#financial literacy 101

Text

youtube

#fine living#financial education#financial iq#personal finance#financial intelligence#financial literacy#how to improve your financial iq#financial skills#financial freedom#luxury living#budgeting#investing#financial literacy 101#finance for beginners#goals#objectives#how to plan#how to set goals#how to achieve goals#how to be better#planning for the future#wealthy#financial knowledge#money#invest#stocks#money advice#stock market#wealth#rich

1 note

·

View note

Text

How to be Rich With Loans? | Financial Education | कर्ज लेकर करोड़ो कमाओ | BookPillow

दोस्तों आप सभी एक ऐसी कंपनी के प्रोडक्ट यूज करते हैं हर दिन जिस कंपनी का नाम था पहले पीठ खुजा हो मैं मजाक नहीं कर रहा हूं 1996 में लरी पेज एंड सर्ग ब्रिन जो फाउंडर्स हैं googleupdate.exe या ब्रांड नेम होना कितना जरूरी है और वो समझने के बाद उन्होंने अपना नाम चेंज किया बैक्रब से google2 में लैरी पेज को $100000 दिए जिन पैसों से लैरी एंड सर्गी ने एक गैराज रेंट लिया और लोगों को हायर किया और आज…

View On WordPress

#alux education#education#education finance#finance education#financial education#financial education 101#financial education canada#financial education for beginners#financial education tips#financial freedom#financial independence#financial iq#financial leverage ratio#financial literacy#financial literacy 101#financial literacy for beginners#financial literacy for dummies#financial management#robert kiyosaki financial education

0 notes

Text

Credit cards and Savings accounts 101

Hi!

Welcome to my blog post discussing how to arrange your financials as an early 20 something year old. We are going to go over credit cards, and savings accounts.

~This is entirely dependent on your lifestyle, too. I am someone who spends a lot on restaurants, rent, and groceries. I travel, but not constantly and when I do, it's usually with Spirit. That’s why I don’t have a credit card for traveling (more on this under the Travel section down). I haven’t done any travel credit card research. So if you’re a travel girlie, do everything I’m telling you below, and then add on a nice travel credit card after consulting www.nerdwallet or something. They will summarize the good ones on the market for you.

Keep reading! ~

Credit cards are really cool because it's a win-win situation for both you and the bank.

>It’s really fantastic for you since you get a lot of protection every time you buy something (if there’s a problem or scam, you can dispute the charge rather than trying to get your money back as with a debit card which is so much harder).

>You also of course get free money in the form of cashback, random benefits specific to each card, and can build your credit score.

[Credit scores can seem really shady but it's honestly an actually smart way humans in finance have managed to quantify a person’s “trustworthiness”. It sounds really dumb but banks need it to figure out who to loan their money to. Especially if you’re trying to buy a house and can’t come up with all the cash instantly. I foresee myself renting til the end of time so I don’t care too much about the house but credit scores can also help you get accepted for some of those really nice, more exclusive credit cards out there 0.0). The downside is that they’re really hard to build up (takes so many years) and can go down unbelievably easily like for missing one payment on your credit card.]

How do the banks benefit from the credit card system?

They earn transaction fees from the merchant (that’s why some smaller businesses sometimes prefer to be paid in cash), and depend on you forgetting to pay or giving into the allure of the credit card limit and maxing out. That’s when the fees and interest rates become astronomical.

SO,

Lesson 1: Do not forget to pay your bill each month! Set up Autopay a few days before the due date! Try to pay it off in full if you can!

Lesson 2: If you remember to do these things, you will profit enormously from the whole shebang and can make the system work for you. It literally pays to be financially responsible.

So, I currently have 4 credit cards. Discover Student, Citi Double Cash, Citi Custom Cash, and Bilt.

Equally important, I have a Citi Accelerate Savings Account.

Since Citi has some of the best cards and savings accounts out there, I also made a checking account with Citi.

In total I have:

Discover Student

Citi Custom Cash

Citi Double Cash

Bilt

Citi Accelerate Savings

Citi Checking Account

Our goal is to get the highest amount of cashback that we can on every purchase that we do.

