Text

How To Resolve TurboTax Error Code 5641? [4 Best Solutions]

The TurboTax error code 5641 is known as a runtime error. Software developers spend a lot of time anticipating such errors to make the software stable before it’s sold. However, some errors occur after the release of the final product. When we encounter the error, it says, “While attempting to install and update TurboTax or when trying to download a state of the program. You may get an error 561 message.” The users can inform the developer about this issue. We can fix this issue by a few methods. But before that, let’s learn the causes and symptoms of error 5641 that you must know.

Why Does TurboTax Error Code 5641 Occur?

Usually, the TurboTax error 5641 occurs when the software has crashed or failed while running. This error occurs as an annoying notification on your screen, and you need to handle it. As we know that this is a runtime error, fixes are usually updating, installing, and uninstalling. The programmers often code for possible errors and design software carefully. But some errors are unpredictable and irresistible. In other words, we can say that no design is perfect and technical glitches and bugs may occur anytime.

Furthermore, some incompatible programs running in the background may be contributing to the error. Apart from this, a memory problem and outdated graphics drivers may create the problem if left unresolved.

How To Detect TurboTax Error 5641?

The runtime errors happen suddenly and unexpectedly. If you try to ignore it, it will pop up on your screen again and again until you don’t address it. There might be deletions or the appearance of new files. However, the error widely results due to the virus infection. Malware intrusion is one of the common issues of the error code 5641. Plus, a gradual decline in the speed of internet connection might be indicating the problem. However, this is not the only case.

How To Fix TurboTax Error Code 5641?

The runtime errors are frustrating, especially when the cause is not known and the solution is not limited. But we have some quick fixes for you that may help you get rid of the error without doing much effort.

Update Your PC Device Drivers

The occurrence of TurboTax error code 5641 can be related to outdated or corrupt device drivers. The drivers may work well for one day and start causing problems the next day. But you can update them to solve any issue. Finding an appropriate device driver may be challenging. The process may be time-consuming and irritating. Plus, downloading the wrong driver may worsen your problem. In order to avoid such issues, use driver update software that will help you to download and install the correct device drivers. For instance, you can use DriverDoc Driver Update Software.

Reinstall Windows

This step can be your savior. Usually, reinstallation of Windows is done to solve plenty of issues, including runtime errors. A clean reinstallation will dismiss everything from your hard drive and let you restart with a new system. Moreover, a reinstallation will remove the other associated issues, such as eliminating the accumulated junk over the usage of your PC.

Update Your Windows

Microsoft has introduced many updates for your Windows system that may solve many issues, including runtime errors. Many times, the problem isn’t as major as it seems. Sometimes a simple update to Windows may get your device back to its mode. Hence, consider installing all the available window updates for your system.

To check the Windows Updates:

Go to the Start button.

Type in “Update” inside the search box and press enter.

Now, the Windows Update prompt will appear.

Click the “Install Updates.”

Perform A Disk Cleanup (Remove the junk, temporary files, and folders)

With time your device may accumulate some junk files from the regular works. If these files are left undeleted, it might impact the performance of your device. It may make your device respond slowly and cause runtime errors, such as error code 5641. In other words, you will clean up free space from your hard drive to make room for current work.

To run a disk cleanup, follow the given steps:

Go to the Start button.

Then, type in “Command” in the search box.

Hold the Ctrl + Shift simultaneously and press enter.

Then, a permission dialog box will appear.

Click Yes.

Now, you will see a black box with a blinking cursor.

Type in “cleanmgr” and press enter.

The disk cleanup will start and calculate how much space you can free.

Then, a disk cleanup dialog box will appear with the checkboxes. The list contains the temporary files that occupy most of the space. You can check them to delete them.

When you check the boxes with unwanted files, click OK.

#intuit turbotax#Turbotax software#install turbotax.com#install turbotax with license code#turbotax sign in#turbotax login#turbotax software#TurboTax Error Code 5641

0 notes

Text

What Is TurboTax Error Code 190 And How To Fix It?

When the system gets the error, it says, “The tax return you are attempting to load contains one or more state tax forms that are not installed on this machine. Please install state to continue.” To fix the TurboTax error code 190, you need to find the possible cause of it. When you know the exact cause of the TurboTax error, it becomes easier to fix the issue.

What Is TurboTax Error Code 190?

When using the TurboTax software for a long time, you may encounter TurboTax error 190 while you file taxes. Your system has got error 190 due to an introduction of virus or malware threats. This happens when the graphics driver installation is incorrect. To fix this issue, you will need to follow a few procedures. Those fixes include relaunching the TurboTax software and running Disk Cleanup to clear the cache. But before you go, let’s see what causes the error code 190 in TurboTax.

What Causes TurboTax Error Code 190?

Before heading to troubleshoot the issue, you must know the causes behind it.

The software may need to be updated; to solve the issue, you will be required to update it with the latest version.

The tax return may need to be corrected. In this case, you need to prepare your files from scratch.

Incorrect graphics drivers may lead to error 190.

When the TurboTax software program is not compatible with the running system program.

If you haven’t cleared the cookies and cache from the settings.

The system on which you are using TurboTax is not updated to its latest version.

How To Fix TurboTax Error Code 190?

To fix error 190, you will have to perform a few solutions on your PC. There are two solutions to fix the error. Once you implement these solutions, the TurboTax software will work effectively, and you can file taxes easily. Look at the solutions.

