#accounts receivable process

Text

Generally, AR refers to the money that the company is owed by its clients or, alternatively, to unpaid bills. The AR simply represents all the unpaid business invoices that you have yet to collect.

Read More: - Accounts Receivable Managements

#accounts receivable#bookkeeping services for small business#accounts payable outsourcing#accounts receivable process#accounts receivable outsourcing#accounts receivable management

0 notes

Text

The Future of Accounts Receivable: Automation and Innovation

Do you know that the future of accounts receivable is looking bright, with automation and innovation leading the way?

With the advent of new technologies such as artificial intelligence and machine learning, the process of managing your accounts receivable is becoming more efficient and accurate.

Now, you may have doubts about What is Automation? and How Automation can help you streamline your Accounts receivable? Let’s discuss that in this article.

What is Automation?

The term automation refers to using technology to perform tasks automatically using machines, software, or other tools without human intervention or control.

An example of automation is a factory assembly line, where machines are used to assemble products automatically. Machines are programmed to perform specific tasks, such as welding or painting, and can work around the clock without the need for human intervention.

Another example of automation is a self-checkout machine at a grocery store, which allows customers to scan and pay for their items without the assistance of a cashier.

Overall, automation can help to increase efficiency, reduce the need for labor, and improve accuracy and consistency in tasks. However, it can also lead to job displacement, as some tasks may be automated and performed by machines instead of people.

How Automation can help you streamline your Accounts Receivable Process?

Automation can help streamline your accounts receivable process by allowing you to quickly and accurately

process invoices and payment requests,

track customer payment history,

generate reports.

This can help you to manage your cash flow and ensure that you are getting paid faster and more promptly.

Here are some specific ways in which automation can help with accounts receivable:

1. Invoice generation:

Automated invoice generation is the process of creating and sending invoices to customers without the need for direct human intervention. Invoices are created in the accounts receivable process when a transaction is completed or a service is supplied to a customer with a credit base.

In most cases, automated invoice creation involves the use of software or a system that creates and distributes invoices to customers based on predetermined workflows or communication templates.

Using automated invoice generation in the accounts receivable process has various advantages. By removing the need for manual data input and invoice production, it can save time and decrease the chance of errors. By providing customers with clear, accurate, and timely invoices, automated invoice production can also help you optimize your invoicing and payment procedures. Furthermore, automated invoice generation can enhance cash flow by allowing you to issue invoices and receive payments from customers more rapidly.

To deploy automated invoice generation, you're invoicing and payment processes must be configured with the right accounts receivable software or system. This may involve integrating the system with your accounting software or other business systems, as well as creating rules or triggers for invoice generation and delivery. Once configured, you can use the system to generate and send invoices to your customers depending on the predefined workflows and communication templates.

2. Payment tracking:

The use of technology and software to monitor and record customer payments is referred to as automated payment tracking in the accounts receivable process. This procedure assists you in successfully managing your accounts receivable, which is the money owed by your customers for products or services that are given but not yet paid for.

Using automatic payment tracking in the accounts receivable process has several advantages.

Accounts Receivable Automation enables you to record payments promptly and correctly as they are made, lowering the chance of errors and blunders.

Automated payment tracking can assist you in identifying potential payment difficulties, such as late or missing payments so that they can be resolved as soon as possible.

By giving real-time information about the state of your accounts receivable process, automated payment tracking may help you manage your cash flow more efficiently.

Overall, automated payment tracking in the accounts receivable process can help you handle your financial transactions and financial management operations more efficiently and precisely than before.

3. Report generation:

In the accounts receivable process, automated report generation refers to the use of software or other technical tools to automatically generate reports linked to the payment of invoices and other debts owing to a business.

These reports may provide information on

the total amount of money owed,

the payment status,

any outstanding amounts.

An aging report, which displays the period that has passed since an invoice was issued and the current state of payment, is a typical type of report generated in the accounts receivable process.

Cash flow reports, which indicate the amount of money flowing into and going out of your business, and accounts receivable summaries, which offer an overview of the total amount of money owed to your business, are two other sorts of reports that can be generated.

You can profit from automated report generation by making it easier to track and manage your accounts receivable. You can save time and resources by automating the process of creating these reports, and you can also make it simpler to discover any errors or errors in your accounts receivable with real-time and updated reports.

Overall, automation can help you streamline your accounts receivable process and improve your cash flow by making it easier to manage invoices, track payments, and generate reports.

Maxyfi – Accounts Receivable Software

The future of accounts receivable is automation. Gone are the days of manual invoicing and payment tracking. With the proliferation of technology in the business world, automation is becoming increasingly necessary to streamline processes and improve efficiency.

One tool that is leading the charge in accounts receivable automation is Maxyfi. This innovative software offers a range of features to help businesses manage their accounts receivable with ease.

With Maxyfi, you can automate the invoicing process, sending out professional-looking invoices to your customers with just a few clicks. You can also set up automatic payment reminders to ensure that you receive timely payment for your goods or services.

In addition to automating the invoicing and payment process, Maxyfi also offers a range of reporting and analysis tools to help you stay on top of your accounts receivable process. You can see at a glance which invoices are outstanding, and take action to follow up on any that are overdue.

Maxyfi also integrates with a range of other business tools, including your accounting software, to ensure a seamless flow of information across your business.

In short, if you want to streamline your accounts receivable process and improve the efficiency of your business, Maxyfi – Automated Accounts Receivable Software is the perfect solution. With its automation capabilities and wide range of features, it is a valuable tool for any business looking to take its accounts receivable to the next level.

Conclusion

To conclude, the future of accounts receivable seems promising, with automation and innovation leading the way. By adopting new technologies and approaches, you can

improve the efficiency and accuracy of your accounts receivable process,

reduce the number of overdue or unpaid invoices,

improve your cash flow and bottom line.

As these trends continue to evolve, we should expect to see even more amazing discoveries and innovations in the accounts receivable market. You can learn more about Accounts Receivable Automation by visiting Maxyfi Blogs.

#accounts receivable software#accounts receivable process#accounts receivable automation#debt collection software#accounts receivable automation software#accounts receivable platform#AR management software#best accounts receivable software#accounts receivable management software#debt collection system#accounts receivable management system#debt collection management system#best accounts receivable automation software#accounts receivable roi calculator#quickbooks invoice reminders#quickbooks automatic invoice reminders#invoice dispute management#ai powered ar automation#accounts receivable metrics#collection effectiveness index

0 notes

Text

I'm very much a, "fuck yeah and fuck you, I don't need validation! I'm me, cunts!" kinda fella, but sometimes I could use support.

