#Rent;Property Investor

Text

IMPORTANT RENTAL CHANGES FROM 01/07/2023 https://t.co/pLNwKmWi8r

View On WordPress

#affordable housing#Australia#BRISBANE#family#INVESTMENT#Investment Property Sales & Management#INVESTOR#ljgrealestate#property management#Property Management; Investment Properties; Sold; Sell#Rent;Property Investor#Research#sales; property sales; property investment; property management

18 notes

·

View notes

Text

My neighbour runs a scam company where he's basically a landlord for landlords (he works from home and takes all his calls in the garden so I get to hear his sale pitch on repeat and it's either a) nonsense or b) just lies) and they've been mildly annoying but like liveable as neighbours. (I mean they haven't fired bb pellets into our garden or thrown constant teen ragers so we can forgive the occasional 1am karaoke party.)

But now the prick has gotten himself a metallic purple lamborghini that he now every single fucking morning revs outside the fucking house at 10am bc he doesn't actually have a real job and then he drives it round the streets for like an hour or so and you can hear it coming back for like a full five minutes bc it's a VERY loud car and we live in a quiet suburb.

Every. Single. Morning.

If they didn't have cameras on their property like the arseholes they are I would very seriously consider pouring sugar in his petrol tank. 🙃🙃🙃

#He also has two fucking huge american suvs that he has to park on the street further up#Bc they fucked their own kerb with all the awful building work they did to the house they're living in#Oh and the house isn't their house#It's a portfolio property that they're living in sometimes bc it's convenient#Fuck knows if they're actually paying rent#Bc of the bizarre hours they keep and bc he's constantly coming and going and actually not always at the property#Everyone kinda thought he was a drug dealer for a bit#Before he got his giant fucking suv custom decalled with his scam company and we realised oh no#He's much worse and contributes much less to society than a drug dealer#It's very hard to listen to him lie badly to investors in his sad little 'garden' (it's a tiny square of astro turf)#When me and jo have had multiple letting agents tell me and jo that landlords aren't accepting ppl on benefits#Which is unlawful#It's been months and we still haven't even got a viewing#Let alone a flat!#We have the funding from the government!!#Nobody wants it though!#I hope his lamborghini tires run over just so many nails or glass#Blog post

7 notes

·

View notes

Text

Tips for working with builders

#property#properties#propertyforsale#property in uk#uk property#propertyinvestment#property for rent#property investing#propertyinvestor#investors#investment#investing#london property#real estate#realestate#realtor#realestate agent#landlords#luxuryproperty#newhome#homebuyers#home buying#property dealer#propertydeals#UK

5 notes

·

View notes

Text

OS RESIDENTIAL PROPERTIES

OS Residential Properties specializes in bespoke property sourcing for busy professionals and investors in UK and overseas. We work to your requirements to help you acquire the best properties with the best returns legally, professionally and compliantly.

#companies that buy houses in london#find a buyer for my house london#find an investor to buy my house in london#guarantee property management london#guaranteed rent for landlords london.

0 notes

Text

Happy Monday Everyone! We hope you had a great weekend!

Checkout this amazing opportunity to own a high income property that is fully rented to great tenants and also has a great upswing to increase income while also potentially being able to sever the lot and build another income producing building while keeping current building.

1299 DORCHESTER AV, Ottawa K1Z 8E8

Multi Family Income Producing Fourplex

with non conforming 5th unit

Listed For Sale at $1,350,880 MLS# 1378344

Lot size: 85 x 100 Feet Zoning: R4U-C allowing for lots of development options

Consists of five 1bedroom units

Gross Income: $80,880

Expenses: $16,801

Net Income: $64,079 ( Cap Rate of 4.7%)

