Text

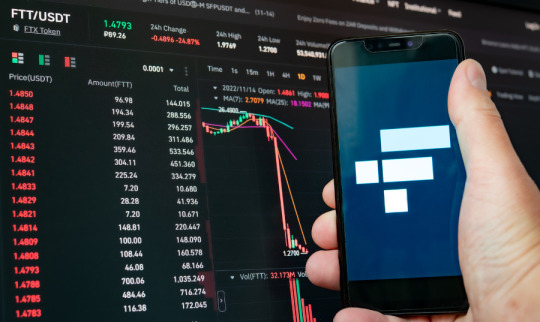

The Horrific Demise of FTX

On November 11, 2022, FTX, one of the leading crypto exchanges, filed for Chapter 11 bankruptcy protection following a quick fall from glory. Sam Bankman-Fried saw his $16 billion net worth drop to almost nothing as the company’s value plummeted from $32 billion to bankruptcy in a couple of days.

The unstable cryptocurrency market was shaken by FTX’s collapse, losing billions of dollars in value and falling below $1 trillion.

The fallout from FTX’s sharp downturn and demise will affect cryptocurrencies for a long time and may even bring down more general markets.

On November 16, 2022, a class-action lawsuit was submitted to a Florida federal court, stating that Sam Bankman-Fried had fabricated a cryptocurrency scam scheme intended to defraud unskilled investors from all over the nation. In addition to Larry David and Kevin O’Leary, other well-known people who allegedly assisted Bankman-Fried in carrying out the scheme are Steph Curry, Shaquille O’Neal, Shohei Ohtani, Naomi Osaka, and Shohei Ohtani.

The FTX collapse will be discussed at a hearing by the U.S. House Financial Services Committee in December 2022.

A Quick FTX History

Founded by Bankman-Fried at 28, FTX has blossomed into one of the largest cryptocurrency exchanges with a $32 billion valuation in three years. Bankman-Fried used aggressive marketing tactics, including a Super Bowl ad campaign and purchasing naming rights to the Miami Heat’s home arena. He rose to prominence due to his political lobbying, donations, and efforts to support the cryptocurrency industry in general. For example, as token prices fell in early 2022, he facilitated $1 billion in deals to help cryptocurrency companies struggling due to token price declines.

What Happened to FTX

The crash of FTX occurred over ten days in November 2022. A CoinDesk scoop on November 2 showed that Alameda Research, the quant trading firm also run by Bankman-Fried, held a $5 billion position in FTT, the native token of FTX. According to the report, Alameda’s investment foundation was also invested in FTT, the token created by its sister company, rather than a fiat currency or other cryptocurrency.

The cryptocurrency industry is concerned about Bankman-companies’ Fried’s undisclosed leverage and solvency.

What Binance is Saying

On November 6, Binance announced that it would sell its whole position in FTT tokens — roughly 23 million tokens worth $529 million. Following the demise of the Terra (LUNA) crypto token earlier this year, Binance CEO Changpeng “C.Z.” Zhao said the decision to liquidate the exchange’s FTT position was based on risk management.

Crisis in FTX liquidity and the Binance Deal

The following day, FTX went through a liquidity crisis. Bankman-Fried made an effort to reassure its investors their assets were safe, but in the days that followed the CoinDesk revelation, the customers demanded withdrawals totaling $6 billion. Before resorting to Binance, Bankman-Fried looked for more funding from venture capitalists. As a result, FTT’s value decreased by 80% in just two days.

On November 8, Binance revealed it had signed a non-binding deal to acquire FTX’s non-U.S. business for an undisclosed fee, helping its close rival out.

Binance cancels the bailout agreement with FTX.

The promise of rescue was only temporary, as Binance withdrew from the agreement the following day. The exchange said on November 9 that it would abandon the FTX acquisition after corporate due diligence revealed concerns regarding, among other things, the improper handling of customer assets.

