Text

Take a step ahead: Improve Document Processing Automation efficiency with IDP

From banking, insurance, and retail, document processing is a big part of today’s operations. These industries deal with a massive amount of physical documents that often lead to redundant operations and human errors if the processes are manual. Consequently, addressing these issues becomes crucial to improve accuracy and speed, with a lower cost of operations. Intelligent document processing helps you meet these internal priorities and enables your business to stay ahead of the competition and offer exceptional customer experience.

Automation in document processing is not only an attractive direction to improve existing operations; it has now become one of the primary requirements for businesses. However, you need to consider these five critical aspects for maximum benefit.

Clarity of your processes and goals

Selecting the right IDP for a specific process will result in a more optimized operation. While a technological adaptation is essential, domain expertise of the technology will make the project successful. The lack of appropriate planning and understanding of the alignment of your document processing needs will lead to the selection of IDPs that are not suited to handle your unique document processing needs.

Your Automation vision

Your automation plan should consider operational, tactical, and strategic aspects according to your objectives. IDPs can reduce costs and help improve customer satisfaction and win rates. It offers a better insight into your operations’ pain points that affect the customer satisfaction rate, leading to a better assessment of automation.

Using IDPs for the core functionality of document classification and data extraction will lead to limited benefits. Identify how you can minimize human touchpoints by integrating your applications with IDPs, having validation rules specific to your process needs, and designing a ‘Human in the Loop’ process to monitor, review and approve. Another aspect you should consider is identifying all areas where IDPs can be used to simplify as many operations as you can.

Your team’s support

While this aspect is often overlooked, IDPs do not eliminate humans; it simply enables them to become more efficient. However, humans must review and approve the processes requiring critical attention. Automation in document processing can bring a lot of anxiety into your teams, which can compromise the success of your initiatives. Being open and transparent with a plan to upskill the existing teams for better evaluation and utilization of your automation will help you to improve their confidence and increase support toward efficient operations.

Collaboration with the IDP team

Another aspect often overlooked is the alignment of your IT and operations teams with the IDP teams. These three stakeholders must work together to implement the IDP and harness the maximum impact. The plan should be clear with deliverables and tasks that can be measured daily. This will ensure that everyone contributes to the implementation without delays or cutting corners. A good implementation plan is a must to enable this.

Know your metrics

Once the IDP is implemented, knowing the metrics that are important for you, what the current state is, and what needs to be done to move towards attaining your business goal is crucial. Your IDP dashboard should have most of these metrics to help you with the numbers at a glance. However, knowing what numbers to track and measure will take new initiatives to improve the performance of your IDP strategy.

Training model

The AI and ML engines in IDPs make them better than OCRs by making them more intelligent and adaptive toward document processing requirements by recording information in a templateless format. However, it is crucial to understand the principles of AI and ML engines and how they are implemented according to your business needs. However, it also depends on the IDP selected, based on whether the AI and ML engines might require a month’s training or are pre-trained. This can have an impact on your go-live dates.

The good thing is that ML engines get better with time because they learn and adapt. For this to happen, the focus should be on designing the human in the loop and machine learning loops, as we don’t want unwanted inputs to be considered by the ML engine for training, and also, we don’t want valid inputs to be missed.

Wrapping Up

Implementing document processing automation for simplifying your processes can be a worthwhile investment. However, to make the initiative successful, you need to have a robust strategy to align your processes and objectives with your team, and deploy the right solution for them. It makes the use of automation more convenient and offers greater opportunity to optimize your operations.

DocVu.AI’s enterprise-level document processing solution makes your operations faster. To know more about the full capabilities of DocVu.AI, visit our website or write to us at [email protected].

0 notes

Text

Invoice Automation Partner To Accelerate Invoice Processing

Effective invoice processing is crucial for modern businesses to ensure financial management. It involves various intricate and time-consuming tasks that demand additional workforce and technology. These tasks comprise capturing invoice data, validating the information, and recording the specifics in financial systems.

The invoice processing procedure can become more complex, especially when dealing with high volumes of invoices, which not only requires expertise but also meticulous attention to ensure accuracy and regulatory compliance.

One solution is to have an in-house intelligent invoice processing system. But, having an in-house intelligent invoice processing system can be more complicated for various reasons, including the need for extensive infrastructure, specialized skills, and continuous maintenance costs. Additionally, it can also divert the company’s focus on core business operations.

The other option is to outsource the invoice processes. Outsourcing the entire invoice processing procedure to a third-party vendor can be a more efficient and cost-effective solution. The vendor can bring their expertise, technology, and experience to the table, streamlining the process and ensuring regulatory compliance. This also eliminates the need for the company to invest in extensive infrastructure and specialized skills, allowing them to focus on their fundamental business. Outsourcing the entire process can assist businesses in enhancing efficiency without incurring additional expenses.

Why Businesses Should Consider Outsourcing Invoice Processing?

Running a business is a challenging task that requires attention to various aspects such as marketing, sales, product development, manufacturing, and operations. However, one crucial area that often gets overlooked is invoice processing, which can be a time-consuming and complex task.

