#State Mortgage and Investment Bank

Link

0 notes

Link

Chief Internal Auditor job vacancies in the State Mortgage & Investment Bank (SMIB)

0 notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

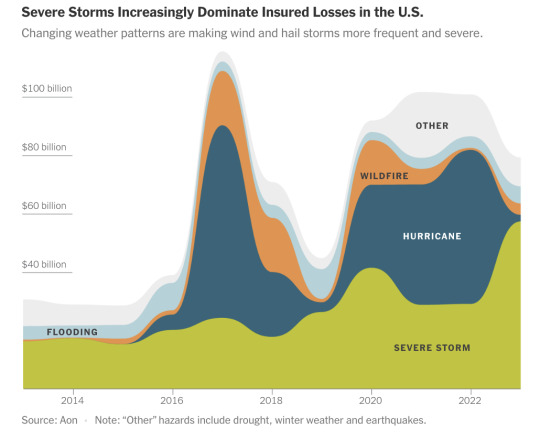

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

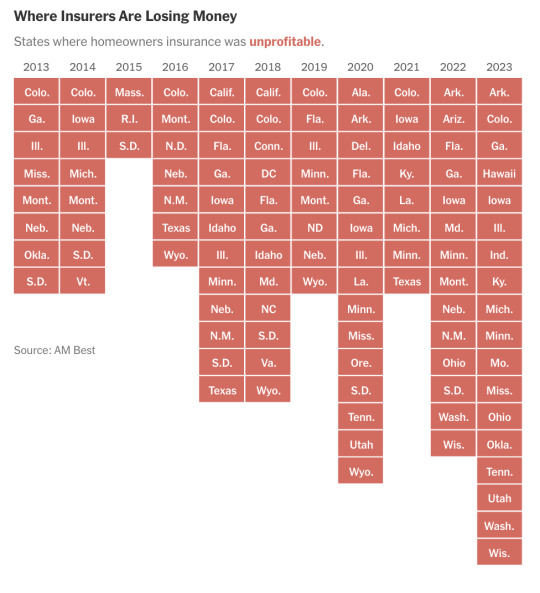

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

106 notes

·

View notes

Photo

Why is the MetLife Building famous?

MetLife Building

It was advertised as the world's largest commercial office space by square footage at its opening, with 2.4 million square feet (220,000 m2) of usable office space. As of November 2022, the MetLife Building remains one of the 100 tallest buildings in the United States.

Can you enter the MetLife Building?

You can enter The MetLife Building from anywhere in Grand Central Station but the entrance closest to The Metlife Building entrance is on 45th Street between Lexington and Vanderbilt.

What offices are in the MetLife Building?

In addition to being the official headquarters of the Metropolitan Life Insurance Company, the MetLife Building houses a number of other major firms, including the headquarters of Dreyfus Corporation, Knight Vinke, the wealth and investment management division of Barclays, the largest office of Greenberg Traurig, DNB, CB Richard Ellis, Gibson, Dunn & Crutcher, Hunton & Williams, Computer Sciences Corporation, Winston & Strawn, Paul Hastings, and Lend Lease Corporation on Level 9. In addition the building serves as the U.S. Headquarters for Mitsui & Co. (USA) Inc, the American subsidiary of Japan’s largest trading company, BNP Paribas Investment Partners and its American subsidiary Fischer, Francis, Trees and Watts.

NOAA Weather Radio Station KWO35, a NOAA transmitter station, is located atop the building.

Impressive tenant roster includes:

There are about 400 tenants throughout Graybar’s 31 floors

Bank of America

Barclays

Bovis Lend Lease

CB Richard Ellis

CSC (Computer Software Corp)

DNB Nord Bank

Fischer Francis Trees & Watts

Hunton & Williams

IgnitionOne

Korn Ferry International

Magnitude Capital

CBRE Global Investors

Merrill Lynch

Dreyfus Corporation

MetLife

Met Life

Gibson Dunn

Novus Partners

Mitsui & Co.

Gibson Dunn & Crutcher

Swarovski

BNY Mellon

Paul Hastings

Winston & Strawn

Federal Home Loan Mortgage Corporation

UBS

J. Fitzgibbons

Metropolitan Life Insurance Company

Preferred Office Properties

Freddie Mac

Oppenheimer & Co.

Nor Bank ASA

Mitsui

Carr Workplaces

Medical Properties Trust

#New York City#new york#newyork#New-York#nyc#NY#Manhattan#urban#city#USA#United States#buildings#travel#journey#outdoors#street#architecture#visit-new-york.tumblr.com#MetLife Building#MetLife

144 notes

·

View notes

Text

A Nebraska lawmaker whose north Omaha district has struggled for years with a housing shortage is pushing a bill that, if passed, could make Nebraska the first in the country to forbid out-of-state hedge funds and other corporate entities from buying up single-family properties.

Sen. Justin Wayne’s bill echoes legislative efforts in other states and in Congress to curtail corporate amassing of single-family homes, which critics say has helped cause the price of homes, rent and real estate taxes to soar in recent years. Wayne said that has been the case in his district, where an Ohio corporation has bought more than 150 single-family homes in recent years — often pushing out individual homebuyers with all-cash offers. The company then rents out the homes.

