#small cap investor

Text

14 Best Stocks for Long Term Investments in India

आज में आपकों 14 Best Stocks for Long Term Investments in India के बारें में बतानें वाला हूँ मुझे उमीद हैं की यह आपकों पसंद आएगी।

भारत में लंबी अवधि के लिए निवेश करने के लिए सबसे अच्छे स्टॉक्स कौन से हैं? यह प्रश्न हर निवेशक के मन में होता है, जो अपने पैसों को समय के साथ बढ़ाना चाहता है। लंबी अवधि का निवेश का मतलब है कि आप कम से कम 1 से 3 साल तक किसी स्टॉक में पैसा लगाते हैं, और उसकी कीमत में…

View On WordPress

#10 best shares to buy today for long term#14 long term stocks to buy now#best long term stocks to buy right now#best share to buy for long term#best share to buy today for long term#best shares to buy today for long term#best small cap stocks for long term#best stocks for long term#best stocks for long term growth#best stocks for long term investors#best stocks to buy for long term in india#long term investment stocks#stocks to buy for long term#stocks to buy today long term#top 14 stocks to buy for long term

0 notes

Text

youtube

Every company needs day traders to trade its stock for sustainable growth and value. But here’s the issue: As a result of the increasing number of public companies, small-cap companies can’t connect with investors today. So, there’s an obvious gap between companies and investors. Hence, SteinbergValentino Group created OTC Markets investor relations firm to bridge this gap.

Get more info ↦ https://www.steinbergvalentino.com/otc-markets-investor-relations-firm/

#SV Group#OTC Markets Investor Relations Firm#Investor Firm#Investor Relations#Investment Advice#Wealth Management#OTC Stock#OTC Markets Firm#IR Firm#Investor Relations Firm NYC#SteinbergValentino Group#Stock Business#Team Investor Relations#An Investor Relations#Capital Market#Investor Relations Solutions#Small Cap Investor Relations#Investor Relations Specialist#Investor Relations Consulting#Youtube

0 notes

Text

After Steep Decline, U.S. Small Caps Tempt Investors With Cheap Valuations

After Steep Decline, U.S. Small Caps Tempt Investors With Cheap Valuations

By Lewis Krauskopf and David Randall

NEW YORK (Reuters) – Shares of smaller U.S. companies are outpacing a rally in the broader equity market as they draw investors looking to scoop up cheaply valued stocks and those betting the group has already priced in an economic slowdown. The small-cap Russell 2000 jumped 10.4% in July against a 9.1% gain for the benchmark S&P 500, its biggest…

View On WordPress

#Caps#Cheap#Collections: Business#decline#Investing News#investors#Reuters#small#steep#Tempt#United States#Valuations

0 notes

Text

#online investor community#financial tools and calculators#cannabis investment opportunities#Small cap companies to watch

0 notes

Text

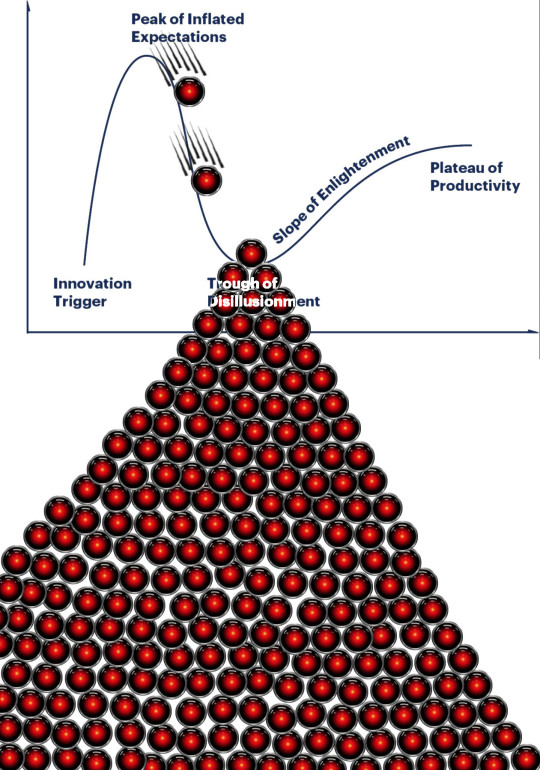

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

431 notes

·

View notes

Text

Will The Market Melt Up Continue To Suck In Investors Before A Potential Reversal?

Money is flowing into small caps, growth stocks, and gold. Is this a bullish or bearish sign? And, what does a one day pop indicate with regard to trend direction?....Watch The Video Here

2 notes

·

View notes

Text

Haves and Have-nots

SURPRISE turns out when I have deadlines I’m really good about writing quickly

Wrote this for @azrielshadowssing ‘s ACOTAR Writing Circle. This is part one of a Modern AU Feysand fic, to be continued by different writers for part two and part three. Can’t wait to see what others do with this!

Enjoy!

Feyre hissed a sharp note as her elbow knocked into a cup of paintbrushes. Firing off curses under her breath, she quickly straightened the cup and dumped the paintbrushes back in before shoving it on the nearest unoccupied space on her shelf.

Scrambling across the room— and tripping on the drop cloth she’d laid out— Feyre slammed her hand on her phone to check the time.

They were going to start arriving any minute.

“Shit, shit, shit,” she continued to mumble obscenities. It didn’t help her cleaning speed, but it did make her feel better.

Frantic hands hastily capped paints and shoved brushes out of sight. Feyre carefully toted her easel and half-finished creation to a corner, making sure it faced away from the one room studio. The drop cloth was a crumpled mess, missing the crisp corners and lines it usually received when Feyre folded it up. She had time to take her brushes to the sink before the irritating scream of the buzzer signaled her time was up. She hustled to the front door of her apartment, buzzing the anticipated guest up and unlocking her front door before sprinting back to the sink. Then she sprinted to the window and shoved it open a grand total of five inches, each of which was a hard fought battle that the window screeched through.

It would be fine. This was fine. Finish cleaning, get out the snacks, act like she was tastefully and intentionally unprepared to host this movie night that she had been obsessing over for a week now.