Relaunch The TurboTax Software

This is the first solution for troubleshooting error code 190. To implement this, follow the given steps:

First, click the “Start a New Return” button.

Then, select the “taxes” tab of the report.

Now download the reports by saving them.

Then, you can close the TurboTax program.

Next, relaunch the TurboTax software.

After that, open the file and check whether the error is fixed.

If this solution doesn’t solve the issue, move to the next solution.

Run disk cleanup

In this step, you need to free some space on the hard drive so the issue can be clear from the software.

First, take a backup of files and make space on the hard drive.

Then, clear the cache and restart your computer.

When your computer restarts, you can run Disk Cleanup to clear the space on your computer.

To do this, click right on the disk.

Then, scroll down and click on Properties. After this, a separate window will open on your computer.

Lastly, select the Disk Cleanup option. The process may take a few seconds to get complete.

Other Ways To Fix Error Code 190

There are plenty of steps you can take to fix the error code 190. Have a look at it.

Verify the internet connection. If the internet is not working properly, you must contact the network service provider to tackle the issue.

Update your TurboTax software to the latest version if it’s not.

Clear the caches and cookies from the settings of TurboTax software to smoothen the function.

Check whether your TurboTax software is compatible with the running system you are using.

Check whether the system on which you will use TurboTax is updated to its latest version.

If the issue isn’t fixed even after trying the steps mentioned above, don’t worry. You can contact customer service. The customer service team will look into your issue and provide you with the best solution in no time.

Conclusion

We have given the best methods to solve the TurboTax error code 190. But before moving forward, you should know the reasons behind this. In this blog, you learn the causes and their appropriate solutions. You can implement them to get rid of the error. Experts provide these solutions. The expert team handles tax software issues regularly and provides the best and most reliable solutions.

FAQs

What To Do If The Solutions Described Don’t Work?

If you cannot solve the issue by the given methods, you can use TurboTax experts’ help to solve the TurboTax error 190. You can contact them on their number and can take professional help.

Why Is The TurboTax Code Not Working?

If the TurboTax license code isn’t working, you may have entered the incorrect code. Then, double-check the code and enter it carefully in the code box on the installation screen. Also, the license code isn’t case-sensitive. Hence you don’t have to worry about capitalization.

How Can I Activate The TurboTax Code?

Download the TurboTax using the license code, enter your activation number in the License code box on the activation screen, and then select Continue to complete the installation process. You can use the same license code on up to five computers to install the software. You will have to purchase another license if you want to use it on more devices.

0 notes

Text

Turbotax Login

Filing taxes is one of those things that are usually not on top of our to-do list. And most of us try to avoid this unless we are backed against a wall. Even large business companies hire expert accountants to file their taxes. But for a normal guy, hiring an accountant to file our taxes is impossible. Fortunately, to make life easier for all the common people who want to file their taxes, TurboTax acts as a helping hand. Visit the TurboTax login page and follow the simple steps to file your taxes.

0 notes

Text

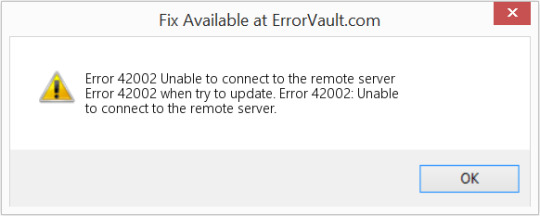

How To Get Rid Of TurboTax Error 42002? [6 Easy Methods]

The TurboTax error 42002 says, 'Unable to connect to the remote server.' The error usually occurs when you are trying to update. This is also called Runtime code 42002 and results when the TurboTax fails or crashes while running. Hence, the error appears as a frustrating notification on your screen until it's correct. Solving the error is mandatory and takes a few methods to do so. This blog is dedicated to the solution of error 42002.

What Causes TurboTax Error 42002?

The error code 42002 is a runtime error and occurs when you update. Now, let's discuss the causes of this. Usually, the error occurs when the TurboTax is loaded out of the limit. Three main reasons cause error 42002. Have a look at them.

Error 42002 Crash

The TurboTax program deals with an error due to a specified task and interferes with the program. This error occurs because TurboTax is unable to understand the input and give appropriate output.

Unable To Connect To The Remote Server Memory Leak

When the TurboTax gets a memory leak, the operating system slowly runs down and reduces the system's resources. Some possible causes are the failure of Intuit to deallocate memory in the program.

Error 42002 Logic Error

The TurboTax error happens when it produces a wrong output even if you have put the correct input.

Generally, error 42002 is caused by a corrupt or missing TurboTax-associated file and sometimes due to malware intrusion. Hence, file replacement is the best and easy way to solve this error.

How To Detect TurboTax Error 42002?

This error occurs without prior warning. It can appear anytime on the screen. Moreover, this error might repeatedly come if they are not solved. Sometimes a file deletion or new files may appear. This symptom usually occurs due to malware infection. The virus infection is one of the causes of runtime error. Sometimes, the users may also see a sudden decline in the internet connection speed, but it's only sometimes the case.

How To Resolve TurboTax Error 42002?

The runtime errors are frustrating and challenging. It may leave you hopeless, and you need an instant fix for this. Here, we are providing you with the best methods to deal with the error.

End The Conflicting Programs

Whenever a runtime error happens, one reason can be the conflicting programs that are causing the problem. Hence, the first solution to fix this is to end those conflicting programs. Follow the given steps for this.