Experts say the scarcity of homes for purchase can be blamed on a multitude of factors, including sky-high mortgage interest rates and years of underbuilding modest homes.

RISING RENT PRICES PUSH RECORD NUMBER OF AMERICANS TOWARD HOUSING CRISIS, PROMPTING LEGISLATIVE ACTION

Wayne's bill offers few specifics. It consists of a single sentence that says a corporation, hedge fund or other business may not buy single-family housing in Nebraska unless it's located in and its principal members live in Nebraska.

"The aim of this is to preserve Nebraska's limited existing housing stock for Nebraskans," Wayne said this week at a committee hearing where he presented the bill. "If we did this, we would be the first state in the country to take this issue seriously and address the problem."

A 14-page bill dubbed the End Hedge Fund Control of American Homes Act has been introduced in both chambers of Congress and would impose a 10-year deadline for hedge funds to sell off the single-family homes they own and, until they do, would saddle those investment trusts with hefty taxes. In turn, those tax penalties would be used to help people put down payments on the divested homes.

Democratic lawmakers in a number of other states have introduced similar bills, including in Minnesota, Indiana, North Carolina and Texas, but those bills have either stalled or failed.

The housing squeeze coming from out-of-state corporate interests isn't just an Omaha problem, said Wayne Mortensen, director of a Lincoln-based affordable housing developer called NeighborWorks Lincoln.

Mortensen said the recession of 2008 and, more recently, the economic downturn driven by the COVID-19 pandemic made single-family housing a more attractive corporate investment than bond markets.

"When that became the case, housing was commoditized and became just like trading any stock," he said. "Those outside investors are solely interested in how much value they can extract from the Lincoln housing market."

Those corporations often invest no upkeep in the homes, he said.

"And as a result of that, we're seeing incredible dilapidation and housing decline in many of our neighborhoods because of these absentee landlords that have no accountability to the local communities," Mortensen said.

Currently, about 13% of single-family homes in Lincoln are owned by out-of-state corporate firms, he said.

As in other states, Wayne's bill likely faces an uphill slog in the deep red state of Nebraska. At Monday's hearing before the Banking, Insurance and Commerce Committee, several Republican lawmakers acknowledged a statewide housing shortage, but they cast doubt on Wayne's solution.

"You know, you can set up shell companies, you set up different layers of ownership. You can move your domicile base. There's just a ton of workarounds here," Omaha Sen. Brad von Gillern said. "I also — as just as a pure capitalist — fundamentally oppose the idea."

14 notes

·

View notes

Text

Social class of M*A*S*H surgeons

I got the idea from reading this interesting post by @majorbaby about Frank Burns.

My reference was 8.3 Social Class in the United States

Charles Emerson Winchester III is upper-class his family has money and social position. He would certainly like you to think that his family is upper-upper class all the way back, and perhaps that's even true.

"Members of the upper-upper class have “old” money that has been in their families for generations; some boast of their ancestors coming over on the Mayflower. They belong to exclusive clubs and live in exclusive neighborhoods; have their names in the Social Register; send their children to expensive private schools; serve on the boards of museums, corporations, and major charities; and exert much influence on the political process and other areas of life from behind the scenes."

B. J. Hunnicutt is upper-middle class. He went to Stanford: he was past of an exclusive fraternity, which Frank Burns comments on. He and Peg may be having cash-flow problems, but they're on the lines of "how do we pay for the second mortgage" not "how do we pay the rent".

"People in the upper-middle class typically have college and, very often, graduate or professional degrees; live in the suburbs or in fairly expensive urban areas; and are bankers, lawyers, engineers, corporate managers, and financial advisers, among other occupations."

We don't get enough clues from the six appearances of Oliver Harmon Jones what social class he was supposed to be before institutional racism cut him from the series.

Henry Blake - insufficient clues about background, but certainly comfortably upper-middle class when drafted.

Frank Burns wants to be upper class and is origins are probably lower-middle class - he wasn't allowed into the exclusive fraternity that BJ Hunnicutt joined.

"Members of the lower-upper class have “new” money acquired through hard work, lucky investments, and/or athletic prowess. In many ways their lives are similar to those of their old-money counterparts, but they do not enjoy the prestige that old money brings."

John McIntyre and Hawkeye Pierce both look like scholarship students to me - McIntyre's accent places him on the South side of Boston, and Pierce's father, though a doctor, probably acquired that training the old-fashioned way, not by eight years of medical school. I place both families as lower-middle class.

"The lower-middle class has household incomes from about $50,000 to $74,999, amounting to about 18% of all families. People in this income bracket typically work in white-collar jobs as nurses, teachers, and the like. Many have college degrees, usually from the less prestigious colleges, but many also have 2-year degrees or only a high school degree. They live somewhat comfortable lives but can hardly afford to go on expensive vacations or buy expensive cars and can send their children to expensive colleges only if they receive significant financial aid."

