#best dividend stocks

Text

Building Wealth with Dividend Investing: A Simple Guide

#dividend investing#dividend stocks#dividend investing for beginners#best dividend stocks#dividend growth investing#dividend investing strategy#dividends#investing for beginners#investing#dividend investing for passive income#stock market investing#dividend#dividend investing explained#dividend investing guide#investing with dividends#monthly dividend stocks#top dividend stocks#guide for investing in dividend stocks

1 note

·

View note

Text

High dividend ETFs to invest in 2023

The most common way to invest in the stock market is to invest in mutual funds or ETFs and high-dividend ETFs are peanuts to new investors, expert’s best suggestion is to invest at an early stage on high dividend ETFs. You can also invest in mutual funds same as in ETFs. There is minimum risk and you have experts who managed ETFs, they try to give the best returns on your investment.

What is an…

View On WordPress

0 notes

Text

10 High-Yield Assets For Monthly Cash Flow In 2023

10 High-Yield Assets For Monthly Cash Flow In 2023

So there are two main ways to make money With any investment out there number one It appreciates in value while you own it Think your home for example and then Number two your investment provides some Form of cash flow such as a rental Property well for the last decade Excluding the prior 12 months you were Rewarded as an investor for focusing Solely on asset appreciation or growth An example…

View On WordPress

#best dividend stocks#cash flow#cash flow investments#dividend investing#dividend stocks#dividend stocks to buy#earn high yield#high yield#high yield investment#high yield stocks#how to earn cash flow#how to make money online#how to make passive income#how to make passive income online#i bonds#income investments#investing for beginners#make money online#nate o&039;brien#passive income#passive income ideas#passive income streams#top dividend stocks#yield

0 notes

Text

Finding the Best Dividend-Paying Stocks: A Review of Sivastatz Dividend Stock Screener

When it comes to investing in the stock market, there are a plethora of options available to choose from. However, one strategy that has gained popularity over time is investing in dividend-paying stocks. Dividend-paying stocks provide investors with a steady stream of income in the form of regular dividend payments, making them a popular choice for investors who are looking for long-term gains. If you are interested in investing in dividend-paying stocks, then a dividend stock screener can be a useful tool to help you find the best options.

One of the best dividend stock screeners available in the market is Sivastatz.

Sivastatz is the best dividend stock screener that is designed to help investors find the best dividend-paying stocks based on their specific investment goals and preferences. The tool is user-friendly and can be used by both novice and experienced investors to screen and analyze dividend stocks in a matter of seconds.

Sivastatz offers a range of features that make it an ideal choice for dividend investors. One of the key features of Sivastatz is the ability to filter stocks based on their dividend yield. Dividend yield is the annual dividend payment per share divided by the stock price. By setting a minimum dividend yield threshold, investors can easily identify high-yielding stocks that can provide them with a steady stream of income.

Another useful feature of Sivastatz is the ability to filter stocks based on their dividend growth rate. Dividend growth rate refers to the rate at which a company increases its dividend payments over time. By setting a minimum dividend growth rate threshold, investors can identify companies that have a track record of increasing their dividend payments over the years.

In addition to these features, Sivastatz also allows investors to filter stocks based on a range of other criteria, including market capitalization, sector, and P/E ratio. This can be particularly useful for investors who are looking for dividend-paying stocks in specific industries or sectors.

Overall, Sivastatz is a powerful tool that can help investors find the best dividend-paying stocks for their portfolio. By using Sivastatz, investors can easily screen and analyze dividend stocks based on a range of criteria, and identify the best options that meet their specific investment goals and preferences. If you are interested in investing in dividend-paying stocks, then Sivastatz is definitely worth considering as your go-to dividend stock screener.

#Best Dividend Stock Screener#High Dividend Stock Screener#Sivastatz#Best Dividend Stock Screener in Australia

2 notes

·

View notes

Text

🔥💰

#back 2 back 2 back#best memes#dank memes#relatable memes#funny memes#tumblr memes#meme#dankmemes#memes#lol memes#dank#dividends#i love dividends#dividend#investors#investor#investment#investing#stonks#investing stocks#stocks#stock market

0 notes

Text

#Dividends#dividend#dividend yield#dividend retirement#dividend stocks#dividend investment#best paying dividend#monthly Dividends#weekly Dividends

0 notes

Text

Right Time to Invest in Low Lying Crude Oil?

