#In California there's only one way that insurance pays for an assisted living

Text

Sass Talks Books: Thank You for Listening, by Julia Whelan

Basic Plot: An audiobook narrator, who doesn't record romance books (anymore - she needed to break into the industry somehow), is given the financial opportunity of a lifetime...recording a romance book. It's a dual narration book, too, which means working with another narrator. Her recording partner quickly becomes one of the best perks of the project, warm and funny and *real* feeling, despite the fact they've never met. (They've never met, right?)

My thoughts: I really enjoyed this one. The author IS an audiobook narrator, writing a book about two audiobooks narrators, and I listed to the audiobook...narrated by the author. I thoroughly recommend that reading experience, by the way. There's a lot of little moments with the two talented voice actor characters slipping into different accents, talking about tone and inflection, and it's an absolute delight to hear the narrator delivering on the script she wrote for herself.

As for the story itself, I'm not far enough into the romance world to know if this book deviates from the romance novel beats enough that it's drifted out of the category, but I can say that it was absolutely charming and enjoyable. And, that the changes made dulled the edges of the parts of romance I bounce off of the most while absolutely being a very loving send-up of the genre. The connection between the two people was very real, but it wasn't the only (or even, I would argue, the most important) relationship developing and changing in the book.

Every character felt connected in a complicated web of love and relationships with other people - it was a joy. And it was used to explore some toothy things that I normally don't get in a book this fun - grief, regret, how you deal with the losses you can't get back, how you rebuild a life. It stayed warm-hearted and kind as a book, but it didn't shy away from real fights, insecurities, and pain.

A handful of warnings to go along with that: the MC has lost an eye, and deals with ableism, and some negative self-perception. There's some diet-culture-based disordered eating for the MC's best friend (not displayed as a good thing). The MC's relationship with her dad has some brutal fights where there's emotional manipulation happening. There's also a real look at the complications of dementia - discussed below.

The protagonist's relationship with her grandmother is a key point of the story, and the grandmother is dealing with encroachment of memory loss and personality change that comes along with dementia. This part surprised me - I work with older adults in long-term care and lol, was not expecting that my professional life would be relevant to the situation. The author made a few errors with the care system in California (where our grandma is based, and where I work). But frankly, only a few, and the way the dementia progressed wasn't one of them. It was good, and heartbreaking, and one of my favorite parts.

Wow...I wrote a lot about this. Suppose that makes sense, considering it was my experience of the book itself. I expected something light and fun, and while I got it, there was depth there too that was a very welcome surprise.

#sass talks books#thank you for listening#julia whelan#Okay I'll be salty in the tags#the things the author got wrong about assisted living#there's a plan to move the grandma from a building she loves but is expensive to one that accepts insurance#In California there's only one way that insurance pays for an assisted living#and there's a two-year waitlist for the person in the grandma's position#it wouldn't have been a quick solution#also they insurance they were citing was Medicaid#which in California is called Medi-Cal#and if the grandmother was on Medi-Cal#she would not have been able to afford her current assisted living for MUCH longer than the novel's plot sets it up to be#but honestly these are deep in the weeds professional quibbles#Things the book got right about long-term care: the ridiculous expense of care tiers#the services likely provided by the building#and the pain and joy of loving someone with dementia#which makes me think the author DID have someone she loved in an assisted living with dementia#but maybe wasn't in California#or didn't have the same financial issues

1 note

·

View note

Text

Honestly, as much as many people point out how much large quantities of money spent by the ultra-wealthy on frivolous things could change their lives as a reason that the level of wealth inequality we're at is absolutely unconscionable, and they're ABSOLUTELY correct that it's a great illustration of the problem...

I think an underrated and equally important illustration is how much those quantities CAN'T do.

Let's think about a million dollars. That's a quantity that says "HOT DAMN, you REALLY made it!" to most people. That's a lot. It's more money than most people will handle at once in a lifetime.

And it can BARELY buy most single-family homes in California. It can't buy many that don't even qualify as McMansions, just...nice houses. It's even worse in NYC, where you can find apartments the size of a postage stamp that it can't buy.

And if you want to RETIRE with "just" a million dollars? You'd better hope you die soon.

Suppose you retire at age 55 with a million dollars. Congratulations! If you live to age 75, that's 50k a year. 85, it's $33k a year. 95? You've got $25k a year...and it's likely that you're ending up with medical bills that take an entire year's worth of money in one go. Ending up in assisted living? Well, the median cost of assisted living in the US is...$54k a year. Congratulations, ALL your money goes to rent now! Every cent! Better hope you die within 15 years!

You COULD avert this by putting the money in a high-yield account and only skimming off the interest, yes - the average retirement account, with an interest rate of 5-8%, would give you $52-83k a year...but even then, you have to have a million dollars in the first place and not withdraw from your initial principal, which, good luck doing THAT with the complications that tend to arise in old age and health insurance deductibles and coverage limits and loopholes to make you pay out of pocket. $83k a year may sound like a lot, and it certainly is to most of us, and even so, life has a way of eating through it fast, especially if you're retirement age.

In addition, there's a concept that I call "item debt" - it's about those things that, sure, you can SURVIVE indefinitely without them, but you will live a longer and healthier life if you have them. This can be anything from a stove that can actually maintain a constant temperature, to a computer that lets you do your job without freezing and crashing every few minutes, to assistive devices. Item debt can be the need for transportation in the US's car-centric society - you can't even afford a shitty old beater, so you have to take the bus 3 hours each way; the first thing you'll do if and when you get the money is buy a car and...then what? Your bills are no less impactful; if anything, they're worse because now you have to pay maintenance on the car. It can take the form of, "well, I really SHOULD be using a wheelchair, but I can't afford that and I can walk ENOUGH that my insurance won't even partially cover it, so guess I'll rely on this $10 cane until it inevitably gets worse." It can take the form of saying "I'd aggravate my various orthopedic problems a lot less if I had more power kitchen appliances, but those are expensive, so I guess I'll make do without" until you can't lift a bowl anymore without hitting 8 on the pain scale. It can be the empty first apartment, bare mattress on the floor, that's a wonderful improvement over wherever you came from but if you don't get a bedframe you're either going to wear out that mattress really fast and have to spend a ton of money replacing it, or have to strain to pick it up and let the underside air out every day, which may not seem like a lot now but will destroy your back over the years if the cheap mattress itself doesn't do it first.

Thing is, most people who are not MULTImillionaires have some form of item debt - and if you have multiple disabled family members or a sufficiently expensive illness in the family (e.g., need for a lung transplant, which can cost upwards of $1mil WITHOUT complications, or cancer that requires a particularly expensive type of chemo), sometimes it'll take something like $10mil to get out of it.

Again, we're talking about WAY more money than most people will see IN THEIR LIVES. We're talking about quantities of money that MOST people are expected to live our entire lives without. We would all live longer, healthier, happier lives if we could all have basic food and water, sufficient living space, and health care including home medical devices as needed, guaranteed. There is no scarcity reason why we SHOULDN'T have these things guaranteed to everyone except a many-times-over-disproven myth that everyone would just stop working and then we'd have no supply chain if we didn't have death by poverty as a constant looming threat.

And so these things remain out of reach to EVEN THE LOW END OF THE WEALTHIEST 10% OF AMERICANS.

And for what? 90% of the country is left second-guessing, postponing, or even outright foregoing NECESSITIES, and FOR WHAT?? So the top 0.5% of fucking assclowns can have megayachts and eat gold and spend amounts of money that could change people's lives on stupid and dangerous shit whose horrible safety standards they can then inflict on the rest of us??

If that doesn't piss you off and tell you something needs to change I don't know what will.

