#intuit turbotax

Text

How To Resolve TurboTax Error Code 5641? [4 Best Solutions]

The TurboTax error code 5641 is known as a runtime error. Software developers spend a lot of time anticipating such errors to make the software stable before it’s sold. However, some errors occur after the release of the final product. When we encounter the error, it says, “While attempting to install and update TurboTax or when trying to download a state of the program. You may get an error 561 message.” The users can inform the developer about this issue. We can fix this issue by a few methods. But before that, let’s learn the causes and symptoms of error 5641 that you must know.

Why Does TurboTax Error Code 5641 Occur?

Usually, the TurboTax error 5641 occurs when the software has crashed or failed while running. This error occurs as an annoying notification on your screen, and you need to handle it. As we know that this is a runtime error, fixes are usually updating, installing, and uninstalling. The programmers often code for possible errors and design software carefully. But some errors are unpredictable and irresistible. In other words, we can say that no design is perfect and technical glitches and bugs may occur anytime.

Furthermore, some incompatible programs running in the background may be contributing to the error. Apart from this, a memory problem and outdated graphics drivers may create the problem if left unresolved.

How To Detect TurboTax Error 5641?

The runtime errors happen suddenly and unexpectedly. If you try to ignore it, it will pop up on your screen again and again until you don’t address it. There might be deletions or the appearance of new files. However, the error widely results due to the virus infection. Malware intrusion is one of the common issues of the error code 5641. Plus, a gradual decline in the speed of internet connection might be indicating the problem. However, this is not the only case.

How To Fix TurboTax Error Code 5641?

The runtime errors are frustrating, especially when the cause is not known and the solution is not limited. But we have some quick fixes for you that may help you get rid of the error without doing much effort.

Update Your PC Device Drivers

The occurrence of TurboTax error code 5641 can be related to outdated or corrupt device drivers. The drivers may work well for one day and start causing problems the next day. But you can update them to solve any issue. Finding an appropriate device driver may be challenging. The process may be time-consuming and irritating. Plus, downloading the wrong driver may worsen your problem. In order to avoid such issues, use driver update software that will help you to download and install the correct device drivers. For instance, you can use DriverDoc Driver Update Software.

Reinstall Windows

This step can be your savior. Usually, reinstallation of Windows is done to solve plenty of issues, including runtime errors. A clean reinstallation will dismiss everything from your hard drive and let you restart with a new system. Moreover, a reinstallation will remove the other associated issues, such as eliminating the accumulated junk over the usage of your PC.

Update Your Windows

Microsoft has introduced many updates for your Windows system that may solve many issues, including runtime errors. Many times, the problem isn’t as major as it seems. Sometimes a simple update to Windows may get your device back to its mode. Hence, consider installing all the available window updates for your system.

To check the Windows Updates:

Go to the Start button.

Type in “Update” inside the search box and press enter.

Now, the Windows Update prompt will appear.

Click the “Install Updates.”

Perform A Disk Cleanup (Remove the junk, temporary files, and folders)

With time your device may accumulate some junk files from the regular works. If these files are left undeleted, it might impact the performance of your device. It may make your device respond slowly and cause runtime errors, such as error code 5641. In other words, you will clean up free space from your hard drive to make room for current work.

To run a disk cleanup, follow the given steps:

Go to the Start button.

Then, type in “Command” in the search box.

Hold the Ctrl + Shift simultaneously and press enter.

Then, a permission dialog box will appear.

Click Yes.

Now, you will see a black box with a blinking cursor.

Type in “cleanmgr” and press enter.

The disk cleanup will start and calculate how much space you can free.

Then, a disk cleanup dialog box will appear with the checkboxes. The list contains the temporary files that occupy most of the space. You can check them to delete them.

When you check the boxes with unwanted files, click OK.

#intuit turbotax#Turbotax software#install turbotax.com#install turbotax with license code#turbotax sign in#turbotax login#turbotax software#TurboTax Error Code 5641

0 notes

Text

That time of year is coming, and since I haven't seen the annual post yet: Taxes

If you're in the same income bracket as me (and let's be honest, we've been pretty good about chasing away the billionaires), you should NEVER use Turbotax

Turbotax pays a loot of money in lobbying to ensure that your taxes stay complicated, so that you have to use them to file your taxes. The thing is! The IRS has a webpage that helps you find a service to do your taxes for free! They aren't allowed to advertise it (Thanks Intuit), but it is the cheat code to make your April 15th so much easier.