Sherman Potter was a farm kid. He joined the cavalry in WWI because he could ride, and though I don't know they've ever mentioned Potter's rank in WWI, I get the impression he was an enlisted man, not an officer. He went to college to train as a surgeon as a military officer. His son-in-law is a salesman. His family may have been land rich before the Great Depression, and lost that land in bank foreclosures. That would put him in working-class origins - if so, the only other officer at the 4077th who had a working-class background is Father Mulcahy, which may explain why they get on so well.

#mash analysis#class analysis#charles emerson winchester#frank burns#sherman potter#hawkeye pierce#trapper john mcintyre#oliver harmon jones#bj hunnicutt#mashposting#henry blake

61 notes

·

View notes

Text

Debt at the heart of the growth paradigm

Before industrialization, much of the world’s population lived in a society with very low per capita economic growth rates. In the 1930’s with the invention of econometrics, economic growth became a symbol of a modern state, and an aspirational goal of the nation to demonstrate progress in comparison to other nations.

However, sustained economic growth comes with an immense social and ecological cost. There is little doubt that increasing pollution and waste generated by the growth economies threaten the well-being of future generations. Likewise, the overuse of the world’s natural resources is eliminating the possibility of people in the majority world achieving the same levels of income as people in high-income countries.

Photo by Alexander Grey on Unsplash

If the problems of the hegemony of growth are obvious, what is creating a “growth trap” so hard to escape?

In today’s economy money is primarily created through the issuance of loans by the private banking sector. Most of the money circulating in the economy is created by private banks. When a person gets a mortgage to buy a new home, the bank creates a deposit account with an equivalent amount of money in the ledger (no new money is printed). However, this deposit is equivalent to other types of money, in fact over 99% of total transactions by value in the UK are bank deposits! Only a fraction of the money is physical cash created by the state.

The problem with this type of money production is that we need to maintain a high level of loans to have money circulating in the economy. Understanding how money is created in the modern economy, and the role of debt in the process of money creation, helps to understand one of the key obstacles to escaping the hegemony of growth.

At the individual level, dept economy means that people must constantly work more than they consume, to be able to pay back their loans. Having a shorter working week, and earning less, is not an option if one needs to pay back a home mortgage or student loan. It is difficult to reduce private debt in the absence of growth.

Likewise, in the non-growing economy, the country governments struggle to pay down their public debt and may need to cut spending on education, health care or other social services. Particularly low and middle-income countries, with large debts issued in foreign currency, are often unable to invest in public infrastructure without taking more loans.

In the worst case to manage their loan payments to international creditors, they must resort to privatising the state assets such as electricity production or drinking water, exposing these “public goods” under speculation of private markets, and making them too expensive to most of the people in the country.

If all loans would be paid back, there would not be money in the economy.

Dept drives growth, which in turn is necessary to avoid financial crises. High levels of public debt mean that growth is the only option to manage the loan without hurting the people living in the country. Likewise, high levels of private debt mean that people have no option other than to continue to contribute their labour to the growth economy.

However, in the current financial system, private banks continue to issue new loans for profit, without any consideration of whether these loans contribute to the economy operating within planetary boundaries or advance equality and social justice.

And while banks and asset mangers cash in profits, the circle of more debt and demands for more growth goes on and on and on….

References

Escaping Growth Dependency – Why reforming money will reduce the need to pursue economic growth at any cost to the environment by PositiveMoney

https://positivemoney.org/publications/escaping-growth-dependency/

Sovereign Money - An Introduction by Ben Dyson, Graham Hodgson and Frank van Lerven

https://www.insearchofsteadystate.org/downloads/Sovereign-Money,-An-Introduction-Dyson-Positive-Money-2016.pdf

19 notes

·

View notes

Note

https://at.tumblr.com/royal-confessions/carole-is-135-million-in-debt-and-trying-to-get/dpgvpxau7knr

Do you know if this is true?

This individual makes a lot of claims so to break it down:

Party Piece’s finances are private, they don’t share full accounts because of the type of company they set up. So we can’t know for sure. The Daily Mail reported they have a deficit of £1.35 million (not dollars; other countries exist and they use different currency!). That is apparently because they invested in expanding the business. I have no idea if that is true because I don’t know where they got it from. I’m not an expert in corporate finances but you’ll find that with organisations - charities, companies, etc - there is a different approach to individuals. If I spent £1.35 million on credit cards I’d probably be in a lot of trouble. But if a company has a deficit of £1.35 million that doesn’t necessarily mean anything. Look at Victoria Beckham’s company which has never been profitable, it haemorrhages huge amounts of money every single year, but it still operates. So there’s nothing inherently concerning about your company being in deficit if you have a plan to get out it. Think of it like a mortgage. Anyone with a mortgage is in massive debt to the bank, but it’s not usually concerning because you have a plan to pay it back in small chunks. So obviously profit is better than deficit but if they’re not concerned, I wouldn’t be yet either.

In terms of them not wanting to pay suppliers, the Daily Mail reports they are in a “payment dispute” with suppliers. It provides no evidence so we can’t be sure of how truthful it is, but it also states that the dispute is Carole would like to make the payment cycle 90 days to reflect the Royal Mail strike, the cost of living crisis etc and her suppliers want to stick with 30. So it’s not about not paying, it’s about changing the payment dates.