#$250k would be able to clear MOST of my item debt#i would be able to get all the kitchen appliances i need to stop destroying my body to cook#id be able to get some mobility devices and braces ive been badly needing#but it WOULDN'T be enough to get me a house that could actually meet my accessibility needs without moving ro a cheaper state#where i would know no one and not be able to see my own doctors anymore#now that ive FINALLY found a medical team that ACTUALLY works for me#and tbh i find THAT to be an even more damning illustration of the problem than what that money COULD do

8 notes

·

View notes

Text

youtube

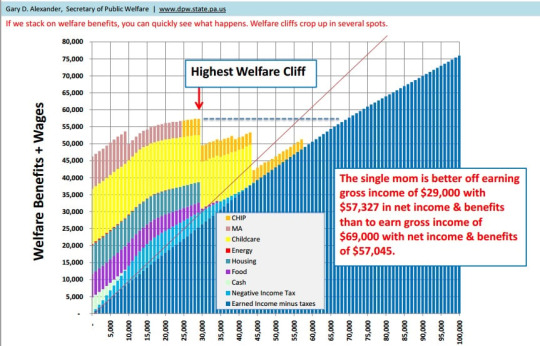

Ok, this has been getting shared again, as obviously the fiat inflationary environment is driving up the cost of living faster than wages, leading the left to call for higher wages. The real economic solution to all this is to abandon the centrally planned government monopoly on currency that drives the boom and bust cycle and drives up the asset prices of the ultrawealthy. What's annoying to me is that we can't criticize the hypothetical or real women who is being described in this situation.

0:00 "you know how to spend a $31 million a year in salary"

Sure, he gets paid probably too much, cause he can secure bailouts for his corporate bank via the government. Just one year later after grilling Dimon about his salary Rep. Porter (D - CA) would vote yes to give $900 billion in corporate bailouts including JP Morgan.

So let's look at the budget for this bank clerk in Irvine, CA:

$35,070

Patricia has a 6y/o

after tax is $29,100 which in monthly salary is $2425

1 bed apartment $1600

$100 utilities

Car payment $250

Monthly gas $150

low cost food budget: $400

cheap cell phone $40

child care: $450

Budget shortfall: $567

Now the questions we're not allowed to ask, because single moms are the most deified group in our society, is where is the father? Is there no child support coming in? If not, why did she have a child with a dead beat? Why is he gone in the first place? Was is divorce? 70% of divorces are initiated by women. Was it domestic abuse? Did you seek assistance from charity for that? Is she a widow? If she was a widow why didn't you get a life insurance payment? Why are you living in this expensive city? Do you have family there? Can they assist you financially? Can they assist with child care? Can you move in with you parents? Your aunt or uncles? Any siblings?

Rep. Porter wants us to ask why can't the bank pay a living wage for a 'families' to make ends meet, but this is not a family, this is a single women living alone raising the child she chose to have with a deadbeat who left her, or a husband she scared off, or a husband who was too stupid to acquire life insurance. She has no immediate or extended family, but she MUST live in one of the most expensive places in america. There is no option to move to a cheaper place, acquire roommates, or live with family. $1600 a month is way too high for this woman's budget for a place to live and simply has to accept either living with family, acquiring a roommate, or moving to a cheaper location.

By the way, if she didn't pay income taxes, she would make up most of that budget shortfall, she pays $497.50 in income tax a month.

Also gas taxes in California are usually the highest in the nation: taxes and fees make up $1.18/gallon. If gas was $4.36/gallon in Irvine, CA then by removing the gas tax she'd save 27% a month on her gas bill bringing that down to $111/month. No gas taxes would save her $39 a month.

Why is she driving an average of 23miles a day (assuming her minivan gets 20mpg). Why does she live so far from work? Or her kids school? Why pay that much to live somewhere and still need to drive an average of 23 miles a day, every single day? Irvine is only 10 miles across in the first place. She's driving the whole of the town and back again every single day? It's got an okay bus system just $69/month for an unlimited bus pass, getting rid of the car would save $331/month.

Okay, now the $250 car payment... on a 2008 minivan... for your single child? She could easily have a smaller vehicle that would cost less to purchase, less to operate, less to insure etc...

But the current KBB for a used 2008 Chrysler town and country is... $4000! Even with no money down, she should be spending closer to $120/month on the car payment (3 year loan at 6%), not $250. Factor in some insurance at $60/month, we're still talking a savings of $70/month.

Again, this woman needs to eliminate her child care by either asking family, maybe her retired parents, aunts/uncles, or a sibling or in-law. Why can't she negotiate working 6 hour days M-F so she can be with the child after school, and work Saturdays while the child is with a friend or relative? $450 a month saved right there.

But most of all, why the hell are you living in Irvine on such a low wage? Not everyone gets to live everywhere. It would be nice to be just minutes from the beach, Catalina island, 3 state parks... but guess what? Lots of other people want to live there too! The rent is going to reflect that. By the way, I just looked up and now the average single bedroom rent in Irvine, CA is as of February 2023 $2,726!

Okay, so the elephant in the room, is that this single mom is still going to receive welfare from the state and federal government. Her real income is going to be about $51,000 if you include her housing, medical, and childcare credits, etc...

This is a woman who made a bunch of shitty life choices and we take up the slack for her and her kid so she doesn't actually have too engage with her community, family, or child's father. But i'm glad she gets to live minutes from the beach!

7 notes

·

View notes

Text

4 Legal Rights That Turmeric Brain Injury Workers’ Comp Survivors Need to Know

Life is unpredictable and it can never be simple after a traumatic brain injury (TBI). Even survivors with little brain injuries might have long-term consequences that affect their lives and careers. People who suffer TBIs as a result of the carelessness of another can seek compensation for their losses through a personal injury lawsuit under California law. A significant TBI survivor lawsuit or conviction can provide much-needed income to assist sufferers and their loved ones rebuild themselves and prepare for the future. Every year, around 1.7 million Americans are affected by TBI.

4 beneficial legal rights of a brain injury worker in California

Benefits from Workers’ Compensation

Workers who have suffered brain damage have the right to seek workers’ compensation payments. The workers’ compensation system in California offers financial aid to pay medical expenditures, rehabilitation costs, and lost income as a result of work-related brain damage. This benefit is critical in enabling access to required medical care and income replacement while recovering.

Disability Insurance

Plenty of firms offer disability benefits to workers who endured brain injuries. The Americans with Disabilities Act restricts firms from entering into competitiveness with handicapped workers, especially individuals who have suffered traumatic brain injuries. Under the programs like Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), that provide monetary support to those who have no ability to work because of disabilities, people with brain injuries may be eligible for disability payments.

Discrimination Legal Protections

Anti-discrimination laws protect brain injury employees. The ADA forbids discrimination against people with disabilities in the workplace. It guarantees that workers with brain injuries are not treated unjustly or are refused employment chances only because of their impairment. Employers must provide reasonable modifications to enable brain injury workers to execute their job obligations successfully.

The Right to Seek Legal Advice

Employees who sustain brain damage as a result of a third party’s negligence or wrongdoing have the right to seek TBI legal advice in addition to workers’ compensation. They could be eligible to file a personal injury lawsuit for additional payment for their pain and suffering, mental agony, and other expenses caused by the brain injury. An expert personal injury attorney can help brain injury employees understand their choices and efficiently manage the legal procedure.

The four-step approach how can we assist you in obtaining the compensation you deserve?

For a boost in your potential of winning the claim you have a right, you need to meet with qualified attorneys who emphasize workers’ compensation claim cases, with traumatic brain injuries. You can get assistance from us in the listed ways:

Legal Counsel

Obtaining Evidence

Negotiation and Resolution

Appellations and Litigation

Conclusion

As a traumatic brain injury workers’ compensation survivor in California, it’s critical to understand your legal rights in order to obtain the assistance and money you deserve. By catching advice from our staff of legal practitioners who have dealt with the traumatic brain injury workers’ comp settlements in California, you will be significantly aided in protecting your rights and gaining the compensation that you want for your medical care. To support you in restoring your life after a traumatic brain injury, remember the fact that you are not isolated as well as that the legal system is on your side. Contact us at (626) 602-9483 or visit us at San Gabriel Valley for a free case evaluation.

