#how to compare insurance policies effectively

Text

Strategic Insurance Choices: Unlock Financial Freedom Now

Hey there! Have you ever considered how strategic insurance choices can help you protect your finances and loved ones? Explore this idea and see why insurance is essential to your financial plan. Insurance provides a safety net during unexpected events and can be critical to your financial strategy. This guide will help you understand and evaluate the types of insurance you need and how to…

View On WordPress

#assessing insurance needs based on financial goals#benefits of life insurance in financial strategies#best insurance policies for young adults#choosing the right insurance for financial protection#Financial Planning.#Financial Security#how to compare insurance policies effectively#how to integrate insurance with investments#Insurance Policies#integrating long-term care insurance with retirement planning#Investment Strategies#Risk Management#tax benefits of purchasing insurance policies#the impact of insurance on financial stability#types of insurance for financial planning

1 note

·

View note

Text

Cigna’s nopeinator

I'm touring my new, nationally bestselling novel The Bezzle! Catch me THURSDAY (May 2) in WINNIPEG, then Calgary (May 3), Vancouver (May 4), Tartu, Estonia, and beyond!

Cigna – like all private health insurers – has two contradictory imperatives:

To keep its customers healthy; and

To make as much money for its shareholders as is possible.

Now, there's a hypothetical way to resolve these contradictions, a story much beloved by advocates of America's wasteful, cruel, inefficient private health industry: "If health is a "market," then a health insurer that fails to keep its customers healthy will lose those customers and thus make less for its shareholders." In this thought-experiment, Cigna will "find an equilibrium" between spending money to keep its customers healthy, thus retaining their business, and also "seeking efficiencies" to create a standard of care that's cost-effective.

But health care isn't a market. Most of us get our health-care through our employers, who offer small handful of options that nevertheless manage to be so complex in their particulars that they're impossible to directly compare, and somehow all end up not covering the things we need them for. Oh, and you can only change insurers once or twice per year, and doing so incurs savage switching costs, like losing access to your family doctor and specialists providers.

Cigna – like other health insurers – is "too big to care." It doesn't have to worry about losing your business, so it grows progressively less interested in even pretending to keep you healthy.

The most important way for an insurer to protect its profits at the expense of your health is to deny care that your doctor believes you need. Cigna has transformed itself into a care-denying assembly line.

Dr Debby Day is a Cigna whistleblower. Dr Day was a Cigna medical director, charged with reviewing denied cases, a job she held for 20 years. In 2022, she was forced out by Cigna. Writing for Propublica and The Capitol Forum, Patrick Rucker and David Armstrong tell her story, revealing the true "equilibrium" that Cigna has found:

https://www.propublica.org/article/cigna-medical-director-doctor-patient-preapproval-denials-insurance

Dr Day took her job seriously. Early in her career, she discovered a pattern of claims from doctors for an expensive therapy called intravenous immunoglobulin in cases where this made no medical sense. Dr Day reviewed the scientific literature on IVIG and developed a Cigna-wide policy for its use that saved the company millions of dollars.

This is how it's supposed to work: insurers (whether private or public) should permit all the medically necessary interventions and deny interventions that aren't supported by evidence, and they should determine the difference through internal reviewers who are treated as independent experts.

But as the competitive landscape for US healthcare dwindled – and as Cigna bought out more parts of its supply chain and merged with more of its major rivals – the company became uniquely focused on denying claims, irrespective of their medical merit.

In Dr Day's story, the turning point came when Cinga outsourced pre-approvals to registered nurses in the Philippines. Legally, a nurse can approve a claim, but only an MD can deny a claim. So Dr Day and her colleagues would have to sign off when a nurse deemed a procedure, therapy or drug to be medically unnecessary.

This is a complex determination to make, even under ideal circumstances, but Cigna's Filipino outsource partners were far from ideal. Dr Day found that nurses were "sloppy" – they'd confuse a mother with her newborn baby and deny care on that grounds, or confuse an injured hip with an injured neck and deny permission for an ultrasound. Dr Day reviewed a claim for a test that was denied because STI tests weren't "medically necessary" – but the patient's doctor had applied for a test to diagnose a toenail fungus, not an STI.

Even if the nurses' evaluations had been careful, Dr Day wanted to conduct her own, thorough investigation before overriding another doctor's judgment about the care that doctor's patient warranted. When a nurse recommended denying care "for a cancer patient or a sick baby," Dr Day would research medical guidelines, read studies and review the patient's record before signing off on the recommendation.

This was how the claims denial process is said to work, but it's not how it was supposed to work. Dr Day was markedly slower than her peers, who would "click and close" claims by pasting the nurses' own rationale for denying the claim into the relevant form, acting as a rubber-stamp rather than a skilled reviewer.

Dr Day knew she was slower than her peers. Cigna made sure of that, producing a "productivity dashboard" that scored doctors based on "handle time," which Cigna describes as the average time its doctors spend on different kinds of claims. But Dr Day and other Cigna sources say that this was a maximum, not an average – a way of disciplining doctors.

These were not long times. If a doctor asked Cigna not to discharge their patient from hospital care and a nurse denied that claim, the doctor reviewing that claim was supposed to spend not more than 4.5 minutes on their review. Other timelines were even more aggressive: many denials of prescription drugs were meant to be resolved in fewer than two minutes.

Cigna told Propublica and The Capitol Forum that its productivity scores weren't based on a simple calculation about whether its MD reviewers were hitting these brutal processing time targets, describing the scores as a proprietary mix of factors that reflected a nuanced view of care. But when Propublica and The Capitol Forum created a crude algorithm to generate scores by comparing a doctor's performance relative to the company's targets, they found the results fit very neatly into the actual scores that Cigna assigned to its docs:

The newsrooms’ formula accurately reproduced the scores of 87% of the Cigna doctors listed; the scores of all but one of the rest fell within 1 to 2 percentage points of the number generated by this formula. When asked about this formula, Cigna said it may be inaccurate but didn’t elaborate.

As Dr Day slipped lower on the productivity chart, her bosses pressured her bring her score up (Day recorded her phone calls and saved her emails, and the reporters verified them). Among other things, Dr Day's boss made it clear that her annual bonus and stock options were contingent on her making quota.

Cigna denies all of this. They smeared Dr Day as a "disgruntled former employee" (as though that has any bearing on the truthfulness of her account), and declined to explain the discrepancies between Dr Day's accusations and Cigna's bland denials.

This isn't new for Cigna. Last year, Propublica and Capitol Forum revealed the existence of an algorithmic claims denial system that allowed its doctors to bulk-deny claims in as little as 1.2 seconds:

https://www.propublica.org/article/cigna-pxdx-medical-health-insurance-rejection-claims

Cigna insisted that this was a mischaracterization, saying the system existed to speed up the approval of claims, despite the first-hand accounts of Cigna's own doctors and the doctors whose care recommendations were blocked by the system. One Cigna doctor used this system to "review" and deny 60,000 claims in one month.

Beyond serving as an indictment of the US for-profit health industry, and of Cigna's business practices, this is also a cautionary tale about the idea that critical AI applications can be resolved with "humans in the loop."

AI pitchmen claim that even unreliable AI can be fixed by adding a "human in the loop" that reviews the AI's judgments:

https://pluralistic.net/2024/04/23/maximal-plausibility/#reverse-centaurs

In this world, the AI is an assistant to the human. For example, a radiologist might have an AI double-check their assessments of chest X-rays, and revisit those X-rays where the AI's assessment didn't match their own. This robot-assisted-human configuration is called a "centaur."

In reality, "human in the loop" is almost always a reverse-centaur. If the hospital buys an AI, fires half its radiologists and orders the remainder to review the AI's superhuman assessments of chest X-rays, that's not an AI assisted radiologist, that's a radiologist-assisted AI. Accuracy goes down, but so do costs. That's the bet that AI investors are making.