#today i fucked up by reactivating my fb account which i haven't done in 2 yrs just to check on some folks id been sending good thought to#place is depressing everyone is miserable and everything feels fake and my mind is like#LOL this is why we left bitch byeeee#so i deactivated again went to work and idc what anyone says there are folks like me that can and do feel the energy and emotions coming of#people and it can fucking suck especially when so many are disregulated so i got a sensory overload and boss was nice enough to let me take#a bunch of breaks today and even scream in her office cause She Gets It (TM)#the weather is rainy and cold i'm getting so many fibro flares idk how i'm moving anymore#ive missed so many days of work already and it's not even fully winter yet i still have my job and im thankful i have an understanding team#but that doesnt pay the bills im still trying to find a way to pay for that doctor appointment coming up#graduate courses began for college and i think i'm gonna be okay but damn did they throw too much info all at once at me and that made#my adhd brain go WELL SHIT#ive been feeling incredibly lonely and not wanted in so many spaces that im struggling to even communicate with the few that i know do#love me for me and nothing else im trying so so so hard to keep being there for people and to keep loving#people that need it cause i don't ever want another human being to ever feel as miserable and unwanted as i have felt#but im also tired because i feel like thats all anyone ever sees me as just this being that can take their woes away and make them feel#amazing and i love that i can do that and listen to so many traumatic stories and help folks process that trauma my boss and many throughou#life have told me i have a gift for healing people and a vibe to me thats different than most and it feels good being around me but today i#just felt like people keep taking and taking and taking and i dont expect anything back thats not who i am id rather give than receive#but damn it i just wish someone could just give me the biggest hug in the world dont even have to say a thing just hold me and be present#and hold space for me to just feel weightless id cherish that more than anything in the world right now#on a positive note...#my dinosaur vo stuff got traction im getting a new cosplay put together i havent done that in 4 years i got to pet a wild deer i made#a coworker laugh so hard his juice went out his nose and my boss peed a little#im slowly taming another wild flock of turkeys and i got a bag of my favorite takis the guacamole flavor#i got a lot to be thankful for and i acknowledge it#but damn it im tired#thank you for coming to my Ted Talk rant and rave#if you made it this far: you're an incredible human being and i love you#please go treat yo self to something nice and know i love you for you

5 notes

·

View notes

Text

just had my one-month check in at the eating disorder clinic where i told off the doctor for cutting my treatment short and not doing literally half of what was included in the treatment criteria. and they AGREED WITH ME!!!!!

#accountability ???? in MY public health care provider??????#it’s more likely than you think !!!!!#anyway they told me why they did what they did and validated my anger and said that they’re gonna inform the supervising doctor#and i’ll probably hear back soon about them checking in with me and they’re gonna give me more info about moving forward#and they’re making a note that i didn’t receive the last half of treatment so that if i need to come#back and re-enter treatment; they’ll just reopen my file so i don’t have to redo the referral and assessment processes#and we’ll pick up where we left off#wild day!!!!!!!#now i need a gd NAP#recovery tag

4 notes

·

View notes

Text

The Strategic Advantage of Outsourcing Accounts Receivable

Photo by Tima Miroshnichenko on Pexels.com

In today’s competitive business landscape, managing accounts receivable (AR) efficiently is crucial for maintaining healthy cash flow and ensuring business sustainability. Recognizing this, many companies, including industry leaders like Swift, Invensis, FedEx Corporation, United Parcel Service, Inc. (UPS), Penske Logistics LLC, and XPO Logistics, are…

View On WordPress

#access to AR expertise#accounts receivable management#accounts receivable outsourcing#AR collections#AR outsourcing benefits#AR process streamlining#AR technology solutions#business cash flow improvement#cost-saving strategies#FedEx Corporation#financial health enhancement#financial operations optimization#focus on core business#Freight#freight industry#Freight Revenue Consultants#future of AR outsourcing#improve cash flow#Invensis outsourcing#invoice processing efficiency#logistics#outsourcing case studies#outsourcing services#Penske Logistics LLC#reduce operational costs#small carriers#strategic business partnerships#Swift logistics#Transportation#UPS logistics

0 notes

Text

Struggling with late payments? Bookkeeping By Pros infographic unveils 5 tips to streamline your Accounts Receivable (AR) for faster collections & improved cash flow. Visit our website for a free consultation.

Accounts Receivable Services

1 note

·

View note

Text

Master the Accounts Receivable Workflow Process

Delve into our comprehensive guidebook aimed at refining your accounts receivable processes and driving your business toward financial success. In today's rapidly changing business environment, adept accounts receivable management is crucial for maintaining strong cash flow and profitability. Timely payments fulfill financial obligations and cultivate lasting customer relationships, fostering satisfaction and loyalty.

Our detailed handbook offers a structured approach to enhancing your accounts receivable procedures. From establishing clear payment terms to incorporating automated invoicing systems, you'll discover practical strategies and best practices that are easily implementable. Moreover, we emphasize the importance of maintaining transparent communication channels with clients and navigating challenging situations like delayed payments.

Learn how to leverage technology, data analysis, and customer relationship management tools to streamline your process of accounts receivable and achieve optimal efficiency. By following our expert advice and proven methods, you can boost cash flow, reduce outstanding accounts receivable, and strengthen the overall financial stability of your business.

Take charge of your workflow today and unlock the vast potential of your business!

1 note

·

View note

Text

10 Powerful Strategies to Slash Your A/R Days in Half

The constant battle against late payments can drag down even the most successful businesses. Overdue invoices tie up critical cash flow, hinder growth, and strain customer relationships. In today's competitive landscape, minimizing Accounts Receivable (A/R) days is an absolute necessity.

The good news? You don't have to resign yourself to slow collections. By implementing targeted strategies, you can significantly expedite your receivables process and unleash the hidden wealth trapped in outstanding invoices.

Simplifying the Journey from Invoice to Payment

Late payments and stagnant receivables can feel like an insurmountable obstacle to your business's cash flow and growth. Invoices remain outstanding, casting a long shadow over financial planning and operational efficiency. But the good news is, you don't have to accept this sluggish reality. By implementing targeted strategies, you can bridge the gap between invoice issuance and timely payment, transforming your A/R process from a tangled web into a smooth, flowing stream.

Buckle up, because we're about to dive into 10 powerful tactics that will slash your A/R days in half and unleash the untapped potential of your receivables.

1. Streamline Invoicing

Go digital: Ditch paper invoices for a faster, more efficient electronic system. Consider online portals or invoicing software for automatic delivery and easier tracking.

Clarity is key: Ensure invoices are clear, concise, and error-free. Include all necessary details like invoice number, due date, payment terms, and contact information.

Early bird gets the worm: Send invoices promptly after completing services or delivery. The quicker you bill, the quicker you get paid.