0 notes

Text

Spine Injury Lawyer: Consequences and Compensation Explained

After an accident that hurts their spinal cord, people frequently suffer from long-term problems, pain, and even paralysis. By going to court against the person who caused your accident, your spinal cord injury attorney can get you monetary compensation for the damages and other losses. They’ll gather proof, talk with the insurance company of the person who hurt you, and maybe even file a legal complaint to secure your compensation.

Impacts Of Painful Spinal Injuries

Spinal cord injuries stop your brain from talking to your body parts, which means you have less control over your limbs. Injuries are called “complete” if you have no sensory or motor skills below the injury, or “incomplete” if you still have certain sensory or motor abilities below the injury.

People with spinal cord injuries all have at least one of the following problems:

Loss of movement, such as in paraparesis or paralysis, where you can’t move at all or only in certain ways.

Loss of senses, like being unable to sense cold, heat, or touch

Spasms or overactive reflexes are signs of this.

Lack of control over the bowels or bladder

Pain or a stinging feeling caused by damage to nerve fibers

Changes in ovulation, sexual function, and sensitivity

Having trouble breathing, coughing, or getting phlegm out of the lungs

The effects of a spinal injury are, of course, much more than just physical or medical. Spinal cord accidents force people to learn how to live within the limits of their injury. They might lose their capacity to work and pay bills, endure much suffering and pain, and deal with many other terrible long-term effects.

Compensation From Spine Injury

We can cover the following compensation and expenses you have spend while having surgery:

Medical Expenses – After a spine injury, bills for care can add very quickly. Our lawyers in California can help you get full payment for your ambulance costs, hospitalization, doctor’s visits, adaptive equipment, prescription medications, and any additional healthcare expenses you have.

Lost Wages – Depending on what the doctor says, you might not be able to go to work for a few weeks or months. Without the assistance of an expert lawyer, it might be hard for you to pay your rent and buy food. With the help of a lawyer, you can get money to makeup for the income you lost, giving you the security you need to get better.

Less ability to make a living – As stated, permanent problems can keep you from working or cause a big drop in your earnings. If that’s the case, these fines can help you makeup for the loss of income.

Pain and Sorrow – Spinal cord damage can cause pain deep in the body, pain that lasts for a long time, and suffering from tense muscles. These injuries can help you deal with the physical pain your condition causes.

Troubled Feelings – Accident and injury patients often have trouble with their emotions, PTSD, anxiety, and other emotional problems. Our California spinal cord injury lawyers can help you get the money you need to pay for therapy and, if needed, prescription medications.

Conclusion

Workers’ compensation lawyers at Gaylord and Nantais can help if you or a loved one has suffered a spinal cord injury on the job. Contact us at this moment at (562) 561-2669 to set up a no-cost consultation.

0 notes

Text

Gastric Bypass Surgery Abroad Can Be Cheaper

Gastric detour a medical procedure can be a daily existence saving choice for hefty people who have been not able to keep a solid load all alone. Stoutness has turned into a significant medical problem in numerous nations. Weight reduction medicines like bariatric medical procedure is exorbitant in US and isn't covered under protection, but weight reduction medical procedure choices, for example, lap band, Mini Gastric Bypass Surgery in Dubai methods are presently being presented at significantly decreased costs in areas like Tijuana, Mexico. Giving limited careful weight reduction choice will assist more individuals with getting the medical procedure so they can get back to a better way of life.

Insurance agency doesn't pay for weight reduction medical procedures like Roux-en-Y medical procedure and using a markdown cost at quality, licensed focuses with board-guaranteed and experienced bariatric specialists in Dubai can give spending plan disapproved of people a minimal expense elective. A similar quality consideration is frequently accessible for 33% to one-half of the expense.

Tijuana Offers Reasonable Gastric Detour Choices

In the event that you are thinking about weight reduction medical procedure and are hoping to set aside cash, remember these focuses prior to going with a last choice.

-Cost. The allure of getting excellent consideration at a vigorously limited rate is the reason a rising number of stout clients are deciding to have their medical procedure acted in Tijuana.

-Accommodation. Go to Mexico is commonly speedy and cheap, particularly from the states that line Mexico. On the off chance that you live in lining states like Texas, California and Arizona, you can frequently drive as fast into Mexico as you could to a significant focus in the U.S.

-Play and Care. Having a limited gastric detour a medical procedure in Tijuana or other city in Mexico might furnish you with enough investment funds to have a mini-get-away and getting a charge out of South-of-the-Line fun before your medical procedure.

-Weight reduction medical procedure choices. Gastric detour Tijuana is only one of a few weight reduction medical procedure choices in Tijuana, Mexico, that are advertised. Lap band and sleeve strategies are different other options.

Why a Weight reduction Medical procedure Could Be Ideal for You

Notable wellbeing takes a chance from are essentially overweight, with cardiovascular illnesses, type 2 diabetes, hypertension, stroke, and certain malignant growths besting the rundown. While gastric detour or another weight reduction medical procedure can transform yourself for a long term benefit, it is as yet a medical procedure. While gambles are minimal, ensure you comprehend systems and what way of life transforms you should pursue a short time later prior to settling on a decision. When you conclude a medical procedure is ideal for you.

0 notes

Text

White pages california usa

#WHITE PAGES CALIFORNIA USA TRIAL#

#WHITE PAGES CALIFORNIA USA FREE#

End-of-life disposal of these phone books puts a huge financial burden on local governments to recycle or dispose of the phone books, not to mention straining the landfill. In addition, phone books are hard to recycle because they are made with a low grade of paper.

#WHITE PAGES CALIFORNIA USA FREE#

There are free and convenient alternatives such as online directory from, and free 411 directory assistance (1800-FREE-411).In recent years, the number of phone books delivered to households and businesses has increased, with two or more competing companies now publishing and distributing books in similar or overlapping geographic areas.A substantial number of trees (in excess 1.2 million) must be harvested every year to produce the newsprint used to produce California telephone directories. On average, about 25% of the fiber used to produce telephone directories comes from post-consumer recycled material.The annual generation of telephone directories in California totals about 105,000 tons (an extrapolation for CA using US EPA 2008 figures.What if the clients turn around and resell the data? "Our expectation is that they won't," she says. The data is sold "for legitimate purposes," she says. Meanwhile, what of the data selling? The California Department of Motor Vehicles was in the news recently for pocketing $50 million yearly for reselling motorists' data to car manufacturers, insurance firms and banks.Ī spokeswoman for the DMV, Anita Gore, says the agency is just covering their costs. Another group says MyLife has violated the Illinois Right of Publicity Act, reselling their “addresses, employment histories, criminal records, social media pictures and other sensitive and personal information.” Spokeo was sued for allegedly displaying inaccurate information, and it went all the way to the Supreme Court, which ruled in favor of the company.Īttempts to reach MyLife for comment were not answered. MyLife is being sued by several consumers, with one group accusing it of bait-and-switching people to pay one fee to find out who is searching for them and then getting extra recurring charges. The other sites had me down in less than a day. A follow-up call said MyLife takes five to seven business days for removal. Worst of all, after calling on Monday (88) to demand my removal from the index and being asked to give my name, street address and birth date, as of Friday evening, everything was still there. That's 27 years ago for what I believe was an illegal U-turn. And it turns out I got what MyLife cited as a "minor infraction" traffic ticket in 1991. It also said I "may" have bankruptcies and liens, sex offender notices and eviction reports.

#WHITE PAGES CALIFORNIA USA TRIAL#

MyLife uses scare tactics to get you to sign up for a membership to see the results.įor instance, MyLife told me "you have arrest or criminal records" and offered me the chance to view these, provided I pay $1 for a three-day trial membership that could be canceled only if I called in. The worst offender: MyLife won't let you opt-out without calling the company first. The company adds that it "will not sell the email address that you provide as part of the opt-out process, or use it for any other purpose, without your prior consent." MyLife Then type in your address and request to be let out. From there, search for your name (and add the state you live in). You can save a step by going straight to the privacy policy (hidden way down, at the bottom of the front page).

