#margin trading

Text

the fact that shakespeare was a playwright is sometimes so funny to me. just the concept of the "greatest writer of the English language" being a random 450-year-old entertainer, a 16th cent pop cultural sensation (thanks in large part to puns & dirty jokes & verbiage & a long-running appeal to commoners). and his work was made to be watched not read, but in the classroom teachers just hand us his scripts and say "that's literature"

just...imagine it's 2450 A.D. and English Lit students are regularly going into 100k debt writing postdoc theses on The Simpsons screenplays. the original animation hasn't even been preserved, it's literally just scripts and the occasional SDH subtitles.txt. they've been republished more times than the Bible

#due to the Great Data Decay academics write viciously argumentative articles on which episodes aired in what order#at conferences professors have known to engage in physically violent altercations whilst debating the air date number of household viewers#90% of the couch gags have been lost and there is a billion dollar trade in counterfeit “lost copies”#serious note: i'll be honest i always assumed it was english imperialism that made shakespeare so inescapable in the 19th/20th cent#like his writing should have become obscure at the same level of his contemporaries#but british imperialists needed an ENGLISH LANGUAGE (and BRITISH) writer to venerate#and shakespeare wrote so many damn things that there was a humongous body of work just sitting there waiting to be culturally exploited...#i know it didn't happen like this but i imagine a English Parliament House Committee Member For The Education Of The Masses or something#cartoonishly stumbling over a dusty cobwebbed crate labelled the Complete Works of Shakespeare#and going 'Eureka! this shall make excellent propoganda for fabricating a national identity in a time of great social unrest.#it will be a cornerstone of our elitist educational institutions for centuries to come! long live our decaying empire!'#'what good fortune that this used to be accessible and entertaining to mainstream illiterate audience members...#..but now we can strip that away and make it a difficult & alienating foundation of a Classical Education! just like the latin language :)'#anyway maybe there's no such thing as the 'greatest writer of x language' in ANY language?#maybe there are just different styles and yes levels of expertise and skill but also a high degree of subjectivity#and variance in the way that we as individuals and members of different cultures/time periods experience any work of media#and that's okay! and should be acknowledged!!! and allow us to give ourselves permission to broaden our horizons#and explore the stories of marginalized/underappreciated creators#instead of worshiping the List of Top 10 Best (aka Most Famous) Whatevers Of All Time/A Certain Time Period#anyways things are famous for a reason and that reason has little to do with innate “value”#and much more to do with how it plays into the interests of powerful institutions motivated to influence our shared cultural narratives#so i'm not saying 'stop teaching shakespeare'. but like...maybe classrooms should stop using it as busy work that (by accident or designs)#happens to alienate a large number of students who could otherwise be engaging critically with works that feel more relevant to their world#(by merit of not being 4 centuries old or lacking necessary historical context or requiring untaught translation skills)#and yeah...MAYBE our educational institutions could spend less time/money on shakespeare critical analysis and more on...#...any of thousands of underfunded areas of literary research i literally (pun!) don't know where to begin#oh and p.s. the modern publishing world is in shambles and it would be neat if schoolwork could include modern works?#beautiful complicated socially relevant works of literature are published every year. it's not just the 'classics' that have value#and actually modern publications are probably an easier way for students to learn the basics. since lesson plans don't have to include the#important historical/cultural context many teens need for 20+ year old media (which is older than their entire lived experience fyi)

23K notes

·

View notes

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney

Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Text

Comprehensive Crypto Margin Trading Exchange Guide For Beginners guide

A comprehensive crypto margin trading exchange guide for beginners is a document that explains the basics of margin trading, the benefits and risks involved, the features and safety of different exchanges, and the strategies and tips for successful margin trading. It can help beginners to learn how to trade with leverage, increase their profits, and avoid common pitfalls. Here is a possible outline of such a guide:

Introduction: Define margin trading, leverage, liquidation, and other key terms. Explain the purpose and scope of the guide.

Margin Trading Basics: Explain how margin trading works, how to open and close positions, how to calculate profits and losses, and how to manage risks.

Margin Trading Benefits and Risks: Highlight the advantages and disadvantages of margin trading, such as higher returns, lower capital requirements, market volatility, interest fees, and liquidation risks.

Margin Trading Exchanges: Compare and contrast the top exchanges that offer margin trading, such as Bybit, PrimeXBT, Phemex, KuCoin, and BitMEX. Evaluate their features, fees, security, liquidity, and customer support.

Margin Trading Strategies and Tips: Provide some practical advice on how to choose the right leverage, set stop-loss and take-profit orders, use technical analysis, diversify your portfolio, and follow the market trends.