The Freezing of FTX tokens

Following reports that Bankman-Fried was looking for up to $8 billion in capital to save the exchange, the Bahamas securities commission froze the assets of FTX Digital Markets, FTX’s Bahamian affiliate, on November 10.

The California Department of Financial Protection and Innovation disclosed that an inquiry into FTX had begun the same day.

On Twitter, Bankman-Fried acknowledged the liquidity situation and apologized for FTX’s non-U.S. exchange’s inability to meet consumer demand. According to Bankman-Fried, FTX miscalculated leverage and liquidity due to “bad internal labeling.” He stated that Alameda would stop trading in the same post.

What is the Future of FTX?

As a cryptocurrency exchange, FTX’s future is in grave danger. Withdrawals are no longer possible as of mid-November 2022, and the corporation “highly advises[s] against depositing,” according to a post on the FTX website.

It will take some time before the broader ramifications of the FTX debacle on the bitcoin market become clear. Investors may already be wary because of worries about stability and security, but FTX, the most significant drop in the brief history of cryptocurrencies, may put them off even more. For example, customers on the FTX platform might be unable to retrieve their assets, which could result in legal action. In addition, the collapse of FTX may be used as justification by the U.S. Securities and Exchange Commission (SEC) and other regulators for strengthening regulatory oversight of cryptocurrencies. As a result, Congress may be more willing to intervene and enact new legislation regulating digital tokens and exchanges.

The demise of the third-largest exchange in terms of volume will cause ripple effects throughout the cryptocurrency community for some time. BlockFi, a cryptocurrency lender, halted client withdrawals on November 11, 2022, and speculations suggest that the company may face trouble in the future. On Nov. 12 and 13, 2022, there was a spike in withdrawals on Crypto.com. Customer withdrawals from Genesis Global Capital’s cryptocurrency lending unit have been suspended. And the collateral harm has probably only just begun.

About CFXN

CFXN meets its users’ banking needs. You gain complete control over what happens to your money without worrying about economic inflation or the security of your funds. The best thing about CFXN is that it introduces cryptocurrency to the general public. And because it is simple to use, even a grandmother or a kindergarten student can use it. Tom invites anyone interested in riding the wave of success in blockchain, finance, and crypto to invest in the project and share in the profits made by CFXN.

To learn more (and in case you have questions) or if you are interested in investing in the project, reach out to Tom at [email protected]

1 note

·

View note

Text

Crypto Fiat Exchange Networx Margin Trading Guide

Crypto Fiat Exchange Networx (CFXN) Margin Trading Guide

With the rise in popularity of cryptocurrencies, margin trading on this volatile asset has opened up new and potentially lucrative possibilities. In this article, we’ll show you how to trade crypto on margin and how to do so using Prime XBT. We’ll also go over the advantages and disadvantages of crypto margin trading, as well as how to get started.

What is margin trading?

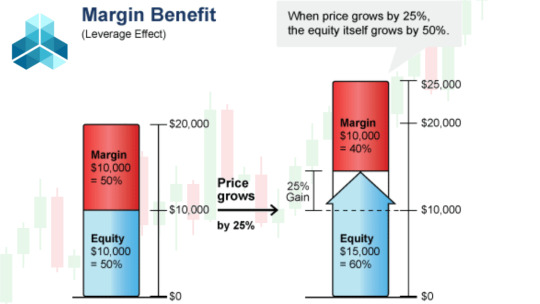

Leverage is used in crypto margin trading to multiply the results of a trade. The margin is the amount a trader has deposited in their account. A margin trading broker will give traders a leverage quotation, which is commonly displayed as a ratio (e.g., 1:5) or a multiple (e.g., 5x), indicating that for every 1 Bitcoin (or other base crypto) placed, they will get 5 Bitcoin (or another base crypto) back.

The broker permits traders to borrow money to open more visible positions. This will have to be repaid in full, but the trader will be able to keep the gains. If your leverage is 1:5, you’ll have $5,000 to trade with if you deposit $1,000. If you use this to buy Ethereum and the price rises 5%, you’ll end up with $5,250 in ETH. If you complete your deal at that point and repay the $4,000 borrowed, you’ll be left with $1,250 and a profit of $250. You would have made a $50 profit if you had executed the same trade in your spot account.