0 notes

Text

5 Ways That California’s Workers’ Compensation System Hurts Workers

California’s workers’ compensation system is supposed to help workers who get hurt on the job get back on their feet. The system is far from ideal, though. In some cases, it causes more harm than good to the workforce. Usually, it hurts workers more than it helps them. Here are five ways California’s system for giving workers’ compensation hurts them.

Read here to know more information about workers’ compensation.

5 Ways California’s Workers’ Compensation Fails The Workers

1. Workers’ compensation doesn’t always pay for injuries on the job.

Workers’ compensation does not necessarily compensate medical bills or lost wages for employees who become ill or injured on the job. In some cases, workers may not be covered or get less than they could have. Some workers’ compensation programs, for example, don’t cover injuries that people cause themselves or that happen outside of work. Also, many programs only pay for a part of a worker’s lost wages and medical bills.

2. Workers’ compensation doesn’t always give workers enough money to compensate for their lost wages.

Workers’ compensation is often there to help pay for their lost wages when a worker gets hurt on the job. But sometimes, workers’ compensation benefits aren’t enough to cover all of a worker’s bills, leaving them struggling to make ends meet.

There are a few reasons why workers’ compensation benefits might not be enough to cover lost wages. First, workers’ compensation benefits are often based on their salary before the injury, which may not be enough to cover their current living costs. Also, workers’ compensation benefits may not be available immediately, which can add to the financial stress of injured workers.

If you get hurt at work, you need to know your rights and what you can do about workers’ compensation. You can be eligible for benefits in addition to workers’ compensation; an experienced attorney can assist you in acquiring the benefits you require and are deserving of.

3. Workers’ compensation doesn’t always pay for medical bills.

Workers’ compensation is meant to help workers who get hurt on the job, but it doesn’t always pay for all of their medical bills. A study by the National Institute for Occupational Safety and Health found that about one-third of workers who were hurt and asked for workers’ compensation did not pay their medical bills.

So, what does this mean for people who get hurt at work? Even if they have workers’ compensation, they may have to pay for some of their medical bills. Especially if the injury is serious, it can be a big financial burden.

If you get hurt at work, talk to your workers’ compensation insurer to find out what is and isn’t covered. You might also want to talk to a lawyer to learn more about your legal options.

4. Workers’ compensation does not always pay death benefits to the families of workers who have died on the job.

Families of employees who pass away while working are frequently compensated financially by workers’ compensation. However, this rule is not always applicable. If a worker dies because of negligence, like not following safety rules, their family might not be able to get death benefits. Also, a worker’s family won’t get death benefits if they die while committing a crime.

5. It’s often hard to get workers’ compensation.

Obtaining workers’ compensation can be challenging. Workers’ compensation is insurance for those who become ill or injured while working. Workers’ compensation is typically mandated by legislation. Workers’ compensation aims to provide a safety net, but obtaining it is not always simple.

There are several reasons why it’s hard to get workers’ compensation. It can be complicated and hard to figure out how to file a claim. Even if a worker files a claim, there is no guarantee that it will be approved. California’s mechanism for compensating injured workers is ineffective in many steps. These numerous weaknesses in the system harm employees and cost companies billions of dollars annually. Some of the most important problems are the long time it takes to file a claim, the high costs, and the low benefits. To learn more about how California’s workers’ compensation system affects employees and companies, contact Pacific Attorney Group or dial (916) 827-3686.

0 notes

Text

5 Ways That California’s Workers’ Compensation System Hurts Workers

California’s workers’ compensation system is supposed to help workers who get hurt on the job get back on their feet. The system is far from ideal, though. In some cases, it causes more harm than good to the workforce. Usually, it hurts workers more than it helps them. Here are five ways California’s system for giving workers’ compensation hurts them.

Read here to know more information about workers’ compensation.

5 Ways California’s Workers’ Compensation Fails The Workers

1. Workers’ compensation doesn’t always pay for injuries on the job.

Workers’ compensation does not necessarily compensate medical bills or lost wages for employees who become ill or injured on the job. In some cases, workers may not be covered or get less than they could have. Some workers’ compensation programs, for example, don’t cover injuries that people cause themselves or that happen outside of work. Also, many programs only pay for a part of a worker’s lost wages and medical bills.

2. Workers’ compensation doesn’t always give workers enough money to compensate for their lost wages.

Workers’ compensation is often there to help pay for their lost wages when a worker gets hurt on the job. But sometimes, workers’ compensation benefits aren’t enough to cover all of a worker’s bills, leaving them struggling to make ends meet.

There are a few reasons why workers’ compensation benefits might not be enough to cover lost wages. First, workers’ compensation benefits are often based on their salary before the injury, which may not be enough to cover their current living costs. Also, workers’ compensation benefits may not be available immediately, which can add to the financial stress of injured workers.

If you get hurt at work, you need to know your rights and what you can do about workers’ compensation. You can be eligible for benefits in addition to workers’ compensation; an experienced attorney can assist you in acquiring the benefits you require and are deserving of.

3. Workers’ compensation doesn’t always pay for medical bills.

Workers’ compensation is meant to help workers who get hurt on the job, but it doesn’t always pay for all of their medical bills. A study by the National Institute for Occupational Safety and Health found that about one-third of workers who were hurt and asked for workers’ compensation did not pay their medical bills.

So, what does this mean for people who get hurt at work? Even if they have workers’ compensation, they may have to pay for some of their medical bills. Especially if the injury is serious, it can be a big financial burden.

If you get hurt at work, talk to your workers’ compensation insurer to find out what is and isn’t covered. You might also want to talk to a lawyer to learn more about your legal options.

4. Workers’ compensation does not always pay death benefits to the families of workers who have died on the job.

Families of employees who pass away while working are frequently compensated financially by workers’ compensation. However, this rule is not always applicable. If a worker dies because of negligence, like not following safety rules, their family might not be able to get death benefits. Also, a worker’s family won’t get death benefits if they die while committing a crime.

5. It’s often hard to get workers’ compensation.

Obtaining workers’ compensation can be challenging. Workers’ compensation is insurance for those who become ill or injured while working. Workers’ compensation is typically mandated by legislation. Workers’ compensation aims to provide a safety net, but obtaining it is not always simple.

There are several reasons why it’s hard to get workers’ compensation. It can be complicated and hard to figure out how to file a claim. Even if a worker files a claim, there is no guarantee that it will be approved. California’s mechanism for compensating injured workers is ineffective in many steps. These numerous weaknesses in the system harm employees and cost companies billions of dollars annually. Some of the most important problems are the long time it takes to file a claim, the high costs, and the low benefits. To learn more about how California’s workers’ compensation system affects employees and companies, contact Pacific Attorney Group or dial (916) 827-3686.

0 notes

Text

And life goes on (though not always in the right direction)

Spencer Reid AU

Description: Spencer Reid has lived a horrible life, and every time he thinks it’s getting better, it somehow gets worse.

Warnings: Bullying, Self harm, Suicide, Kidnapping/blood, Rape/Sexual assault, Depression, Death, Cussing, Drug use (if there are any others please message me and I will gladly add them. There is no warning too small.)

Word Count: 5.4k

The first time Spencer gets beat up it is his eight birthday. He doesn’t celebrate. His dad gets “stuck at work” (in reality he is out cheating on his wife with his assistant) and his mom forgets. He goes to the park with a book knowing that would be the best way to spend his birthday. A group of neighborhood kids walks up to him and asks him if he wants to hang out. He, of course, says yes.

Oh stupid and naive little boy.

They guide him to the bleachers and push him to the ground. Spencer looks up at them through teary eyes and they laugh. The first punch breaks his glasses and the second breaks his nose. The kicks against his abdomen bruise his ribs and cause him to throw up his breakfast. They all keep laughing. It isn’t until an hour later when they finally get tired and leave. Spencer curls himself into a fetal position and tries not to swallow the blood gushing from his nose.

