is the Bangalore Metro Rail Company Limited (BMRCL) which could be answerable for the metro rail-based mostly public transport system. For the bigger Bangalore Metropolitan Area, the Bangalore Metropolitan Land Transport Authority (BMLTA) is responsible for the coordination of all land-transport matters.

Optimizing an internet site requires goal-setting and planning. Many on-line businessmen are trying for simple to comply with Web optimization tutorials to assist them to improve the recognition and visibility of their webpage.

The spine of communication is killer content advertising and marketing, our marvelous content hooks the reader and client’s total, we publish blogs, articles relevant to the right prospect we audit your present website and digital materials, newsletters write up’s and proclaim it appropriately for which we stand as among the finest Advertising Agencies.

There can also be the requirement for the formation of ward committees in each one or more wards which shall be open to public participation. There is no such thing as denying that white advertising makes an enterprise much more highly effective.

We work with our purchasers to establish their business objective with sensible, content material-pushed communications for suitable audiences. In something you do, whether in your business or your private life, you will get the very best outcomes if you begin with the end in mind! You will not obtain a reply.

You should utilize tutorial advertising to add completely different media to your site, which can assist you to engage visitors higher and may improve your search engine results. The BDA, which formulates the Comprehensive Growth Plan (CDP) for the town, can also be accountable for land-use zoning, regulation, and planning of land, offering websites, creating city infrastructure, and improving the urban atmosphere.

WHEREASTHE BANGALORE International Airport Area Planning Authority (BIAAPA) is vested with the sanctioning of land-use of the area around the brand new Bengaluru International Airport. Many different departments of the state government like the Public Works Division (PWD) Income Department, City Planning Division, Health Division, Schooling Division, Horticulture Division, and so forth and likewise play necessary roles in the administration of the town. Each State government and UT administration shall appoint a State Implementing Agency (SIA) to make sure the graceful implementation of the Scheme

. Our bodies like BESCOM or BWSSB don't have any domestically elected representatives for consultations in their panel nor are they held accountable to the BBMP however are only answerable to the state authorities.

The executive powers of the Company are vested with the Commissioner who's a non-elected member appointed by the State government. The Mayor, who is elected by the councilors amongst themselves, shall preside over every assembly of the Company and should give route to the Commissioner about the implementation of any resolution of the Company or Standing Committee.

The Authority might infrequently, decide the charges and charges payable by entities throughout their appointment, including utility charges, annual subscription fees, and fees for individual Authentication transactions. For a very long time, she has had issues living below the identical roof as her dad. Here’s a couple of focus areas the place digital and creative agencies can save time, in addition to some specific instruments.

In case you do not need sufficient energy retailers in your room so that your amp can be plugged in regularly, get yourself a powerboard. On high of all these, we also have ABIDe Activity Force which, though not a statutory authority that may exercise functions, is a robust force in metropolis administration.

Whereas considering the application, the information furnished by the applicant, and its eligibility, the Authority might confirm the information by physical verification of paperwork, infrastructure, and technological help which the applicant is required to have. The applicant shall furnish such data and clarification to the satisfaction of the Authority, within the time as may be specified in this regard by the Authority.

0 notes

Text

Limited liability Firm Registration in Indiranagar

Certvalue

Limited liability Registration is necessary for any association of people to join for a business purpose and continue with legal bindings, sharing their profits according to law. We are giving the best services for Limited liability Registration in Bangalore. We prepare Limited liability Deed with the help of professionals according to the requirement of the customer and register the Limited liability Firm with Registrar of Firms on behalf of the customer.

Limited liability and Proprietorship are the 2 most popular forms of business organizations in India. The reason why these 2 forms of organizations are so popular is because they are relatively easy to set up and the no. of statutory compliance required to be done by these forms of organizations is relatively less than the statutory compliance applicable to LLP's and Companies.

In one of our previous articles, we explained on how easy it is to start a Proprietorship Firm (Recommended Read: How to start a Proprietorship Firm) and in this article, we would be focusing on How to start a Limited liability Firm in India.

Choosing the Limited liability Name

The partners are free to choose any name as they desire for their limited liability firm subject to the following rules:-

1. The names must not be two identical or similar to the name of another existing firm doing similar business to lead to confusion. The reason for this rule being that the reputation or goodwill of a firm may be injured, if a new firm could adopt an allied name.