Factors to Consider:

Market Conditions: Assess the current market conditions and trends. Understand the factors influencing oil prices, such as global demand, geopolitical tensions, and production levels.

Supply and Demand: Changes in global oil supply and demand can significantly impact prices. Consider the current balance between supply and demand and any potential disruptions to the oil supply.

Geopolitical Factors: Geopolitical events, such as conflicts in oil-producing regions, can affect oil prices. Stay informed about geopolitical developments that may impact the oil market.

Economic Indicators: Monitor economic indicators, such as GDP growth, industrial production, and transportation trends. Economic conditions can influence oil consumption and, consequently, prices.

Technological Advances: Advances in technology, such as improvements in renewable energy sources, can impact the long-term demand for oil. Consider the potential effects of technological changes on the oil market.

Environmental Policies: Policies aimed at reducing carbon emissions and promoting clean energy can affect the long-term outlook for the oil industry. Stay informed about environmental regulations and their potential impact on oil demand.

Diversification: If you decide to invest in commodities like crude oil, consider diversifying your investment portfolio. Diversification helps spread risk and reduces the impact of poor performance in any single asset.

Risks and Challenges:

Volatility: Crude oil prices are highly volatile and can be influenced by sudden and unpredictable events. Investors should be prepared for price fluctuations.

Leverage and Derivatives: Some investors use leverage or derivatives to amplify their exposure to oil prices. While this can magnify gains, it also increases the risk of significant losses.

Timing the Market: Timing the market can be challenging. Even if oil prices are currently low, they could continue to decline. It's challenging to predict the bottom of a market.

Storage Costs: Investing in physical oil or oil-related financial instruments may involve storage costs. Consider these costs in your investment strategy.

Investment Vehicles:

Stocks of Oil Companies: Investing in stocks of established oil companies can provide exposure to the industry without directly dealing with the commodity.

Exchange-Traded Funds (ETFs): There are ETFs that track the performance of oil prices or oil-related indices, providing a way for investors to gain exposure to the oil market.

Futures and Options: Some investors trade oil futures or options contracts, but these are complex financial instruments that require a deep understanding of the market.

Before making any investment decisions, it's crucial to conduct thorough research, consider your risk tolerance, and, if needed, consult with a financial advisor. Investing in commodities like crude oil involves risks, and it's important to approach such investments with a clear understanding of the market dynamics and your own financial goals.

Right Time to Invest in Low Lying Crude Oil Prices? with Ace Investors | ACE Investors

#stock market live#stock market asx#stock market today#stock market#youtube#buy dividend stocks#dividend stocks australia#best penny stocks to buy#penny stocks to buy now#buy penny stocks#penny stock market#penny stock#investing stocks#stock analysis#stock#stocks

1 note

·

View note

Text

youtube

Stock Market for Beginners: A Step-by-Step Guide to Financial Freedom 💰📈

#dividend investing#passive income#financial freedom#stock market#stocks#dividend stocks#dividend growth investing#how to make money#smart money#financial education#passive income ideas 2023#best stocks to buy now#stocks to buy now#penny stocks to buy now#best stocks to invest in 2023#trading live#stock market for beginners#make money#make money online 2023#earn money online#make money online#earn money#stocks to buy#how to make money online#Youtube

0 notes

Video

youtube

Best Dividend Stocks Under Rs-50 Passive Income Stocks Earn Extra Money ...