First, launch the Task Manager by clicking the Ctrl+Alt+Delete simultaneously. From this, you can see a list of programs that are running currently.

Move to the Processes tab and end the programs one by one selecting each program and then clicking the End Process button.

Next, you have to observe if the error message reoccurs each time, you end the process.

When you observe which program is causing the error, then move to the next troubleshooting step and reinstall the application.

Update Or Reinstall the Conflicting Programs

Use the control panel to update/reinstall conflicting programs. Follow the steps mentioned below.

Windows 7: Click the Start button and click the Control panel. Then, uninstall a conflicting program.

Windows 8: Click the Start button and scroll down to click More Settings and then click Control Panel > Uninstall a program.

Windows 10: Type Control Panel in the search box and click the result. After that, click uninstall a program.

Under Programs and Features, click the problem and program and click Update or uninstall.

If you select to update, then you will have to follow the instructions to complete the update. But, if you choose to uninstall, you will have to follow the instructions to uninstall and then re-download. Also, you can use the application's installation disk to reinstall the program.

Update The Virus Protection Program

The virus infection causes a runtime error in your system and should be deleted immediately. Ensure you update your virus program and run a scan of the computer or run a Windows update and get the latest virus definition. This method can protect your TurboTax software from causing errors due to a malware introduction.

Reinstall Runtime Libraries

You are receiving the error due to an update, such as the MS Visual C++ package, that may need to be properly installed on your system completely. To fix the issue, you can uninstall the package and install a fresh copy. Follow the steps below.

Go to Programs and Features and select the Microsoft Visual C++ redistributable package to uninstall the package.

Then, click Uninstall on the top of the list, and when you are done, restart your computer.

Next, download the latest redistributable package from Microsoft and then install it.

Run Disk Cleanup

A low free space on your hard disk might create a runtime error. Follow the steps below to perform it.

First, take a backup of your files and free up space on your hard drive.

Also, clear cache and cookies and then reboot your computer.

Run Disk Cleanup, open your Explore window, and right-click on the main directory.

Lastly, click Properties and click Disk Cleanup.

Reinstall Your Graphics Driver

The error may be related to the bad graphics driver; you need to install them again to fix the issue. To do this:

Open the Device Manager and locate the graphics driver.

Then, right-click on the video card driver and click uninstall.

After that, restart your computer.

0 notes

Text

Turbotax.com support

TurboTax is the answer if filing your taxes is a problem. You can quickly and conveniently submit your taxes with TurboTax. Your backlog of unpaid taxes and a TurboTax login are all you need. You are prepared, to begin with its user-friendly design and straightforward filing process. TurboTax makes filing taxes a simple affair. Additionally, if you get stuck, you have access to professionals.

1 note

·

View note

Text

How to Solve TurboTax Error 25300? [Get The Best Solution]

The TurboTax error 25300 is the most common TurboTax error. It is also called runtime error. The software developers take the TurboTax through many levels of debugging to remove the bugs before releasing it to the public. Some errors, like error 25300, may occur from reporting. TurboTax users may face this error if they are using the software regularly.

While getting the error 25300, the user can report the issue to Intuit inc. Then, the developers can rectify its source code and get an update in the market. Therefore, the developers can use the updated packages for TurboTax available from their website to fix error 25300 and other related errors.

What Causes TurboTax Error 25300?

Usually, the error 25300 occurs when the TurboTax is loaded up. Now, let’s see the common causes of error 25300.

Error 25300 crash

When a program ends abruptly while running, the error caused is called error 25400. This error occurs when the TurboTax inputs don’t correctly process. And the outputs are usually confused.

TurboTax error memory leak

The memory leak makes your system slow down, and so does the system output.

Error 25300 logic error

The logic error happens when you put the correct data, but the device produces the wrong output.

Mostly, the error 25300 file problems occur due to TurboTax-related file missing or virus infection or malware intrusion. Hence, the best way to fix this issue is to replace the Intuit Inc file with a new one manually.

The software developers program the code predicting the possible errors. Also, there are no perfect designs, and errors can come even with the best design. Technical glitches can happen during runtime when errors are not addressed during the design and testing.

Also, incompatible errors running in the background may cause runtime errors. A memory issue, outdated graphic drivers, or a virus infection may also be possible reasons. But whatever the problem, the error must be resolved to avoid further issues.

Ways To Resolve TurboTax Error 25300

We have listed some best remedies to tackle the error.

Eliminate The Temporary Files And Junk From Your System

Your system gets a build-up of junk files from web surfing and system usage. If these files aren’t deleted early, it may cause the TurboTax to respond slowly and cause error 25300. This is due to the overloaded hard drive and file conflicts. Hence, cleaning up these files with Disk Cleanup will not only solve the error but will also increase your system’s performance speed.

Let’s see how to run disk cleanup on your Windows (XP, Vista, 7, 8, and 10)

First, click the Start button.

Then, type “command” in the search box.

Now, hold the Ctrl+Shift on the keyboard and press enter.

A permission dialogue box will appear on the screen.

Then click Yes.

Then, a black box will appear with a blinking cursor.

Type in “cleanmgr” and press enter.

Now the Disk Cleanup will start and calculate the space you can clear up.

Then you will see a Disk Cleanup dialog box with a series of checkboxes you can select. Mostly, the temporary files occupy most of the disk space.

