#cash advance apps that work with chime

Text

cash advance apps that work with chime

cash advance apps that work with chime

0 notes

Text

cash advance apps that work with chime

cash advance apps that work with chime

0 notes

Text

cash advance apps that work with chime

cash advance apps that work with chime

0 notes

Text

what cash advance apps work with chime

what cash advance apps work with chime

1 note

·

View note

Text

what cash advance apps work with chime

what cash advance apps work with chime

0 notes

Link

https://www.effectivestuffs.com/cash-advance-apps-that-work-with-chime/

0 notes

Text

How To Get Your Paycheck Early

Axos Bank additionally runs promotions once in a while so you could get a little further money for opening an account. Read our Current review for all the major points about this account. This article was subjected to a complete fact-checking course of.

Early direct deposit is mostly a free and automatic characteristic at a bank. Automatic, on this case, means there’s no sign-up required if you’re eligible. And early means one to two days ahead of payday, so when you usually get a paycheck on Friday, it will arrive on Wednesday. The Wealthfront Cash Account is a strong high-yield checking account. But when you're seeking to open a separate savings account, check out our greatest high-yield financial savings accounts guide.

She seeks to make sophisticated topics easier to understand and less intimidating to the common reader with accurate, dependable info and transparent writing. Her experience includes banking product evaluations and general subjects common to non-public finance corresponding to saving and budgeting. Her work has been featured in Money Under 30, Investor Junkie, Doughroller, Saving for College and APY GUY. Lunch Money is an easy-to-use budgeting app that permits you to join your accounts, make a customizable finances, and observe your expenses.

One provides up to 10% money back on its app-based checking account, its solely product. With this account, clients also can earn a competitive APY on their financial savings steadiness, save a half of their paychecks automatically and get mentioned paycheck two days early. There are no requirements to qualify for early paydays with direct deposit.

Final Thoughts On Getting Paid Early

Your financial state of affairs is unique and the services we evaluate will not be right for your circumstances. We don't offer monetary recommendation, advisory or brokerage companies, nor will we suggest or advise people or to purchase or sell particular shares or securities. Performance data could have modified because the time of publication.

youtube

"As our transformation efforts take hold, taxpayers will proceed to see marked enchancment in IRS operations in the upcoming filing season," said IRS Commissioner Danny Werfel. "IRS workers are working onerous to make positive that new funding is used to help taxpayers by making the process of getting ready and submitting taxes easier." So, as you discover the world of apps that allow you to get paid early, keep in mind to make smart selections and use these instruments responsibly. Read the hows and whys to know what cash limits you may have and the way you’ll pay them again. It costs $1 per month, but it’s not an expensive membership and has a lot to offer to assist you handle your money and get it early.

Chime processes and posts direct deposits as quickly as they arrive in. You’ll get a push notification and an email so you can begin spending and saving instantly. Just launch the Chime app, faucet Move Money and then Move your direct deposit. Here, you can copy your account and routing numbers to share along with your payroll supplier.

You’re Our First PrecedenceEach Time

Our scores bear in mind a product’s features, prices, shopper ratings, safety and different category-specific attributes. The content material on this website is for informational and educational functions solely and shouldn't be construed as skilled monetary recommendation. Please seek the guidance of with a licensed monetary or tax advisor before making any selections based mostly on the data you see right here.

Current Individual Account required to apply for the Current Visa® secured cost card. Paycheck advance apps might help give you wanted monetary assistance when the unexpected happens in the midst of a pay cycle whenever you don’t have money. There are some issues even the most effective banks can't do for you.

It's important to keep track of tax regulation and life adjustments that may affect your state of affairs and adjust your paycheck withholding by way of Form W-4 with your employer as wanted, he stated. Your federal and state paycheck withholdings have an effect on how much taxes you pay throughout the year. You can expect a refund when you've overpaid or a tax invoice when you have not paid enough. People ought to plan to file electronicallywithdirect deposit.

Up to 1 day early, but restricted to the Free Active Duty Checking account. Are a kind of bank that primarily operates without physical branches. Are for-profit institutions whose accounts are federally insured by way of the Federal Deposit Insurance Corp.

This information may be different than what you see when you go to a financial institution, service provider or particular product’s site.

Dashia was previously a workers writer at NextAdvisor, the place she lined credit cards, taxes, banking B2B funds.

More of these on-demand gig corporations are offering same-day pay all of the time.

Below, find 32 accounts that supply this service, and an evidence of how they can do it and why it might be smart to take benefit. Direct deposit is the fastest method to get your paycheck into your checking account. Some of the most effective checking accounts make this course of even faster by implementing early direct deposit options. While it’s an excellent function, not each monetary establishment is as a lot as par with user advantages. You must create a checking account with another firm that gives this feature.

1 Early Pay is routinely available to checking, savings and cash market prospects who receive qualifying ACH direct deposits. Capital One is one of our top choices for banks with early direct deposit as a end result of it delivers the convenience of on-line banking from a full-service institution. Capital One additionally has branches in choose places and provides fee-free entry to over 70,000 ATMs. SoFi doesn’t supply separate checking or financial savings accounts at this time—only the combined “Checking and Savings” account.

For many, that leads to taking another advance before the following paycheck and another paycheck after that. You’re at all times behind and depending on the app and the advances it presents to get you thru the month. Called Albert Instant, it’s free to make use of, but you should have a Genius subscription, which has a month-to-month charge. You can also pay a small charge to get your money immediately somewhat than in two to 3 business days. As accrued salaries are siphoned off from the paycheck itself, that would imply less deposits going into banks and credit score unions through the payroll process--an instance ofdeposit displacement. Information supplied on Forbes Advisor is for instructional purposes solely.

Is A Paycheck Advance A Loan?

According to the DailyPay website, companies have seen a 41% decrease within the turnover of DailyPay users. DailyPay customers are additionally more more doubtless to come to work as a result of they'll see an immediate return on the hours they work. Here are a number of the hottest apps that may loan you cash till payday. However, you also needs to be practical about your cash habits. Continuously requesting your paycheck early can lead to reliance on early paychecks and loans, trapping you in a cycle you probably can't escape.

You may arrange direct deposit with an employer, companies you're employed with as a contractor, or even the U.S. authorities for tax refunds or Social Security advantages. Signing up for early direct deposit is easy – but monitoring it's even simpler. We’ll send you a push notification and an e-mail once your paycheck is prepared.

1 note

·

View note

Text

5 Paycheck Advance Apps That Will Assist You Receives A Commission Early

You can autopay your stability in your next payday and with on-time payments, you would qualify for the brand new credit card from Possible in time as properly. Many different factors can affect the timing of a refund after the IRS receives a return. Some returns may require extra review and may take longer.

The main benefit of getting paid early apps is accessing your paycheck up to two days early by way of direct deposit. Instead of falling into this cycle, use these cash advance apps when you need them. Then give consideration to tips on how to make further money on the facet or learn how to handle your money extra effectively.

Up to 4.60% APY on checking and financial savings account balances could be yours if you arrange direct deposit or by depositing $5,000 or more each 30 days. Members without direct deposit earn 1.20% APY on checking and financial savings balances. Many lenders offer quick private loans that don’t require good credit, however you’re prone to pay higher rates of interest or charges for them. These types of loans could include installment loans or money from payday lenders. Potentially safer choices embrace paycheck advance apps and credit score builder loans. Current is taken into account one of the best checking accounts because of its 24/7 customer support availability and talent to ship your paychecks early.

youtube

The technical storage or access is required to create consumer profiles to send promoting, or to trace the person on an internet site or across a number of web sites for comparable advertising purposes. The technical storage or access that's used completely for nameless statistical functions. The quantity you probably can access will be after taxes and any garnishments have been deducted. On-demand pay—Walmart employees can rise up to eight drawdowns on their wage ahead of scheduled payouts. Employees get the primary eight drawdowns free of charge, but pay a payment for subsequent makes use of.