“Feyre, love!”

The tension that squeezed Feyre’s heart released. That was the power of Mor’s voice, that was how warm and welcoming it sounded.

“Hey!” she tossed over her shoulder, rushing to finish cleaning her brushes. “How was your week?”

“Dreadful,” Mor slid next to Feyre, wrapping an arm around her waist and kissing her cheek. “So many meetings. Why didn’t you save me, Feyre?”

“I like this extra affection,” she joked through the burning blush on her face. Mor was a very attractive woman and Feyre was not immune. “What did I do to deserve it?”

“It’s a down payment,” Mor said. “So that next time, you’ll come up with some reason to need me and I can skip my meetings.”

“I think you secretly like sitting at the head of a table and being in charge,” Ferye said. “No matter how much you complain.”

“Please, Feyre, I don’t sit at the head of the table unless I’m dealing with the male investors and I need to stake my claim.” Mor tossed her hair over her shoulder. On anyone else it would look overdone and cliche, but no gesture or look on Mor was ever anything but perfect.

“You’re done with those stuffy quarterly meetings though, right?” Feyre dried her brushes on a rag. “Back to the real work next week.”

“Hm, we have that meeting on the new product branding,” Mor leaned back out of Feyre’s space. “Are you getting to sit in on that?”

“I am.” Feyre couldn’t help the proud grin. She was just a team member, just another graphic designer for Mor’s growing empire, but she got to sit in on this big meeting. A year ago, Feyre never would have seen where she ended up. Even more shocking— that Mor would some day end up in her dinky little studio apartment.

She hadn’t expected to strike up a friendship with Mor, but somehow it had happened. Two months after graduating, she ended up at Mor’s tiny start up. A year later, and things were no longer so tiny. But their humble beginnings had made everyone close, and for some reason, Mor had been especially taken with Feyre.

“Can I help with anything?” Mor asked as Feyre finished drying her hands.

“Um…let me get out some bowls and snacks, and you can help put it all out.” Feyre darted around the small kitchen, bringing out the grocery bags of cookies, chips, and candy she had purchased for movie night. Certainly a dent in her budget, but a worthwhile one.

Mor tore open a bag of chips and poured them into a bowl. “You got a lot.”

Feyre busied herself with setting out the snacks, avoiding Mor’s gaze. “I like to…know I did a good job.”

“I know,” Mor said. “There’s enough here to make everyone happy. Now come on, I know Cassian said he’d bring the projector and screen, but we can move some stuff around before then.”

The only reason Feyre scored on hosting this movie night was because of the studio apartment. Just big enough to prop up a big screen, lay out some rugs, and lounge in a pile like they were at a sleepover. Cassian was bringing the projector and screen, and everyone had said they would bring blankets and pillows, so all Feyre was really providing was the space and the snacks.

She only hoped it all went right. She liked these people that Mor had introduced her to. The youngest, Tarquin, was still three years older than her. At 22, almost 23, Feyre often felt naive and clueless.

And it wasn’t just her age. It was who she was and who they were.

Mor had her own company, started with money and the connections she had from her family. Others owned their own businesses or held high-power jobs, sat on boards of directors or managed massive inheritances.

And then there was Feyre and her studio apartment on the edge of the city. Fresh out of college and vowing never to get another roommate unless the alternative was being unhoused, it could take upwards of an hour to reach her new friends at their apartments, townhomes, the fancy restaurants they didn’t need reservations for, and the exotic coffee shops they always wanted to meet at.

Sometimes it felt like Feyre had fallen into a dream and couldn’t wake up. Sometimes it felt like a nightmare.

Slowly, guests trickled in and her studio was transformed into a giant slumber party. Feyre scrambled to make sure everyone was comfortable. She handed Azriel a pack of Cadbury chocolate buttons she got just for him because he didn’t like sharing his chocolate, then monitored the microwave as several bags of popcorn rotated through. When Amren arrived, she made sure the older woman had a wine glass in her hand, and she kept Cressida’s gluten-free cookies set aside until she showed up.

“Oh, sweetie, you didn’t have to do that,” Cressida beamed. “How nice! I brought my own snacks but…”

“Oh,” Feyre deflated. What, Cressida didn’t think she could be a good host?

“No, no, this looks so much better!” Cressida grabbed the box of cookies and sauntered to the growing pile of pillows on top of Feyre’s rug. At the far end of the room, Cassian and Mor were snapping at each other as they tried to get the projector set up.

She did a quick headcount. Everyone was present and accounted for. Well, those who were able to make it, anyway.

“Ready to start?” Feyre’s voice rose in an attempt to be heard over the din.

“Not yet!” Mor waved a hand, eyes glued to her phone. “Rhys will be here in ten minutes!”

Several emotions competed for space in Feyre’s head. A bit of shock, panic, joy, and dread.

Cressida perked up. “I thought he was out all week?”

“Just got back a few hours ago.” Mor waved a hand. “It was one of those fancy retreats where they talk and eat and drink more than they work.”

“Don’t you know, that’s called networking, Mor,” Cassian snickered.

“The point is,” Mor said. “Rhys will be here soon.”

Rhys would be here soon. Rhys was coming. To Feyre’s small little studio. The ten minutes rushed by much too quickly, and then he was there.

“It’s movie night, not a happy hour—”

“How did you get here so quickly?”

“Sit, sit— no, you idiot, take off your shoes first!”

“Where’s the remote—?”

“Rhys, your shoes are so shiny I can see my reflection.”

Feyre stood on the edge of the mess, watching as everyone greeted Rhysand. He welcomed their affection with an easy smile, obediently removing his shoes like Mor wanted and folding himself to sit down. He was out of place in his gray button up and slacks, made just slightly casual with rolled up sleeves and a few buttons undone.

“I dropped off my bags at home and came straight here,” Rhys explained.

“Mor, what favor did you trade to get him to come?” Azriel asked.

“No favor,” Rhys said. “No convincing needed. I’m happy to be here.”