0 notes

Text

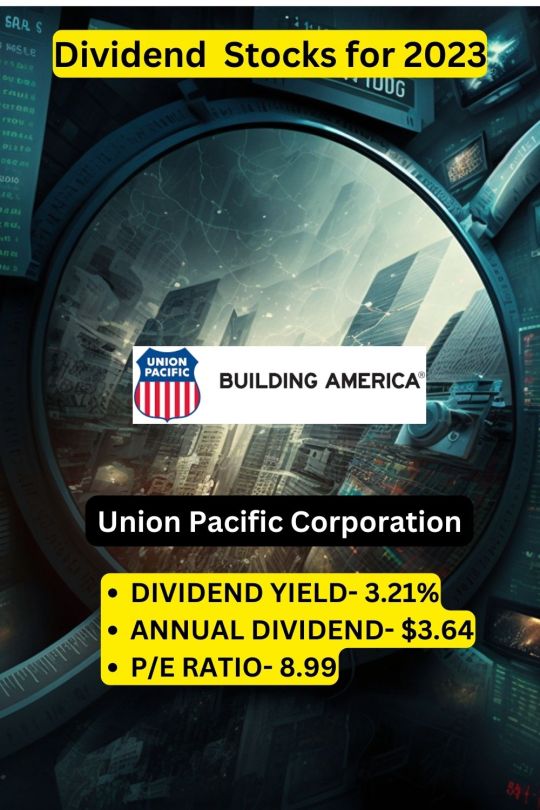

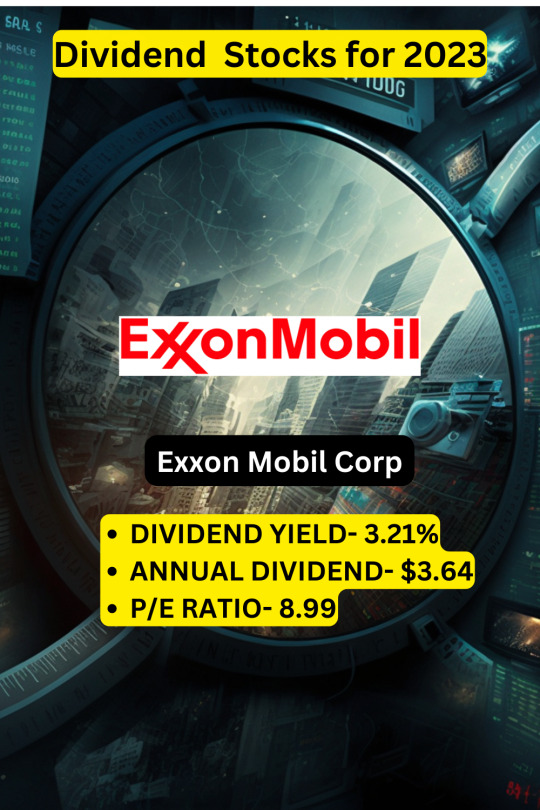

Best dividend stocks to invest in 2023

Read more

0 notes

Text

10 High-Yield Assets For Monthly Cash Flow In 2023

10 High-Yield Assets For Monthly Cash Flow In 2023

So there are two main ways to make money With any investment out there number one It appreciates in value while you own it Think your home for example and then Number two your investment provides some Form of cash flow such as a rental Property well for the last decade Excluding the prior 12 months you were Rewarded as an investor for focusing Solely on asset appreciation or growth An example…

View On WordPress

#best dividend stocks#cash flow#cash flow investments#dividend investing#dividend stocks#dividend stocks to buy#earn high yield#high yield#high yield investment#high yield stocks#how to earn cash flow#how to make money online#how to make passive income#how to make passive income online#i bonds#income investments#investing for beginners#make money online#nate o&039;brien#passive income#passive income ideas#passive income streams#top dividend stocks#yield

0 notes

Text

Top 5 Best Dividend US Stocks To Buy In June 2023

Top 5 Best Dividend US Stocks To Buy In June 2023

Exploring the Best Dividend US Stocks to Buy in June 2023: A Closer Look at the Economy and Top Picks

Introduction: Now that the debt cycle debacle is presumably behind us, we can shift our attention back to the economy. Economic data is lackluster, and there is a split among economists on whether the Federal Reserve will raise rates during their…

View On WordPress

#5 Best Dividend Stocks Of June 2023#5 Best Dividend Stocks To Buy Now#best dividend stocks 2023#best dividend stocks for passive income#best dividend stocks of all time#best dividend stocks to buy and hold#Best dividend us stocks to buy now for long term#best long-term dividend stocks#highest dividend-paying stocks in world#top 5 dividend stocks

0 notes

Text

Using a High Dividend Stock Screener: A Guide to Identifying Reliable Sources of Passive Income

When it comes to investing in the stock market, one of the key considerations for many investors is the potential for dividend income. Dividends are a portion of a company's earnings that are paid out to shareholders, usually on a regular basis. High dividend stocks can provide a steady stream of income for investors, making them an attractive option for those who are looking for a reliable source of passive income.

