#$^GSPC

Text

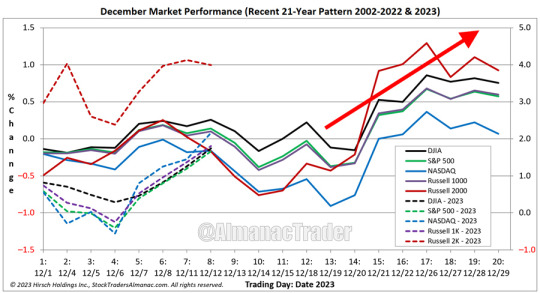

Moderating Inflation & Final Fed Meeting Clear Path for late-December Surge

This week’s CPI and PPI releases showed the moderating trend of inflation continues. Prices are still rising just at a slower pace and the rate of change could finally fall back before the Fed’s target of 2% next year. In response to and in anticipation of lower interest rates, the market has enjoyed above average gains in December.

As of the close on December 12, DJIA was up 1.74%, S&P 500 +1.66%, NASDAQ +2.16% and Russell 2000 up an impressive 3.99% (right side vertical axis of chart above). The market did experience some typical early December weakness this year after bucking the trend of weakness on the first trading day. Even though the market has already enjoyed above average gains this month, we still anticipate more to come with the potential for a new all-time closing high from DJIA before year end.

26 notes

·

View notes

Photo

Buenos días Guanajuato. . . . #SPiCollective #collectivestreetphotography #Streetphotographers #gspc #streetclassics #thestreetphotographyhub #streetfinder #streethunters #dpspstreet #guitar #guanajuato #mexico (at Centro de Guanajuato) https://www.instagram.com/p/CmjplCOr9-c/?igshid=NGJjMDIxMWI=

#spicollective#collectivestreetphotography#streetphotographers#gspc#streetclassics#thestreetphotographyhub#streetfinder#streethunters#dpspstreet#guitar#guanajuato#mexico

2 notes

·

View notes

Text

GSPC LNG Recruitment 2023 Manager and Other Post

GSPC LNG Recruitment 2023: GSPC LNG Limited is a Joint Venture company of the Government of Gujarat. Released New Job Vacancy For Shift Manager, Shift Engineer Posts.

GSPC LNG Recruitment 2023

Job Recruitment Board

GSPC LNG

Notification No.

–

Post

Various

Vacancies

20

Job Location

Various

Job Type

Govt

Application Mode

Online

Gspc lng recruitment 2023 notification

Important…

View On WordPress

0 notes

Photo

moon shine streetdreamsmag #streetweekly #gramslayers #ourstreets #spicollective #streetgrammers #bevisuallyinspired #hsinthefield #street_life #storyofthestreet #lensculturestreets #lensonstreets #capturestreets #zonestreet #myspc #streetphotography #gspc #streetphotographers #artofvisuals #moodygrams #eclectic_shotz #agameoftones #way2ill #justgoshoot #exploretocreate #hbouthere #streetclassics #wynwood #Miami @AndTHeLastWaves @StreetPhotographers @StreetDreamsMag @StreetScape @LensCulture @EyeEmPhoto @thecitymag_ @justgoshoot @the.street.photography.hub @streets_vision @streetphotographyjournal @urbanandstreet @streetphotographyinternational @streetphotographyworldwide @magnumphotos @streetartglobe @streetshared @citykillerz @urbanromantix @gramslayers @streetphotographers_art (at Wynwood Life) https://www.instagram.com/p/CpvL2jFOxIp/?igshid=NGJjMDIxMWI=

#streetweekly#gramslayers#ourstreets#spicollective#streetgrammers#bevisuallyinspired#hsinthefield#street_life#storyofthestreet#lensculturestreets#lensonstreets#capturestreets#zonestreet#myspc#streetphotography#gspc#streetphotographers#artofvisuals#moodygrams#eclectic_shotz#agameoftones#way2ill#justgoshoot#exploretocreate#hbouthere#streetclassics#wynwood#miami

0 notes

Text

Stock market today: Nasdaq futures pop, Tesla surges after earnings with more heavyweights on deck

Tech stocks popped ahead of the bell on Wednesday, outstripping the broader market as investors welcomed Tesla’s (TSLA) cheaper car pledge and waited for the next rush of corporate earnings.