He walks alone to the hospital. His mother doesn’t notice he’s gone until the doctor calls her and asks her to pick up her son. His dad shows up with her. Spencer thinks he looks embarrassed. He refuses to meet his eyes. At first he thinks it’s because of his now crooked nose that will certainly need surgery but he later realizes that he is embarrassed of him. He is ashamed of who his son is. That is the first time that he cries himself to sleep. He gets beat up regularly after that.

. . .

Spencer is ten when his father leaves. He tries to convince him to stay. He keeps reciting statistics about how a divorce could affect a child but all his father does is look at him with disgust and walk out the door. His mother has one of her episodes later that same night. Spencer can’t bring himself to calm her down so he locks his door and picks up his physics text book. Half way through the chapter he feels tears falling down his cheeks. He does his best to wipe them away but it’s no use. He allows himself to cry as he thinks about what his father leaving will inevitably cause. His mother is in no condition to hold down a job and he has no way of making money to pay for food and electricity. He’s glad that their medical insurance takes care of all of his mother’s medication. He eventually settles down and brings his blankets over his body, the distant sounds of his mother practicing for a lecture that will never come lulling him to sleep.

The next day he goes straight to the local newspaper station and asks if he could have a job delivering the papers to the local neighborhoods. The owner is apprehensive at first until Spencer explains his situation. The man sighs and hands him a bag filled to the brim with the day’s news. Spencer rushes out of the building and jumps on his bike. He delivers newspapers everyday at six in the morning for the next two years.

He becomes used to hunger. He can’t buy books anymore as he is barely scraping together enough money to have a decent meal everyday. He never complains though. He forces the tears away and keeps moving forward. Things will get better.

. . .

When he’s thirteen when he leaves for university. Cal-Tech. It’s the start of a new life. He enjoys his classes and regularly converses with his professors. Every time he gets the chance he takes the trip down to Las Vegas to check on his mom. She always assures him that she is perfectly fine (even though she isn’t) and he needs to stop worrying so much.

He gets a job at the library. He puts the books back in their respective shelves and his eidetic memory certainly makes it easier. It isn’t fun, not in the slightest, but it pays better than selling newspapers and he’s in desperate need of money. He stays at the library between shifts and works on his homework. He uses the library’s computer since he can’t afford his own.

He excels in all of his classes and makes extra money out of tutoring. The older students don’t take offense to a fourteen year old correcting them on their mistakes, for that he is extremely thankful. Still, it doesn’t mean he has friends. Most twenty-year-olds don’t want to spend their free time hanging it out with a know it all pre-teen.

. . .

He slides a razor blade against his arm for the first time when he is fourteen. He doesn’t know exactly what makes him do it. The stress of college at such a young age or maybe the fact that he is completely alone in California. He considers the fact that it may be from the bruise forming on his lower abdomen, courtesy of a group of Frat guys. Maybe it’s all of the above.

The only thing he knows for sure is that he relishes in the pain it gives him. It isn’t the same type of pain he feels whenever he gets beat up, no this feels better. He gives himself two cuts before hiding the blade and cleaning himself off. He wraps a bandage over his forearm and goes to class.

The next day he sits in the bathroom and debates whether he should do it again. He knows he shouldn’t. He is aware that this is not good for him. He thinks about going to the campus therapist but quickly shuts down the idea. He can’t talk about what he is going through. He has no right to feel the way he does. He is going to a prestigious college on a full ride scholarship. He is passing all of his classes, he finds them easy. But he can’t help the way he feels. He looks at himself in the mirror and feels disgusted with what he sees.

He has no one. No one to take care of him. No one to talk to. No one to ask him how his day went. He understands why his father left. He wouldn’t want to have himself as a son either.

He slides the blade three times.

Two weeks later he is up to six cuts per day. The scars are ugly but Spencer can’t bring himself to care. He avoids looking in the mirror, it only makes the desire to feel the cold blade on his skin worse. No, he isn’t suicidal, at least he doesn’t think so, but he can’t help but throw his head back as blood gushes down his arm.

. . .

He is sixteen when his mother dies. He has just finished his first PhD and comes home to visit and celebrate. At one point he goes out to the store and comes back to find his mother on the floor.

She isn’t breathing.

He eyes the bottle of pills on the floor and then looks to the counter to see another one.

They’re both empty.

He cries. He cries for over an hour before he gets up and starts packing his stuff. He takes all of his money as well as some clothes and other necessities. He calls the paramedics on his way out the door. He takes the first bus out of Las Vegas and never looks back.

He doesn’t return to Cal-Tech. Social Services finding him will be too easy if he does. He’s a minor and his guardian is dead. He has two options. He can either find a way to contact his dad (which social services probably does) and go live with him. He doesn’t dwell on the thought long. Option two is to allow himself to be turned over to the state and be inevitably placed in an overcrowded foster home that only takes children in for money. He dismisses the thought quickly. He ends up choosing option number three.

He runs away. He ends up in Arizona. He doesn’t remember how many buses it takes him to get there. He stays at a cheap motel and has to resist the urge to walk to the bathroom and open old scars. It’s been months, he tells himself, you have to be strong. He makes a call to the University of Oxford. They had offered him a scholarship when he had originally applied when he was thirteen. He declined their offer, obviously, and decided to stay closer to home. Closer to his mom. Who is dead now. He shakes his head and forces himself to stop thinking about it. He requests to talk to the Dean. He gives his name and he is quickly transferred to his office.

Yes, they do have a place for him in school. Of course, they would be honored to have him complete his studies there.

Spencer hangs up the phone and calls the airline. One way ticket to England please. The next day he lugs his belongings all the way to the airport, not having enough money for a cab. He boards the plane and stares out the window officially saying goodbye to his life in the states.

. . .

Maeve is dead. He is twenty years old and he is tied to a chair staring at his dead fiancée. He sees the blood pooling around her body and his throat feels raw from all the screaming. This isn’t supposed to happen. His life was finally good, stable. The first real glimpse of happiness he’s had since he was ten. Life can’t have gotten this bad.

They have both been held captive for four days. Spencer being forced to watch as the man who took them repeatedly raped the woman he is in love with. Forced to endure having the shit beat out of him. Having to endure the feeling of the needle piercing his skin and ultimately enjoying the high that came afterward.

The man smirks at him, the gun still in his hand.

“YOU SON OF A BITCH!” His voice comes out hoarse, not even he can recognize it. The man simply laughs and walks over to him. He holds the gun to his head and Spencer closes his eyes. He’s going to die. He wants to die. He craves the feeling of vast emptiness that came with death. He doesn’t think that he can deal with any more pain.

The pressure of the gun leaves his head. He looks up and the man smiles at him, but there is no sincerity in his eyes. He hears the man saying something along the lines of “death is too easy” before plunging another needle in his vain. Spencer’s eyes roll back as a feeling of ecstasy overcomes his body. He hears the man walk away before he passes out. He wakes up to see officers untying him. He sees paramedics close the black bag over Maeve’s face. He feels tears fall down his face.

“No,” he repeats over and over. He hears paramedics ask him his name. Does he remember how he got here? Can he tell them where he lives? Their questions fall on deaf ears. All Spencer can think about is how when he eventually gets out of the hospital he will have to go back to an empty apartment. He will have to pack up Maeve’s stuff. He will have to face her parents and tell them what happened. He will have to tell her dad that he will never get to walk his little girl down the aisle and her mom that she would never take her dress shopping. Spencer would never meet the eyes of the woman he loves as she reaches the altar. He will never get to say ‘I do’ and call her Mrs. Reid.

He finds a dealer as soon as he gets home.

. . .

He’s twenty two when he gets his fifth PhD. He has been clean for a little under a year and it is all thanks to his boss. He’s been living with him since he moved out of his apartment. He works at the local police station. He gives profiles on serial criminals. No one is ever going to have to go through what he went through. Not if he can help it.

