Text

Christmas Exclusive Gifts!

Merry Christmas Everyone!

I have got a special gift. It will consist of 500 coupons and gift voucher. Only the first 500 people following this blog and commenting here will get it.

More details will be available at 31 December.

For now follow us, mention your friends and family. Don't forget to share this as much as you can.

#free gift#gift#free coupon#free money#voucher#reach#viral#viralpage#viral video#make this go viral#make this happen#make this blow up

10 notes

·

View notes

Text

Get Great Credit Score Without Any Credit Card!

To get a credit card you must have a credit score. But you can’t have credit score without a credit card!

It might sound insane but it is real. However, getting a credit score without a credit card is not impossible anymore. Follow the below steps to get a great credit score in no time

Take a easy to get loan like personal loan, student loan, car loan. Then repay your debt fully without breaking any policy.

Be an Authorized user of a credit card and use it responsibly.

Always Pay your rent and utility bills in time.

Get a credit builder card.

Use any sort of credit responsibly.

There are many things to consider. Please read the original article on Build Credit Score without a credit card to find out.

#credit#credit repair#credit cards#credit rating#credit growth#credit score#personal finance tips#personal finance#personal growth#financial freedom#financial planning

11 notes

·

View notes

Text

Easiest Way to Open Bank Account Without Any ID

We all know opening a bank account is impossible without a valid government ID. But what if I tell you a secret?

With some tricks, you can open a bank account without any ID. Ahh you might be thinking that I am talking about online banks.

No, I am talking about legit renowned banks. Such as

Bank Of America

Capital One

Charles Schwab and

Citibank

So how do you do it?

Read the entire article on Free Bank Account Without Id to find out about the rest of the steps.

#bank#online banking#free bank account online#open banking#personal finance tips#personal finance#financial planning#personal growth#financial freedom#finanças

1 note

·

View note

Text

5 Amazing Ways to Avoid Paying Credit Card Interest

Like other loans, the money you spend using your credit card also comes with an interest. Generally, it is known as credit card APR.

Here are 5 simple ways to avoid credit card interest

Always Pay your credit card bill on time.

Properly utilize your grace period.

If your credit card has an interest saving balance or similar feature then pay the minimum balance to avoid purchase APR.

Utilize Introductory purchase apr.

Do not use your credit card for Cash Advances and Balance Transfer.

Read the original article here for more tricks on avoiding credit card interest

2 notes

·

View notes

Text

Get Rich Blogging- Complete Guideline In 2022

Though blogging is not as profitable as it used to be back in the day. Nevertheless, if you have great writing skills and vast knowledge of a particular sector then you can still be a millionaire by blogging.

Here is how to earn millions from a blog

Premium Advertisement

High Quality Affiliate Programs

Selling SaaS and Luxury Products

Read the complete guideline here How to become a Millionaire Blogger

#get rich#personal finance tips#personalgrowth#personal finance#earn money online#earn extra money#make money online#make money now#make money tips

0 notes

Text

Save A Ton In Retirement

Renting an apartment in retirement can be a bit complicated but it’s doable. Here is how to rent an apartment if you are retired

Show Your Bank Statement

Exhibit Your Assets and Credit Score

Present a Guarantor

Offer Advance Rent

Convince Your Landlord

To read the full process please visit the original article at How To Rent An Apartment In Retirement

#retirement#retiree finances#retirementplanning#retirerich#retireearly#personal finance tips#personal finance#personalgrowth#financial feasibility#financial planning#financial freedom

1 note

·

View note

Text

Reddit Can Make You Rich- Find Out Now

Do people make money on Reddit?

Yes, a lot of people earn actual bucks from Reddit. So how do you do it and where to find the jobs at?

1. Make Money On Reddit Without skills

Writing short reviews

Participating in surveys

Selling gift cards

Get paid to post on Reddit

Opening accounts on certain platforms

Data entry

Ad view and clicking tasks

2. Make Money On Reddit With Skills

Programming

Designing or visual effects

Writing

Proofreading

Online Tutoring

Web Designing

Virtual Assistant

Digital Marketing

3. Earn Passive Income From Reddit

Affiliate programs

Selling stuff on Etsy tips

Investment ideas and insights

Online Course making tips

Selling photographs or paintings

Flipping retail products

Read the original article on Make money on reddit to find out where to find these jobs and some tricks to earn extra.

#earn extra money#make money now#make money tips#passiveincome#personal finance tips#personal finance#personalgrowth#earn money online#make money online

1 note

·

View note

Text

3 Ways Grow Your Money Like Never Before

Apart from your emergency fund, you have some sort of savings stacked up in a bank account or in your hand. But the problem is

If your money is not growing, then it’s decreasing its value.

Because according to research every year our money loses 3-8% of its value due to inflation. So, keeping your money in a regular savings account is not the wisest idea.

Here are some ways to make your money work for you

Open High yield-savings Account

Invest In Mutual Funds, Stocks, or Bond

Invest In Real Estate

Create a Passive Income Stream

Utilize Credit Card Reward points and Coupons

If you plan and implement properly then your money will grow by itself. However, do not put all your money in one place. Try to diversify your savings by investing it in different places or assets. So, if you start losing money from one, you can recover from another.

