#Stock market investing

Note

Hi Ms Bitches, I'm a young adult with shitty money situations who's trying to have a money-flush future, but it seems like playing the stocks and shareholders game is one of the best ways to do that nowadays (sadly the well paying job market is uninterested in hiring me until I get my degree). But I REALLY HATE the stocks/shareholders game. It gets my punk hackles up. How can I wrap my anti-capitalist brain around this world enough to make it work in my favor? Any advice on where to start?

We love our darling little punk baby bitches. The stocks and shareholders game (investing) is indeed one of the best ways to build a secure financial future. But we totally understand your hesitation! We talked about it a lot in this episode of the podcast:

Season 4, Episode 1: “Index Funds Include Unethical Companies. Can I Still Invest in Them, or Does That Make Me a Monster?”

If you're uneasy about becoming a shareholder, you have two options that are a little more punk:

Invest in small local businesses instead. The returns will be smaller, but there's nothing more punk rock than supporting small local businesses. Check out our how-to at the link below.

Invest in index funds. It's less punk rock, but it's also less gamified than picking individual stocks and consciously choosing to support companies like Tesla. Again, check out the link below.

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

Investing Deathmatch: Managed Funds vs. Index Funds

Did we just help you out? Tip us!

40 notes

·

View notes

Text

Steps to Building Wealth: A Guide to Achieving Financial Freedom

Becoming wealthy is a dream shared by many, but achieving it is not always easy. Building wealth takes time, patience, and a solid financial plan. Here are a few steps you can take to increase your chances of becoming wealthy:

Create a budget: The first step to building wealth is understanding your income and expenses. Create a budget that allows you to save and invest a significant portion of…

View On WordPress

#Becoming Wealthy#budgeting#Building Wealth#Diversified Portfolio#Entrepreneurship#Financial Advisor#financial freedom#Financial independence#Financial success#Investing#Lifestyle Inflation#money management#Multiple streams of income#Passive Income#Passive income strategies#Real estate investing#retirement planning#Side business#Stock market investing#Wealth creation

40 notes

·

View notes

Text

#how to invest in stocks#investing for beginners#stock market#investing#the most important thing in investing in stocks#stock market investing#stock market for beginners#stocks#value investing#share market basics for beginners#stock market in india#the single most important metric for stock market investing#the most important things when buying stocks#how to begin investing in the share market#investing in your 20s#investing in international stocks

2 notes

·

View notes

Text

Stock Market Investing

Stock Market Investing is risky as well as rewarding. At the Money Expo Mumbai 2024, investors will get ample chances of learning stocks and trading.

0 notes

Text

Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

Smart passive income ideas can secure your financial future and provide steady earnings. Explore profitable ventures like rental properties, dividend stocks, and online businesses.

Securing a prosperous future requires savvy income strategies that work for you around the clock. Passive income streams offer a way to earn money without the need to actively work all the time. These strategies include investing in real estate for long-term rental profits, engaging in the stock market for dividends, or leveraging digital platforms to sell products or create content that generates revenue continuously.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Passive Income Essentials

Securing your financial future doesn’t have to mean working endless hours. Smart passive income strategies can unlock a world where earnings grow even as you sleep. There’s a wealth of options out there — each with its unique strengths. To navigate this domain, understanding the basics and choosing the right streams is vital.

Demystifying Passive Income

Passive income often seems shrouded in mystery. Many people wonder if it’s a practical goal. In essence, it’s earning money from investments or work you’ve done once. This could mean rental income, dividends, or sales from an e-book. Distinct from active income, it requires less time to manage daily.

Purchase and rent out property

Invest in dividend-paying stocks

Create digital products for sale

It’s about smart choices now for long-term benefits. For the ideal start, assess the potential risks and returns of each option.

Financial Stability Through Passive Streams

Passive income is more than just extra cash. It’s a step toward lasting financial safety. The goal is to create multiple income sources that can support your lifestyle, even if you stop working. Diversification is key — spreading your investments across different areas reduces the risk.

Type of Passive Income Benefits Real Estate Steady income and property value growth Stocks with Dividends Regular income plus potential stock value increase Creating an Online Course Earn with each new student enrollment

Review these options to align with your life goals and economic situation. Start building that foundation for a more secure and sustained income stream today. Remember, the path to financial freedom involves planning and the savvy generation of earnings on the side. Get started, and watch your financial health flourish over time.