Conclusion:

Summarize the main points of the guide, provide some additional resources, and encourage the readers to start margin trading with caution and confidence.

If you want to read more about margin trading, you can check out these resources:

Comprehensive Crypto Margin Trading Exchange Guide For Beginners

#web3#web3community#margin trading#cryptocurrency trading#cryptocurrency#blockchain#investment#altcoin#dappfort

0 notes

Text

Binance Adds GFT, COS, and SYS to Margin Trading Platform

In a move to expand its offerings and provide more options to its users, Binance has recently added GFT, COS, and SYS as new borrowable assets on its Cross Margin and Isolated Margin platforms. Additionally, new trading pairs have been introduced on the Cross Margin platform, including COS/USDT, GFT/USDT, and SYS/USDT. This article will delve into the details of these new additions and provide an…

View On WordPress

#Amplified profits#binance#Borrowable assets#Collateral ratios#COS#COS/USDT#Cross Margin#Experienced traders#GFT#GFT/USDT#Isolated Margin#Isolated Margin trading pair#Leverage#Long#Margin Data#Margin trading#Novice traders#Rates#Responsible trading#Risk#Risk management#Risks and disclaimers#Shorting#Specific risk exposure#Stablecoin#Stop-loss orders#SYS#SYS/USDT#Trading pairs#USDT (Tether)

0 notes

Text

What Is Margin and How Does It Work in the Stock Market?

Margin trading, a feature of the stock market, enables investors to acquire more stocks than their available funds. Instead of purchasing stocks at their market price, investors can buy them at the margin price. This involves borrowing money from your stockbroker, which, like any loan, comes with an interest charge. It grants investors access to larger sums than their existing funds, allowing for greater market exposure. Margin trading, also known as leverage trading, carries its own set of risks but can lead to higher returns when market speculations are accurate.

How Margin Trading Operates

Investors interested in margin trading must possess a Margin Trading Facility (MTF) account, distinct from a Demat Account. To initiate an MTF account, you can request your broker's assistance. SEBI periodically specifies the eligible securities for MTF accounts. This account boosts your purchasing capacity, potentially increasing gains. Brokers apply an interest rate to the loan amount, which is the money you contribute to margin trading.

For instance, if Person X has Rs 20,000 but wishes to buy Rs 50,000 worth of shares, they can do so through Margin Trading by paying a percentage of the total amount. Assuming an authorized broker sets a 20% margin requirement, X would pay 20% of Rs 50,000, with the broker lending the remaining Rs 40,000 while charging interest on the margin amount.

Now, if X initially possessed Rs 50,000, they could straightforwardly buy Rs 50,000 worth of shares. If the share price rises on the same day, increasing the invested amount to Rs 55,000, their return on investment would be 10%. However, in margin trading, where the initial investment was only Rs 10,000, the returns would be significantly higher than 10%.

Conversely, if the market experiences a downturn, X's losses through margin trading would exceed those in regular trading. Additionally, if X doesn't sell their shares before a specified deadline, the broker has the right to sell them, often referred to as "squaring-off," and use the proceeds to cover potential losses.

Features of Margin Trading in India

The following are some noteworthy features of margin trading.

Investors can leverage their stock market position based on the margin requirement, offering cash or securities as collateral.

Securities available for trade in an MTF account are predetermined by SEBI and the stock exchange.

Only SEBI-authorized brokers are permitted to open MTF accounts for investors.

As market conditions appreciate, the margin derived from your collateral stocks will also increase, enabling the purchase of more securities under MTF.

Positions can be carried forward up to T+ N days, where T represents the trading day, and N indicates the number of days a position can be extended, a value set by individual brokers and varying among them.

Conclusion

Margin trading substantially boosts buying power but comes with the potential for amplified losses if the market takes an unfavorable turn. Consequently, extreme caution is essential when engaging in margin trading investments. You can approach trusted brokerage houses like BlinkX where all the terms and conditions are transparent. So, you can trade on margin at low charges.

0 notes

Text

Navigating the Ups and Downs of Margin Trading Accounts | HugeCount

In the fast-paced realm of financial markets, a trading account opens the door to a world of possibilities. The advent of technology has brought about a surge in online trading accounts, redefining how individuals engage with the markets. Among the various trading options available, margin trading accounts stand out as both a boon and a […]

Source: https://hugecount.com/finance/navigating-the-ups-and-downs-of-margin-trading-accounts/

0 notes

Text

Margin Trading adalah: Pengertian, Fasilitas, dan Hal Penting Lainnya

Margin trading adalah sesuatu yang asing untuk kalangan awam, tapi berbeda jika terkait investor saham. Berhubungan erat dengan saham, margin trading merupakan salah satu istilah dalam trading yang menyatakan ketersediaan saham dalam melakukan bisnis.