If the price of crypto goes awry after you open your position — say, down instead of up — the crypto exchange will “margin call” your trade when the price reaches a point where you begin losing the borrowed funds. So you’d have to continue increasing funds above that threshold to avoid getting margin calls and losing your trade.

Why trade on margin?

Short sales: Short selling frequently employs the concept of margin. When you short sell cryptocurrencies, you’re betting that their price will fall at some point in the future, a process that’s commonly referred to as “shorting.” Trading on margin increases the size of a short position and thus its earnings. However, the contrary is also true: if the deal goes wrong, the potential for losses might be significant.

Managing risk: Traders also use margin as a risk management strategy to limit or hedge their losses. You can, for example, hedge a long bet on the price trajectory of an asset by shorting the same asset with an equivalent or lesser amount.

Assume you have $10,000 in your trading account, and your broker permits you to borrow up to 50% of that amount, or $5,000 in the margin. The value of your trading account rises to $15,000 as a result. You could get $150 if your purchased shares grow 10%. Conversely, if they fall 10%, you’ll lose $150, or $50 more than if you hadn’t borrowed anything at all.

How does margin trading work in cryptocurrency?

Cryptocurrency trading, let alone crypto margin trading, is not offered by most traditional brokerages. Because of the volatility of cryptocurrencies, individual traders have been deterred from making large bets with margin trading funds. Institutional investors, according to statistics, do 70% of all current cryptocurrency trading using API calls. In place of brokerages, cryptocurrency exchanges have become popular places to trade on margin. However, this service is not available in all exchanges.

For the exchanges that allow margin trading, leverage amounts and interest rates vary depending on customer demand and regulatory variables in various geographical jurisdictions. Some European exchanges, for example, allow for up to 125X leverage on specified futures contracts. Furthermore, margin loan interest rates change with the currency rate. Some lenders, for example, impose an annual interest rate, while others charge an hourly rate.

According to a prevalent misperception regarding trading on margin with cryptocurrency, individual traders can perform arbitrage techniques between different geographical areas. However, this isn’t accurate: Some regulated cryptocurrency exchanges only allow nationals or expatriates living in the country to trade. Moreover, by adhering to strong Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations that require proof of identification of each user who uses the exchange platform in that country, exchanges assist in the implementation of all-important regulatory and compliance rules.

Tips to keep in mind when trading cryptocurrency on margin

To begin with, the bitcoin asset class is not uniformly regulated throughout the world, which might be detrimental to your trade. For example, a cryptocurrency exchange ban, such as the one enforced by China in 2017, could ruin the value of your assets.

Second, bitcoin and cryptocurrency tokens represent a novel asset class, with price fluctuations that previously followed unpredictable patterns with little to no link to conventional markets’ technical or fundamental analytic ideas. Margined bitcoin trades may therefore result in larger gains or losses, so margin trading should only be done by experienced traders who are familiar with risk management.

Finally, margin trading necessitates an in-depth knowledge of the worldwide bitcoin market. There are practically hundreds of bitcoin exchanges all around the globe. Some of them are not trustworthy, and using them might result in losing your invested funds. As a result, before you consider margin trading, especially bitcoin margin trading on a crypto exchange, you should extensively investigate the platform you intend to utilize.

Get to learn more about Crypto Fiat Exchange Networx by reaching out to one of its co-founders at [email protected]

1 note

·

View note

Text

Introducing The New Universal Wallet

When you think of a wallet, what goes through your mind? You often think of a storage location where you keep cash and cards. What about a crypto wallet? The same concept applies only that this time what is stored is crypto assets and not fiat cash. What if someone asks you about a universal wallet? Will you be able to explain what it is? This is what you will learn today.

