#bank runs

Text

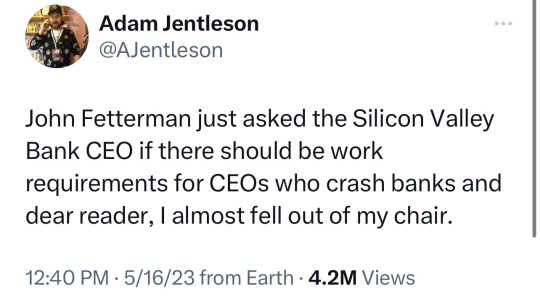

"Republicans want to give a work requirement for SNAP. A hungry family has to have these kinds of penalties," said Fetterman.

SNAP is the Supplemental Nutrition Assistance Program. Republicans want to make it even harder than it already is to access life-saving programs like SNAP and Medicaid, as a part of their “debt ceiling” “negotiations,” and their never ending attempts to to gut the social safety net, and their never ending assault on poor people.

"Shouldn't you have a working requirement after we bail out your bank with billions?" Fetterman asked Gregory Becker (a registered Republican), the former Silicon Valley Bank executive.

Other than blaming the media, customers and anyone except SVB Bank, Becker did not have a good answer.

It’s worth noting that

A) Becker dumped nearly 12,500 shares for more than $3.5 million on Feb. 27, the same day that Chief Financial Officer Daniel Beck unloaded $575,180 worth of company stock, and many SVB executives received exorbitant bonuses just hours before the bank run.

And B) Greg Becker lobbied the federal government to relax Dodd-Frank provisions on regional banks, and then Trump did precisely that.

245 notes

·

View notes

Link

If you keep a diary or news journal, be sure to write down March 9, 2023 as the day that a full-blown bank run began at non-traditional banks in the U.S.

Bank depositors were already nervous after federally-insured Silvergate Bank (ticker SI) announced on Wednesday evening that it was closing and liquidating. Its publicly-traded stock had already lost over 90 percent of its market value over the prior 12 months at that point.

Silvergate had made the fatal decision several years ago to become the go-to bank for crypto companies, including scandalized Sam Bankman-Fried’s collapsed house of frauds, FTX and Alameda Research. As details of its questionable activities related to Bankman-Fried’s enterprises emerged, 68 percent of its deposits related to crypto companies took flight in just the last quarter of 2022. After Silvergate confirmed in an SEC filing on March 1 that an investigation of its conduct was underway at the U.S. Department of Justice, and that it had doubts about its ability to continue as a going concern, its fate was sealed.

Now, for the second time in less than two weeks, depositors are panicking over the fate of another federally-insured bank. This time it’s Silicon Valley Bank (ticker for holding company is SIVB) which, like Silvergate Bank, had become a go-to bank for a special niche customer. Instead of crypto, its niche was venture capital outfits and private equity firms.

Silicon Valley Bank is not a small bank. According to its regulatory filings, as of December 31 it held $161.4 billion in domestic deposits and $13.9 billion in foreign deposits.

The bank panicked investors and depositors alike on Wednesday when it said it would issue $2.25 billion more in stock (thus diluting other stockholders) and that it had taken a $1.8 billion loss on substantially all of its available-for-sale bonds. The stock price reacted by plummeting yesterday, closing down 60.41 percent in one trading session. In premarket trading this morning, the shares were down another 40 percent at one point.

As for the potential for a continuance of a depositor run this morning, the bank is likely feeling the pain from the following paragraph that appeared in the Wall Street Journal last night:

“Garry Tan, president of the startup incubator Y Combinator, posted this internal message to founders in the program: ‘We have no specific knowledge of what’s happening at SVB. But anytime you hear problems of solvency in any bank, and it can be deemed credible, you should take it seriously and prioritize the interests of your startup by not exposing yourself to more than $250K of exposure there. As always, your startup dies when you run out of money for whatever reason.’ ”

The figure, $250,000, refers to the amount of federal deposit insurance per depositor, per insured bank.