Failure to pay due attention to invoice processing can be a huge mistake, resulting in delayed payments, damaged vendor relationships, and financial penalties. Fortunately, businesses can turn to invoice outsourcing as a solution.

1. Save Time and Energy

Time is valuable for any business owner or manager, and invoice processing can consume a lot of this resource. By outsourcing this task to a qualified provider, businesses can free up valuable time and energy to focus on other areas of their operations.

Outsourcing invoice processing alleviates the burden of managing this task, increases productivity, and potentially boosts profits. With more time for strategic initiatives, businesses can identify new opportunities, improve customer satisfaction, and strengthen relationships with vendors and stakeholders.

2. Process Invoices Accurately and on Time

Outsourcing of invoice processing ensures that your vendor invoices are processed accurately and promptly. Invoice processing service providers typically have experienced professionals who handle this work efficiently and while implementing quality control measures to guarantee accuracy. Therefore, outsourcing your invoice processing is the way to go if you want to eliminate errors and delays.

Moreover, outsourcing of invoice processing also helps you get your invoices processed faster through access to technology and resources. Therefore, an invoice processing service can greatly assist you if you need your invoices processed urgently.

3. Save Money by Reducing the need for In-house Staff

If you process your invoices in-house, you may find that your accounting and administrative costs increase due to additional staff and infrastructure requirement. However, by outsourcing this task to a provider with expertise in invoice processing, you can reduce costs by up to 50%.

While you won’t need to hire and train additional staff to handle this task; you may also reduce your requirement of other support staff. With these savings, you can redirect your resources to other critical business areas, such as product development or marketing.

4. Streamline And Simplify Your Workflow

Outsourcing invoice processing to a specialized team simplifies your business operations, leading to smoother transactions and more efficient financial management. This results in a hassle-free payment process for your vendors while you enjoy streamlined bookkeeping and accounting tasks. By eliminating unnecessary steps in the invoicing process, you save valuable time and effort and gain better control over your finances.

5. Help you Stay Organized and In Control of Your Finances

Outsourcing invoice processing gives you access to valuable tools and resources that simplify your financial management. For instance, reputable providers typically use software solutions that help you track your invoices and payments efficiently. Furthermore, invoice processing companies often offer online portals that allow you to monitor your vendor invoices and manage your bank accounts more effectively. These portals enable you to stay informed and in control of your financial data, which helps you make better business decisions.

6. Maximize ROI by Outsourcing Complex Tasks

For small to medium-sized businesses, achieving a positive return on investment (ROI) in their day-to-day operations is challenging. However, outsourcing this task to a qualified company provides numerous benefits and a greater potential for profitability. By leveraging the expertise and resources of an experienced provider, businesses optimize their ROI, operate more efficiently, and achieve greater success.

7. Gain Access to Expertise and Resources

Outsourcing invoice processing is an effective way for businesses to access specialized knowledge and resources they may not have in-house. This helps to level the playing field and allows smaller businesses to compete with larger enterprises.

Working with a team of experienced professionals who understand the nuances of invoice processing is a significant advantage. They provide valuable insights and best practices to help ensure vendor invoices are processed accurately and efficiently, allowing you to focus on other critical business areas.

Criteria for Evaluating an Outsourcing Partner

So you’re considering outsourcing, which is great! It can definitely help save your money and improve efficiency. But with so many options, knowing who to trust with your critical business functions can be tough.

You want to find an outsourcing partner that can hit the ground running in just a few weeks and has the experience, skills, and knowledge to handle your needs. Of course, you also need them to be reliable, affordable, and trustworthy. It’s a lot to consider, but finding the right partner can make all the difference!

When evaluating your outsourcing partner, your primary focus is the vendor’s ability to meet your requirements. Below are some of the criteria you should consider.

While identifying the reputation of the outsourcing partner, businesses should consider:

Experience and expertise in invoice processing operations

Industry knowledge and understanding of business requirements

Track record of quality performance and customer satisfaction

Scalability and flexibility to meet evolving business needs

Availability of advanced technology and automation capabilities

Competitive pricing and cost savings

Compliance with regulatory requirements and data security standards

Communication and Collaboration are critical factors in selecting an outsourcing partner as it ensures business requirements are met, and expectations are managed. Collaboration between the business and the outsourcing partner can also help identify improvement areas and optimize invoice processing operations. Identifying the tech solution needs to consider the following factors:

Integration capabilities with existing software and systems

Ability to extract data from various invoice formats

Accuracy and speed of data extraction and processing

Customization options to meet unique business needs

User-friendliness and ease of use

Availability of support and training resources

Looking for an IDP solution that ticks all the right boxes? Look no further than DocVu.AI! With DocVu.AI, you’ll get all the features to streamline your invoice processing without sacrificing speed or accuracy. Plus, you’ll stay on top of all the latest regulatory requirements, ensuring compliance every step of the way.

The best part? DocVu.AI offers unparalleled experience, expertise, scalability, flexibility, and compliance criteria. So why wait? Choose DocVu.AI for all your invoice processing needs today!

But how and why is DocVu.AI the best invoice processing outsourcing partner? Here are a few of the benefits and capabilities of DocVu.AI to affirm that it is the right outsourcing partner.