Read the in detail original article here Make Your Money Work For You-3 Most Effective strategies

#personal finance tips#personal finance#earn extra money#make money tips#make money now#get rich#personalgrowth

1 note

·

View note

Text

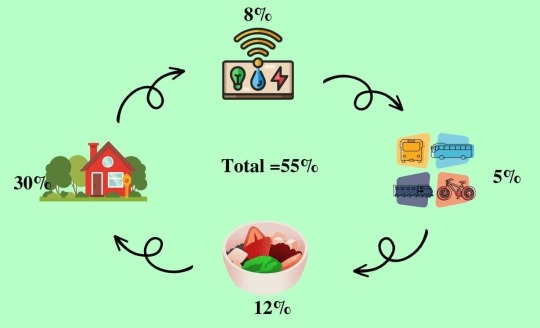

Never Cut Cost On These While Budgeting Or You will Suffer

Having a hard time dealing with the financial situation?

If so then a good budget can bring you some financial stability. However, no matter how rigorous your budget is, you must not ignore four things while budgeting. The are also known as the four walls. But what are they?

Food

Shelter

Utilities

Transportation

You should put at least 50–60% of your budget in these. Find out why you should not cut costs in these four things.

#budget#growth#financial freedom#financial planning#budgeting#personal finance tips#personalgrowth#personal finance

2 notes

·

View notes

Text

Debt Can Make You Rich- Here is how to do it

Using debt to make money might seem like a crazy idea. Because there is a misconception that debts are always bad. However, not all debts are scary.

Moreover, if you can use your efficient debts responsibly then you might as well make some wealth out of it. Well, how to use debt to make money?

Here are 5 exclusive ways to make money out of debt

Use Low-Interest Debt To Pay Off Inefficient Debt

Take Low interest Debt and Invest In Real State

Use Low interest Debt To Acquire or start A trending Business

Utilize Debt To Acquire Skills or Education

Recycle and consolidate debt to make more money.

Read the original article On How To Use Debt To Make Money to find out each point in detail.

#debt#personal finance tips#debt free#make money tips#make money now#personalgrowth#financial freedom#personal finance

1 note

·

View note

Text

5 Tips to Make A Ton of Money From Pinterest

Love spending time on Pinterest? Then why not make it a side hustle?

Yes, you heard it right. You can spend time on your favorite app and also make money. But how do you make money from Pinterest?

Here are a few ideas about how to make money on Pinterest

Firstly, you can use Pinterest to drive traffic to your blog or website and earn money through advertising or affiliate marketing.

Then you can get affiliate links from brands, promote their products and get a good old cut for each product sold by your link.

If you have an e-commerce or DIY shop then you can use Pinterest to drive traffic to your eCommerce website, sell products and make money.

In case you manage to make a lot of followers on Pinterest then you will get sponsors too.

If you are successful on Pinterest then you can sell a Pinterest marketing course and make money from it.

You can manage a Pinterest business account for people and charge for it.

Lastly, you can join the Pinterest Creator Rewards Program to get some bucks.

Read the entire article On Make money From pinterest to find out more effective ideas and tips.

#make money tips#make money now#online income#pinterest#personal finance#personalgrowth#personal finance tips

3 notes

·

View notes

Text

Fired Before Retirement?- Don’t worry, Apply these Methods

Getting fired before retirement is an unfortunate thing. But according to a research

"Around 56 percent of American people aged 50 or more lose their job at least once before retirement."

So, It is not rare at all. At least not in the United States. But what to do if you get fired just before retirement?

If your age is below 60 and you get fired before retirement then you must do these to protect your interests

If you are able to work then look for new employment. Because no matter how much money you have on your hand, it can still be short due to rising inflation.

Apply for unemployment benefits immediately after getting fired before retirement.

Don’t take your pension fund from your employer in cash without consulting a tax accountant or tax attorney. Otherwise, you might end up facing serious tax penalties.

Don’t withdraw lump sum from your 401(k). If you do then you might face tax penalties.

Consult with a financial advisor for the management of your pension fund.

If your healthcare is tied with your employer and you have a family, take advantage of COBRA Health insurance. Otherwise, find a private healthcare solution.

If you are above 62 then

Apply for Social Security Benefits. Though how much you will get depends on your age. But still getting something is better than nothing.

Consult with a tax accountant before withdrawing any money from your 401(k) or pension fund to avoid tax penalties.

Find a financial expert or advisor for managing your retirement fund.

Sign up for Medicare if you are above 65. If not then use COBRA if you have a family. Otherwise, find the most suitable private healthcare solution for you.

For more suggestions and tips read the original article here-https://www.pfwhizz.com/getting-fired-before-retirement/

#retirementplanning#life#personalgrowth#finance#economy#retiree finances#retirement#financial feasibility#personal finance#personal finance tips

0 notes

Text

Incredible Strategy To get Rich With Low Income

Budgeting is the first step towards financial literacy. I know budgeting with a low income can be tough. But you must try. It will not only help you to survive but also bring stability and help you achieve financial freedom.

To Budget On low income you need to

If you do not earn enough to save or then look for passive income opportunities to earn more money.

Avoid restaurants and takeaways at any cost.

Try to cut unnecessary living expenses like going to bars or pubs, gym memberships, and cable bills.

Look for cheaper recreational opportunities and go to the local library, join free events and shows, and spend time in parks.

Avoid using your car as much as you can and shift towards public transportation.

Get rid of all your bad habits which cost money.

Do not spend outside your limit and never go into debt.

For the full article please visit How To Budget Money on Low Income

#tumblr#tumblrlife#tumblrphoto#envywear#PleaseForgiveMe#tumblrphotos#tumblrlove#tumblrpic#tumblrpics#tumblrposts#tumblrpost#perfect#tumblrpicture#tumblrpictures#tumblrthings#tumblrstuff#instatumblr#beautiful#love#tumblrgram#personal finance#budgeting#financial freedom

1 note

·

View note