Unfortunately, the bank panic spread quickly yesterday to other banks – both large and small. PacWest Bancorp (ticker PACW) lost 25.45 percent of its market value by the closing bell yesterday while First Republic Bank (ticker FRC) fell by 16.51 percent. Mega banks on Wall Street were also not immune to the fallout: Bank of America (ticker BAC) lost 6.20 percent while the largest bank in the U.S., JPMorgan Chase (ticker JPM) – which is also battling lawsuits and escalating press about its ties to deceased child sex trafficker Jeffrey Epstein – fell by 5.41 percent.

The Federal Deposit Insurance Corporation (FDIC), whose Deposit Insurance Fund (DIF), has to make good on deposits at insured U.S. banks in the event of a bank failure, noted in February that unrealized losses at U.S. banks for bond holdings totaled $620 billion at the end of the fourth quarter of last year. When interest rates rise, as they have dramatically over the past year, the current market value of bonds issued at lower locked-in interest rates fall. That is typically not a problem for banks – unless there is a stampede by depositors to get their money out of the bank and the bank is forced to sell the bonds at a loss to raise liquidity.

https://wallstreetonparade.com/2023/03/bank-stocks-plummet-as-bank-runs-in-the-u-s-gain-momentum-at-federally-insured-non-traditional-banks/

11 notes

·

View notes

Text

“Also among Lane’s clients: FTX. Federal prosecutors are now examining Silvergate’s role in banking Sam Bankman-Fried’s fallen empire. The more pressing problem is that the collapse of FTX spooked other Silvergate customers, resulting in an $8.1 billion run on the bank: 60 percent of its deposits that walked out the door in just one quarter. (“Worse than that experienced by the average bank to close in the Great Depression,” The Wall Street Journal helpfully explained.)

In its earnings filing, we found out that Silvergate’s results last quarter were absolute dogshit, a $1 billion loss. Then, on March 1st, Silvergate entered a surprise regulatory filing. It says that, actually, the quarterly results were even worse, and it’s not clear the bank will be able to stay in business.

(…)

“If Silvergate goes out of business, it’s going to push funds and market makers further offshore,” Ava Labs president John Wu told Barron’s. The issue is how easy it is to get into actual cash dollars, which in finance-speak is called liquidity. Less liquidity makes transactions more difficult. Already there is a broader gap between the price at which a trade is expected to go through at and the actual price at which it executes, Wu said.

So Silvergate’s troubles are a problem for the entire crypto industry.”

“Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank's 40-year-run.

Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company's downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

(…)

"This was a hysteria-induced bank run caused by VCs," Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. "This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face."

(…)

The roots of SVB's collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

(…)

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

(…)

Now, thanks to the bank run that ended in SVB's seizure, those who remained with SVB face an uncertain timeline for retrieving their money. While insured deposits are expected to be available as early as Monday, the lion's share of deposits held by SVB were uninsured, and it's unclear when they will be freed up.”

“First Republic shares fell 52% in early trading before storming back to near the previous day's closing level, only to then finish the day down 15%. Investors expressed concerns about unrealized losses on assets at the bank as well as its heavy reliance on deposits that could turn out to be flighty.

(…)

First Republic's shares have lost 34% of their value in the past week.

(…)

In its annual report, First Republic said the fair-market value of its "real estate secured mortgages" was $117.5 billion as of Dec. 31, or $19.3 billion below their $136.8 billion balance-sheet value. The fair-value gap for that single asset category was larger than First Republic's $17.4 billion of total equity.

All told, the fair value of First Republic's financial assets was $26.9 billion less than their balance-sheet value. The financial assets included "other loans" with a fair value of $26.4 billion, or $2.9 billion below their $29.3 billion carrying amount. So-called held-to-maturity securities, consisting mostly of municipal bonds, had a fair value of $23.6 billion, or $4.8 billion less than their $28.3 billion carrying amount.

(…)

Total deposits at First Republic were $176.4 billion, or 90% of its total liabilities, as of Dec. 31. About 35% of its deposits were noninter-est-bearing. And $119.5 billion, or 68%, of its deposits were uninsured, meaning they exceeded Federal Deposit Insurance Corp. limits.”