Sure. Happy to be in Feyre’s small apartment, sitting on the floor, after days in one of the most luxurious resorts in the world, talking to people who made more money in a month than Feyre did in years.

“Ready!” Her voice was a little too loud, but she didn’t let that stop her from starting the movie, getting settled, then handing a bowl of popcorn to Rhys.

“Thank you, Feyre darling,” Rhys grinned. “And thank you for inviting us—”

“Shh!”

Feyre shared a grin with Rhys. She was captivated by him until he broke the staring contest. While Rhys watched the movie and threw a handful of popcorn into his mouth, Feyre watched out of the corner of her eye. God, even the way he chewed was attractive.

She would not be surprised if everyone was clued into her massive crush by now. It started out as annoying attraction— a man too pretty for his own good. Then Feyre actually talked with him, and she could feel that attraction grow into something more dangerous.

But she maintained control of her rational mind. It was fine to have a crush. Healthy and normal. She knew nothing would, could ever come out of it. Rhys was seven years her senior and out of her league.

A harmless crush, one that was embarrassing should anyone ever mention it. But Feyre would get over it one day.

One day, she would be able to sit next to him in the dark, watch a movie, and retain what was on screen. But when the movie was done and the lights flickered on, grumbles and stretches and plans for the next meet-up floating in the air, Feyre found she hadn’t really enjoyed the movie at all. She had just thought about Rhys.

Her friends gathered their things and helped clean up. She pushed them out of her house, insisting that she could handle it herself. It was late, they needed to get home, Rhys had just come back from a flight that day and needed to rest. The offers for help and cajoling flew back and forth for ten minutes as Feyre worked to empty her home.

Soon, Feyre thought she had gotten everyone on their way. But when the door closed and the sink was running in the kitchen, she realized she missed a person.

Rhys washed the dishes silently, without complaint.

“Oh— Rhys, you don’t have to…” Feyre scrambled over. “Really, it’s fine. Leave it.”

He smiled at her. “I’ll wash, you dry and put away.”

“You should get home,” Feyre insisted. “You must have had a long day.”

“I’m fine,” he shrugged. “Slept a bit on the plane. It’s nice to stand and be a little active.”

He wasn’t stopping, and Feyre couldn’t move him. So she dried the dishes and put them away as he washed.

When she was on the last of the bowls, he gently touched her lower back. “I’ll be out of your hair soon.” He brushed past her to her bathroom.

Feyre finished cleaning the kitchen. Tomorrow she’d do her chores, sweeping and mopping, dusting, there was a load of laundry to do…

“What’s this?”

Rhys’s voice blended into the sound of the city at night— sirens and people talking, cars rumbling and music drifting out of windows. She spun around, watching as he turned her easel to see her work in the light.

“Oh, that’s just…” Feyre wrung her hands, stepping closer, not knowing if it was to explain or to gently remove his hands and hide her painting once more. “Um. A small project.”

“Looks great.”

“Yeah, it’s almost done,” she shrugged. “Just uh, something for fun.”

It was more than that. Feyre didn’t know why she concealed the truth.

The painting was based on a family photo, a loose retelling of a depressing story. The photo was crisp and clean, showcasing lifeless smiles and leeched personality. Feyre, Elain, Nesta; three young girls molded into identical shapes for this occasion. Their mother, ice cold and beautiful, and their father, prideful.

Feyre did not remember the day they took that picture, standing in front of their new home before the housewarming party.

“Your family, right?” Rhys murmured. “Mor told me that your mother passed when you were young.”

“That’s the last picture we took all together before she died,” Feyre nodded at the canvas. “Well no— obviously that’s not the picture. I meant, the painting is based on the picture.”

“Based on, but not the same,” Rhys said softly, still staring at the canvas.

“Yeah.” Feyre wrapped her arms around herself, shielding something vital. “How could you tell?”

“I don’t think any parent would accept this as the finished product,” he chuckled. “You don't look very happy.”

“No.” Feyre smiled. “I remember really hating that dress.” But that’s only part of it.

Rhys hummed. “You look like you were a stubborn child.”

Feyre tilted her head back and forth, noncommittal. “I didn’t act the way my mother wanted me to act.”

“And your sisters?”

Elain looked like a doll. If they all looked slightly lifeless in the photograph, Elain was completely dead in the painting. Stripped of her own personhood as a child, she had to grow and come into her own. Nesta, on the other hand, looked mean. An outsider would think her cruel. Feyre knew that her oldest sister was just fierce, and it took time, maturity, and experience to learn how to channel her fire away from the undeserving.

“We were all…different people,” Feyre sighed. “I don’t know. I tried to capture how I felt during that time, who I thought everyone was. It seemed more honest. I look at that photo, and…I used to think I should feel more, you know? That’s the last picture I took with my mom because she didn’t want to take pictures when she was sick. But I couldn’t feel anything about it because it felt fake. So…I thought if I tried to paint it, show a little more honesty…I don’t know. It’s stupid.”

“It’s not,” Rhys finally took his gaze from the unfinished work, smiling at Feyre. “I think it’s pretty brave.”

She didn’t expect that. “Cool”, maybe, said in a way when someone didn’t quite know what word to use. “Interesting”, to show that it wasn’t his style but he could appreciate it.

But brave?

“Like I said, just a little project.” Feyre uncrossed her arms, walking to the front door. “I’ve kept you long enough.”

“Do you paint often?” Rhys asked, taking his sweet time in joining her.

“When I can,” she shrugged. “I am lucky to have a job where I get to flex creative muscle every day, but my thing was always painting.”

He hummed. “Do you do commissions?”

Feyre laughed. “It’s just a hobby, Rhys.”

“That’s not a no.”

“I’d paint for friends,” she said. “No payment necessary.”

“Good to know.” Rhys finally opened the door, casting one last look at the painting before sliding out of her apartment. “Goodnight, Feyre darling.”

“Good night.”

~*~

It was the “Feyre darling” that started the crush.

Slipped out when Feyre was still new, still an outsider, she had first found it insulting. Infantilizing and rude, since they barely knew each other. Rhys figured out it annoyed her, and that only made him whip out the nickname more.