Pro tip:

I’ve found it helpful to write down which credit cards to use for which purchases in a sticky note in your wallet if you need help remembering.

Spending Money:

Discover Student

This is a fabulous beginner card. It offers rotating categories for getting 5% cashback. This year, from January to March, you would get 5% back on Restaurants. Also, for the first year they double your cashback, so you get 10% back! That’s huge!! Every other miscellaneous purchase gets 1% back which is meh. They publish a yearly calendar with all the categories, and so for these three months, my sticky note said:

Restaurants: Use Discover card

Citi Custom Cash

This one also has rotating categories, but you choose the category that you want 5% back in. Since I was using Discover for restaurants, I chose groceries for this. Every other miscellaneous purchase gets 1% back which is meh. When Discover has a different category, like Gas Stations, that’s when I either pick restaurants for this or keep it at groceries, depending on what I’m spending more on.

My sticky note said:

Groceries: Use Citi Custom Cash card

Bilt

This is (at the time) the only card on the market that offers points on rent! Woah! Which is especially crazy because, as the creator of Bilt said, “rent is your highest spending category each month”. It is because of that precise reason that basically every credit card avoids paying rent and charges such an annoyingly high percentage for using your credit card to pay rent online. They don’t want to shell out 20 bucks a month for your 1k rent charge. Bilt gives you 1x points for each dollar you pay in rent. You can redeem these points in either cash (the lowest redemption rate) or in airline or hotel points (a higher redemption rate). I’m saving mine up for miles but even if you cash out, it's still not a rate to scoff at. Plus you don’t have to pay a credit card charge if you use their card which is bananas!

My sticky note said:

Rent: Use Citi Double Cash card

Citi Double Cash

This has to be my favorite. It was my first one and I used it for everything. Now that I have my restaurants, groceries, and rent covered, I use this as a net for all my other purchases. The Urban Outfitters planter, or a Target run, etc. You also can’t use the category cards for big stores like Walmart or Target (unless they specifically mention it) so this card is perfect for those. It gives 2% back for everything, which hella adds up. Now that you have all your bigger spending categories covered, Citi Double Cash comes in so absolutely clutch.

My sticky note said:

Everything else: Use Citi Double Cash card

Travel

There are some great credit cards out there that allow you to earn airplane miles or hotel points with purchases, or give travel insurance if you book using that card (I have had to use that more than once!). I don’t have one yet, but that seems like the next step in life. I’ve heard Chase has some good ones, and of course googling the best travel cards on the market is always the easiest route.

Keeping Money

Savings Account

Savings accounts have taken a complete 180 degree turn since a few years ago. Before, they would only give you a small percentage like 0.5% for the money you keep with them. That’s what your local credit union will give you. Now, there are accounts called High Yield Savings Accounts or HYSAs that give you anything from 4-5% back! Even if you have 200 dollars saved up, I would 10000% recommend opening one of these. It's the best place to store your money, and you can let it sit back and just let your money work for you. I have the Citi Accelerate Savings Account that gives me 4.47% right now, one of the highest on the market. There are some cards that match that interest rate or slightly higher but since I have 2 Citi cards already, I find it easiest just to have this one since everything can be in the same dashboard and it's easier to transfer money.

(https://www.citi.com/banking/savings-account)

Checking Accounts

This is just a basic account where usually people deposit their money from their jobs, and pay off their credit cards, utilities, etc., with. I have a Citi Checking Account because I’m integrated in their ecosystem and it's the easiest, but mine doesn’t earn any interest on money. This was previously unheard of but some checking accounts nowadays earn interest for you! The future is now. O.o

That’s all folks!

All of this is friendly advice. Even if you don’t go with any of these cards, I hope you get the idea of how to sit down, look at your spending categories, look at the cards available on the market, and play a little matching game to pair each category to each card.

Once again, I’m underlining the importance of having a HYSA asap rather than letting your money sit in a checking account, because that’s free money on it each month! Try to avoid opening a bunch of credit cards all at the same time because that will hit your credit score (once again, opening the HYSA won’t though).