Get confirmed ways to earn extra cash from your cellphone, pc, & more with Extra. Get vetted aspect hustles and proven methods to earn additional cash sent to your inbox. California loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-78868. Sign in to view your account and routing numbers or download the shape. Sign up and we’ll ship you Nerdy articles about the cash matters that matter most to you along with other methods that can assist you get more from your money.

And not solely are you capable to earn as a lot as 15X money again at choose merchants, but in addition they provide savings with a price of four.00% APY. Apps such as Empower and Dave might offer money advances, but these must be paid off when your next paycheck arrives. Each app also has distinctive options, so see which features most align together with your financial targets and wishes. The greatest payday advance app is the one which most accurately fits your needs. Apps like Chime and Current supply on-line financial services and will help you obtain your paycheck up to two days early.

Wells Fargo Early Pay Day

Restrictions and/or third get together charges may apply, see EarnIn.com/TOS for particulars. Employers can also use apps to assist their workers get the money they want between paychecks. If you’re an employer, you might want to look into these apps in your employees. If you’re an worker, ask your human resources department if any of these apps can be found. The app also presents a credit-builder loan and stories all of your funds to the three major credit bureaus .

MoneyLion lets you rise up to $250 in immediate advances when you hyperlink a checking account. If you need more, you may must open a RoarMoney account, which works like a checking account, and accept recurring direct deposits. Opening a RoarMoney account will also offer you entry to sooner funding times and decrease fees if you want faster delivery of the funds. Early payday apps usually don't require a credit verify and in addition charge comparatively low charges, making them a less expensive various to payday loans and different short-term borrowing options. That stated, they solely present a short-term solution to monetary hardship, and it is best to keep away from counting on them frequently. Here are 5 of the top paycheck advance apps and what they offer.

We are frequently bettering the user expertise for everybody, and making use of the relevant accessibility guidelines.

Outside of work, she enjoys spending time together with her 14-year-old Shih Tzu named Money, and her 5-year-old Bichon named Tibber.

With the help of those instruments, you won’t have to rely on cash advances to cover these unplanned expenses; you’ll have money within the bank to deal with them.

With most get-paid early banking apps, no credit score check will be performed.

To set up a direct deposit, your employer will ask in your checking account number and routing number.

Many is not going to be out there to freelancers but solely hourly workers. An early paycheck isn’t always the best answer to pay payments. Surprisingly, there's numerous ways to receives a commission early. Take a look at some of the most typical methods to receives a commission earlier than your pay interval is up. Or, perhaps you tripped over your child’s toys and are facing an sudden medical bill for your twisted ankle. An early payday helps you cover your bills with out taking on pointless debt.

Must have $0.01 in Savings Pods to earn an APY on the portion of balances as much as $2000 per Savings Pod, as much as $6000 total. Faster entry to funds relies on comparison of conventional banking insurance policies and deposit of paper checks from employers and government companies versus deposits made electronically. Direct deposit and earlier availability of funds is subject to timing of payer's submission of deposits. Empower is designed for individuals who want easy accessibility to their cash and need to continue enhancing their financial state of affairs.

Payactiv

However, Brigit doesn’t supply money advances to simply anybody, you have to meet the following app requirements. You begin with a balance of zero in your ExtraCash account. If you take a money advance from the account, the balance becomes negative, but there’s no overdraft fee. The ExtraCash account from Dave is an internet banking account —You can use its overdraft characteristic to provide yourself a no-interest advance. Providing me with that information, and what the ensuing value is, isn’t rocket science. Many utilities already provide cell apps that give prospects the ability to observe their usage.

Of those that used the service three or more instances, 14% additionally took out three or more payday loans. A money-saving frugal mom, budgeting fanatic, and private finance skilled. With my grasp's degree in training and life experience, I help families get monetary savings, generate income on-line, and attain monetary freedom. These apps permit you to entry your paycheck before your regular payday, making certain that you can cover bills, buy groceries, and more when you should. You’ll have to be a member for two months earlier than requesting an early paycheck, nevertheless it demonstrates that you receives a commission and will pay back the superior money.

It has several forms of checking accounts, however Chase Secure Banking℠ is the one one that provides early direct deposit so you'll be able to receive paychecks as a lot as two days early. But if early direct deposit would not matter to you, you could be more interested in one other Chase checking account — one that permits you to waive the monthly charge or enroll in overdraft protection. Capital One 360 Checking is a completely licensed and FDIC-insured checking account that offers extra optional products, like savings accounts, credit cards, and different conventional banking providers. There are not any minimum opening steadiness requirements or month-to-month upkeep fees. Current checking accounts additionally include many other useful benefits. You may qualify for as a lot as $200 in fee-free overdraft protection, and you have access to 40,000 fee-free ATMs worldwide.

Simmons Bank review External hyperlink Arrow An arrow icon, indicating this redirects the user." Revolut evaluate External hyperlink Arrow An arrow icon, indicating this redirects the user." Regions Bank LifeGreen Checking Account evaluation External hyperlink Arrow An arrow icon, indicating this redirects the consumer."

Here are the most effective money advance apps to cover you until payday. Many monetary institutions examine your credit historical past as part of the account opening course of. Depending on how extreme your credit challenges are, you could be declined for a checking account.

Some banks may ask you to fill out a kind acknowledging you’d like to make use of an early direct deposit or early pay function, but many automatically enroll you when you arrange direct deposit. If you’re struggling to make ends meet between paychecks, your main goal should be to either cut back your expenses, increase your revenue, or each. But enhancing https://zilbank.com/get-paycheck-early takes time, it doesn’t occur in a single day. In the meantime, Get Paid Early apps like Albert, Current, or Dave could make it easier to manage your funds while making banking more convenient. The most appropriate option is the one which checks a lot of the packing containers for you.

If you've an internet checking account, online savings account, or cash market account with Discover, your ACH deposits may be eligible for Early Pay. No minimal deposit to open an account and get started plus no overdraft fees with a Chase debit card that helps you stay inside your steadiness. Most workers wait for their bosses to provide their paychecks. Many companies use schedules to determine when to pay employees.

You need to qualify for a money advance, but as soon as approved, they deposit the money into your account for quick use. With the help of those tools, you won’t must depend on cash advances to cowl these unplanned expenses; you’ll have money in the financial institution to care for them. Here are some solutions to relatively widespread questions on what they are (and aren’t) and the way they work. However, in case your credit is poor, the rate of interest on a private loan could probably be as high as 36%. Additionally, these loans typically come with origination fees of 1% to 6%. So, before signing off on a loan, examine the entire value to ensure using your credit card wouldn’t be cheaper.

Receiving your paycheck early enables you to use the cash sooner. While this construction helps you cover emergency expenses, it can additionally result in dangerous spending habits. Spending money as quickly as it arrives makes it harder to accumulate wealth and transition to a easy retirement. Current’s spending insights might help you avoid overspending.

1 note

·

View note

Text

Getting Your Paycheck Early: Tips And Methods

Taxpayers often see a generic message stating that their returns are still being processed and to verify again later. With the enhancements, taxpayers will see clearer and more detailed updates, including whether or not the IRS wants them to reply to a letter requesting extra data. The new updates will scale back the need for taxpayers to call the IRS for solutions to primary questions. When you want to get your paycheck early or want to have full entry to it on payday, you've some choices to select from.

youtube

Once it’s up and working, you can use a cash advance provision to entry funds even earlier. The money advance/overdraft provision is usually tied to your direct deposits. Next, check out which deposits qualify for early direct deposit.

You can switch the money to your bank account, load it to a Payactiv Visa prepaid card, or obtain it in cash at a Walmart Money Center. There’s a $1.99 charge for cash pickup and prompt deposits to cards apart from the Payactiv card. To protect you against overdrafts, Fifth Third offers their Extra Time function. If you overdraw your account, you may make a deposit anytime before midnight Eastern on the enterprise day after your account was overdrawn. If that brings your account as much as no much less than a zero balance, no overdraft charges will apply. No credit verify might be carried out, however you should have a Chime checking account to qualify.