As their accounts are protected, we have no evidence to support the idea Gary has given funds to Party Pieces. It would only be a problem for me if they’d accepted his money after he hit his wife in 2017. Before that, he was a gross idiot but that was about it. Also Party Pieces was started in 1987. Gary was 22 lol. From what I can tell he didn’t become a director of the company that made him his money until around 2000 and became a millionaire in 2005 so for the first 15 years - when they were sending their kids to expensive schools and lived in a nice house they bought almost mortgage free - they couldn’t have been relying on him to bank roll them exclusively.

So basically there’s some kernels of truth here, some things are made up, and all of it is viewed through the lens of hating Carole, a private citizen whose financial situation is not actually our business!

25 notes

·

View notes

Text

Investing 101

Part 3 of ?

In the first installment of this series I discussed stocks. Stocks are also referred to as Equities, because if you own a company's stock, you own Equity in the company. Stocks entitle you dividends and you can benefit from growth of the stock price. But stocks can be volatile. Fortunately there are other securities you can purchase which usually offer less risk.

Bonds, are essentially loans made to companies and government entities. Bonds can have a variety of maturities (i.e. length of time until the loan is repaid) and interest rates. Companies can issue bonds instead of getting a loan from a bank. Likewise, government entities (ex. cities, counties, school districts, states and the US Treasury) issue bonds. A school district might issue a bond to build a new high school; a state might issue bonds to build a new tollway. The US Treasury issues bonds to fund the operations of the government. For as long as you've been an adult, you've heard about the US Budget Deficit, right? But do you know what it is? The budget deficit is simply the yearly government spending which exceeds the government's revenue (taxes). The sum of all the annual budget deficits is called the National Debt. The US Treasury issues bonds throughout the year to borrow the money necessary to fund the budget deficit. The interest on government bonds is usually tax exempt - that makes them a favorite of people who want to lower their tax bill. Because government bonds are tax exempt, they pay lower interest than a comparable corporate bond.

In general, bonds have lower risk than equities and pay interest regularly. With the exception of US Treasuries, bonds can be less liquid - i.e. take longer to sell in the event you need your cash back immediately. Bonds are also usually considered lower risk than equities, so an investor might purchase them to lower the overall risk in his/her portfolio (more on that later).

Each bond pays a fixed interest rate for the life of the bond (ex. 4%), but the price of the bond can go up and down based on market demand. On the day of issuance, let's assume you bought a 10 year, corporate $100 bond paying 4% interest. You paid the corporation $100 and every year for 10 years you will receive 4% interest and at the end of 10 years the company will repay the $100. If you wanted to sell the bond the next day, you could probably sell it to someone else for $100. Because you can sell for it face value, the Yield is the same as the interest rate. Let's also assume that 1 year later the company's only factory burned in a fire and it wasn't insured. It is much less likely that the company will be able to repay the bond you bought. If you tried to sell the bond to someone else, you'd probably have to discount the bond - perhaps sell it for $80 instead the $100 you paid. Now the Yield has declined, even though the interest rate is still 4%. Conversely, assume the factory never burned and instead the stock market tanked. Now everyone is desperate for an investment paying 4% and is willing to pay $120 for you $100 bond (an exaggeration to be sure); in this case the Yield on your bond has increased above the 4% interest.

The safety of bonds is measured and reported by rating agencies and impacts the price/yield. The bonds of companies which are less likely to be able to repay are rated lower than those with strong earnings and cash flow. Lower rated bonds have more risk, but they have higher interest rates and yields. Junk Bonds are bonds issued by high risk companies. Investors can make a bunch of money from junk bonds, but they can lose their investment too. (The 2008-09 financial crisis was caused in part by rating agencies not accurately reporting the risk associated with bonds composed of home mortgages.)

Historically, a broad portfolio of equities will generate greater returns over the medium/long term than a bond (debt) portfolio. If you have a long investment horizon (ex. >5 years) you want to invest in stocks. Occasionally, however, the stock market will have correction or there will be a recession etc and the stock market will drop. If you need cash during one of those periods and have to sell your stocks, you're going to sell at the bottom of the market and lose money. For this reason, investments with a short time horizon tend to favor bonds; the price (yield) of bonds is generally less volatile and you can count on the cash flow of regular interest payments. That's why as investors age, they start to shift the balance of their portfolio from equities to bonds. If I'm 70 years old and the market tanks, I can't wait 5 years for the market to recover; so I'm going to keep more of my money in bonds. The return on my bond investments is low, but so is the risk.

Only 12 people or so are reading these things, so if you have questions please ask.

16 notes

·

View notes

Text

Your Black World

http://bit.ly/1dwTN6Q

It is no secret that slavery rests at the foundation of American capitalism and is often synonymous with the sugar, tobacco, and/or cotton plantations that fueled the Southern economy. What many may not know is that slavery also rests at the foundation of many notable corporations. From New York Life to Bank of America, several companies have benefitted from slavery. Many of the companies even acknowledged their involvement in slavery and offered apologies in an attempt to reconcile their tainted history but, is an apology enough?