Here is the IRS service

I have personally used FreeTaxUSA off of the IRS's recommendation and I highly recommend it.

Remember: Lobbying is Bribery under any other name, and the actions of Turbotax and other corporate lobbyists are contemptible. but at least taxes don't have to suck as much as they want it to

#I literally never post#so sorry if this is cringe or whatever#but infoposts are important if it means fucking over the corporate world#Taxes#Turbotax#IRS#Intuit#FreeTaxUSA

475 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

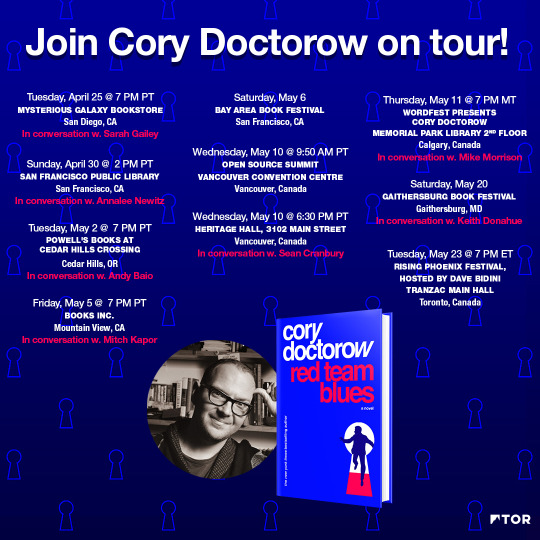

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

176 notes

·

View notes

Text

PSA: if you are in the US and are filing your taxes this year, do not use TurboTax.

Instead, use freetaxusa.com. It sounds a bit like a suspicious website, but it's actually legit.

I've been using it to file my own taxes for years and they've been awesome / easy to use. Federal filing is free, but you might have to pay a small fee if there's state taxes, but I'm not entirely sure.

You will be saving money and not giving business to scummy Intuit, which is a net win for everyone.

Just wanted to pass along the message to hopefully help someone!

Sincerely,

An accountant who hates how the American tax filing system works

#taxes#don't use TurboTax#just trying to help#accounting#not affiliated in any way#I just have a vendetta against Intuit

7 notes

·

View notes

Text

TurboTax Super Bowl File 2024 Sweepstakes - Chance To Win $1 Million Dollars Cash

Eligibility: United States and Canada (excluding Quebec), 18+

This Sweepstakes Ends on February 15th, 2024.

0 notes

Text

there is an upside to being unemployed the entire year and it's not having to do any fucking taxes

if partner wants the payment from his parents HE can do their taxes this year I'm not touching that shit again, what a fucking headache. four years we've been doing this shit and it's always telephone tag and them never understanding they don't withhold enough taxes for a refund and we've gotten them every deduction they qualify for. sorry you owe four thousand bucks!!! literally not my fault!!!!! go bitch at a CPA!!!!

#z.chat#/vent#i fucking loathe the way taxes are done and i want to burn TurboTax/intuit to the fucking ground

1 note

·

View note

Text

do people know about the pilot program the irs is running for free tax filing

info will be updated as we get closer to filing season - it's not running in every state and whether you can participate depends on how complicated your taxes are, but if you hate turbotax/paying people to figure out how much money you owe the government, check it out - it's called the IRS Direct File program and is a direct result of the inflation reduction act!

#us politics#there's also the irs free file program#which is a public-private partnership#but i say fuck turbotax/intuit#use the one that doesn't involve them if possible#and make the pilot successful so the program is expanded and intuit chokes and dies#anyway i just found out about this so hopefully i will be able to use it for my 2023 taxes

1 note

·

View note

Text

turbotax over here getting philosophical at me

#intuit please sponsor my blog#taxes#american taxes#laundry and taxes#capitalism#turbotax#intuit#not cosmere

1 note

·

View note

Text

Turbotax Deluxe vs Premier

Turbotax Deluxe vs Premier

Turbotax Deluxe vs Premier: Turbotax Deluxe is the best option for people who are not self-employed or have rental properties. It’s also a good option if you’re not eligible for the free version.

Turbotax Deluxe vs Premier

TurboTax Free Edition

Turbotax free edition is designed to allow low income families and individuals with qualifying incomes to file their taxes for free.