2. Offer Multiple Payment Options

Cater to convenience: Accept a variety of payment methods like credit cards, debit cards, bank transfers, and online wallets. The more flexibility you offer, the higher the likelihood of receiving timely payments.

Automate recurring payments: Encourage long-term clients to opt for automatic payments, eliminating the need for manual intervention and potential delays.

3. Leverage Early Payment Incentives

Sweeten the deal: Offer discounts or early payment rewards to incentivize customers to settle invoices sooner. This can significantly impact your A/R turnover.

Tiered discounts: Consider a tiered discount structure, offering increasingly attractive benefits for earlier payments.

4. Proactive Communication is Key

Early and friendly reminders: Set up automated email or SMS reminders as invoices approach due dates. Keep the tone professional yet friendly and avoid accusatory language.

Personalize outreach: Don't rely solely on automation. Dedicate time to personalized phone calls or emails for large or overdue invoices.

5. Invest in Technology

Automated collections: Utilize software that automates late payment notifications, escalating follow-up actions, and even debt collection efforts.

Data-driven insights: Leverage analytics tools to identify trends in payment behavior and tailor your collections strategies accordingly.

6. Build Strong Customer Relationships

Transparency and communication: Foster open communication with customers regarding payment terms and expectations. Address any concerns promptly and maintain a positive relationship.

Flexible payment plans: Consider offering flexible payment plans for certain customers facing temporary financial difficulties. This can build loyalty and prevent future delays.

7. Outsource Collections (Strategically)

For complex or chronic cases: While keeping the bulk of collections in-house is often preferable, consider outsourcing complex or chronic cases to professional debt collection agencies.

Maintain control: Ensure clear communication and collaboration with any external agencies to maintain transparency and protect customer relationships.

8. Monitor and Refine

Track key metrics: Regularly monitor A/R days, average invoice age, and collection success rates. Identify areas for improvement and adjust your strategies accordingly.

Benchmark against industry standards: Compare your A/R performance to industry benchmarks to gauge your progress and identify areas for potential improvement.

9. Automate and Collaborate

In today's tech-driven world, manual tracking and tedious follow-ups are relics of the past. Leverage automation tools to streamline routine tasks like payment reminders, late fee applications, and even initial debt collection efforts. This frees up your team to focus on complex cases and cultivate positive relationships with high-value clients.

But remember, technology is simply a tool, not a magic bullet. Foster seamless collaboration between your collections team and other departments like sales and customer service. Align strategies, share valuable insights, and ensure a consistent, professional approach to resolving payment issues. By combining the efficiency of automation with the human touch of effective communication, you can create a powerful synergy that drives faster resolutions and builds lasting customer loyalty.

10. Embrace Continuous Improvement

A/R optimization is not a one-time fix. Treat it as an ongoing journey of experimentation, adaptation, and refinement. Regularly analyze your A/R data, identify patterns, and assess the effectiveness of your implemented strategies. Don't be afraid to test new approaches, adjust existing tactics, and embrace a learn-as-you-go mentality. This continuous improvement mindset ensures your A/R practices stay dynamic and evolve alongside your business, keeping you ahead of the curve and ensuring a healthy, cash-flowing future.

The Ripple Effect: Beyond the Numbers of A/R Improvement

Improving A/R days isn't just about boosting a single metric on your financial dashboard. It's about unleashing a chain reaction of positive changes that can ripple across your entire business. Let's explore the far-reaching impact of optimized A/R management:

1. Financial Stability and Growth:

Enhanced cash flow: Faster collections mean quicker access to critical capital. Use this influx to invest in new equipment, marketing initiatives, or expansion plans.

Improved profitability: Reduced A/R days translates to lower carrying costs and bad debt write-offs, boosting your bottom line. This increased profitability attracts investors and opens new financial opportunities.

Debt reduction: Freeing up cash flow allows you to pay down debt obligations faster, minimizing interest expenses and strengthening your financial position.

2. Operational Efficiency and Productivity:

Reduced workload: Streamlined A/R processes free up valuable time and resources for your finance team. They can focus on strategic tasks like financial forecasting and budgeting instead of chasing overdue payments.

Improved inventory management: Faster cash flow facilitates timely supplier payments, ensuring a consistent flow of raw materials and products. This minimizes stockouts and production delays, enhancing operational efficiency.

Boosted employee morale: Timely payments to vendors not only maintain positive relationships but also contribute to a more collaborative and efficient work environment.

3. Enhanced Customer Relationships and Retention:

Improved customer experience: Efficient payment options, proactive communication, and prompt dispute resolution foster a positive customer experience. This builds trust and loyalty, leading to higher retention rates and increased repeat business.

Reduced customer churn: By eliminating friction points in the payment process and demonstrating professionalism in collections, you minimize customer frustration and incentivize timely future payments.

Strengthened brand reputation: Efficient A/R management reflects positively on your brand image, demonstrating financial stability and professionalism. This enhances brand trust and attracts new customers.

The ripple effect of A/R improvement extends far beyond financial metrics. It touches every aspect of your business, impacting operations, customer relations, brand reputation, and ultimately, your long-term success. By prioritizing A/R optimization, you're not just addressing past due invoices; you're laying the foundation for a stronger, more resilient, and thriving future for your company.

Conclusion

The journey from invoicing to payment need not be a cumbersome battle against late payments. This blog has explored ten powerful strategies to transform your Accounts Receivable (A/R) process from a complex web into a smooth, flowing stream. From streamlining invoicing to leveraging technology, building strong customer relationships, and embracing continuous improvement, these tactics are designed to slash A/R days in half and unlock the untapped potential of your receivables.

Furthermore, the ripple effect of A/R improvement extends well beyond mere financial metrics. Enhanced cash flow not only contributes to financial stability and growth but also leads to operational efficiency, increased productivity, and a positive impact on employee morale. Improved customer relationships and retention, along with a strengthened brand reputation, showcase the profound influence of optimized A/R management.

In prioritizing A/R optimization, you're not just addressing overdue invoices; you're laying the groundwork for a more resilient and thriving future for your company. The ripple effect touches every facet of your business, ensuring long-term success in today's competitive landscape.

#revenue cycle management#revenue cycle service#revenue cycle services#Accounts Receivable (A/R) process#Accounts Receivable (A/R) optimization#Accounts Receivable (A/R) days

0 notes

Text

Best Practices for Receiving Invoices: Transforming Your AP Workflow

At Mynd Integrated Solution, we recognize the critical role that effective invoice management plays in the overall efficiency of your Accounts Payable (AP) workflow. In today’s fast-paced business landscape, optimizing the process of receiving invoices is not just a best practice; it’s a transformative strategy that can elevate your entire financial operation.