MoneyLion allows you to borrow between $80 to $250, interest-free in your unpaid wages. This service is just obtainable to people who have a direct deposit that averages around $400. To qualify, you’ll have to have the power to consistently preserve a constructive balance the day of and the day after your payday. FlexWage is another app that enables on-demand entry to a portion of your wages. When you request your money, the funds might be deposited right into a Flexwage Visa Payment Card instantly. The fees will range based on the employer, but based on FlexWage’s website, they'll all the time be lower than overdraft fees or short-term borrowing rates of interest.

The financial savings account additionally offers cell check deposits and cash administration tools that will help you observe your budgets. Current additionally works with American gas stations to remove temporary holds that fuel stations usually place on your cards to ensure they receive full payment for the gas. When you join MoneyLion, you’ll have to pay a charge of $9.ninety nine a month. That membership charge consists of access to services like overdraft protection, assist to repay loans, and no late charges. Your checking account might allow you to see your paycheck before payday.

Receiving An Early Paycheck Has Its Perks, However You Would Danger An Overdrawing In Case Your Check Doesn’t Arrive If You Count On

You can then transfer the cash you’ve earned immediately to your checking account. This interest-free money advance has no late fees—making it easy to get the cash you need with out going deep into debt. The draw back of early pay apps is that your employer has to take part for you to get access. Your employer may limit withdrawal amounts or require a minimal stability to withdraw. Some employers companion with early pay apps to let you cash out your paycheck in advance.

Here are some choices that let you withdraw your wages the same day you worked. These corporations aren’t loaning you cash in your paycheck out of the kindness of their hearts. If you're already dwelling paycheck to paycheck, dipping into your earnings to pay charges isn’t a super state of affairs.

You can see where you spend most of your cash and obtain personalized ideas that may keep your bills down. Lowering your costs will assist you to get extra out of direct deposits and save your money. Why would someone wait two days to get the money they may simply as easily get proper away? Of course, early direct deposits aren’t excellent, and they have some drawbacks to contemplate earlier than enabling them on your bank account. Current is a cellular finance app with options for convenient overdrafts, financial savings pots, round-up savings, and getting paid early.

To qualify, you’ll want to enroll in a Chase Secure Banking account, which automatically enrolls you into early direct deposit. Automated Clearing House credit transactions qualify for direct deposit, however Chase depends on your payer’s code to determine if your payment qualifies -- a typical standard. 1 Early entry to direct deposit funds depends on the timing of the submission of the payment file from the payer.

Faq About Apps To Get Paid Early

To arrange direct deposit, copy your routing and account numbers and share them along with your employer or payroll supplier. If you're thinking about looking for other apps like Chime, check out our in-depth guide on the topic. Early direct deposit is an early deposit of your whole paycheck. It arrives closer to your pay date than a paycheck advance can — usually two enterprise days early and no more than four. Cash advance apps pay you for some of the work you’ve already done this week, even when your paycheck is still several days away. For example, the app transfers the $100 you have to borrow to your checking account, and when your subsequent paycheck arrives, the app takes $100 immediately from it to cowl the fee.

Increased help out there on the toll-free line and an expanded buyer call again characteristic designed to considerably cut back wait occasions.

If I use $10 of electricity today, the utility might give me a 10% low cost if I pay every day, 5% if I pay weekly, and no discount for paying month-to-month.

You begin receiving interest in your cash the moment it lands in your bank account.

Speaking of Walmart, the retailer has partnerships with two fintech startups--Even Responsible Finance and PayActiv--that enable its US workers get a part of their salary paid before payday.

But you’ll need to make certain your direct deposit kind is included earlier than applying.

However, your deposits with Chime are nonetheless FDIC-insured. Bancorp Bank and Stride Bank offer banking providers for Chime. Chime doesn’t offer any physical branches, however 60,000 fee-free ATMs are available. CNET editors independently choose every product and service we cover. Though we can’t evaluation each obtainable financial firm or offer, we strive to make comprehensive, rigorous comparisons to be able to spotlight the most effective of them.

Good things come to those who wait, however why must you be the one who waits? Insurance related providers provided via Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC. Auto, homeowners, and renters insurance companies supplied via Karma Insurance Services, LLC (CA resident license # ). We’ve rounded up our high picks from the obtainable apps that can help you decide which get-paid-early app might be a good match on your financial state of affairs. NerdWallet's scores are decided by our editorial staff.

With some help from expertise, you have a extra favorable possibility. Paycheck advance apps might help you get the money you should make ends meet with out the scary feeling of stepping into high-interest debt. Here are seven apps that can allow you to get a paycheck advance when you need it most. We receive compensation from the services and products talked about in this story, but the opinions are the creator's own. Learn extra about how we make money and our editorial insurance policies.

It takes solely seconds to set up an account, and once you link your bank, you'll be able to apply for a cash advance and not utilizing a credit score examine. First, if your employer presents it to you as a profit, you'll find a way to sign up for earned wage entry. It lets you gather your wages as soon as you earn them. This service comes with a $1 charge for each day you utilize it, capped at $5 for each two-week pay interval until you've direct deposit to your Payactiv Visa debit card, then it’s free.

This financial institution also costs a $25 prolonged overdraft fee in case your account stays overdrawn for seven consecutive days. We looked at 10 get-paid-early apps and compared features corresponding to fees, rates of interest and mortgage amounts. We also considered budgeting instruments, overdraft warnings and other further perks. Compensation may factor into how and the place merchandise seem on our platform . But since we usually earn cash whenever you discover an give you like and get, we attempt to show you provides we think are a great match for you. That's why we provide features like your Approval Odds and financial savings estimates.

1 note

·

View note

Text

10 Cash Advance Apps to Help You Stay Afloat Until Payday

In today's fast-paced world, unexpected expenses can leave you strapped for cash and in need of a quick solution. Whether it's a sudden car repair, medical emergency, or last-minute school expenses, you might find yourself in a tight spot with your finances. Thankfully, technology has made it easier for you to get the funds you need through cash advance apps. With lower fees than traditional payday loans and quick processing times, these apps can be a lifesaver when you're in a bind. In this article, we will explore the top 10 cash advance apps that can help cover you until payday.

CLICK HERE TO Get Cleo $250 FAST CASH ADVANCE

1. EarnIn: Best for Earnings-Based Borrowing

EarnIn is a unique cash advance app that allows you to access your money based on the number of hours you've worked. By tracking your work hours, the app enables you to borrow funds according to your earnings. In addition, EarnIn offers a notification feature that alerts you when your bank balance is low, ensuring that you stay on top of your finances.

Features

Amount: $100 to $750

Processing Time: One to two business days, with the option for instant access through EarnIn's Lightning Speed feature

Repayment: Due on your next payday

Fees: Voluntary tipping model, allowing you to choose a tip up to $14. Overdraft protection requires a recurring tip, but can be set to $0 if not needed.

Pros and Cons of EarnIn

Pros Cons Higher borrowing limit as you use the app more frequently Fees may apply for using Lightning Speed feature

2. Chime: Best for Overdraft Protection

Chime is a financial technology company that offers a checking account with SpotMe® overdraft protection. This feature allows eligible members to overdraw their accounts by up to $200 on debit card purchases without incurring fees. In addition to overdraft protection, Chime also provides a secured credit card and a savings account for users with a required checking account.

Features

Amount: Up to $200

Processing Time: Instantly

Repayment: Due on your next payday

Fees: None, with the option to tip

Pros and Cons of Chime

Pros Cons Overdraft protection up to $200 Only functions as overdraft protection Optional tipping Requires a Chime account with at least $200 in monthly direct deposits

3. Brigit: Best for Same-Day Loans

Brigit allows you to borrow up to $250 on the same day you apply, provided that your application is submitted before 10 a.m. ET. While the app requires a monthly fee to access its cash advance feature, Brigit also offers free access to financial experts who can help you manage your spending within your budget.