The History Behind the Universal Wallet

Once upon a time, there was an international accountant named Thomas Bowen (Tom for short). In his journey as an international accountant, he noticed that people lacked complete control over their cash assets. The bank duped people into believing their cash assets were safe with them, but in a sense, they were profiting.

Because people trusted the bank so much, they became blind to what happens behind the scenes. Then entered blockchain technology.

Blockchain uses what is called a decentralized ledger system. This system consists of an infinite chain of digital ledgers that hold every transaction information that ever happened in the blockchain. All these transaction data are immutable, so you cannot tamper with or change them. These chains of ledgers are decentralized, which means it’s peer-to-peer, and no third-party (especially the government) is involved with what happens within these registers.

The Birth of the Universal Wallet and its Exchange

As blockchain technology entered the world, so did lots of opportunities. Skepticism wasn’t left behind since this technology is still relatively new. Do you recall how people reacted to the internet when it was first conceived? That’s how people are reacting to blockchain technology still in its infancy.

Tom took advantage of this technology, and he (together with a couple of his friends) invented the Universal Wallet and its Exchange. He named the exchange Crypto Fiat Exchange Networx (CFXN).

This wallet and its exchange platform aren’t like any other. It uses a new kind of technology called the casino chip system, and this allows you to:

Convert one crypto to another

Convert Fiat to Crypto

Convert Crypto to Fiat

All these with CFXN are possible without getting any third party involved.

CFXN the Solution to all Your Banking needs

CFXN offers its users their banking needs. Without worrying about economic inflation, or the security of your funds, you get total control of what happens to your money.

The best thing about CFXN is that it introduces cryptocurrency to the masses. And since it’s easy to use its universal wallet, someone like a granny or a kindergarten pupil can use it without any hurdle.

Tom invites everyone interested in riding the wave of success in blockchain, finance, and crypto to invest in the project and get a share of the profits CFXN is making.

To learn more (and in case you have questions) or if you are interested in investing in the project, reach out to Tom at [email protected]

Just make sure you are one of the characters who bring the story of this project into a happily ever after.

#universal wallet#cfxn#exchange#cfxn universal wallet#Cryptocurrency#blockchain wallet#blockchain technology

1 note

·

View note

Text

How to Store Your Cryptocurrency

Before Blockchain wallets came along, traditional wallets were the ones used to store cash. They were slow, they had a central point of failure (the banks), and they had an issue of keeping track of all the balances in the accounts.

Furthermore, they were prone to hacks. This method proved to be a method full of issues and problems. Trust was fully on the central banks to keep your money safe. Then Blockchain technology came into the picture, and with it, it disrupted every industry. And the most affected sphere was the finance industry. If you weren’t as sceptical as most people to novelty, then you saw the benefits that Blockchain brought with it. This is what brought us the Blockchain wallets, a modernised way to store your cash in the form of crypto.

What is a Blockchain Wallet?

A Blockchain wallet is a crypto wallet that enables users to store and manage their cryptocurrencies.

Some benefits of using a Blockchain wallet are:

1. Exchange of funds is easy — you don’t have to go through complex and time-consuming technical stuff to make your transactions.

2. It’s secure — you can safely do your transactions without any hurdle.

3. The wallet is accessible from the web and also mobile devices.

4. Your privacy is maintained — you’re able to make your transactions without your name showing in the Blockchain.

5. Has features that are necessary for secure and safe transfers and transactions between different parties.

A Blockchain wallet works in a similar way you send and receive money through your PayPal account. But instead of fiat cash, cryptocurrency is used. Examples of Blockchain wallets are: Ledger, Trezor, Jaxx, Paper wallets among other Blockchain wallets.

So how does a Blockchain wallet work?

How Does a Blockchain Wallet Work ?