It took me about four years starting as a freshman in college to get all four of these credit cards. Companies frown at opening more than 5 in 24 months (Chase’s secret 5/24 rule) but you can start with at least the Citi Double Cash one if not more. As always, you can come to me with any questions!

Xoxo,

mangoesforlyfe

#finance#credit cards#credit score#financial literacy#credit cards 101#finances 101#basic finance#how to take care of your money

1 note

·

View note

Text

Investing 101: Starting Your Journey in the Stock Market

Written by Delvin

Investing in the stock market can seem daunting for beginners, but with the right knowledge and strategies, it can be a rewarding endeavor. If you’re new to stock market investing, understanding some key concepts and strategies can help you navigate this financial landscape more confidently.

Understanding the Stock Market

The stock market is where buyers and sellers come…

View On WordPress

#dailyprompt#Financial#Financial advice for beginners#Financial Literacy#Investing 101#knowledge#money#Personal Finance#Stock Market#Stocks

1 note

·

View note

Text

Promoting Financial Literacy With Digital Content

The internet is full of dubious financial advice. Amid all that misinformation and people having more control over their money than ever, financial literacy has arguably never been more crucial. Businesses in the finance sector can turn that need into a profitable marketing strategy.

Consumers require more financial literacy to take better care of their assets. Finance businesses need their…

View On WordPress

#Business#business advice tips#Marketing Strategy 101#Promoting Financial Literacy With Digital Content#small business advices#small business tips#visual content marketing

1 note

·

View note

Text

"Bold the facts" OC game

tagged by @dirty-bosmer to do this OC personality quiz. Thanks!

tagging: @jentucker @tallmatcha @chennnington @itslettinggo and anyone who wants to do it!

For my Lone Wanderer Talia after events of Fallout 3

✧˖°. PERSONAL

$ Financial: wealthy / moderate / poor / in poverty

✚ Medical: fit / moderate / sickly / disabled / disadvantaged / non-applicable

✪ Class/Caste: upper / middle (i guess?) / working / unsure / other

✔ Education: qualified (some basic vault 101 school & work related, but she'd say she smashed wasteland survival) / unqualified / studying / other

✖ Criminal Record: yes, for major crimes / yes, for minor crimes / no / has committed crimes, but not caught yet (according to Regulators anyway) / yes, but charges were dropped

✧˖°. FAMILY

◒ Children: had a child or children / has no children / wants children

◑ Relationship with Family: close with sibling(s) / not close with sibling(s) / has no siblings / sibling(s) is deceased

◔ Affiliation: orphaned / abandoned / adopted / found family / disowned / raised by birth parent(s) (until he ran off then died!!) / not applicable

✧˖°. TRAITS + TENDENCIES

♦ extraverted / introverted / in-between

♦ disorganized / organized / in-between

♦ close-minded / open-minded / in-between

♦ calm / anxious / in-between / highly contextual

♦ disagreeable / agreeable / in-between

♦ cautious / reckless / in-between / highly contextual

♦ patient / impatient / in-between

♦ outspoken / reserved / in-between / highly contextual

♦ leader / follower / in-between

♦ empathetic / vicious bastard / in-between / highly contextual

♦ optimistic / pessimistic / in-between

♦ traditional / modern / in-between

♦ hard-working / lazy / in-between

♦ cultured / uncultured / in-between (very cultured by wasteland standards but not quite enough for many Tenpenny residents) / unknown

♦ loyal / disloyal / unknown / highly contextual

♦ faithful / unfaithful / unknown <.< / highly contextual

✧˖°. BELIEFS

★ Faith: monotheist / polytheist / atheist / agnostic

☆ Belief in Ghosts or Spirits: yes / no / don't know / don’t care / in a matter of speaking

✮ Belief in an Afterlife: yes / no / don’t know / don’t care (she doesnt really see the point in thinking about it) / in a manner of speaking