Then it stuck. Then Feyre paid attention. “Feyre darling” became less mocking and more affectionate.

A nice nickname, an inside joke between friends. Rhys would not be whispering it in her ear or saying it with tenderness.

Rhysand was turning 30 soon, and he had a full time job and promotions under his belt and property he owned. Feyre was 23 and in her first full time position and making spreadsheets to budget every month and hope to tuck away some money into a meager savings account. She had to ask HR how a 401k worked.

A harmless crush that would pass, that’s all it was. In the meantime, Feyre focused on being a good friend.

The next time everyone met was when Mor hosted one of her dinner parties— complete with a nice tablecloth (and a table large enough to fit them all), pretty plates, a separate salad fork and dinner fork, and wine pairings. Mor catered from exclusive restaurants, treating guests to a rotating variety of cuisine.

Feyre arrived early to help set up, rubbing her chilled nose as the elevator brought her up to Mor’s floor. The weather wasn’t cold yet, but it was turning nippy. The elevator ride up was long enough to get her mostly defrosted, and the warmth in Mor’s apartment finished off the job.

Large windows gave a magnificent view of the city. At night, staring out at the thousands of lights was mesmerizing, and during the day Feyre could spend an hour just observing all the life happening down below. Inside, Mor had furnished her apartment with warm colors and clean lines.

They chatted as they expanded Mor’s massive dinner table, adding in a piece in the middle and chairs to the ends.

“So,” Feyre started. “I have a question for you.”

“As long as it’s not about work.”

“It’s not,” Feyre said. “I need a picture of Rhys’s family.”

She hadn’t missed the way Rhys looked at her painting, or the way he asked if she did commissions. Rhys was intrigued by the idea of turning a photo into a nice painting, and his birthday was fast approaching.

While others might get him nice gifts, a new expensive watch or tickets to some high-culture show, Feyre had less to work with. She could spring for some nice oils and a new canvas though.

Mor set down her stack of dishes, giving Feyre her full attention. “Why?”

“When everyone was over for movie night, he saw this piece I was working on,” Feyre said, explaining the concept and Rhys’s interest. At the end, Mor loosened up a bit. “So, yeah, I think it would be a good birthday gift.”

“I think he would like it,” Mor said. “He would appreciate that you put so much time and effort into creating something. But…how much do you know about Rhys’s parents and sister?”

“Nothing,” she freely admitted. “Other than they’ve all passed.”

Mor nodded slowly. “Your personal project is focused on revealing…truths, I guess. Are you going to attempt the same with Rhys?”

“I’ll try,” she shrugged. “But it’s not personal, so it’s not the same.”

“Right,” Mor hummed. “Well. I’ll say this. Rhys’s parents did love each other, very much. But his father was always focused on legacy and security for the family, so much so that I think he missed a lot of what was right in front of him. They went through a lot of passionate ups and downs, but it seemed like things could have been settling when Rhys’s sister was born. I remember going to their house and feeling like something changed. But then…”

“They died,” Feyre completed the thought.

Mor nodded. “Rhys…obviously it still hurts, but he’s in a good place now.”

“Do you think he’d appreciate the portrait?” Feyre worried.

“I think so,” she shrugged. “Try and take his temperature today. If you think you can pull it off, I’ll send you a picture.”

They dropped the conversation to finish preparing. Feyre obediently dished out food into pretty platters, finishing up with putting together the salad when the guests started to arrive.

Around Feyre, conversations about planning exotic holiday vacations, the latest fluctuations of the stock market, gossip about the family everyone else knew, and insider knowledge about the passage of some labor bill shot back and forth.

It would be easier to be jealous of these people if they were anything but kind.

The first time Mor introduced Feyre to some of her friends— just Cassian and Amren— Feyre had almost run away. Amren had complained about her trip to Austria, and Cassian had bemoaned the black-tie event he had to attend and the tuxedo he would have to dust off.

She hadn’t expected a deep conversation to happen right there, middle of the day, lunch at a trendy restaurant. But somehow the topic had come up, and she learned that she and Cassian had more in common than she originally thought.

Obviously, Feyre had been wary about judging a book by its cover ever since then.

Plenty of people in this group were born with silver spoons in their mouth, that was true. But, blessedly, they were aware of it.

“Oh no, you don’t want that,” Helion found Feyre at the wet bar, looking through bottles of wine. “It has an expensive price tag, but it’s not worth it. Try this one.”

“Thanks.” Feyre waited as Helion poured the dark red into a glass, just a bit for her to taste. “Not bad.”

“Amren will tell you it has notes of cherry,” Helion shrugged. “It takes a real snob to detect that, I think.”

Said the man who owned a stable of horses upstate.

Feyre poured herself more wine, letting the warmth flood her senses and fill her with confidence. She had a goal for tonight. If she backed off now, it would be too easy to let it go.

She lingered near the drinks, hoping for the chance to spring her trap. Any moment, Mor would announce the start of dinner and they would have to take their seats.

Rhys wandered over, reaching for the jug of water, and Feyre stepped forward. “Hey, Rhys,”

“Feyre, how are you?” he smiled, pouring himself water and then facing her.

Step one, complete.

“Enjoying the cooler weather,” she said. “But I know that in a couple of months, I’ll be saying the exact opposite.”

“Not a fan of winter?” Rhys asked.

“Not a fan of the cold.” Inescapable, penetrating cold. Memories of little to no heat and numb toes. “My birthday is in the winter, so…it’s not all bad.”

“Right,” Rhys said. “December 21.”

“Yup.” She tried not to smile too broadly when she realized Rhys knew when her birthday was. “And…you’re November…?”

“Sh!” He hissed, but the exaggerated way he looked around told her it was mostly comical. “I don’t want to make a big deal out of my birthday.”

Feyre’s head tilted in confusion. “Mor is your cousin— how can you hide your birthday from her?”

“They all know when my birthday is,” Rhys said. “I just don’t want to remind them.”

