#how to invest in the stock market

Note

Hi! I fully do not understand investing, but I’m going to follow the directions you and others give about IRA investments. The one thing that I totally do not grasp is the allocating the funs into an index. Isnt there a scenerio where the index loses money and by retirement age you check it out and it went completely under or something?

Hey kiddo! And welcome to the wide world of investing. You're on the right track by starting an IRA for your retirement.

Yes, there are people who lose money by investing their retirement fund. This happens when they retire at the same time a recession or stock market crash happens. And it's fucking unlucky timing.

If you invest $100, and the market falls to the point that it's worth $80, you will lose money if you pull your money out when it's worth $80. But after the fall, when the market recovers so your original investment is worth $120, and THEN you pull your money out... you will have made money!

In other words, timing matters. We explain exactly how this works here:

Wait... Did I Just Lose All My Money Investing in the Stock Market?

Now to address the second part of your question. You can avoid the risk of losing money by regularly adjusting your allocation. When you're young and many years from retirement, you can allocate your portfolio aggressively into higher-risk investments. Who cares if you lose money in the short term? As we explain in the link above, you don't actually LOSE the money until you take the money out of the stock market.

But as you get older and nearer to retirement, you want to lock in your gains by moving your money from high-risk investments like stocks to safer investments like bonds. That way when you get within a few years of retirement, you can kind of "protect" your investments from being overly affected by market fluctuations.

In other words: allocation is not a one-time activity. We explain this more here:

Investing Deathmatch: Stocks vs. Bonds

This was a big oversimplification, but we go into detail about all of this here:

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

If you liked this article, join our Patreon!

160 notes

·

View notes

Text

Do you want to be an investor? Learn to invest

How to learn to invest Introduction

Investments are a way to grow your money over time. Investments can be in the form of stocks, bonds, mutual funds, real estate, or any other form of assets.

Learning to invest is an important skill that can help you achieve your financial goals. There are many different ways to learn investing, including

How to learn to invest

reading:

There are many books…

View On WordPress

#come fare trading online#corso di trading online gratis#day trading#forex trading#how to invest#how to invest as a teen#how to invest as a teenager#how to invest for beginners#how to invest for teenagers#how to invest in 2020#how to invest in index funds#how to invest in real estate#how to invest in stock market#how to invest in stocks#how to invest in stocks for beginners#how to invest in stocks for teens#how to invest in the stock market#how to invest money#how to invest money as a teenager#how to invest money in stock market#how to invest under 18#How to learn to invest#how to pick stocks to invest in#how to start trading#intraday live trading#intraday trading#learn to invest#live day trading#live intraday trading#live options trading

0 notes

Text

Mastering the Share Market: A Comprehensive Basic Guide for Share Market Beginners

Introduction:

The Indian share market is a dynamic landscape offering abundant opportunities for investors. This blog aims to demystify the complexities of the market, empowering readers with insights and strategies for informed decision-making.

Section 1: Understanding the Share Market

1. What is the Share Market?

The share market, also known as the stock market, is a platform where the buying,…

View On WordPress

#How to invest in the stock market#infosys company share price#national stock exchange#nse national stock exchange#punjab national bank stock price#rate of share of reliance industries#reliance industries stock price#sensex index today#sensex sensex today#sensex today#share market basics#share market news#share price punjab national bank#state bank of india stock price#stock market analysis#stock market for beginners#Stock market investing strategies#Stock market trends in India#tatasteel share price today#Tips for investing in the stock market#todays sensex

0 notes

Text

youtube

7 Secrets to Building a Profitable Portfolio from Nothing! 📊💰- How To Make Money

In this video, we're going to teach you how to build a profitable investment portfolio from nothing! You don't need a lot of money to get started – in fact, you can start with as little as $10,000! We're going to explain how to find profitable dividend stocks and how to build a successful investment portfolio. By the end of this video, you'll know how to make money online and build financial freedom for yourself! "Welcome to InvestSmartAmerica, your one-stop destination for financial freedom and investment advice! 🚀 Our mission is to help you build wealth through passive income ideas, affiliate marketing, and smart investment tips. We'll explore various wealth-building strategies, including real estate investing and stock market analysis, to help you achieve financial freedom. 💰 Join our community today and embark on your journey toward a secure and prosperous future! 🌟 Don't forget to subscribe and hit the notification bell 🔔 to stay updated on our latest content!"