0 notes

Text

Transforming Accounts Receivable: A Deep Dive into Modern Solutions with Kapittx

In the dynamic world of modern business, effective accounts receivable (AR) management has become a linchpin for sustained growth and financial stability. The increasing demand for streamlined financial processes necessitates the adoption of innovative solutions.

Every company invests substantial resources to grow the business and revenue. However, that revenue must be converted into cash.

The team and the processes responsible for converting revenue to cash by effectively managing receivables are –

Also managing 100% of company’s revenue

Either can save or lose millions in the form of bad debt and interest cost

As a customer touch point, can influence customer service and satisfaction, directly affecting revenue.

Why current AR process is not effective?

Traditional accounting ERPs with spreadsheets, once considered revolutionary, have become outdated in the face of rapid advancements in Automation, Machine Learning, and Artificial Intelligence (AI). The historical approach of relying on spreadsheets, emails, phone calls, and personal visits to manage receivables has persisted through generations. However, the limitations of these traditional processes, marked by manual tasks and delays, are evident in the current fast-paced business landscape.

The Challenge of Traditional AR Processes:

Traditional AR processes are notorious for their inefficiencies, resulting in delayed payments and increased Days Sales Outstanding (DSO). Their lack of agility poses a significant challenge for businesses striving to navigate fluctuating payment behaviors, complex customer interactions, and the growing demand for real-time data insights.

The Emergence of Innovative Solutions:

Acknowledging the critical need for a modern approach to AR management, innovative platforms like Kapittx have come to the forefront. These solutions leverage automation, analytics, and AI to effectively address the complexities of the modern business environment, empowering CFOs and finance organizations to take control of their receivables and cash flow.

Benefits of AI-Powered AR Tools and Processes:

Increased Cash Flow and Reduced DSO: AI-powered tools streamline processes, resulting in quicker payments and a notable reduction in Days Sales Outstanding.

Boost in Credit Sales and Margins: Improved efficiency enhances credit sales and profit margins, contributing to overall revenue growth.

Enhanced Productivity of Collection and Sales Teams: AI-driven automation increases the productivity of collection and sales teams, saving valuable time for managers and CFOs.

Reduced Bad Debt and Interest Costs: Advanced analytics minimize the risk of bad debt, leading to substantial savings in interest costs.

Lower Administrative Costs: Automation across the revenue cycle reduces administrative costs, optimizing overall financial operations.

Decrease in Deductions and Concessions Losses: AI-powered tools help identify and mitigate deductions and concessions losses, preserving revenue.

Enhanced Customer Service: Improved efficiency and responsiveness contribute to enhanced customer service, fostering stronger client relationships.

Decreased Administrative Burden on Sales Force and Management: Automation reduces the administrative burden on the sales force and management, allowing them to focus on core revenue-generating activities.

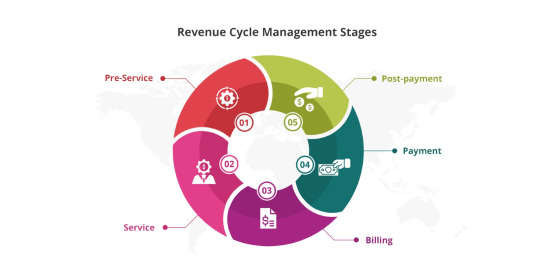

Drivers of Receivable Management

What are the drivers of receivable management? Which are within the control and outside the of control of the receivable management team? When is a good time to change your AR process :

Receivables management is an art that requires finesse in human interactions and creative problem-solving. Simultaneously, it is a science that leverages data, analytics, and technology to optimize processes, manage risks, and drive strategic decision-making. The most successful CFOs, Finance Controllers, Credit Managers or Receivables Managers are those who seamlessly integrate both the artistic and scientific aspects, adapting to the dynamic nature of the field. It encompasses business processes, technological tools, workforce skills and motivation, corporate culture, evolving behaviors of customers and colleagues, an optimal organizational structure, performance metrics, incentives, and adaptability to navigate shifting external factors.

The quality of the revenue cycle operation is reflected in the receivables asset. Any mistake in the order, fulfillment, invoicing, payment, or customer satisfaction process will result in a delayed or incomplete payment in the receivables ledger.

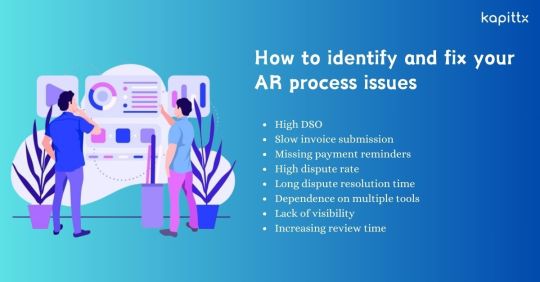

How to identify and fix your AR process issues

Accounts receivable is a critical function that affects your cash flow, customer satisfaction, and profitability. However, many businesses struggle with inefficient and outdated AR processes that lead to poor performance and customer dissatisfaction. Here are some common indicators that your AR process needs a rehaul:

High DSO: If invoice collection period is 50% more than the credit period, it means you are taking too long to collect payments from your customers. This can affect your working capital and cash flow. High DSO can also indicate that you are not managing your customer credit risk effectively, or that you are not enforcing your payment terms consistently.

Slow invoice submission: If you are not sending your invoices to your customers within 2 to 5 days of invoice generation, you are missing out on the opportunity to get paid faster. Delayed invoice submission can also cause confusion and disputes with your customers, especially if they receive multiple invoices at once or if the invoice details are inaccurate or incomplete.

Missing payment reminders: If you are not sending timely and friendly payment reminders to your customers, you are letting them forget or ignore their payment obligations. Payment reminders are an essential part of your AR process, as they help you maintain a positive relationship with your customers and encourage them to pay on time.

High dispute rate: If you are receiving a lot of invoice disputes from your customers, it means that there is something wrong with your invoicing process or your product or service delivery. Invoice disputes can cause delays in payment, damage your customer trust, and increase your administrative costs.

Long dispute resolution time: If you are not resolving invoice disputes quickly and efficiently, you are prolonging the payment cycle and creating frustration for your customers. Dispute resolution time is a key metric that reflects your customer service quality and your AR process effectiveness.

Dependence on multiple tools: If you are using different tools to manage your receivables, such as accounting ERP, spreadsheets, and report generating tools, you are creating unnecessary complexity and inefficiency in your AR process. Using multiple tools can cause data inconsistency, duplication, and errors, as well as increase your operational costs and time.

Lack of visibility: If you are not able to track and analyze the reasons for payment delays, you are missing out on valuable insights that can help you improve your AR process and customer experience. Understanding the root causes of payment delays can help you identify and address the internal and external factors that affect your AR performance.