“Scared of turning thirty?” Feyre teased.

“No, aging is a gift,” he said with unexpected sincerity. “Just…don’t like inconveniencing people.”

Something shuttered on his face, but Feyre couldn’t probe into it. She didn’t have the time. Later. She might get that chance to ask another time, who knows?

“Well,” she tried to be relaxed, but the way she gripped her wine glass probably was giving away her nerves. “I’d like to make you a gift. And before you say anything, it would not be an inconvenience! It would be something I want to do.”

“Oh, Feyre, you really don't—”

“I insist!” She plowed forward, though was mindful to keep her voice down. Rhys didn’t want people knowing, so she could respect that. “You asked if I do commissions— and when people ask that they are interested. So I’m going to paint you something.”

Rhys raised an eyebrow. “Do I get to know what it is?”

“I’d like it to be a surprise,” Feyre said truthfully. “But I also don’t know if you’ll like it.”

“I really don’t care what it is,” Rhys said without hesitation. “I’m sure I’ll appreciate whatever you make.”

Feyre bit her lip, trying to think of a way to phrase her question without giving it away. “Well…I don’t know. I asked Mor what she thought—”

“Then I’m sure it’ll be fine,” he said, looking away for a moment when someone called his name.

She panicked just a bit. “Rhys, I should just ask—”

“Feyre,” he interrupted gently. “Really. Don’t worry about it so much.”

“This is a painting for you,” Feyre pointed out. “I could misinterpret horribly…”

“If you need direction, you can ask Mor.” Done with the conversation, Rhys backed away. “But I’m interested in your vision, Feyre darling.”

Well. That was as definite an answer as she was likely to get. The next day, Mor sent over the photograph.

~*~

There was a strange balancing act in creating this kind of art.

The piece had to be revealing and poignant— there was a message there, and it needed to be expressed. But too obviously, to gaudy or in your face, and it could not be appreciated.

The depth needed to be in the detail. Feyre aimed to create something that was pleasant to look at upon a glance and beautiful to meditate on. She did ask Mor about Rhys’s family, just wanting to know enough to not offend.

The hand that Rhys’s father laid on his wife’s shoulder had a tighter grip, just a bit exaggerated from the photo. His little sister got a twinkle in her eye, a tilt in her head that screamed innocence and just a hint of something impish. Rhys’s stance changed, from perfectly upright and still to something more dynamic, feet positioned as if ready to keep moving. And his mother got some imperfections, flyaway hairs and an uneven posture as she leaned just a little bit closer to her daughter. Her smile grew, crinkling her eyes.

Feyre added movement, added some life that didn’t exist when everyone was trying to look their best for a fancy photo. It was as terrifying as it was exhilarating. There was a story happening.

The next time everyone crammed together, it was at Rhys's townhome for game night. Monopoly and Catan were banned, as they took much too long and created some extreme emotion, but Battleship, Cards Against Humanity, Clue, and Uno (with some crazy house rules) were some of the approved offerings.

Feyre shrieked in laughter and playfully booed, sampling a few of the games with a rotating cast of opponents and participating as a spectator in lulls. When the pizza arrived, everyone broke to grab a slice.

“I can’t believe we won’t be able to do a Halloween party,” Cressida bemoaned. “When’s the next time everyone is going to be in town? What’s the next excuse to get together?”

“Thanksgiving?” Helion offered.

It was probably Rhys’s birthday, but Feyre kept her mouth shut. So did Mor, Cassian, and Azriel.

Cressida didn’t get that memo. “Huh, maybe…wait no! Rhys! Your birthday!”

He accepted the attention with a smile. “Yes?”

“Don’t do that.” She was close enough to playfully slap his shoulder. “It’s in just a few weeks! What are we doing?”

Rhys shrugged. “I don’t have any plans.”

“Oh no,” Cressida gasped like it was the worst thing in the world. “But you’re turning thirty!”

Helion laughed. “No need to remind the man, Cress.”

“You’re older than all of us, you shouldn’t be making fun of anyone’s age,” she shot back. “But really, Rhys. No plans?”

“Nah,” he shrugged.

Cressida huffed. “Is no one else bothered by this?”

Silenced greeted her. Feyre was giving her own present, and it was a private thing that she would most likely present to him when they were not in a group setting. She was sure that Rhys would probably do a quiet family thing at home with Mor, Cassian, and Azriel, maybe Amren too.

“Unbelievable,” she rolled her eyes. “I bet you all forgot.”

“I didn’t forget,” Azriel said. “I already have a gift in mind.”

“It’s a 30th birthday! You have to do something more fun than just a gift!” Cressida said.

Tarquin shrugged. “It’s a little late to plan now. I’m sure if Rhys had wanted something big, he would have said.”

“Please, it’s Rhys,” Cressida snapped. “And it’s not too late. I already have an idea and I can put it together.”

“Do I get to know?” Rhys asked. “It is my birthday, after all.”

“We’re spending a long weekend at the family beach house,” Cressida announced.

Ferye frowned. “Isn’t it a little cold for a beach vacation?”

“It’ll be fine,” Cressida waved a hand, already scrolling through her phone.

Mor cleared her throat. “The beach house is in Turks and Caicos.”

Oh.

“I’ll get the staff to prepare the house,” Cressida murmured. “We’ll have catering for a party, but for those of us staying at the house I’ll have to make sure the staff does grocery shopping…”

“Free beach vacation? I’m in.” Cassian said.

Cressida pointed at Cassian. “That’s the spirit! It’s Rhys’s birthday! It’s a milestone! Let’s make it fun! I’ll book a DJ and put together a guest list for one night, and that can be the larger party, but the rest of the time it’ll be just us. Mor, you still have that guest list from the summer picnic, right? They’ll all be able to fly out for a weekend.”

“This is too generous, Cress,” Rhys interjected with a polite smile.

“No way,” she put her hand on his arm. “Not for you.”

Something curdled in Feyre’s stomach. She looked away, but the sight that greeted her wasn’t much better. Amren and Varian were looking at his phone, seeming to be searching for flights. All the faces were of mild interest.