#real estate#dividend investing#passive income#financial freedom#stock market#stocks#dividend stocks#real estate market#how to make money#financial education#investment#portfolio#investment portfolio#investing for beginners#housing market#housing market 2023#how to invest#how to invest in stocks#stock market for beginners#how to invest in the stock market#stock investing for beginners#how to invest money#how to get started with investing#Youtube

0 notes

Text

How to make money in Stock Market - EARN WHILE YOU LEARN | How to earn money | Easiest way!!!

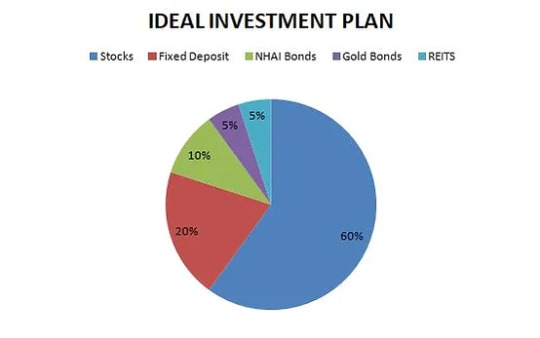

Ideal Investment Plan Pie Chart

If you put ₹ 1 lakh in education you will get a certificate.

If you put ₹ 1 lakh in FD at 7%, it will become 2 Lakh in 10 yrs & 2 months.

If you put ₹ 1 lakh in good stocks, it will become minimum 10 Lakh in 10 yrs.

Real Life Example:

MRF share price over last 10 yrs.

o Rs 1 Lakhs invested In MRF in 10 yrs became 13 Lakhs

Minda Share Price over last 10…

View On WordPress

#how to invest#how to invest in stock market#how to invest in stocks#how to invest in the stock market#how to make money#how to make money in stock market#how to make money in stocks#how to make money in the stock market#how to make money online#how to start investing in the stock market#make money#make money in the stock market#stock market#stock market for beginners#stock market investing#stock market investing for beginners

1 note

·

View note

Text

The stock market and personal investing

The stock market and personal investing

The stock market can be a daunting and confusing place for those who are new to personal investing. However, understanding the basics of how the stock market works and learning some key strategies can help you make informed decisions and potentially see a return on your investments.

First, it’s important to understand that the stock market is a…

View On WordPress

#how to invest in stocks#how to invest in the stock market#how to invest in the stock market for beginners#how to start investing in the stock market#investing#investing 101#investing for beginners#investing in stocks for beginners#investing in the stock market#personal finance#stock market#stock market crash#stock market for beginners#stock market investing#stock market investing for beginners#value investing