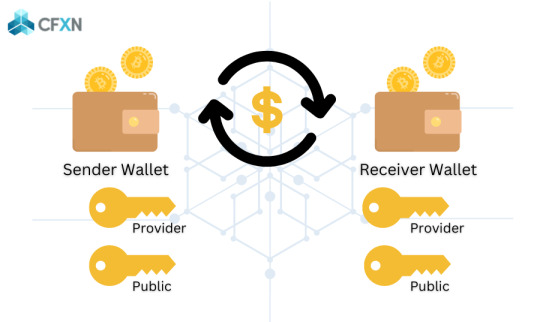

To understand how Blockchain works, you first need to understand what a public key and a private key are. You’ll also need to understand how these two keys are related to Blockchain wallets.

Whenever you create a Blockchain wallet you’re provided with both the public key and the private key associated with your wallet.

Here’s an analogy to explain this:

Imagine a person (let’s call him John) who knows your email address. Every time John wants to send you an email he has to use your email address to send those emails. You give out your email address to the ones you want to send you emails. But these people can’t use your email account to send out emails to others.

For them to send emails from your email account, they need to have access to your account’s password. Blockchain wallets follow a similar process using a private key and a public key.

So, speaking, your email address acts like the public key. You can send it to anyone whom you want to send you money in crypto form. The private key acts like your email’s password. To access your Blockchain wallet and spend the money in it, you must use the private key.

Your private key should never be disclosed to anyone else. If anyone gets access to your private key, then it’s game over. You’ll lose all your cryptocurrencies and go through a huge loss.

Features of Blockchain Wallet

1. It’s easy to use — it’s quite user-friendly.

2. It’s highly secure — since it uses cryptography this makes it hack-proof.

3.The transaction is an instance — you don’t have to wait for days to receive your cash. It takes less than 24 hours to receive cash from others.

4. Multiple currency conversions — this shows that you can use the crypto wallets to convert one currency to another.

Types of Blockchain Wallets

There are two main types of Blockchain wallets:

1. Hot wallets (storage) — they’re like normal wallets which you carry for your day-to-day activities and it’s user friendly.

2. Cold wallets (storage) — these wallets act like vaults where cryptocurrencies are stored. They’re highly secure in that they have a high level of security.

Hot Wallets

They’re online wallets through which cryptocurrency can quickly be transferred. They’re mainly on the cloud on the internet. Examples of these wallets are, Coinbase, Blockchain .info, and many more.

The private keys are stored in the cloud for faster access and transfer. Hot wallets are easy to access, they’re available 24/7. But they have a risk of unrecoverable theft once hacked.

Cold Wallets

Cold wallets are digital offline wallets where the transactions are signed offline and later disclosed online. For example, Trezor and Ledger.

In cold wallets, cryptocurrencies are stored in hardware or a printed paper document. The method of transaction helps in protecting the wallet from unauthorized access and vulnerabilities.

Blockchain wallets can further get categorised and distinguished on these criteria:

Software wallets — an application downloaded on a device (either desktop or mobile). Examples of software wallets include Jaxx, Bread wallet, Copay, among others. It’s often web-based. This wallet is usually accessible online.

Hardware wallets — they’re often like a USB drive. Mostly, they have plug and play technology.

Paper wallets — printable public key and the public key that can be kept on paper and stored in a secure place.

Figure 1 — Software wallet Meta Mask

Software wallets can further be differentiated into:

a) Desktop Wallet

b) Online Wallet

c) Mobile Wallet

Desktop Wallets

Desktop wallets are like cold wallets in that the private keys are stored in cold servers. You can unplug them from the internet and do all your transactions offline.

In case the main server gets down or gets lost, you can use the cold server as a backup. You can download this wallet on any computer. But to access it, you must use it in the system you first installed on it.

For safety purposes, you must make sure to keep backups on your servers, always keep your systems in check, and always ensure that you keep your computer away from others to prevent theft.

The great thing about these wallets is that they’re cost-efficient. A great example of a desktop wallet is Electrum, and it’s one of the most popular cryptocurrency desktop wallets.

Online Wallets

These types of wallets run on the cloud and the internet. You have the freedom and the benefit of accessing them on any device. The private keys are stored online in the cloud and managed by a third party.

