#retirementplanning

Text

Learn How To Build 8 Income Streams at https://www.8incomeStreams.co

Tag friends who need to see this!

#investmentplan#retirementplans#investmoney#retireyoung#investinginyourself#financialplan#financialgrowth#earlyretirement#moneymatters#retirementplanning#retirementplan#retireearly#moneymanagement#financialadvisor

4 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

youtube

#entreprenuership#retirementplanning#financial freedom#economic integration#economic independence#budget#investing stocks#investingtips#pension#making money#money matters#earn money online#developers & startups#youtube#financial#free money#make money as an affiliate

3 notes

·

View notes

Text

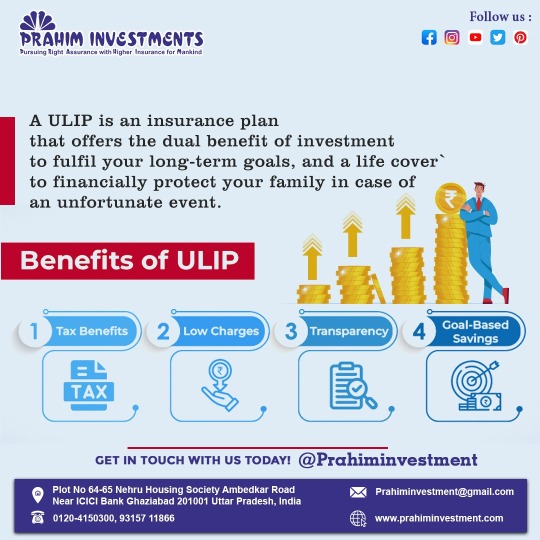

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Kaufman ISD names new superintendent [Video]

#RetirementPlanning#SeniorsFinancialPlanning#SeniorsRetirementPlan#SeniorsRetirementPlanning#UnitedStatesRetirementPlanning#Retirement Planning#Seniors Financial Planning#Seniors Retirement Plan#Seniors Retirement Planning#United States Retirement Planning

2 notes

·

View notes

Text

#finance#money#investing#budgeting#savings#personalfinance#financialplanning#wealthmanagement#retirementplanning#credit#debtfree#financialfreedom#stocks#investments#financialliteracy#moneymanagement#taxes#mortgages#loans#insurance#entrepreneurship#bank

3 notes

·

View notes

Text

#MakeMoney#Investment#FinancialFreedom#WealthBuilding#Savings#PassiveIncome#Entrepreneurship#StockMarket#RealEstateInvesting#FinancialLiteracy#Cryptocurrency#InvestingTips#RetirementPlanning#PersonalFinance#SavingsGoals#FinanceGoals#EntrepreneurLife#SideHustle#OnlineBusiness#WorkFromHome#MakeMoneyOnline#BusinessIdeas#StartUp#MoneyMotivation#FinancialSuccess#IncomeStreams.

5 notes

·

View notes

Photo

#harghartiranga #hargharsip #systematicinvestmentplan #wealthbuilding #wealthcreation #wealthmanagement #mutualfunds #investment #investthroughsip #sip #goals #goalsetting #familygoals #kidsfuture #retirement #retirementplanning #housing #dreamhome #homeloans #emi #buyhomes https://www.instagram.com/p/Chix8clqZmf/?igshid=NGJjMDIxMWI=

#harghartiranga#hargharsip#systematicinvestmentplan#wealthbuilding#wealthcreation#wealthmanagement#mutualfunds#investment#investthroughsip#sip#goals#goalsetting#familygoals#kidsfuture#retirement#retirementplanning#housing#dreamhome#homeloans#emi#buyhomes