2. The name must not contain words like Crown, Emperor, Empress, Empire or words expressing or implying the sanction, approval or patronage of Govt except when the State Govt signifies its consent in writing to the use of such words as part of the firm name

How to Create Limited liability Deed ?

The document in which the respective rights and obligations of the members of a limited liability is written is called the Limited liability Deed.

A limited liability deed agreement may be written or oral. However, practically oral agreement does not have any value for tax purposes and therefore the limited liability agreement should be written. The following are the essential characteristics of a limited liability deed:-

Name and Address of the firm as well as all the partners

Nature of business to be carried on

Date of Commencement of business

Duration of Limited liability (whether for a fixed period/project)

Capital contribution by each partner

Profit sharing ratio among the partners

The above are the minimum essentials which are required in all limited liability deeds. The partners may also mention any additional clauses. Some examples of additional clauses which may be mentioned in the limited liability deed are mentioned below:-

Interest on Partner's Capital, Partners' Loan, and Interest, if any, to be charged on drawings.

Salaries, Commissions etc, if any, payable to partners

Method of preparing accounts and arrangement for audit

Division of task and responsibility i.e. the duties, powers and obligations of all the partners.

Rules to be followed in case of retirement, death and admission of a partner

The Limited liability Deed created by the partners should be on a stamp paper in accordance with the Indian Stamp Act and each partner should have a copy of the limited liability deed. A Copy of the Limited liability Deed should also be filed with the Registrar of Firms in case the firm is being registered.

How to Register Limited liability deed in India

Limited liabilitys in India are governed by the Indian Limited liability Act, 1932. As per the Limited liability Act, Registration of Limited liability Firms is optional and is entirely at the discretion of the partners. The Partners may or may not register their Limited liability Agreement.

However, in case the limited liability deed is not registered, they may not be able to enjoy the benefits which a registered limited liability firm enjoys.

Registration of Limited liability Firm may be done before starting the business or anytime during the continuance of limited liability. However, where the firm intends to file a case in the court to enforce rights arising from the contract, the registration should be done before filing the case.

The procedure for Registration of Limited liability Firms in India is fairly simple. An application and the prescribed fees are required to be submitted to the Registrar of Firms of the State in which the firm is situated. The following documents are also required to be submitted along with the application:-

1. Application for Registration of Limited liability in Form No. 1

2. Duly filled specimen of Affidavit

3. Certified True Copy of the Limited liability Deed

4. Ownership proof of the principal place of business or rental/lease agreement thereof.

The application or statement must be signed by all the partners, or by their agents especially authorized in this behalf. When the registrar is satisfied with the points stated in the limited liability deed, he shall record an entry of the statement in a register called the Register of Firms and issue a Certificate of Registration

The Register of Firms maintained at the office of the Registrar contains complete and up-to-date information about each registered firm. This Register of Firms is open to inspection by any person on payment of the prescribed fees

Any person interested in viewing the details of any firm can request the Registrar of Firms for the same and on payment of the prescribed fees, a copy of all details of with Firm registered with the Registrar would be given to the applicant

It should however be noted that registration with the Registrar of Firms is different from Registration with the Income Tax Dept. It is mandatory for all firms to apply for Registration with the Income Tax Department and have a PAN Card.

After obtaining a PAN Card, the Limited liability Firm would be required to open a Current Account in the name of the Limited liability Firm and operate all its operations through this Bank Account.

For more info contact us

https://www.consultry.in/llp-registration-in-indiranagar/

#Limited liability Firm Registration in Indiranagar#bangalore#karnataka#Limited liability partnership

0 notes

Link

BSJ & Associates is the best audit firm in bangalore offers quality auditing services including assurance service, statutory audits, tax audits, internal audit, bank audits etc. by the team of dedicated professionals who have vast experience in handling audits for various industries. Contact now!

0 notes

Text

#incometax#incometaxballer#incometaxballers#incometaxclapback#incometaxballin#incometaxes#incometaxeffect#incometaxloans#incometaxmiami#incometaxmoney#top statutory audit services#best accounting firm in bangalore#best statutory audit services in bangalore#statutory audit services#statutory compliance#statutor

0 notes

Photo

Goods and Service Tax Service In Bangalore

https://www.cakga.com/goods-and-service-tax-service-in-bangalore/

Here we provide services of Goods and Service Registration, Return and Advice how to maintain your File as well as provide Audit of Tax (Internal and Statutory Audit), Income Tax Preparation with best and expertise solutions.