✯ Belief in Reincarnation: yes / no / don’t know / don’t care / in a manner of speaking

❃ Belief in Aliens: yes / no / don’t know (she'll believe it when she sees it) / don't care

✧ Religious: orthodox / liberal / in between / not religious

❀ Philosophical: yes / no / highly contextual

✧˖°. SEXUALITY & ROMANTIC INCLINATION

❤ Sexuality: heterosexual / homosexual / bisexual / asexual / pansexual

❥ Sex: sex-repulsed / sex neutral / sex favorable / naive and clueless

♥ Romance: romance repulsed / romance neutral / romance favorable / naive and clueless / romance suspicious (generally suspicious)

❣ Sexually: adventurous / experienced / naive / inexperienced / curious

⚧ Potential Sexual Partners: male / female / agender / other / none / all

⚧ Potential Romantic Partners: male / female / agender / other / none / all

✧˖°. ABILITIES

☠ Combat Skills: excellent / good / moderate / poor / none

≡ Literacy Skills: excellent / good / moderate / poor / none

✍ Artistic Skills: excellent / good / moderate / poor / none

✂ Technical Skills: excellent /good / moderate / poor / none

✧˖°. HABITS

☕ Drinking Alcohol: never / special occasions / sometimes / frequently / alcoholic / former borderline alcoholic turned sober

☁ Smoking: tried it / trying to quit / quit / never / rarely / sometimes / frequently / chain-smoker

✿ Recreational Drugs: tried some / never / special occasions / sometimes / frequently / addict

✌ Medicinal Drugs: never / no longer needs medication / some medication needed / frequently / to excess

☻ Unhealthy Food: never / special occasions / sometimes (not sure what is healthy/unhealthy in the wasteland lol) / frequently / binge eater

$ Splurge Spending: never / sometimes / frequently / shopaholic

♣ Gambling: never / rarely / sometimes / frequently / compulsive gamble

4 notes

·

View notes

Text

Finance 101: Building a Strong Financial Foundation

Understanding the basics of finance is crucial for building a strong financial foundation. Whether you're just starting your journey to financial independence or looking to improve your financial literacy, mastering the fundamentals of finance is essential. In this guide, we'll explore the key concepts of finance and provide tips for building a solid financial foundation.

Understanding Income and Expenses

The first step in building a strong financial foundation is understanding your income and expenses. Income refers to the money you earn, whether from a job, business, or investments. Expenses are the costs associated with your day-to-day living, such as rent, groceries, utilities, and transportation. Tracking your income and expenses will help you identify areas where you can save and manage your money more effectively.

Creating a Budget

Creating a budget is essential for managing your finances. A budget is a plan that outlines your income and expenses, allowing you to allocate your money towards your financial goals. Start by listing all your sources of income and categorizing your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment). Then, allocate a portion of your income towards savings and investments, ensuring that you're living within your means.

Saving and Investing

Saving and investing are key components of building wealth and achieving financial security. Saving involves setting aside a portion of your income for future needs or emergencies. Aim to save at least 10-20% of your income each month and keep your savings in a high-yield savings account or money market fund for easy access. Investing, on the other hand, involves putting your money to work to generate returns over time. Consider investing in stocks, bonds, mutual funds, or real estate to grow your wealth and achieve your long-term financial goals.

Managing Debt

Managing debt is another important aspect of finance. Debt can be a useful tool for achieving financial goals, such as buying a home or funding education, but it's essential to use it wisely. Avoid taking on more debt than you can afford to repay, and prioritize paying off high-interest debt, such as credit card balances. Consider consolidating or refinancing your debt to lower your interest rates and make repayment more manageable.

Building an Emergency Fund

Building an emergency fund is crucial for financial stability. An emergency fund is a savings account that you can tap into in case of unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save at least three to six months' worth of living expenses in your emergency fund to provide a financial cushion and peace of mind in times of need.

Protecting Your Assets

Protecting your assets is essential for safeguarding your financial future. Purchase insurance policies, such as health insurance, life insurance, auto insurance, and homeowner's insurance, to protect yourself and your loved ones from unexpected financial losses. Review your insurance coverage regularly to ensure that you have adequate protection and adjust your policies as needed.