“It might be a lot, but it’ll be worth it.” Cressida turned back to her phone. “Right, I need food, I need to contact the staff, we’ll have to coordinate flights and rides…and I’ll need to go shopping. Mor, what was that name of the boutique you were talking about? The appointment-only one, I know it’s late notice but do you think they could fit me in?”

“Cress, it’s winter, they won’t have bikinis…”

Feyre sipped her cider, then rose to throw away her empty plate. The rest of them could talk about their fun plans. She would not be participating.

She didn’t have the money to fly out of the country for a long weekend, especially not with little more than a month's notice. Not to mention the vacation time. The only people who would be able to do such an insane thing were her insanely rich friends.

She knew Cressida wasn’t purposefully excluding her. Feyre was a newer friend, not even that close to her, and Cressida probably never had to make those accommodations.

Hell, Cressida probably didn’t even include Feyre in the invitation. It would be beyond generous to open her home to someone she didn’t really know that well.

Feyre tried to mollify herself as she darted to the bathroom. So she wasn’t participating in this fun. That was fine. She had her own way of celebrating Rhys’s birthday, and that was enough. And if she had to take an extra few minutes in the bathroom to get her emotions under control, well, that was just healthy and mature.

She meandered down the hall, hoping that the conversation had moved on and she could convince Azriel for a rematch at Battleship.

“...it’s really a lot, Cress,”

“You deserve it.”

It was rude to eavesdrop. Feyre should have just keep walking. But she didn’t move out of the hall, keeping to the shadows and out of sight from the bright kitchen.

Rhys’s laugh seemed a little forced.

“I mean it,” Cressida’s voice was so low Feyre almost didn’t catch it. “If you had it your way, you would stay at home for your birthday and return any gifts. This is the compromise.”

“Well, at least you are talking about it with me,” Rhys sighed. “I hate when people push their ideas on me.”

“Who would push themselves on you?”

“Happens more often than you’d think,” his voice was just a bit strained. “It just… reminds me of my dad railroading me, or pretending he was giving me options when he was really just trying to force me into accepting his decision. He didn’t understand that what was important to him wasn’t important to me”

“Well, the vacation is mandatory,” Cressida said. “The itinerary is on the negotiating table.”

“Thanks for the transparency,” Rhys answered. “I really didn’t want any surprises though…”

Feyre heard enough. She slipped into the living room and tried to forget the conversation.

Logically, she knew that Rhys was not talking about her and her gift. But she also realized that she might be doing exactly what Rhys just said he despised. She didn’t take his no for an answer when he said she didn’t have to do anything for his birthday. She took something she cared about— her art— and assumed Rhys would care. She even hedged on telling him what the painting was.

Oh God, the painting included his father. Mor said Rhys had a rocky relationship with him, but that was true disdain Feyre had heard…what had she done?

She was in a trance for the rest of the evening, going through the motions and forcing smiles. Blessedly, everyone was so consumed with party planning that Feyre flew under the radar.

“I’m going to head out,” Feye announced when she had enough. Cressida, in the interest of being transparent, asked who could help cover costs and started rattling off astronomical numbers. No one said it, but being able to cover the cost of the music or food or chip in for a fun excursion suddenly felt like the price of admission.

“I should get going too.” Just her luck, it was Cressida that spoke up.

Feyre kept her attention on her phone, wincing at the price of getting an Uber. Subway it was, then. She tugged on her coat and said her goodbyes, ready to be done with the night. Feyre hustled outside, hands in her pockets to keep them warm as she walked towards the nearest station.

“Feyre!”

She resisted grinding her teeth together and turned around, a pleasant expression plastered on her face. “What’s up?”

Cressida stalked closer. “Where are you going?”

“Um,” she looked around, as if that would provide clarity to the question. “Home?”

Cressida rolled her eyes. “You’re taking the subway.”

“Yeah?”

“Absolutely not.”

“What?” Feyre gaped.

“You’re not taking the subway alone at this time of night,” Cressida said. “I can’t believe Rhys would let you leave his home without offering a ride.”

Rhys knew better than to try and control Feyre. And he probably was busy planning his fancy birthday vacation.

“It’s fine,” she said. “I’ve done it before—”

“Come on,” the other woman turned away, expecting Feyre to follow. “I’ll drop you off.”

“You don’t have to.”

“I insist!” Cressida unlocked her car, opening the passenger door open like a chauffeur. “Get in.”

“You live in the opposite direction,” Feyre backed away. “It doesn’t make any sense—”

“You live so far, it’ll be faster for me to drop you off than to take the subway,” Cressida pointed out. “Just get into the car, Feyre, don’t be so stubborn.”

She hated taking the offered favor. But it would be faster and more comfortable to go with Cressida.

Feyre got into the car.

If Cressida thought it was awkward, she didn’t say anything. The low volume of her music filled the air, quiet enough to hold a conversation if they desired.

Ferye really didn’t want to talk. Cressida, though, obviously wanted the exact opposite. “Are you getting anything for Rhys?”

“Um,” she hesitated. Her gift suddenly seemed so silly. But the longer she was silent, the more suspicious it would seem. “I was going to paint something for him.”

“Oh, that’s cool.” Cressida said one thing, but her tone said something different.

Feyre sat up a little straighter, defensive. “What?”

“I don’t see Rhys as an art guy,” she shrugged, conveniently avoiding Feyre’s gaze and keeping her eyes on the road. “I mean, sure, he might kind of like it. But he’s not like Amren, right? He’s not going to gallery showings and stuff, he’d buy something to hang on his wall from Crate and Barrel.”

“Well…I’m glad I can give him something nice then.” Maybe. Her great idea seemed less and less ingenious by the minute, but Ferye could salvage something. Some sort of pretty, but meaningless piece to hang in a hall. She didn’t have any other ideas.

“Oh no, I don’t mean to discourage you!” Cressida said. “Really! I know you care about your work, and I can tell that you would put so much of yourself in it. And I’ve seen some of your stuff, you’re really good. I’m just one opinion.”