Discover an exceptional investment opportunity at 1299 Dorchester Ave. This high income producing fourplex building comes with a fifth non-conforming unit, elevating its earning potential and cashflow. Positioned on a large 85 x 100 foot lot with R4U-C zoning, Nestled in a prime location ,close to amenities, schools, and transportation, it has consistent occupancy and strong rental demand. Perfect for investors seeking to expand their portfolio, its proven income generation and development possibilities make it an attractive purchase. High Net income of $64,079 with Cap Rate of 4.7%. Loads of development potential while keeping current building. Roof (2019), Furnace (2014). Contact us today for more information

Your Ottawa Realtor Sorin Vaduva Team

#ottawa #carlington #ottawasrealtor #soldbysorin #fourplex #highincome #largeland #forsale #ottawarealtor #ottawaincomeproperties #oreio #ottawarealestateinvestor #multifamilypropertyottawa #highincome #fullyrented

#ottawa#fourplex#carlington#ottawas realtor#soldbysorin#income property ottawa#large land#for sale#ottawa income homes#ottawa real estate investor#multi family property#high income#fully rented

0 notes

Text

#Tax Implications#Selling Property#Renting Residential Property#Real Estate Investors#Capital Gains Tax#Depreciation Recapture#1031 Exchange#Rental Income Taxation#Passive Activity Losses#Deductible Rental Expenses#Cost Segregation Studies#Qualified Business Income Deduction#Home Office Deduction#Record-Keeping

0 notes

Text

LEASE VS. RENT

The main difference between lease and rent agreement is the period of time they cover. A rental agreement tends to cover a short-term, usually 30 days while a lease contract is applied to long periods usually 12 months, although 6- 18 months contracts are also common.

The term of the lease contract cannot be modified until it ceases to exist whereas the terms of a rent agreement can modified by the landlord.

The unique point of difference between these two are that at the end of a lease agreement, the lesse gets an offer to buy the leased asset by paying a residual amount, however there are no such offers included in a rent agreement.

The choice between leasing and renting is very difficult, but the company can decide it by analysing the requirements of the asset.

If the asset is required by the company throughout the year and so on, then it would be better to go for a lease. However, if there are no such requirement, then the company may opt for renting.

0 notes

Text

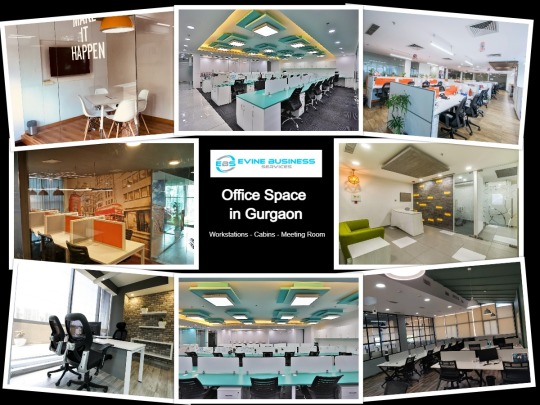

Find the Perfect Place for Your Business #Evinebusinessservices

Make your business dreams come true with #commercial#office#space for #lease in #Udyog#Vihar, #Gurgaon. With great amenities and a convenient location, this is the perfect place to start or expand your business. Find out more now!

Workstations

Cabins

Conference room

Reception with waiting area

Cafeteria

Server room

Lift

Power backup

We have multiple office spaces available in All Locations.

Contact @ 9999568224 For More Details.

Email ID:- [email protected]

Website:- https://www.evinebs.com

#industrial and #commercial#properties both.