Futures on the tech-heavy Nasdaq 100 (^NDX) rose roughly 0.5%, coming off a sharp closing gain. S&P 500 (^GSPC) futures were up 0.1%, continuing a rebound from its longest losing streak of 2024, while Dow…

View On WordPress

1 note

·

View note

Text

Nasdaq futures pop, Tesla surges after earnings with more heavyweights on deck

New Post has been published on https://petnews2day.com/news/general-news/nasdaq-futures-pop-tesla-surges-after-earnings-with-more-heavyweights-on-deck/?utm_source=TR&utm_medium=Tumblr+%230&utm_campaign=social

Nasdaq futures pop, Tesla surges after earnings with more heavyweights on deck

Tech stocks popped ahead of the bell on Wednesday, outstripping the broader market as investors welcomed Tesla’s (TSLA) cheaper car pledge and waited for the next rush of corporate earnings. Futures on the tech-heavy Nasdaq 100 (^NDX) rose roughly 0.5%, coming off a sharp closing gain. S&P 500 (^GSPC) futures were up 0.1%, continuing a […]

See full article at https://petnews2day.com/news/general-news/nasdaq-futures-pop-tesla-surges-after-earnings-with-more-heavyweights-on-deck/?utm_source=TR&utm_medium=Tumblr+%230&utm_campaign=social

#OtherNews

0 notes

Text

Nvidia AI Chips Face Competition From Big Tech and Start-Ups [ NASDAQ:NVDA ]

Nvidia AI Chips Face Competition From Big Tech and Start-Ups [News Summary]

Amazon, Google, Meta, AMD, and Intel have big ambitions to catch up with

Nvidia’s dominance in AI chips.

Nvidia (NVDA) has been the talk of Wall Street for a couple of months as

the company helped lead the S&P 500 (^GSPC) to record numbers and…

There are plenty of chip stocks out there for long-term investors to…

View On WordPress

0 notes

Text

Stock market, Disney board victory, Apple robotics: 3 things

U.S. stocks (^DJI, ^IXIC, ^GSPC) hope to break their losing streak in the first week of the second quarter as markets digest recent comments from Federal Reserve Chair Jerome Powell and prepare for the U.S. Friday job.

Disney’s (DIS) board of directors emerged victorious from activist investor Nelson Peltz’s initiative, with shareholders rejecting Peltz’s bid for a board seat.

Lastly, Apple…

View On WordPress

0 notes

Text

Chứng khoán kết thúc 2023 với chuỗi chiến thắng lịch sử

Cổ phiếu kết thúc năm 2023 với chuỗi chiến thắng lịch sử. S&P 500 (GSPC) bước vào năm mới sau khi tăng 9 tuần liên tiếp, đây là tuần tăng liên tiếp dài nhất tăng kể từ năm 2004.

Tuần giao dịch đầu tiên của năm 2024 sẽ ngay lập tức thử thách đà tăng trưởng với báo cáo việc làm quan trọng của tháng 12 dự kiến được công bố vào sáng thứ sáu. Lịch kinh tế cũng sẽ có ghi chú cuộc họp từ Cục Dự trữ…

View On WordPress

0 notes

Text

A Bull Market Is Coming: 2 Growth Stocks Could Increase Sales 139% and 332% in 5 Years, According to Wall Street Analysts

One school of idea states the next booming market starts when the S&P 500 (SNPINDEX: ^ GSPC) reaches a brand-new record high. By that requirement, the benchmark index is approximately 10 portion points far from booming market area. That limit is especially significant since the S&P 500 returned approximately 285% throughout the last 5 booming market.

In the meantime, financiers ought to have a…

View On WordPress

0 notes

Text

Stocks rise as all eyes turn to inflation data: Stock market news today

US stocks regained momentum on Wednesday, as investors assessed hotter-than-expected inflation data and prepared for more on Thursday while looking to Federal Reserve minutes for a window into policymakers’ thinking on interest rates.

The Dow Jones Industrial Average (^DJI) finished up 0.2%, while the S&P 500 (^GSPC) gained 0.4%. The tech-heavy Nasdaq Composite (^IXIC) put on roughly 0.7%,…

View On WordPress

0 notes

Text

May Almanac: Historically Poor in Election Years

May has been a tricky month over the years, a well-deserved reputation following the May 6, 2010 “flash crash”. It used to be part of what we once called the “May/June disaster area.” From 1965 to 1984 the S&P 500 was down during May fifteen out of twenty times. Then from 1985 through 1997 May was the best month, gaining ground every single year (13 straight gains) on the S&P, up 3.3% on average with the DJIA falling once and NASDAQ suffering two losses.