Feyre swallowed roughly. “But you don't think it’s a good idea.”

She tapped her fingers on the steering wheel. “I just don’t want to see you hurt when Rhys doesn’t react the way you might want him to. It’s Rhys, he’ll appreciate the gift of course. But it’s…ugh, how do I put this? Helion is arranging a private tour of an observatory because Rhys is a nerd obsessed with space. Mor is probably going to set aside a day for them to spend together and reminisce on childhood memories. And I want to give him a vacation because he always works so hard and literally never takes a moment for himself.”

“And my gift…” Feyre could barely speak. “Doesn’t matter as much.”

“It matters,” Cressida shot a glance at Ferye. “It does, because it matters to you. But don’t project that onto Rhys. Like I said, he’ll appreciate it, but I don’t want to see you get hurt because he doesn’t seem to care or like it as much as you might anticipate.”

Thankfully, they were only five minutes away from her apartment. Enough time for Feyre to fall silent in quiet contemplation, a late night a good excuse for the murmur of thanks and quick retreat when Cressida dropped her off.

As soon as she was out of the car, icy wind pierced her shields. Feyre’s throat tightened as she hustled into her building, pounding up the stairs. By the time she was through the door, she was well and truly humiliated.

Her phone chimed. Feyre automatically glanced at it and then wished she hadn’t.

Good appointment with orthopedic surgeon. Elain’s text read. Identified a problem, Dad will need more physical therapy, but they’re hopeful it’ll lessen the pain.

Nesta’s reply appeared. Send the bill, we’ll split it three ways. How many weeks of therapy?

Idk, at least 8 I think.

Feyre sagged, falling against the closed door. She and her sisters were getting by now, but their dad’s medical bills always put a strain on all three of them.

Definitely no vacations, or even trips to fun cafes, or going to see a new movie in her future. Not for a while. She took a deep breath, already thinking about her spreadsheets, then looked up.

The unfinished portrait taunted her from the corner.

She was such an idiot. Rhys might think her painting was cool, might have shown genuine interest— but that was because he was Rhys. He wouldn’t make her upset or be anything but kind, simply because Feyre was Mor’s friend.

But she wasn’t a part of his life, wasn't in the same circle. She had foolishly projected her own passions onto him, poured her soul into something that could never see the light of day again.

Grabbing a trash bag from under the sink, Feyre stalked towards the easel.

Pack it up. Get rid of it, and this entire night. She had miscalculated what to give Rhys, and quite honestly she had probably been miscalculating about her place here for a while.

She felt like a nice little pet, a charity case to be ogled by the rest of them until it was convenient to leave her behind. But that didn’t worry them, because they had been to her studio and they knew her too well, and what kind of broke 22-year-old would walk away from rich successful friends?

Feyre sniffed back tears, the product of a long week and too many bottles of cider at game night. She needed sleep. Rest, and in the morning she would be feeling less sorry for herself.

But first.

The painting stretched the plastic bag, sharp corners poking out. Feyre almost left it at her door, ready to be thrown out. But it was too obvious there, too in-her-face. She banished it under her bed instead. There, it could keep the monsters from her nightmares company and be forgotten under a layer of dust and regret.

62 notes

·

View notes

Text

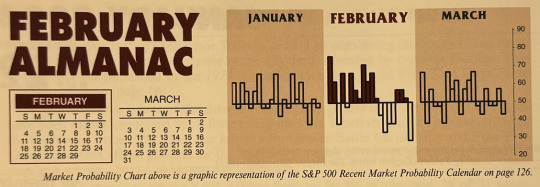

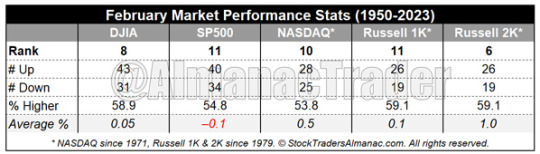

February 2024 Almanac: Second Worst S&P 500 Month since 1950

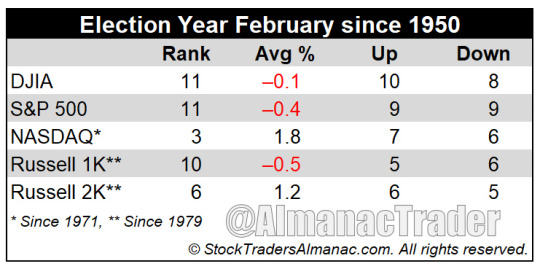

February is in the middle of the Best Six Months, but its long-term track record, since 1950, is not that impressive. February ranks no better than sixth and has posted meager average performance except for the Russell 2000. Small cap stocks, benefiting from “January Effect” carry over; historically tend to outpace large-cap stocks in February. The Russell 2000 index of small cap stocks turns in an average gain of 1.0% in February since 1979—sixth best month for that benchmark. Russell 2000 has had a tough January which could indicate the January Effect may not boost small caps this February.

A strong February in 2000 boosts NASDAQ and Russell 2000 rankings in election years. Otherwise, February’s performance, compared to other presidential-election-year months, is mediocre at best with no large-cap index ranked better than tenth (DJIA and S&P 500 since 1950, Russell 1000 since 1979).

Not a subscriber? Sign up today for a Free 7-Day Trial to Almanac Investor to continue reading our latest market analysis and trading recommendations and get a full run down of seasonal tendencies that occur throughout each month of the year in an easy-to-read calendar graphic with important economic release dates highlighted, Daily Market Probability Index bullish and bearish days, market trends around options expiration and holidays. In addition, the Monthly Vital Statistics Table combines stats for the Dow, S&P 500, NASDAQ, Russell 1000 and Russell 2000 and puts them all in a single location available at the click of a mouse.

4 notes

·

View notes

Text

Elizabeth Collins-Stoddard x Fem!Reader: Of Signatures and Subtlety

Summary: "I chose you." or A late-night conversation between you and your partner.