Features

Amount: Up to $250

Processing Time: Same-day approval if applied before 10 a.m. ET, or next business day for later applications. Instant cash may be available for users with a connected debit card.

Repayment: Scheduled according to your income, with the option to reschedule once after two on-time repayments

Fees: $9.99 per month for the Plus paid plan

Pros and Cons of Brigit

Pros Cons No late fees or penalties for delayed repayment $9.99 fee to access cash advances Option to reschedule payment Early cut-off time for same-day funding without a connected debit card Free access to financial experts No instant deposit options

4. MoneyLion: Best for Multiple Options

MoneyLion is more than just a cash advance app; it also offers financial tracking, investment accounts, and various other features to help you manage your finances. With a range of borrowing options, MoneyLion ensures that you have access to the funds you need when you need them most.

Features

Amount: $50 to $250, with larger loan amounts available for RoarMoney account holders or Credit Builder Plus members

Processing Time: 24 to 48 hours for RoarMoney account holders, three to five days for external account transfers, or instant access with a Turbo Fee

Repayment: Due on your next payday

Fees: Optional tipping, plus fees ranging from 49 cents to $5.99 for instant delivery to RoarMoney accounts and $1.99 to $8.99 for external accounts

Pros and Cons of MoneyLion

Pros Cons Access to larger loan amounts Up to eight weeks required to become eligible for maximum Instacash amount Variety of account features Fees required for same-day fund access

5. Current: Best for Checking and Spending

Although not a traditional cash advance app, Current offers Overdrive protection for users who overdraw their accounts by up to $200. This feature can provide a quick and easy solution when you're in need of a small cash infusion to tide you over until payday.

Features

Amount: $200

Processing Time: Instant

Repayment: Due on your next payday or deposit date

Fees: None

Pros and Cons of Current

Pros Cons No overdraft fees with Overdrive protection Requires minimum monthly direct deposits No monthly fees Not a true cash advance

6. Dave: Best for Highest Cash Advance

Dave offers the largest cash advance in the industry, providing up to $500 through its ExtraCash feature. New members also receive a Dave Spending Account, which allows for instant fund access with a small fee.

Features

Amount: Up to $500

Processing Time: One to three days, or instantly with an express fee

Repayment: Due on your next payday, with the option to edit the repayment date

Fees: $1 monthly subscription fee, optional tipping, and express fees ranging from $1.99 to $9.99 for Dave Spending Accounts and $2.99 to $13.99 for external transfers

Pros and Cons of Dave

Pros Cons Offers the largest cash advance in the industry Express fee required for instant fund access

7. Empower: Best for Quick Cash Advances

Empower provides cash advances of up to $250, along with an Empower Card that offers up to 10% cash back on purchases at select merchants. Additionally, the card provides free transactions at 37,000 ATMs nationwide, and Empower cardholders can receive their paychecks up to two days early

Features

Amount: Up to $250

Processing Time: Instant

Repayment: Due on your next payday

Fees: $8 subscription fee, but no interest or late fees

Pros and Cons of Empower

Pros Cons Interest-free borrowing up to $250 $8 subscription fee after a 14-day free trial

8. Payactiv: Best for Short-Term Loans

Payactiv is more than just a cash advance app; it also allows users to pay bills, access discounts on department store purchases and prescription drugs, and manage their finances all in one place. By offering a set percentage of your earnings as a cash advance, Payactiv ensures that you have access to the funds you need when you need them.

Features

Amount: A set percentage of your earnings

Processing Time: Instant access to Payactiv Card, 48 hours for other debit card transfers, or instant transfers with a $1.99 fee

Repayment: Not required, as you're accessing funds you've already earned

Fees: Free with direct deposit to Payactiv card, $1.99 fee without direct deposit, and $2.99 processing fee for cash pickup at Walmart or instant deposit to another card

Pros and Cons of Payactiv

Pros Cons Offers bill payment and product discounts Fees apply without a Payactiv card

9. Vola: Best for Same-Day Cash Advances of Up to $300

Vola is one of the few cash advance apps that offer same-day advances of up to $300 without a credit check, making it one of the easiest options for quick access to funds. With support for over 6,000 credit unions and banks, Vola provides a convenient and flexible solution for your cash advance needs.

Features

Amount: Up to $300

Processing Time: Within five hours

Repayment: Manually or automatically on the due date

Fees: Subscription fees ranging from $2.99 to $28.99

Pros and Cons of Vola

Pros Cons Same-day cash advances up to $300 Subscription fee applies No credit check required Five-day cool-off period between repayments and new advance requests

10. Albert: Best for No Late Fees

Albert is designed to simplify your financial life, offering instant cash advances and automatic repayment without any late fees. By providing a user-friendly and straightforward solution for cash advances, Albert ensures that you have access to the funds you need without any hidden costs or surprises.

Features

Amount: Up to $250

Processing Time: Instant access with a fee or two to three days for free

Repayment: Due on your next payday

Fees: No fees for instant cash advances to Albert Cash, but small fees apply for instant advances to external accounts

Pros and Cons of Albert

Pros Cons No late fees or penalties for delayed repayment 30-day free trial of Albert Genius required for Albert Instant access (can be canceled) Cash Advance Apps at a Glance

App Maximum Loan Amount Transaction Speed and Loan Fee EarnIn $750 1 to 3 days, $0.99 to $3.99 fee Chime $200 Instant, no loan fee Brigit $250 1 to 2 days, no loan fee; $9.99 subscription fee MoneyLion $250 12 to 48 hours, $0.49 to $8.99 fee Current $200 Instant, no loan fee Dave $200 Up to 3 days, $1.99 to $13.99 fee Empower $250 Instant, no loan fee; $8 subscription fee Payactiv A set percentage of earnings Instant to Payactiv Card or 48 hours for other debit card transfers, $1.99 to $2.99 fee Vola $300 Within 5 hours, no loan fee; subscription fee applies Albert $250 2 to 3 days, small fee for instant delivery Pros and Cons of Cash Advance Apps

Before choosing a cash advance app, it's important to weigh the pros and cons of each option to ensure that you select the best fit for your financial needs. While some apps may offer lower fees or larger loan amounts, others might provide additional features or faster processing times. By carefully evaluating the benefits and drawbacks of each app, you can make a more informed decision and avoid potential pitfalls.

Pros

Emergency fund access: Cash advance apps can provide a much-needed financial lifeline when unexpected expenses arise, such as car repairs, medical bills, or school costs.

Small loan convenience: For those in need of a small cash infusion to tide them over until payday, cash advance apps offer a simple and efficient solution without the hassle of traditional loans.

Cons

Fees can add up: Although many cash advance apps advertise low fees, these seemingly small costs can accumulate over time, especially if you frequently rely on the apps for financial assistance.

Potential debt cycle: With automatic repayment features and easy access to funds, it can be all too easy to fall into a cycle of borrowing and debt with cash advance apps.

FAQ

To help you make the best decision for your financial needs, we've answered some frequently asked questions about cash advance apps below.

What is the easiest app to get a cash advance? Vola allows you to borrow up to $300 without a credit check, making it one of the most accessible options. However, each app has its own eligibility criteria, so be sure to research and choose the one that best suits your situation.

What app offers the largest cash advance? Dave provides up to $500 through its ExtraCash feature, while EarnIn offers up to $750 based on hours worked.

Are cash advance apps payday lenders? No, cash advance apps are not the same as payday lenders. While both provide short-term loans, cash advance apps typically do not require credit checks and have lower fees than traditional payday loans.

What app provides a $50 cash advance? Most cash advance apps offer $50 loans if you meet their qualifications. Be sure to read the fine print and choose an app with favorable terms for your needs.

How can I borrow $300 on Cash App? The maximum borrowing limit on Cash App is $200. To access this feature, go to the "Banking" header and select "Borrow." Note that Cash App Borrow is only available to users who meet certain requirements.