Benefits – Drive a More Efficient Invoicing Process with DocVu.AI

Breakdown silos with seamless integration

DocVu.AI understands the importance of seamless integration with your business-critical systems. That’s why we offer pre-packaged connectors and APIs that allow you to connect to your workflows and data easily. With our software, you integrate with any ERP system effortlessly and use our standard connectors for popular brands such as Microsoft Dynamics, SAP 4/HANA, Coup, NetSuite, and Oracle® EBS. You trust us to ensure your invoice processing is integrated smoothly and efficiently with your existing systems.

Automate Document Processing with AI

DocVu.AI offers an AI-powered solution that digitizes, classifies, and extracts data from invoices in real-time. Our purpose-built AI can handle structured and unstructured invoice data, making it easy to process multi-page invoices and large batches quickly and accurately.

Future proof your business and AP functions

DocVu.AI empowers your accounts payable function with critical business insights promptly. By automating your invoice processing, we accelerate the flow of information and provide you with the necessary data to make informed decisions about your cash management, working capital management, and overall business health. Our intelligent platform leverages real-time data extraction and classification, enabling you to access the insights you need to drive strategic decision-making easily. With DocVu.AI, you can say goodbye to slow, manual processing and hello to streamlined and informed decision-making.

Capabilities – World-Class Invoice Automation

Organizations that work like tomorrow use DocVu.AI intelligent automation to transform their invoicing process outsourcing and realize best-in-class performance.

Multi-Channel Invoice Capture

DocVu.AI handles invoices coming from various channels, including XML format, scanned documents, paper-based invoices, and PDF files. No matter how your suppliers choose to send their data, we’ve got you covered with our advanced AI-powered solution. We’ll process your invoices quickly and accurately, regardless of the format, so you can focus on running your business.

Purpose-Built AI

DocVu.AI uses AI to emulate human thinking and problem-solving. This allows our platform to understand various invoice layouts and locate the necessary information, regardless of the format the data is in.

Electronic Invoicing

DocVu.AI helps you keep up with the increasing demand to adopt electronic invoicing in compliance with global mandates. Our solution is designed to support the processing of both structured and unstructured data in any format, including electronic invoices.

Workflow Automation

DocVu.AI handles your approval workflows and exceptions seamlessly with our intelligent automation. It automatically routes exceptions for review while keeping a detailed data trail of all handoffs between people and automation. This ensures that your approval workflows are managed efficiently and effectively without any manual intervention required.

KPI/SLA Management

DocVu.AI provides you with the ability to track and manage key performance indicators (KPIs) and service level agreements (SLAs) associated with your invoicing process. By doing so, you gain valuable insight into how work is being done, where money is being spent, and why. With DocVu.AI, you’ll have the tools you need to optimize your invoicing process and improve overall business performance.

ERP Integration

DocVu.AI offers out-of-the-box integration to seamlessly route validated data into your existing ERP systems. This integration not only saves you time and effort but it also positively impacts your ROI without requiring expensive custom integration projects. With DocVu.AI, you easily and efficiently integrate your invoice processing with your existing systems, allowing you to focus on driving business success.

0 notes

Text

Is Your Finance and Accounting Function Missing Out on the Power of Unstructured Data?

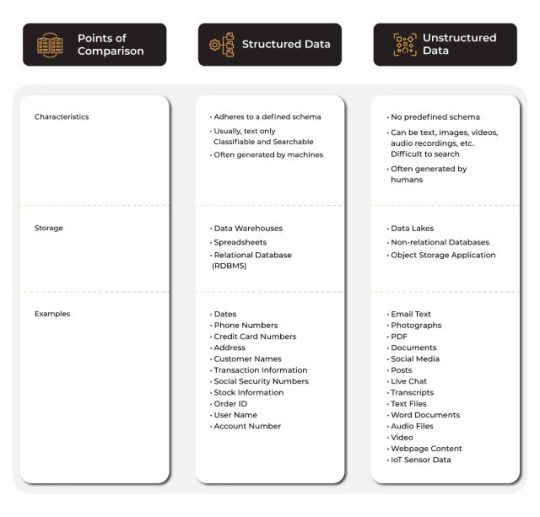

Documents are integral to key business processes, and enterprises have traditionally relied on knowledge workers to manually process documents or use fragmented automation tools/scripts. Research indicates that approximately 80% to 90% of the data generated and collected by companies is unstructured, lacking clear organization or formatting. This unstructured data, often referred to as “dark data,” presents a challenge as machines struggle to read or understand it due to the absence of identifiable patterns.

Within this untapped data lies transformative potential. While structured data provides insights into what is happening, unstructured data reveals why. It plays a crucial role in driving predictive capabilities, end-to-end automation, and the advancement of commercialized AI.

