#Wire Transfer

Text

How is y’all day going ?

Shit has to be done urgently

#selfie#morning selfie#errands#girls who like girls#girls with tattoos#girls with piercings#morning tips#perfect face#my face#lovely eyes#pretty girls#pretty face#faceapp#self love#self care#self portrait#tumblr girls#glasses#dayshift at freddy's#life series#real life#wire transfer#wire transfer payments

8 notes

·

View notes

Text

Good morning !!

Happy Easter 🐣

Enjoy The Chocolate This Easter

#selfie#curvy girls#girls with piercings#girls with tattoos#good morning#mirror selfie#morning pics#beauttiful girls#bussiness#cashapp#happy easter#easter sunday#chocolate#chocolate easter eggs#lovers#self care#me#just me#thicc girls#girls on girls#girls on tumblr#girls who like girls#pretty face#chilling adventures of sabrina#zelle#wire transfer#SoundCloud

3 notes

·

View notes

Text

Work: Not every wire you think is fraud is fraudulent

Me:

*Five seconds and a weird wire later*

Me:

#work stuff#work shit#reaction#invader zim#gir#wire#wire transfer#bank#credit union#look this is the only way i can express my frustrations without fear of work finidng out

2 notes

·

View notes

Text

Unlock Global Financial Connectivity with Trusted Wire Transfer Services: Safely Send and Receive Funds Across the Globe

The simplicity with which money may be sent around the world in the current digital era is unparalleled. Financial technology and internet financial services have made wire transfer services a safe and practical way to move money quickly. You can send wire transfer online because it is a reliable way to move money across borders. You can use this for supporting family members who live abroad, settling payments for goods and services, or enabling commercial operations.

Protects Transactions from Fraud and Unauthorized Access:

Senders and recipients can feel secure knowing that wire transfers offer a strong security layer. Wire transfers are protected from fraud attempts and illegal access by sophisticated authentication and encryption mechanisms. Financial institutions further improve security measures by adhering to strict regulatory standards to ensure compliance. An additional degree of protection is added when wire transfers necessitate verification procedures like security questions or token authentication. Verification procedures, regulatory compliance, and encryption technology all work together to make wire transfers a safe and dependable way to send money over the world.

Efficient and Secure Solution for Sending Money Across Borders:

A dependable and effective way to send money across borders is through international wire transfers. They allow people and businesses to safely send money to foreign receivers for remittances, purchases, and commercial transactions. With faster processing periods than conventional international money transactions, wire transfers send payments to recipients globally. Furthermore, they offer traceability and transparency, enabling both senders and recipients to monitor the status of their transactions and verify the money transfer. So, wire transfers are a reliable method for international money transfers, providing security and speed.

Swift Solution for Domestic Transfer of Funds:

Sending money within the same nation can be done quickly and reliably with domestic wire transfers. For personal or business use, wire transfers can easily transfer funds domestically. With faster processing periods than checks or bank drafts, domestic wire transfers send funds quickly. It is also possible for senders and receivers to track the status of their transactions and confirm the transfer of funds due to the accuracy and openness provided by wire transfers. They are safe and convenient for sending money within the same country, ensuring financial security.

Provides Convenience over Conventional Methods:

The advantages of wire transfers over more conventional methods include their dependability, efficiency, and speed. With faster processing periods than checks or bank drafts, wire transfers can send funds almost instantly. This fast turnaround is ideal for urgent or time-sensitive payments. They also allow senders and receivers to track and verify funds. Smooth and safe wire transfers give individuals and businesses peace of mind and efficiency in money transfers.

In conclusion, wire transfers provide an unmatched degree of efficiency, security, and simplicity in the current digital world. They are fast and trustworthy for individuals and businesses sending money abroad or domestically. Senders and recipients can feel secure knowing that transactions are shielded from fraud and illegal access by extensive safety precautions. Wire transfers are ideal for sending money due to their fast processing periods and transparent tracking. They are reliable and efficient for sending money swiftly and securely in a fast-paced environment.

0 notes

Text

Overcoming Typical Mistakes in International Wire Transfer Security

If you need to make or receive payments from suppliers or clients spread throughout the globe, you have to depend on international wire transfers. Large sum transfers are made quickly and reliably with this extensively used method of payment. Today, many online payment platforms offer this payment option to users, making it easier to send funds globally. But users have to be careful about security when making international wire transfers as one mistake can cause damages to your financial operations and reputation. So here are some key mistakes that you should avoid when making wire transfers globally.