AO3

A/N: I've been sitting on this one for a minute! I wrote it at the beginning of October when I attempted to do Fictober (privately) and then ended up in the midst of the busiest month I've ever had! So I fell off the Fictober train but not without writing this. I feel like Elizabeth is really unappreciated and that makes me sad.

Little snippets into day-to-day life are always my favorite to write, but also what I struggle with. So I really hope everyone enjoys it!

Tag List: @escapetodreamworld @ghostsunderstoodmysoul @multifandomfix

Warning(s): None

Running a Cannery was a lot more involved than you expected. You curse Angelique for making it look simple as you sign off on another contract and throw it on top of the enormous pile, wincing as you try and flex your hand. Had you known better, you wouldn’t have agreed to take on such a large role; you’d rather run around all day than sign another piece of paper.

A hand settles on your shoulder and you look up into a pair of smug eyes. Elizabeth raises an eyebrow, a not-so-subtle smile pulling at her lips.

“Yes, dear?” You ask.

“You’re grumbling under your breath again,” Elizabeth says and her smile grows a little, “I told you that I can transfer some of the contractual obligations to Barnabas.”

Absolutely not. Barnabas is a good cousin, sure, but he’d been very odd in the beginning about how your role in the company was larger than his. You wouldn’t give any of his outdated views fuel, however small they may be.

You give Elizabeth a long look and she chuckles. Her hand brushes over your shoulder and the back of your neck as she crosses around the desk, glancing out the window overlooking the Port. It’s raining and growing darker with every minute. Lights on the fishing boats out in the water bob up and down, while some pass and dock just below the window.

It’s a peaceful scene that you often take a few minutes to enjoy, when the paperwork is manageable. Busy season had brought in enough money for new boats and with it, new employees. More fish meant more work, who knew?

“How are the preparations for tonight going?” You ask, capping your pen and joining her by the window.

She takes a deep breath, pinching the bridge of her nose, “Are people always so infuriating?”

“Typically. That’s why I let you handle them.”

“Well, they’ve been nothing short of exhausting. It’s a banquet for investors, for heaven’s sake, not a coronation. And that awful Scavena woman won’t stop interrupting preparations to suggest changes to the floral arrangements.”

You try to hide your smile, “Still holding energy about her, Liz?”

“I’ll stop doing so when she stops asking after you. ‘Oh how is the dear girl, Elizabeth?’” She mocks, a scowl on her face, “'Do tell her to give me a call, would you? I so miss our teas.’ Ugh.”

“She’d be less obnoxious if you’d let me make a scene.”

Many times you’d suggested some overt display of affection to ward off the woman. A few dates—a few very bad dates—had left her following after you like a lost puppy. Sure, she was pretty, but why settle for pretty when you had Elizabeth? Miss Scavena had been a moment of weakness before your perfect woman had given you a chance.

Elizabeth wasn’t one for public displays of anything, least of all affection, so all you’d managed was a lingering kiss on the cheek in front of the other woman. And you’d been given a stern lecture afterwards for that. It didn’t help that Carolyn had been going on and on that night about how obnoxiously loving you two were; you conveniently forgot to pick up her favorite ice cream at the grocery store that week.

“Absolutely not.”

“Then ignore her. I chose you. Doesn’t that count for anything?” You ask, batting your eyelashes.

“I suppose.” Elizabeth rolls her eyes.

Arms crossed over her chest, she tries to keep her scowl in place when you steal a long kiss. But her blushing cheeks say all you need to hear. She even goes so far as to steal one herself before pulling back and crossing the room, throwing behind her, “I want those contracts done before the dinner!”

“Yes, dear.” You laugh as the door closes behind her and settle in for another few hours of cramped signatures.

#elizabeth collins stoddard#elizabeth collins stoddard x reader#dark shadows#dark shadows x reader#elizabeth collins stoddard imagine#dark shadows imagine#elizabeth collins#wlw#wlw imagine#oct2022#multimilfswritings

39 notes

·

View notes

Text

Diversifying Your Investments: A Guide to Balancing Midcap and SIP (Systematic Investment Plan) Mutual Funds

Many investors focus their portfolios heavily on large cap stocks while ignoring midcap and small cap companies. However, diversifying your holdings across market capitalizations can provide greater growth opportunities and balance risk. Combining midcap funds with an SIP mutual fund (Systematic Investment Plan) allows you to spread your assets efficiently.

Midcap mutual funds invest in mid-sized companies that offer higher growth potential than large caps that are already well established. Though midcaps carry higher volatility, the long-term growth can outweigh short-term fluctuations. A well-managed midcap fund invested in over 50 companies can mitigate the risk through diversification. Midcap funds have delivered nearly 14% annual returns over the last decade, outperforming large cap funds.

Rather than trying to hand-pick midcap stocks, investing through a mutual fund scheme allows you to gain exposure managed by an experienced fund manager. They can identify fast-growing companies across sectors before they gain wider attention. A SIP plan spreads your investment out steadily in the fund through small periodic contributions rather than a lump sum. This lets you take advantage of rupee cost averaging and reduces the impact of market ups and downs.

SIP plans start with minimal amounts like ₹500 per month so you can begin without a large capital pool. The enforced saving discipline will help you accumulate a corpus over time without worrying about market timing. SIP instalments can be automated directly from your account, making investing completely hassle-free. As your savings grow, you can increase the SIP amount.

A prudent approach is to allocate about 30% of your portfolio to midcap funds through SIP, with the balance in large cap funds. This allows you to benefit from midcap growth while limiting risk through diversification. Avoid investing in just one midcap fund. Spread your investment across 2-3 funds from different fund houses to diversify fund manager risk.

Review and rebalance your portfolio at least annually to maintain your target allocation. As your midcap funds grow, part of those gains can be booked periodically and shifted to large cap funds. This ensures you lock in some gains and maintain your original asset allocation.

Rather than chasing the hot new IPO or small caps, a disciplined SIP plan in diversified midcap funds can help grow your wealth steadily. Focus on long term metrics like rolling returns rather than short term NAV changes. With patience and consistency, your SIP portfolio will reap the benefits of midcap investing.

2 notes