1 note

·

View note

Text

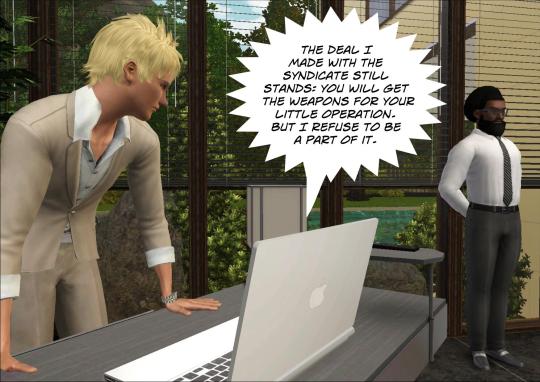

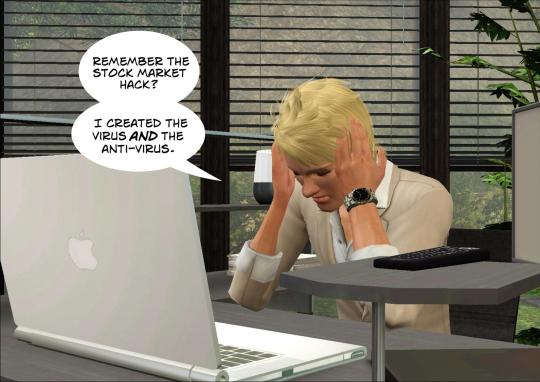

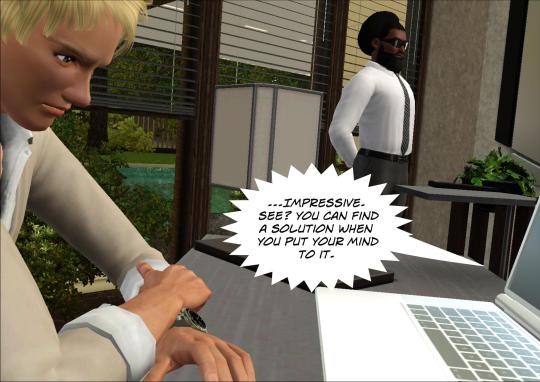

Author's note: Reference is made to the following scenes: (1), (2), (3)

#ts3#sims 3#sims 3 story#sims stories#tteot story#laurie golzine#omar ayad#muhammad al-saud#i'm sorry for going into details#i hate doing that#look i work in investment but imposter syndrome is kicking me hard#plus it's kind of difficult to make a plot look seamless when there is so much time between updates#in summary: laurie is managing a conglomerate including an investment fund of which noah is a partner#so laurie is a shareholder of a small tech company through that fund#he sold the antivirus via noah to that company as a solution to the virus he developed himself#when the stock market got hacked (by laurie) all companies rushed to get an anti-virus#but it also contained a spyware (also by laurie)#and this is how laurie's main business is now stealing data#laurie arc

68 notes

·

View notes

Text

HOW RICH IS OTEMPES (a theoretical anyalasis)

#how much does being a guardian pay#DID OTEMPES INVEST IN THE STOCK MARKET#kabwjwhabwHAT#HOW CAN HE JUST THROW AWAY THIS SORT OF MONEY#his net worth is more than this btw#super paper roblox#spr#spr slander#sorta but more like a shitpost

13 notes

·

View notes

Text

Want to learn how to invest?

ATTENTION CITIZENS OF BITCH NATION.

Our beloved comrade, Dumpster Doggy aka Amanda Holden, is teaching an investing workshop starting THIS SUNDAY, FEB 4. Dumpster Doggy designed this workshop as your first step toward financial freedom, and it is perfect for beginners and those who just want to understand the reasoning and mechanics behind investing.

This workshop is for you if you:

Have debt — yes, you should consider investing even if you have debt now

Don't know where to start

Want to be certain that your educational foundation is absolutely solid

Understand that investing is the key to building wealth, and know that a paycheck alone is not wealth

Don't want to work forever

Want your money to start working for you

Know that you just need to get started—no matter how small the dollar amount!

Know that education must be your foundation and that investing without knowledge is dangerous

Have a workplace retirement account

Don't have a workplace retirement account

The course costs $15. We wouldn't recommend something paid like this if we didn't believe in it, so this endorsement does NOT come lightly. Amanda is one of our ride-or-dies, and she left Wall Street so she could teach investing through a feminist lens.

But if $15 is too rich for your blood, we are offering Amanda's course FOR FREE to our Patreon donors. Sign up at the $5 level or higher and it's yours ($15-$5=$10 SAVINGS HOLY CANNOLI). We'll have the information for Patreon donors up tomorrow.

Lastly, if you can't make it live, you'll still get a recording of the workshop. So don't worry if you're not available this Sunday. Ok here are those links again:

Investing for Freedom Workshop with Dumpster Doggy

Bitches Get Riches Patreon for free access to workshop

#investing#stock market#how to invest#how to invest in the stock market#stocks#trading stocks#investors#investments#personal finance#money#money advice#money tips#making money#investing stocks#stockmarket

114 notes

·

View notes

Text

7 Reasons to Create Cash Flow with the Stock Market

Seven reasons to use and create cash Flow with the stock market Have you ever thought about retiring and Not having to worry about money anymore Most people consider retirement as the Time when they no longer have to work However for some retirements may never Come due to a lack of savings or their Savings being too small due to inflation Using cash flow to retire is an Alternative that grows…

View On WordPress

#andy tanner#business ideas#cash flow#cashflow game#financial education#financial literacy#how to get rich#how to invest#how to make money#how to make passive income#investing for beginners#kiyosaki#make money#motivational speakers#network marketing#passive income#reasons to cash flow the stock market#rich dad poor dad#robert#Robert Kiyosaki#stock market cash flow#stock market cash flow andy tanner