We will make your business to GST Compliance. Returns are required to be filed digitally online through a common portal to be provided by GSTN

To help SMEs and Startups start, manage and grow their business, we have a panel of Chartered Accountants (CAs) in Bangalore.

Goods and Services Tax (GST) is an indirect tax (or consumption tax) imposed in India on the supply of goods and services. It is a comprehensive multi-stage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except few; multi-staged as it is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, as it is collected from point of consumption and not point of origin like previous taxes.

CA Kalyan Ghosh & Associates is one of India’s largest financial services marketplace for Income Tax Services in Bangalore.

0 notes

Text

LLP Registration Bangalore

Bangalore is a hub for new business registration and the start of the latest companies, including LLP registration in Bangalore.

LLP is a complete form of Limited Liability partnership firm, which the LLP Act, 2008, has governed. The plus point of LLP is that it has the dual benefit of partnership firm and private company benefits.

LLP business is best for risk-oriented services, where the partner's responsibility is limited to the associated decision taken by the firm.

LLP Registration procedure in Bangalore

LLP is a corporate type of business, just similar to a private limited company.

It has a minimum of two designated partners to manage the LLP firm.

Steps in LLP Registration in Bangalore

· Select the unique Business name for the reservation

· Obtain the documents from each partner

· Get the DSC to designated partners

· Registration of the LLP

Documents required under LLP Registration

Before proceeding with LLP Registration, we must make sure the below.

Get the unique business name by a suffix of LLP, and get it reserved.

Once the LLP name reservation is approved, we can proceed with the Registration of the LLP.

Steps involved in LLP Registration in Bangalore

There are three main steps in the LLP registration

· Name Reservation of the LLP in Bangalore

· Registration of the LLP in Bangalore

· Filing the LLP Agreement with MCA in Bangalore

Below are the essential documents must for LLP registration.

· Pan and aadhar of each partner

· DIN number of each designated partner or allotment of new DPIN

· Get the business rental agreement in LLP’s name

· Utility bills like electric bills or phone bill

LLP Subscriber

consent letter

LLP Features

As the LLP is a mixed version of the partnership firm and Private company, many features are mainly added from both.

· It’s a hybrid business from a Firm and a Company

· LLP is a corporate body; it has been separately recognized as a body corp

· LLP has continuity of the business even partner's death or resignation

· LLP partner has limited exposure to the risk of the company upto their capital investment

· LLP can use its common seal to represent its business

LLP partner's responsibility in Bangalore

LLP’s unique character is its partner's limited liability to the business.

The LLP law protects the partners from unforeseen risks, where their assets are safe from any 3rd party recovery notice.

Also, LLP law protects any partner from misuse without the consent of all the partners.

If any unforeseen vent happens and the business gets lost, the partners are not liable for the risk to the company.

LLP form 8 & Form LLP 11

LLP is a corporate entity; it must comply with the Mca rules and regulations for compliance.

There are two types of returns with LLP.

Form 8 filing with Mca

Form 8 is a year-end for accounting and solvency report filing with MCA; the due date is 30th October of each year.

Non-filing of LLP form 8 attracts a late fee every day.

Form 11 filing with Mca

Form 11 is a year-end annual report filing with MCA; the due date is 30th May each year. It has the details of management affairs, several partners' details, declaration of the partner's investment, payables, etc.

Benefits from LLP business

· No capital required for LLP Registration

· No limit to the number of owners in business

· Significantly lower cost to register the LLP

· No statutory audit is directed to your LLP

· Dividend distribution tax does not apply to your LLP

LLP ITR tax filings

You must file LLP’s ITR irrespective of the business income, loss, or nil return.

Every year, LLP ITR is filed before 31st July.

Form ITR 5 to report the business's net profit or loss, capital, liability, assets, etc.

LLP Income tax rate is 30% of the net taxable income after adjusting partners' remuneration interest payment etc.

Benefits from our LLP in-house consultants

· Professionally qualified consultants

· Expert in the LLP Act and filings

· Error-free LLP tax filings from the last ten years

Apart from tax return filing, they handle tax department notices, advise clients about resolving tax disputes, etc.