Diving Into The Stock Market

Exploring the stock market opens up a world of possibilities for passive income. It’s a tried-and-true approach that savvy investors leverage for long-term financial gains. You don’t need to be a Wall Street expert to get started. With the right strategy, anyone can tap into this lucrative avenue.

Dividend-yielding Stocks

Dividend-yielding stocks stand out as a solid option for passive income. They pay out a portion of profits to shareholders regularly. This means you earn money simply for owning the stock. Consider these key points:

Choose companies with a history of stable dividends.

Look for those with potential for dividend growth.

Reinvest dividends to compound your earnings.

Index Funds & Etf Portfolios

Index funds and ETFs offer a more hands-off investment approach. They track specific market indices and spread your investment across numerous stocks. This leads to a balanced and diversified portfolio. Here’s why they’re advantageous:

Lower fees: Expense ratios are typically minimal with index funds and ETFs.

Automatic diversification: Instant exposure to a variety of assets helps mitigate risk.

Simplicity: They’re easy to purchase, making them ideal for first-time investors.

Comparison of Dividend Stocks vs. Index Funds & ETFs Investment Type Income Potential Risk Level Dividend Stocks High Moderate to High Index Funds & ETFs Varies Low to Moderate

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Real Estate For Residual Income

Earning while you sleep sounds ideal, and real estate often fits this dream. With strategic investments, you can build a robust stream of passive income. Real Estate remains top-tier for growing wealth. Let’s dive into real estate strategies that can secure a more prosperous future.

Rental Properties Revenue

Rental properties can turn a tidy profit monthly. Location is everything, so choose areas with growth potential. Starting can be more hands-on, but many opt for management services to handle day-to-day tasks. Here’s why rentals rock:

Steady Cash Flow: Monthly rent payments go straight into your pocket.

Tax Advantages: Deduct property expenses from your income.

Appreciation Over Time: Rentals can increase in value, boosting your net worth.

Your investment in real estate can grow with careful planning. Understanding the market helps ensure success.

Real Estate Investment Trusts (reits)

REITs are powerful for portfolio diversification. They allow small investors to earn from large real estate ventures without owning the properties themselves. Stock-like ease with real estate rewards! Key REITs facts include:

Pros Cons High Dividend Yields Sensitive to Interest Rates Liquidity Like Stocks Market Fluctuations Diversified Assets Less Control Over Investments

Credit: printify.com

Online Ventures That Generate Cash

Embarking on online ventures unlocks doors to a world where income flows even as you sleep. The internet is bustling with opportunities to create a stream of passive income. Let’s explore some smart ways to fill your pockets without the constant hustle.

Blogging And Affiliate Marketing

Blogging is not just a platform for sharing ideas. It’s a robust money-making tool. A successful blog captures the attention of thousands, opening avenues for monetization. Adding affiliate marketing turns your content into a cash magnet. Here’s how to start:

Select a niche that you love and know well

Launch a blog with a user-friendly CMS like WordPress

Regularly post high-quality content

Apply SEO strategies to increase visibility

Join affiliate programs related to your niche

Recommend products through your posts

Remember, consistency is key. Regular updates paired with SEO will drive traffic. Higher traffic leads to more earnings through affiliate links.

Creating And Selling Digital Products

Digital products offer a limitless income potential. They’re convenient to create, distribute, and sell globally. Popular digital products include:

Type of Product Examples Platforms to Sell eBooks Guides, Novels, How-tos Amazon Kindle, Your Website Online Courses Video Tutorials, Lectures Udemy, Teachable Stock Photography Photos, Graphics Shutterstock, Adobe Stock

To succeed, identify your audience’s needs. Create valuable content. Market through social media and email lists. An initial effort can translate into regular sales without any added work.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Turn Hobbies Into Income Channels

Imagine your favorite hobby making cash while you sleep. Turn hobbies into income channels and see the magic happen. Your passion can unlock a stream of income. Transform leisure activities into lucrative ventures. Dig deep into hobbies and spot money-making potentials. Read on for smart ways to monetize your interests!