9 notes

·

View notes

Text

#how to invest in stocks#investing for beginners#stock market#investing#the most important thing in investing in stocks#stock market investing#stock market for beginners#stocks#value investing#share market basics for beginners#stock market in india#the single most important metric for stock market investing#the most important things when buying stocks#how to begin investing in the share market#investing in your 20s#investing in international stocks

2 notes

·

View notes

Text

Introduction to Stock Market Investing: A Beginner’s Guide

#stock market for beginners#how to invest in stocks#stock market#how to invest in the stock market#how to invest in stocks for beginners#stock market investing#investing for beginners#how to start investing in the stock market#how to invest#how to invest in stock market#investing in stocks for beginners#stock market explained#how to start investing in stocks#how to make money in stock market#investing for beginners guide#how to enter stock market for beginners

1 note

·

View note

Text

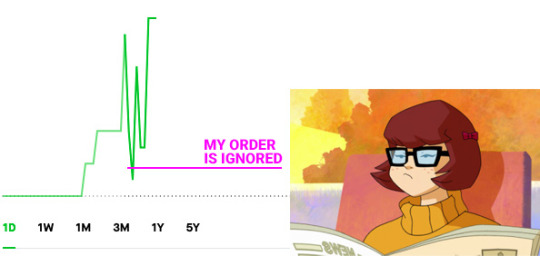

I've talked about institutional traders, and in general there is a lot of public rambling about "you can't beat the big systems, they have latest-tech internet connections and literal atomic clocks" etc.

Here is a real-world example of what happened about 5 minutes ago

Stocks operate on an auction system: "I have 100 shares, I'll sell them for $1/each."

"I want to buy 50 shares, I'll buy the for $1.00/each."

"I want to buy 50 shares, I'll buy them for $1.02/each."

(me, slower than the second person) "I want to buy 50 shares, I'll buy them at $1.00 -- ARGH!"

If you're not an institution, your order needs to either fit within the pricing (had I said $1.01) or timing.

You can offer whatever you want, you don't have to increment your order by a penny, this is just an example.

Fictionalized accounts of the real world make it sound like you never win (hence the writing of this).

The truth is more, you win when you're lumped into the timing and price of an institutional order, which is very common considering the oceanic volume.

There is not 1 or 2 institutions at play. There are a lot, thousands, if not more.

And there are teams and individuals within each institution that are similarly competing internally.

I am not clamoring around my computer or phone waiting for the split second to scream "BUY" or mash buttons.

Which is a good thing because I have neither the patience nor temperament for something so dramatic and serious.

One of the ways around this is to have an open limit buy order (there are open limit sell orders too, which are the same thing in reverse). This can be for "today only" or "for the next 90 days" (other brokers may have different time frames, I don't know, I've always dealt with these two options).

You can also specify, for either, "only during the hours the market is open" or "extended hours, which is a little bit before it opens and a little bit after it closes, but only on market days."

Using an open limit buy order, set for 90 days, set for extended hours, using the above real-world example, my order is waiting for this stock to drop low enough to trigger the order automatically.

Which, if it does successfully, will be done in a batch of some institution handling their business or solo if I am pricing it between institution orders.

If this doesn't happen in 90 days, or if I get tired of waiting and want to do anything else with the money, I can say "you know what, cancel this."

The money goes from "pending" back into my account and I can pursue another opportunity or just withdraw it from the broker all together.

In either instance, 100% of the order funds return to me. There is no charge with my broker or the market itself.

I hope this has been another installment of demystifying the stock market! May you risks be tolerable, may your gains be mighty, may your losses be within your measured tolerances!

3 notes

·

View notes

Text

The stock market and personal investing

The stock market and personal investing

The stock market and personal investing

The stock market can be a daunting and confusing place for those who are new to personal investing. However, understanding the basics of how the stock market works and learning some key strategies can help you make informed decisions and potentially see a return on your investments.

First, it’s important to understand that the stock market is a…

View On WordPress

#how to invest in stock market#how to invest in stocks#how to invest in the stock market#how to start investing in the stock market#investing#investing 101#investing for beginners#investing in stocks for beginners#investing in the stock market#personal finance#stock market#stock market crash#stock market for beginners#stock market investing#stock market investing for beginners#stocks#value investing

1 note

·

View note