LLP Registration fee in Bangalore

LLP registration fee is relatively lesser compared to other Companies.

· LLP Registration fee: Rs.5000 plus govt. fee

· Time required: 15 days from the date of receipt

Difference between LLP and partnership Firm

The main difference is given below

· LLP has a separate legal business, but the partnership has no such independent legal status

· Under LLP, the partner has limited risk, whereas in partnership partner has unlimited risk

· In LLP, there is no limit for the number of partners, but in partnership, it has 100 only

· LLP can hold property in its name, but a partnership cant hold property in its name

· You can form LLP with foreign nationals, but in a partnership firm, no such option

· Law creates LLP, but the partnership is created by Contract with partners.

Why are Team LLP consultants different?

Our expert team of LLP consultant is worked with Big MNCs in the Registration, taxation, and Accounting department for more than ten years; they hold LLP Act, tax, and financial management degrees from reputed institutes, including ICAI and ICSI, etc.

They are giving benchmark advisory services at affordable fees across Bangalore.

They properly review the LLP agreement, accounting, invoicing, purchase, etc., before taking a call on the tax planning and filings.

They have a good network with MCA, Roc, and the Tax office to minimize the litigations to clients.

We have an LLP registration and filing process with a benchmark fee.

Our Llp experts do quick checks.

· Review the required documents and advise accordingly

· Internal assessment and update to management

· Advise on the best option for management

· Handover the finalized report for finalization of LLP books

The Team In filings Bangalore basedconsultants firm comprised team members from CA and CS professionals practicing from last 15+ years in Bangalore,

providing host of services includingLLP advise, LLP tax advisory services, Company Registration, Trademark registration, Trademark objection filing, Trademark hearing, Company Registration, GST services, Tax return filing as well as Gst advice Service, Tax consultancy, and Management have been providing various tax planning, business setup filing-related services from the 15 years in India.

Find your Team IN FilingsLLP management consultant to get the assured LLP Registration, LLP tax filing service on time with best tax plansfast and efficiently with our Team member and get an expert advice to help you with minimized riskadvise, Trademark renewal update.

This includes LLP law periodical update, Trademark status report,LLPtax compliance, GST support invoicing software and filing software that is free. GST invoicing, cloud-based filing software, as well as Accountants Assistance.LLP Registration 5K+ is processed. Rapid and reliable Companytax filing service provider in Bangalore. Karnataka

Contact Team IN Filings

Trust our dedicated Team of professionals to get your LLP Registered service today.

Get in touch with our Team today and get a FREE consultation!

Reach us to manage your Accounting, Gst, Tax services, and Trademark.

Call at +91-7019827351 [email protected] to get your LLP service done!

0 notes

Link

Kros-Chek Consultancy Services established in 2014, is a young firm of Chartered Accountants, Company Secretaries and Corporate Lawyers providing finance, accounting, taxation, audit, corporate secretarial and legal services to Start-ups, Corporates and other legal entities.

We have a vibrant and experienced team with a wealth of experience in the areas of service that we provide. At Kros-Chek we provide end to end services right from the inception of the business to ongoing compliances to final exit from the business.

Rely on us for effortless completion of tasks such as preparation of digital signature certificate and company incorporation certificate.

Moreover, we offer post-incorporation services such as legal compliance, preparation of legal documents, and management of accounts and taxes. We can also help you understand the procedure to easily obtain funds by way of bank loans, as well as from angel investors and venture capitalists.

We provide an all-inclusive suite of company registration services in Bangalore that are fully customized to perfectly match your needs and help you save on tax filing, legal, and varied bookkeeping expenditures.

Kros-Chek we provide end to end services from the inception of the business to ongoing compliances to final exit from the business. In the current era of globalization, having the best corporate governance practices, information security processes and strong compliance culture are considered as the USP of any organization. We assist our clients in accomplishing their goals of building an organization with bespoke industry practices based on their regulatory, statutory and industry-specific requirements.

We can help our clients with

Consultancy Services - for their business like analyzing their account payable, the examination of a business and checking the accounting services that you need.

Problem Solving - We are a team of experts that identify opportunities when the conventional approach fails & find a fresh perspective to deliver a solution.

End to End Services - With a holistic approach we offer service consisting of book-keeping, payroll management, taxation, compliance management, etc.

