#Finance Revolution

Text

Mastering the Art of Wealth: Sigzen Technologies Redefines Accounting and Finance with ERPNext

In the fast-paced world of modern business, where every transaction counts and financial mastery is key, Sigzen Technologies emerges as a trailblazer, transforming conventional approaches to accounting and finance. As a leading service provider, Sigzen Technologies understands the intricate demands of contemporary businesses, and their integration of ERPNext represents a paradigm shift in how…

View On WordPress

#Accounting Insights#Accounting Revolution#ERPNext System#Finance Mastery#Finance Revolution#Financial Strategies#Financial Success

0 notes

Text

According to a study by BusinessDIT, 90% of the brands worldwide are investing in AI, and 83% strongly believe that AI will help them maintain or gain competitive edge.

From enabling personalized financial services to optimized store layouts in retail industry, AI is revolutionizing various sectors across industries.

Our recent blog unveils how AI is transforming industries like finance, retail, healthcare, manufacturing, and retail.

#ai#finance revolution#retail tech#healthcare ai#manufacturing automation#marketing ai#ai innovation

0 notes

Text

Betty looks elegant in this pose. New Frev-Betty dropped! I like this picture so much!

33 notes

·

View notes

Text

BE ALERT!!! 👇👇👇💯💯

Imagine a future where the central bank holds all the power and control over our financial transactions.

This is the reality that could come with the introduction of a Central Bank Digital Currency (CBDC). Unlike traditional forms of money, a CBDC would give the central bank absolute authority over the rules and regulations that dictate its use. This means that the government would have unprecedented control over our financial activity, which could have dire consequences for our freedom.

One of the biggest concerns with a CBDC is its potential threat to privacy. With the ability to track every transaction and gather vast amounts of data, the government would have endless opportunities to monitor and control citizen's financial activity. This level of surveillance could be used to target political opponents and suppress dissent. The mere thought of a government having such power should raise alarm bells for anyone who values their freedom and privacy.

Furthermore, a CBDC could be easily weaponized against those who oppose the government’s agenda. By controlling access to funds and monitoring transactions, the government could effectively silence dissenting voices and stifle any opposition. This would create a chilling effect on free speech and undermine the very foundations of FREEDOM

It is crucial that we carefully consider the implications it could have on our freedom and privacy. The power that a central bank would wield with a CBDC is unprecedented, and we must ensure that safeguards are in place to protect our rights and liberties. The future of CBDC should not come at the expense of our fundamental freedoms. Congress should prohibit the Fed and Treasury from issuing such. CBDCs have no place in the American economy.

Move your funds into the Quantum Ledger Account and be safe from government agendist. We can be reached via email (check bio for email) or a DM away.

# EyesOpenAmerica

#bad government#bad omens#breaking news#donald trump#bank of america#wells fargo#world news#bank clash#chase bank#bank crash#world bank#new york#currency#decentralisation#decentralised finance#education#educate yourself#reeducate yourself#rebel#carbal#biden#joe biden#democrats#democracy#washington dc#white house#stay woke#qfs#quantum financial system#socialist revolution

31 notes

·

View notes

Text

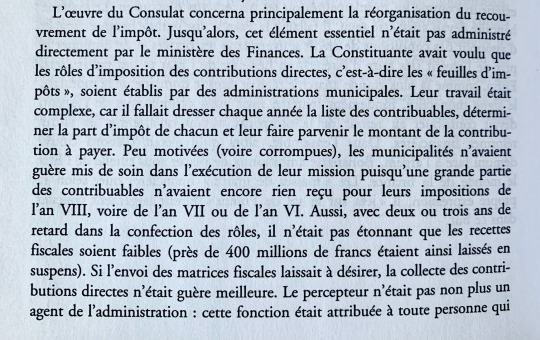

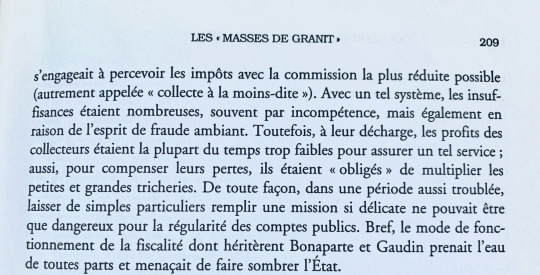

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda.