Lastly, check the boxes you want to clean and then click OK.

Stop The Conflicting Programs

The conflicting programs running in the background may cause runtime error 25300. Hence, you first need to stop those conflicting programs to resolve the issue. Let’s see how.

First, open the Task Manager by clicking the Ctrl+Alt+Del simultaneously. Then, you will see a list of running programs.

Move to the Processes tab and close the programs by selecting them one by one and clicking the End Process button.

Now, check if the error reoccurs after stopping the processes.

You can move to the next troubleshooting step when you detect which program is causing the error.

Update Or Reinstall The Conflicting Programs

Once you close all the programs, it’s time to update or reinstall them using the Control Panel. Let’s see the process step by step.

Windows 7: Go to the Start button and click the Control Panel. Then, uninstall a program.

Windows 8: Go to the Start button, scroll to More settings, click Control Panel, and Uninstall a program.

Windows 10: Type in Control Panel in the search box and click the result. Then, click Uninstall a program.

Under Programs and features, click the program and click Update or Uninstall.

If you want to update, you have to follow the on-screen directions to complete the process, and if you want to uninstall, then follow the prompts to uninstall and re-download, or you can use the app’s installation disk to reinstall the program.

Uninstall And Reinstall The TurboTax Program

If the TurboTax error 25300 error is associated with a specific program, you must reinstall TurboTax software.

For Windows 7 And Windows Vista

Click the Start button and open Programs and Features.

Then, click the Control panel on the right side menu.

Click Programs.

Now, click programs and features.

Navigate the TurboTax error 25300 associated programs under the name column.

Then, click the TurboTax-associated entry.

Next, click the Uninstall button at the top of the menu.

At last, follow the on-screen instructions to complete the uninstallation of error 25300.

For Windows 8

Bring the cursor to the bottom left of the screen to get the Start Menu image.

Then, right-click to produce the Start Context Menu.

Click Programs and features.

Navigate TurboTax error 25300 associated programs under the name column.

Click the TurboTax-associated entry.

Now, click Uninstall/Change at the top of the menu.

Lastly, follow the directions given on the screen to complete the installation of the error 25300 associated program.

Source URL: - https://intuit-turbotaxlicense.com/how-to-solve-turbotax-error-25300/

0 notes

Text

TurboTax Review 2023 [In-Depth Explanation]

Tax season can be overwhelming, especially when you don’t know all the formalities involved. Even if you do, it is still hard to fulfill those. Looking for a tax advisor, calculating all your numbers, finalizing those, standing in queues, and getting your tax audited–it is a draining experience. What if there were a tax solution that does all of that with ease in minutes? There are a lot of programs, and TurboTax Review is one of them.

0 notes

Text

TurboTax Review 2023 [In-Depth Explanation]

Tax season can be overwhelming, especially when you don’t know all the formalities involved. Even if you do, it is still hard to fulfill those. Looking for a tax advisor, calculating all your numbers, finalizing those, standing in queues, and getting your tax audited–it is a draining experience. What if there were a tax solution that does all of that with ease in minutes? There are a lot of programs, and TurboTax is one of them.

TurboTax is one of the most popular platforms available. It’s an easy-to-use tax filing service that walks you through the entire process. From filing to getting a refund, everything is covered. But before you dive in, you may be wondering if it’s the right choice for you.

This in-depth review will help you make an informed decision about whether or not it’s the right choice. We’ll discuss the features and benefits of TurboTax, such as its comprehensive tax guidance, secure filing options, and free filing options. We’ll also explore the cost of the platform, its user-friendliness, and its customer service. With this review, you’ll be able to make an informed decision without any trouble.

Overview of TurboTax

TurboTax is an online tax filing platform and an easy-to-follow companion that aids your tax filing process. It walks you through the process from start to end, making your tax preparation as simple as possible. TurboTax is available in both free and paid versions. The free version is the perfect choice for basic tax filers, while the paid versions are designed for more complex tax situations.

Features and Benefits of TurboTax

Comprehensive Tax Guidance

TurboTax walks you through every step of the tax filing process, ensuring you don’t miss any important information.

Secure Online Filing

All your information is stored online, and the company uses secure protocols to protect your information. So, you don’t need to worry about any possible data thefts.

Free Filing Options

TurboTax has both free and paid versions available. The free version works for basic tax situations. However, it has limited functionality.

Dedicated Tax Experts

TurboTax has a team of dedicated tax experts, including CPAs and tax attorneys, who are available throughout the tax season to answer any questions you may have.

Cost of TurboTax

You get various options to work with when it comes to filing your taxes with TurboTax. We are discussing all of them below.

Free Edition

The free Edition comes with basic functionalities, such as filing simple federal and state tax returns. However, the definition of the word “simple” is unknown, and you can never know for sure if you can get away with the free version or not. It also covers W-2, EIC, and child tax credits. You should not expect anything extraordinary for free. Let’s see all of the features below.

Free filing of simple taxes (federal and state involved)

Covers W-2, EIC, and child tax credit

Audit Guidance

24/7 online support

Deluxe

The Deluxe costs you $39, and it is aimed towards maximizing tax deductions and credits. We are listing some of the additional features below.

Searches 350+ tax deductions and credits to offer the best to you.

Mortgage and property tax deductions are also taken care of.

Way to turn donations into deductions.