Services What We Offer

#Tax auditors in HSR Layout#auditing services in HSR Layout#accounting consultants in bangalore#auditing & Assurance services in HSR Layout#financial consultants in HSR Layout#accounting Consultants services in HSR Layout

0 notes

Text

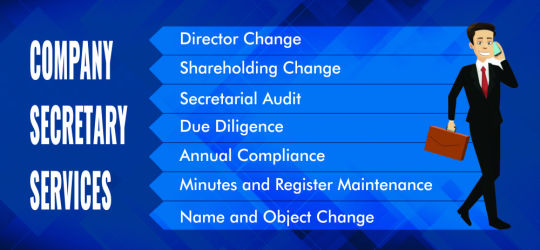

Company Secretarial Services in Bangalore

Are you the one who is looking for the top most Company Secretarial Services in Bangalore? CA Advisors offers a wide range of professional company secretarial services includes Company / LLP Incorporation Services, Company Start Up Services Packages, Corporate Compliance Management, Maintenance of Statutory Records & Submission of Annual Returns, Secretarial Audit and Corporate Law Services and also offers a wide range of new methodology and ideas to ease our clients with burdened administrative procedures across their functional and geographical boundaries.

We are to be recognized as most trusted, affordable and excellent consulting firm among startups, small & medium business entities and our Team Members are having vast and diversified expertise knowledge.

Service Offered by CA Advisors include:

Tax Advisory

Accounting Services

Audit & Assurances

Company Secretarial Services

CFO Services

and Management Consultancy Services.

What does a Company Secretarial Services in Bangalore do?

At CA Advisors our secretarial team deals with each and every business within its own context. We combine our experience with the latest technology in order to give a cost effective company secretarial solutions. We are one of the best Company Secretarial Services in Bangalore who play a vital role in managing the board and corporate law management, consents of stakeholders, getting approvals from the respective government authorities and also help to handle the corporate cases and resolve disputes among shareholders.

Company Secretarial Services provided by CA Advisors include:

Company / LLP Incorporation Services

Company Start Up Services Packages

Corporate Compliance Management

Secretarial Audit and Corporate Law Services

CA Advisors the best Company Secretarial Services in Bangalore and their duties include ensuring the probity of the corporate governance frameworks, being superintend for the efficient administration of a company, ensuring compliance with statutory and regulatory requirements and implementing decisions made by the Board of Directors.

We provide services in complying with the provisions of the act and render legal advisory services. Implementing transactions like change in object of the company/change in name of the company/appointment and resignation of director/shifting of registered office, acquisition of control, audits, transfer or transmission of shares, compliance audits, due diligence audits etc.

Why choose us?

We have a team of experts, help you to assist and provide a better guidance in order to solve all your business related aspects. Our team provides a way and led the entrepreneurs to run their business in a secure way. All kinds of secretarial services will be provided to make a person, a well-balanced entrepreneur.

Our Vision

We shall achieve our vision by delivering best in class advisory services to our clients with excellent collaboration, professionalism and services through our exceptional professionals. Our objective is to support our clients to achieve their success progressively in consistent manner.

At CA Advisors we provide Company Secretarial Services in Bangalore and We respect the confidentiality of information obtained during the course of performing professional services and will ensure not to disclose any such particulars without proper and specific authority or unless there is a legal or professional right or duty to betray.

CA Advisors is the best Company Secretarial Services in Bangalore, We shall ensure to maintain high level of integrity in our relationships, be it with our clients or with any of our stakeholders. We shall be straightforward and honest in performing our professional services.

https://youtu.be/dtgNN-CE9o0

#company secretary consultant in bangalore#company secretary firms in bangalore#company secretary professional

0 notes

Text

ALPHA FREIGHT - Clearing and Forwarding Agents in Bangalore

We at Alpha Freight constantly aim to be the most preferred logistics solutions provider. As a Leader in Import & Export handling, excels in understanding the client requirements and provides the best Solution.Our team is specially trained to understand every client's requirements. It enables us to offer Import / Exports, Asset Audit, Custom Clearing Services, Customs compliance services, Warehousing Services, License and Inward & Outward services etc.

What we do :

1. Filling of Export and Import Documentation on time.

2. Submission of Reports and Returns Online.

3. Maintenance of statutory requirements as per scheme guidelines.

4. License Amendments.

5. Online Transaction.

Reach us at : http://www.alphafreightindia.com/

0 notes