“Signature becomes the third-largest bank to ever fail in the U.S., behind Silicon Valley Bank and Washington Mutual in 2008, if its assets haven't changed significantly since the end of 2022. Signature had $110 billion in assets as of Dec. 31, ranking 29th among U.S. banks. It had $88 billion in deposits as of that date, and approximately 89.7% were not insured by the Federal Deposit Insurance Corporation.

(…)

Signature served clients in the cryptocurrency world and had been trying to reduce its exposure. Like Silvergate Bank, another crypto-friendly bank that said last week it would voluntarily wind itself down, it suffered from a deposit outflow in the aftermath of the collapse of crypto exchange FTX. Deposits dropped 17% in the fourth quarter of 2022 as compared to the year-earlier period.

(…)

Now that Signature has been seized, Circle, issuer of the second largest stablecoin, "will not be able to process minting and redemption [for the stablecoin] through SigNet," and "will be relying on settlements through BNY Mellon,” CEO Jeremy Allaire said on Twitter Sunday evening.

Circle’s USD coin fell below its crucial $1 peg Friday after the company disclosed $3.3 billion in cash reserves held with the failed Silicon Valley Bank despite attempted withdrawals Thursday. After falling to 88 cents on Saturday, the company announced it planned to cover any shortfall from its SVB losses using “corporate resources.””

“Credit Suisse shares on Monday reached a new record low, falling as much as 15% as investors continued to hammer away at the stock of the Swiss banking giant after the collapse of banks in the U.S.

(…)

Credit Suisse CSGN CS has lost money for five straight quarters and says it’s expecting to post a loss before tax this year. It’s undergoing a big transformation after losing billions lending to the Archegos family office and having to freeze $10 billion worth of funds tied to Greensil Capital. Wealthy clients pulled out about $100 billion from Credit Suisse in the fourth quarter.”

#silvergate#silicon valley bank#svb#first republic bank#frb#signature bank#circle#bank#banks#crypto#currency#bank runs#credit suisse

5 notes

·

View notes

Text

The Onset of the Banking Nightmare - Unfairness Unveiled!

Welcome to our blog post where we delve into the dark side of the banking industry and expose the unsettling truth behind its practices. In this eye-opening exploration, we shed light on the onset of the banking nightmare, uncovering its inherent unfairness. Prepare to be astounded as we unveil the hidden dimensions of an industry that has long been overshadowed by corruption and exploitation.…

View On WordPress

#bank runs#banking collapse#banking crisis#banking crisis 2023#banking mergers#banking takeover#banks#big banks#credit crisis#credit crunch#economic crisis#economic news#fdic bailout#fed rate hikes#first republic collapse#gold#interest rate hike#investing news#pacwest#pacwest merger#rate hike#recession 2023#regional banks in trouble#sean foo#svb collapse#us bank collapse#US bank failure#US banking collapse#US banking crisis#wall street panic

0 notes

Text

"The regional bank crisis that shocked the financial world this spring, which saw three of the largest bank failures in U.S. history, is still playing out, as consumers find it harder to get loans. Preventing a similar crisis should be top on Congress’s to-do list. So it is encouraging that lawmakers appear poised to adopt, in a bipartisan manner, a modest yet worthwhile measure to discourage future bank failures by making it easier for federal regulators to claw back pay from reckless executives.

...

Silicon Valley Bank, the first to fail, took excessive risks. It had an unusually high number of uninsured depositors, and it was slow to react to the fact that its assets had fallen substantially in value as the Federal Reserve hiked interest rates. SVB executives failed at Banking 101: ensuring there are enough assets to cover liabilities. SVB collapsed. The FDIC took it over and had to provide $20 billion from a government deposit insurance fund to rescue all depositors. SVB chief executive Greg Becker had lobbied Congress for years to loosen regulations on midsize banks like his. He also suspiciously sold more than $3.5 million in SVB stock shortly before the collapse. Yet he has faced few consequences beyond losing his job. The Recoup Act seeks to change that."