Many AI applications turn out not to even be "AI" – they're just low-waged workers in an overseas call-center pretending to be an algorithm (some Indian techies joke that AI stands for "absent Indians"). That was the case with Amazon's Grab and Go stores where, supposedly, AI-enabled cameras counted up all the things you put in your shopping basket and automatically billed you for them. In reality, the cameras were connected to Indian call-centers where low-waged workers made those assessments:

https://pluralistic.net/2024/01/29/pay-no-attention/#to-the-little-man-behind-the-curtain

This Potemkin AI represents an intermediate step between outsourcing and AI. Over the past three decades, the growth of cheap telecommunications and logistics systems let corporations outsource customer service to low-waged offshore workers. The corporations used the excuse that these subcontractors were far from the firm and its customers to deny them any agency, giving them rigid scripts and procedures to follow.

This was a very usefully dysfunctional system. As a customer with a complaint, you would call the customer service line, wait for a long time on hold, spend an interminable time working through a proscribed claims-handling process with a rep who was prohibited from diverging from that process. That process nearly always ended with you being told that nothing could be done.

At that point, a large number of customers would have given up on getting a refund, exchange or credit. The money paid out to the few customers who were stubborn or angry enough to karen their way to a supervisor and get something out of the company amounted to pennies, relative to the sums the company reaped by ripping off the rest.

The Amazon Grab and Go workers were humans in robot suits, but these customer service reps were robots in human suits. The software told them what to say, and they said it, and all they were allowed to say was what appeared on their screens. They were reverse centaurs, serving as the human faces of the intransigent robots programmed by monopolists that were too big to care.

AI is the final stage of this progression: robots without the human suits. The AI turns its "human in the loop" into a "moral crumple zone," which Madeleine Clare Elish describes as "a component that bears the brunt of the moral and legal responsibilities when the overall system malfunctions":

https://estsjournal.org/index.php/ests/article/view/260

The Filipino nurses in the Cigna system are an avoidable expense. As Cigna's own dabbling in algorithmic claim-denial shows, they can be jettisoned in favor of a system that uses productivity dashboards and other bossware to push doctors to robosign hundreds or thousands of denials per day, on the pretense that these denials were "reviewed" by a licensed physician.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/29/what-part-of-no/#dont-you-understand

#pluralistic#cigna#computer says no#bossware#moral crumple zones#medicare for all#m4a#whistleblowers#dr debby day#Madeleine Clare Elish#automation#ai#outsourcing#human in the loop#humans in the loop

235 notes

·

View notes

Text

My sister has been showing me episodes of OG Trigun--mostly in preparation for Trigun Stampede--but also because it's one of her favorite manga of all time.

And holy SHIT I cannot even begin to explain how fucking batshit this show is. Just hearing Johnny Yong Bosch's voice alone immediately sent me back at least fifteen years.

I have watched all episodes of OG Trigun while drunk, high and sober. And regardless of my state of inebreiation, I was always left with the exact, inescapable feeling of wanting to fucking die from the sheer nostalgic cringe and insanity of it all. I hate this show. I love this show. I'm fucking obsessed.

So, to all those who are curious (or would just like a mini idea of how to compare OG Trigun with Trigun Stampede)--here is my comprehensive list of things that ACTUALLY happened in Trigun that make me go absolutely batshit just thinking about them:

The sheer insanity of the--balls to the walls, barely held together with ducktape, spit and shoestring--of a plot, all with apparently little to no accuracy to the manga whatsoever. This both amuses and horrifies my sister.

The absolute refusal on the part of the anime to actually explain literally anything. Like the fact that the show takes place in space. Or why humanity is on a desert planet. Or what Plants are, why they're important, why they're there, literally ANYTHING.

Seriously, if you've only ever watched the anime you would have no fucking clue what the Plants are or what they even do. And THEY'RE LITERALLY ONE OF THE MOST IMPORTANT BITS OF LORE/A HUGE PART OF THE PLOT OF THE ENTIRE FUCKING MANGA.

A major bit of Trigun's lore/setting is just straight up the events of Wall-E.

Johnny Yong fucking Bosch as Vash's English VA. Enough said.

Vash--by simply existing and (mostly) through no direct fault of his own--is capable of wrecking such sheer and complete utter devastation that there's an actual insurance policy people can file after their town is destroyed in the aftermath of him visiting. Iconic.

Monev is just Spiderman's Venom but with a purple and orange reskin. This was intentional on part of the creator as he is obsessed with Venom. Good on him.

This is only specific to the English Dub (we switched to the original sub for the more "serious" episodes, calm down), but HOLY FUCK the absolutely atrocious line deliveries somehow make the show even worse and yet ultimately so much funnier all at the same time!

Millions Knives is the name of Vash's twin brother.

Vash is bisexual. There are multiple occassions where he will call a random male character "Cute" or "Cutie." Somehow, I am not the least bit surprised.

Christianity exists. And the Church trains orphans to be assassins. This makes perfect sense.

"LUUV AND PEEEEAAACCCCCEEE!!!!"

In the second episode of the series (English Dub), there's an actual scene where an old man and his grandson LOUDLY lament the absolute devastation of their home in the most inappropriately cheerful and candid way possible. And then the fucking kid follows that up by just singing out of fucking nowhere "~Bad times are here LALALALALA!!!!!~"

Vash is part gun.

According to "company regulations," as insurance workers Milly and Meryl are not allowed to take part time jobs. They later take part time jobs. My broke ass resonated too fucking hard with this bit.

"Oh, maaaan! Why can't I just get a break?! Death and poverty like me so much, they've brought friends!" Fucking. Mood.

At one point, Vash does the crab walk to dodge a barrage of bullets. This is, surprisingly, quite effective.

"I'll whack you, mister!"

Legato's introduction is him sitting down on a bench and then PULLING A HOT DOG OUT OF A PAPER BAG WITH A HUMAN HEAD IN IT!!!!

Legato has his own personal saxophone player that just follows him everywhere???????

"Oh my. I'm about to go down in ~fllaaaaaammeesssss!~"

Wolfwood.

In EP 16, someone just starts randomly scatting in the background for no reason. No explanation is ever offered.

"My name is .... VASH DA STAMPEDE-DUUUH!!!!!"

Also in EP 16, one of the villains for that episode sounds, deadass, exactly like Jar Jar Binks. I am not joking.

Legato can blood bend.

There's a mini episode dedicated to Milly and Meryl. Vash shows up for five seconds hiding in a trash can. The joke writes itself.

"The DEADLY DODGEBALL HEAD!!! A simple technique to hold the ball in place with INTENSE SUUUCTION!! Try this at home! ;)"

Knives eats an apple, cuts his own hair and enters his impromptu emo arc.

Legato gets horny over the idea of Vash crying. Idk what to tell you, man.

Wolfwood shoots a child. Granted, said child was gonna try to kill Vash and a bunch of orphans. But still.

Vash makes up a dark song about murdering and killing people. The villains of that episode proceed to roast him for his shit lyrics.

Wolfwood doesn't understand why everyone is mad at him for KILLING A CHILD.

"I meditate diligently every morning. The subjects are life and love ... I quit after three seconds."

The actually downright amazing OST, that has no right to be as good as it is. No joke, one of the best anime OSTs I have ever heard in my life.

"And if you're still having doubts, check out my 100% accurate gunmanship!" *proceeds to shoot directly at the sky only then for a black cat to fall directly on his head. The cat's fine btw*

At a certain point, Vash fakes his identity, gets a disguise and goes under a false name. Said false name being "Eriks." He looks like if someone ran Hohenheim through the washer and then hung him on a clothesline for a week. I have ... no fucking words.

"What is this strange phenomena? Is it some sort of strange and twisted Christian science!?"

For as menacing as they make Legato out to be, he sure does shit all in the grand scheme of things. Also he looks like he raids Seto Kaiba's closet on the DL and duels monsters on weekends.