Monetizing Creative Skills

Got a knack for creativity? Harness this power for passive income. Here’s how:

Create digital products: E-books, courses, art pieces, and music tracks.

Print-on-demand services: Sell custom designs on tees, mugs, and more.

Stock photography: Click and sell images to stock photo websites.

Remember, quality content stands out. Polish your skills consistently. Keep your digital presence strong. Engage with online communities. These steps help sell more.

Leveraging Peer-to-peer Platforms

Peer-to-peer platforms are goldmines for passive income. Here’s a quick look at options:

Platform Activity Etsy Sell handmade goods. Airbnb Rent out extra space. Turo List your car for others to use.

Credit: www.bankrate.com

Frequently Asked Questions

Q. What Is Passive Income?

Passive income involves earning money without active, daily involvement. It’s generated from ventures like rental properties or royalties from creative works. This approach can offer financial security over time through consistent, scalable streams.

Q. Can Blogging Generate Passive Income?

Yes, blogging can generate passive income. Once you create quality content and optimize for SEO, you can earn through affiliate marketing, ads, or selling digital products. Regular updates and marketing strategies help maintain and grow your earnings.

Q. What Are The Best Passive Income Strategies?

The best passive income strategies include investing in dividend stocks, real estate rentals, peer-to-peer lending, creating an online course, and writing an ebook. These require varying levels of initial effort but can provide ongoing income with minimal maintenance.

Q. How Does Affiliate Marketing Provide Passive Income?

Affiliate marketing provides passive income by promoting other people’s products. You earn commissions for sales made through your unique referral links. It’s effective when you have a strong online presence and can persuade your audience to make purchases.

Conclusion

Embracing passive income strategies can transform your financial landscape, securing a brighter future. Diverse options, from real estate investments to digital products, offer paths to sustainable earnings with minimal ongoing effort. Start small, scale sensibly, and watch your wealth grow.

Your financial freedom might just be a well-chosen venture away. Dive in and let your money work for you.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Thanks for reading my article on Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

#Online Business Opportunities#Affiliate Marketing Strategies#Real Estate Investment#Stock Market Investing#Cryptocurrency Earnings#Peer-to-Peer Lending#E-commerce Dropshipping#Digital Products Selling#Blogging for Income#Automated Trading Systems#Dividend Stocks#Royalties from Intellectual Property#High-Yield Savings Accounts#Mobile App Development#Virtual Real Estate#Social Media Monetization#Online Courses Creation#Crowdfunding Investments#Passive Income Apps#Freelance Passive Income#Bond Investing#Passive Income Books#Niche Websites#YouTube Channel Revenue#Rental Income Strategies#Affiliate Earnings#Affiliate Marketing#Affiliate Marketing Guide#Affiliate Marketing Mastery#Affiliate Marketing Training

0 notes

Text

Investing In The Stock Market Hoping For A Quick Profit

Investing in the stock market with the sole aim of making a quick profit can be a risky strategy. While it is possible to make money quickly in the stock market, it is also possible to lose money just as quickly.

It's important to remember that the stock market is volatile and subject to fluctuations based on various factors, including economic conditions, political events, and company performance. Short-term price movements can be difficult to predict, and investing based on short-term trends can lead to poor investment decisions.

Instead of focusing on quick profits, it's generally a better strategy to invest in the stock market with a long-term perspective. This means taking a strategic approach to investing and focusing on building a diversified portfolio of stocks that align with your financial goals and risk tolerance.

Diversification helps to spread your investment risk across different stocks and sectors, reducing the impact of any one company's poor performance on your portfolio. Investing with a long-term mindset also allows you to ride out short-term market fluctuations and take advantage of the compounding effect of returns over time.

In summary, investing in the stock market hoping for a quick profit is a risky strategy. Instead, focus on building a diversified portfolio of stocks with a long-term perspective to achieve your financial goals.