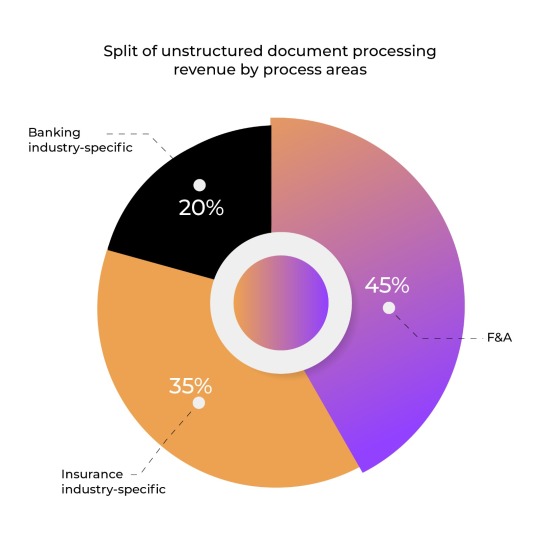

Among the various functions, Finance and Accounting contributes the highest revenue in processing unstructured data, i.e. 45%, which indicates the need to process unstructured data efficiently in the Finance and Accounting function.

But there is a problem…

In most organizations, manual effort is often required to parse and capture data from unstructured documents for further processing or deriving actionable insights. These manual processes are time-consuming and error-prone, and hence impact processing time and associated costs.

To address these challenges, many organizations have implemented their own solutions, relying on internal legacy applications for data entry. However, these applications often suffer from poor user experience, slow performance, and lengthy update cycles, negatively impacting employee experience. This impact is particularly pronounced in customer-facing processes, where longer turnaround times also affect the customer experience.

Due to the limitations of traditional capture solutions, which are ill-suited for semi-structured and unstructured documents, a significant portion of the document volume remains unprocessed. The inability to convert documents into a structured format restricts the value of automation tools like RPA, which require data in a structured and defined format for subsequent task automation. As a result, document-centric processes fall outside the scope of automation initiatives, leading to limited value realization.

So, how can enterprises address the processing of unstructured data?

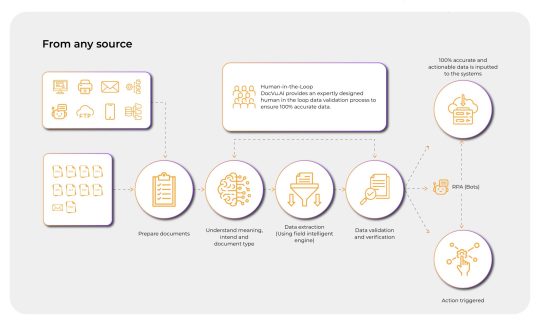

These challenges have given rise to AI-enabled document processing solutions, known as IDP solutions. These solutions extract relevant data from documents and convert it into a structured format that can be easily fed into downstream applications such as Enterprise Resource Planning (ERP) and other transactional systems. IDP solutions can automate the processing of various documents, offering greater speed and accuracy compared to traditional approaches.

The Role of IDP in Processing Unstructured Data

IDP refers to the use of software products or solutions to capture data from documents (such as emails, text, PDFs, and scanned documents), understand the intent, categorize, and extract relevant data for further processing.

Through intelligent algorithms, IDP accurately captures essential information from documents, such as vendor details, invoice amounts, payment terms, and transaction dates. The extracted data is transformed into a structured format, facilitating integration with financial systems and databases. This structured data enables organizations to streamline accounts payable, accounts receivable, and financial reporting processes. It also allows for better analysis, forecasting, and decision-making by providing comprehensive and organized financial insights.

By employing IDP in the Finance and Accounting function, organizations can achieve greater efficiency, reduce manual errors, and improve compliance. It saves valuable time and resources that would otherwise be spent on manual data entry and extraction. Moreover, IDP enhances data accuracy and auditability, enabling organizations to gain deeper insights into financial trends and patterns.

Selecting the Best IDP Solution for Your Business

Enter DocVu.AI. As a leading IDP solution, DocVu.AI revolutionizes the way organizations handle unstructured data. By seamlessly integrating into Finance and Accounting workflows, DocVu.AI offers a comprehensive suite of features designed to capture, categorize, and extract relevant data from a wide range of documents, including emails, text files, PDFs, and scanned documents.

With advanced AI capabilities, DocVu.AI simplifies the extraction of actionable data from various unstructured documents such as invoices, receipts, financial statements, and contracts. It goes beyond simple optical character recognition (OCR) to understand the intent of the content and categorize and extract relevant data with remarkable accuracy.

End to End Automated IDP Workflow

The platform employs intelligent algorithms to identify and capture essential information from documents, including critical financial details like vendor names, invoice amounts, payment terms, and transaction dates. This eliminates the need for manual data entry and significantly reduces errors, saving valuable time and resources for finance and accounting professionals.

DocVu.AI then transforms the extracted data into a structured format that seamlessly integrates with financial systems and databases. This structured data can be easily processed and analyzed, enabling organizations to automate accounts payable and accounts receivable processes, generate accurate financial reports, and make informed decisions based on comprehensive insights.

By utilizing DocVu.AI, the Finance and Accounting function can enhance efficiency, improve data accuracy, and ensure compliance with regulations. The platform empowers finance professionals to rapidly extract actionable data from unstructured documents, enabling faster decision-making, improved forecasting, and a deeper understanding of financial trends and patterns.

With its advanced capabilities and user-friendly interface, DocVu.AI is a game-changer for the Finance and Accounting function, streamlining processes, optimizing resource utilization, and unlocking the true value from unstructured data.