History has consistently shown that slavery has diminished the quality of life for African Americans and simultaneously enhanced the quality of life for White Americans. From institutionalized racism to blocked social and economic opportunities, African Americans are often excluded of African Americans.

Apologies cannot compensate an entire race of people for all of the social and economic ills they face as a result of their enslavement. They cannot address the residual effects of slavery. They cannot provide job opportunities to a race of people who are experiencing high unemployment rates. Apologieswithout action from the very systems they helped to create. Had it not been for slave labor, many corporations would not be where they are today and for these companies to acknowledge their involvement in slavery and then simply say ‘Oh, I’m sorry”, is to downplay their role in perpetuating the degradation are nothing more than a futile attempt to correct a wrong by pacifying the wronged. Instead of apologies, these companies could give back to the African American community bydonating to HBCUs, investing in minority businesses, offering more minority scholarships, or launching initiatives to increase their number of minority employees.

New York Life New York Life found that its predecessor (Nautilus Insurance Company) sold slaveholder policies during the mid-1800s.

2. Tiffany and Co Tiffany and Co. was originally financed with profits from a Connecticut cotton mill. The mill operated from cotton picked by slaves.

3. Aetna Aetna insured the lives of slaves during the 1850’s and reimbursed slave owners when their slaves died.

4. Brooks Brothers The suit retailer started their company in the 1800s by selling clothes for slaves to slave traders.

5. Norfolk Southern Rail Road Two companies (Mobile & Girard and the Central of Georgia) became part of Norfolk Southern. Mobile & Girard paid slave owners $180 to rent their slaves to the railroad for a year. The Central of Georgia owned several slaves.

6. Bank of America Bank of America found that two of its predecessor banks (Boatman Savings Institution and Southern Bank of St. Louis) had ties to slavery and another predecessor (Bank of Metropolis)accepted slaves as collateral on loans.

7. U.S.A. Today U.S.A. Today reported that its parent company (E.W. Scripps and Gannett) was linked to the slave trade.

8. Wachovia Two institutions that became part of Wachovia (Georgia Railroad and Banking Company and the Bank of Charleston)owned or accepted slaves as collateral on mortgaged property or loans.

9. AIG (American International Group) AIG purchased American General Financial which owns U.S. Life Insurance Company. AIG found documentation that U.S. Life insured the lives of slaves.

10. JP Morgan Chase JP Morgan Chase reported that between 1831 and 1865, two of its predecessor banks (Citizens Bank and Canal Bank in Louisiana) accepted approximately 13,000 slaves as loan collateral and seized approximately 1,250 slaves when plantation owners defaulted on their loans

#Shocking List of 10 Companies that Profited from the Slave Trade#us slavery economics#reparations are due

33 notes

·

View notes

Link

Assistant General Manager job vacancies in the State Mortgage & Investment Bank (SMIB)

0 notes

Link

Assistant General Manager job vacancies in the State Mortgage & Investment Bank (SMIB)

0 notes

Text

When i’ve bought or sold a home the mortgage companies have always looked at three documents:

A. The appraisal,

B. The seller’s disclosure statement,

C. The buyer’s statement of financial condition

Any factual misstatements or material omissions on B or C can result in a conviction for fraud for the signee(s)

https://www.federalcriminaldefenseadvocates.com/mortgage-fraud

[From the Article]

Some common types of mortgage fraud are: [I’ve added the numbering]

Intentionally providing false financial statements;

lying about income (income fraud);

providing false tax returns;

overvaluing a property's value (appraisal fraud);

providing fake employment verification;

manipulated credit scores/reports;

stating that the property acquired is for residential purposes but in actuality is for investment purposes which gives lower interest rates (occupancy fraud)…

In United States federal courts, mortgage fraud is prosecuted as wire fraud, real estate fraud, bank fraud, mail fraud and money laundering, and you may face a maximum of 30 years in prison and up to a $1 million fine.

•••••••••••••••••••••••••••••••••

Donald Trump, his sons, his companies and other of his executives have been found liable for fraud in the on going civil trial.

Just as you or I would be if we did ANY of the above.

The State had demonstrated that the Trump Organization committed repeatedly 1, 2, 4, 6, 7 plus others not listed above

Judge Engoron’s ruling on the State’s Motion for Summary Judgment noted that the State compared documents in the Trump Organizations records which at odds with the Statements of Financial Conditions subpoenaed from banks which had provided Trump loans.

Donald Trump’s attorneys filed three motions against the State; were rejected three times by the Judge; then appealed three times and were rejected three times.

•••••••••••••••••••••••••••••

Lead attorney Kise has argued before the US Supreme Court and won his cases

If he had any any any other legal arguments howler specious or nebulous for an appeals court he would have made that appeal before the train wreck of testimony by Trump and Sons.

Undoubtedly Trump, who considered himself smarter than the Judge, opposing counsel, and his own $3million retainer attorney, paid close to ZERO attention to Kise’s attempt to prep him as a witness.