Para investor saham harus pandai mengelola dana yang ada untuk meraup keuntungan lebih besar. Namun, ada kalanya kurang tercukupinya dana guna pembelian saham. Bagaimana solusi terbaiknya, tentu penggunaan fasilitas margin trading bisa jadi pilihan.

Pengertian Apa Itu Margin Trading

Kadang, membeli saham saat harga rendah tapi memiliki potensi besar sangat menggiurkan bagi pebisnis saham. Hanya saja ketika dana dalam RDN tidak bersahabat, keinginan dapat pupus begitu saja.

RDN merupakan Rekening Dana Nasabah yang wajib dimiliki oleh perorangan atau badan usaha dan berguna untuk melakukan transaksi efek perlakukan saham. Jika RDN tidak mencukupi bagaimana akan melakukan pembelian saham?

Margin trading adalah solusi cepat dan tepat saat pebisnis saham untuk mengatasi kekurangan modal. Bursa saham menyediakan fasilitas margin yang menggiurkan untuk gerak cepat para investor agar terus bermain saham meski modal kurang mencukupi.

Lalu apa itu margin trading dan pengertiannya secara lengkap?

Margin trading adalah fasilitas guna meningkatkan daya beli dalam menjaminkan saham yang dimiliki untuk mendapatkan pinjaman modal dari perusahaan sekuritas. Dari fasilitas tersebut nasabah atau pelaku saham dapat melakukan transaksi dengan modal lebih besar dari awal.

Pada intinya adalah margin trading lebih memudahkan pelaku saham dalam menjalankan dan membeli saham yang diinginkannya. Dengan begitu perputaran transaksi berjalan terus dan saling menguntungkan.

Jika tertarik dengan adanya margin trading, sebaiknya mengetahui berbagai hal penting terkait permainan saham ini. Begitu pula dengan cara kerja, keuntungan dan kerugian yang mungkin terjadi.

Cara Kerja Margin Trading

Margin trading memberikan pinjaman untuk pelaku saham dengan modal kecil dengan beberapa syarat dan ketentuan berlaku. Pinjaman modal margin trading adalah sesuatu yang berbeda ketika melakukan pinjaman kepada bank konvensional.

Bagaimana dengan sistem kerjanya, bisa melihat tahapannya berikut ini.

1. Memulai Margin Trading

Artinya nasabah membuka rekening dan pihak investor otomatis diminta menentukan persentase margin sekaligus total dari nilai pesanan.

2. Konsep Leverage Ratio

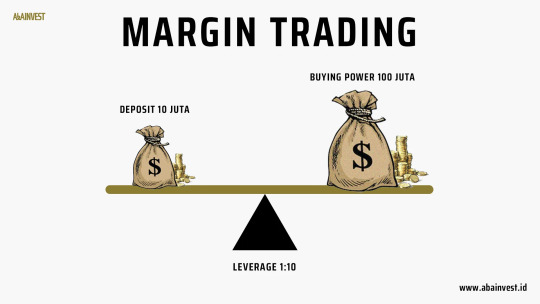

Kaitannya dengan konsep rasio atau perbandingan antara dana investor dengan dana pinjaman dari perusahaan sekuritas. Perusahaan sekuritas ini bertindak sebagai broker.

3. Pembuatan Leverage Trading

Adapun pembuatan leverage trading dengan merepresentasikan rasio dana pinjaman dari margin. Contoh margin trading untuk membuka transaksi sebesar 10 juta rupiah dengan leverage 10 : 1. Dari pihak investor akan menyediakan modal hanya 1 juta rupiah.

4. Beda Tingkatan Leverage Trading

Dalam perbandingan seperti contoh tersebut berbeda-beda tergantung saham. Rasio dalam pasar saham biasanya 2 : 1, berbeda dengan kontrak berjangka yang melakukan perbandingan hingga 15 : 1.

Berbeda pula dengan beberapa saham lainnya misalnya saja Forex yang mencapai leverage sebesar 50 : 1 bahkan 200: 1. Adapun penggunaan leverage yang normal berkisar antara 2 : 1 hingga 100 : 1.

5. Membuka Posisi Jual Beli

Pemanfaatan margin trading sebagai pembuka dalam perdagangan saham. Dalam posisi long margin maka penggambaran saham menjadi aset investor dalam agunan keperluan pinjaman modal.