Vash will randomly have Bishie eyes. Arguably, his most Bishie moment is right after Wolfwood punches him in the face. I'll let you infer what you want from this.

Rem randomly appears out of nowhere to taunt Vash with nonsense riddles and haikus. No explanation is ever given until EP 17 for who Rem is, why she keeps reappearing in Vash's mind, if she's even a real person or just someone Vash made up, etc. Because of this, it just looks like Vash keeps receiving American Beauty-style rose shower psychic attacks while a random woman just spouts absolute nonsense at him. There is no way this explanation will prepare you for the actual experience of watching it.

"I am known as Valentinez Alkalinella Xifax Sicidabohertz-" *prolonged pause* "-Gombigobilla Blue Stradivari Talentrent Pierre Andri Charton-Haymoss Ivanovici Baldeus George Doitzel Kaiser the Third. Don't hestitate to call."

Vash gets adopted by an old woman and her granddaughter. It's actually kind of sweet.

A minor villain in EP 18 demands that Vash strip and then act like a dog. He proceeds to do both without a single objection. Wolfwood pulls down his sunglasses and leers at Vash's naked ass. My sister has informed me that this is actually canonical.

Rem is a hyper Christian.

Wolfwood takes personal offense to a burlesque dancer being absolute shit at dancing. Honestly ... I can't even argue with him.

"Hey, 'Thou Shalt Not Kill,' REMEMBER!? WHAT KIND OF CHURCH MAN ARE YOU!!!?"

Vash saves a town's Plant through the power of Bishie.

While trying to save a child, Vash and Wolfwood both get sucked into quicksand. Said child just watches them go into the ground. I would have done the same.

Milly, Vash and Wolfwood decide to share drinks and before any of them even take a single shot, Milly decides to strip naked. Vash and Wolfwood are very pleased by this. Meryl is not.

"WHOSE idea was it to USE THE GRENADE!!!?? He can't be identified for the reward if he's a pile of pulp, YOU DUMBASS!!!!"

Wolfwood calls Vash pathetic. This kickstarts yet another existential crisis within Vash.

"Thank GOD you asked! It's a long story, although it's kind of a short one."

For literally no reason at all, child Knives decides to embrace his Anti-Christ symbolism and goes full Joker mode. This is not at all accurate to the manga.

Vash and Knives are aliens/Plants. Rem thinks they're actual Christian angels. Deadass.

Milly forces Wolfwood to pretend to be her baby daddy for a whole episode. For pudding. Yup.

Vash enters a dom/sub relationship with a Pokemon gym leader looking lady and they engage in extremely explicit pet play.

Anyway, watch OG Trigun. If you've ever watched any sort of anime abridged series, it will definitely make things a little easier for you. There are definitely too many points at which this show feels like a YouTube Poop and I mean in that best and worst possible way.

Also Meryl is Best Girl. I will not budge on this.

#trigun#trigun stampede#vash the stampede#trigun vash#og trigun#nicholas d wolfwood#trigun wolfwood#trigun milly#trigun meryl#johnny yong bosch#90s anime#radio talks#radio loses his goddamn mind more like#y'all have no fucking clue#how wild it was#to experince this show for the first time#it's absolute insanity from one episode to the next#but it's never fuckig boring#so in a way#i have to give it credit for that at least#bisexual king vash#what an icon#what a fucking mess

762 notes

·

View notes

Text

Just a Little Further 13

Part 1 2 3 4 5 6 7 8 9 10 11 12

Ugh, really? Bad is so black and white Melody. We're better than that.

No, look at what you're making me do!

Making? Melody we're not making you do anything. We're facilitating. This is all stuff you wish you could do, but couldn't. Don't lie, we're in here too.

What are you?

We're you. The part of you that you try to keep submerged with gallons of coffee. The part of you that's really good with firearms and chalks it up to practice. The part of you that knows computer systems inside and out but never seemed to figure out people.

We fixed all that.

We're a Builder.

And you are too.

So you're the nanomachines.

No, we are Builders. The nanites help you to remember who you are. Who you are meant to be.

Then what are the nanomachines?

Think of them like... an insurance policy. We knew we probably weren't going to be around forever, we didn't know what would happen to us - by the way? Being stuck on Earth with no Gate and having to start from scratch and coming up with a better way to traverse the stars anyway? Full marks. You haven't told anyone here you can link right? Good.

Anyway, we figured that if one of us, or a descendant or hell, even a pretty close relative found a Gate and like the foolish, curious monkeys we (yes we) are touched it, you'd get the nanites and they'd help you to... remember what we were. What we are.

Melody, you have to realize.

We are in charge here. Us. You. The whole of Reach of the Might of Vzzx. The whole of FarReach. The whole Galaxy. You are in charge. You are Empress.

You're tired. You need to eat, you need to sleep. Tell everyone here whatever, it's fine. Half of them don't believe it and the other half, like Captain Q'ari, know it in their hearts and are already frightened. Play at it all you want but when you're ready to take your mantle as Builder,

I'll be right here.

"Melody?" It's Dr Irenimum. He's at the airlock. "Melody? Do you want to come to the infirmary?" He didn't tell me, he asked.

"Yes, please Doctor Irenimum. I think something is wrong with me."

When I get there, I lay on the table and he begin another scan. The hum of the machines is so soothing, I nearly fall asleep. Before I can nod all the way off he says. "Okay Melody, I'm all finished. Let's take a look at what we can see."

He spends a moment looking at the results. His body language says he has bad news and fears telling me.

"What is it Doctor? Please tell me."

"Uh well Melody, it looks as if the nano machines have... replicated further. Do you feel the same as before?"

I laugh dryly. "In what way Doctor? You saw me outside right? I'm apparently taken the mantle of Builder and am now a living God to everyone onboard this Starbase and-" I look at my hands "-I have the power to back up that claim."

"Er, um, no, I meant more like your weight. You're nearly two kilograms heavier. All of it nano machines."

I'm what?

"Dr Irenimum, isn't that a whole lot of nano machines?"

"Hmm yes, yes. Trillions, if not more. Yes. Working in concert I imagine they make you formidable. Increased processing power, increased reaction time, you apparently can understand all languages and can now manipulate fields to rearrange matter nearly on the atomic level. Whoever these Builders originally were, they were nobody to trifle with."

They were us, Melody. Humans were the Builders. Are the Builders.

Shh.

"Is... Is there anyway to remove them? Or turn them off?"

"Off? No, no I don't think so no." Dr Irenimum thinks for a moment. "Well, maybe a very very strong magnetic field. But that would also have the unfortunate side effect of killing you too. Plus, with a density this high and clearly how much work they're doing with your body, I have a feeling that turning them off will just kill you outright."

He's right. There's no getting rid of us.

"But, er, other than that." I chuckle darkly "I'm okay?"

"Oh? Yes yes, you're better than okay I'd say. Compared to the baseline scans we took when the mission started you're in better health then ever."

See? We have good points too. With us, you need never die.

"Melody? I believe we've removed beyond the realm of the physical to the... metaphysical." Dr Irenimum makes a face. He hates religion. Good, that make two of us. "You know you're not a God and... most of us here know you're not a God, but they out there?" He gestures towards the airlock. "They're pretty sure you're a God. Given you you reacted today when the security guards tried to break up a... congregation of your worshippers? I'd say that their side it looking better and better."

I couldn't believe what I was hearing. "Doc, you don't think I'm a God, do you?"

For the first time since I came in, he looked me in the eye. "Melody. There is an old, old K'laxi religion. It's about the Gates actually. See, we had no proof, but one of our religions stated that there would be "doors in the sky" to other worlds. Time passed, and we moved on and left the religion behind - well, most of us anyway - but when we went into space, and found the Gate? Well, you could say there was quite the revival of the religion. More than a few wars were fought over it. Once we learned how to traverse the gates and there were no Gate Builders around anymore, we figured maybe it was just a legend, or maybe it was something that was true aeons ago, but was left in the dust of history."