Premier

Premier costs you $69 and provides you with everything that comes in Deluxe, along with some added features.

Stocks, bonds, ESPPs, and other investments are covered.

Imports your crypto and stock activity automatically.

Covers additional income like rental property income

Self-Employed

This is the costliest of the package and costs you $89. It is built keeping Self-Employed and business persons in mind. Let’s see what it has to offer.

High-quality guidance for people who work independently, such as freelancers, small business owners, and independent contractors.

It brings in industry-specific deductions so that you can save the most.

Audit assessment

So, you get decent pricing options to work with, and the pricing in itself is not that much. However, one of its competitors, H&R block, offers nearly the same for quite less.

User-friendliness

A key feature of TurboTax is its user-friendliness. The platform is designed to be as simple as possible, making it easier for you to navigate. You can search for terms, use helpful categories to organize your information, and take advantage of a step-by-step guidance system. This makes it easier to complete your taxes, regardless of your level of tax knowledge.

So, using the program overall is a good experience whether you are a newbie or an experienced one.

Customer Service

TurboTax is committed to providing a high level of customer service. The platform has a dedicated help center that can be used for both general information and specific tax-related questions. The help center also has a search option, making finding information relevant to your tax situation easier. If you have a more complex tax situation, TurboTax has a dedicated team of tax experts who can help you with any questions or concerns you might have.

Conclusion

TurboTax is an online tax filing platform that lets you file taxes from the comfort of your home. This user-friendly platform makes completing your taxes easier, regardless of your level of tax knowledge. And they also got a dedicated team of tax experts ready to assist you with any questions or concerns. With these features and benefits, TurboTax is a great choice for tax filing. Though TurboTax provides solid features, it is definitely not the most affordable of all. And the business version of the product is not mac compatible. If you got an apple device, then you won’t be able to use it.

Source URL: - https://intuit-turbotaxlicense.com/turbotax-review/

0 notes

Text

Tax filing has been a long and stressful process. But it's not so now. With TurboTax software, doing your taxes has never been easier. Everything is in place from an intuitive interface to expert guidance to make your tax filing journey a breeze. Visit TurboTax Login to get started with the procedure. The login process is quite easy, just provide them with everything they ask for, and you're good to go.

0 notes

Text

TurboTax Login Track My Refund Status [Explained]

Many TurboTax users have many doubts regarding tax refund status. The refund filing may be a complex procedure, don’t worry; we will help you with your filing. In this blog, we will also clear all your doubts regarding TurboTax. The major doubt everyone has is the reasons for the delay in TurboTax refund processing. So let us start the blog for everything you need to know about TurboTax login track my refund status.

0 notes

Text

TurboTax Login Track My Refund Status [Explained]

Many TurboTax users have many doubts regarding tax refund status. The refund filing may be a complex procedure, don’t worry; we will help you with your filing. In this blog, we will also clear all your doubts regarding TurboTax. The major doubt everyone has is the reasons for the delay in TurboTax refund processing. So let us start the blog for everything you need to know about TurboTax login track my refund status.

Where’s My Refund Application

The time taken by the IRS system is highly dependent on the method you choose for filing your tax. You can either refund via mail or using an e-file.

E-Filing Returns Via Direct Deposit – E-filing your returns using direct deposit is the fastest method to get your federal tax refund. Typically, the IRS issues a refund within 21 days after the completion of the acceptance process if it has no issues.

Mailed Paper Returns – Usually, the processing time for mailed paper returns is 4 weeks, but it can take as long as 8 weeks to complete the refund process. But if you want your refund processed in less time than the IRS itself, caution you not to choose this method for refunding.

Reasons For Delay In Tax Refund While Filing In TurboTax

The following are the reasons for the delay you could in the tax refund process:

You may experience delays in receiving your tax refund when your refund file has any kind of errors, like the Advanced Child Tax Credit or Recovery Rebate Credit.

The second reason for the delay may be when you have incomplete documents or if you have filed an inaccurate return.

If your tax filing needs any review.

Or if your return file includes Form 8379, which is for the Injured Spouse Allocation. This kind of case could take around 14 weeks the processing.

When your income tax file includes an additional child tax or earned income tax credit.

Tax Refunding Process In TurboTax

Following is the tax refunding process in TurboTax:

Start off by checking the refund status 24 to 48 hours prior to the e-filing.

Then return the received notice within 24 to 48 hours of e-filing.

After that, your refund status will be changed from “Return Received” to “Refund Approved.”

You can use the “Where’s my refund” tool to know the refund date.

Where’s my refund” tool sends you a notification when the refund will be generated.

Final Words

We hope you found this blog helpful; if you have any doubts regarding TurboTax, refer to our Frequently Asked Questions.

Frequently Asked Questions

How To Correct An Error In TurboTax?

If you’re using TurboTax online, all you need to know is to log in to your account and then amend the return which was filed and accepted.

If you use our CD/download product, sign back into your return and select “Amend a filed return.” You must file a separate Form 1040-X for each tax return you are amending.

How To Reset And Start Over In TurboTax?

Follow the below steps to reset and restart TurboTax:

First of all, sign in and open your TurboTax account.

Then, go to the Turbo Tax tools from the left Menu.

After that, click on Clear and Start Over.

And finally, click on Yes for confirmation.

How To Cancel Errors In TurboTax?

Following are the instructions you can follow to cancel errors in TurboTax:

First of all, switch to the forms mode.