Seeking Financial Education

Finally, seeking financial education is essential for building a strong financial foundation. Take advantage of resources such as books, articles, podcasts, and online courses to expand your knowledge of personal finance. Consider working with a financial advisor or attending financial literacy workshops to gain expert guidance and advice on managing your finances effectively.

Conclusion

In conclusion, building a strong financial foundation requires understanding the basics of finance and implementing sound financial practices. By mastering concepts such as income and expenses, budgeting, saving and investing, managing debt, building an emergency fund, protecting your assets, and seeking financial education, you can lay the groundwork for a secure financial future. Start implementing these principles today to achieve your financial goals and build wealth for the long term.

#finance#financial literacy#financial education#financial goals#financial stability#financial security#financial practices#financial future#emergency funds#investment#manage money#budgeting#personal finance#financial industry#financial planning

0 notes

Text

Financial Literacy 101: Essential Money Management Skills for Success

Introduction:

With advice from Morpheus Consulting, financial literacy is essential for successfully managing life's financial components.

It gives people the ability to decide wisely, accomplish their objectives, and safeguard their future.

We'll go over important money management techniques in this blog, offering insightful advice to help you take charge of your financial situation and reach your greatest potential.

1. Budgeting:

The foundation for financial security is laid by budgeting. It entails allocating income according to goals, savings, and spending. Monitoring spending patterns guarantees that one is living within one's means and facilitates improved money management.

2. Saving and Investing:

Establish an emergency fund to cover unforeseen costs. Make headway with your savings for future objectives like buying a house or retiring. To increase your wealth over time, look at a variety of investment possibilities such stocks, bonds, mutual funds, and real estate.

3. Debt Management:

Good debt management is necessary to maintain good financial standing. Make paying off high-interest debt your top priority, and think about consolidation options. Financial load can be reduced by looking into loan refinancing and minimizing credit card debt.

4. Financial Planning:

Establish precise financial objectives and create strategies to meet them. Review often and make adjustments when needed. Planning for finances guarantees that short- and long-term goals are aligned.

5. Understanding Taxes:

Learn about various taxes and ways to reduce your tax obligations. Making wise financial decisions requires an understanding of property tax, capital gains tax, and income tax.

6. Insurance Awareness:

Recognise the different insurance kinds and make sure you have enough coverage. Property, health, and life insurance provide protection against unforeseen costs and hazards.

7. Continuous Learning:

Developing financial literacy takes time. Keep yourself updated on tax law changes, investment opportunities, and financial trends. Constant learning guarantees flexibility and well-informed choices.

Conclusion:

Acquiring prosperity and financial security requires developing money management abilities. Essential measures include knowing taxes, being aware of insurance, managing debt, saving, investing, budgeting, financial planning, and lifelong learning.

Mastering financial literacy is not only essential for personal success but also serves as a cornerstone for potential franchisees of Morpheus Consulting's innovative recruitment model, empowering them to make informed financial decisions and drive their entrepreneurial journey forward.

.

For more Recruitment / Placement / HR / Consultancy services, connect with Morpheus Consulting:

📞: (+91) 8376986986

🌐: www.mhc.co.in

#career advice#finance#financial planning#money management#morpheusconsulting#morpheushumanconsulting

0 notes

Text

The Role of Mass Media in Financial Literacy

Ramsey Solutions has noted that approximately 80 percent of American workers live paycheck to paycheck, while approximately 40 percent of the population is unable to cover emergencies exceeding $400. Similarly, 75 percent of Americans have an existing debt obligation, while about 40 percent of Americans devote over half of their monthly income on settling debt obligations. Looking at these facts, it’s hard not to conclude that a large percentage of Americans are not financially literate. Mass media including radio, podcasts, and social media have been noted to significantly contribute to financial literacy, reducing the cycle of financial ignorance.