The…

View On WordPress

#1099 Income#audit assistance#Income tax#Internal Revenue Service#Intuit#Past Year Over Payments#Tax#Tax preparation#Tax refund#TurboTax#turbotax deluxe vs premier

0 notes

Text

Intuit turbotax business 2018 windows for uber driver

If you work from home, you should know these important tax implications of setting up a home office. Read more…Ģ021 saw an unprecedented number of workers and businesses using a work-from-home model. When you are hired as a contractor for a business or beginning work as a freelancer, you may be asked to complete a W-9 and provide it to the business that will be paying you. One of the most common situations is when someone works as an independent contractor for a business. Read more…įorm W-9 - What Is It and How Is It Used?įorm W-9 is a commonly used IRS form for providing necessary information to a person or company that will be making payments to another person or company. But if you are self-employed or make money on your investments or rental property, you may need to make estimated tax payments every quarter, rather than wait until you file your annual tax return. Usually, that's enough to take care of your income tax obligations. If you are an employee, your employer withholds income taxes from each paycheck based on a completed W-4 Form. Read more…īeginner's Tax Guide for the Self-Employedīefore you take your first step into the world of entrepreneurship, there's a checklist of things you'll need to do to avoid tax problems while your venture is still in its infancy. If you own or work at a barbershop or hair salon, there may be tax deductions that you can take advantage of this tax season. Tax Filing Tips for Hair Salons, Barbers, and Hairdressers Under Web Content, select Enable JavaScript.Subscribe and receive all Self-Employment Taxes.Go to the Safari menu and click Preferences.Go to the Firefox menu and click Preferences.Go to the Tools menu and click Internet Options.Toggle the javascript.enabled preference (right-click and select Toggle or double-click the preference) to change the value from false to true.In the search box, search for javascript.enabled.Click I'll be careful, I promise if a warning message appears.In the address bar, type about:config and press Enter.Under JavaScript, choose Allow all sites to run Javascript.Under Privacy, click Content settings.At the bottom of the page, click Show advanced settings.How to Enable JavaScript ?BROWSER_CHECK_WINDOWS? Chrome To help your computer access and navigate TurboTax more easily, JavaScript must be enabled in your browser. Please enable JavaScript in your browser.

0 notes

Note

Since governments generally have most or all of the data they need to assess taxes, what’s the point of having people file their own taxes? It seems like an unnecessary duplication of labor, since the IRS or equivalent bureau still needs to check and make sure that you filed correctly.

So see here and here:

So yeah, the reason is that there's a whole industry (dominated by Turbotax and H.R Block) that makes a lot of money by setting themselves up as middlemen, upselling people tax prep services that most of them don't actually need, and then lobbying the Federal government against cutting out the middlemen.

And this industry is politically allied with Congressional Republicans who believe that making people fill out their own taxes makes them more anti-tax and anti-government, and thus more likely to identify as conservative Republicans.

37 notes

·

View notes

Text

Turbotax is blitzing Congress for the right to tax YOU

Every year, Americans spend billions on tax prep services, paying a heavily concentrated industry of giant, wildly profitable firms to send the IRS information it already has. Despite the fact that most other rich countries have a far more efficient process, many Americans believe that adopting this process here is either impossible, immoral, or both.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That puts tax preparation in the same bucket as other forms of weird American exceptionalism — like the belief that we’re too untrustworthy to have universal healthcare, or that we’re so violent that we must all have assault rifles to protect ourselves from one another.

For those of you who aren’t familiar with how they do it in, say, the UK, here’s how it works: your employer submits all of your paystubs to the tax authorities; likewise the custodians of your pension and other people who send you money. The tax authority also knows about your major deductions, like your kids or other dependents.

The tax authority uses this information to fill in a tax return for you and they mail it to you. It’s simple and easy to understand. If they missed some information, or if your tax status has changed, or if you’ve got new deductions, you can amend this return — or throw it away and start over by yourself or with a tax professional.

For the vast majority of Britons, filing their tax returns takes a few minutes once a year, and it’s free. For the minority who don’t fit the standard form, the system works like it does in the US — you either tackle it alone, or do it with professional help.

The IRS could easily do the same thing. Even in a world where many of us are being “casualized” and have income coming in as independent contractors, the IRS knows about it, thanks to the 1099 form. Sure, the IRS might make mistakes, and if you’re worried about that, you can either manually review the precompleted return or pay someone to do it.

It’s a no-brainer, or it would be — if it wasn’t for decades of lobbying by the massively concentrated tax-prep industry — wildly profitable corporate giants like HR Block and Intuit, the parent company of Turbotax, who spent 20 years lobbying congress, spending millions to ensure that Americans would have to pay the Turbotax tax in order to pay their income tax.