Verify All Information: If you are using digital platforms to send international wire transfers, you will have to input important information like account details of the payee, email and other financial data. So, always make sure that the information you add is correct. It would be a good idea to double check the details before initiating the payment. Some payment platforms also allow you to automate the data entry process, in which case, you can relax and send wire transfers without having to worry about errors.

Use Reliable Platforms: Since many payment platforms are available today, it is very common to overlook the security features of these portals. Always make sure that the platform provides the best security measures that prevent your data from falling into the hands of criminals. If the platform has encryption and authentication measures in place, it means that they are reliable and safe.

Don’t Fall for Phishing Mails: Phishing is a very common form of security threat where hackers try to compromise the security of your device by sending emails. So, if you receive emails from unknown sources with links, be sure not to click on it. Installing security software will also allow you to maintain the integrity of your payment platform and financial processes.

Monitor Your Account: It is always a good idea to keep a close eye on your transaction activities to make sure that your accounting data and international wire transfer details are in order. If you notice any loose ends or mismatches while going through your account activities, you should certainly take note of it and try to resolve the problem as quickly as possible.

Always be Careful: There have been cases where individuals got urgent payment requests from unknown sources and they transferred the money without any review or evaluation. Such urgent requests can be a form of fraud at times and you have to keep your guard up not to fall for such types of scams. Always confirm the payment process with your payee and ensure that the request is legitimate.

International wire transfer is a convenient form of payment that is very helpful to businesses with global ties. But you have to be careful when using online payment platforms when making wires to prevent fraud and other mistakes. Make sure to use a trusted platform that provides good security and have other measures in place to ensure safety.

0 notes

Text

Mastering the Art of Negotiating Fees for Wire Transfers

In today's globalized world, wire transfers have become an indispensable tool for conducting international transactions. Whether you're sending money to family overseas, paying suppliers for goods and services, or managing finances while studying abroad, understanding how to negotiate fees for wire transfers can save you both time and money. In this blog post, we'll explore strategies for mastering the art of negotiating fees for wire transfers, empowering you to make informed decisions and optimize your financial transactions.

Understand the Fee Structure: Before entering into negotiations, it's crucial to have a clear understanding of the fee structure associated with wire transfers. Fees can vary widely depending on factors such as the sending and receiving countries, the amount of money being transferred, and the financial institution facilitating the transfer. Familiarize yourself with the different types of fees involved, including transaction fees, exchange rate margins, and intermediary bank charges.

Shop Around: Don't settle for the first wire transfer service you come across. Take the time to shop around and compare the fees and exchange rates offered by different financial institutions and money transfer providers. Look for transparent pricing and competitive rates that minimize hidden costs and maximize the value of your transfer. Online comparison tools can be valuable resources for evaluating your options and identifying the most cost-effective solution.

Negotiate with Your Bank: If you have a longstanding relationship with your bank, don't hesitate to leverage it to negotiate lower fees for wire transfers. Schedule a meeting with a representative from your bank to discuss your needs and explore opportunities for fee reductions or waivers. Highlight your loyalty as a customer and inquire about any special promotions or discounts available for international transactions. Negotiating directly with your bank can result in significant savings over time.

Consider Alternative Providers: In addition to traditional banks, consider exploring alternative providers for wire transfer services, such as online money transfer platforms and fintech companies. These providers often offer competitive exchange rates and lower fees compared to banks, making them attractive options for cost-conscious consumers. However, be sure to research the reputation and reliability of any alternative providers before entrusting them with your money.

Bundle Services: Some financial institutions offer discounts or incentives for customers who bundle multiple services, such as checking accounts, savings accounts, and credit cards. Inquire about the possibility of bundling your wire transfer services with other banking products to qualify for reduced fees or special offers. Consolidating your financial relationships with a single provider can simplify your banking experience and potentially lower your overall costs.

Optimize Transfer Timing: The timing of your wire transfer can impact the fees you incur, particularly when it comes to exchange rate fluctuations. Monitor currency exchange rates and choose opportune moments to initiate your transfers when rates are favorable. Additionally, consider scheduling your transfers during off-peak hours to avoid premium pricing associated with high-demand periods. By strategically timing your transfers, you can minimize costs and maximize the value of your transactions.

Explore Fee-Free Options: Some financial institutions offer fee-free wire transfer options for certain types of transactions or under specific conditions. For example, you may qualify for fee waivers if you maintain a minimum balance in your account or if you use a designated transfer method. Review the terms and conditions of your banking relationship to identify any fee-free options that may be available to you. Taking advantage of fee-free alternatives can result in significant savings over time.