2 notes

·

View notes

Text

Ebbs and flows (Shot, Reverse Shot)

Sometimes it feels like an entire lifetime has transpired between posts. Thinking about the time that has transpired is bittersweet. On one hand it's like "oh shit, time is really getting away from me" and on the other hand it's like "oh shit, look how far I've come!" And that remains the state of this whole journal thang. Duality. The shitty times and the good. Ebbs and flows. Reading through that last post, I vividly remember the feelings of hopelessness around dating, around feeling stuck.

It's always ebbs and flows, it seems. My outlook is still kinda gloomy. I didn't sleep well at all last night and I was in bed almost all day today feeling like absolute death. It's hard not to contemplate how I would deal with situations like this differently if I had my own space. Or maybe I wouldn't even be in this predicament because I would have a more consistent healthy routine and get the things I want to do done during the day and actually sleep at night. We're in that weird transitional period between seasons where al the winter clothes need to be dug out and summer clothes put away. Three people in a two bedroom place means there's not a lot of room for everything and so a lot our clothes are in storage. Even the minor inconvenience of digging everything out brought on those thoughts of 'what if?' "In my own place I wouldn't have to deal with this shit. It would all just be there in one spot."

I do my best get over these humps and resume some form of mental stability and normalcy. I try to think about positive strides. Work is still just okay, but 'just okay' is a lot better than awful and I have to keep that in mind. I'm starting the process of doing some certification courses, making moves, to hopefully make more money, to hopefully make some LITERAL moves sooner rather than later. Talked to the folks at my bank about saving more over the next little while, started the conversation about mortgage pre-approvals and what it would ACTUALLY take to move out. Baby steps. Wish they weren't so baby, but they're steps. Seems to be a theme doesn't it? "Just okay" is better than "awful." "Baby steps" are better than no steps at all. And a date is better than no date.

That one girl who I told myself not to freak out about when the date didn't happen...the one prospect left after all of the seemingly "great luck" I was having on the apps for a while...the one girl I had been talking to since all the way back in July when I was visiting my friend on the East Coast...the "last remaining light" as it were (if I can invoke a little Audioslave)...the date didn't happen that day but it did eventually happen. And it went well. And I'm seeing her again in a couple of weeks. And she's cool and she's nice and all I can really do is hope it goes well.

I have a bad habit of getting too invested. It happened almost a year ago to the day, with the one other girl from these apps that I seemed to have a decent connection with. It fizzled early, after two dates. All I can really hope for is to make it to three this time. Just let it rock. Don't get my hopes up too high. I suppose I have to remember that if it doesn't work out, there are still so many other things to focus on. And the year is almost over. That part is fucking wild. But it means I made it another year.

There's another trip coming. In a week I'm going to Mexico with a small group and if I'm being honest, for the longest time I was kind of mad at myself I ever let them convince me to go. I was dreading it. A fucking trip to a tropical destination RIGHT as it's starting to get shit cold around here...and my spoiled ass was sulking about it. As it approaches now I'm coming to my senses and getting a bit more excited. It's another break from everything. Another opportunity to reset. Those don't really come as often as I want them so I should count my fucking blessings. AND my folks might take a little trip as well after I get back, meaning yet another nice stint of time where I've got the place to myself, when I can imagine what it'll be like when I'm back out on my own, when I've finally reclaimed the last of that independence I have been so fixated on.

It's ebbs and flows right? Sad, lonely, and sick of the same routine. Hopeful, open, and changing it up. I gotta grasp at those straws as they whizz past me as I fall super fucking fast toward my destination, not realizing the speed in which I'm moving.

There was a bit of an ant problem in my apartment the last few weeks. Got a few traps, seems to have cleared 'em right up. I'm sure there's a metaphor in there somewhere. There's always a solution I guess? Even if the solution is just knowing that a REAL solution will get here eventually.

Ebbs and flows. The flows are good, and demand to be gone with. So I'm going to try to go with the flow.

Until next time.

2 notes

·

View notes

Text

More than anything, it was World War I that brought residential construction to a halt in New York (and, for that matter, other American cities). Even before the United States entered the war, the price of building materials had started to go up, and by late 1918 they cost nearly twice as much as they had in early 1914. Even at the inflated prices, they were often very hard to find—and, if found, very hard to ship. With so many men serving in the armed forces and so many others taking jobs in war-related industries, labor was also in short supply. It was much more expensive too. Between 1913 and 1918 wages in New York City went up 10 percent for carpenters, 16 percent for bricklayers, 25 percent for painters, and 80 percent for laborers. As a result, the cost of construction rose roughly 50 percent. To build a typical five-story brick walk-up on a fifty by one hundred foot lot cost $32,000 in 1913, $40,000 in 1916, and $50,000 in 1918. An even greater obstacle to residential construction was that savings banks, insurance companies, and other financial institutions were rejecting applications for mortgages with what Frank Mann called “monotonous regularity.” According to their executives, they had put much of their money into Liberty Bonds. What little capital was left was being invested not in residential mortgages, which yielded only 3 percent after federal and state taxes, but rather in tax-exempt state and local bonds, which paid 5 to 6 percent, and in gilt-edge securities, which paid 7 to 10 percent.