However, with so many stocks available on the market, it can be overwhelming to try to identify which high dividend stocks are worth investing in. That's where a high dividend stock screener comes in.

What is a High Dividend Stock Screener?

A high dividend stock screener is a tool that helps investors filter through the thousands of stocks available on the market to identify those that pay a high dividend yield. The screener uses various criteria to narrow down the list of potential stocks, such as dividend yield, dividend payout ratio, and dividend history.

Using a high dividend stock screener can save investors a significant amount of time and effort when it comes to researching potential investments. Instead of manually sifting through financial statements and other data to determine a stock's dividend yield and other key metrics, investors can use a screener to quickly identify potential candidates.

How to Use a High Dividend Stock Screener

To use a high dividend stock screener, investors need to determine what criteria they want to use to filter the available stocks. Some of the most common criteria include:

Dividend Yield: This is the percentage of a company's stock price that is paid out in dividends each year. A high dividend yield indicates that a company is paying out a significant portion of its earnings to shareholders.

Dividend Payout Ratio: This is the percentage of a company's earnings that are paid out in dividends. A high dividend payout ratio indicates that a company is using a significant portion of its earnings to pay dividends.

Dividend History: This refers to a company's track record of paying dividends. Investors may want to look for companies that have a long history of paying dividends and have consistently increased their dividend payments over time.

Once investors have determined their criteria, they can input them into a high dividend stock screener and generate a list of potential stocks that meet their requirements. From there, investors can further research each stock to determine if it is a good fit for their investment portfolio.

Benefits and Risks of Investing in High Dividend Stocks

There are several benefits to investing in high dividend stocks. For one, they can provide a reliable source of income for investors. Additionally, dividend-paying companies are often more established and financially stable than those that do not pay dividends.

However, there are also risks associated with investing in high dividend stocks. For example, a company may reduce or suspend its dividend payments if it experiences financial difficulties. Additionally, high dividend yields may be a sign that a company is not reinvesting enough of its earnings into growth and development, which could limit its long-term potential.

It's important for investors to carefully research each potential investment and consider their risk tolerance before investing in high dividend stocks.

Conclusion

A high dividend stock screener can be a valuable tool for investors who are looking for reliable sources of passive income. By using a screener to filter potential stocks based on criteria such as dividend yield, dividend payout ratio, and dividend history, investors can save time and effort when it comes to identifying potential investments.

However, it's important to remember that investing in high dividend stocks carries risks as well as rewards. Investors should carefully research each potential investment and consider their risk tolerance before investing in high dividend stocks.

Know More About Below Keywords

QBT Share Price

LON RBS

LON SAR

LON SOLG

2 notes

·

View notes

Text

#Dividends#dividend#dividend yield#dividend retirement#dividend stocks#dividend investment#best paying dividend#monthly Dividends#weekly Dividends#dividend investing#investing course

0 notes

Text

Best Dividend Paying Penny Stocks In India 2023

Indian Share Market There are a lot of potential penny stocks that can give good returns to investors. Many beginners are interested in penny stocks, due to the share price and they can gain more experience in it.

In recent times penny stocks are more searched by new traders, due to their low cost and low risk. Today we can see the Penny stocks that pay dividends in 2023.

What Are Penny…

View On WordPress

1 note

·

View note

Text

What are dividend growth stocks?

What are dividend growth stocks?

Which are the best today?

"Returns matter a lot. It's our capital." — Abigail Johnson

The accumulation of wealth from investments in stocks is determined by the long run rate of return on investments.

Many investors find companies that pay regular and increasing dividends attractive.

https://bit.ly/3wTkeBw

0 notes