Increasing review time: If you are spending more time reviewing your receivables than acting on them, you are wasting your resources and losing your competitive edge. Reviewing your receivables is important, but it should not take away from your core activities, such as collecting payments, resolving disputes, and building customer relationships.

According to a study, 70% of the invoice payments are delayed not because customers want to delay, but due to internal challenges and broken AR processes. Therefore, it is crucial to optimize your AR process and eliminate the inefficiencies and errors that cause payment delays.

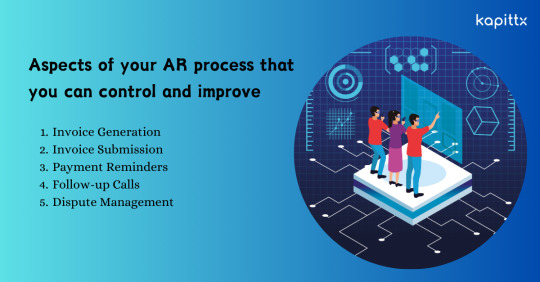

Aspects of your AR process that you can control and improve:

Invoice generation: You can automate your invoice generation process and ensure that your invoices are accurate, complete, and compliant with your customer’s requirements. You can also use electronic invoicing to reduce paper usage, printing costs, and delivery time.

Invoice submission: You can automate your invoice submission process and send your invoices to your customers via their preferred channel, such as email, web portal, or EDI. You can also use invoice tracking to confirm that your invoices are received and opened by your customers.

Payment reminders: You can automate your payment reminder process and send personalized and friendly reminders to your customers via their preferred channel, such as email, SMS, or phone. You can also use payment reminder templates to ensure consistency and professionalism in your communication.

Follow-up calls: You can automate your follow-up call process and schedule and execute calls to your customers based on their payment behavior and risk profile. You can also use call scripts to ensure that your calls are polite, respectful, and effective.

Dispute management: You can automate your dispute management process and capture, categorize, and assign disputes to the right person or team. You can also use dispute resolution workflows to ensure that disputes are resolved in a timely and satisfactory manner.

Aspects of your AR process that you cannot control:

Customer errors: If your customer makes a mistake in placing an order, receiving a product or service, making a payment, or updating their information, it can result in a past due or short payment in your receivables ledger. You can try to prevent customer errors by providing clear and accurate information, instructions, and support to your customers.

Customer dissatisfaction: If your customer is unhappy with your product or service, or with your customer service, they may withhold or delay their payment as a form of protest or retaliation. You can try to prevent customer dissatisfaction by delivering high-quality products and services, and by providing excellent customer service.

Automation is revolutionizing receivables management. Credit and collection software offers work flow, data management, and analysis tools that surpass even the best ERP systems. By enabling access to all the information related to the invoice-to-cash process and providing the tools to act on that data from a single user interface, companies that have adopted receivables management software have achieved dramatic improvements in performance, as seen by reduced DSO and delinquencies. But efficiency is not the only benefit. The data collected from credit and collection activities also provides valuable customer and process insights that can be used to enhance customer profitability, invoice accuracy, and customer satisfaction. When used properly, receivables management automation becomes the missing link between back office operations and front line customer relationship management.

What to look for to modernise your AR Process?

In the ever-evolving landscape of finance, the adoption of automation is crucial for staying competitive and optimizing operational efficiency. Modernizing your Accounts Receivable (AR) process through automation is not just a trend but a strategic move to enhance productivity, minimize errors, and foster a more agile business environment.

Key Considerations for Modernizing Accounts Receivable process with Automation:

Integration Capabilities:

Ensure that the automation solution seamlessly integrates with existing systems, ERPs, and other relevant tools to avoid disruptions and enhance overall efficiency.

Scalability:

Choose an automation solution that can scale alongside your business growth. This ensures that the system remains effective and adaptable as your AR needs evolve.

User-Friendly Interface:

Opt for an automation platform with an intuitive and user-friendly interface. This reduces the learning curve for your team and promotes swift adoption across different departments.

Data Security and Compliance:

Prioritize platforms that adhere to stringent data security standards and compliance regulations. Protecting sensitive financial information is paramount in the modern business landscape.

Customization and Flexibility:

Look for automation tools that offer customization options to tailor the solution to your specific AR processes. Flexibility is key to accommodating diverse business requirements.

Workflow Automation:

Identify a solution that automates routine and time-consuming tasks, such as invoice processing, payment reminders, and data entry. This not only saves time but also reduces the risk of human errors.

Analytics and Reporting:

Choose a platform that provides robust analytics and reporting features. Real-time insights into AR performance empower decision-makers to identify trends, make informed decisions, and strategize for the future.

Collaboration Features:

Opt for automation tools that facilitate collaboration among team members and stakeholders. Effective communication and seamless collaboration are crucial for a streamlined AR process.

Customer Experience Enhancement:

Prioritize solutions that enhance the customer experience. Automation can improve the speed and accuracy of invoicing, payment processing, and dispute resolution, leading to increased customer satisfaction.

Cost-Benefit Analysis:

Conduct a thorough cost-benefit analysis to assess the potential return on investment. While automation involves an upfront investment, the long-term benefits in terms of efficiency and cost savings often outweigh the initial costs.

Modernizing your Accounts Receivable process through automation is not just a technological upgrade; it’s a strategic decision to future-proof your finance operations. By considering these key factors, you can select the right automation solution that aligns with your business goals, enhances efficiency, and propels your organization toward sustained success in the dynamic financial landscape.

#ar management#Accounts Receivable Software#Accounts Receivable Automation Process#AR Collection#AR Software#Accounts Receivable Management Tools#AR Automation Solution

1 note

·

View note

Text

It's common for businesses like yours to encounter manual errors and delays in managing their accounts receivables, which they believe to be inevitable. By requiring employees to perform manual tasks, they spend more time on basic tasks and less time on adding value to the organization. This reduces productivity automatically.

Yes, manual accounts receivable processes are prone to mistakes and delays, which may be detrimental to a company's bottom line.

But who says it's unavoidable? It can be avoided and prevented from occurring. Let's take a look at how.

Some common errors and delays in the Accounts Receivable Process

1. Manual Data entry:

The traditional accounts receivable process, which is done using spreadsheets, is always comfortable for most individuals. Manual data entry is prone to errors and delays, which may be both time and money-consuming.

Poor cash flow maintenance.

Poor record maintenance and management.

Follow-ups were delayed and irregular.

You may think that these are standard errors that all organizations make while manually processing and monitoring accounts receivable.

Yes, however, most people are unwilling to modify their accounts receivable process to boost cash flow and productivity.

For example;

If a business owner submits a wrong invoice or payment amount by accident, they may not recognize the error until it is too late.