#investment advisory#multi bagger stock recommendations#stock market investing#best long term stocks

1 note

·

View note

Text

Investing 101: Building Wealth for the Future

In the dynamic landscape of personal finance, one fundamental principle stands out as a cornerstone for achieving long-term financial success—investing. Whether you’re just starting your journey to financial independence or looking to enhance your existing portfolio, understanding the basics of investing is crucial. This blog aims to guide you through Investing 101, offering insights into the…

View On WordPress

#bond investments#compound interest#consistent investing#equity investment#financial education#financial independence#financial security#how to invest money#importance of investing#invest money#investing#investing basics#investing tips#investing wisely#investment portfolio#money#real estate investment#start investing early#stock market investing#wealth building

0 notes

Text

Building Wealth with Dividend Investing: A Simple Guide

#dividend investing#dividend stocks#dividend investing for beginners#best dividend stocks#dividend growth investing#dividend investing strategy#dividends#investing for beginners#investing#dividend investing for passive income#stock market investing#dividend#dividend investing explained#dividend investing guide#investing with dividends#monthly dividend stocks#top dividend stocks#guide for investing in dividend stocks

1 note

·

View note

Text

https://join.robinhood.com/cecilm29

ROBINHOOD ROBINHOOD

#Robinhood app#Robinhood trading#Stock trading app#Commission-free trading#Financial technology#Online investing platform#Stock market app#Investment portfolio management#Trading stocks#Personal finance app#Cryptocurrency trading#Robinhood stocks#Investment app#Fintech services#Online brokerage app#Stock market investing#Robinhood investments#User-friendly investing#Stock market analysis#Robinhood features

0 notes

Text

🖋 Secrets of Stock Market Investing

🔰 The stock market can be astonishing, exceptionally for rookies. But fret not! Stock market books are here to assist investors at all levels.

1️⃣ Education & Empowerment: Investors are empowered by stock market literature.

2️⃣ Strategy Creation: They assist in creating successful investment plans.

3️⃣ Market Insight: They offer information to help you make wise choices.

4️⃣ Useful Hints: Books provide advice on diversification and objectives.

Explore more at 👉 here

Download the mobile app👉 here

'RYZ' is the online trading brand of 'Gill Broking'

#investing#stock trading#stock market#indian stock market#stock market investing#tradelikeapro#thank you

0 notes

Text

How to Profit from One of the World’s Fastest-Growing Stock Markets

What do you think of this article? Do you have any questions or comments about investing in the Indian stock market in 2023? Share your thoughts with us in the comment section below. We would love to hear from you.

Are you looking for a way to generate extra income and achieve your financial goals?Do you want to learn how to invest in one of the most dynamic and lucrative markets in the world?If yes, then you have come to the right place!This is a second article in the series, Indian Stock Market November 2023. Here we will show you how to invest in the Indian stock market in 2023. We will provide you with…

View On WordPress

#Indian stock market#stock market companies#stock market guide#stock market investing#stock market portfolio#stock market sectors#stock market tips

0 notes

Text

Expert tips on Stock Market Investing Strategies

Hey there, Tumblr fam! 👋 Are you ready to unlock the secrets of the stock market and embark on a thrilling investing adventure? 📈💰 Let's take a trip down memory lane and explore some awesome insights we've gathered about stock market investing. Buckle up, it's going to be a wild ride! 🎢✨

🌟 Cracking the Stock Market Puzzle 🌟 Discover the tips, tricks, and fascinating insights we've uncovered for all you beginner investors out there. We're here to make the stock market less intimidating and more exciting! 🧩🚀

🔍 Understanding the Basics 🔍 Don't worry about complex strategies. We'll show you how to learn from the market's behavior and your own experiences. Get ready to dive in and become an active participant in this financial playground! 💡💪

🤝 Direct Stock Purchase 🤝 Imagine owning a piece of your favorite companies! With direct stock purchase, you gain control over stock selection, enjoy potential dividends, and experience the thrill of being a part-owner. It's like having backstage access to the business world! 🎟️💼

🌐 Mutual Funds: Your Investment Sidekick 🌐 Not quite ready to fly solo? No problem! Mutual funds are here to guide you. They offer professionally managed portfolios, diversification, and expert advice. Get ready to team up with financial superheroes! 🦸♀️💫

🔍 Fundamental Analysis: Be a Finance Detective 🔍 Become the Sherlock Holmes of finance by unraveling the secrets of fundamental analysis. Learn to evaluate companies, spot profitability, and outsmart competitors. It's time to don your detective hat and make savvy investment decisions! 🕵️♂️🔎