He based the past two years of his schooling solely on his new career choice. He gets an internship two months after the incident.

He’s high most of the time.

He still passes all of his classes with flying colors but his new boss knows that something is up with him, even if he has only known the kid for a month. The police chief approaches him one day when Spencer is sitting on his desk going over a cold case file. He invites him to dinner at his house and Spencer is both relieved and worried. Relieved that he wouldn’t have to go back to his god forsaken apartment for a few more hours and worried because he doesn’t know how bad his craving will get. He has developed a routine. Shoot up, go to school, go to work, come home at five, shoot up again.

An hour into dinner and his boss asks him the question. Are you okay? It’s a loaded question, they’re both aware but Spencer notes that the man is genuinely concerned for his well being. He breaks down. He tells him everything. He doesn’t know why he is sobbing in front of a man who he has only known for a short while. Why he is telling him all of his problems. Why he rolls up both of his sleeves and shows him the scars that graze his inner elbow, and the ones that have healed over his forearm.

From a psychological perspective he knows why he is doing it, why he allows himself to be so vulnerable in front of the man. He longs for a father figure. For a man to comfort him and care for him. He wants what his father never gave him as a child, what he never gave him as a teenager, what he never gave him as an adult.

“I’m sorry sir,” Spencer sniffles. He is being unprofessional.

“You don’t have to call me sir, you know? You can call me Roger.” Spencer nods, not having the strength to speak up again. “You’re staying the night and then tomorrow we’ll go to your apartment to pack up your stuff and you’re moving in. I’m going to help you get clean.”

Spencer is shocked but can’t bring himself to argue. He is exhausted. The next day they do just what Roger said they would do. It is a long journey. He will stay clean for about three weeks before something happens that makes him fall back to his disgusting habit. Roger will sometimes come home to see Spencer sobbing in the bathroom, a syringe lying next to him. He immediately pulls him close and assures him that it’s okay.

He beats it though. It will be a year next month since the last time he had any drug in his system. He’s proud of himself.

Roger walks over to him as he closes his phone. They are in one of their co-worker’s backyard. They all insisted that they needed to celebrate his new achievement. Spencer had rolled his eyes but accepted their kind gesture and is now sipping his drink and making conversation when Roger calls his name.

Roger takes a second to mull over the progress Spencer made. He’s proud of him. He loves the kid like his own but the future of their father-son relationship will be determined what he is about to say.

“Hey, what’s up?” Spencer asks casually, pushing a hand through his long hair.

“I just got a call from Interpol,” he pauses, Spencer freezes. “They have offered me a position.” He waits for Spencer’s reaction.

“You’re leaving.” Spencer can’t believe this is happening. Not again. He starts to wonder if life will ever allow him to have even a sliver of happiness.

“I am.” Spencer avoids looking at him. “But I want you to come with me.” That catches his attention.

“What?”

“I told them that if they want me then they will also have to offer a position to the smartest and most hard working man I know. I made it clear that I am not going to take the position unless they put you on my team. So what do you say? Want to work at Interpol with me?”

Spencer is shocked to say the least. It’s a great opportunity. Tears well up in his eyes as he looks at the man who cares for him like a son. The man who encouraged him to beat his addiction, who makes him feel like he is worth something. He nods his head and hugs him. He hears their co-workers cheering behind them and he lets out a laugh. Maybe life will allow him to be happy.

. . .

Wrong. Life always likes to give Spencer a nice kick in the ass. He has been working at Interpol with Roger for about a year and a half and at the ripe age of twenty-four he is one of their most valued members. He is seated quietly at his desk, nursing a horrible migraine when a file is dropped in front of him. He looks up at Roger and sees the sympathy in his eyes. He furrows his eyebrows in confusion before picking up the file.

His breath hitches in his throat.

Couple kidnapped and held for four days. Woman shot execution style with evidence of repeated sexual assault. Male beaten brutally with traces of narcotics in his system.

He can’t breath. He tries but he can’t seem to make his lungs work. He starts to hyperventilate. He can hear Roger saying his name but he can’t focus enough to respond. He’s back. It’s been four years and there has been no cases with even a similar M.O. He is aware that he is having a panic attack but he can’t bring himself to even try and match Roger’s breathing. His inner elbow itches.

No.

It would make things easier. No dealing with the pain.

No. No. No. I won’t do it. Not again.

It’s only once. You want to. You’re weak.

No. I’ve come so far, I will not give it up.

Then how about the blade? Just like when you were fourteen. Weak little Spencer Reid. You’re pathetic.

NO!

He doesn’t remember passing out.

He wakes up with Roger standing over him. He apologizes and Spencer reassures him that he is fine. He wants to work the case. No, not wants, needs to work the case. Roger refuses. But he knows the case better than anyone. They argue for a while. In the end Spencer wins (he always wins).

Roger informs him that a team of profilers from the FBI is coming to help solve the case. The killer wasn’t dormant, he went to the United States and continued killing there. Same M.O. Only last week did he return to the U.K.

“The FBI has worked this case and they want to continue working it,” Roger explains.

Spencer nods and walks back to his desk. He starts going over the file and victims. He realizes that his name isn’t listed. The victims start with his first kill in the U.S. He feels relief at the fact. He studies the file for a few more hours before Roger tells him to call it a night. They walk to the car together and head home.

The next day the FBI team arrives. The Behavioral Analysis Unit. Spencer has heard of them, he even studied some of their cases when he first started profiling. They walk in and go straight to Roger, completely ignoring Spencer. He’s not surprised. Strangers never seem to realize that he actually works here. He doesn’t exactly have a sign over his head that reads “I have an IQ of 187 and have five PhDs. I also have an eidetic memory and can read 20,000 words per minute.”

Roger greets them and introduces them to Spencer.

“This is Dr. Spencer Reid, he’s my lead on the case and my second in command. If I’m not available, anything he says goes.” The team all wears various expressions of shock.

A white male with dark hair, who Spencer assumes is the leader, breaks first and introduces himself and the rest of them. “I’m Agent Hotchner, these are SSAs Rossi, Morgan, Jareau, Greenaway, and Prentiss and our technical analyst Penelope Garcia.” He holds out his hand and Spencer hesitates.

“Oh uh I don’t shake hands.” Roger snorts fondly while the team all assumes the Dr. to be a pretentious asshole (he isn’t) (most of the time). They were all led to the conference room which Spencer has already set up. There are two maps on the walls, one of England and the other of the U.S. There are tacks placed at the places where all the victims were held.

The FBI has been here for three weeks and are no closer to catching the killer. Two other couples have been taken. Spencer never goes to the crime scene. He is barely holding it together, the itch on his arm getting stronger as he clutches his sobriety coin, he can’t bear to look at the scene that is almost identical to the one he found himself in four years ago. Of course the team doesn’t know this. They all think that he doesn’t have the guts to do the job. They often find themselves discussing the young man’s incompetence and how if he can’t handle the case then he shouldn’t work it. They always stop the conversation when he walks in though. One day however, they don’t hear his approaching footsteps as they make fun of him.

“How old is he? 15? The kid is too damn young to be working a job like this.” Morgan pops a peanut in his mouth after speaking.

“He probably fucked his way into his position,” JJ says.

“I mean the way he handles the files. He can’t even look at the pictures. He looks like a baby watching a horror movie,” Prentiss laughs.

“I still don’t understand. Who let him in here? This isn’t a daycare or a kindergarten.” All three agents laugh at JJ’s comment before a voice shuts them up.

“You don’t know me.” Their heads snap up to see the man in question standing in the doorway. “You have no right to judge me.” The glare he is giving them is scarier than Hotch’s.

“Kid we-” That draws the line.

“I’m not a kid Agent Morgan. The only people acting like children in this building are you three. You have no idea what I have been through. I’m sure you wouldn’t even be able to handle a fraction of the shit show that is my life.” His breathing is heavy and his voice is rising along with his temper.