Pinjaman dengan sistem jatuh tempo, artinya margin trading adalah metode pinjaman dengan investor harus membayar utang margin tersebut. Tentunya sesuai syarat dan ketentuan di awal yang berlaku.

Terdapat pula bunga pinjaman jika pelaku saham atau investor saham gagal dalam melakukan pembayaran utang. Jika hal ini terjadi maka akan terjadi pemberlakuan likuidasi untuk menutup kerugian utang.

Jika hal tersebut terjadi akan menanggung konsekuensi lain karena aset milik investor akhirnya dapat dijual paksa. Memerlukan perhitungan jelas agar hal seperti ini tidak terjadi dan tidak merugikan investor saham.

Hal Penting yang Harus Diketahui Tentang Margin Trading

Perdagangan saham membutuhkan modal tidak sedikit, tentunya hasil tergantung dari modal awal tersebut. Dana besar akan mendapatkan keuntungan dengan harapan lebih besar padahal pembelian saham tidak hanya satu atau dua lembar saja.

Satuan kebutuhan saham dalam bentuk lot dengan satu lot berisikan 100 lembar. Hitungan harga per lembar sehingga membutuhkan dana tidak sedikit.

Keterbatasan modal bukan lagi menjadi masalah dengan adanya margin trading. Margin trading adalah solusi terbaik tapi tetap perhatikan hal penting sebelum terjun langsung dalam urusan dana trading.

Hal penting yang harus diketahui terkait margin trading adalah:

1. Tidak Semua Menyediakan Margin Trading

Fasilitas margin trading memang menguntungkan jika modal sempit tapi tidak semua sekuritas menyediakan fitur ini. Bursa Efek Jakarta (BEJ) memberikan izin bagi sekuritas dengan kriteria tertentu.

2. Mengajukan Permohonan Khusus

Margin trading adalah fasilitas menggiurkan para pelaku saham, hanya saja perlu pengajuan khusus kepada pihak sekuritas. Meskipun pihak sekuritas memiliki fitur atau fasilitas margin trading, jika tidak melakukan permohonan tetap tidak bisa menggunakan fasilitas tersebut.

3. Syarat dan Ketentuan Berlaku

Dalam menggunakan fasilitas margin trading, terdapat syarat dan ketentuan khusus dalam pendaftarannya. Masing-masing sekuritas memiliki metode perdagangan saham dengan aturannya sendiri, antara lain:

· Terdapat batas limit maksimum modal talangan yang didapatkan.

· Berapa besar bunga yang berlaku.

· Data yang diperlukan dan yang lainnya.

Jika ingin menggunakan fasilitas margin trading syarat ketentuan harus terpenuhi semuanya.

4. Saham Tertentu yang Dapat Diperjualbelikan

Penggunaan margin trading tidak untuk semua jenis saham. Hanya saham tertentu dan terpilih sesuai dengan persyaratan bursa dan dapat diperjualbelikan menggunakan fasilitas margin trading.

Dalam hal ini bisa mengetahui datanya secara lengkap setiap bulan yang diterbitkan otoritas BEI. Data berupa Daftar Efek Margin yang dapat dijual belikan pakai margin trading.

5. Bunga Harian

Margin trading adalah sistem jual beli saham menggunakan bunga harian. Hitungan per hari ini membuat investor saham harus pandai memilih saham mana yang sebaiknya dibeli dengan prospek yang bagus ke depannya. Dengan demikian keuntungan jelas didapatkan.

Keuntungan lain jika prospek bagus adalah pinjaman dalam fasilitas margin trading segera terlunasi sebelum jatuh tempo. Dengan demikian tidak perlu membayar bunga jika terjadi transaksi dalam sehari itu. Misalnya saja beli siang dan jual pada sore hari.

6. Pahami Aturan dengan Baik

Sebelum memutuskan menggunakan fasilitas margin trading pahami dan mengerti aturan mainnya, antara lain:

· Jatuh tempo

· Aturan pelunasan

· Atuan forced sell

Memahami aturan margin trading dengan baik akan meminimalkan resiko.

7. Hubungannya dengan Saham Syariah

Bagaimana jika trader Muslim ingin menggunakan fasilitas margin trading ini? Trading saham dapat dibilang terlarang dalam ketentuan investasi saham secara syariah. Jika ingin menghindari riba ada baiknya tidak menggunakan fasilitas margin trading.

Dalam banyak hal, margin trading memberikan banyak kelebihan. Namun, tak menampik adanya kekurangan dan investor saham perlu mengetahuinya.