Making matters even worse for the builders was a series of tough measures that the Wilson administration had adopted to prevent the diversion of materials, labor, and capital from the war effort. Underlying these measures, which started in late 1917 and culminated in late 1918, was the belief, as Treasury Secretary William G. McAdoo put it, that “building operations absorb the very materials and the very labor and the very kind of money, that the Government requires most urgently at this time.” Acting on this belief, the Railroad Administration gave low priority to the shipment of materials used in residential construction. The Department of Labor classified the building trades as nonessential. The Capital Issues Committee of the Federal Reserve Board pretty much excluded the building industry from the money markets. And in a move that pushed the industry to what Senator William M. Calder of New York called the “zero hour for building,” the federal government imposed restrictions on the use of materials for structures that cost more than $2,500. Not long afterward, the War Industries Board ordered builders to stop work except on projects that needed only finishing touches. Even in those cases, New York's builders needed a permit from the Mayor's Committee on National Defense to complete the job.

— Robert M. Fogelson, The Great Rent Wars (2013)

4 notes

·

View notes

Text

Greetings Bernard Arnault,

Charmed Circle Services

If you refer to a group of people as a charmed circle, you mean that they seem to have special power or influence, and do not allow anyone else to join their group.

A protection racket is a type of racket and a scheme of organized crime perpetrated by a potentially hazardous organized crime group that generally guarantees protection outside the sanction of the law to another entity or individual from violence, robbery, ransacking, arson, vandalism, and other such threats, in exchange for payments.

Green Crime is illegal activity that involves the environment, biodiversity, or natural resources. There are generally five types of major environmental crime: illegal logging, fishing, and mining, and crimes that harm wildlife and generate pollution.

State-corporate crime is a concept in criminology for crimes that result from the relationship between the policies of the state and the policies and practices of commercial corporations.

Tax Haven Lobbying

State-corporate crime is a concept in criminology for crimes that result from the relationship between the policies of the state and the policies and practices of commercial corporations.

Organized transnational crime is organized criminal activity that takes place across national jurisdictions, and with advances in transportation and information technology, law enforcement officials and policymakers have needed to respond to this form of crime on a global scale.

Government Joint Venture

Example: Government Part Owned Coal & Diamond Mines

international corporation that specializes in coal & diamond mining, coal & diamond exploitation, coal & diamond retail, diamond trading and industrial coal & diamond manufacturing sectors.

Example: Debswana Diamond Company Limited Influenced

Debswana is a joint venture between the government of Botswana and the South African diamond company De Beers; each party owns 50 percent of the company

Ecological Preservation Company

Farmland Real Estate

Acquisition

Lease

Gross Margin

China Big Four Influence: Industrial and Commercial Banks, Construction Bank, & Agriculture Banks (Ag Banks)

Products

Finance and insurance, consumer banking, corporate banking, investment banking, investment management, global wealth management, private equity, mortgages, credit cards

Gross Margin Loan

In exchange for farmland development or startup give cash for gross margin %

LVMH Digital Wallet

Air Miles Credit Card

Client Card (Gift Card/Social Club)

Drop Shipping

Isolated Investment Platform/Newsletter

Distributors Type

Wholesale distributors provide that liaison, buying large quantities of products from manufacturers, storing them and then supplying them to retailers and other businesses.

Distributors

Distributors have a business relationship with manufactures and have partial ownership of the product they sell. Some distributors buy exclusive rights to buy a company's product to ensure that they are the sole distributor of that product in the area. Distributors often sell to wholesalers and retailers, creating minimal contact with the final buyers.

Indirect selling

Indirect selling is when a company uses an intermediary to distribute and sell its product. Indirect selling marketing channels can use varying amounts of intermediaries. In the most direct distribution route, the manufacturer can sell their product to an intermediary who then sells the product to a consumer. However, they may sometimes involve more than one intermediary in the distribution of a product.

This marketing channel encompasses many of the examples of intermediary channel uses, including shopping malls and chain retailers.

LVMH Distribution & Cash Conversion Cycle

Big Pharma Distribution Model

Wholesalers purchase drugs from manufacturers and distribute to a variety of customers, including independent, chain, or mail-order pharmacies, hospitals, long-term care, and other medical facilities.

Wholesale Distribution Clients

Drop Shipping

Malls

Modeling Agencies

Wedding Directors

Private Schools

Social Club

Art Auctions

Film Production Companies

Car Dealerships/Shows (Collaboration)

Jewelers (Gift Card Distribution for Store Credit)

Political Cabinet

Tennis Clubs (Dress Code)

Dinner Hall Rental Companies

Hair Salons (Gift Card Distribution for Store Credit)

Investment Banks (Gift Card Distribution for Store Credit)

Wholesale Client Requirement

Retailer Fair with Retail Advisory Groups Collaboration Business Incubator

Business incubator is an organization that helps startup companies and individual entrepreneurs to develop their businesses by providing a fullscale range of services starting with management training and office space and ending with venture capital financing.

What Can Companies Do To Improve Cash Conversion Cycle Times?

Invest in Real-Time Analytics.

Encourage Earlier Payments.