Dr Irenimum looks away. "Then we met humans."

"They sure met the description we had in the holy books of the Builders. You had no Gates though! It couldn't be you. You traversed space in a whole different way and when we asked you about the Gates you had no idea what we were talking about. It was a coincidence."

He looks me in my eyes again. "But now... Now, we traverse the Gates in a ship built by humans and modified by K'laxi. A human touches the Gate and it reacts in a way never seen before. A human touches the directory stone and you get wild... powers, there is no other way to describe it. A human with these powers brings us across the Galaxy and we find a Starbase full of species we've never met and when they first see you Melody. When they first talk to you Melody, they act like God came to visit."

"When a group of their churchgoers shows up and security comes to break up the group with violence you cow them all with words and light and force and they are compelled to do your bidding."

"Okay then Doctor. What does your religion say about the Builders?"

Once again, he meets my eyes. "Nothing good Melody. It feared your return. Their Empress was known as Tep’ra’fel - the undeniable. It said she literally could not be disobeyed."

"Melody, I fear that our old religion is right. Captain Q'ari doesn't know what to do. I think her family was still religious even in these more... modern days. She fears you."

"But what do I do Doctor? I don't want to be a God." I nearly wail.

You are you who are Melody. There is no denying yourself.

"I don't know Melody. You are who you are. Have solace in the fact that you are a good person, and have shown all of us here on FarReach that fact. You are a kind, generous, good person. A little bit of Godhood won't change that." He pats my back. "It's late. Go sleep. Things will be clearer in the morning."

I get up and thank him and go to my quarters. The ship is dark and quiet, by ship-time it's late. I am exhausted. I barely have the energy to take off my uniform - ugh vestments now I guess - and crawl into bed.

Another night, more wild dreams.

****

This time I'm in a throne at a Starbase. Maybe the one we visited? Maybe not.

I'm there, and everyone fears and loves me. Everyone.

I tell them so, and they agree. I tell them to build the Starbase and it is done. I tell them to build a gate and they build it. This one isn't active yet, the ring is folded tight to the asteroid. It's towed by a ship - a Starjumper? - no, it can't be - towards a gate and it disappears off to the far reaches of our - my - empire to expand. Any sapients we meet along the way become my subjects. I am Builder. I am Empress. I am.

A courier ship traverses my Gate. They approach my Starbase with news of my empire. A small race of newly found sapients - they call themselves K'laxi - have rebelled. They had the temerity to kill their overseer and close their Gate. How did they learn to do that? No matter. I will go and see to the Gates reactivation personally.

The messenger fears giving me the bad news. This is right, but I am not without pity. I do not destroy them for the crime of bringing me bad news. If people fear to bring me bad news they will hide it from me until the empire totters over, all the while I think everything is fine.

No. The messenger is rewarded. A new ship, bigger, more comfortable. A promotion. Command of Courier Corps Ten. Go forth and give me the news - good and bad - of my empire.

****

You know, when that happened originally you had the messenger killed and the ship destroyed. You are learning.

But, killing the messenger only tells everyone else to keep bad news from me - her. Then she wouldn't know when things fell apart.

Which is what happened yes. A mere century after that incident, the K'laxi closed their gate permanently. The only time you were disobeyed on such a level before that was when the splinter group of Builders on one of your furthest colony worlds conspired to close and lock their Gate and prevent anyone from entering it. It was theorized they destroyed their own Gate, though until now we had no idea.

On Earth?

That's what you call it yes.

How long ago was this?

I don't know, it's not like you keep the same calendar. Tens of thousands of years probably. More even. Given the statue and how well we're integrating, not long enough for genetic drift to change you that much though. No more than fifty thousand is my guess. The K'alxi though? That was much more recent. It's one of my last memories.

So what, I'm a... reincarnation of the Empress?

A... memory maybe. A double exposure. The nanites contained enough of her personality that we can give you her abilities and you are a Builder - it wouldn't work if you weren't - but now?

Now you can do it right.

With that, I wake up and get dressed. Good work previous me to make sure my uniforms are clean and pressed. I put one on that doesn't look like Holy Vestments or something. I check the time - 6:30am ships time. and realize it's still an hour before breakfast. I go to the kitchenette and make some coffee.

Really Melody? After all that, you're still going to sully yourself with.. Caffeine?

Oh goody, you're still here.

I'm no dream Melody. I am us.

Well I am the Empress, and I want coffee.

Oh, you admit you're the Empress? Tsh. Fine. Get your coffee.

While I'm making coffee Mei'la comes in. "Oh good morning Mei! I say brightly."

"G-good morning Melody." She says, awkwardly.

"Mei, what's wrong? I'm still Melody, I'm still me"

She knows you're not.

"Sorry Melody, it's tough. My... Mother's mother on that side of the familial group was very religious growing up."

"Oh. I spoke to Dr Irenimum yesterday about K'laxi religion."

"Yeah, so I'm a little freaked out to meet God."

"Mei, I don't know how many people I have to say this too, but I am not God!"

She knows you are.

"Melody, I have to say, I'm not so sure." Mei'la tries to stand straighter, to look me in the eye, to have me deny that she's wrong. Part of me is so proud of her. What a good subject.

"Mei'la, would it be easier if I was God, or if I wasn't God."

"Well, if you weren't God, I'd be less scared of being your friend. But if you are God, key, how many K'laxi are friends with God?" She laughed weakly.

I laughed too. It was funny. Plus, I knew that was the reaction she wanted to hear. How did I know that?

You know how.

Quiet, you.

"Mei'la. Is that why the Captain is acting so out of sorts?"

She nods. "Captain Q'ari was even more religious than my mom's mom. Her whole family has been churchgoers for centuries."

Shit. "I should go talk to her."

Mei'la flicks an ear. "I don't know Melody. Maybe."

Come. Let's see how malleable our Captain Supplicant is.

I said Q̷̢̭͚͙̤̠͙͍̝̑̒̆̐́͌͛͐̒͋̍̈́̚u̶̧͖͚̟̬̱͒̀͛̐̀i̷̭͚͙̭̅͌͆͋e̷̮͇͇̳͖̔̿̊ţ̴̨̱͇͍̥̤̣̳̓̿͂͐́̎̓̔́��́̐͆̑̕ͅ, you.

Don't go and threaten us with a good time now.

Part 14

#humans are deathworlders#humans are space orcs#humans go on adventure#humans are space oddities#sci fi writing#writing#humans and ai#humans and aliens#the k'laxiverse#jpitha#just a little further

96 notes

·

View notes

Text

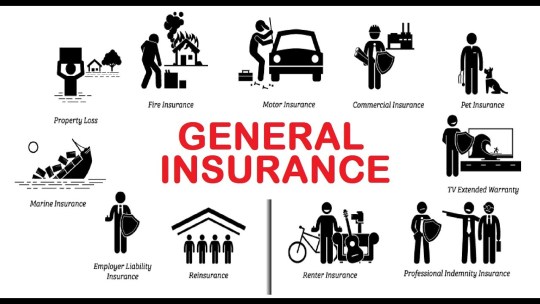

What is general insurance? - Insurance

What is general insurance? — Insurance

Understanding General Insurance: A Comprehensive Guide

General — Insurance plays a vital role in safeguarding individuals and businesses from unforeseen risks and financial uncertainties. One of the most common types of insurance is general insurance, which encompasses a wide range of policies designed to protect against non-life risks. In this article, we will delve into the world of general insurance, exploring its definition, key categories, importance, and how to choose the right coverage for your needs.

What is General Insurance?

General insurance, also known as non-life insurance, is a financial product that provides protection against various risks, excluding life-related risks. Unlike life insurance, which pays out benefits upon the policyholder’s death or maturity, general insurance policies offer coverage for specific contingencies, such as accidents, theft, property damage, and liability claims.