Today, there is an increase in social media platforms dedicated to having financial conversations. These platforms make discussing common financial topics relatable and simple. They ensure that conversations are not relegated to abstract concepts - rather, they discuss practical issues. In the past, most people could not afford financial advisors. However, social media is filling that gap and opening up access to financial advice for everyone.

The decentralization of financial advice through mass media has resulted in about 62 percent of Americans feeling empowered and having access to these resources. Similarly, 50 percent of Americans believe they have optimized their finances as a result of financial advice that they have received from social media.

Personal finance information spread through mass media, particularly social media, is heavily utilized by younger adults, particularly Gen Zs. This segment of the population is less likely to hire a finance coach or wealth manager. Rather, they make their financial decisions based largely on infographics, short and sweet posts, podcasts, and easy-to-digest videos.

Mass media has also been instrumental in fostering positive financial behaviors like savings and investment. For example, the use of mass media platforms like radio and television has been instrumental in creating financial education for workers’ pension preparedness. Similarly, there are radio shows that serve as spending habit monitors. For instance, a radio station might dedicate five to 10 minutes of airtime to educate low-income earners on how to segment or apportion their daily income. This has been instrumental in helping low-income households to shift detrimental financial habits. Some of these shows also advise people against predatory financial practices like Ponzi schemes and gambling.

Also, there is an increasing amount of business-focused media that allows a wide range of readers to monitor the markets and have access to world and business news. Platforms like WSJ, Morning Brew, and CNBC create content that seeks to simplify financial knowledge. For example, WSJ has a 5-Week Investing Challenge, Morning Brew publishes the Money Scoop newsletter, and CNBC, in conjunction with Acorns, publishes the financial newsletter Money 101.

Similarly, podcasts have been instrumental to the growth of financial literacy. An increasing amount of financial podcasts help listeners break down abstract and complex financial concepts. Podcasts often often go into much greater detail in their coverage of personal finance than other media, enabling the average listener to make well-informed decisions. Podcasts are also distinct from other media because of their flexibility, as listeners are able to garner financial insights at their convenience.

0 notes

Text

youtube

TODAY'S TOPIC:

Discover a treasure trove of financial wisdom and intrigue with our carefully curated selection of 16 must-watch shows and documentaries on Netflix. Dive into the adrenaline-fueled heists of "Money Heist" and uncover corporate corruption in "Dirty Money." Explore the roots of the 2008 financial crisis in "Inside Job" and witness the triumph of the human spirit in "The Pursuit of Happyness." From the investment strategies of "Becoming Warren Buffett" to the societal impacts of "The Social Dilemma" and "The Great Hack," each title offers invaluable insights into wealth, risk, and resilience.

Delve into the world of financial fraud with "The China Hustle" and gain perspective on market collapse in "The Big Short." Uncover the dark realities of white-collar crime in "American Greed" and challenge consumerist ideals in "Minimalism." Examine economic inequality in "Capital in the Twenty-First Century" and confront the consequences of ambition in "Breaking Bad."

Witness the rise of American industry titans in "The Men Who Built America" and learn from the cautionary tale of "Fyre: The Greatest Party That Never Happened." Finally, ride the rollercoaster of Wall Street excess with "The Wolf of Wall Street" and glean wisdom from the Oracle of Omaha in "Becoming Warren Buffett."

From thrill-seeking adventures to introspective journeys, each recommendation offers a unique perspective on wealth, integrity, and the pursuit of happiness. Join us on The Wealthy Status as we unravel the mysteries of financial success and empower you to master the art of wealth-building. Let's unlock greatness together!

#fine living#financial education#financial iq#personal finance#financial intelligence#financial literacy#how to improve your financial iq#financial skills#financial freedom#luxury living#the wealthy status#budgeting#investing#financial literacy 101#finance for beginners#how to plan#how to set goals#how to change your life#how to win#growth#wealthy#financial knowledge#money#netflix#netflix series#brain#movies#documentaries#netflix movies#financial strategy

0 notes

Text

Financial Literacy 101: Exploring Different Types of Loans and Their Mechanics

Types of Loans

Loans are an essential aspect of personal finance and can help individuals achieve their goals, from purchasing a car or a home to starting a business.