Why wait then?

Discover the transformative capabilities of DocVu.AI and unlock the value of unstructured data in your Finance and Accounting processes. Schedule a demo or contact us to learn more about how DocVu.AI can revolutionize your document processing.

0 notes

Text

Unleash the Future of Mortgage Servicing with DocVu.AI

Mortgage Servicing can be a daunting and tedious process, given the vast array of tasks ranging from loan administration to managing defaults. At its core, mortgage servicing is an intricate undertaking that involves monitoring various aspects such as loan terms, interest rates, and any changes in the loan agreement over time. It is about ensuring that borrowers and lenders remain on the same page throughout the life of the loan, which, in itself, is a challenging task.

When there is a substantial volume of loans under management, the data involved in mortgage servicing can be huge. This includes a comprehensive spectrum of borrower details, ranging from their names and contact information, to their financial histories. Handling a high volume of loan details also requires inputting and validating extensive data including loan terms and payment records. Manually processing all this data is not only time-consuming but also susceptible to errors.

The Challenges of Traditional Manual Mortgage Servicing

Servicing requires meticulous attention to detail, swift response times, and an unwavering commitment to accuracy. The challenges of adhering to these principles when relying solely on manual operations are evident. Every task, from inputting borrower information to managing payment records, is subjected to the limitations of human capacity and the relentless pace of the digital era. In this context, automation emerges as a game-changer, offering a transformative shift to a world – a realm where efficiency meets precision!

The Power of Automation in Mortgage Servicing

Automated solutions, driven by cutting-edge technologies such as Artificial Intelligence and Machine Learning, not only alleviate the labor-intensive burden of manual work but also elevate the level of accuracy, enabling mortgage servicers to navigate the dynamic landscape of the modern financial industry with confidence and excellence.

The widespread use of the mortgage servicing domain requires tools that can handle bulk Mortgage Servicing Rights (MSR) processes, quickly evaluate and establish early stage defaults or loss mitigation strategies, and even assist in the often complex and multifaceted realm of foreclosure servicing. Automation in this space isn’t just about speed; it’s about ensuring a seamless, accurate, and enhanced service experience for all stakeholders involved.

DocVu.AI: A Paradigm Shift in Mortgage Servicing

DocVu.AI emerges as a trendsetter offering an Intelligent Document Processing (IDP) Solution tailored for mortgage servicing clients. Let’s dive deep into how DocVu.AI is rewriting the rules and transforming the industry:

High Accuracy and Speed: The software employs advanced algorithms that can swiftly scan, read, and interpret documents. It reduces the chance of human errors, ensuring that every piece of information, no matter how minute, is captured correctly.

Bulk MSR Automation: Managing Mortgage Servicing Rights in bulk can be overwhelming. DocVu.AI’s system is built to handle high volumes of data, streamlining processes and ensuring every right is recorded, managed, and serviced effectively.

Early Stage Default and Loss Mitigation: Recognizing potential defaults at an early stage can be a game-changer. DocVu.AI’s predictive analytic tools help in proactive identification, allowing for timely interventions and loss mitigation strategies, saving both time and money.

Foreclosure Servicing Assistance: Navigating foreclosures requires tact, accuracy, and efficiency. DocVu.AI simplifies this intricate process, ensuring all relevant documents are in order and regulatory compliances are met.

Integration Capabilities: The power of DocVu.AI is further amplified by its ability to seamlessly integrate with existing systems, ensuring a smooth transition, and enhancing the existing tech ecosystem.

The Way Ahead

As the mortgage industry continues to evolve, so does the need for innovative solutions that not only meet the challenges of today but also anticipate those of tomorrow. DocVu.AI stands as a testament to how automation, when implemented correctly, can revolutionize even the most complex of industries. For mortgage servicing clients, this translates to improved efficiency, reduced errors, and an overall streamlined process that brings value to businesses and their customers alike.

0 notes

Text

How automation in AP works and how it can improve your accounting process

Accounts Payable is one of the most vital processes across industries. The amount of time organizations take to manage the workflow due to multiple data points, sources of information, multiple invoice formats, and touchpoints can be massive. Automating the entire process can help streamline the process by leveraging business intelligence. Further, it reduces the time for receiving, processing and paying invoices by identifying the critical information and eliminating manual tasks.

An average business has 24% of its monthly revenue held up in terms of trade credit in the US. Consequently, it offers a huge opportunity to utilize smarter processing solutions to keep accounts payable updated. Automating the AP processes with an IDP solution can be beneficial here.

This article will give an overview of how automation in AP works and how it can improve your accounting process. So without waiting further, let’s delve into it.

Accounts Payable cycle – The lifeline of business operations

In simple terms, Accounts Payable are the records of financial transactions that contain detailed information regarding a company’s purchases. This department deals with orders, invoices, and other checks regularly to record the financial liabilities of a company.

Usually, a standard AP process has some basic workflow — identifying all the vendors and determining their payment terms aligning with the purchase orders. After fulfilling the purchase orders and receipt of invoices, the accounts department then makes the payments according to the agreed timeline. However, the entire process is often manual, making it prone to errors. Further, it may need more critical information and consistency in document formats or sources, making the process inadequate for auditing.