Negotiate Bulk Discounts: If you frequently conduct large-volume wire transfers, consider negotiating bulk discounts with your bank or money transfer provider. Demonstrate your commitment to ongoing business and inquire about the possibility of securing preferential pricing based on your transaction volume. Negotiating bulk discounts can yield substantial savings and improve the cost-effectiveness of your international financial transactions.

Stay Informed: The landscape of international banking and wire transfer services is constantly evolving, with new providers entering the market and regulatory changes impacting fee structures. Stay informed about industry developments, regulatory updates, and emerging trends to ensure that you're always equipped with the knowledge needed to negotiate effectively. Subscribe to newsletters, follow industry publications, and engage with financial experts to stay abreast of the latest developments in the field.

Seek Professional Advice: If navigating the complexities of wire transfer fees feels overwhelming, don't hesitate to seek professional advice from a financial advisor or consultant. An experienced professional can offer personalized guidance tailored to your specific needs and circumstances, helping you navigate the negotiation process with confidence and clarity. By tapping into expert knowledge and insights, you can optimize your wire transfer strategies and achieve your financial goals more efficiently.

In conclusion, negotiating fees for wire transfers through Unipay Forex requires a combination of knowledge, strategy, and persistence. By understanding the fee structure, shopping around for competitive rates, leveraging relationships with financial institutions, and exploring alternative providers, customers can maximize the value of their international transactions and minimize unnecessary costs. Whether sending money abroad for personal or business reasons, mastering the art of negotiating wire transfer fees with Unipay Forex empowers individuals to make informed decisions and achieve optimal outcomes in their financial dealings.

#wire transfer#international wire transfer#wire transfer from usa to india#wire transfer from india#wire transfer from india to usa#wire transfer companies#wire transfer from india to canada#wire transfer money

0 notes

Text

Maximize Efficiency and Security via Online Bank Wire Transfer

In this digital age, both people and businesses care a great deal about how quickly and safely they can make financial transactions. Online bank wire transfer stands out as a strong way to send money quickly and safely, even though there are many other choices. This method is a great mix of speed, security, and trust because it uses both the fast internet and the strong security standards used by banks.

Understanding bank wire transfers

An online transfer of money from one business to another is accomplished through a bank wire transfer. A wire transfer can be performed through a cash office transaction or by moving money from one bank account to another. Wire transfers are unique because they are fast and safe, which makes them perfect for big operations or when the user needs to send money right away.

The Efficiency of Online Bank Wire Transfers

Online bank wire transfers are primarily attractive due to their efficiency. The old ways of sending money require people to visit banks and other financial institutions in person. This can take a long time. While sending money online, the sender does not need to be present. They can start their transactions from home or the office. This saves a lot of time.

In addition, wire payments done online are quick. Most of the time, money can be sent and be in the recipient's account within a day. This makes it a great choice for deals that need to be done quickly. This level of efficiency is very helpful for businesses that need to meet tight goals or people who need to get money right away.

Security: A Top Priority

Any financial transaction must prioritize security, and online bank wire transfers shine in this area. The use of modern encryption technology by financial institutions helps to ensure that online operations are secure, and that private information does not fall into the wrong hands. By ensuring that both the sender and the receiver are who they claim to be, the verification steps that are included with wire transfers provide an additional degree of protection for the transaction.

Financial institutions also provide a range of services and tools to improve security, like transfer restriction settings and transaction alerts. Users can rest easy knowing that their money is being transmitted in a secure and safe manner due to these precautions.

International Transactions Simplified

The capabilities of bank wire transfers greatly help international business transactions. They offer a dependable and effective way to send money to almost anywhere in the world in a variety of currencies. Businesses involved in international trade especially benefit from this worldwide reach, which enables them to safely and quickly settle payments with partners abroad.

As it concludes, when it comes to financial transactions, online bank wire transfers are the best option in terms of efficiency and security. Both people and companies can profit from quick, safe, and dependable money transfers by being aware of and utilizing this technique. Online wire transfers can be a very useful tool in the user’s financial toolbox, providing peace of mind and enabling smooth financial operations.

0 notes

Text

International Payment Transfer

#International Payment Transfer#international money transfer#wire transfer#international money transfers#money transfer#international fund transfer#google pay international transfer#international money transfer in google pay#international wire transfer#international bank transfer#international money transfer app#wise money transfer#international transfer#gpay international transfer#international payment#cibc international transfer#international funds transfer

1 note

·

View note

Text

Yet another first world problem: getting payments from clients overseas

Seeing multiple SWIFT overseas wire transfers not only fail but fail slowly and inscrutably has me wondering how international commerce is even possible.