But are you feeling overwhelmed by all the different types of loans available in the market?

Do you find yourself confused by the jargon used by financial institutions when discussing loan mechanics?

Fear not, because in this post,…

View On WordPress

0 notes

Text

How does Investing and Stewardship 101 by author Gilbert Frank differentiate it from traditional finance guides?

Unlock the secrets to financial success with Investing and Stewardship 101 by author Gilbert Frank. This transformative book offers readers a unique opportunity to explore the world of financial literacy through engaging stories and practical lessons. Frank's approach goes beyond traditional finance guides, intertwining real-life experiences with timeless wisdom. Whether you're striving to achieve your most passionate ambitions or navigate the complexities of modern life, this book provides a compass to cross the hurdles and distractions. Join us as we embark on a journey of discovery, uncovering the keys to financial empowerment and personal growth. With Investing and Stewardship 101, Gilbert Frank invites readers to embark on a transformative journey toward a healthier, wealthier, and wiser future.

0 notes

Text

Exploring the World of Cryptocurrency and Blockchain Technology

Written by Delvin

In recent years, cryptocurrency and blockchain technology have emerged as transformative forces, revolutionizing the way we think about money, transactions, and data security. This blog post aims to provide a comprehensive overview of cryptocurrency and blockchain technology, delving into their origins, key concepts, real-world applications, and potential implications for the…

View On WordPress

#Cryptocurrency#dailyprompt#Exploring Blockchain Technology#Exploring the World of Cryptocurrency and Blockchain Technology#Financial#Financial Literacy#Investing#Investing 101#money#Real World Applications#Understanding Cryptocurrency

0 notes

Text

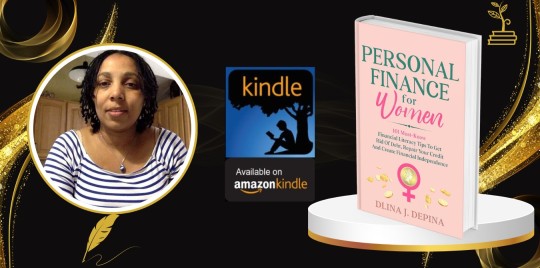

Personal Finance for Women: 101 Must-Know Financial Literacy Tips to Get Rid of Debt, Repair Your Credit, and Create Financial Independence

Personal Finance for Women: 101 Must-Know Financial Literacy Tips to Get Rid of Debt, Repair Your Credit, and Create Financial Independence

H&S Magazine’s Recommended Book Of The Week

Personal Finance for Women by Dlina J. Depina

Empowering Women Through Financial Literacy

In today’s world, more women are entering the workforce than ever before. However, despite achieving high-paying positions,…

View On WordPress

#Amazon Kindle#available in Kenya#Best Author 2020#Best books 2020#best kindle books#Book Of The Week#conflict resolution#Dlina J. Depina#download kindle app#download kindle books#effective communication#Empowered Refusal#empowerment#global#Kenya#Kindle Edition#Life&039;s Direction#Nairobi#Order Online#Order Online In Nairobi#Order online kenya#Personal Finance for Women#Personal growth#personal transformation#psychology#Saying No with Confidence#Self Help#setting boundaries#Vanessa Patrick

0 notes

Text

Empowering Futures: Essential Financial Literacy Topics for Students 💰📚

Unlocking the doors to a secure financial future begins with knowledge! 🌐💡 As students navigate the exciting journey of academia, it's crucial to equip them with the tools needed to make informed financial decisions. 🚀 Here are some key financial literacy topics every student should explore:

1️⃣ Budgeting Basics: Learn the art of budgeting to effectively manage income and expenses. 💸 Track spending, prioritize needs over wants, and set financial goals.