Speed Up the Delivery Time.

Make It Easier To Pay.

Simplify Your Invoices.

Rental and Recruitment

Graduation and Wedding Rentals allows for customer experience turning dreamers into clients

Wearing LVMH for the first time at Graduation is Emotionally Symbolic

Celebrations release the feel-good chemicals oxytocin, dopamine, and endorphins, which lower the stress hormone cortisol. This doesn't mean you simply are in a better mood, though your mood will improve. It also means you'll have clarity of thought and feel more in control.

Oxytocin is known as a social bonding hormone, unfortunately, though, it can also be the trigger to addiction.

Golf & Tennis Endorsement

Endorsement Wear Contracts (Product Placement Scheme)

This Bridges the LVMH Brand and Logo to Future Athletes where Nike isn't that Popular compare to other Nike endorsed athletes

Golf and Tennis are posh so the endorsements fit LVMH target audience

Rugby Kit Sponsor

Secure South African Athletes and Create a Larger Presence in South Africa (Natural Resources)

Athleisure Wear

Big and Tall Athleisure Clothing

Minimum Net Worth Condos with Luxury Strip Malls

Gift Card Program Drop Shipping : Promotion Program, Have a grace period for gift card top up (treat like a prepaid rewards credit card); Curated accessories promotional codes. Cash is acquired without product sold. (Starbucks with a twist)

Trade Shows: Promotional Model, This type of model books jobs that help sell or promote a certain commodity. Promotional models are often found at trade shows and other live events. As a whole, these models must be personable, outgoing, and have a strong knowledge of the product they are representing.

LVMH Inclusive (Minimum Spending) Social Club: Cross-functional Collaboration Based Shopping

Project

Cross collaborate through divisions to create a specific project. Projects are a curation of a series of products from multiple divisions. Goal is to have people attached to projects, not products. View Projects as Different Personalities. (Harvard Business Review)

Landscaping & Gardening Expos

Festive Activities for Consumers

Natural Resources Humid Subtropical Climate Farming with Security Operations (SecOps)

Material Sourcing

Porter's Model Pharma Industry

Porter's model can be applied to any segment of the economy to understand the level of competition within the industry and enhance a company's long-term profitability. The Five Forces model is named after Harvard Business School professor, Michael E. Porter.

Porter's 5 forces are:

Competition in the Industry

The first of the Five Forces refers to the number of competitors and their ability to undercut a company. The larger the number of competitors, along with the number of equivalent products and services they offer, the lesser the power of a company.

Suppliers and buyers seek out a company's competition if they are able to offer a better deal or lower prices. Conversely, when competitive rivalry is low, a company has greater power to charge higher prices and set the terms of deals to achieve higher sales and profits.

Potential of New Entrants Into an Industry

A company's power is also affected by the force of new entrants into its market. The less time and money it costs for a competitor to enter a company's market and be an effective competitor, the more an established company's position could be significantly weakened.

An industry with strong barriers to entry is ideal for existing companies within that industry since the company would be able to charge higher prices and negotiate better terms.

Power of Suppliers

The next factor in the Porter model addresses how easily suppliers can drive up the cost of inputs. It is affected by the number of suppliers of key inputs of a good or service, how unique these inputs are, and how much it would cost a company to switch to another supplier. The fewer suppliers to an industry, the more a company would depend on a supplier.

As a result, the supplier has more power and can drive up input costs and push for other advantages in trade. On the other hand, when there are many suppliers or low switching costs between rival suppliers, a company can keep its input costs lower and enhance its profits.

Power of Customers

The ability that customers have to drive prices lower or their level of power is one of the Five Forces. It is affected by how many buyers or customers a company has, how significant each customer is, and how much it would cost a company to find new customers or markets for its output.

A smaller and more powerful client base means that each customer has more power to negotiate for lower prices and better deals. A company that has many, smaller, independent customers will have an easier time charging higher prices to increase profitability

Threat of Substitutes

The last of the Five Forces focuses on substitutes. Substitute goods or services that can be used in place of a company's products or services pose a threat. Companies that produce goods or services for which there are no close substitutes will have more power to increase prices and lock in favorable terms. When close substitutes are available, customers will have the option to forgo buying a company's product, and a company's power can be weakened.

Understanding Porter's Five Forces and how they apply to an industry, can enable a company to adjust its business strategy to better use its resources to generate higher earnings for its investors.

What Are Porter's Five Forces Used for?

Porter's Five Forces Model helps managers and analysts understand the competitive landscape that a company faces and to understand how a company is positioned within it.

KEY TAKEAWAYS

Porter's Five Forces is a framework for analyzing a company's competitive environment.

Porter's Five Forces is a frequently used guideline for evaluating the competitive forces that influence a variety of business sectors.

It was created by Harvard Business School professor Michael E. Porter in 1979 and has since become an important tool for managers.

These forces include the number and power of a company's competitive rivals, potential new market entrants, suppliers, customers, and substitute products that influence a company's profitability.

Five Forces analysis can be used to guide business strategy to increase competitive advantage

Regards,

Adrian Blake-Trotman

10 notes

·

View notes