2. Misplaced or lost invoices:

An invoice is a sort of bill that is given to the customer asking for payment for services or products provided on credit. A decent invoice should be formal, professional, and, most importantly, in a suitable tone.

Not Sending Your Invoice Instantly.

Fail to provide a payment deadline.

The invoice was delivered to the wrong person.

Services are not listed.

Your invoice is lacking in politeness.

Terms are not being stated.

There was no follow-up.

These are some of the common mistakes and errors that wreak havoc on invoices and the responses they trigger.

Invoices are widely ignored or misplaced when handled manually. This may result in payment delays since the business owner may be unable to locate the invoice when it is needed.

3. Inaccurate record-keeping:

Keeping track of your customers and payments manually may be time-consuming and error-prone. This can result in erroneous records that are difficult to update and may even lead to customer disputes.

Inaccurate record-keeping is the practice of failing to maintain the records properly. This can be purposeful or accidental, and the consequences for individuals, organizations and even nations can be severe.

lack of training,

lack of attention to detail,

lack of correct protocols

These are all major causes of faulty record-keeping. Incomplete or erroneous records can lead to lost or wrong information, misunderstandings, and a lack of responsibility.

To prevent these issues and guarantee that their records are dependable and trustworthy, you must prioritize proper record-keeping.

4. Lack of visibility:

Accounts receivable visibility refers to a scenario in which an organization does not have a clear or complete view of the money owed to them by their customers.

This can be caused by a variety of circumstances such as

including insufficient record-keeping,

poor customer communication,

lack of appropriate systems and processes for tracking and managing accounts receivable.

a lack of visibility over your accounts receivable can make it difficult to

manage your cash flow,

plan for the future,

ensure that you get paid on time.

It can also lead to misunderstandings and disagreements with your customers, as well as financial losses for your organization.

5. Slow payment processing:

Slow payment processing in accounts receivable entails a situation in which a business or organization takes a substantial amount of time to handle payments owing to them by their customers.

This can occur for several reasons, including

a lack of effective systems and processes for managing accounts receivable,

insufficient employees or resources,

a significant volume of payments that must be handled.

slow payment processing can be a big concern for your business, causing

cash flow problems,

challenges controlling and projecting income,

even disagreements and lost customers.

To minimize sluggish payment processing, make sure you have adequate systems and processes in place for handling your accounts receivable, as well as enough employees and resources to manage the number of payments you receive.

How to eliminate Manual Errors and Delays?

An accounts receivable automation software can help you eliminate manual errors and delays in your accounts receivable process. Many of the tasks associated with managing your accounts receivable, such as

issuing invoices,

monitoring payments,

reconciling accounts,

are automated by this software.

The software can help reduce the probability of errors and improve the accuracy and efficiency of the accounts receivable process by automating these tasks.

Implementing data validation checks is one method that accounts receivable automation software can help avoid manual errors. These checks can help to ensure that the information being entered into the system is proper and full, lowering the possibility of mistakes like transposed digits or wrong customer information.

Additionally, accounts receivable management software can help eliminate manual delays by automating tasks such as invoice generation and payment tracking. This can speed up the accounts receivable process and reduce the time it takes to process payments, leading to faster turnaround times and improved customer satisfaction.

Overall, using accounts receivable software can help you in improving the accuracy and efficiency of your accounts receivable process, reduce the risk of errors and delays, and improve your financial health.

Maxyfi – Accounts Receivable Software

With Maxyfi - an Accounts Receivable Automation Software, you can enhance and empower your business through efficient collections, powerful workflows, and customizable templates. The following are some of the benefits that you’ll get from Maxyfi.

1. Accounts Receivable Process with Prioritized List

In the accounts receivable process, a prioritized list is a rating of outstanding invoices based on the urgency and necessity of their payment. This list assists in prioritizing which invoices should be paid first, such as those with upcoming due dates or the highest outstanding amounts. This guarantees that the company maintains a healthy cash flow and avoids any concerns with late payments or defaults on existing obligations.

Maxyfi Accounts Receivable Management Software with the help of underlying power full AI engine with workflows, creates the prioritized list for actions in a flash, saving hours of manual activity and increasing productivity!

2. Accounts Receivable Automated Reminders

Accounts receivable automated reminders are a system that sends invoice reminders to customers regularly to remind them to settle their outstanding debts. This can assist organizations in more efficiently managing their accounts receivable process by ensuring that invoices are paid on time and reducing the number of outstanding bills.

Automated reminders may be delivered through email or SMS and can contain the amount owed, the invoice number, and other relevant information. This can assist to enhance the business's connection with its customers by demonstrating that the business is proactive in managing its accounts receivable and is committed to maintaining a positive working relationship.

Maxyfi provides an infinite number of pre-defined templates to meet workflow requirements, as well as customization capabilities and automatic reminders to improve efficiency. You can also make one from scratch!

3. Accounts Receivable Workflow Management

Workflow management in accounts receivable is the act of monitoring and coordinating the flow of work associated with handling incoming payments for an organization.

Invoicing customers,

following up on delinquent payments,

applying payments to accounts,

reconciling accounts to verify that all payments are accounted for and correctly documented are examples of such activities.

Workflow management in accounts receivable aids in the seamless and effective operation of the accounts receivable process, as well as the timely receipt of payments.

Powerful workflows that help your organization in tracking high-priority prospects and personalizing follow-up communications to slow or non-paying customers. Overall, it ensures that your company recovers all outstanding debts.

4. Accounts Receivable Dispute Management

Accounts receivable dispute management is the process of resolving disputes that emerge when a customer or client questions the authenticity of an invoice.

This procedure normally entails analyzing the disputed invoice and accompanying documents, collaborating with the client to settle the dispute, and making any required account modifications. The purpose of dispute resolution is to handle problems promptly and effectively while preserving strong customer relationships.

Handles disputes efficiently without losing on unrecoverable debts. Also helps boost effective conversations and good customer experience.

5. Promise to Pay Requests in Accounts Receivable Automation Software

Accounts receivable dispute management is the process of resolving disputes that arise when a customer questions the validity of an invoice.

This procedure normally entails analyzing the disputed invoice and accompanying documents, collaborating with the customer to settle the dispute, and making any required account modifications. The purpose of dispute resolution is to handle problems promptly and effectively while preserving strong customer relationships.

A payment plan or payment agreement, which defines the terms and circumstances of the payment, including the amount to be paid, the due date, and any penalties for late payment, is often used to document the promise to pay. To ensure a healthy cash flow and financial stability, businesses must carefully manage their accounts receivable and follow up on any outstanding debts or commitments to pay.