Freelance life can involve some uncertainty about when a client will pay out an invoice, but the wait after that funds transfer commences should be minimal–unless the client sits on the other side of an ocean, in which case I’ve lately found myself thinking that it might be faster for the other company to hand an envelope full of cash to a courier.

I wish I knew why this were so. But while…

View On WordPress

#ACH#bank transfer#Brex#cryptocurrency#fintech#international wire#Mercury Bank#PayPal#SWIFT#SWIFT code#wire transfer#wise.com

0 notes

Photo

Which credit cards do you ghat available... with you let funds it up.. and make some money together.. dm me if you are ready let have a business together..

1 note

·

View note

Text

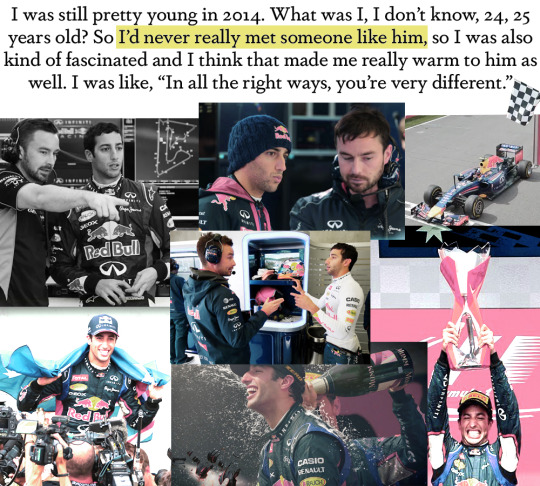

Daniel + Simon

for @blamemma 🤍 | quotes: x | x | x | x | x | x | x

#if there are errors on this i take no responsibility. i shouldve been studying while making this so i churned it out with little care.#i was never going to finish this until emma spied the wip folder on my desktop and offered me her first born or something like that to do i#i expect millions to be wire transferred within 4 to 5 business days#daniel ricciardo#simon rennie#edits#op

306 notes

·

View notes

Text

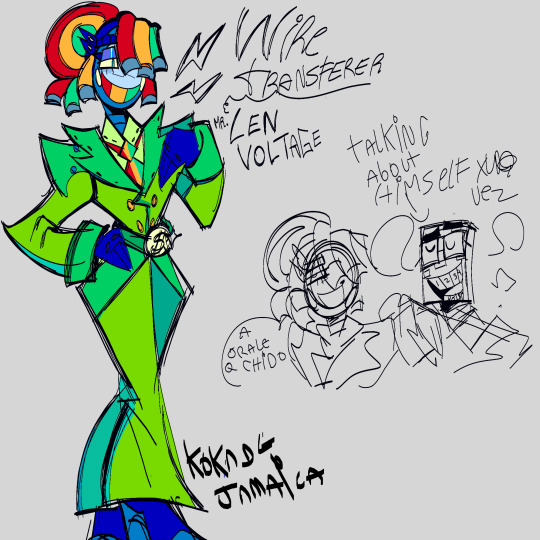

I drew one of my bobots again, i like how the colors turned out

23 notes

·

View notes

Text

This motherfucker is really trying to send a wire for $25k for shoes with no invoice or paperwork. To a person, mind you, not a business.

Get the fuck outta here.

0 notes

Text

WEED STANK IS OUT, POKEMON TRANSFERRING IS IN!

also I'm pretty sure the *moment* I finish moving everyone my OG ds is gonna materialize out of the ether, but better to get it done now than rely on luck digging it out of a box somewhere.

#scraping in under the wire here but! the DS works! and I've done my diamond to black transfers already#next is plat and y and ss#i think that's it for the ones that need to be sent to black to get them in bank#then I'll probably throw this ds back on marketplace or wherever. pass it on to someone else looking for one before the deadline

6 notes

·

View notes

Text

Experience lightning-fast wire transfers across borders, revolutionizing global transactions. With cutting-edge technology and streamlined processes, our service ensures swift and secure fund transfers, empowering businesses and individuals to move money across borders with unparalleled speed and efficiency. To know more in details, visit our website today: https://unipayforex.com

#wire transfer#international wire transfer#wire transfer from usa to india#wire transfer from india#wire transfer from india to usa#wire transfer companies#wire transfer from india to canada#wire transfer money

0 notes

Text

Mei Mei’s domain expansion probably has something to do with emptying bank accounts…

#domain expansion: Boundless Wire Transfer#mei mei#utahime iori#jujutsu kaisen season 2#jjk#lol#good anime#wtf#funny as hell#good manga

8 notes

·

View notes