Kelebihan Margin Trading

Apabila perencanaan dilakukan dengan benar, margin trading memberi lebih banyak keleluasaan investor saham dalam melakukan transaksi. Keuntungan margin trading dapat dilihat dari banyak sektor, antara lain:

1. Menghindari Suspend Buy

Suspend buy terjadi jika menggunakan akun reguler sekuritas dan belum dapat membayar hingga dua hari pasca perdagangan saham, sehingga broker dilarang membeli saham. Dengan margin trading, tetap dapat melakukan transaksi saham dengan limit selama rasio tercukupi.

2. Biaya Rendah

Terdapat pinalti keterlambatan jika menggunakan rekening reguler dengan denda mencapai 0,13% perhari. Penggunaan margin trading hanya 0.05% berdasar calendar day.

3. Lebih Fleksibel

Holding period lebih fleksibel dengan transaksi hingga 3 hari pasca perdagangan saham. Hal itu jika jaminan rasio mencukupi.

4. Memaksimalkan Keuntungan

Keuntungan dapat diraih jika harga saham naik terus dan stabil.

Pendapatan keuntungan memberikan lebih banyak kesempatan dalam melakukan permainan saham. Laba semakin banyak dan berani melakukan transaksi lain yang sekiranya memberi banyak keuntungan.

Kerugian Margin Trading

Jika ada keuntungan terdapat pula kelemahan dari margin trading. Sebelum menggunakan fasilitasnya, pahami dulu apa kerugiannnya. Adapun kerugian margin trading adalah:

1. Gagal Bayar

Resiko pertama yang terjadi jika gagal bayar. Apabila terjadi keuntungan besar dengan fasilitas margin trading, bukan masalah untuk melunasi kewajiban utang. Akan tetapi ada resiko terburuk yaitu adanya capital loss.

Dengan adanya capital loss kemungkinan membayar akan gagal, ujungnya terjadi penjualan aset secara paksa untuk pemenuhan kewajiban pelunasan.

2. Capital Loss

Resiko kedua adalah capital loss karena bursa saham fluktuatif tidak dapat diprediksi secara tepat. Segala resiko yang menimbulkan kerugian bisa terjadi dengan mudah. Ketika terdapat saham menjanjikan untuk kemudian dijual lagi, belum tentu kenyataan seperti harapan.

Saham dapat anjlog dalam hitungan hari bahkan jam. Dengan demikian akan terjadi capital loss. Pembelian sedikit mungkin bukan menjadi masalah besar, tapi pembelian dalam jumlah banyak menciptakan kerugian besar.

Kerugian yang terjadi memberikan efek pada pelunasan dalam fasilitas margin trading. Keadaan rugi membuat trader tidak mampu melakukan pembayaran bahkan pelunasan serta bunga. Gagal melakukan kewajiban, aset harus mampu terjual paksa.

Guna menghindari kerugian, dapat melakukan beberapa hal sebagai tameng. Terdapat dua hal yang sebaiknya menjadi perhatian, yaitu:

· Memahami aturan fasilitas margin trading secara benar dan tepat.

· Pemilihan saham secara tepat dan perhatikan fluktuasi yang terjadi sehingga tidak sampai salah pilih.

Tentunya hal tersebut bukan hal mudah, membutuhkan proses dan pengalaman untuk berani mengambil resiko. Keuntungan dan kerugian margin trading perlu dipahami dengan baik guna tahu laba dan meminimalisir resiko kerugian.

Kesimpulan

Menggunakan fasilitas margin trading sangat menggiurkan karena meskipun modal limit tetap mampu bertransaksi dalam jual beli saham. Hanya saja perlu memikirkan resiko yang terjadi jika terjadi hal di luar perkiraan dalam efek saham.

Meskipun begitu, tetap saja margin trading adalah modal para investor saham guna mendapatkan banyak keuntungan lebih besar. Meskipun investor sendiri tidak memiliki modal cukup guna melakukan pembelian.

Artikel sumber bisa ditemui di link ini

Kumpulan Blog ABA Invest bisa ditemui di link ini

0 notes

Text

Margin trading allows traders to amplify gains and losses by opening leveraged positions. Though risky, it can offer big rewards when used properly. Here's a full guide on how to margin trade correctly and profitably on GDAX → dijicrypto.com

GDAX offers up to 3x leverage for advanced crypto traders looking to access powerful trading strategies beyond simply buying and holding. However, margin trading is not for the inexperienced and exposes you to liquidation risks if not done carefully.

