#stock market for beginners 2023

Text

Top 15 Must-Know Stock Market Terms for New Investors

#stock market for beginners#stock market#investing for beginners#how to invest in stocks for beginners#stock market investing#how to invest in stock market#how to invest in stocks#stocks#how to invest in the stock market#stock market crash#stock market for beginners 2023#stock market terms#best stocks to buy now#stock market news#15 key stock trading terms#stock market terms for beginners#stocks to buy now#how to outperform the stock market

1 note

·

View note

Text

How to Get Started with Affiliate Marketing: A Step-by-Step Guide to Making Money

In the fast-paced digital landscape of 2023, finding viable ways to generate income online has become increasingly crucial. One avenue that has gained significant traction is affiliate marketing. Whether you're a seasoned digital entrepreneur or just starting, this step-by-step guide will help you navigate the world of affiliate marketing, providing insights and tips to ensure a successful start to your affiliate journey.

Read more »

#Passive Income Strategies"#“Online Side Hustles”#“Investing for Beginners”#“Home Business Ideas”#“Financial Independence Tips”#“Freelance Income Opportunities”#“Money-Making Apps 2023”#“Stock Market for Beginners”#“Real Estate Investment Tips”#“Earning Money from Home”

1 note

·

View note

Text

youtube

🧠💰Warren Buffett's Secrets: How to Turn $1,000 into $1,000,000 - Make Money Online

#real estate#dividend investing#passive income#financial freedom#stock market#affiliate marketing#how to start affiliate marketing#stocks#dividend stocks#dividend growth investing#how to make money#how to make money online#smart money#dave ramsey#how to make money online 2023#affiliate marketing for beginners#passive income ideas#passive income 2023#passive income ideas 2023#Warren Buffett#make money#make money online#smart money tactics#Youtube

0 notes

Text

Best Practices in Your First Year of Stock Market Trading 2023

Best Practices in Your First Year of Stock Market Trading. Learn the top 5 best practices for successful stock market trading in your first year. This comprehensive guide provides valuable insights, tips, and strategies to help you navigate the stock market with confidence.

Entering the stock market can be an exciting and potentially lucrative venture. However, it’s essential to approach stock…

View On WordPress

#15 Biggest Mistakes of Stock Market Investors#5 Reasons Why the Senior Citizen Savings Scheme is a Smart Investment#A Beginner&039;s Guide to Reading Share Market Charts 2023#Advantages and Disadvantages of Investing#Best Practices in Your First Year of Stock Market Trading 2023

0 notes

Text

youtube

Indian mutual funds are buying these 5 stocks aggressively | Mint Explains | Mint

Making an investment decision is a challenging task. With a plethora of stocks available to choose from, how can one make a wise and informed decision? Some people adopt the strategy of observing the purchases and sales made by the leading mutual funds.

#stock market#stock market news#mutual funds#how to invest#mutual fund#top mutual funds#how to invest in mutual funds#mutual funds india#mutual funds investment#best mutual fund for 2023#mutual fund markets#investment#stocks#best stocks to invest in 2023#best stocks to buy now#stocks to buy#how to make money#share market#investing for beginners#mint explain#mint#investing#finance#stock market for beginners#mutual funds for beginners#Youtube

1 note

·

View note

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

A Comprehensive Guide to The Best Stock Market Courses in 2023

online trading courses in kerala are educational programs designed to teach individuals about investing in the stock market. These courses can range from basic introductory courses to advanced programs designed for experienced investors.

Taking a stock market course can be incredibly beneficial for individuals who want to become financially literate and learn how to manage their own investments. By taking a course, you can learn about different investment strategies, how to analyze stocks, and how to create a diversified portfolio that suits your investment goals and risk tolerance.

Here are some of the top stock market courses and programs to look out for in 2023:

Online Trading Courses in Kerala: These courses are designed for individuals who want to learn how to trade stocks online. They cover topics such as technical analysis, charting, and trading psychology.