In the years since 1997, May’s performance has remained erratic; DJIA up fourteen times in the past twenty-six years (four of the years had gains exceeding 4%). NASDAQ suffered five May losses in a row from 1998-2001, down –11.9% in 2000, followed by fourteen sizable gains of 2.5% or better and seven losses, the worst of which was 8.3% in 2010 followed by another substantial loss of 7.9% in 2019.

Since 1950, election-year Mays rank rather poorly, #9 DJIA and S&P 500, #8 NASDAQ and Russell 2000 and #7 Russell 1000. Average performance in election years has also been weak ranging from a 0.4% DJIA loss to a 0.6% gain by Russell 2000. Aside from DJIA, the frequency of gains in election year Mays is bullish, but down Mays have tended to be big losers. In 2012, DJIA, S&P 500, NASDAQ, Russell 1000 and 2000 all declined more than 6%.

3 notes

·

View notes

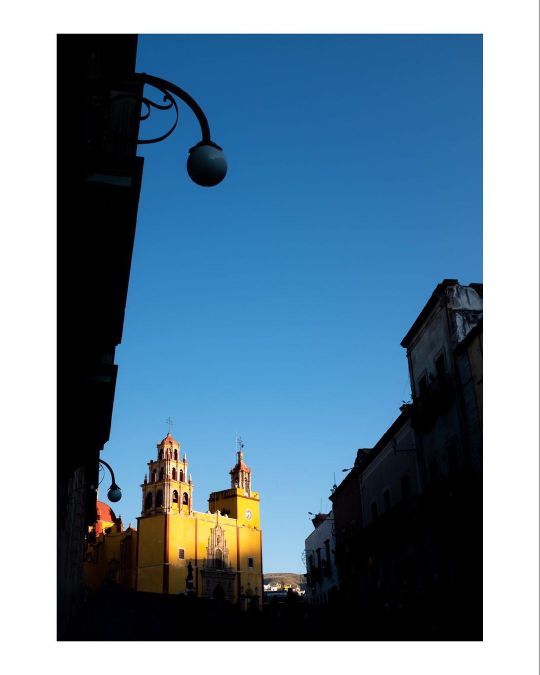

Photo

1696 . . Basilica of Our Lady of Guanajuato . . #SPiCollective #collectivestreetphotography #Streetphotographers #gspc #streetclassics #thestreetphotographyhub #streetfinder #streethunters #dpspstreet #mystreet_bnw #streetphotography #bcncollective #eyephotomagazine #life_is_street #tnscollective #thestreephers #thephotosector #timeless_streets #streetmoment #streets_storytelling #streetsgrammer #gf_streets #ricohgr3 #somewheremag #guanajuato #mexico #lensculture #cathedral #sleepwalker (at Guanajuato Centro, Plaza De La Paz) https://www.instagram.com/p/CqLDCGdAqIG/?igshid=NGJjMDIxMWI=

#spicollective#collectivestreetphotography#streetphotographers#gspc#streetclassics#thestreetphotographyhub#streetfinder#streethunters#dpspstreet#mystreet_bnw#streetphotography#bcncollective#eyephotomagazine#life_is_street#tnscollective#thestreephers#thephotosector#timeless_streets#streetmoment#streets_storytelling#streetsgrammer#gf_streets#ricohgr3#somewheremag#guanajuato#mexico#lensculture#cathedral#sleepwalker