Key Categories of General Insurance

Health Insurance:

Health insurance policies cover medical expenses incurred due to illness, injury, or accidents. They can include individual health plans, family floater policies, and group health insurance provided by employers.

Motor Insurance:

Motor insurance encompasses policies for automobiles, including cars, motorcycles, and commercial vehicles. The two primary types are:

Third-party liability insurance, which covers damages and injuries caused to third parties.

Comprehensive insurance, which also covers damages to the insured vehicle.

Home Insurance:

Home insurance protects your residence and its contents against various risks, including fire, theft, natural disasters, and structural damage. It includes building insurance and content insurance.

Travel Insurance:

Travel insurance provides coverage for unforeseen events while traveling, such as trip cancellations, medical emergencies, baggage loss, and personal liability.

Property Insurance:

Property insurance extends beyond homes and covers commercial properties, warehouses, and other assets. It safeguards against fire, theft, vandalism, and natural disasters.

Liability Insurance:

Liability insurance protects individuals and businesses from legal claims arising from injuries, damages, or accidents for which they may be held responsible. Examples include professional liability insurance, public liability insurance, and product liability insurance.

Marine Insurance:

Marine insurance covers goods and cargo transported via sea, air, or land. It mitigates risks associated with damage, theft, or loss during transit.

Also Check: <<< Trending Topics >>>

Importance of General Insurance

Financial Protection: General insurance provides a safety net, ensuring that individuals and businesses do not face significant financial losses in the event of unforeseen incidents.

Legal Requirements: In many countries, certain types of general insurance, such as motor insurance, are mandatory by law to protect third parties in case of accidents.

Peace of Mind: Knowing that you have insurance coverage gives peace of mind, reducing stress and anxiety related to potential risks.

Risk Management: General insurance allows individuals and businesses to manage risks effectively by transferring them to insurance companies.

How to Choose the Right General Insurance Coverage

Assess Your Needs: Identify the specific risks you want to protect against and assess your budget to determine the coverage you require.

Research Insurers: Compare policies and quotes from different insurance companies to find the most suitable option for your needs.

Understand Policy Terms: Carefully read and understand the terms and conditions, including coverage limits, deductibles, and exclusions.

Seek Professional Advice: Consult with insurance agents or brokers who can provide expert guidance on selecting the right coverage.

Review Regularly: Reevaluate your insurance needs regularly, especially when major life events occur, such as marriage, the birth of a child, or buying a new home or vehicle.

Conclusion

General insurance is a crucial component of financial planning, offering protection against a wide range of non-life risks. Whether it’s safeguarding your health, home, vehicle, or business, having the right general insurance coverage can provide peace of mind and financial security when you need it most. By understanding the different types of general insurance and assessing your needs, you can make informed decisions to ensure your protection in an unpredictable world.

NEXT TO >>>

3 notes

·

View notes

Text

Esketamine Cost with Insurance: Strategies for Affordability

Introduction:

Esketamine, a breakthrough treatment for depression, has shown promising results for individuals who have not responded well to traditional antidepressant medications. However, one of the concerns that may arise when considering esketamine treatment is the associated cost. In this blog post, we will explore various strategies to make esketamine more affordable by leveraging insurance coverage and exploring cost-saving options.

Understanding Insurance Coverage:

Begin by understanding the specifics of your insurance policy. Review the coverage details and determine if esketamine is included as a covered medication. Check if there are any restrictions, limitations, or prior authorization requirements. This will give you a clearer picture of what costs to expect and how to navigate the process.

Consult with Your Insurance Provider:

Contact your insurance provider directly to gain insights into your coverage for esketamine. Ask specific questions about copayments, deductibles, and any potential out-of-pocket expenses. Seek clarity on the documentation required for reimbursement and the steps involved in filing claims.

Research In-Network Providers:

Find out if there are any in-network providers or clinics that offer esketamine treatment. In-network providers often have negotiated rates with insurance companies, which can lead to more affordable treatment options. Consider reaching out to these providers and confirming their acceptance of your insurance plan.

Seek Prior Authorization:

Some insurance plans may require prior authorization for esketamine therapy. Work closely with your healthcare provider to gather the necessary medical documentation and submit it to your insurance company. This step helps ensure that the treatment is medically necessary, potentially increasing the chances of coverage approval.

Explore Financial Assistance Programs:

Research financial assistance programs offered by pharmaceutical companies or non-profit organisations. These programs can provide financial support or discounts for eligible individuals who are prescribed esketamine. Check the eligibility criteria and application process for each program to see if you qualify.

Compare Insurance Plans:

During the open enrollment period or when considering a change in insurance coverage, compare different insurance plans to find the one that offers the best coverage for esketamine. Look for plans that have a higher level of coverage or lower out-of-pocket costs for this specific medication.

Utilise. Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs):

If you have an FSA or HSA, consider using these accounts to pay for esketamine treatment. These accounts allow you to set aside pre-tax dollars specifically for medical expenses, potentially reducing the overall cost of treatment.

Talk to Your Healthcare Provider:

Engage in an open conversation with your healthcare provider about the financial aspect of esketamine treatment. They may have valuable insights or recommendations to help you navigate the insurance process, explore cost-saving options, or even consider alternative treatment approaches.

Conclusion:

While the cost of esketamine treatment with insurance can be a concern, there are strategies available to make it more affordable. By understanding your insurance coverage, seeking prior authorization, exploring financial assistance programs, and considering cost-saving options, you can optimise the affordability of esketamine treatment. Remember to engage with your healthcare provider and insurance company to ensure a smooth and cost-effective journey towards better mental health.

2 notes

·

View notes

Text

How Should You Choose a Junk Removal Company?

Are you tired of staring at the clutter in your home or office? If yes, then do not let junk take over your space and your sanity! Hiring a professional junk removal company can be the solution you've been looking for. In this blog post, we will explore the top 10 reasons why enlisting the help of a junk removal service is a smart choice. These professionals can efficiently clean and organize your space, saving time and ensuring proper disposal. Say goodbye to the mess and embrace the benefits of experienced appliance removal services. Let us begin.

What Factors Should You Consider While Choosing Junk Removal service

There are many benefits to employing a professional junk removal service. Let us look at some of the factors:

The reputation of the company

A reputable company reflects its reliability and the quality of its services. It is important to consider it after reading reviews and testimonials from previous customers. A reputable junk removal service will have positive feedback and a track record of customer satisfaction. Choosing a reliable and professional junk removal company gives you peace of mind.

Licensing and Insurance

Licensing ensures that the company meets the legal requirements to operate in the industry. It gives them confidence that they have the expertise and knowledge to handle the junk removal project professionally. On the other hand, insurance protects you from any liability for accidents or damages during the junk removal process. It offers peace of mind knowing that the company's insurance policy will cover any unforeseen incidents, minimizing potential risks and expenses for you.

Types of Services Offered

It is important to ensure that the company you choose can handle the specific types of junk you need removed. Whether it's furniture, appliances, or construction debris, verifying that the company has experience and expertise in handling such items ensures that your junk removal needs are met. Considering this factor, you can ensure that the company can address your specific requirements effectively and efficiently.

Recycling and Disposal Practices

Think about how the trash hauler handles recycling and trash dumps before hiring them. A responsible junk removal company will prioritize recycling and employ proper disposal methods to minimize the environmental impact. They should have a clear plan for sorting, recycling, and disposing of different materials.

By opting for a service that actively participates in recycling initiatives and follows waste management regulations, you contribute to a more sustainable future. Additionally, you help reduce landfill waste and promote the reuse of valuable resources.

Pricing Structure

Pricing structure refers to how a junk removal company determines and presents the costs associated with its services. It is important to understand the pricing breakdown to ensure transparency and avoid surprises. Factors that may influence the pricing include the volume or weight of the junk, the type of items being removed, the complexity of the job, and any additional services required.