3 notes

·

View notes

Photo

June 15th is celebrated as World Elderly Abuse Awareness Day. This day aims to raise about the plight of elderly people who are abused and harmed. Elder abuse is one of the most neglected problems of our society. Our elders need our time and support, not just materialistic things. They spent their lives to make ours better, so now it’s our turn to help make their old age better and comfortable. . . . For Support: @aortafoundation P/C. : @whitecoataarushi #abuse #agedcare #agingparents #debtfree #dementiacaregiver #domesticviolence #elderabuse #elderlaw #elderlylove #familycaregiver #grandchildren #grandparents #joebiden #lawyer #nursinghome #olderadults #personalinjury #retirementlifestyle #retirementplanning #aortafoundation #support #aorta https://www.instagram.com/p/Ce0FeGrvdWb/?igshid=NGJjMDIxMWI=

#abuse#agedcare#agingparents#debtfree#dementiacaregiver#domesticviolence#elderabuse#elderlaw#elderlylove#familycaregiver#grandchildren#grandparents#joebiden#lawyer#nursinghome#olderadults#personalinjury#retirementlifestyle#retirementplanning#aortafoundation#support#aorta

3 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals

Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline

Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation

Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement

Diversifying Your Portfolio

Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments

Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice

Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning

What is the ideal age to start retirement planning?

Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income?

While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal?

Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring?

It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet?

Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise?

Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion

Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

Soar to Success: Embrace the World of Social Media Freelance Jobs!

Introduction:

Are you tired of the daily grind and longing for financial freedom? Well, buckle up because I'm about to take you on a thrilling ride into the realm of social media freelance jobs! Picture this: earning money from the cozy confines of your home, all while sipping on your favorite beverage. Sounds too good to be true? Think again! With social media freelance jobs, you can turn your dreams into reality and embark on a journey to a lucrative freelance career. So, grab your virtual passport and get ready to explore the boundless opportunities that await!

Unveiling the Gig Economy:

Say goodbye to the traditional 9-to-5 grind and hello to the gig economy – a world where freedom and flexibility reign supreme. In this digital age, social media freelance jobs have emerged as the shining stars, offering individuals the chance to earn a steady income by completing simple tasks from the comfort of their homes. From managing social media accounts to creating captivating content, the possibilities are endless in this dynamic landscape. So, why settle for a mundane desk job when you can dive headfirst into the exciting world of social media freelancing?

The Power of Passive Income:

Imagine waking up to a flood of notifications, each one signaling another payment deposited into your bank account. With social media freelance jobs, passive income becomes a reality. Whether you're crafting engaging blog posts, designing stunning graphics, or managing online communities, your work continues to generate income long after you've hit the submit button. So, sit back, relax, and watch as your bank balance grows while you enjoy life's little pleasures.

Unleash Your Creativity:

Gone are the days of stifled creativity and corporate monotony. With social media freelance jobs, you have the freedom to unleash your creative genius and let your imagination run wild. Whether you're a wordsmith crafting witty captions or a visual maestro designing eye-catching graphics, there's a niche for every creative soul in the world of social media freelancing. So, dust off your creative cap, channel your inner Picasso, and get ready to dazzle the digital world with your talent!

Navigating the Freelance Jungle:

Now, I won't sugarcoat it – navigating the freelance jungle can be intimidating for beginners. But fear not, fellow adventurer, for I am here to be your guide! From building your online presence to securing your first gig, I'll equip you with all the tools and strategies you need to thrive in this competitive landscape. So, roll up your sleeves, sharpen your skills, and get ready to conquer the freelance jungle like a true warrior.

Your Journey Begins Now!

In conclusion, social media freelance jobs offer a passport to financial freedom and creative fulfillment. With the click of a button, you can unlock the gateway to a world of endless possibilities and embark on a journey to a lucrative freelance career. So, what are you waiting for? Click here to take your first step towards success and join the ranks of thriving social media freelancers today!