A promise is one of the most common approaches to collecting payment dues where the customer is made to agree to pay by the date and systematically follow up to ensure they pay. Maxyfi Accounts Receivable Software has the best promise tracking and integrated follow-up communication mechanism.

6. Call Back Request in Accounts Receivable Automation Software

A callback request is when a customer requests to be contacted about their outstanding balance or payment at a later time in the accounts receivable process. This might be because they require more time to gather the necessary finances, or they may like to discuss a payment plan or other solution.

When your customer is unable to make a payment or resolve an outstanding amount on the initial call with your organization’s accounts receivable management system, they often request a callback.

Well, Maxyfi offers a Call Back option in its customer portal for customers to reach out easily and discuss their payment plan later.

7. Outbound Email & SMS in Accounts Receivable Management Software

Outbound email and SMS in accounts receivable refers to the practice of sending emails and text messages to customers to remind them of outstanding payments or to convey account information.

Payment due dates,

payment reminders,

account changes,

other account-related information

maybe included in these messages.

Outbound email and SMS can help you manage your accounts receivable process and keep your customers up to date on their invoices.

Maxyfi allows you to configure your business email as well as your SMS gateway credentials, which determine where the email/SMS is delivered from your business account.

8. Customer 360 View

In accounts receivable, a customer 360 view refers to a full, holistic perspective of a customer's financial data, including outstanding invoices, payment history, and creditworthiness. This sort of perspective is critical in the accounts receivable process because it enables organizations to better manage outstanding invoices and make accurate credit and collection choices.

You may gain a detailed picture of your customer's financial status with a customer 360 view and use that information to streamline your accounts receivable process and increase your overall cash flow.

This shows a thorough summary of your

customer's invoices,

due and late payments,

workflow action schedule,

contact information, and so forth.

This allows your company to track and monitor each customer and collect pending payments on time.

9. Real-Time Analytics and Dashboard

A tool that gives an up-to-date picture of your accounts receivable process is real-time analytics and a dashboard in the accounts receivable process.

It lets you analyze and monitor your accounts receivable performance in real-time, giving you insights into customer payment trends, delinquent invoices, and other crucial metrics. The dashboard also displays data visually, allowing you to rapidly discover areas for improvement and take action.

Maxyfi AR CRM provides a powerful and sophisticated dashboard that provides an informative view of

Overdue Summary,

Aging Summary,

DSO,

Needs Action,

Top Debtors,

Customer Segmented view

of the phases of collection, they are in.

Final thoughts: Maxyfi Accounts Receivable Automation Software

You may now understand how to easily eliminate manual errors and delays while increasing and expanding your company's cash flow and productivity. If anything is still holding you back, give it a free trial.

You can easily learn the magic of accounts receivable automation by reading the Maxyfi blogs.

#accounts receivable software#accounts receivable process#accounts receivable automation#debt collection software#accounts receivable automation software#accounts receivable platform#AR management software#best accounts receivable software#accounts receivable management software#debt collection system#accounts receivable management system#debt collection management system#best accounts receivable automation software#accounts receivable roi calculator#quickbooks invoice reminders#quickbooks automatic invoice reminders#invoice dispute management#ai powered ar automation#accounts receivable metrics#collection effectiveness index

0 notes

Text

When he told the people around him about filing a lawsuit, Rensburg said he received a lot of support. "Many lawyers decided to join us in the lawsuit. Many of those who have joined are Muslims, but I am not. They feel obligated to assist this cause, but I believe that what is happening is incorrect."

What happened in Iraq is an example of this, he said, noting that no one held the US accountable for the crimes it committed in the Middle Eastern country as the issue was not given the necessary importance.But now people believe what is happening in Palestine is an ideal scenario for the legal process to be carried out, the South African lawyer said, adding that "the US is busy spending more money and more resources to (allow Israel) commit the crime.”

“No one says stop, enough is enough," he remarked.

Rensburg said the genocide case filed by South Africa against Israel at the ICJ will serve as a guide for their case against the US and UK, and that they will begin the process based on the outcome of the case and the steps to be taken by the United Nations.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#south africa#icj hearing#icj#joe biden#rishi sunak#endisraelsgenocide#gaza genocide

14K notes

·

View notes

Text

How automation in AP works and how it can improve your accounting process

Accounts Payable is one of the most vital processes across industries. The amount of time organizations take to manage the workflow due to multiple data points, sources of information, multiple invoice formats, and touchpoints can be massive. Automating the entire process can help streamline the process by leveraging business intelligence. Further, it reduces the time for receiving, processing and paying invoices by identifying the critical information and eliminating manual tasks.

An average business has 24% of its monthly revenue held up in terms of trade credit in the US. Consequently, it offers a huge opportunity to utilize smarter processing solutions to keep accounts payable updated. Automating the AP processes with an IDP solution can be beneficial here.

This article will give an overview of how automation in AP works and how it can improve your accounting process. So without waiting further, let’s delve into it.

Accounts Payable cycle – The lifeline of business operations

In simple terms, Accounts Payable are the records of financial transactions that contain detailed information regarding a company’s purchases. This department deals with orders, invoices, and other checks regularly to record the financial liabilities of a company.

Usually, a standard AP process has some basic workflow — identifying all the vendors and determining their payment terms aligning with the purchase orders. After fulfilling the purchase orders and receipt of invoices, the accounts department then makes the payments according to the agreed timeline. However, the entire process is often manual, making it prone to errors. Further, it may need more critical information and consistency in document formats or sources, making the process inadequate for auditing.

Automating your AP process might be the key to all these issues. It offers better management of invoices, purchase orders, and other financial documents and makes the entire process smoother.

Why do Finance and Accounts need intelligent automation?

The digital-first ecosystem has made several redundant tasks easier for executives. A business can have data on purchase orders, payment records, accounts payable reconciliations, and vendor information readily available on its system. However, managing the invoices received, usually in unstructured formats, might be a challenge to become efficient. Automating the process can seamlessly increase efficiency, reduce errors, and allow an audit trail with a few clicks. Further, it helps in having holistic insights into the company’s financial transactions without requiring additional manual efforts.

An automated accounts payable is set up by identifying the vendors and tracking accounts that have regular transactions with the company. Next, it needs to index and extract the relevant information from the documents and manage the payments. Companies having a manual system can find the effort tedious and prone to human errors due to multiple stakeholders, layers or permissions, and chances of incorrect inputs. Automating the process makes all of these almost nonexistent and improves the process’s efficiency and accuracy.

How intelligent automation in Accounts Payable works

An automated AP processing solutions uses AI and ML as the core of its system. It leverages several technologies, such as OCR, computer vision, and intelligent document processing, to cut down redundant and manual tasks to make the process seamless.