Automating your AP process might be the key to all these issues. It offers better management of invoices, purchase orders, and other financial documents and makes the entire process smoother.

Why do Finance and Accounts need intelligent automation?

The digital-first ecosystem has made several redundant tasks easier for executives. A business can have data on purchase orders, payment records, accounts payable reconciliations, and vendor information readily available on its system. However, managing the invoices received, usually in unstructured formats, might be a challenge to become efficient. Automating the process can seamlessly increase efficiency, reduce errors, and allow an audit trail with a few clicks. Further, it helps in having holistic insights into the company’s financial transactions without requiring additional manual efforts.

An automated accounts payable is set up by identifying the vendors and tracking accounts that have regular transactions with the company. Next, it needs to index and extract the relevant information from the documents and manage the payments. Companies having a manual system can find the effort tedious and prone to human errors due to multiple stakeholders, layers or permissions, and chances of incorrect inputs. Automating the process makes all of these almost nonexistent and improves the process’s efficiency and accuracy.

How intelligent automation in Accounts Payable works

An automated AP processing solutions uses AI and ML as the core of its system. It leverages several technologies, such as OCR, computer vision, and intelligent document processing, to cut down redundant and manual tasks to make the process seamless.

These technologies can help detect information from multiple documents, digitize them, and extract relevant information according to the companies’ requirements or the preset business rules. Further, it can capture the required data from templateless formats and present it in a coherent way, allowing automation of the entire process without requiring human intervention.

DocVu.AI, a leading enterprise-grade intelligent document processing, helps you simplify your accounts payable process in a few steps. These are:

Pre-processing of documents – Selection and classification of documents according to multiple attributes.

Data extraction – Extraction of relevant information into electronic form according to the data fields and importing them into the processing system using automation to reduce human errors.

Data validation and Quality Checks – Reviewing and rechecking the extracted data for accuracy and validating them for recapturing missing data fields or further processing.

Ideal AP automation system requirements

Automating your accounts payable system helps businesses manage the entire process without any human intervention, resulting in more accurate and efficient settlements of accounts. It considers multiple document formats across vendors and leverages an intelligent machine-learning model to understand the data points better to extract relevant information. Further, it makes the entire process extremely fast as multiple to and fro between stakeholders becomes less and requires no manual cross-checks for errors.

DocVu.AI helps companies leverage their document processing system to become flexible and scale their invoice processing as needed. It offers straight-through processing of accounts payable with customized business rules engines to offer bulk processing of documents with greater efficiency.

In Conclusion

In a world that is fast adopting tech-based solutions, it is prudent to explore certain advancements and realign business processes according to your requirements. Realizing the need for automation in processing your accounts payable can be one such necessary transformation. Automating AP using an IDP solution helps you save time, improve efficiency, and offer more accurate processing without multiple approvals due to the embedded machine learning models.

If you are looking to consider IDP implementation to streamline your accounts payable process. Contact us today to learn more and schedule a demo. https://www.docvu.ai/industry/finance-accounting/

#automation#intelligent document processing#document processing#mortgage processing#idp#mortgage#accounts payable#accounts receivable management services

0 notes

Text

Templateless Approach To Intelligent Document Processing

One of the common challenges with most Intelligent Document Processing (IDP) solutions is their reliance on a template-led approach, which typically involves creating and maintaining individual templates for different document types and variations. While templates are effective for processing structured and standardized documents, they can fall short when dealing with documents that have extensive unstructured data. Around 80% to 90% of data is unstructured, lacking clear organization or formatting. This data, often referred to as ‘dark data’, presents a challenge as machines struggle to read or understand it due to the absence of identifiable patterns.

HERE ARE SOME OF THE ISSUES ASSOCIATED WITH TEMPLATE-LED IDP SOLUTIONS:

TEMPLATES DON’T SCALE

Scalability is a critical factor that necessitates a templateless approach to data extraction in intelligent document processing.

While a template-based approach may be suitable for simple and low-volume use cases with minimal document type variation, it becomes impractical when dealing with complex scenarios. For example, automating the auto insurance claims process requires more than just extracting specific data such as name, address, and account number from a standardized claim form. It involves handling a wealth of additional information, such as photos, body shop estimates, and claims adjuster notes. Attempting to cover all possible permutations with templates would require an enormous number of templates, and the system would quickly fail as soon as a new document type is encountered.

To overcome these challenges associated with the template-led approach in IDP solutions, a templateless IDP approach has emerged as a viable solution. Templateless IDP leverages advanced technologies such as machine learning, deep learning, and natural language processing to extract data from identity documents without relying on predefined templates. Instead of using fixed templates, these systems are trained on large datasets to learn different document types’ underlying patterns, structures, and characteristics.

Templateless IDP systems become capable of handling a broader range of document formats, variations, and even previously unseen document types. This approach significantly reduces the need for manual template creation and maintenance, enabling faster implementation and easier scaling across different document types. It empowers organizations to process identity documents more efficiently, leading to improved accuracy and streamlined document processing workflows.