Then click on the item value you wish to cancel.

After that, click on Override from the Edit menu both for Windows and Mac.

Why Doesn’t TurboTax Start My Taxes?

There are many reasons you’re not able to clear and start fresh in TurboTax Online. One reason may be that you’re using a free version of the TurboTax application, and you need to switch to the paid version of TurboTax.

Visit — TurboTax Login

0 notes

Text

turbotax download login

Filing your taxes doesn't have to be stressful and tedious. Luckily, with TurboTax, they are not. Just visit the TurboTax login page and follow along. TurboTax will walk you through the process step-by-step, ensuring you don't miss any important details. It's fast, easy, and secure. If you ever encounter an issue, their expert advisors are always there to help you out. And make your tax filing journey more enjoyable and intuitive.

#Turbotax.com#install turbotax.com#Turbotax Login#Turbotax.com support#install turbotax with license code#Turbotax sign in#Turbotax software#Turbotax taxing app

0 notes

Text

Where Is My TurboTax Refund 2022? [+Check Status Online Guide]

TurboTax is a leading software for the preparation of e-filing of your tax returns virtually from a system or mobile device with a stable internet connection. You don’t need to save anything on the computer. This online platform lets you track your taxes automatically and hassle-free. This blog focuses on the TurboTax refund policy. We will discuss what it is and how to track it.

0 notes

Text

Where Is My TurboTax Refund 2022? [+Check Status Online Guide]

TurboTax is a leading software for the preparation of e-filing of your tax returns virtually from a system or mobile device with a stable internet connection. You don’t need to save anything on the computer. This online platform lets you track your taxes automatically and hassle-free. This blog focuses on the TurboTax refund policy. We will discuss what it is and how to track it.

What Is A Tax Refund?

You get a tax refund when the Canada Revenue Agency collects more income tax than you own. You can consider it as a saving which you didn’t know about. The refund is estimated according to your total income, the taxes you paid, and whether you have required deductions and credits to warrant a refund. When you receive your tax refund depends on when and how you file your tax return, the accuracy of the information on your tax return, and how you choose to receive your refund. You can check the refund in just 21 days.

Where’s My Refund?

If you were waiting for your tax return impatiently to get deposited into your checking account, you don’t need to get anxious. The IRS owns an online tool called “Where’s My Refund?” which allows you to check the status of your refund. Then, you need to enter your personal information, and you can find out when it will come. TurboTax also provides a Where’s My Refund Tracking guide that teaches you everything about the process and how to check the federal tax refund status.

How To Check Your Tax Refund Status Online?

To check the tax refund status online, you need to follow the given steps. Then you can successfully check the status.

Wait

Before checking the refund status, wait for at least three days after e-filing. Whenever you e-file your tax return to the IRS, it will need about three days to update the information on the website. When you e-filed your tax return using TurboTax, you can check the e-files status online to check if IRS approves it. You will also get an e-mail confirmation directly from the IRS.

After you mail a paper copy of your tax return, you should wait three weeks before checking the refund status according to IRS guidelines. Many taxpayers who e-filed will get the tax refund sooner.

Get A Copy Of Your Tax Return

Before you finally check your refund status, you must have some information from your tax return. So, get a copy of your tax return if you have printed it.

You should have the following information from it:

The social security number you entered at the top of your tax return.

The filing status you picked, which you can place in the top portion of the first page of your tax return.

The total amount of your tax refund can find at the end of your tax return.

Move To The “Where’s My Refund?” Page On The IRS Website

After accessing the “Where’s My Refund?” tool, you get three separate boxes to provide your filing status, exact refund amount, and Social Security number. When you are done entering this information, click on the “Submit” button on the page to check the status of your refund.

Other Methods To Check Your Tax Refund Status

In case you don’t have access to the internet or computer, you can directly call to IRS at 800-829-1954 to get the status of your refund. You will need the same three pieces of information which you have used in the online tool. Hence, ensure you have a copy of your tax returns.

Furthermore, TurboTax has a Where’s My Refund Tracking step-by-step guide to help you find the status of your IRS and state resources to track the tax refund and check your return status.

You can file your own taxes using TurboTax. For this, you need to answer the normal questions.

How to Calculate a Tax Refund?

When you are using tax software like TurboTax, your information will be transferred automatically to the correct line of the tax return and then calculated.

Here I have explained how to calculate your tax refund amount:

Calculate your total income by adding all your employment and investment earnings.

Then, apply all deductions for which you are capable to the taxable income to reduce it.

Now, subtract your total credits from your total payable amount or the taxes owed.

If you get a negative number in the result, enter it on line 4800 of your return, and then you will receive a tax refund in that amount. However, if it’s positive, you should pay this balance owed by the tax year deadline and enter the amount on Line 48500.

Conclusion

TurboTax allows you to e-file tax returns. It has become a well-known online platform for maintaining your taxes. Its users and popularity are progressing. If you want to get your refund on tax, you will have to go through certain steps to do this. You need to use the IRS’ ‘Where’s My Refund?’ tool. To use this tool, you must have your social security number, ITIN, filing status, and refund amount.

Visit - TurboTax Login

0 notes

Text

How To Fix TurboTax Error Code 36? [9 Easy Solutions]

After being a well-known face in the software world, TurboTax still has to deal with numerous errors, which may discourage users. If you find TurboTax error code 36, it may be an installation-related issue. It shows that the installation has failed. In Windows, it may be an indication of an unknown device. You will have to find the cause of its occurrence and then jump to the solutions. And many users don’t know how to resolve such errors, and they exaggerate the problem.