This complete guide covers:

• How margin trading works

• Requirements to enable it on GDAX

• Strategies like going long, short selling and arbitrage

• Risks like liquidation, interest costs and 24/7 market volatility

Start small and manage risk effectively if you wish to benefit from the opportunities that margin trading presents. With great power comes great responsibility.

Read the full guide by Dijicrypto to learn how to trade crypto responsibly on GDAX using margin → dijicrypto.com

0 notes

Text

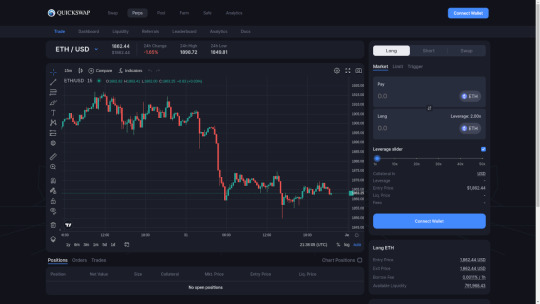

QuickSwap Launches Perpetuals, Gains $8M+ In Volume

The increasingly popular QuickSwap decentralized exchange has gained $8.8 million in total volume as of May 31, 2023 since it launched its perpetuals/margin trading features on Polygon zkEVM a couple of weeks ago. Over $10,000 in fees have been earned so far and its QLP pool is now worth over $4.6 million.

The new features come at a much-needed time when large centralized cryptocurrency…

View On WordPress

0 notes

Text

Key Factors That Influence the US Stock Market

Key Factors That Influence the US Stock Market

Stock and share markets are where financial instruments like stocks, shares, etc., are traded. This is considered an aspect of the free market economy, making it possible for investors to generate capital gains and contribute to GDP growth in this country. Due to market fluctuations, investing in stocks can be risky, but the return is also higher than that of other investment instruments.

But to minimize loss, one can make intelligent investment choices by diversifying portfolios. Therefore, understanding the factors that affect the share market is only fair. Let’s further profoundly understand the key factors influencing the US stock market.

Factors Influencing the US Stock Market;

1. Gross Domestic Product

The Gross Domestic Product, or the GDP of a given country, is one of the most widely diverse macroeconomic factors. In theory, GDP represents the value of all finished goods and services in a country at any time. This provides a quick view of the country's economic situation. In most countries, GDP growth is typically measured annually and, in some cases, quarterly.

In the United States, the government releases the GDP for each calendar year and the annual GDP for each quarter. Using information obtained through surveys of manufacturers, retailers, and real estate developers and the analysis of trade flows, this figure is calculated by the BEA Bureau of Economic Analysis. To put it bluntly, GDP measures economic growth or contraction, giving an overview of the country's state of affairs.

2. Unemployment Rate

The outlook is positive, and investors expect retail sales to increase, leading to higher corporate profits if the unemployment rate falls and the employment rate rises. They drive up the number of stocks they buy and positively impact stock markets. On the other hand, if unemployment rates increase and jobs decrease, this implies a negative outlook for investors as they seek to hedge stocks or redeem their investments.

3. Inflation

GDP and inflation, commonly known to influence stock markets, are two more frequent macroeconomic factors. The increase in prices for goods and services, or an increase in monetary supply, constitutes inflation as a matter of principle. Price increases in goods and services are the result of inflation. If the money supply in the economy increases, consumers will have more money to spend on products and services, leading to a rise in prices.

The consumer price index, or the Core Consumer Price Index, is used as a measure of US inflation. While CPI measures changes in prices of all goods and services, Core CPI excludes food and energy-related products/services since they tend to have more price volatility than the others. Inflation is also a result of GDP growth.

4. Industrial Input

Although we don't live in an industry-dominated world, industrial output remains a crucial indicator of America's economic strength. The Federal Reserve shall make available an industrial production index, or IPI, for each month, indicating output in the manufacturing, mining, electrical, and gas sectors. The report also provides an overview of the capacity, the ratio of output capacity utilization, and production levels that can be maintained sustainably.

5. Retail Sales

We're living in a world governed by consumers. Retail sales are a crucial source of revenue for the US economy. The US Bureau of Census tracks consumer demand monthly and compiles durable goods and service sales data. This is crucial in an economy such as the US, where nearly two-thirds of GDP comes from consumer spending.

The factors stated above are the major fundamental factors that affect the US stock market.