THE BENEFITS OF FOLLOWING A TEMPLATELESS APPROACH TO IDP

In traditional template-based extraction approaches, users often expect some minimal training to make minor template changes. However, the reality is that users need to undergo training for each type of template, which can be a cumbersome process.

To illustrate this, let’s consider an enterprise that deals with hundreds of vendors monthly, each using different versions of invoices. Creating and maintaining templates for this diverse set of invoice documents becomes laborious. The number of consulting hours needed to establish templates for various document types can quickly accumulate, resulting in significant costs. The time and effort involved remain substantial even if the templates are developed internally. Unfortunately, during this ‘pre-automation phase’, enterprises do not yet reap the benefits of automation.

When we extend this example to encompass the range of document types that an enterprise needs to process for its business operations, it becomes evident that a template-led approach significantly prolongs the time required for automation. Furthermore, such an approach becomes relatively expensive when considering the costs associated with creating and maintaining these templates.

It is evident that adopting a ‘templateless approach’ in IDP can lead to a significant reduction in the Total Cost of Ownership (TCO) for the solution and enable faster time-to-automation. With this approach, there is no need to wait for an extended period solely for template creation without experiencing any real document automation. By relying on content rather than templates for extraction, minor changes in document structure require minimal or no training.

The processing of a similar set of documents with variations can be automated by utilizing a single document definition and ontology. We estimate a 30% to 70% reduction in setup time for defining a document (e.g., an invoice document) compared to the process of setting up a template for a specific document type and version in competing products that employ a template-led approach. This not only allows enterprises to start benefiting from document automation through IDP more quickly but also allows them to allocate the time and effort saved from creating numerous templates to more strategic and higher-priority tasks. Additionally, there are cost savings when professional services charges are involved.

Furthermore, the advantage of not having to create a new template for minor changes in a document that was previously processed using an existing template adds to the benefits. This eliminates the need for redundant template creation and streamlines the document automation process.

GET UP AND RUN FASTER WITH A UNIQUE, TEMPLATELESS APPROACH

The templateless approach provided by DocVu.AI offers significant benefits, including a major reduction in set-up time and faster time-to-automation, compared to several competing IDP products. By adopting DocVu.AI, businesses can avoid creating and managing numerous document templates, which helps lower the Total Cost of Ownership (TCO) and accelerates time-to-value.

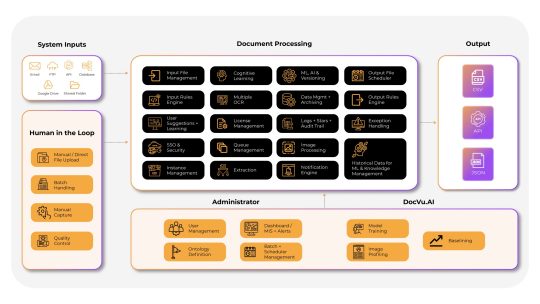

DocVu.AI Solution Architecture

AI/ML-enabled: DocVu.AI leverages advanced AI/ML capabilities and pre-built business rules to enable automated verification and validation of data, resulting in a higher percentage of Straight-Through Processing (STP) and improved accuracy in document processing. The solution continuously learns and improves through AI/ML algorithms and user inputs.

Scalability and flexibility: DocVu.AI offers enhanced flexibility and scalability. It is designed to be horizontally scalable, making it suitable for cloud deployment. Depending on your organization’s specific requirements, it can be utilized as a SaaS or deployed on-premises.

Business User focused: DocVu.AI provides an intuitive user experience tailored for business users. The easy-to-use Configurator and compelling UI allow business users to quickly achieve document automation. The solution offers browser-based access, ensuring faster document processing and a seamless user experience.

Seamless Integration: DocVu.AI seamlessly integrates with leading RPA products and other APIs, enabling end-to-end automation. By combining the power of RPA and IDP, unstructured data from documents can be ingested and converted into structured data, streamlining the automation process and enhancing overall efficiency.

EXPANDING TO INTELLIGENT AUTOMATION:

THE CASE OF A MAJOR US BANK

In reality, users are adopting a combination of process- and data-driven approaches to achieve end-to-end process automation. By combining RPA and IDP, users can address both the “doing/execution” and “thinking” aspects of document processing.

An excellent example of this approach is a US bank that needed to digitize 30 million documents while acquiring six smaller banks. By leveraging a combination of RPA, IDP, and AI/ML tools, the bank successfully digitized, indexed, summarized, and classified these millions of documents in approximately six weeks. This automation effort resulted in a 50% reduction in operating expenses (OpEx) while achieving an auto-classification accuracy of 98%. The tangible business impact of this automation is evident, highlighting how such complex use cases cannot be effectively handled using fragmented or isolated automation approaches.

By adopting a mix of process- and data-driven automation, organizations can optimize their operations, achieve significant cost savings, and enhance accuracy and efficiency in handling large volumes of documents. This approach allows for a comprehensive and integrated solution that tackles the various aspects of document processing and empowers users to achieve end-to-end automation effectively.

Take the leap towards streamlined operations, enhanced efficiency, and increased productivity. Contact us today and embark on a transformative journey with DocVu.AI.