This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

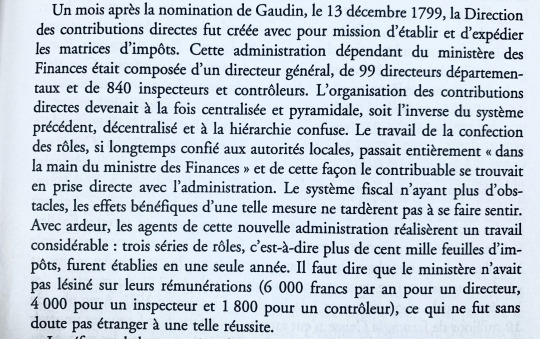

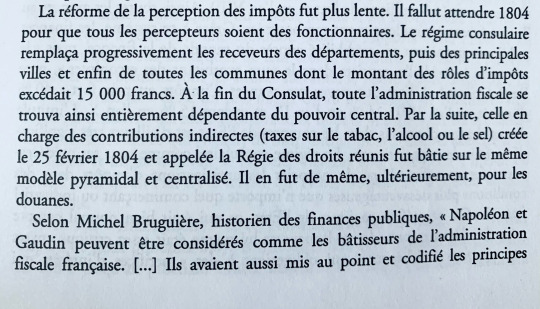

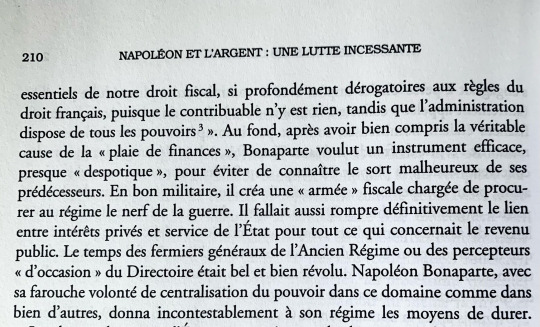

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

French:

Page 208

Page 209

Page 210

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection system#taxation#law#napoleonic code#source#french history#branda#Pierre branda

36 notes

·

View notes

Text

Financial Sovereignty: How Bitcoin and DeFi Empower Individuals

Introduction: Defining Financial Sovereignty

In today’s world, financial sovereignty is increasingly becoming a priority. Financial sovereignty is the ability to fully control one’s financial assets and decisions without interference from external entities. In the face of rising inflation, unpredictable bank policies, and growing government interventions, this concept has gained importance. With innovations like Bitcoin and decentralized finance (DeFi), individuals can now take significant steps toward gaining control over their financial futures.

The Current Financial System’s Limitations

The traditional financial system, despite its familiarity and pervasiveness, has significant limitations. Banks often impose excessive fees, impose arbitrary limits on transactions, and face inherent risks of collapse. Government monetary policies, such as quantitative easing, can lead to inflation and devaluation of the currency, eroding people’s savings. Such vulnerabilities can leave individuals without the ability to protect their wealth.

Bitcoin as a Path to Financial Sovereignty

Bitcoin provides a decentralized alternative that empowers individuals to regain control over their finances. With its limited supply and borderless transactions, Bitcoin is designed to resist inflation, censorship, and external manipulation. It operates on a peer-to-peer network, meaning no central authority controls its value or distribution. Its properties offer a means for anyone to hold and transfer wealth securely, regardless of government regulations or the stability of the banking system.

Decentralized Finance (DeFi) as an Alternative Financial System

Decentralized finance takes the concept of financial sovereignty even further. By leveraging blockchain technology, DeFi platforms offer a new financial system without traditional intermediaries. Individuals can participate in borrowing, lending, and trading directly with others, often at lower fees than banks. DeFi’s trustless protocols enable a broader range of financial activities without requiring centralized permission.

Becoming Your Own Bank: Practical Steps to Financial Independence

So how does one achieve financial sovereignty? Here are some practical steps:

Research and Educate: Learn about Bitcoin and DeFi to understand their benefits, risks, and how to safely participate.