0 notes

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney

Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Text

Crypto Fiat Exchange Networx Margin Trading Guide

Crypto Fiat Exchange Networx (CFXN) Margin Trading Guide

With the rise in popularity of cryptocurrencies, margin trading on this volatile asset has opened up new and potentially lucrative possibilities. In this article, we’ll show you how to trade crypto on margin and how to do so using Prime XBT. We’ll also go over the advantages and disadvantages of crypto margin trading, as well as how to get started.

What is margin trading?

Leverage is used in crypto margin trading to multiply the results of a trade. The margin is the amount a trader has deposited in their account. A margin trading broker will give traders a leverage quotation, which is commonly displayed as a ratio (e.g., 1:5) or a multiple (e.g., 5x), indicating that for every 1 Bitcoin (or other base crypto) placed, they will get 5 Bitcoin (or another base crypto) back.

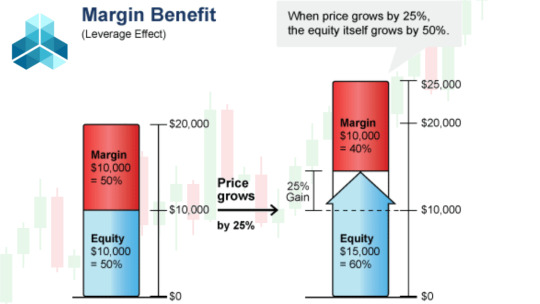

The broker permits traders to borrow money to open more visible positions. This will have to be repaid in full, but the trader will be able to keep the gains. If your leverage is 1:5, you’ll have $5,000 to trade with if you deposit $1,000. If you use this to buy Ethereum and the price rises 5%, you’ll end up with $5,250 in ETH. If you complete your deal at that point and repay the $4,000 borrowed, you’ll be left with $1,250 and a profit of $250. You would have made a $50 profit if you had executed the same trade in your spot account.

If the price of crypto goes awry after you open your position — say, down instead of up — the crypto exchange will “margin call” your trade when the price reaches a point where you begin losing the borrowed funds. So you’d have to continue increasing funds above that threshold to avoid getting margin calls and losing your trade.

Why trade on margin?

Short sales: Short selling frequently employs the concept of margin. When you short sell cryptocurrencies, you’re betting that their price will fall at some point in the future, a process that’s commonly referred to as “shorting.” Trading on margin increases the size of a short position and thus its earnings. However, the contrary is also true: if the deal goes wrong, the potential for losses might be significant.

Managing risk: Traders also use margin as a risk management strategy to limit or hedge their losses. You can, for example, hedge a long bet on the price trajectory of an asset by shorting the same asset with an equivalent or lesser amount.

Assume you have $10,000 in your trading account, and your broker permits you to borrow up to 50% of that amount, or $5,000 in the margin. The value of your trading account rises to $15,000 as a result. You could get $150 if your purchased shares grow 10%. Conversely, if they fall 10%, you’ll lose $150, or $50 more than if you hadn’t borrowed anything at all.

How does margin trading work in cryptocurrency?

Cryptocurrency trading, let alone crypto margin trading, is not offered by most traditional brokerages. Because of the volatility of cryptocurrencies, individual traders have been deterred from making large bets with margin trading funds. Institutional investors, according to statistics, do 70% of all current cryptocurrency trading using API calls. In place of brokerages, cryptocurrency exchanges have become popular places to trade on margin. However, this service is not available in all exchanges.

For the exchanges that allow margin trading, leverage amounts and interest rates vary depending on customer demand and regulatory variables in various geographical jurisdictions. Some European exchanges, for example, allow for up to 125X leverage on specified futures contracts. Furthermore, margin loan interest rates change with the currency rate. Some lenders, for example, impose an annual interest rate, while others charge an hourly rate.

According to a prevalent misperception regarding trading on margin with cryptocurrency, individual traders can perform arbitrage techniques between different geographical areas. However, this isn’t accurate: Some regulated cryptocurrency exchanges only allow nationals or expatriates living in the country to trade. Moreover, by adhering to strong Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations that require proof of identification of each user who uses the exchange platform in that country, exchanges assist in the implementation of all-important regulatory and compliance rules.

Tips to keep in mind when trading cryptocurrency on margin

To begin with, the bitcoin asset class is not uniformly regulated throughout the world, which might be detrimental to your trade. For example, a cryptocurrency exchange ban, such as the one enforced by China in 2017, could ruin the value of your assets.

Second, bitcoin and cryptocurrency tokens represent a novel asset class, with price fluctuations that previously followed unpredictable patterns with little to no link to conventional markets’ technical or fundamental analytic ideas. Margined bitcoin trades may therefore result in larger gains or losses, so margin trading should only be done by experienced traders who are familiar with risk management.