You have to depend on third-party services. The wallet can be accessed from Android, Desktop, and iOS in Apple. This wallet is sort of a universal one because of its accessibility on multiple devices.

Mobile Wallets

Mobile wallets are similar to online wallets except they’re designed and built specifically for mobile usage or mobile accessibility.

The mobile wallets are user-friendly in that the user interface for making transactions is made easy. A great example of a popular mobile wallet is the Mycelium crypto wallet.

Figure 2 — Three different hardware wallets

Hardware Wallets

Hard Wallets are typical cold storage devices like a USB flash drive used to store the private keys in a protected secure hardware device. These wallets are similar to portable devices that can be plugged and played using your computer.

They are less prone to malicious attacks, malware, hackers, and anything that might have bad intentions for your cryptocurrencies.

Great examples of Hardware wallets are Trezor, Ledger Nano S, and Keep key. These are some of the best and top hardware wallets currently in existence.

Point to note: To make a transaction you have to ensure that your hardware wallet is plugged into your system before doing any transaction.

Paper Wallets

Paper wallets are an offline process of storing cryptocurrencies. They are often printed in the form of paper consisting of a private key and a public key, or a public address (often accessed using a QR code). Since paper wallets are safe they’re widely used for storing large amounts of cryptocurrencies.

Examples of paper wallets are Bitcoin paper wallet and My Ether wallets. These are the paper wallets that are widely used.

To make a transaction, paper wallets work with software wallets or also known as online wallets. And to transfer funds from your software wallet, you must send it to the public address as shown in your paper wallet. That is the QR code shown on the printed paper wallet. Make sure you check out bitaddress.org if you would like to store your crypto on a paper wallet.

Comparison of Blockchain Wallets

Blockchain info

1) Support both Bitcoin and Ethereum

2) It’s easy to use

3) It has low transaction fees

Ledger Nano S

It’s a hardware wallet:

1) That offers high security for your account.

2) Is available for Bitcoin, Ethereum, and Litecoin users.

3) It’s possible to maintain multiple accounts and access anytime.

Bitcoin Paper Wallet

1) Helps you to print your Bitcoin wallet and keep it only for yourself.

2) It minimizes the threat of hacking.

Jaxx

Software wallet that enables currency exchange within the wallet.

Additional information

Included in this list is the Crypto Fiat Networx Exchange (CFXN) wallet. This is a new international wallet that supports multiple Fiat currencies and Cryptocurrencies.

The wallet uses a token chip conversion system to convert your crypto to its equivalent cash, one crypto to another crypto, and cash to crypto without the use of any middleman.

The wallet is still in its infancy. To get to know more about CFXN as a project and in case you want to be partners with the project kindly reach out to the founder’s project at [email protected]

#cfxn#Cryptocurrency#crypto wallet#cryptocurrency wallets#crypto#exchange#crypto exchange#blockchain wallet

1 note

·

View note

Text

How Does Financial Technology Work?

Financial technology (Fintech) refers to new technology that aims to improve and automate the delivery and use of financial services. At its core, fintech is used to assist companies, business owners, and consumers in better managing their financial operations, processes, and lives through the use of specialized software and algorithms that run on computers and, increasingly, smartphones. The term “fintech” is an abbreviation for “financial technology.”

When the term “fintech” first appeared in the twenty-first century, it was initially applied to the technology used in the back-end systems of established financial institutions. However, there has been a shift to more consumer-oriented services and, as a result, a more consumer-oriented definition since then. Fintech now encompasses a wide range of sectors and industries, including education, retail banking, fundraising and nonprofit, and investment management, to name a few.

Fintech also includes the creation and use of cryptocurrencies like Bitcoin. While that sector of fintech receives the most attention, the real money is still in the traditional global banking industry, which has a multi-trillion-dollar market capitalization.

Understanding Financial Technology

In general, the term “financial technology” refers to any advancement in how people conduct business, from the invention of digital money to double-entry bookkeeping. However, financial technology has grown explosively since the Internet and mobile Internet/smartphone revolutions. Fintech, which originally referred to the application of computer technology to the back office of banks or trading firms, now refers to a wide range of technological interventions into personal and commercial finance.