Gift link https://wapo.st/3XmAYNZ

1 note

·

View note

Link

Can't control it? Destroy it.

0 notes

Text

𝐊𝐞𝐚𝐧𝐮 𝐑𝐞𝐞𝐯𝐞𝐬 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐢𝐧𝐠 𝐚𝐭 𝐭𝐡𝐞 𝐇𝐚𝐫𝐝 𝐑𝐨𝐜𝐤 𝐇𝐨𝐭𝐞𝐥 𝐢𝐧 𝐀𝐭𝐥𝐚𝐧𝐭𝐢𝐜 𝐂𝐢𝐭𝐲, 𝐍𝐉 - 𝟏𝟎/𝟎𝟖/𝟐𝟑

#*tucks hair behind his ear*#Keanu Reeves#*#kreevesedit#flashing gif#keanuedit#yeah my boyfriend's in a band#THE DAY AFTER I MET AND SAW HIM#keke babe do you not get dizzy doing all that head bobbing#h a n d s#MAJESTIC#hi i love an old man#a hair tie claw clip barrette butterfly clip one of those big ones that looks like a flower#*runs hand down his forearm like it's a staircase bannister*#......it's been a long week......i apologize#people who don't like gray hair are weak#i will give you 43 cents and a cookie if you let me play with your hair#...that was already a tag#but the offer still stands#i'll even throw in a $2 bill i work at a bank i can get some#are backpacks you wear in the front a thing? because i would like to be one#v e i n s#can't believe he's really been here and hot my whole life#that is a long™ torso#more room to wrap around#hands so big they could hold two ankles at once#omg who said that

4K notes

·

View notes

Text

What Will Happen When Banks Go Bust? Bank Runs, Bail-Ins and Systemic Risk

Financial podcasts have been featuring ominous headlines lately along the lines of “Your Bank Can Legally Seize Your Money” and “Banks Can STEAL Your Money?! Here’s How!” The reference is to “bail-ins:” the provision under the 2010 Dodd-Frank Act allowing Systemically Important Financial Institutions (SIFIs, basically the biggest banks) to bail in or expropriate their creditors’ money in the…

View On WordPress

#bail-in#bailout#Bank of North Dakota#bank runs#Dodd-Frank#Ellen Brown#FDIC#Federal Reserve#public banking#quantitative easing#systemic risk

0 notes

Text

HAPPY 16TH BIRTHDAY!!! To this elderly bapy boye!!! he...!!!

#cats#ghhbbb this is the first time I've genuinely considered tumblr blazing a post lol but no.. i shant.. I feel too weird putting financial#information into tumblr or whatever unless I made like a seperate bank account or something not associated with anyhting else lol#but I gave it serious contemplation which is really sayng something (the evil magical spell that all cats cast over u by their perfection)#ANYWAY.................... old man!!!!!!!!!!!!!!!!!!!!!!!!!#it's technically like march 8th but I did his party a little early. I have other pictures to post later maybe too..hrmm#The '1' candle is actually a '4' candle with the side part cut off because they didn't have any 1s#I went all out (like under $15 still lol) and got new birthday decorations for him instead of using the same old#ones from the past like 5 birthdays that I've done for the cats lol..#His theme was rainbows mostly in as light of colors as I could find#The legal age to drive a car in the US is 16 so.... honk honk beep beep.. I shall go out and buy him the most expensive car on the market#as soon as March 8th comes. then he can run little errands (probably mostly getting kibbles or chicken somewhere)#stealing the rotisserie chickens from walmart or something lol#AND they would let him have them. He would drive up and walk inside and they'd call the manager to come over#and they would be so moved by his presence and his big goofy stare that they would just be like..... okey.. have all the chicken in the#entire store. Actually. have the store. it's yours now. And This would continue all the way up the chain until he was handed#the entire walmart company. And every other company. a boy who owns everything. probably wouldnt use it for evil. he'd just abolish#everything and then focus on eating chickens.. ........ chibken son...