Set up a Bitcoin Wallet: Create a secure, non-custodial Bitcoin wallet to hold your cryptocurrency.

Diversify Investments: Develop a strategy that may include holding Bitcoin alongside other assets or investing in a diverse portfolio of DeFi tokens.

Explore DeFi Platforms: Carefully explore decentralized lending, borrowing, and yield-earning opportunities.

Case Studies: Real-World Examples

Individuals and even countries have found financial sovereignty through Bitcoin and DeFi. In Venezuela, where hyperinflation rendered the local currency nearly worthless, many turned to Bitcoin as a stable store of value. In El Salvador, Bitcoin adoption aimed to provide financial inclusion for the unbanked. These examples highlight how Bitcoin and DeFi can offer meaningful protection against monetary instability.

Conclusion: Taking Control of Your Financial Future

In a world where economic uncertainty prevails, financial sovereignty is an invaluable goal. Bitcoin and DeFi provide unique opportunities for individuals to protect their wealth and make independent financial decisions. By becoming educated and carefully engaging with these technologies, anyone can become their own bank and secure their financial future.

For those interested in this journey, take the next step by continuing to research, asking questions, and exploring the potential of decentralized finance. Your financial future is worth the effort.

#bitcoin#financial empowerment#financial freedom#financial planning#finance#financial education#bitcoin revolution

2 notes

·

View notes

Text

OKAY BUT CLOCKWORK REVOLUTION LOOKS SO FUCKING GOOD???? It's giving me hella Bioshock Infinite vibes and I'm so down for that.

12 notes

·

View notes

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals.

Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support.

Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere.

Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels.

Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

3 notes

·

View notes

Text

“Only fools, pure theorists, or apprentices fail to take public opinion into account.”

Jacques Necker was a Genevan banker and statesman who served as finance minister for Louis XVI. He was a reformer, but his innovations sometimes caused great discontent.

Born: 30 September 1732, Geneva, Switzerland

Died: 9 April 1804, Geneva, Switzerland

Swiss Origins: Necker was born in Geneva, Switzerland, in 1732. His Swiss background made him a foreigner in the French political landscape, and this sometimes influenced the perception of his policies.

Self-Financed Publication: Necker was known for his publication titled "Compte Rendu," or "Report on the Finances." This document, which detailed the state of France's finances, was unique in that Necker personally financed its publication. This move aimed to showcase transparency and gain public support.

Resignation through Illness: In 1781, Necker resigned from his position as Finance Minister, citing health reasons. His resignation was accepted, but he continued to influence French politics from behind the scenes. He was later recalled to office in 1788.

Criticized by Revolutionaries: Despite being initially celebrated for his efforts to improve financial transparency, Necker faced criticism from revolutionary figures like Maximilien Robespierre. They accused him of being too sympathetic to the monarchy and not fully supporting the revolutionary cause.

Exile in Switzerland: After the fall of the Bastille in 1789 and the escalation of the French Revolution, Necker resigned once again. Fearing for his safety, he sought refuge in Switzerland. His departure marked the end of his active political career.

#Jacques Necker#French Revolution#Finance Minister#Louis XVI#Economic Reforms#Enlightenment#Transparency in Government#Swiss Banker#Statesman#Political Reform#Public Finances#1789 Crisis#National Assembly#Royal Finances#Dismissal from Office#Necker Reports#French Monarchy#Social Unrest#Financial Management#Legacy of Jacques Necker#quoteoftheday#today on tumblr

1 note

·

View note

Text

The Revolution of Decentralized Finance (DeFi)

Hey friends! 🌐 Check out this eye-opening blog on the game-changing #DeFi revolution, featuring current benefits and exciting future directions. Explore #financialinclusion, #privacy, #governance, and more in the future of finance! 🚀

In the rapidly evolving landscape of the financial world, a disruptive force has emerged, challenging traditional banking systems and revolutionizing how we handle money. Decentralized Finance, commonly known as DeFi, is an innovative concept built on blockchain technology that empowers individuals with greater financial autonomy, transparency, and inclusivity. In this blog, we will explore the…