📚 Knowledge and Practice 📚 Gain a solid understanding of the stock market by analyzing companies, using fundamental and technical analysis, and honing your skills through practice. Get ready to level up your investing game! 📚💪

💪 Discipline: Your Path to Success 💪 Stay disciplined and avoid impulsive decisions. Set clear entry and exit points, and have the courage to cut your losses when needed. Discipline is the secret ingredient for long-term success! 🚦💰

So, Tumblr friends, are you ready to unlock the doors to stock market investing? Get excited, because the journey awaits! Let's dive in, unravel the mysteries, and make those investments shine. Happy investing! 🎉✨💼

Here's your gift: Expert advice on Stock Market Investing.

#beginners guide#currencyveda#financial education#investing for beginners#investment resources#investment strategies#portfolio diversification#risk management#stock market insights#Stock market investing#stock market tips

1 note

·

View note

Text

Busting Myths and Fears of Stock Market Investment in India: A Comprehensive Guide

Introduction:

Investing in the stock market can seem intimidating, especially with the various myths and fears associated with it. However, understanding the realities and dispelling these misconceptions is crucial for those looking to grow their wealth and achieve financial goals. In this comprehensive guide, we will debunk common myths surrounding stock market investment in India. By providing…

View On WordPress

#Financial education#Individual investors#Investment myths#Long-term investing#Stock market investing

0 notes

Text

How to make money in Stock Market - EARN WHILE YOU LEARN | How to earn money | Easiest way!!!

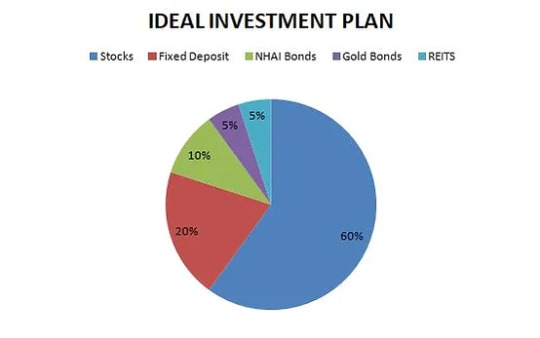

Ideal Investment Plan Pie Chart

If you put ₹ 1 lakh in education you will get a certificate.

If you put ₹ 1 lakh in FD at 7%, it will become 2 Lakh in 10 yrs & 2 months.

If you put ₹ 1 lakh in good stocks, it will become minimum 10 Lakh in 10 yrs.

Real Life Example:

MRF share price over last 10 yrs.

o Rs 1 Lakhs invested In MRF in 10 yrs became 13 Lakhs

Minda Share Price over last 10…

View On WordPress

#how to invest#how to invest in stock market#how to invest in stocks#how to invest in the stock market#how to make money#how to make money in stock market#how to make money in stocks#how to make money in the stock market#how to make money online#how to start investing in the stock market#make money#make money in the stock market#stock market#stock market for beginners#stock market investing#stock market investing for beginners

1 note

·

View note

Text

The stock market and personal investing

The stock market and personal investing

The stock market can be a daunting and confusing place for those who are new to personal investing. However, understanding the basics of how the stock market works and learning some key strategies can help you make informed decisions and potentially see a return on your investments.

First, it’s important to understand that the stock market is a…

View On WordPress

#how to invest in stocks#how to invest in the stock market#how to invest in the stock market for beginners#how to start investing in the stock market#investing#investing 101#investing for beginners#investing in stocks for beginners#investing in the stock market#personal finance#stock market#stock market crash#stock market for beginners#stock market investing#stock market investing for beginners#value investing

1 note

·

View note

Text

Introduction to Stock Market Investing: A Beginner’s Guide

#stock market for beginners#how to invest in stocks#stock market#how to invest in the stock market#how to invest in stocks for beginners#stock market investing#investing for beginners#how to start investing in the stock market#how to invest#how to invest in stock market#investing in stocks for beginners#stock market explained#how to start investing in stocks#how to make money in stock market#investing for beginners guide#how to enter stock market for beginners

1 note

·

View note