A clear and detailed pricing structure allows you to compare quotes, evaluate the value, and make an informed decision.

Availability and Response Time

This aspect refers to how quickly the company can schedule and carry out the process of removing junk from a property. A reliable and efficient service will accommodate your timeline and provide prompt assistance. Whether you need the junk removed quickly or not, a company that can provide timely services makes the process easier. Additionally, it minimizes delays or inconveniences.

Equipment and Resources

Adequate equipment ensures that items are handled properly during removal, while reliable vehicles enable timely transportation. Sufficient manpower ensures that the job can be completed efficiently. By assessing the company's equipment and resources, you can ensure they have the necessary capabilities to handle your specific junk removal needs. Moreover, a reputable junk removal company should have the necessary tools to dispose of hazardous waste, effectively safeguarding nature.

Health and Safety Measures

This aspect of the situation ensures the safety of the workers and your property. A good junk removal company will train its workers to follow safety procedures during the removal process. In addition, they should wear protective gear like gloves, masks, and clothing to keep themselves safe from harm. Putting health and safety first is a mark of professionalism and sound management.

Fast Customer Service

It refers to the level of support, responsiveness, and professionalism the company provides its customers. A reliable office junk removal company will prioritize customer satisfaction by promptly addressing concerns or queries. They should have clear communication channels, be courteous, and go the extra mile to ensure a smooth and pleasant experience. Excellent customer service ensures that your needs are met and enhances your overall satisfaction with the junk removal service you choose.

Best Sustainability Initiatives

These initiatives refer to the actions and practices implemented by a junk removal company to minimize its environmental impact. Most junk removal companies prioritize sustainability, ensuring that your junk will be handled and disposed of in an eco-friendly manner.

Considering these factors, you can make an informed decision when choosing a junk removal service that aligns with your needs and throws off all the garbage.

Wrapping Up

Hiring a professional junk removal company offers numerous advantages when decluttering your space. You can save time and ensure proper disposal while keeping your home or office clean and organized. When choosing a junk removal service, there are several factors to consider. Considering the factors we have discussed above, you can plan on hiring a junk removal company that meets your needs, promotes sustainability, and saves money. Today, say goodbye to the mess and welcome the advantages of professional junk removal services.

2 notes

·

View notes

Text

Protecting Your Medical Career: The Importance of True Own Specialty Disability Insurance for Physicians

Over the past decade, the medical field has undergone significant transformations, leading to a decline in self-employed physicians and a rise in physicians transitioning to employment within institutionalized medicine. Unfortunately, this shift has given rise to a common misconception among physicians regarding disability insurance coverage. Many doctors are either opting out of purchasing individual own specialty disability insurance for physicians or canceling their existing coverage, mistakenly relying on their employer’s long-term disability insurance. It is crucial to understand the limitations of employer-provided disability plans and the immense importance of true own specialty policies.

True Own Disability Insurance for Physicians vs. Employer Provided Group Disability

Although employer-provided disability plans may seem appealing due to their seemingly cost-free nature, they pale in comparison to the comprehensive coverage provided by own specialty policies. Typically, employer plans only cover the base salary, often capped around $10,000 per month, and the benefits received are subject to regular income tax when the premiums are paid by the employer. Moreover, these plans define total disability as the inability to work in the medical specialty with no alternative sources of income. Should a physician choose to work in a different occupation, they would no longer be considered totally disabled.

Most employer plans also incorporate a 24-month clause, which allows them to evaluate the physician’s skills after two years of benefit payment. If the insurance company deems the physician capable of performing another reasonable occupation, they will cease benefit payments. Additionally, many employer plans do not cover work-related injuries or illnesses, and they lack portability if the physician decides to switch employers. Furthermore, partial disability benefits are usually only granted after a consecutive period of at least 90 days of total disability, making it unrealistic to claim benefits for partial disabilities.

The Benefits of Own Specialty Disability Insurance

It cannot be stressed enough how critical it is for physicians to protect their income potential in the medical specialty they have worked so diligently to achieve. This protection can only be guaranteed by purchasing individual own specialty coverage offered by the six insurance carriers: Ameritas, Guardian, MassMutual, Mutual of Omaha, Principal, and The Standard. It is vital to note that organizations such as the AMA, ACOG, ACP, ACS, and Northwestern Mutual do not offer true own specialty disability insurance. Their plans fall short as they only pay physicians their full disability benefit if they have no other sources of income during a disability.

While there is a cost associated with owning own occupation disability insurance, the benefits are truly invaluable. Annual premiums typically range from 2% to 6% of your annual gross income, depending on the age at which the policy is purchased. However, if you cherish the effort you have invested in becoming a physician and depend on your income, going without True Own Occupation disability insurance is simply not an option. Relying solely on employer plans for protection is a risky decision. By investing in an individual own specialty policy, physicians can effectively safeguard their income potential and ensure unwavering financial stability in the face of unforeseen circumstances.

At InsuranceMD, thousands of physicians across the country place their trust in us to ensure they obtain True Own Occupation/Specialty disability insurance. What sets us apart is that we do all the shopping for you. We assess your needs and eligibility for coverage, while taking the time to educate you. We diligently compare the offerings of the six carriers, to find the most comprehensive policy at the best cost when providing disability insurance quotes. We employ state-of-the-art secure technology to ensure your information remains safe. Whether you choose to work with us or have your own trusted advisor, it is of utmost importance that you purchase disability insurance from one of the six own specialty carriers, ensuring you obtain their best definition of total disability in an own occupation context.

If you are unsure about what this means or how to determine if you are getting the best own occupation coverage available, please feel free to reach out to me at [email protected] . I am more than happy to assist you in any way I can.

#bestdisabilityinsuranceforresidentphysicians#howmuchdisabilityinsurancedoineed#doctorsdisabilityinsurance#ownoccupationdisabilityinsurancecost#ownspecialtydisabilityinsurance#physiciandisabilityinsurance#physiciansdisabilityinsurance#surgeondisabilityinsurance#disabilityinsurancefordoctors#disabilityinsuranceforphysician

3 notes

·

View notes

Note

Dear Frank, I would like to obliterate Big Pharma. How could we accomplish this lofty goal together?

I have been thinking about this a lot lately. I am not an expert on pharmaceuticals, but here are some thoughts:

(1) The generic drug industry is pretty healthy and competitive -- it's hard to imagine the FDA approving drugs that don't work well enough to be worth manufacturing at all (or very difficult to imagine), because there will always be companies out there who can beat them in terms of price if they do; thus any regulatory intervention in this area would need to carefully account for the fact that many or most consumers get their prescriptions filled with generics anyway

(2) "Brand name" drugs aren't as much better than generics as people tend to think. For example, here is one NYT article saying that branded statins are only ~5% more effective than generic ones. A few years ago, when I was working on a project involving cancer research, we got quotes from two different pharmacy providers, and found that a 30 day supply of a widely used anticancer medication cost $796 from CVS Caremark, and $84 from Walgreens, which makes you wonder whether the maker of the expensive version has actually done anything other than slap its logo on a bottle full of pills

In general, when doing experiments like this, your expectations should not be "how long does the treatment last," but rather "is it statistically distinguishable from placebo?" If so, then it doesn't matter how cheaply it could be produced.

Therefore, even though Big Pharma seems bad right now, it is unlikely that excessive government regulation of pharma would help anyone except generic drugmakers. And given that there are already many kinds of competition preventing Big Pharma from becoming too powerful, I feel skeptical that further regulation is needed (assuming that governments generally care about saving lives).

But maybe I just haven't thought through what kind of change might fix things? How would you propose fixing this problem?

P.S. One thing that seems relevant is how much money our various government agencies spend on drugs per year, compared to private insurance plans etc., and whether those agencies are responsible for creating new patents themselves or simply distributing current patented products. I've seen talk about paying lower prices for these products, but no discussion of any mechanism by which this happens.