In conclusion, cash advance apps can be a valuable resource for those in need of quick financial assistance. By carefully researching each app and considering your specific needs, you can find the best solution for your situation. Remember to always borrow responsibly and never take on more debt than you can afford to repay.

#cash advance#personal finance#short term loans#financial tips#emergency funds#borrowing money#payday loans#financial planning#debt management

1 note

·

View note

Text

Hey everyone, I need y’all’s ear (or eyes) for a minute. I know a lot of us are in a financial bind these days, but hoping someone(s) could still help.

I’m in a sorta desperate situation right now, I’m staying at a hotel because my “friend” evicted me, and I wasn’t able to find an affordable place, or a new roommate before the 20 days were up. Luckily, I just got full time at my job, but it started on the 23rd so this week will be my first full check, but I’ve run out of funds already.

I really can’t go to a shelter because I’ve stayed in them before and the chaos really deepened my depression and anxiety(which makes my ADHD worse also). I’m doing all I can at the moment to make extra money, like apps and donating plasma.

I’ve already asked friends, family and some local organizations, but friends/family are tapped out, and the organizations are either tapped out for the month, or can’t help me due to me paying for a hotel. I’ve managed to make it work through apps, selling a few things, and cashing out at my job last week, but now I have one night I don’t have the money for, nor can I make up the money for until Monday(which I have off thankfully!). I’ll be cashing out Monday and possibly having another advance coming that day, plus I plan to donate plasma so that should get me through until payday which is Tuesday. I’ve also signed up for my employer’s associate emergency fund, but that, if approved, probably won’t come until maybe Wednesday, not sure.

To be transparent, I work at Walmart in Lacey Washington State, at #4757 off of Yelm Hwy. I get paid early because of Chime and MoneyLion, both which have overdraft services, though my Chime one is currently deactivated since I’ve sent my deposits to MoneyLion for the few months. Should re-activate this Tuesday.

I did find a room for rent week by week in a good area, so I’m hoping it’s available come Tuesday. But that will take up half my paycheck while the other half will be other living expenses.

I’m attaching a photo of me holding the letter, and I’m really just asking for a loan.

I’m asking for $170, and I can pay it back next Saturday with a little extra for a thank you. I need it by 10am tomorrow July 31st (it’s 10pm here currently on July 30th) if possible, since I work 11am-8pm and may need to go move money around.

I have CashApp, PayPal, Zelle, Chime, MoneyLion, ApplePay and GooglePay. For Apple my number is on the Zelle QR code. Thanks for any help anyone is able to give, and I’m sorry I have to be asking this🥺

0 notes

Text

Tidying up.

Aizawa Shouta x Reader

Quirless Au

Warnings: Mild angst themes (Like super mild), Fluff, Dadzawa, Part 1 of ? (Listen this idea suddenly hit me and I needed to write it okay?)

You hated this job.

Your knuckles rasped against the wood grained door, your feet tapping on the worn welcome mat. Your brows furrowed after a moment of waiting, lifting up your phone you double checked the time and address. Just as you were about to press the button to lock your phone the door creaked open. A cheery smile lit your features as you prepared to introduce yourself.

“I didn’t call you, please leave.” The tall raggedy man grumbled.

Your smile dropped, your eyebrows shooting up in surprise. You had dealt with rude customers before but never one so...blunt. You were about to attempt to speak when the door was promptly shut…. ‘Well then.’ You huffed indignantly. You were about to knock again, lips pulled down in a scowl as you thought up a variety of insults in case he opened up again.”I drove a whole ass hour to get here, I had other things to do, this scruffy looking bum dares.” You muttered, fist raised, tongue ready to lash out in frustration.

Once again you were cut off by the door opening, and you quickly dropped your hand. A tired lanky teenager stood in front of you lavender iris ringed with dark shadows. ‘Damn, someone get this kid some nyquil.’ You thought a polite smile sliding onto your face. The tired looking teen ran his pale fingers through his plum colored hair, a sheepish smile on his face.

“I’m sorry about that Ma’am.” He sighed. “My father’s a bit of a recluse…”

“Let me guess. You called?” You sighed, when he nodded. This wasn’t a first for you, kids usually called your mother’s cleaning service when they’re parents were….unable. He opened the door wider and allowed you and all of your supplies into the house…. ‘Dear god what natural disaster passed through here.’

“Sorry about all the mess, Dad’s been in a rough place for a while and well I’ve been too busy to.. Well you know.” He shrugged ushering to the nasty looking home.

“Right…” You hummed. Looking around to see where you would begin.

“So, I already paid in advance.” He added showing you the cash app. You nodded and watched as he shrugged on a jacket. He was about to head out when you cleared your throat. “Oh right, So Eri’s room is always clean and, His room is a no go zone.”

You nodded once more, slipping on a pair of gloves. The child left with a wave muttering about getting to the elementary school on time. Your smile quickly faded once he was out the door, a scowl claiming your lips as you began to pick up trash. An ugly feeling washed over you as you thought of the kid’s father. ‘Lazy, repulsive asshole.’ You summarized. You absolutely loathed people like that. “Forcing his kid to take up so much responsibility.” You grumbled.

“What a prick.” You huffed, moving the heavy bags to the corner of the door. You continued to clean the rest of the place, scrubbing stains out of walls, washing food off dishes, sweeping, mopping, retching at the putrid stench of the main level bathroom. Once the main floor was done, you set up the stairs towards the bedrooms.

‘Eri’ You read the cursive name on the pink and white plaque. You opened the door and hummed. It was clean. ‘I wonder if she cleans it herself or her brother does.’ You mused grabbing the hamper in which she kept her dirty clothes. You lightly cleaned her relatively clean bathroom and walked off to the purple haired kid’s room. You found nothing unusual. A couple clothes on the floor, scrunched up balls of paper overflowing from a small trash can and junk food wrappers. What did stand out was a picture he had on his desk. It was the same as the one in the living room. ‘Cute.’ You thought looking at the two kids standing by their father.

“Heh he’s actually not half bad looking.” You mumbled looking at the clean shaven man in the photo.

It wasn’t long before you were in their basement, clothes rolling in the wash while you stretched. ‘There goes my saturday’ You sighed, looking at the golden light of sunset from a recently cleaned window. You heard the door open upstairs.

“Woah~ Toshi-nii it’s so clean!” You heard a childish voice squeal.

‘Of course it’s clean I worked my ass off.’ You scoffed bitterly.

“Ms. (Lastname)?” You heard the teenager call out.

“Down here kid.” You called back, feeding the drying machine an armful of dark muted colors.

Two pairs of feet walked down the narrow steps and you soon found yourself looking down at a cute cotton-candied haired girl. Her large ruby eyes threw you off. ‘Different mothers?’ You thought. “The place looks a lot better, thank you.” The polite teenager bowed.

“Yes Thank you!” The smaller child chimed. “I think daddy’s going to feel much better now right Toshi-nii?” She looked up at him for confirmation.

“Yeah.” He replied. “Thanks again.”

“You don’t have to thank me.” You chuckled sheepishly “I’m just doing my job.”

They nodded in understanding, chatting idly as you finished the laundry. They spoke about mindless things, Eri told you tales of what her class did while the kid you now knew as Shinsou Hitoshi carried the folded clothes up the stairs and to their respected rooms. Thankfully it was finally time for you to leave. The siblings saw you to the door, grateful smiles on their lips.

“You're coming back next saturday right?” Eri asked, you nodded tiredly.

.

.

.

.

The next Saturday arrived much sooner than expected much to your dismay. You had been busy all week submitting resumes and cover letters but you hadn’t heard back from anyone. You parked in front of the two story household and you briefly wondered how the family inside was doing. Then you thought of the two sweet kids and their neglectful father…

“Ughh” You rolled your eyes and slid out of your car. This time Eri opened the door a smile on her cherubic face.

“Hello again Ms.(Lastname).” She chimed.