0 notes

Text

October's first trading week ended with a twist after Wall Street reversed earlier losses on Friday and surged to the closing bell as investors digested a strong jobs report that blew away expectations.The S&P 500 (^GSPC) gained about 1.2%, while the Dow Jones Industrial Average (^DJI) climbed roughly 0.9% or about 290 points. The tech-heavy Nasdaq Composite (^IXIC) rose 1.6%.The September jobs data did not show the signs of cooling in the labor market that were forecast. The US economy added 336,000 jobs in September, almost twice the number expected. That could give the Fed more evidence that the labor market remains strong, making the case for a more restrictive policy for longer.Friday's data is the last key payrolls report before the central bank's next policy meeting.Read more: What the Fed rate-hike pause means for bank accounts, CDs, loans, and credit cardsThe Fed is also watching the bond markets, as Fed official Mary Daly said Thursday that if long-term bond yields remain around current levels, then policymakers may not need to raise interest rates again. The rally in yields continued Friday after the jobs print, with 10-year US Treasury yields (^TNX) going back up past 4.8%.The bond sell-off may well continue, given there's no clear catalyst to stem the bleeding, according to some analysts. It would take a washout in stocks or softening in the economy to prompt a retreat in yields, they believe.Worries about growth have weighed on oil prices, which are set for their biggest weekly loss since March thanks to a clouded demand outlook. WTI crude oil futures (CL=F) wavered around $83 a barrel on Friday, while Brent crude futures (BZ=F) kept hold of the key $84 level.Dow gains nearly 300 points after US economy flashes signs of strengthOctober's first trading week ended with a twist after Wall Street reversed earlier losses on Friday and surged to the closing bell as investors digested a strong jobs report that blew away expectations.The S&P 500 (^GSPC) gained about 1.2%, while the Dow Jones Industrial Average (^DJI) climbed roughly than 0.9% or about 290 points. The tech-heavy Nasdaq Composite (^IXIC) rose 1.6%.Surging bond yields put the squeeze on government debtThe rapid rise in bond yields has renewed concerns over the government debt, highlighting what deficit watchers see as a looming crisis that could do long term damage to economic growth.On Friday, yields on 10-year Treasuries (^TNX) were as high as 4.89%, and they have held over 4.5% for two weeks. Their climb accelerated after the Fed signaled it would raise rates once more before the end of the year. Investors are also grappling with signs that the central bank will keep rates higher for longer as the Fed struggles to yank inflation down to its 2% target.By raising interest rates to tackle inflation, the Fed has made it more costly to finance government debt, alarming deficit hawks.That's because rising rates, or the higher cost of borrowing, has a large impact on the federal budget. Interest on government debt is on track to cost $10 trillion over the next decade, according to estimates. In the fiscal year of 2022, American taxpayers spent $475 billion in interest on the national debt. The following year that figure climbed to $640 billion. And as a percentage of GDP, the costs of servicing the debt is projected to rise from 2.4% in 2023 to 3.6% 2033.Even if the Fed’s next rate hike is the last of the cycle, as forecasts suggest, the costs of paying down government debt will keep increasing, as Washington's new borrowing comes at higher interest rates. Government estimates of future interest payments paint an onerous picture that experts say could spell an unworkable budget. In 10 years, interest payments are projected to exceed $1.4 trillion annually. That's more than defense spending is expected to cost in that period.SBF's friends offer some of most damaging evidence at trialThe people closest to Sam Bankman-Fried and who know him best are the same ones whose

testimony presents the a major problem for the FTX founder during his criminal trial, which began earlier this week.The first-hand accounts of Bankman-Fried's inner circle go to the heart of the allegations against the 31-year-old crypto entrepreneur, reports Yahoo Finance's Alexis Keenan. Their testimony offers some of the most damaging evidence presented thus far, bolstering allegations that he embezzled billions in FTX customer funds while misleading investors and lenders.Gary Wang, who co-founded FTX and the crypto hedge fund called Alameda Research, said he created computer code at Bankman-Fried's direction to exempt Alameda from the rules that applied to other FTX customers. The features of the code gave Alameda unlimited access to customer funds deposited into FTX, extraordinary lines of credit to place margin trades on the exchange, and the ability to incur negative balances. Wang, 30, met Bankman-Fried at summer camp when he was seven years old and they later became college classmates at Massachusetts Institute of Technology.At trial, however, the long-time friends sat across from one another as Wang delivered a narrative of alleged wrongdoing.Other members of Bankman-Fried's tight circle are also expected to testify, including Caroline Ellison, the former CEO of Alameda Research and a one-time romantic partner, as well as former FTX chief engineer Nishad Singh. Wang, Ellison and Singh have pleaded guilty to criminal charges.JAs is often the case on BLS Employment Situation days, the initial move in stocks (down) was reversed (up). The Dow, Nasdaq, and S&P 500 are all up more than 1% and having their best day since August.Delving into the market reaction going back three decades to 1993, the S&P 500 is up only about half the time the following day, with an average gain of 0.04%. The following week is also positive about 50% of the time with an average loss of 0.50%. But that jumps to about 70% when looking out longer term. One quarter later, the S&P 500 is up an average of 3.32%.For the Nasdaq, the results in the short term are a bit better and roughly match the longer-term S&P 500 results when it comes to win percentage. The Nasdaq averages positive results for each time frame presented, with the index up 4.56% on average one quarter later.We'd be remiss if we didn't note the huge reaction in bonds as well.Treasury rates have reversed off the highs of the day when the 10-year yield peaked at 4.89% -- an eyewatering 17 basis points (bps) jump. But the 10YY is still up a material 6.5 bps as we write.Looking at the historical cases when the indices were up over 1% and when the U.S. 10-year Treasury yield jumps over 5 basis points (bps), we get the following results.In this scenario, next-day results improve in the S&P 500 to a 0.22% average with a roughly 60% win rate. The Nasdaq results improve over some time frames and regress under others.Bottom line: today's results point to more bullishness ahead with only a small chance that today's risk-on mood is just a fake-out.How the food industry might adapt to more widespread weight loss drugsConsumer packed goods companies are confronting the possibility that a new wave of appetite suppressing drugs will change the way Americans eat. In the years ahead, if the medications are more widely adopted, that could translate to new shopping habits, where carts are filled with less food, and with snacks and meals that pack fewer calories.But as Conagra CEO Sean Connolly said Friday, after the company reported earnings, food companies have been grappling with shifting consumer fads and trends for decades. "Back in the '90s with Snack Wells, it was all about fat and calories. And if you just look in the last few years, we've gone from grain-free to cauliflower to keto. I mean it's constantly evolving," Connolly said.Rather than being caught flat-footed by pharmaceutical advancements, Connolly described a product design process in which companies are plugged into the latest desires of