“We’re sorry it’s just that you’re so young. We didn’t think-” Spencer cuts Prentiss off.

“Exactly. You didn’t think did you? Well let me enlighten you. I was brutally bullied since I was eight. My father left me and my paranoid schizophrenic mother when I was ten. I had to work to pay the bills and to be able to have a meal at least once a day. Then I went to college and things got better right? Not really since I still had no friends so I decided self harm was the way to go. Oh and my mother died when I was sixteen. The only person who ever gave a shit about me, killed herself. I came home one day and she was lying on the ground with an empty bottle of pills next to her. I packed up and left because I refused to go with my father or go into foster care. Do you think my life got better after that?” He waits to see if they will answer. They don’t.

“Well for a while it did. I met the love of my life and we were going to get married. And then we were kidnapped. I was tied to a chair and drugged regularly as I watched my fiancée get raped. Then the psychopath put a gun to her head and shot her in front of me. I watched as the blood pooled around her body and I kept wishing that he had killed me as well. I kept doing drugs. Believe it or not, four days of getting shot up with dilaudid made me an addict. It took me a year to be able to get clean. And when I finally thought it was over a file got dropped on my desk. He was back. The reason for my nightmares, the man my therapist keeps trying to make me forget, was back,” he paused and took a deep breath. “So I’m sorry agents if I can’t go and examine the scene. I’m sorry that I get a little jittery when looking at the case files. But don’t you ever accuse me of not being able to do my job. I’m damn well good at what I do, despite my age. Yes I am only twenty-four but you three have made it quite clear that I am much more mature and capable of doing this job than you are.” With that he turns around, only to come face to face with Roger. He nods at him, a sign that he can leave. Spencer walks out of the conference room and toward the elevator. He gets in, waits for the doors to close and bursts into tears.

Back in the conference room Morgan, Jareau, and Prentiss are faced with an angry Unit Chief and a fuming Director.

“I want you out of here,” Roger looks at the three agents before turning back to Hotch. “I will not allow you to continue working this case with us unless they leave right now. They should get suspended for the trouble they have caused. Dr. Reid is one of Interpol’s greatest assets and I will not tolerate three strangers who got here three weeks ago to stand here and insult him. So Agent Hotchner unless they are sent home, your team is no longer welcomed here. And I will make sure to report this to your Section Chief and the FBI Director.” Roger walks out of the room and goes after his son.

Hotch turns back to his team and none of them think they have ever seen him look as angry as he does that very moment. “Prentiss, Morgan, Jareau, pack your bags, you're leaving. You’re suspended two weeks without pay, effective immediately. After your suspension is over you’ll have a meeting with the director to discuss your future at the Bureau. If it were up to me the three of you would be fired, but sadly it isn’t. You have shamed and dishonored the reputation of the Bureau and frankly I wouldn’t be surprised if Interpol severed ties with us. Now I am going to apologize to Dr. Reid and Roger and I hope to see you gone by the time I come back. I do not want to hear another word out of you unless it is an apology.” Hotch leaves the room but not before sending them one last glare. Rossi, Elle, and Garcia all look at them and follow after Hotch. To say they are disgusted by their teammates’ behavior is an understatement.

Spencer is inside his car, sniffling and trying to get himself together. He doesn’t know what came over him inside the conference room but all the stress from the past three weeks took a toll on him and he found the perfect outlet to release it. A knock on his window startles him. Roger smiles before opening the door and sitting in the passenger seat. They sit in silence for a while, neither of them sure how to approach the conversation.

“You’re not in any trouble,” Roger starts. “If you hadn’t yelled at them son, I was going to and we both know how that would have ended up.” They both chuckle and fall into a comfortable silence.

“Do you think we’ll catch him?” Spencer speaks up.

“With you working the case? There is no doubt in my mind.”

They do catch him. Two weeks later Spencer is standing in an abandoned warehouse in front of the unsub with his revolver raised. The man, Tommy Montgomery, had his gun at the woman’s head, a sick smile on his lips.

“I remember you,” Montgomery exclaimed. “I killed your fiancée four years ago, didn’t I?”

Spencer could kill him right now. “Put the gun down. You don’t have to do this. We can help you if you just put the gun down.” Spencer recites the speech that he has said dozens of times to dozens of criminals.

“Help me?” the man laughed. “You don’t want to help me. You want me to rot in a cell for the rest of my life. We both know there is only one way this can end.” Montgomery raises his gun at Spencer but he isn’t fast enough.

Spencer unloads three rounds straight to his heart. He lowers his weapon and rushes over to him. He places two fingers above his collarbone--he will never admit that nothing brought him greater joy than realizing that he had no pulse. He goes to untie the male victim as paramedics rush inside. Roger walks over to Spencer once they are outside and pulls him into a hug.

“It’s over son.”

Spencer cries and clings onto him as sobs rack his body. He separates himself and takes a few calming breaths. He walks over to the BAU team, which now only consists of three members and their tech analyst. He thanks them profusely and the three of them reassure him that he has nothing to thank them for. Hotch looks at the young genius for a second before making an offer.

“You know we have three spots open on our team now. If you want to, you are always welcomed at the FBI.”

“Oh,” he doesn’t know what to think. He hasn’t gone back since he was sixteen. Was he ready? “Thank you really. I’m not sure I’m ready to go back to the states at this moment but maybe in a few months or years, if you’ll still have me, I’ll gladly join you.” Spencer holds out his hand and Hotch laughs before taking it and giving it a firm shake.

“Good luck Dr. Reid.”

“You too.”

. . .

Five months later Spencer goes back to Oxford. He’s doing better. His cravings don't come as often and when he looks in the mirror, he isn’t ashamed or disgusted at what he sees. His therapist only requests to see him once a week now and Roger doesn’t hover over him at work.

He stands in the cemetery next to the church he was going to be wed at. He walks across the wet grass, scrunching his face at the squishing noises his shoes make. He faces Maeve’s grave and a shaky breath leaves his lips. He sits down next to the tombstone and starts talking. He tells her about everything that happened in the past months and how he finally avenged her death. He tells her about his progress and how his mental health has improved so much since he last talked to her. He sits there for hours during the day and well into the night until he runs out of things to say.

“You would be so proud of me sweetheart. But now to what I actually came here to say. I came to say goodbye.” He takes a deep breath as a few tears roll down his cheeks. “I will love you forever and I will keep missing you every single day. But it is time that I move on. I need to find happiness and maybe that happiness isn’t here. I ran away when I was sixteen and I don’t want to run away anymore. So this may be the last time in a while that I come and talk to you. I love you Maeve Reid, to the moon and back.” Spencer stands up and places the ring he was going to wear for the rest of his life on top of the tombstone. He walks away as he takes out his phone and dials a number he never thought he would actually call. It rings for a few seconds before a familiar voice comes through the receiver.

“Hotchner.”

“Does the offer still stand?”

#tw rape#tw self harm#tw drugs#Spencer reid#aaron hotchner#jenifer jareau#emily prentiss#elle greenaway#derek morgan#penelope garcia#david rossi#spencer reid x reader#spencer reid x oc#spencer reid imagine#spencer reid au#hotch x reader#criminal minds#cm#bau#bau fic#bau x reader#mgg#mgg x reader#mgg blurb#mgg fanfiction#spencer reid angst#criminal minds au#criminal minds gen fic

99 notes

·

View notes

Text

Doctors and Their Patients in Los Angeles Unite Against Health Net Over Denying Claims

Joining forces in order to Health Net, doctors from Los Angeles and two patients will now file a lawsuit against one of Centene Corporation’s known subsidiaries.

Overview

In order to be able to sue its target, a Los Angeles group representing a number of doctors have joined forces with two patients on suing Health Net for the accusations of it denying claims solely based on the insurer’s definition of “medical necessity”, according to a news article report posted by Reuters.