These technologies can help detect information from multiple documents, digitize them, and extract relevant information according to the companies’ requirements or the preset business rules. Further, it can capture the required data from templateless formats and present it in a coherent way, allowing automation of the entire process without requiring human intervention.

DocVu.AI, a leading enterprise-grade intelligent document processing, helps you simplify your accounts payable process in a few steps. These are:

Pre-processing of documents – Selection and classification of documents according to multiple attributes.

Data extraction – Extraction of relevant information into electronic form according to the data fields and importing them into the processing system using automation to reduce human errors.

Data validation and Quality Checks – Reviewing and rechecking the extracted data for accuracy and validating them for recapturing missing data fields or further processing.

Ideal AP automation system requirements

Automating your accounts payable system helps businesses manage the entire process without any human intervention, resulting in more accurate and efficient settlements of accounts. It considers multiple document formats across vendors and leverages an intelligent machine-learning model to understand the data points better to extract relevant information. Further, it makes the entire process extremely fast as multiple to and fro between stakeholders becomes less and requires no manual cross-checks for errors.

DocVu.AI helps companies leverage their document processing system to become flexible and scale their invoice processing as needed. It offers straight-through processing of accounts payable with customized business rules engines to offer bulk processing of documents with greater efficiency.

In Conclusion

In a world that is fast adopting tech-based solutions, it is prudent to explore certain advancements and realign business processes according to your requirements. Realizing the need for automation in processing your accounts payable can be one such necessary transformation. Automating AP using an IDP solution helps you save time, improve efficiency, and offer more accurate processing without multiple approvals due to the embedded machine learning models.

If you are looking to consider IDP implementation to streamline your accounts payable process. Contact us today to learn more and schedule a demo. https://www.docvu.ai/industry/finance-accounting/

#automation#intelligent document processing#document processing#mortgage processing#idp#mortgage#accounts payable#accounts receivable management services

0 notes

Text

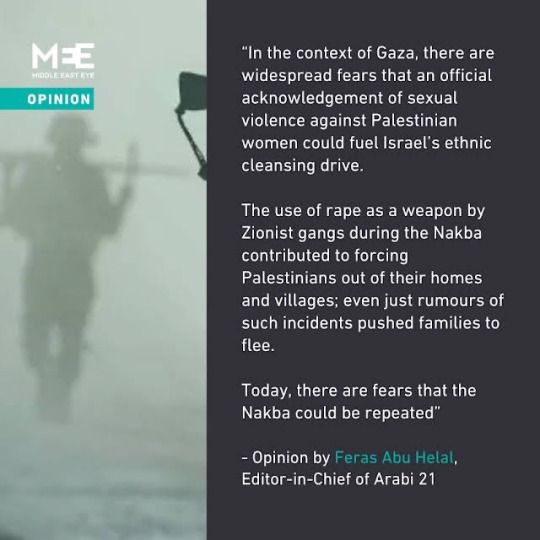

“Since the 7 October attacks, Israel has repeatedly accused Hamas of committing sexual violence during its incursion. Many mainstream western media outlets have paid considerable attention to these allegations, despite a lack of concrete evidence. But while reporters must always take such accusations seriously, it is equally important for them to uphold journalistic standards in the process - and there appear to have been serious lapses in that regard.

At the same time, allegations involving Palestinian women in Gaza have received far less airtime.

Despite a UN report citing testimonies from Palestinians who said they were sexually assaulted and beaten while in Israeli detention, the mainstream western media has failed to give this issue much attention.

In addition to the UN report, there are many documented cases of Palestinian women who described sexual abuse at the hands of Israeli forces. Detainees reported being stripped to their underwear, beaten, searched and threatened with rape. Despite all the documented cases of sexual assault, however, Israel has used a single incident to refute them all. After Al Jazeera recently covered an alleged eyewitness account of the rape of a Palestinian woman by Israeli forces at al-Shifa hospital, the network backtracked upon learning the claims were fabricated, with a former managing director saying the woman had misled people “to provoke an emotional response”. After the report was debunked, Israeli Foreign Minister Israel Katz suggested that the UN was wrong to take any such reports seriously. This is a dangerous position, considering that the UN and other human rights groups have recorded myriad other incidents of sexual assault and humiliating treatment of Palestinian women by Israeli soldiers. All of this has left us in a situation where Israel, despite being accused of sexual violence in the ongoing war on Gaza, continues to benefit from the silence of mainstream western media - and sometimes the silence of the victims themselves.”

By - Feras Abu Helal

#free Palestine#free gaza#I stand with Palestine#Gaza#Palestine#Gazaunderattack#Palestinian Genocide#Gaza Genocide#end the occupation#Israel is an illegal occupier#Israel is committing genocide#Israel is committing war crimes#Israel is a terrorist state#Israel is a war criminal#Israel is an apartheid state#Israel is evil#Israeli war crimes#Israeli terrorism#IOF Terrorism#Israel kills children#Israel kills innocents#Israel is a murder state#Israeli Terrorists#Israeli war criminals#Boycott Israel#end Israeli terror#end Israeli occupation#end Israeli apartheid#Israel is a genocidal state#free Palestine 🇵🇸

3K notes

·

View notes

Link

With the diverse array of technology and services available in 2022, there’s no reason you should watch your clients make money while your revenue stream stays flat. Whether you use white label accounting services, discover ways your clients can save money, or rebuild their entire financial structure, there are plenty of ways to improve profitability.

#outsourcing accounting#finance accounting service#customized accounting#account bookkeeping#business bookkeeping#basic bookkeeping#bookkeeping for accountants#small and medium business#accounts payable outsourcing services#accounts payable services#account payable process#accounts receivable outsourcing#accounts receivable management services#financial statement preparation#fiscal year accounting#year end accounting#outsourced tax preparation#tax preparation services#tax return preparation#white label service#cpa bookkeeping#certified accounting#white label partner#outsourcing bookkeeping services#cpa accounting

0 notes

Photo

Quality, Precise, Virtual QuickBooks Services for your Company! Reduce your Overhead TODAY by 50%.

We specialize in Virtual QuickBooks Bookkeeping and tailor our services to fit your company’s specific needs.

Our Virtual Bookkeeping Services are here to help you with:

Recording Financial Transactions

Accounts Payable Management

Accounts Receivable Management

Financial and Managerial reports

Inventory/Stock Management

Budgeting and Forecasting

Financial and Analytical support

Payroll Processing

Interested in getting a quote from us? Please fill up this short form to help us achieve an understanding of your requirement.

#Recording Financial Transactions#Accounts Payable Management#Accounts Receivable Management#Financial and Managerial reports#Inventory/Stock Management#Budgeting and Forecasting#Financial and Analytical support#Payroll Processing#vocisinc

0 notes