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

The tax-prep industry couldn’t have done this on their own — their astroturf campaigns were joined by a grassroots of useful idiots, betwetters like Grover Norquist and his acolytes, who openly demand that tax preparation be as difficult and painful as possible, to drum up support for their campaign to “get the US government down to the size where we can drown it in the bathtub.”

These extremists are joined by many independent tax-prep specialists, who are seemingly convinced that every taxpayer has 11 dependents, four different kinds of pension savings, and six all-cash side-hustles, two of them international. Some people do have complicated taxes — as a writer with income from all over the world, I’m one of them — but most people don’t.

The point of getting the IRS to send you pre-populated tax returns isn’t to deny you the opportunity to pay excellent, knowledgeable tax-prep specialists if you need them — it’s to spare most of us from the needless expense of paying Intuit and HR Block to perform the rote form-filling by which the rake in billions in profits.

In reality, the campaign to defund the IRS isn’t — and will never be — about helping “the little guy.” As Propublica’s IRS Files demonstrate, the defunded, shriveled IRS is a billionaire’s plaything, which is why America’s top 400 earners pay less tax than you do:

https://pluralistic.net/2022/04/13/taxes-are-for-the-little-people/#leona-helmsley-2022

The commonsense utility of the IRS supplying you with prepopulated returns is so obvious that the tax-prep industry has had to really work to hold it at bay. The most successful scam was Freefile, a program cooked up by the tax-prep cartel that claimed it would provide free tax-prep to low-income Americans.

Freefile was a literal fraud: Intuit and its co-monopolists used a raft of deceptive “dark patterns” to trick people — students, veterans, retirees, and the poorest among us — into paying for services that they were entitled to use for free. Almost no one managed to find and use the Freefile offerings they’d hidden in a locked filing cabinet in a disused subbasement behind a sign reading “Beward Of the Leopard.”

This was so obviously crooked that the companies were eventually forced to give it up, but they weren’t done — their eye-watering, voluminous terms of service contained buried binding arbitration clauses that prohibited the people they ripped off from suing them:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Despite — or, more realistically, because of — the rising fury at the tax-prep industry’s years of unchecked corruption, Intuit has actually increased its lobbying spending this year: Open Secrets reports that in 2022, Intuit showered lawmakers with a record $3.5m:

https://www.opensecrets.org/news/2023/02/turbotax-parent-company-intuit-is-pouring-more-money-than-ever-into-lobbying-amid-push-for-free-government-run-tax-filing/

Their target? The $15m that the Inflation Reduction Act allocated to the Treasury Department to explore free tax filing. Intuit’s line is that this would be “a waste of taxpayer money” and a “conflict of interest” — the same tired boomer nonsense that Norquist has been shoveling since the Reagan administration. Once again, the proposal isn’t to ban Intuit from offering tax prep services — it’s to create a public option that lets people freely choose to pay for tax prep if they think they need it. It’s a breathtaking act of paternalism to claim that we’re all sheeple, too stupid to spot the IRS’s greedy attacks on our pocketbooks.

Here’s a choice quote from Intuit: “Creating a government run tax preparation program would be a waste of taxpayer dollars and further disenfranchise low income taxpayers. A direct to IRS tax prep system is a multi-billion dollar solution looking for a problem.”

https://www.businessinsider.com/turbotax-free-tax-filing-biden-inflation-reduction-act-hr-block-2023-1

Unsaid: the tax prep industry rakes in billions of dollars from American taxpayers every single year. The $44.8m the cartel has spent lobbying against free filing since 1998 is a fantastic investment — for them. The dividends they reap from it come out of all of our pockets.

Another bargain? Hiring ex-government officials to work for Intuit, lobbying their former colleagues:

https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2022&id=D000026667&t0-Revolving+Door+Profiles=Revolving+Door+Profiles

Or, as Senator Elizabeth Warren bluntly put it, “adroit influence peddling”:

https://www.opensecrets.org/news/2022/06/members-of-congress-call-for-an-investigation-of-intuits-lobbying-practices-amid-mounting-turbotax-controversies/