Fully furnished office space available for rent in Udyog Vihar, Golf Course Road, #Golfcourseextension road, Sector 32 & 44. Gurgaon

#CommercialofficespaceinGurgaon

#invest#investor#investment#retail#retailers#newprojectcomingsoon#NewProject2023#NewProjectAlert#gurgaonrealestate#realstate#gurgaon#officeleasing#wemakeyourmoneygrow#gurgaonproperties#realestatedevelopers#realestate#gurgaon#buildinghappiness#propertyingurgaon#gurugramrealestate.#RealEstate#officespace#officespaceingurgaon

#plugnplayofficespaceingurgaon

#coworkingspaceingurgaon

#callcentreseatsingurgaon

#furnishedofficespaceingurgaon

#udyogvihargurgaon

#dedicatedspace

#managedoffice

#industrial and#commercial#properties both.#Fully furnished office space available for rent in Udyog Vihar#Golf Course Road#Golfcourseextension road#Sector 32 & 44. Gurgaon#CommercialofficespaceinGurgaon#invest#investor#investment#retail#retailers#newprojectcomingsoon#NewProject2023#NewProjectAlert#gurgaonrealestate#realstate#gurgaon#officeleasing#wemakeyourmoneygrow#gurgaonproperties#realestatedevelopers#realestate#buildinghappiness#propertyingurgaon#gurugramrealestate.#RealEstate#officespace#officespaceingurgaon

0 notes

Text

Damnnn embarrassing for Chloe Molloy's accountant that they give her a $20k tax bill lmao do better for our queen, assholes

#she needs a new accountant#i would be happy to look at her finances#she's not claiming enough CLEARLY#the blazers for the fox footy boundary riding can be all claimed under protective clothing#also under protective clothing is anything used to protect from male vitriol saying that Wayne Carey is better at boundary riding#which is a lot#home office expenses obviously but it'd be home gym#any time spent at home working out in the gym - that's deductible cos you're doing it for work#idk she'll have to write into the barefoot investor he'll be able to help her out#get a property in Sydney with a second bedroom and rent it out#orrr because she's moving to Sydney so get one in Melbourne - literally anything & rent that i mean Daisy Pearce would have a few in Vic#so many ideas to tax evade#the government makes it so easy for you#during covid landlording wasn't that profitable but now i bet it is#they're getting their power back#tenants had the power during covid as the victims but now landlords are taking it back!!!!!! they're becoming stronger!!!!!!!#renting has become SCARCE apparently (is the rumour spread by LANDLORDS)#All the landlords got together for a meeting and said 'hey what if we pretended that rental houses were SCARCE lmao we'll make a killing!'#jerks

0 notes

Text

Why should we invest in real estate? = #differhome #www.differhome.com

There are several reasons why one might choose to invest in real estate:

1. Potential for long-term appreciation: Real estate values can appreciate over time, potentially providing a good return on investment.

2. Passive income: Renting out a property can generate a steady stream of income.

3. Diversification: Real estate can diversify an investment portfolio, reducing risk and potentially enhancing overall returns.

4. Tangible asset: Unlike stocks and bonds, real estate is a tangible asset that you can see and touch, making it a more concrete investment for some people.

5. Tax benefits: Real estate investment can provide tax benefits, such as deductions for mortgage interest, property taxes, and depreciation.

However, it’s important to keep in mind that real estate investment also carries risks and may not be suitable for everyone. It’s advisable to do thorough research, understand the market and consult with a financial advisor before making any investment decisions.

More info #differhome

#instagram.com/differhome/

#taxes#concrete#realestateinvestment#people#research#mortgage#realestate#bungalow#differ#differhome#apartment#home#commercial#investor#rent#property#Differhome#_differ_home#differ_home#realtors#realestateagent#license#market#realestatemarket#localguides#residential#plotforsale#online#search#homebuyers

0 notes

Text

advice for #renters #ljgrealestate #tenants #property #investors #housing #supply #interest-rates #landlords #research #property-managers #property-management Established #1996 #word-of-mouth #marketing #referrals #client-focused #property #professionals #brisbane-wide Property Blog 💃🕺❤️

advice for #renters #ljgrealestate #tenants #property #investors #housing #supply #interest-rates #landlords #research #property-managers #property-management Established #1996 #word-of-mouth #marketing #referrals #client-focused #property #professionals #brisbane-wide Property Blog 💃🕺❤️