Fintech now refers to a wide range of financial activities that can be completed without the assistance of a person, such as money transfers, check depositing with your smartphone, applying for credit without visiting a bank branch, raising funds for a business startup, or managing your investments. According to EY’s 2017 Fintech Adoption Index, one-third of consumers use at least two or more fintech services, and those consumers are becoming more aware of fintech in their daily lives.

Fintech in Action

The most talked-about (and funded) fintech startups all have one thing in common: they are designed to be a threat to, challenge, and eventually usurp entrenched traditional financial services providers by being more agile, serving an underserved segment of the population, or providing faster and/or better service.

Affirm, for example, aims to eliminate credit card companies from the online shopping experience by providing consumers with the ability to secure immediate, short-term loans for purchases. While interest rates can be high, Affirm claims to provide a way for consumers with poor or no credit to secure credit while also building their credit histories. Similarly, Better Mortgage aims to simplify the home mortgage process (and eliminate the need for traditional mortgage brokers) by providing users with a verified pre-approval letter within 24 hours of applying. Green Sky aims to connect home improvement borrowers with banks by assisting customers in avoiding entrenched lenders and saving money on interest by providing zero-interest promotional periods.

Platforms like Crypto Fiat Networx exchange (CFXNX) implement the use of blockchain in their fintech. What this platform does is convert cash to crypto and (or) crypto to cash using a casino concept from the 16th century. This platform is relatively new and its main target is the online gaming industry and the casino gaming industry. The platform is still seeking investors to aid in its development and expansion. So, if you are an investor and would like to join the CFXNX network, reach out to its CFO and one of the founders Thomas Bowen at [email protected].

Conclusion

Fintech has transformed many industries, most notably banking, trading, insurance, and risk management. Fintech firms, which include startups, technology companies, and established financial institutions, use emerging technologies such as big data, artificial intelligence, blockchain, and edge computing to improve the accessibility and efficiency of financial services.

3 notes

·

View notes

Link

CFXN is the perfect platform for anyone looking to get into the world of cryptocurrency.

Website: http://cfxn.io

Technology: https://t.me/cfxntoken

#cfxn#cfxn token#cfxn exchange#crypto#blockchain#blockchaintechnology#technology#Cryptocurrency#investing

37 notes

·

View notes

Link

The CFXN networx is a great opportunity for entrepreneurs and businesses of all sizes. It provides access to a wealth of resources, including education, training, and networking opportunities. If you are looking to expand your business or take it to the next level, then the CFXN networx is definitely worth considering. So what are you waiting for? Join today!

5 notes

·

View notes

Link

CFXN will use DLT private Blockchain for the management of the decentralized repository as per the requirement.

Visit: https://cfxn.io

5 notes

·

View notes

Link

Leverage Trading Cryptocurrency Guide 2022: How to Trade Crypto With Leverage

4 notes

·

View notes

Text

Three reasons NOT to use Bitcoin with Three reasons TO use a crypto payment system

There is a lot of hype about using Bitcoin as a form of payment while some of the hype is deserved there are important reasons not to use Bitcoin directly. Unless you have Bitcoin, you purchase when it was a lot cheaper, or you want Bitcoin these are three reasons not to use Bitcoin as a form of payment for everyday purchases.

Reason One

Bitcoin is a volatile virtual coin whereits value isderived from the open market. As a result,the value is constantly changing making it unstable for payments. The value one day can be$50,000 and the next $45,000 or $55,000 only the market knows for sure. Either way it is not a very stable form of payment.

Unless the goal of the transaction is to acquire or use Bitcoins you already own the value of the transaction will fluctuate with the price of Bitcoin.

The only way to lock in value is to convert the Bitcoin to a stable coin or convert to fiat instantly at the end of the transaction which adds cost and undermines the use of Bitcoin.