View On WordPress

#accessibility#Benefits of DeFi#Borderless Transactions#Borrowing#compliance#Control#Cross-Chain DeFi#decentralized finance#Decentralized Identity#Decentralized Lending#DeFi#DeID#Financial Inclusion#Financial Revolution#Future of DeFi#Governance Improvements#Green DeFi#Innovation#Insurance#Interoperability#Liquidity#ownership#Privacy Solutions#Programmable Smart Contracts#Real-World Asset Integration#regulation#Risk Mitigation#scalability#Security#Sustainability

3 notes

·

View notes

Text

Faerie Tale Theatre Reviews: The Emperor’s New Clothes

“The people care not one whit for the inner workings of government. They only care that I look the part. If I’m to appear as a slovenly, disheveled ragamuffin, the subjects would assume that I am as common and ordinary as they are and unfit to rule this vast kingdom. No, they want to look up to me. They need to admire me. They demand I oppress them! And I shall.”– The Emperor’s raison d’etre that…

View On WordPress

#1980&039;s#80&039;s fantasy#80s#80s television#Alan Arkin#Art Carney#Barrie Ingham#Clive Revill#comedian#con men#dandy#Dick Shawn#emperor#Faerie Tale Theatre#faerie tale theatre reviews#fashion#French Revolution#Georgia Brown#hans christian andersen#minister of finance#Peter Medak#prime minister#review#review series#shelley duvall#swindlers#television review#the emperor&039;s new clothes#the king&039;s new clothes#Timothy Dalton

4 notes

·

View notes

Link

Descent into darkness and isolation

#British#Anglo-American establishment#hegemony#imperialism#neocolonialism#colour revolutions#regime change#assassination#terrorism#sanctions#finance#hypocrisy#lawlessness#wars#genocide#unaccountability

1 note

·

View note

Text

Happy Birthday, Carnot!

#lazare carnot#claude antoine prieur#betty from finance#frev#french revolution#the csp#shitpost#my awful art

16 notes

·

View notes

Text

Don't keep quiet as they have keep deceiving us that everything is fine, everything is not fine no matter what, the bank and exchanges will still crash and all money in there will be lost forever and nothing we can do about it but only Quantum Financial System (QFS) will save the world with the biggest reserve as it's backed up by digital gold and silver known as the ISO 20022 stellar XLM silver and ripple XRP gold and backed by precious gold 🥇 and silver 🥈 well secured on the stellar Blockchain technology and being guided 🔐 by Quantum stellar initiative QSI.

I hope everyone have started stocking up on this recommended currency as it's going to take over the fiat $ currency and become the world 🌍 currency used for future transactions paying bills and others trading, the whole world will be using one currency and all evil will be getting rid off dept and mortgages will be cleared from everyone as the new system will save the world and NESARA GESARA retirement payouts will be paid to all QFS users as well...we can be reached via email (check bio for email) or a dm away.

#EyesOpenAmerica

#GESARANESARA #FinancialRevolution #NESARA #QFS #Decentralized #XRP #GESARA

#breaking news#bank of america#wells fargo#donald trump#democracy#democrats#republicans#new york#currency#world news#education#educate yourself#reeducation#reeducate yourself#quantum financial system#qfs#decentralised finance#white house#washington dc#be aware#stay woke#socialist revolution#bank clash#bank crash#chase bank#business#community#bad government#bad omens#carbal

13 notes

·

View notes

Text

The Rise of Digital Wallets: Transforming Transactions in India

0 notes

Text

India's AI Revolution: Powering Change & Innovation

What do you think about India's AI revolution? Share your thoughts and questions below!

India’s tech world is buzzing with excitement, and it’s all about Artificial Intelligence (AI). This powerful technology is changing everything around us. Imagine robots delivering your food, or smart software helping doctors and teachers do their jobs better. AI revolution in India is making this happen right now! This article isn’t just about the cool tech stuff, though. It’s also about the…

View On WordPress

#AI education India#AI finance India#AI government India#AI healthcare India#AI in India#AI revolution in India#India AI innovations

0 notes