2️⃣ Credit 101: Understand the importance of credit scores, how they're calculated, and the impact on future financial endeavors. 📊📈

3️⃣ Saving Strategies: Explore various saving methods, from emergency funds to long-term investments. 💼💹

4️⃣ Debt Management: Grasp the implications of student loans, credit card debt, and strategies to responsibly handle them. 🎓💳

5️⃣ Investment Insights: Delve into the world of investments, stocks, bonds, and mutual funds. Learn how to make your money work for you. 📈💹

6️⃣ Understanding Taxes: Familiarize yourself with tax basics, deductions, and the importance of filing returns accurately. 📑💵

7️⃣ Entrepreneurship Exploration: Unleash your entrepreneurial spirit by learning about starting a business, managing finances, and fostering innovation. 🚀💼

8️⃣ Insurance Awareness: Discover the importance of insurance in protecting your assets and mitigating risks. 🛡️🏡

9️⃣ Financial Planning: Develop a comprehensive financial plan that aligns with your short-term and long-term goals. 📊📆

🔟 Economic Literacy: Understand the broader economic landscape, how it affects personal finances, and stay informed about global economic trends. 🌍📰

In a world where financial landscapes are ever-evolving, arming oneself with financial literacy is the key to success. 🗝️💼 Let's empower the next generation to make informed financial decisions and pave the way for a prosperous future! 🌟💰

#ceo#ceo program#education#across the spiderverse#study#study financial#succession#financial literacy#online financial literacy courses

0 notes

Text

Stock Market Unveiled: Navigating the Financial Landscape on Tumblr

Introduction:

Welcome to a corner of Tumblr where finance meets creativity, and the stock market takes center stage. In this space, we'll embark on an exploration of stocks, investments, and market trends, making financial literacy a vibrant and engaging journey for every Tumblr user.

1. Stock Market 101: Simplifying the Basics:

Let's kick off our Tumblr journey with a crash course in stock market fundamentals. From shares and dividends to market indices, let's break down the jargon and build a foundation for a more financially savvy Tumblr community.

2. Investing Vibes: Making Finance Accessible:

Investing isn't just for Wall Street aficionados. Explore tailored investment strategies, tips, and insights designed for the Tumblr audience. Let's make the stock market an inclusive space for everyone to dip their toes into the world of investments.

3. Animated Trends: GIFs for Market Dynamics:

Visual storytelling takes precedence on Tumblr, so why not bring market trends to life through GIFs? Let's turn economic cycles and investment patterns into mesmerizing animations, making the stock market not only understandable but also visually captivating.

4. Microblogging Financial Nuggets:

Embrace the art of microblogging to share bite-sized financial wisdom. From quick investment hacks to highlighting market quirks, let your Tumblr blog be a treasure trove of concise yet valuable insights that resonate with the scrolling fingers of your audience.

5. Infographics for Financial Aesthetics:

Infographics meet aesthetics on Tumblr. Create visually appealing graphics that simplify intricate financial concepts. Break down stock market terminology, investment strategies, and economic principles into easily shareable and visually pleasing content.

6. Polling the Market: Interactive Engagement:

Gauge the Tumblr community's sentiments on market trends through interactive polls. Ask questions about stock preferences, investment goals, or predictions, creating a dynamic and engaging dialogue around financial topics.

7. Success Stories Unleashed:

Share success stories of individuals who navigated the stock market successfully. Feature interviews, testimonials, or even your own experiences to inspire and motivate your Tumblr followers to embark on their own financial journeys.

8. Market Haikus and Quotes:

Infuse creativity into finance by crafting stock market-inspired haikus or sharing insightful quotes. Let your Tumblr blog become a haven where the elegance of language meets the precision of financial insight.

9. Textual Analysis, Tagged Discussions:

Stay abreast of market news and trends and share your analysis through well-crafted text posts. Use tags effectively to reach a broader audience interested in real-time market updates and financial discussions.

Conclusion:

In this Tumblr space where creativity and finance collide, we aim to unravel the complexities of the stock market. Whether you're here to learn, share, or simply scroll through visually captivating insights, let's transform the stock market from a complex concept into a community-driven, creatively explored landscape. Let the Tumblr stock market journey unfold!

1 note

·

View note