the consumer, changing things like packaging, serving size and ingredients to keep up with the trends that shoppers are chasing."If we end up seeing changes in consumer eating patterns, let's say they go to smaller portions, then we evolve the innovations, and we design smaller portions. If they switch to different types of nutrients, we evolve the innovation, we switch to different types of nutrients. If they change the kind of pack sizes they snack on, we'll change that."Connolly also acknowledged that the potential consumer shifts prompted by the new class of drugs won't happen overnight. "So this is the kind of stuff that will happen over 5, 10, 15 years, not over the next 6 months. But I think the key to navigating these kinds of just constantly evolving consumer environment is you have to be externally focused. You've got to study these consumer trends and you've got to rapidly design in what the consumer is looking for into your products," he said.Stocks trending in afternoon tradingHere are some of the stocks leading Yahoo Finance’s trending tickers page in afternoon trading on Friday:Walmart (WMT): Shares of the retail giant fell by more than 3% Friday afternoon following remarks from an executive who noted that the company is seeing a "slight change" in the carts of shoppers on the diabetes and weight loss drug Ozempic, Wegovy, and other appetite suppressants.Overstock (OSTK): The company's surge continued on Friday afternoon, rising more than 12% after Camping World (CWH) CEO Marcus Lemonis joined Overstock's board, and proceeded to buy over 33,000 shares.Pioneer Natural Resources (PXD): Shares of the shale producer surged more than 11% Friday afternoon after reports that oil giant Exxon Mobil was finalizing a blockbuster deal to acquire it, worth about $60 billion.Taiwan Semiconductor (TSM): Shares rose more than 2% after the company reported a smaller-than-expected decline in revenue, boosted by demand for AI and other advanced chips. Taiwan Semiconductor produces chips for Apple, Nvidia and other tech companies.Dow gains more than 200 points in reversalA Friday morning trading session that began on a sour note has turned into an afternoon surge as Wall Street reconsiders the impact of a stunning jobs report.The S&P 500 (^GSPC) gained 0.9%, while the Dow Jones Industrial Average (^DJI) rose about 0.8% or 250 points. The tech-heavy Nasdaq Composite (^IXIC) climbed more than 1%.Stocks trending in morning tradingHere are some of the stocks leading Yahoo Finance’s trending tickers page in morning trading on Friday:Pioneer Natural Resources (PXD): Shares of the shale producer surged more than 10% Friday morning after reports that oil giant Exxon Mobil was finalizing a blockbuster deal to acquire it, worth about $60 billion.Levi Strauss (LEVI): After reporting that revenue fell short of expectations and cutting its full-year sales guidance, the clothing company fell 0.83%.Taiwan Semiconductor (TSM): Shares rose more than 1% after the company reported a smaller-than-expected decline in revenue, boosted by demand for AI and other advanced chips. Taiwan Semiconductor produces chips for Apple, Nvidia and other tech companies.Tesla (TSLA): Shares in Tesla fell over 2% Friday morning after the company again cut prices of its Model 3 compact sedan and the Model Y SUV. The US Securities and Exchange Commission is also suing the company's chief executive, Elon Musk , to compel him to testify over his actions surrounding the purchase of Twitter, now called X.Stunning jobs report bolsters the 'higher for longer' stance at the FedThe blockbuster September jobs report released on Friday came in nearly double the figure that economists had predicted. The muscular reading offered yet another data point showing the economy is more resilient than many had expected, even in the face of an aggressive tightening campaign by the Federal Reserve.Experts say the strong labor market bolsters the case for the Fed to increase rates again, and further