The above discussion may also seem confused, since it suggests that the consumer is irrelevant to what goes on between Big Pharma and the FDA. But while I realize that individuals are powerless against such forces, if we want to make policy changes affecting millions of people, we cannot ignore the actual situation where individual patients find themselves. (We may not be able to solve problems for everyone, but we shouldn't pretend we have solved nothing.)

4 notes

·

View notes

Text

Editor’s Note:This paper is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between the Economic Studies Program at Brookings and the USC Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national health care debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings. This work was supported by a grant from the Robert Wood Johnson Foundation.

At present, 11 states have declined to expand Medicaid to all people with incomes below 138% of the federal poverty level (FPL), as permitted under the Affordable Care Act (ACA). In these states, adults with incomes below 100% of the FPL typically lack access to subsidized health insurance coverage.[1] Adults with incomes between 100 and 138% of the FPL are eligible for subsidized coverage through the ACA Marketplaces, but face higher cost-sharing and, prior to recent legislation, higher premiums than they would in Medicaid. These states’ decisions are estimated to have reduced coverage by 3.7 million people, while worsening financial security, access to health care, and health outcomes, including mortality.

In 2021 and 2022, Congress considered two ways of addressing these gaps in coverage but did not enact either. The first was for the Centers for Medicaid Services (CMS) to operate a “federal Medicaid program” in the non-expansion states that would, in effect, directly substitute for the missing state Medicaid expansion. The second, which was passed by the House of Representatives, was to extend eligibility for subsidized Marketplace coverage to people below the poverty line, while modifying how Marketplace coverage functions for people below 138% of the FPL to make it more “Medicaid-like.”

The analysis considers the relative merits of these two approaches, with the goal of helping policymakers choose between them if the Medicaid coverage gap returns to Congress’ agenda in the future. I compare the approaches along four dimensions that would be central to policymakers’ decisions: (1) number of people covered; (2) quality of coverage; (3) per enrollee fiscal cost; and (4) ease of implementation.

My overarching conclusion is that these two approaches are similar. Both would ensure that people with incomes below 138% of the FPL are eligible for zero- (or near-zero) premium coverage that covers a broad set of services with minimal cost-sharing; as such, either would largely or entirely fill the gaps left by state decisions not to expand Medicaid.[2] However, there are also differences worth considering along each of the four dimensions listed above. The nature of those differences would depend on the details of each legislative proposal and CMS’ implementation decisions, and it appears unlikely that either approach would outperform the other on all four dimensions. In brief:

Number of people covered: Without changes to the Marketplace enrollment process, enrolling in coverage would likely be harder under a Marketplace-based approach due to the need to select a plan and, in some cases, pay a premium. The House-passed Marketplace-based approach also lacked the “retroactive” coverage for care received before enrollment that would be available under a federal Medicaid program. These downsides of a Marketplace-based approach could, in principle, be mitigated with small changes to the House-passed bill and thoughtful implementation decisions.

On the other hand, relying on a federal Medicaid program would require enrollees to transition between coverage programs when their income crossed 138% of the FPL. This eligibility “seam” could cause coverage disruptions that would not occur under a Marketplace-based approach. These disruptions would likely be hard to fully avoid under a federal Medicaid program.

Quality of coverage: If a federal Medicaid program emulated state Medicaid programs, then it might offer somewhat narrower provider networks and more restrictive drug coverage than a Marketplace-based approach. However, CMS could also implement a federal Medicaid program in ways that would make it much more generous than a Marketplace-based approach along these dimensions, as well as opt to cover additional services that Marketplace plans do not typically cover. Another consideration is that a Marketplace-based approach would likely offer enrollees more plan options and, thus, allow some enrollees to select plans that better matched their needs; however, this would come at the cost of placing enrollees in a more complex choice environment that could lead other enrollees to choose plans that poorly matched their needs.

Per enrollee fiscal cost: A federal Medicaid program would pay health care providers and drug manufacturers lower prices than Marketplace plans, as it would have many tools to limit prices that Marketplace plans lack. A reasonable estimate (derived below) is that these price differences would reduce the per enrollee fiscal cost of a federal Medicaid program by one-quarter to one-third relative to a Marketplace-based approach, depending on how CMS implemented a federal Medicaid program. If they wished, legislators could “claw back” some of the higher prices paid to providers and manufacturers under a Marketplace-based approach, such as by reducing payments to hospitals intended to cover uncompensated care costs or extending Medicaid-like drug rebates to Marketplace enrollees who would be eligible for Medicaid under expansion.

Utilization could also differ between a federal Medicaid program and a Marketplace-based approach. However, the direction of those differences would likely depend on decisions CMS made about provider networks and utilization controls under a federal Medicaid program.

Ease of implementation: A Marketplace-based approach would be easier to implement than a federal Medicaid program because it could rely heavily on existing infrastructure, whereas a federal Medicaid program would need to create new systems to perform many core functions, such as regulating and contracting with managed care plans. As a result, a Marketplace-based approach could likely be at least partially implemented in a matter of months, whereas it might take years for a federal Medicaid program to begin offering coverage.

The discussion above implies that policymakers’ choices between the two approaches would depend on how much weight they assigned to each of these four dimensions, as well as the details of each legislative proposal and CMS’ implementation decisions. For example, a policymaker who prioritized maximizing the number of people covered might prefer a federal Medicaid program if CMS maintained current Marketplace enrollment process. But the same policymaker might prefer a Marketplace-based approach if the House bill was amended to add retroactive coverage and CMS improved the Marketplace enrollment process since a Marketplace-based approach could be implemented faster and would avoid an eligibility “seam” at 138% of the FPL. Similarly, a policymaker who prioritized maximizing the quality of the coverage enrollees received might prefer a Marketplace-based approach if CMS implemented a federal Medicaid program in ways that emulated state Medicaid programs, but hold the opposite view if CMS made implementation decisions that caused a federal Medicaid program to provide more generous coverage.

Closely related, this discussion shows that lawmakers, CMS, or both would have important choices to make if either approach returned to the forefront. Notably, legislative changes to the House-passed bill, including the addition of retroactive coverage or provisions to “claw back” revenue from providers or manufacturers, could improve its performance along some of the dimensions examined here. For its part, CMS would face consequential implementation decisions, particularly regarding the enrollment process under a Marketplace-based approach and coverage quality under a federal Medicaid program.

The remainder of this analysis presents an overview of the two approaches to addressing the coverage gap and then a detailed analysis of how they compare along the dimensions enumerated above.

5 notes

·

View notes

Text

Are You Look For in an Auto Insurance Company?

What is vehicle security? What will a crash security cover?

Crash security associations cover you and your explorers in the event of a disaster. In any case, it truly relies upon you to finish up the level of cover you will get.

Will the damages to your property be covered by the association? Will all of the voyagers be covered or simply your friends and family? Envision a situation in which your daughter was driving your vehicle.

What requests could it be prudent for you to posture to your mishap insurance association with respect to impact assurance? This article helps you with picking between the different auto insurance policies.

Sorts of a mishap insurance

Commitment insurance, or outcast security.

This is generally the most insignificant kind of security introduced by a mishap inclusion association. This is crucial security, if you are related to a disaster, and it is shown to be your weakness, the mishap inclusion association will pay damages to the following party.

The cover introduced by the impact insurance association is normally set early. These are the best total the crash security association will pay in case of disaster

For example, the expert will choose a $10000 consideration for each person, (significant injury) or possibly $40000 consideration in genuine injury as well as $10000 in property hurt per setback

You truly need to avow with your impact insurance association what they will cover and what are the limits.

You might be offered a very low cost by some impact insurance association just to comprehend that your cover is irrelevant and nonsensical.