0 notes

Text

How To Fix TurboTax Error Code 36? [9 Easy Solutions]

After being a well-known face in the software world, TurboTax still has to deal with numerous errors, which may discourage users. If you find TurboTax error code 36, it may be an installation-related issue. It shows that the installation has failed. In Windows, it may be an indication of an unknown device. You will have to find the cause of its occurrence and then jump to the solutions. And many users don’t know how to resolve such errors, and they exaggerate the problem.

TurboTax error code 36 is triggered in this blog, where we will learn the step-by-step solution to fix this error. The very first step in troubleshooting an issue is recognizing the cause and acting accordingly.

What Is TurboTax Error 36?

This is a common issue that many users deal with. However, not everybody is aware of the causes. Error 36 can arise due to an installation failure on your operating system. Instances are sudden crashing of software and applications, and they stop running. This type of error is annoying and immediately has to be resolved.

Causes Of TurboTax Error 36

The below mentioned are the main causes of error 36:

TurboTax has failed or crashed.

Malware intrusion

Installation failure

Sudden shutdown

Improper deletion of application or software.

Outdated version of antivirus program

You are unable to copy files to the hard drive.

How To Fix TurboTax Error Code 36 On Windows?

Hundreds of users experience the issue while working on their Windows computers. Here we enlisted the ways to fix them quickly in a step-by-step process. Try them for yourself.

Solution 1: Use Task Manager To End The Process

If you observe a run time error on your system, you should end the conflicting processes from the task manager. Follow the below steps to do so:

Use “Ctrl + Alt + Del” altogether to launch “Task Manager” on your screen. There you will see a list of running programs.

Then, click the “Processes” tab.

Thereafter, click the programs one by one and end them via the “End Process” button.

Simultaneously, check whether the error code has diminished.

When you get the conflicting program causing the issue, reinstall it.

Solution 2: Update Or Reinstall The Programs

Once you know which program is causing the error, uninstall it and reinstall it. Check the process for different Windows versions. You have to use the control panel to do it.

Windows 10

Navigate “Control Panel” in the Windows search bar.

Then, click on “Control Panel” when it’s displayed.

Now, uninstall a program.

Windows 8

Click the “Start” menu.

Then, scroll down to find “More settings.“

Now, click on “Control Panel.”

Finally, uninstall a program.

Windows 7

Go to the “Start” menu.

Then, go to “Control Panel.”

At last, uninstall a program.

Solution 3: Update Your Antivirus Program

Ensure your Antivirus program is updated, as some outdated features may cause the errors. Therefore, it’s important to look for the latest version and install it.

Solution 4: Reinstall The Runtime Libraries

The error 36 may arise due to an outdated MS visual C++ package. If it’s not properly installed on your system, you need to uninstall and install it. Here are the steps:

Type in “Control Panel” in the Windows search bar.

Then, click on “Control Panel” when seen.

Now, move to “Uninstall a program.”

Navigate “Microsoft Visual C++ Redistributable package” from the list of programs.

At last, click the “Uninstall” button at the top.

Then, reboot your system if required.

Solution 5: Perform Disk Cleanup

A low space might also cause error code 36. Hence, in this method, you will learn to clean the disk. Before cleaning, take a copy of your files and then go forward. Follow the given steps:

Navigate “Disk Cleanup” in the Windows search bar.

Then, click the “Disk Cleanup.”

Select the drive you want to clean up.

Then, click the “OK” button.

Under “Files to delete,” select the file you want to delete.

At last, select the “OK” button.

Once you are done, reboot your system.

Solution 6: Reinstall The Graphic Driver

The outdated graphics driver may interfere with the installation process. Hence, confirm whether your graphics driver is updated or corrupted. If you find them corrupted, uninstall and install the latest one. Here are the steps:

First, launch “Device Manager” on your system.

Navigate “Graphics driver.”

Then, click on “Video card driver.”

Now, click the “Uninstall” option.

You can restart your system then.

Solution 7: Manage Internet Settings

When the TurboTax is related to Internet Explorer, you have to adjust the internet settings. The following steps tell the method.

1. Reset Your Web Browser

Click on the search bar on Windows 10 & 8 and type in “Internet Options.”

Then, move to the “Advanced” tab.

Now, click on the “Reset” button.

Click on the “Start” menu in Windows 7.

Then, search for “Control Panel.”

Thereafter, move to “Internet Options” on the left.

Then, click on the “Advanced” tab.

Click the “Reset” button.

2. Disable Script Debugging

From the “Internet Options” Windows, choose the “Advanced” tab.

Then, navigate “Disable script debugging.”

Now, checkmark on “Radio” icon.

Disable the “Display a notification about every Script Error” option.

Then, click the “Apply” button. And then click “OK.”

Once you are done, reboot your PC.

Solution 8: Perform A Malware Scan

TurboTax may get crashed when a sudden malware enters it. In this case, you need to perform a system scan. Here are the steps to do it:

First, click the “Start” menu.

Then, launch “Command Prompt.”

Now, type “cleanmgr” in the “Command Prompt” window.

Press the “Enter” button.