drives home the need for the central bank to maintain elevated rates for a longer period of time."Friday's jobs report suggests that the labor report remains very strong and cements the case for an additional Fed rate hike this year, and it also likely delays the pace of eventual rate cuts," said Robert Schein, chief investment officer at Blanke Schein Wealth Management. "Investors will need to get used to the higher for longer narrative on interest rates given the strength of the economy."The market is now predicting a greater likelihood the Fed will increase rates next month, according to the CME FedWatch Tool. Just a day before the jobs report, the forecast showed a 20% probability of a rate increase in November. That number jumped to nearly 30% on Friday.Since job losses aren't piling up as a consequence of the Fed's prior rate hikes, some experts point to the increasing likelihood of a soft landing. "Resilient jobs growth shows there is some cushion for the Federal Reserve’s efforts to cool inflation without causing job losses," said Daniel Zhao, Glassdoor’s lead economist. "'As the labor market is in a resilient holding pattern, we’re one month closer to exiting 2023 without a recession."Stocks open lower after blockbuster jobs reportThe first week of October headed for more losses after stocks sank at the opening bell on Friday. Investors recoiled after the newly released September jobs report showed the US economy added 336,000 jobs, shattering expectations that had called for 170,00 additions. The latest jobs data fueled concerns that the labor market isn't slowing as fast as the Federal Reserve would like as it struggles to lower inflation.The S&P 500 (^GSPC) lost 0.5%, while the Dow Jones Industrial Average (^DJI) decreased by about 0.3% or nearly 100 points. The tech-heavy Nasdaq Composite (^IXIC) gave up about 0.5%.Show moreClick here for the latest stock market news and in-depth analysis, including events that move stocksRead the latest financial and business news from Yahoo Finance

0 notes

Photo

swing streetdreamsmag #streetweekly #gramslayers #ourstreets #spicollective #streetgrammers #bevisuallyinspired #hsinthefield #street_life #storyofthestreet #lensculturestreets #lensonstreets #capturestreets #zonestreet #myspc #streetphotography #gspc #streetphotographers #artofvisuals #moodygrams #eclectic_shotz #agameoftones #way2ill #justgoshoot #exploretocreate #hbouthere #streetclassics #wynwood #Miami @AndTHeLastWaves @StreetPhotographers @StreetDreamsMag @StreetScape @LensCulture @EyeEmPhoto @thecitymag_ @justgoshoot @the.street.photography.hub @streets_vision @streetphotographyjournal @urbanandstreet @streetphotographyinternational @streetphotographyworldwide @magnumphotos @streetartglobe @streetshared @citykillerz @urbanromantix @gramslayers @streetphotographers_art (at Wynwood Life) https://www.instagram.com/p/CpeN1mcuQh9/?igshid=NGJjMDIxMWI=

#streetweekly#gramslayers#ourstreets#spicollective#streetgrammers#bevisuallyinspired#hsinthefield#street_life#storyofthestreet#lensculturestreets#lensonstreets#capturestreets#zonestreet#myspc#streetphotography#gspc#streetphotographers#artofvisuals#moodygrams#eclectic_shotz#agameoftones#way2ill#justgoshoot#exploretocreate#hbouthere#streetclassics#wynwood#miami

0 notes

Text

Why the stock market is having 'digestion problems' this earnings season

Earnings season hasn’t been able to keep the stock market rally afloat over the past week.

After an aggressive rally to all-time highs to start the year, the S&P 500 (^GSPC) has tumbled in April as rising bond yields and slimmed expectations for Federal Reserve interest rate cuts have put a damper on investors’ enthusiasm.

And given the significant rise in share price of some of the market…

View On WordPress

#earnings per share#earnings season#Emanuel#Evercore ISI#Julian Emanuel#market rally#price action#stock market

0 notes