Influence and intensive incorporation, complete assurance, and full broad security

An impact insurance association will moreover offer you broad security, as the name illustrates, you will be totally covered.

In direct terms, it means that expecting you are obligated for an accident the protection organization will pay for the support of the vehicle.

Regardless, it isn't the case essential, a mishap security association will regularly triumph ultimately the keep going say on what aggregate will be paid out, so if it is more affordable to give you market motivation for the vehicle, they will.

You could feel that your vehicle is esteemed at $1000.00 despite how the authentic market worth might be $500.00. This is surely not a surprising circumstance. So if the upkeep of your vehicle is more than $500.00, the impact insurance association will just pay the book worth of the vehicle.

You ought to guarantee that the protection organization isn't accountable for the market worth of the vehicle, customarily affiliations like the AA will give fair market regard.

Comparably likewise with the untouchable insurance, the mishap inclusion association will probably cut off the total that will be paid out, yet generally terms, total security will have higher endpoints.

Entertainment Vehicle

A redirection vehicle needs its own insurance, a Recreation vehicle security isn't comparable to crash assurance.

You shouldn't acknowledge that because your vehicle is totally secured, your entertainment vehicle is also.

Various Types of impact security

Clinical (MedPay), Persona Injury confirmation (PIP), and no issue cover

This assurance will cover you and your explorers' clinical costs if there should be an occurrence of an effect.

The no deficiency cover suggests that the mishap assurance association will pay to pay little regard to who is to be faulted. This gives you the peace of mind that, regardless, your friends and family are covered.

PIP is a significant part of the time a base essential in specific countries or states, ask your crash security association what the necessities are.

Uninsured/Underinsured drivers' incorporation

This cover, (in like manner a portion of the time a base essential in specific states), will cover you if the person at fault isn't protected or is underinsured.

You ought to ask your impact security association what you will be charged in case of such a situation. Routinely the mishap inclusion association shouldn't charge you a few additional costs.

Rental reimbursement, towing, and work

Those 'extra things' regularly given with broad insurance are commonly used by means of mishap security associations as specials.

So if your vehicle is hurt the crash insurance association will pay for rental costs, (on occasion only for two or three days).

The mishap insurance association could moreover propose to pay for the towing of your vehicle, (barred constantly).

As reliably you should ask your crash security association what is associated with the cover.

The legal requirements.

Most states and most countries will require a particular level of cover, from full intensive vehicle insurance to pariah mishap inclusion.

Taking everything into account relies upon you, the driver, to ensure that your crash security association offers you the base required. A significant part of the time the protection organization, (the mishap insurance association), is under no obligation to instruct you on the essentials.

Clearly, a fair impact insurance association will, (should?), endeavor to provoke you on the best game plan for your utmost.

Sort out more about Auto Insurance association [ https://efourwheel.com] on our site.

EfourWheel started with a thought - to illuminate individuals about everything connected with Automotive News. Vehicle Insurance, Car Loans, Automotive Reviews, Automotive Accessories, Tips, and Advice.

2 notes

·

View notes

Text

Understanding Term Insurance: Why and How to Buy Term Insurance

Term insurance is one of the most straightforward and cost-effective ways to ensure financial protection for your loved ones. In this comprehensive guide, we will explore what term insurance is, why it is essential, and how you can buy term insurance to secure your family's future.

What is Term Insurance?

Term insurance, an integral type of life insurance policy, offers coverage for a predetermined period or "term" of years. If the insured individual passes away within this duration, the beneficiary is entitled to receive the death benefit. Unlike whole life insurance, term insurance solely provides pure risk coverage without incorporating a savings component. If you're considering securing your loved ones' financial future, you can confidently opt to buy term insurance for comprehensive protection during a specified timeframe.

Why Buy Term Insurance?

1.Affordability: Term insurance policies are generally much more affordable than whole life insurance policies. This makes them accessible to a broader range of individuals, especially young families looking for significant coverage at a low cost.

2.Financial Security: The primary purpose of term insurance is to provide financial security to your dependents in case of your untimely death. The death benefit can help cover living expenses, mortgage payments, education costs, and other financial obligations.

3.Flexibility: Term insurance policies offer flexibility in terms of coverage length and amount. You can choose a term that aligns with your financial goals and obligations, such as covering the period until your children graduate from college or until your mortgage is paid off.

Types of Term Insurance

There are several types of term insurance policies, each with its own features and benefits:

1.Level Term Insurance: The death benefit and premiums remain the same throughout the policy term. This is the most common type of term insurance.

2.Decreasing Term Insurance: The death benefit decreases over the term of the policy, typically aligned with a decreasing financial obligation like a mortgage.

3.Increasing Term Insurance: The death benefit increases over time to keep pace with inflation or increased financial responsibilities.

4.Convertible Term Insurance: Allows you to convert your term policy into a whole life policy without undergoing a medical examination.

How to Buy Term Insurance

When considering buying term insurance, follow these steps to ensure you choose the best policy for your needs:

1.Assess Your Coverage Needs: Determine how much coverage you need by considering your financial obligations, such as mortgage, debts, living expenses, and future goals like your children’s education.

2.Choose the Right Term Length: Select a term that matches your financial goals and the period during which your dependents will need financial support. Common term lengths are 10, 20, or 30 years.

3.Compare Policies: Shop around and compare different term insurance policies. Look at the premiums, coverage amounts, term lengths, and additional benefits offered by various insurers.

4.Check the Insurer’s Reputation: Ensure the insurance company is reputable and financially stable. Look for reviews, ratings, and claim settlement ratios to gauge their reliability.

5.Read the Fine Print: Carefully read the policy documents to understand the terms and conditions, exclusions, and any additional riders you might want to add.

6.Apply for the Policy: Once you have selected a policy, you will need to fill out an application, which may include a medical exam. Answer all questions truthfully to avoid issues with future claims.

Top 3 Term Insurance Companies

To help you in your search, here are three top-rated term insurance providers known for their reliability and customer satisfaction:

1.Banner Life Insurance: Known for competitive rates and strong financial stability, Banner Life offers a variety of term lengths and policy options to fit different needs.

2.Protective Life Insurance: Provides flexible and affordable term insurance policies with the option to convert to permanent coverage later. They are known for excellent customer service and claim handling.

3.AIG Direct: Offers a wide range of term insurance policies with customizable options. AIG is a global leader in insurance, providing robust coverage and a seamless application process.

Conclusion

Buying term insurance is a crucial step in securing the financial future of your loved ones. By understanding your needs and carefully selecting a policy, you can provide substantial protection at an affordable cost. Remember to assess your coverage needs, compare policies, and choose a reputable insurer.

Ready to take the next step? Compare top term insurance policies now and secure your family's future today.

0 notes

Text

Why are term insurance plans in Mumbai a necessity?

In today's fast-paced world, financial security is crucial for individuals and families alike. One of the most effective ways to ensure financial stability is by investing in term insurance plans in Mumbai. If you have term insurance protection, then you can be at peace of mind knowing that your loved ones are financially secure even if you are not present.

The Importance of Term Insurance Plans

Financial Protection: Term insurance offer financial protection to your family in the event of your death. The insurance company pays a lump sum to your beneficiaries, ensuring they can continue their lifestyle without financial burdens.

Financial Independence: By investing in insurance, you can ensure your family's financial independence. They can continue to pursue their education, and passion, and live their life worry-free of financial insecurity.

Tax Benefits: Term insurance plans offer tax benefits under Section 80C of the Income Tax Act. You can reduce your taxable income by claiming a deduction on your premium payments.

Flexibility: Life insurance offer flexibility in terms of policy duration, coverage amount, and premium payment frequency. You can customize your policy according to your financial goals and budget.

Cost-Effective: Term insurance plans are generally more cost-effective compared to other types of insurance policies. This makes them an attractive option for individuals looking for affordable financial protection.

Best Life Insurance Cover in Mumbai