Source Domain.com.AU & channel 9

Check out our testimonials pages on http://www.ljgrealestate.com.au🙏

North…

View On WordPress

#affordable housing#Australia#BRISBANE#family#INVESTMENT#ljgrealestate#property#PROPERTY INVESTMENT#property investor; sales; rentals#property law#property management#queensland#Queensland; ljgrealestate#Rent;Property Investor#RENTALS#rentals sales property investor#Research#sales; property sales; property investment; property management

1 note

·

View note

Text

#indiana#cash buy house#house for sale#cash investor#investing#real estate#cash buy indiana#rei#off market#forsale#real estate investors#real estate investing#real estate investment#residential real estate#indiana rental house#rental property#rent ready

1 note

·

View note

Text

#RentingVsOwning #Owning #HomePurchase #BuyAHouse #RentAHouse #investor #Investing #Financing #InvestmentProperty #InvestmentProperties #OwnMyHome #SellMyHome #SellingOttawaRealEstate #Exp613 #RealEstateNeverSleeps #ExpRealty #Barrhaven #Kanata #Stittsville #StittsvilleNorth #Carp #Greely #Manotick #RideauForest #BarrhavenRealEstate #KanataRealEstate #StittsvilleRealEstate #CarpRealEstate #GreelyRealEstate #RiversideSouth #RiversideSouthRealEstate #FindlayCreek #FindlayCreekRealEstate #ManotickRealEstate #Ottawa #OttawaRealEstate #SellingOttawa #HowToSellMyHome

#rent#rentingvsowning#renting#owning#investor#investment#investment property#investment properties#investors#ottawa#ottawarealestate#ottawahousesforsale#barrhaven#exprealty#ottawahomesforsale#exp613#exp#kanata#expottawa

0 notes

Text

starting to feel a little stressed about finding a place to live. It’s not that I can’t afford the stupidly high rent increases because I can (to a point). And it’s not that I make for a bad rental application - my partner and I both have full time incomes and a spotless record. Plus my partner is a teacher so he’s never going to be out of work. It’s just that there are too many people looking right now and it genuinely feels like I’m playing musical chairs with everyone else in my city right now and I’m desperate not to be the one that misses out on a seat.

#if it wasn't for that dickhead in Sydney#the real estate was all like#no no we're going to sell the unit to an investor so they'll continue renting to you#and Sydney dickhead was like oh yeah I won't move there until the end of 2023#so they can keep renting it for a year#and then the property was sold#and she was like sike!#I'd like to live there at the end of 2022 you're out bitches#but of course we're not part of that negotiation and have no rights in this at all#and now we're trying to move during one of the biggest rental crises in fifty fucking years

0 notes

Text

Scooby-Doo villains had the right idea, I'm gonna start dressing up in elaborate costumes to scare off rich property investors and tourists and fucking landlords. My home town usesd to have almost no folks stuck on the street and now our whole downtown is a tent city. These people grew up here. You know who didn't? The retired millionaires renting out one bath no bed 80sq ft. broom closets for a grand and a half. Not to be all "get the fuck outta here" but damn go fuck up wherever you grew up, I gotta watch teenagers smoke crack now. Fuck

#Vent post#Sorry guys I thought about it too long and got cranky again#“This is such a beautiful place”#Well yeah Mike it sure used to be#Fuck#Drugs cw

1K notes

·

View notes

Link

Below is one of the top misconceptions about Term Life vs. Whole Life Insurance:

MYTH: It’s better to buy term life insurance and invest the difference.

BUSTED: Real Estate Investors know better than anyone that it is better to OWN than to RENT. Why rent your insurance when you can own it and benefit from the equity built inside your policy?

You may have heard people suggest “buying term and investing the difference”, but investing in the market involves risk. As a Real Estate Investor, you’re already taking a lot of risk. Does it really make sense to take risk with your safe money as well?

#100yearrei#real estate investor#t#erm life insurance#whole life insurance#equity#owing property#renting property#financial engineering

0 notes