“Hey.” You greeted, your hand coming down to pat her head. To your relief the house was much tidier than last time and it looked like you would be out much sooner than last time. That made you happy. You decided to start in the kitchen today. You passed the threshold of the kitchen when you noticed that the rest of the household occupied the space.

“No.” You heard the man groan, he was seated on a stool overlooking the purple haired kid. “Do it gently so that the shells don’t all fall in.”

“You make it sound so easy.” Shinsou huffed. The teenager sighed irritably. “I’m not cut out for this.” The dark haired man chuckled, the kid’s cheeks flushing pink in embrasement.

“I’ll do it.” He suggested. “I’m sure we’d all like to eat breakfast before noon.” He teased.

“No I got it.” Shinou insisted, it was then that you saw his eyes shift to an object. You followed his gaze to stare at the crutches leaning against the counter… ‘Oh…’

“Toshi! Daddy! Ms. (Lastname) is here.” Eri interrupted. You felt the change in atmosphere immediately. A dark cloud seemed to hang over the man now, his posture tense a clipped hello slipping past his lips.

“Morning.” Shinsou greeted.

“Morning.” You repeated, side eyeing the silent man. “I’ll get started upstairs.” You quickly excused yourself, your heart dropping to your feet. Shame washed over you, filling your veins with an icy-hot concoction. You hadn’t noticed but Eri followed after you, surprising you when she spoke.

“It happened recently.” She mumbled. “...Daddy’s leg.” She clarified.

“...I see…” You didn’t know what to say to the little girl. As you cleaned you couldn’t help but feel guilt eat at your bones. ‘I’m a fucking idiot, judging people right off the bat like that.’ Suddenly a lot made sense.

“C-can I help?” You smiled at the child.

“I dunno Eri-chan.” You mused.

“Please?”

Your resolve crumbled once she gave you a look that should be illegal. There wasn’t much to clean but that was okay. Eri was a cheery child and her silly stories helped pass the time. That was until you heard her tummy rumble.

“You should go down and eat.” She shook her head, her brows furrowing in...disgust.

“Toshi-nii is cooking.” She grimaced.

“That bad?” You laughed. She nodded somberly. Your conversation was cut off when you heard a loud crash coming from downstairs.

Alarmed both you and Eri rushed downstairs towards the kitchen. You found yourself caught in their family drama, Eri was in tears, Shinsou’s eyes were turned up in hurt and worry and their father Aizawa Shouta? He was on the ground, his prosthetic a couple of feet away.

“Da-”

“Don’t, I can do it myself.” The man shouted, the children flinching at his desperate tone. You didn’t like to intervene in other’s lives especially not your mother’s clients but well you felt...bad? Dropping your gloves onto the counter you leaned down to help the man back up. His dark eyes glared at you, lips parting to speak.

“Shut up.” you grunted before he could even sound a syllable. He was heavy and surprisingly thick. Shinsou quickly went to his other side, supporting his father up onto a chair. Once he was seated he rested his head onto his hand, dark locks covering his face.

Eri pressed to his side, small arms hugging him, while Shinsou went to grab the prosthetic…. You suddenly felt awkwardly out of place. You were basically spectating watching as his arm came around Eri and when Shinsou’s arm wrapped around his shoulder he held in tightly an apology slipping past his lips.

“It’s okay dad.” Shinsou sighed. “It’s hard I know.”

Aizawa didn’t answer, and you went to retrieve their first aid kid. After that incident the scruffy man ordered Ihop for breakfast.

.

.

.

You thought of them throughout that week. They were a small little broken family but.. Ultimately they were going to be okay, they were healing. Your week was uneventful once more, your mother pushing you to become more involved in her cleaning company. You had other plans but still no call backs.

The two story house looked more inviting that saturday. You were surprised to see the man of the house open the door. He wasn’t really talkative but he ushered you to the master bedroom. It wasn’t as bad as you had thought. You vacuumed the carpet, washed and changed the sheets. You were relieved that he hadn’t stayed to watch you clean his room.

‘He’s kinda scary.’ You thought, allowing his silent disposition to jar you. ‘But he was really good with his kids so he’s not as bad as I thought.’ You left his room after it met your standards and walked down to the basement to get the rest of his clothes out of the drying machine. To your surprise you found something laying inside one of the baskets.

“A..cat?” You mused. “How come I haven’t seen you around.” Squatting down you allowed the fluffy kitty to sniff your fingers, a smile coming to your lips when the cat rubbed its head against your hand. Happy purrs shook the furry critters body, you hadn't noticed but Shinsou had walked down the stairs.

“Oh hey (Name).” After last saturday you had left asking the kids to just call you by your first name.

“When did you guys get a cat?” You asked scratching the kitty’s head, both hands coming to lovingly squish the feline’s head.

“We’ve had her for a while.” He laughed. “She just loves to hide.”

“Then how come I didn’t see her litter?” You mused.

“.....It’s hidden, you know the plant in the living room?” You nodded. “The pot is the box, it’s the only thing we make sure is always clean.” He shrugged.

“Huh. I never noticed.” You shrugged.

“That’s ‘cause your head’s always in the clouds.” He stated. “That’s not to say you're doing a bad job, it's just that you always look like you're not here or don’t want to be here. Sorry that was rude.”

“No it’s okay don’t apologize.” You sighed, stoking the cat’s soft fur, chuckling when she nipped your fingers.

“So you don’t want to be here?” He asked.

“Not really.” You sighed. “Cleaning isn’t my ideal job but it’s what’s paying the bills.” You shrugged. “Adult life ain’t what it’s all cracked up to be.” You laughed.

He didn’t ask anymore questions and thus your time in their household was brief that saturday…..

.

.

.

.

“Morning.” You greeted the family, they were crowded in the kitchen watching as Shinsou burned an egg. You laughed when the fire alarm went off and you grabbed a cloth to wave the smoke and silence it. “I see you're still bad at cooking.”

He rolled his eyes muttering under his breath, Aizawa and Eri laughed much to his chagrin. “Ugh dad makes it look easy.”

“That’s because it is.” You found yourself speaking in time with Aizawa’s deep baritone. Your face heated up in embarrassment and you looked away from him.

“Then you do it.” The purple haired kid scoffed.

“And give you a free meal?” You asked.

“Yes please.” Eri whined. “Anything but burt eggs and toast. Please (Name)”

“I-”

“You don’t have to Ms. (Name).” Shouta’s deep voice rumbled. “And you two don’t need to add onto her workload here.”

“N-No it’s no issue.” You flustered. “It’s the least I could do.” ‘Afterall you did increase my pay.’

“Finally! Something edible!” Eri cheered as she dug into her food. You felt a bit strange sitting there at the table with them. Shinsou reigned in his snark.

“This is actually really good.” He mumbled.

“Yeah, we haven’t had a breakfast like this in a while.” Eri added. You cringed at the wording, your eyes shifting to the dark haired man. If the words had affected him, he was very good at hiding it you noted. The comment flew by without anyone questioning it but you made out the way his jaw clenched.

After cleaning up you continued onto the house. It seemed like each saturday there was less to and less to do. Work flew by with Eri or Shinsou’s idle chatter.

“And then Mrs. Rei said that my drawing was the bestest drawing in the whole class!” Eri grinned proudly.

“Really?” You added enthusiastically.

“Yup!” Silence reigned for a moment until she asked another question. “Ms. (Name)?”

“Hm?”

“Are you married?” She asked innocently.

“No.” You laughed.

“Why not? You're really nice and pretty.” She pondered.

“Well… I was engaged once.” You hummed, setting another folded pants on top of an ever growing pile.

“What happened?” She asked.

“...It..It didn’t work out.” You mumbled. “..But never mind that you said you had a play next sunday?”

“Yes, You should come see. Daddy and Shinsou are coming too!”

.

.

.

.

You buried your face into your hands and groaned. It’s been months and no one would take you on. Not even the Mcdonalds!? ‘It would be wise if you’d just stay in the background, playing nice with cleaning chemicals.’

“When are you going to give up (Name)?” You heard your mother chime.