Lawsuit Details

The original lawsuit was filed in the Los Angeles Superior Court office in 2012, accusing the defendant Health Net of unfair and unlawful business practices. The aim of the lawsuit is to prevent Health Net and other similar companies from using the excuse of “medical necessity” as a way for them to deny medical assistance.

It has been also added that the health insurance company has denied the claims of the patient members due to it “being expensive”, which was confirmed by Rocky Delgadillo, the chief executive of Los Angeles County Medical Association.

Delgadillo has added that this kind of lawsuit is groundbreaking in the medical insurance industry, wherein he stated that this kind of issue shows that companies like Health Net and its parent company Centene Corporation will prioritize profits ahead of its customers, regardless of their current situation.

He added that the actions of Health Net in the said issue show that it is dictating on what medical care to provide to its members. The decision of which medical treatment is necessary for a patient and which one will cover it should be done by a doctor and not by a businessman, he said.

Response of Health Net

As a response to the accusations being thrown at them, the management of Health Net gave a statement in regards to it, saying that the current medical care today is a complex system, wherein there would be different medical opinions as to what constitutes as necessary medical care.

They’ve added that they have followed the guidelines when it comes to medical care, which has been established by the state of California’s two regulators, namely the Department of Managed Health Care (MHC) and the Department of Insurance, respectively.

Plaintiff’s Statements Over The Issue

To provide evidence and statement against Health Net, one of the plaintiffs of the said lawsuit by the name of Robert Mendoza, a 59-year old resident from Monrovia living in Los Angeles. Unfortunately for him, he was diagnosed with a rare type of prostate cancer. His doctor told him that he needs a specialized form of surgery, as cancer he had was very rare, as it can only occur within 60 worldwide.

In regards to the issue, he stated that he was forced to raise $30,000 from his funds meant to be used for paying income taxes and some from her wife’s life insurance policy since Health Net denied the claims of Mendoza.

It looks like prostate cancer (and its variants) is not a “necessary medical care” to them, apparently. Mendoza added that he felt that he was deceived by Health Net when his claims weren’t approved by their management, since he was a long-time member of the said company, starting from 1990. After his surgery that he paid out from his pocket and with some assistance from her wife’s life insurance policy, Mendoza was cancer-free a year later.

Another Plaintiff by the name of Kalana Penner has also given out a statement in regards to Health Net’s lack of action and care when it comes to its own patients who are in need of using their own plans & services. In Penner’s case, her request for a permanent device that can help her cope with her debilitating back, neck, and head pain was declined by Health Net. However, that decision was reversed in 2011 after the California Department of Insurance ruled out that Penner’s request should be covered.

2 notes

·

View notes

Note

maybe? 👉👈 steve taking a really long time with college (like on one year and off one yours year, on, off, on, off) and he still doesn't really know what he wants to do and he gets really frustrated bc billy just did college all in one go and steve is taking forever and he feels down on himself? idk im feeling the whump rn???

Steve had left high school having no idea what he wanted from the rest of his life.

That’s not true, he had some idea.

He knew he wanted to leave Hawkins, follow Billy wherever he was going. He knew he wanted to be with Billy for the rest of his life, he knew he wanted to leave the past behind and make new friends, people who were kind, and fun, and didn’t bat an eye when Billy pulled him into his lap.

But that’s about it.

So when Billy graduates high school, and gets a full ride to UC Berkeley, and they move into a cheap apartment in downtown Oakland, Steve is so happy that he got out.

He gets a job waiting tables at a restaurant down the street, pays half the rent and buys the groceries while Billy’s in class.

But then two years pass, and Billy’s soaring through college, working to his degrees, plural, because he just couldn’t decide between studying English Literature or Biology with a focus in research.

So he’s majoring in both and getting a minor in Italian because then I’ll know what you’re sayin’ when you start horny babblin’.

And Steve was at the same restaurant.

True, he was assistant manager now, and it came with a pretty okay raise, and he even gets dental insurance, but he feels so stuck.

So he enrolls in community college.

He starts with some general classes, still completely unsure of what he wants to study.

Billy said it was okay to just rule out things you don’t want to study, to nearly fail a math course and know that accounting is not for you.

So when Steve finishes his first year, he at least knows what he doesn’t want to pursue.

Meanwhile Billy has an internship at a lab through Kaiser Permanente. And he can read and write Italian than Steve can.

Steve is walking home from his job at the restaurant when it happens. He’s crossing the street, and gets hit by a car.

He’s taken to the hospital, where he’s informed of a fractured spine and another concussion.

He’s told his injury could’ve been much more severe, that he will not experience paralysis, but he needs physical therapy and walking will be difficult for a while.

Their finances take a big hit.

Billy’s internship doesn’t pay super well, and with Steve being unable to work for the foreseeable future, he’s fired.

Billy has insurance through the school, but because on paper, he and Steve have no real relation, Steve’s medical bills come out of pocket.

So Steve is bedridden for months. He can’t work or get groceries, or do fucking anything but lay there.

They can’t afford physical therapy.

But Billy has a friend studying to be a PT, and she comes over every Saturday, and practices her technique on him in exchange for ten bucks and a few beers.

And so the money Steve tucked away for school is rapidly diminishing.

By the time Billy graduates, Steve is a year into recovery. He still gets dizzy at odd intervals, and his back gets stiff when it rains, but Billy gets a job right away, doing research on flu vaccines.

And Steve goes back to work.

He gets a desk job, something he won’t have to be on his feet all day for. He works reception for a message therapist, which comes with free massages, which work wonders on his back.

So in the fall, he decides to give his education another shot.

He learns that history is not for him, and that his nutrition course was fine until they began looking into how the body processes nutrients, and he was fucking lost. He takes a few business classes, thinking, hoping genetics would take over and this is something he could do.

But his dad was right to take away the job opportunity at his own firm. Steve was not cut out for this.

After a year of research, Billy is promoted three times. He ends up working on some extremely important study that Steve does not understand for the fucking life of him.

But he sits and listens every time Billy explains what he did that day, even though Steve gets so sad when Billy mentions having to kill the lab mice to study their bodies.

So Steve is two years into community college, five years into living in Oakland with Billy, and he still is lost.

He takes a semester off, working more hours, trying to save up some money.

Because Billy is beginning to think about grad school, and that shit’s not cheap.

But Billy decides to postpone that, work for a few more years, and besides, he’s caught between studying something to put him in a research field, or just straight up going to medical school to study infectious disease.

Because Billy could. He’s smart enough for medical school, smart enough to research and be a doctor.

And Steve has a smushy spine and half a degree in nothing.

A semester off turns into a year.

A year and a semester.

Two years.

They’ve been in California for seven years, and Billy gets into grad school in San Diego. They move south and Billy spends late nights pursuing a Masters in Immunology.

And Steve works the front desk at a pediatrician’s office.

He’s flipping through a course catalog from the San Diego Community College when Billy comes home from his new job, the position he got after applying to only three labs.

He kissed the top of Steve’s head, moving to grab himself a beer from the fridge.

“You thinkin’ of going back?”

“I don’t know.” Steve slid the catalog closed. “Is it even worth it?”

“That’s something you have to decide.” Billy sat down, sliding the catalog towards him. Steve had crossed off the classes he had already taken, the ones he new he wouldn’t like. “And you know, going to school isn’t the only option. You could get an apprenticeship, master a trade.”

“I can’t do anything where I need to bend over for really any length of time. So that rules out plumber, and car mechanic, and anything physical like construction, or landscaping or even general contracting is right out.”

Steve could feel the old shame, the doubt and the self hatred crawling up his spine.

“I have nothing to offer. I have no discerning skills, and in seven years I’ve only made it through two years of goddamn community college, and here you are, ripping through grad school like a fourth degree is easy.”

“Stevie, you’ve got a lot to offer. We just gotta find something that suits you.” He took Steve’s pen, turning to the back page of the catalog. “Okay, we’re gonna write down all of you strengths, and think of career paths that could fit those. I’ll go first, you’re extremely caring. You’d be good at any career where you care for people.”