#FinancialFreedom#artists on tumblr#InvestSmart#Budgeting#WealthBuilding#FinancialLiteracy#PersonalFinance#SaveMoney#InvestingTips#DebtManagement#RetirementPlanning#FinancialEducation#MoneyManagement#FinancialEmpowerment#FinancialSuccess#EconomicIndependence

0 notes

Text

Embrace Frugality

By embracing frugality, individuals gain control over their finances, liberating themselves from the cycle of endless consumption. It's a mindset shift that fosters creativity, resourcefulness, and gratitude for life's simple pleasures. Embracing frugality allows for the cultivation of financial resilience and the pursuit of long-term goals, leading to a more fulfilling and sustainable way of living.

Learn more at https://reps.modernwoodmen.org/slong

0 notes

Text

Passive Income: What It Is and Ideas for 2024

In today's dynamic economic landscape, the concept of earning passive income has become increasingly appealing. While the traditional nine-to-five job remains a cornerstone of financial stability for many, the allure of generating income passively, where money works for you instead of the other way around, has captured the imagination of millions.

In this blog post, we delve into the essence of passive income, explore its significance in 2024, and provide innovative ideas to help you embark on your journey toward financial freedom.

What is Passive Income and Explain its importance in 2024?

Passive income refers to earnings derived from sources requiring minimal to no effort to maintain. Unlike active income, which demands ongoing participation (such as a regular job), passive income streams can continue to generate revenue even when you're not actively involved.

This type of income offers flexibility, scalability, and the potential for long-term wealth accumulation. The year 2024 presents a unique landscape for passive income seekers. With advancements in technology, changes in consumer behavior, and evolving market trends, new opportunities emerge for individuals to create diverse streams of passive income.

Moreover, the aftermath of global events like the COVID-19 pandemic has underscored the importance of financial resilience, making passive income more relevant than ever.

Passive income can come from various sources, including:

1. Investments: Income generated from investments such as stocks, bonds, mutual funds, and real estate properties.

2. Royalties: Income earned from intellectual property rights, such as royalties from books, music, patents, or trademarks.

3. Business Ownership: Income generated from owning and operating a business like Truly Passive that does not require active involvement in day-to-day operations, such as rental properties or a profitable online business.

4. Affiliate Marketing: Income earned by promoting and selling products or services for other companies or individuals, usually through affiliate programs.

5. Digital Products: Income generated from selling digital products such as e-books, online courses, software, or digital downloads.

Importance of Generating Passive Income in 2024:

1. Financial Stability:

In an increasingly volatile economic environment, having multiple streams of passive income can provide a buffer against financial uncertainties. Diversifying income sources reduces reliance on a single source of income, making individuals more resilient to economic downturns, job loss, or unexpected expenses.

2. Flexibility and Freedom:

Passive income allows individuals to break free from the constraints of traditional employment and achieve greater flexibility and freedom in how they earn a living. By generating income passively, individuals can have more control over their time, allowing them to pursue other interests, spend time with family, or travel without sacrificing their financial security.

3. Wealth Accumulation:

Passive income streams have the potential to accumulate wealth over time, thanks to the power of compounding and the ability to reinvest earnings. By consistently reinvesting passive income into income-generating assets, individuals can accelerate wealth accumulation and achieve long-term financial goals, such as retirement or financial independence.

4. Adaptability to Technological Advancements:

Technological advancements continue to reshape industries and create new opportunities for passive income generation. From the rise of digital platforms and e-commerce to advancements in automation and artificial intelligence, individuals can leverage technology to create innovative passive income streams that capitalize on emerging trends and consumer behaviors.

5. Rising Cost of Living:

With the cost of living steadily increasing in many parts of the world, passive income can help individuals supplement their primary income and maintain their standard of living. Whether it's to cover essential expenses, save for the future, or enjoy a higher quality of life, passive income provides a valuable source of additional income to meet financial needs.

Passive income will play a crucial role in 2024 as individuals seek financial stability, flexibility, and long-term wealth accumulation. By diversifying income sources, embracing technological advancements, and harnessing the power of passive income, individuals can achieve greater financial security and independence in the years to come.