“Never.” You muttered tiredly.

“....Look, I know he ruined every other avenue of work for you but at least you still have this.” She tried to console.

“This!? This mother! I’m fucking tired of this!? I have a fucking degree, I have expirence! I had a life!? And I want it back!?” You shouted. “I don’t want to clean toilets and wash windows for the rest of my life!?!”

Your mother frowned, her hand coming to rest on your shoulder. “I know.” She whispered her arms wrapping around your trembling form. “Trust me sweetheart if there was any other way I could help you I would...and I’m sorry… this is the best I can do.”

“I’m sorry.” You cried. After a while you had calmed down. Your mother suggested you go out on a walk to clear your head. You decided to kill two birds with one stone and went to grab groceries.

You cursed your ex as you strolled down the aisles of the produce section. “Motherfucking asshole ruining my life ‘cause his bitch ass was fucking chea- Adikndeubfo” The word that left your mouth surprised the tall man infront of you. He was in slight awe at how you were able to vocalize that sound…

“Evening Ms.(Name).” Aizawa’s lazy voice lolled.

“M-Mr. Aizawa.” You flushed. ‘Shit I think he heard that!?!??!!?’ You shreeched internally.

“Didn’t know you liked to curse out fruit.” He chuckled, adjusting his grip on his cane.

You were grateful that he didn’t question you about what you were fiercely muttering. You looked around him trying to spot his kids.

“Just me.” He smiled. “Well and a friend.”

“Friend? Oops sorry that came out wrong.” You laughed sheepishly.

“Hard to believe?” ‘Is he….Joking around right now?’ A smile curved your lips as another apology slipped past your lips. “An old friend dragged me out.” He found himself explaining as he walked along with you. You had noticed that he was getting better at walking with his prosthetic, soon he wouldn’t even need his cane.

“(Name)?” You were broken out of your trance.

“W-what?” You asked. “Sorry I spaced out for a second.”

“Right. I just.. I wanted to thank you.”

“What for?” Your brows were furrowed in confusion.

“Doing more than what your job required.” He said vaguely, he left your side with a wave as he approached a blonde haired man who argued about a cereal brand with a bluenette.

.

.

.

.

“Oh you met his friends?” Shinsou mused as he stirred the pot with intense focus.

“Yeah, one of them looked really familiar.” You hummed as you mopped the floor. “Did you make sure to taste it?”

“He’s a radio host and, yes I did. But i’m not sure if it has enough salt.” You opened a drawer and pulled out a spoon dipping it into the thick liquid that he was stirring.

“Wow.” You breathed. “It’s actually good.”

“Ha. Ha.” He huffed.

You left the kid to his own devices and walked to the living room where ‘Hana’ laid curled up in Aizawa’s lap. Her eyes were two curved lines as she slept, Shouta’s hand barely resting on her form, his other arm wrapped around a sleeping Eri.

“Let me guess you let her stay up late last night?” You teased. His sigh told you all you needed to know and you laughed.

“You can’t keep letting Eri do whatever she wants.” You heard Shinsou call from the kitchen.

The smile on Aizawa’s face made your heart thump, and you quickly looked away from the warm smile. It wasn’t directed at you but it was completely heart melting. Hana rolled out of his lap as he made to stand up, his arms going underneath Eri’s small form, Strong arms lifting the child with ease.

“I guess she can sleep in a bit more.” He mumbled, there was a slight limp in his step but otherwise he made it up the stairs with relative ease, you trailed behind him opening Eri’s door so that he could set her on her bed. His hand pet her hair tenderly and you remembered how ill you thought of him before.

“You know… It was Oboro who pitched the idea to Hitoshi.” He began.

“What idea?” You whispered.

“To hire someone to clean up the place… I was.. I was in a really dark place after the accident and I felt so damn useless. I was failing my kids.” He sighed. “I’m glad you didn’t leave when I shut the door on you that day. Which reminds me I never apologized for that.”

“It’s water under the bridge Mr. A-

“Shouta.” He corrected.

“Shouta.” You repeated, your face catching warmth.

“I owe you a lot Ms. (Name), No don’t say it’s just your job, it isn’t your job to speak with my kids, to teach Shinsou how to cook, to help with shopping and to spend all the time you do here.”

‘I’ve been spending a lot of time here lately haven’t I?’ You mused as his words sunk in. In all honestly you began to grow fond of this family.

“(Name).” You looked towards him.

“If there is anything you ever need, if it’s within my power I’ll help you without a second thought.” He said earnestly.

“T-Thank you..”

“No, thank you… for tidying up.” You slapped your palm to your face at the pun, a smile on your face.

“Please don’t” You laughed. Shouta then pressed his index finger to his lips, eyeing the sleeping Eri. You covered your mouth, looking to see if she had stirred, just as you were about to let out a sigh of relief-

“Yo! Shouta~ We’re here!”

“What smells this good?”

And Eri was then awake…. You couldn’t help but laugh when the dark haired man dragged his hand down his face with a sigh.

…..Maybe this job wasn’t so bad...

290 notes

·

View notes

Photo

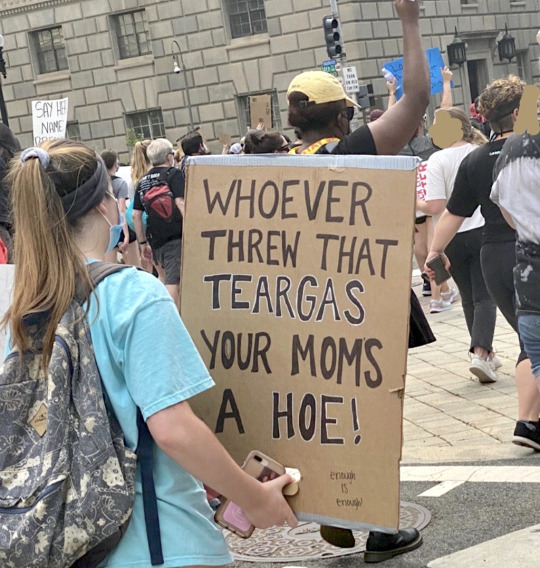

first off, major apologies for not answering this in a more timely fashion! I hope you stayed safe out there, anon.

y’all know I’m terrible with asks but I’m genuinely not sure how I managed to miss this one. I’m gonna answer it even though some time has elapsed because lbr, this stuff isn’t going away anytime soon.

there are a lot of great resources out there with advice about the more dangerous (and topical) aspects of protesting, so instead of getting into that, I’m gonna link some here:

Protesters’ Rights (ACLU)

Safety During Protests (Amnesty International)

Safe Protesting Infographic (AOC)

Dealing with Tear Gas (Occupy Wall Street)

Useful Apps for Protesters (Allure)

Protesting During a Pandemic (LiveScience)

with that covered by the experts, I’m gonna focus on some of the more practical, basic stuff I’ve learned over the years.

G’s tips for attending protests

Use the buddy system. I can’t stress this enough. I strongly advise you not to go to any protest alone, especially if it’s on a larger scale or if you know there’s going to be police presence. Whether it’s a friend, a relative, or someone you trust whom you’ve met through activism, make sure there’s someone with you who knows you, including any medical conditions you have—you’re basically each other’s emergency contact for the day. Decide in advance on a rendezvous point in case you get separated from them. I’ve heard of instances where having a “protest buddy” and asking to stay with them was the difference between getting arrested and thrown in a van vs. being issued a citation and then left alone.

^that’s my sister’s hand holding the sign in the foreground. buddy system!

tons more under the cut!