Reason Two

Unless the transaction was to use and acquire Bitcoin there needs to be a conversion from Bitcoin to fiat currency or another crypto coin. Both buyer and seller must have compatible Bitcoin wallets to handle a direct transaction. If the buyer does not own Bitcoin, it must be purchased on an exchange or directly from a seller either way it requires a fiat or crypto transaction. This adds an extra step the same is true in reverse if you are the seller and do not want to hold Bitcoin. Without a secure wallet personal Bitcoins are in danger of being lost or stolen.

Unless the goal of the transaction is to acquire or use Bitcoins you already own the value of the transaction will fluctuate with the price of Bitcoin.

The only way to lock in value is to convert the Bitcoin to a stable coin or convert to fiat instantly at the end of the transaction which adds cost and undermines the use of Bitcoin.

Reason Three

Bitcoin transaction can create unintended tax consequences for the buyersand sellers. Some countries tax the gain in value as a result of a transactionwhich could apply to all parties of the transaction. The gain is determined based on the cost of the Bitcoin and the value received for the Bitcoin.

For example, in the United States crypto is considered property not money so if you use Bitcoin you purchase for $20,000,to buy a car when Bitcoin is worth $50,000 then the difference between the cost of your Bitcoin ($50,000 -$20,000 = $30,000 gain) the value of the purchase determines the profit or loss on the transaction.

This simple purchase would result in taxable income of $30,000. This will not impact those in countries where crypto profits are not taxed but for everyone else it is an added cost.

Three reason to use a token-based payment system

Blockchain technology was developed to make funds transfers safer, more secure, faster, and cheaper by bypassing traditional financial institutions. Companies like CFX Networx use Blockchain technology for all the advantage Blockchain offers to itsaccount holderswhile eliminating many of the disadvantage of alternative payment systems.

Reason One

The actual fundstransfer uses tokens which have the advantage of representing any value chosen at the time of the transfer. To transfer $25,000 USDT to a merchant in Europe the systemconverts the USTD to tokens during the transfer to the merchants account where it can remain in tokens or received in Euro or crypto. The value of the transaction is the fixed at transfer rates so neither the buyer or seller loses or gains value due to market volatility.

Reason Two

Specialized crypto payment systems uses private tokens as a means of transfer between transferring parties. This adds a level of privacy and security not found in traditional networks where banks, credit card companies, along with other third parties use the information for marketing purpose by tracking the transactions and storing the information is a single database that can be hacked.

Reason Three

Having an account on a specialized exchange like CFXN will allow the account holders greater control over their funds be it fiat or crypto or a variety of each. Account holders can select the form of payment and the seller can choose the form of payment received. Account holders can use their deposits to generate income for themselves and not the exchange. Unlike banks which use deposit for their own profits some exchanges allow the account holders to generate income with their own funds.

Tax consequences can be managed within a specialized exchange as the transfer token is not owned by either the buyer or seller the tokens are only a means of transfer from one account to another. Once transfer is made the account holder determines the type of unit sent or received.

In summary, not all crypto payment systems or transactions are the same with privacy, security or value. It is important to know the difference options based on your specific needs. If you are doing a onetime transfer, then it does not really matter as much but if you are a merchant with hundreds or thousands of buyers then the system you use for crypto payments is very important.

#crypto payment systems#Bitcoin crypto payment system#cfxn token#cfxn exchange#crypto#blockchain#exchange#Cryptocurrency#bitcoin#cfxn

8 notes

·

View notes

Text

CFXN world's best Crypto and Fiat Exchnage

This ICO is fоr a new CFXN token initiаtеd bу Crypto Fiat Exchange Networx, and thе token number is 2,000,000 CFXN. CFXN will use DLT private Blockchain for the management of the decentralized repository.

If you want to know more about CFXN Token. Please Join our telegram Channel , We have our experts 24/7 on support.

Please Visit Our website : www.cfxn.io

Facebook : www.facebook.com/cfxntoken

Telegram : www.t.me/cfxntoken

vimeo

8 notes

·

View notes