Ideas for Generating Passive Income in 2024:

1. Investing in Dividend Stocks:

Dividend-paying stocks can be a lucrative avenue for passive income. By investing in reputable companies with a history of consistent dividend payments, you can enjoy regular income without actively managing your investments.

2. Real Estate Crowdfunding:

Participating in real estate crowdfunding platforms allows you to invest in properties without the hassle of property management. Platforms like Fundrise and RealtyMogul enable you to pool resources with other investors to access lucrative real estate opportunities.

3. Creating Digital Products:

In the digital age, creating and selling digital products such as e-books, online courses, or software can be an excellent way to generate passive income. Once you've developed the product, you can continue to earn revenue through sales without additional effort.

4. Peer-to-Peer Lending:

Peer-to-peer lending platforms connect borrowers with individual investors, providing an opportunity to earn interest on funds lent out. While it carries some risk, diversifying your investments across multiple loans can mitigate potential losses.

5. Building a YouTube Channel or Blog:

Monetizing content creation through platforms like YouTube or blogging can yield passive income through ad revenue, affiliate marketing, or sponsored content. Consistently producing high-quality content in a niche market can attract a loyal audience and steady income over time.

6. Robo-Advisors and Automated Investing:

Robo-advisors offer automated investment management services, making it easy for individuals to invest in diversified portfolios tailored to their risk tolerance and financial goals. With minimal effort, you can passively grow your wealth over time.

7. Renting Out Assets:

Whether it's renting out a spare room on Airbnb, leasing out equipment, or even renting out your car through platforms like Turo, leveraging idle assets can provide a steady stream of passive income.

8. Affiliate Marketing:

Partnering with companies to promote their products or services through affiliate marketing can be a lucrative source of passive income. By earning a commission for every sale or lead generated through your unique affiliate link, you can monetize your online presence effectively.

The Final Wrap-Up:

As we navigate the complexities of the modern economy, harnessing the power of passive income has become an increasingly vital aspect of financial planning. Whether you're looking to supplement your existing income, achieve financial independence, or simply diversify your revenue streams, the possibilities for generating passive income in 2024 are abundant.

Take charge of your retirement planning advice journey with expert guidance from Trulypassive.com. Our platform offers tailored financial planning for retirement, ensuring you're equipped with the strategies and insights needed to achieve your long-term goals. Start planning for a secure future now!

By exploring innovative ideas, embracing technological advancements, and adopting a proactive mindset, you can embark on a journey toward financial freedom and unlock the full potential of passive income in your life. Discover the secrets to unlocking true passive income potential with Truly Passive– where financial freedom meets innovative opportunities.

#RetirementPlanning#FinancialFreedom#SecureFuture#PlanAhead#RetirementGoals#FinancialIndependence#RetirementSavings#WealthManagement#FuturePlanning#SecureRetirement#InvestForRetirement#FinancialPlanning

1 note

·

View note

Text

Geoarbitrage: Our Escape from New Jersey

Picture this: less stress over bills, more time for travel, a life that feels truly YOURS. That's what geoarbitrage has done for us. Check out my new blog post for the honest truth about our journey (and whether this strategy could work for you too!)

Okay, buckle up folks, because I’m about to tell you how my husband Jeff and I escaped a seriously un-fun retirement scenario with a little thing called geoarbitrage. Never heard of it? Basically, it’s using the power of different living costs around the world to make your money go WAY further. In our case, it meant ditching our soul-crushing New Jersey property taxes and becoming part-time…

View On WordPress

#budgetretirement#digitalnomad#earlyretirement#expatlife#expatsinmexico#financialfreedom#geoarbitrage#locationindependent#Mexico#parttimeexpat#parttimeseniornomad#retireearly#retirementplanning#retireyoungtravelsmart#travelmore#workfromanywhere#workfromanywhere Hybrid Retirement Emphasis: hybridretirement

0 notes