Don’t rely on your phone. Depending on the size and density of your protest, service may be spotty or data may stop working entirely in some areas. Don’t expect to navigate with GPS, or be able to text/call your group if you get separated. Consider leaving your phone at home or in the car. There are reports of phones being tracked by police in some places, and it’s always possible it’ll get confiscated if you’re detained. If you do bring a phone, I suggest turning off location services.

ok so I don’t always take my own advice

Know the rules and goals for your particular protest. These can vary between locations and organizations, so don’t assume you already know. For example, at most DC protests, only clear backpacks are allowed, and signs may not have wooden sticks or anything that could be used as a weapon. Does everyone follow these rules? Nope—and I rarely see them enforced! But it’s a case of “better safe than sorry.” Don’t give the cops any excuse whatsoever to detain you.

this is a great sign, but I would never carry it using a plank like this

Knowing a protest’s goals and purpose is also important. I read an article last week about a DC BLM event where people were dancing in the street, essentially having a party. The article painted it as though these idiot protestors had shown up and then gotten distracted and stopped taking their movement seriously. But I remembered the same event differently (having both read about it in advance and passed by it on the day of.) What was actually happening was that it was one of several concurrent events—protests, marches, vigils—and this one’s specific goal was to create a safe and positive space for black people to celebrate their blackness. It was supposed to be a party, a form of self-care so that people who’d been suffering could decompress and uplift each other. No one there had lost sight of the movement.

Ideally, find the organizers and follow them on social media! Most organizers are great at breaking down the rules and expectations for a particular protest.

Know your limits—and those of the others in your group—and plan accordingly. Have realistic expectations for how far you’re going to be able to push yourself, physically and otherwise. Do you have chronic pain, or a bad foot? Find somewhere to park yourself early on in the day so you don’t end up walking miles and miles. Is someone in your group claustrophobic? Hang back at the edge of things, or find a high wall to sit on so they aren’t engulfed by crowds. It’s easy to think of protesting as some sort of grand sacrifice where you have to push yourself really hard to prove your commitment to the movement, but you’re not gonna help anyone by collapsing from heat exhaustion. Take breaks, and stay safe, fed, and hydrated. Practice self-care.

Pack light—or heavy, depending on your goals. Unless you’re going to be passing out supplies, I suggest packing light. Invest in a water bottle carrier with a strap, or a fanny pack, or a platypus. Wear something with big pockets, so you can avoid bringing a bag or backpack if possible. It’s especially useful to have your hands free if you’re planning to carry a sign!

my usual protest packing list:

phone (highly optional; see above)

cash (enough to buy a meal, take public transportation, etc)

keys (key singular, actually. I take the one I need off my keychain and leave the others behind.)

metro card

ID

water

energy bar

meds (in my case, a sudafed and an ibuprofen)

I can fit all of this into my pockets except a water bottle. I don’t even bring a wallet.

Conversely, you can take the opposite approach and pack heavy, in order to be super prepared or pass out supplies to others. One of my friends brings a backpack with a sign on it that reads “I HAVE: WATER, SNACKS, TYLENOL, TAMPONS, SUNSCREEN...ASK ME FOR WHAT YOU NEED!” At the most recent BLM protest I attended, there were people passing out everything from water bottles to pizza to masks to whiskey. But every protest is different! Don’t count on any supplies to be easily available. If you need it, bring it.

the empty pizza box on the right says “come make a sign here.”

Know your surroundings, and pay attention. This is a big one. I don’t mean that you should never attend a protest somewhere you’ve never been before, but I suggest doing some research if you do. Know where you’re going and when, know the street closures and the path of any marches, know the nearest metro/subway stops and whether they’re going to be open on the day of. Especially know if there’s anywhere you aren’t allowed to be. For example, when protesting at the NRA's headquarters, you can’t step off the sidewalk or you’ll be on their property, and then you can be arrested for trespassing.

Pay attention to signs, traffic patterns, and especially police presence. The other day I noticed that although the police and the National Guard were unarmed as the mayor had promised they would be, the DEA was also present, and they absolutely were armed.

Another part of knowing your surroundings is knowing where relief areas are. If it’s a big enough event, businesses, churches, and even places like theaters will open their doors to protestors to use their bathrooms, charge phones, and rest somewhere with AC. Social media usually has this information if you know where to look for it—check local activist blogs. For my DC folks, check Popville.

On a related note, know which businesses do and don’t support the movement! You don’t wanna wind up buying lunch at a place that gives free meals or discounts to police. Look for places that offer discounts or deals to protesters. For example, in 2018 both Cava and Shake Shack offered discounts for March for Our Lives protesters. Guess where I ate lunch and dinner that weekend? Chains like those ones usually make the news, and local businesses will often put up signs in support of movements to let protesters know they are welcome.

there’s lots more I could say, but the tl;dr version is

keep yourself and others safe.

feel free to chime in if you have something to add/if I missed anything!

#repost#reference#links#protest tips#racism mention //#food mention //#alcohol mention //#asks#anonymous#sorry for double-posting it was gonna drive me insane otherwise#but uh REBLOG THIS ONE

40 notes

·

View notes

Link

https://www.effectivestuffs.com/cash-advance-apps-that-work-with-chime/

0 notes

Text

5 Key Aspects needed in an exceedingly Mobile Banking App

We sleep in the planet of digitalization wherever everything goes virtual. the facility of the digital mobile device isn't simply restricted to communication with others however conjointly to examine on social media and activity vital business work with few faucets.

In a world wherever technology is taking part in an important role, there's little doubt that mobile application has become a hub of such technologies. It provides a platform to nearly do all the action on mobile that we tend to sometimes do on the desktop. Listed square measure some key aspects that square measure expected for a Mobile Banking App to own.

1. easy however easy design:

One of the most effective ways in which to grab the eye of the purchasers is by making place of work banking answer on a mobile platform that's simple to navigate and easy to style. There square measure numerous banks that use fragmented options and force the client to explore the options that eventually cause poor navigation. however this can not last long. The mobile app ought to have the search operate furthermore that must be easy. There ought to be good shortcuts that may build it simple for obtaining the most effective options.

2. Advanced Security with Alerts

The platform of mobile banking could seem to be safe however if there aren't any advanced safety options then it suggests that nothing. Since mobile banking has the foremost crucial however sensitive information, users in fact would need to the most effective of the protection against cyber thieving and hacking.

To have the most effective banking app, it's vital to work that the app comes with higher sign-in practicality. you want to make sure that all the steps concerned in linguistic communication sure a Mobile banking app square measure extremely secured. To use a triple-crown banking app and have a calming expertise, the sign-in method should be simple, fast, and secure.

3. personalised cash management

There square measure numerous {ways|ways that|ways in that} by which personalised cash managed will be one among the most effective banking options. There square measure corporations like Varo, Fintech, Notable Moven, and Chime that have their saving and budgeting tools at the side of some ancient establishments that caught the eye of such options.

With personalised management of cash solutions, mobile banking can give its customers an improved insight into banking with the proper use of machine learning. The -powered tool provides the income analysis and even categorizes the disbursal.

4. CORE Banking options

The centralized on-line period exchange banking so as works the CORE banking feature is one essential back-end answer that processes the dealings and even posts the upgrades on a direct basis. With the learned person grade baking answer, completely different services square measure currently accessible across multiple channels. With such small Finance Solutions, there'll be a specialization for retail banking, securities commerce, and wholesale banking too. at the side of different capabilities like:

Interest rate calculation

Deposits and withdrawals

Loan management

Customer relationship management (CRM)

Introductions to new money product

Record maintenance

5. Accessible client service choices

To be the most effective Mobile banking app. it's vital to own economical client service too. help will be in variety of live phone, bot, live chat, or virtual help. The chat at virtual platform has gained quite success since it's utilized by a number of the notable banks like Ally Bank, capital one, and bank of America. The chatbots will haven't simply text communication however conjointly spoken communication designed. Besides, it directly makes a reference to the person with the app.

0 notes

Text

Cash Advance Apps That Work With Chime

Cash Advance Apps That Work With Chime

Most people are unable to save money because of their income or long-term loans. However, short-term loans relieve them for a while. With the transformation of the world to digitalization, several modernized apps are available for mobile banking. Here are the top cash advance apps that work with Chime.

From one payday to the other, some of the finance applications are there to facilitate you…

View On WordPress

0 notes