The neoliberal economists’ theory of regulatory capture is a kind of helpless nihilism, grounded in the Public Choice Theory doctrine that says that regulators will always be captured, so we should just get rid of regulators or make them as weak as possible, so they won’t become cordyceps-ridden puppets of the industries they oversee:

https://doctorow.medium.com/regulatory-capture-59b2013e2526

But capture isn’t inevitable. Sure, if you have a referee that’s weaker than the teams, you’ll never get a fair game — nevermind what happens when the ref either used to work for one of the teams or is sure of a cushy job with them when the season’s over. If you want a small government, you need small corporations — need to block the anticompetitive mergers and predatory conduct that lets companies grow so large that they can fit their regulators into the little change pocket in their blue-jeans.

https://doctorow.medium.com/small-government-fd5870a9462e

Anyone who lived through witchhunts, torture and mass surveillance after 9/11 has good reason to want their government small enough to be accountable — but a doctrine of small governments and giant corporations is a plutocrat’s charter — a recipe for regulatory capture so grotesque it is indistinguishable from farce.

[Image ID: An ogrish, tophatted, cigar-chomping giant holds the US Capitol building aloft contemptuously, pinched between the thumb and forefinger of a white-gloved hand. He stands at a podium bearing the Turbotax checkmark logo, yanking a lever in the form of a golden dollar-sign. He stands before a IRS 1040 tax form.]

intuit, turbotax, irs, taxes, death and taxes, corruption, monopoly, freefile, grover norquist, regulatory capture,

#pluralistic#intuit#turbotax#irs#taxes#death and taxes#corruption#monopoly#freefile#grover norquist#regulatory capture

139 notes

·

View notes

Note

Do you have any good recommendations for cheap/free tax software?

So, I've seen posts going around about inexpensive tax software via the IRS, although last time I tried that (years and years ago) it just sent me to the "free" turbotax site, which was only free if you didn't need any special forms and now may not be free at all, I'm told a lot of people get charged hundreds by turbotax.

Most "free" sites are also only free if you earn less than a specific threshold, usually around $70K. The IRS has a list of options here, but I'm afraid I know nothing about any of them (readership, feel free to chime in by comment or reblog). IRS Free File is probably a good bet but I have no idea what their site is actually like, so I don't know if it's at all user friendly, and the one time I filed directly through the IRS I immediately fucked it up and owed them an extra $50 which they came after me for, so, you know. You get what you pay for.

After that first disastrous year, I just went to H&R Block and I've been filing there my entire adult life. They're very intuitive; they just ask you questions and you answer them, and they tell you how much you owe. I'm a homeowner and technically I own a small business, so I have to file extra weird forms, and I earn above threshold now anyway, so I just pay the $50 or whatever it is (the federal and state forms both cost a certain amount but they just take it out of my refund). That also means they store my previous year's return, so that I don't have to go digging for it to add its info into the next year.

I think this is super important: whatever you use, if at any point they show you a PDF of a completed tax filing form, SAVE IT. It is probably the only time you will see it and often if you want it later they'll charge you for it. SAVE THE COMPLETED FORM WHEN YOU SEE IT. Even if it's not an official document it has information you will need next year.

But yeah, I've filed with H&R Block for I think about 15 years now, first as a free user and now as a paid user, and I have no complaints. Otherwise I'm afraid I'm not much help, but hopefully the readership can offer resources!

178 notes

·

View notes

Text

If you file taxes in America, here's a reminder that you're probably able to do it for free, and companies work really REALLY hard to make sure you pay

This article from ProPublica (a reputable, nonprofit newsroom that does a lot of investigative journalism) will make you furious. It's from 2019, so the good news is that in the years since, the IRS was given a bunch of money and this year is actually piloting their own online filing thing, which TurboTax absolutely hates, of course. But the article is worth reading to understand the width and breadth of the money and industry that is trying to steer people into paying.

By the way? Approximately 70% of taxpayers are eligible for the existing IRS Free File program (not through TurboTax, they've got their own, deceptive advertising, and aren't part of the official government program), but less than 5% of eligible taxpayers did.

The big companies count on people getting stressed and just giving in and paying even when they shouldn't have to. They've invested a lot of time and energy into forcing taxpayers to needlessly pay for tax returns.

#those numbers are disgusting#seriously the whole article is disgusting. the depths TurboTax went to to force millions of people to pay#and still does. this is not a problem of the past#gonna have to incorporate Free File into my list of Topics I Care Strongly About And You will Hear About It#politics#kinda#links

18 notes

·

View notes

Text

Join me in saying '"FUCK TURBOTAX, AND FUCK INTUIT!"

19 notes

·

View notes