319 notes

·

View notes

Text

Two quick examples of what’s wrong with our banking “regulation” in America:

The CEO of Silicon Valley Bank, Gregory W. Becker, sat on the board of the Federal Reserve Bank of San Francisco. You know, the same Federal Reserve that was responsible for “supervising” and “regulating” Silicon Valley Bank.

This is a literal case of hiring foxes to guard the hen house.

It gets worse. Before the FDIC took over, Silicon Valley Bank employees received their annual bonuses that ranged anywhere from $12k to $250k

The system is broken. Or it’s working exactly as planned, depending on your perspective, I guess. (source) (source)

We need to bring back strong government regulations over things like banking and railroads, for example.

44 notes

·

View notes

Note

How did I get here... (Had to remember I was a wukong blog)

MASTER POST

Previous 💜

Next 💙💜

#lego monkie kid#lego monkie kid fanart#monkie kid#monkie kid fanart#lmk#lmk fanart#monkie kid macaque#lmk macaque#lmk sun wukong#monkie kid sun wukong#blue and violet#Wukong I'm not sure if spontaneously popping into existence was a good idea#this was really funny though I'll give you that#wukong is out of his depth in this theatre room I think he should run away from what is clearly Macaque's territory#fun fact I actually had to pull up Wukong's design ref for this lmao#not because I forgot what he looked like but because I genuinely believe that drawing Mayor and Macaque so much as messed up my memory bank#silly monkies go burrrrrrr

176 notes

·

View notes

Text

Can we come to an agreement that he is the sexiest guy on the planet ⁉️ 😫

#him and topper can run a train on me#drew starkey x imagine#rafe cameron imagine#rafe cameron x reader#rafe outer banks#rafe cameron#drew starkey x reader#outerbanks rafe#drew starkey x y/n#drewstarkeydaily#rafe obx

380 notes

·

View notes

Text

Fatal Warning: U.S. Recession is Guaranteed, Experts Say" - A Blog Post Title

The U.S. economy has been going through a rollercoaster ride lately, and experts warn that a recession is guaranteed. In this blog post, we will explore the reasons behind this grim prediction and what it means for the American people. As we delve into the economic indicators and trends, we’ll provide actionable insights for individuals and businesses to navigate through these uncertain times.…

View On WordPress

#bank runs#banking collapse#banking crisis#brics#commercial real estate crisis#economic news#eu recession#fed pause#fed rate hikes#g7 vs brics#germany recession#global recession#global recession 2023#gold#inflation crisis#investing news#sean foo#SHTF#SHTF 2023#US banking crisis#us dollar#US economic collapse#US economic crash#US economic crisis#US economy#US real estate crash#US recession#US recession 2023#US recession 2024#why gold why now

0 notes

Text

When you're talking to Patty, you only have male family members. REMEMBER THAT

#even when otto tries to help he gets knocked down#trolls#trolls oc#trolls oc cory#trolls oc otto#trolls oc patty#trolls comic#trolls ocs#patty and otto are bonding .. idk what theyre doing but theyre doing it together#maybe patty had to go to the bank or something and they ran into cory#otto just serves step kid who didnt want to run errands with his step mom#even though hes older than patty#probably. i havent decided but wouldnt that just be so funny#“patty we should break up.. i cant date someone the same age as my son 😭” “otto is older than me ma'am : )”#pobodys nerfect#WHAT WOULD YOU DO???? YOU WOULD DATE THAT MILF!!!!!#WHAT WOULD YOU DO???? YOU WOULD DATE THAT DYKE WRESTLER!!!!!#anyway

215 notes

·

View notes

Link

Monopolists try to poison the well

0 notes

Text

Dolly, Dolly, Dolly, Dolly...

I'm begging of you, please just leave your man.

Dolly, Dolly, Dolly, Dolly...

'Cause I can love you better than he can.

#ts4#sims 4#sims#dolly x jolene forever#leave that man dolly neither of you need him#run AWAY with that beautiful bank teller!

125 notes

·

View notes