Solution 9: Restore Your System

When no method works, you can try restoring your system to solve numerous issues so your system will return to its original state. To do so, follow the below steps:

First, press the “Windows” key.

Now open “Control Panel.”

Then, press the “Ctrl + F” keys together to open a search bar.

Type in “Recovery” and open it.

Now, select the “Open System Restore” option.

Then, click “Next.”

Choose one option from the “Restore Points” list.

Again, click “Next.”

Then, press the “Finish” button.

At last, click the “Yes” option when the prompt appears.

Conclusion

By following these steps, you can quickly fix the TurboTax error code 36. The errors are a result of an outdated version of the operating system or your antivirus program. Hence, an update to them may fix your issue. Besides this, adjusting the internet settings and running malware scans can also benefit. Restoring your system can eradicate many issues in the background and help you get the previous state of the computer.

Visit - install turbotax.com

0 notes

Text

How Do I Fix TurboTax Error 214? [Step-By-Step Guide]

The TurboTax error 214 is known as a runtime error. It’s one of the common bugs in the software, and many users have dealt with this while working online. People use this software worldwide to maintain their federal taxes yearly, and getting such errors is annoying. It becomes more frustrating when you aren’t aware of the causes and solutions for this. This is why we made this separate blog for TurboTax error 214 that will guide you throughout your online journey.

Read the full blog to study the solutions. Otherwise, you will make the situation worse. A delay in accessing the TurboTax program may result in late return filing and penalties from the IRS. We will see error 214 in detail.

What Does TurboTax Error 214 Mean?

Error 214 arises when the TurboTax crashes while running. This error is considered a “runtime” error and a software bug. However, the programmers perform different levels of debugging to ensure that the software should be error-free. But still, such errors happen, unfortunately. The program won’t access unless the error is fixed. The corrupted files and malware are the possible carriers of this error. If it is left unsolved, it may affect your whole system.

Runtime errors occur due to incompatible programs running simultaneously in the background. Also, a bad graphics driver or malware infection may be the possible reasons.

What Are The Reasons For Error 214?

The possible reasons for error 214 are listed below:

Error 214 program crash: A sudden termination of the program due to an invalid format. The TurboTax or OS fails in this case.

TurboTax Memory leak: A memory leak can also cause error 214, due to which your operating system doesn’t perform the same and may crash your system.

Error 214 logic error: This error arises when the TurboTax produces the wrong output. A fault in the source code of software produces the wrong output. Also, the corrupted files and malware intrusion are the other factors causing error 214.

How To Fix TurboTax Error 214?

There are multiple ways to fix error 214. Have a look at them:

Fix 1: End Conflicting Programs

As discussed above, the runtime error may arise due to incompatible or conflicting programs; we need to close them to fix the issue. Here are the steps to end these unwanted programs:

First, open the Task Manager by clicking Ctrl+Alt+Del altogether. This will enlist the programs running in the background.

Then, switch to the processes tab and end the programs one by one by clicking each program and then clicking the “End Process” button.

Verify whether the error message reoccurs when you end each process.

Once you recognize which program is causing the issue, you can proceed with troubleshooting steps. Also, reinstall the application again.

Fix 2: Reinstall Conflicting Programs

Once you end the conflicting programs, reinstall them using the control panel. Here is how you can reinstall them:

In Windows 7, click the Start button and click on Control Panel and proceed with uninstalling a program. And then, re-download it and reinstall the program via the application’s installation disk.

In Windows 8, go to the Start button and scroll down to More settings. Then, click on the control panel and uninstall a program. Then reinstall it by re-downloading the program.

In Windows 10, type in the control panel in the web search bar and click on the results. Now, continue with uninstalling and reinstalling a program.

Fix 3: Update Your Antivirus Program

Your antivirus should immediately discard malware attacks and threats causing runtime errors. Therefore, check for your antivirus update. If it’s outdated, update it with the latest version so it can scan your computer thoroughly or run a Windows update to get the latest version of the virus definition.

Fix 4: Perform Disk Cleanup

The runtime error may also result from low free space on your system. You have to check for it and run a disk cleanup. Here are the steps:

Remember to take a backup of your files to free the space on your hard drive.

Clear your cache and reboot your system.

To run a disk cleanup, open the explorer window and then right-click.

Then, click properties and then “Disk Cleanup.”

Fix 5: Reinstall Your Graphics Driver

An outdated graphics driver may be the reason for a runtime error. If they are causing issues, follow the given steps:

Open the Device manager and navigate the graphics driver.

Then, right-click the video card driver and click uninstall.

Now, restart your computer.

Fix 6: Reinstall Runtime Libraries

The error may arise due to the updates, such as the MS Visual C++ package, which may not be installed correctly. You just need to uninstall the current package and install a fresh version. See the steps for it:

Go to Programs and Features and navigate Microsoft Visual C++ Redistributable package.

Then, click Uninstall at the top of the list.

When you are done, reboot your system.

Then, download the latest redistributable package from Microsoft and reinstall it.

Conclusion

TurboTax error 214 is a software bug that may be caused due to multiple reasons. It is also called a Runtime error. The error occurs when the graphics driver or your antivirus program isn’t updated. Also, some conflicting programs in the background may be causing the error. Corrupted files can also be a big reason for causing error 214. Reinstallation of the conflicting programs is recommended to fix them. Disk cleanup and reinstallation of runtime libraries could fix the issue.

Visit — install turbotax.com

0 notes