Finally, margin trading necessitates an in-depth knowledge of the worldwide bitcoin market. There are practically hundreds of bitcoin exchanges all around the globe. Some of them are not trustworthy, and using them might result in losing your invested funds. As a result, before you consider margin trading, especially bitcoin margin trading on a crypto exchange, you should extensively investigate the platform you intend to utilize.

Get to learn more about Crypto Fiat Exchange Networx by reaching out to one of its co-founders at [email protected]

1 note

·

View note

Photo

What Are The Differences Between Margin and Futures Trading?

0 notes

Text

How To Protect Your Assets When Trading Margin

How To Protect Your Assets When Trading Margin

- Risks associated with trading margin

- Why Binance is the best platform for margin trading

- Cheap interest rates on Binance

#Binance #margin #trading #crypto #bitcoin @binance #Binance #BNB

In this article, I talked about how to protect your assets when trading margin.

Even in a market dip, profits are more guaranteed in margin trading than in traditional trading.

But margin trading is associated with a high risk of loss of assets.

If that’s your worry, then you’ve come to the right place.

By the time you’re done reading this post, you’ll know how to protect your assets while…

View On WordPress

#Are margin accounts protected#avoid losses on binance#binance margin#How do you cover margin balance#How do you trade on margin safely#Is Margin Trading a good idea#Is Margin Trading good for beginners#margin risks#margin trading#trading on binance#What is margin trading and how does it work#Why you should never trade on margin

0 notes

Note

what does it mean when people say stuff like individual morality or action is incompatible with class analysis or class struggle?

alright so like one of the key ideas about class analysis is the idea that classes (as a whole) have economic interests that affect all their members but don't extrapolate out to an individual analysis.

for example, let's say that you can't find a job, and somebody offers to pay you below the table for below minimum wage. it's in your individual interest to do this--it beats having no job! but as a member of the working class, once this practice becomes normalized, suddenly the standards of pay for everyone are lower because people know that they can just pay less than minimum wage under the table. competition between workers for jobs drives wages down for everyone, leaving them all in a worse situation overall even if each individual choice to scab, to accept lower pay, to resist unionization, etc, leaves the person who makes it better off. cf. karl marx on what happens when wages and working conditions deteriorate:

The labourer seeks to maintain the total of his wages for a given time by performing more labour, either by working a great number of hours, or by accomplishing more in the same number of hours. Thus, urged on by want, he himself multiplies the disastrous effects of division of labour. The result is: the more he works, the less wages he receives. And for this simple reason: the more he works, the more he competes against his fellow workmen, the more he compels them to compete against him, and to offer themselves on the same wretched conditions as he does; so that, in the last analysis, he competes against himself as a member of the working class.

— Karl Marx, Wage Labour & Capital

similarly, any individual member of the working class is completely dispensable and replaceable by capital. if one person refuses to work unless they're paid a higher wage, they'll be fired and replaced with somebody who doesn't. the individual worker has no economic leverage whatsoever. but the working class has incredible economic leverage! and so does the intermediate stage between the working class and the individual--organized segments of the working class (e.g. trade unions) have economic leverage. if one person strikes, the capitalist can fire them. if 40,000 people strike, your industry is going to shut down.

so the reason why class analysis is compatible with individual action is that your incentives measurably change when you start organizing--it's in the interests of the individual to compete, but in the interests of the class to cooperate. and obviously you cannot just expect everyone to spontaneously coordinate! you, the individual, are disposable to capital! if you, personally, refuse to take the under-the-table offer, either on moral grounds or because you recognize your class interest, your neighbour's going to take it--unless you and her get together and agree that neither of you will take it. that's the only way that the guy making the offer is going to have to give in and offer the job for a living wage.

and this is what organization is--trade unions (although they have severe limitations!), communist parties, and other worker's organizations allow the working class to pursue their collective interest--which can only be pursued by collective action, because engaging in the strategies of collective action as an individual, without the cooperation of your peers, is high risk for no reward.

#ask#marxism#the effects of electoral politics are far far more limited in scope than trade union activity but the same holds for voting#which is what the original post i was responding to was about#if you 'vote blue no matter who' then the bourgeois party you're showing loyalty to--#--will have no reason whatsoever to even marginally offer to improve your life#and if you as a solitary individual tell joe biden 'well im not voting for you unless you promise so and so social democratic reforms'#he is gonna be like lol lmao dont care#while if you and your several thousand friends all get together and say that#he will at least be obligated to pretend to care before immediately reneging on it bc he ultimately serves capital

855 notes

·

View notes