0 notes

Text

Streamlining Finance and Accounting for CFOs – Championing Future Opportunities

Introduction

As a CFO, you are at the forefront of driving financial success and shaping your organization’s future. However, your responsibilities in handling various functionalities and overseeing daily operations often consume more time than you can spare from focusing on the holistic growth of your organization. Additionally, outdated workflows with manual validation or approval processes lead to delays in managing cash flow or creating robust financial plans. Therefore, enhancing the efficiency of the entire Finance and Accounting functionality, including O2C, P2P, R2R, and FPA, becomes crucial for you to champion future opportunities (CFO).

Adopting cutting-edge technologies is imperative to pursuing growth, efficiency, and improved financial management. One such solution that has revolutionized document management and processing is Intelligent Document Processing (IDP). This article will explore how DocVu.AI, an IDP solution, can free up your time and enable you to drive cost savings, improve efficiency, foster growth, enhance environmental, social, and governance (ESG) efforts, and elevate financial management tasks.

Create Wealth for Stakeholders

As a CFO, staying ahead of the game can be a constant challenge. The business landscape is rapidly changing, and your time and resource demands are ever-increasing. It’s critical that you have the time to ensure that your organization can show long-term growth and create wealth for all stakeholders.

With DocVu.AI, you can automate your Finance and Accounting functions, freeing your time to focus on strategic initiatives that drive growth and create future opportunities. Our AI-powered solution ensures compliance, improves efficiency, and saves costs, allowing you to stay ahead of the curve and make data-driven decisions. Let DocVu.AI be your partner in Championing Future Opportunities (CFO)!

Navigate Economic Uncertainties

You have a lot on your plate in your role as a CFO, especially during times of economic uncertainty. That’s why you deserve that additional time to focus on strategic initiatives. At the same time, it’s also imperative that your Finance and Accounting functions keep operating efficiently, error-free, and cost-effectively.

Let DocVu.AI automate your routine Finance and Accounting transactions and support you in saving costs and improving efficiency while also ensuring compliance. This shall surely and certainly give you that extra time to navigate the business into the future and reinforce you in Championing Future Opportunities (CFO)!

Foster New Initiatives

As a CFO, you play a vital role in driving growth and innovation in your organization. But with increasing demands and limited time, it can be challenging to focus on new initiatives that can propel your company forward. That’s where DocVu.AI comes in.

By automating your time-consuming Finance and Accounting processes, you can free up time to explore new opportunities. Make data-driven decisions and confidently drive your business forward. Don’t let manual financial tasks hold you back from Championing Future Opportunities (CFO) – let us handle the details while you focus on the big picture.

Support Digital Transformation

Digital transformation has become essential for businesses to remain competitive in today’s rapidly evolving landscape. However, daily transactional Finance and Accounting functions can consume a significant portion of your time and hamper progress toward digital transformation goals.

DocVu.AI can help you overcome this hurdle by automating your Finance and Accounting processes and allowing you to redirect your focus toward strategic initiatives that drive growth, create future opportunities, and ensure your organization stays ahead of the curve.

Champion ESG Initiatives

As champions of sustainability and responsible business practices, you play a crucial role in enhancing your organization’s ESG efforts. Yet, implementing and managing ESG programs require dedicated time and resources.

By leveraging DocVu.AI’s advanced automation technology, you can streamline your financial processes, reduce errors, improve compliance, and cut costs. It lets you automate ESG-related data from various sources, ensuring transparency and facilitating compliance with regulatory requirements. It enables measuring, monitoring, and reporting key sustainability metrics, providing stakeholders with the necessary environmental and social impact insights. With the time freed up, you can engage in proactive analysis, perform in-depth financial modeling, and collaborate with other executives to develop robust business strategies that fuel growth and deliver long-term value.

Drive Cost Savings

One of the key responsibilities of a CFO is to identify and drive cost-saving initiatives. However, it can be challenging to dedicate time and resources to these efforts when you’re burdened with manual financial tasks.

DocVu.AI can help alleviate this burden by automating time-consuming Finance and Accounting processes such as order to cash, procure to pay, record to report, and financial planning and management. By freeing up your valuable time, you can proactively identify cost-saving opportunities, strengthen customer relationships, and cultivate meaningful connections.

Strengthen Customer Relationships

As a CFO, your role is crucial in driving growth and innovation, but it’s challenging to focus on building strong customer relationships amidst increasing demands. Enter DocVu.AI, the solution that automates your time-consuming Finance and Accounting processes, freeing up your valuable time.

With more time, you can cultivate meaningful connections with customers, driving your business forward. Don’t let manual financial tasks hinder your customer relationships. Instead, let DocVu.AI handle the details while you focus on nurturing those important connections.

Wrap Up

As a CFO, you have a pivotal role in driving growth, innovation, and positive change within your organization. By embracing the power of automation with DocVu.AI, you can unlock your full potential and overcome the challenges that hinder your progress. By leveraging technology to handle routine financial processes, you can confidently make data-driven decisions, champion future opportunities (CFO), and secure a prosperous future for your business. Embrace automation and unlock your potential as a CFO with DocVu.AI.

If you are looking for an IDP solution to improve the efficiency of your Finance and Accounting activities, please visit DocVu.AI for more information.

1 note

·

View note