Share Market Training Institute in Kerala: This program offers comprehensive training in stock market investing. It covers topics such as fundamental analysis, technical analysis, and risk management.

Stock Market Courses in Malappuram: These courses are designed for beginners who want to learn the basics of investing in the stock market. They cover topics such as stock market terminology, stock market indices, and how to read financial statements.

Best Stock Market Courses in Malappuram: This program offers in-depth training in stock market investing. It covers topics such as investment analysis, portfolio management, and risk management.

Investing Courses Online: These courses are designed for individuals who want to learn about different types of investment strategies. They cover topics such as value investing, growth investing, and income investing.

When evaluating the pros and cons of online trading vs offline trading, it’s important to consider your personal preferences and investment goals. Online trading offers convenience and flexibility, while offline trading may offer more personalized service and support.

A typical stock market course may include topics such as investment analysis, portfolio management, and risk management. Benefits of taking a Stock Market Courses in Malappuram include gaining financial literacy, learning how to manage your own investments, and potentially achieving higher returns on your investments.

#online trading courses in kerala#stock market courses in malappuram#share market training institute in kerala#best stock market courses in malappuram

2 notes

·

View notes

Text

"STOCK MARKET TRADING 2023: A BEGINNER'S GUIDE"

The stock market can be a daunting and confusing place for beginners. With constantly changing market conditions and an overwhelming amount of information, it can be difficult to know where to start. However, with the right guidance and knowledge, anyone can begin to understand and navigate the world of stock market trading. In this beginner's guide, we'll cover the basics of stock market trading in 2023, including key terms, strategies, and tips for success.

What is the Stock Market?

The stock market is a platform for buying and selling shares of publicly traded companies. Companies use the stock market to raise capital by issuing shares to investors in exchange for ownership in the company. Investors can then buy and sell these shares on the market, with the price of the shares determined by supply and demand.

Key Terms to Know

Before diving into stock market trading, it's important to understand some key terms that you'll encounter:

Stock: A share in a publicly traded company.

Index: A collection of stocks used to measure the performance of the overall market.

Exchange: The platform where stocks are bought and sold.

Broker: An intermediary who facilitates stock trades between buyers and sellers.

Bull market: A period of rising stock prices.

Bear market: A period of falling stock prices.

Different Types of Stocks

Not all stocks are created equal, and it's important to understand the different types of stocks that exist:

CONTINUE READING THIS POST

2 notes

·

View notes

Text

Progress on 2 personal projects

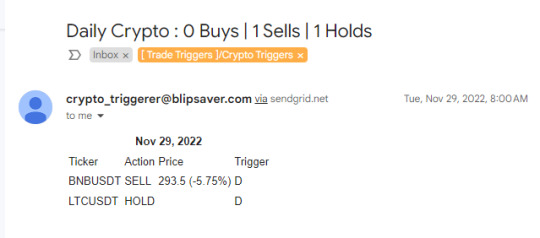

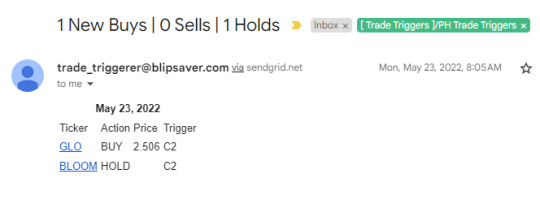

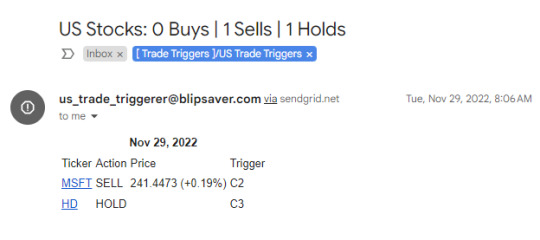

Project # 1 - Trade Triggerer Phase 2

What was Trade Triggerer Phase 1?

In my previous posts, I've shared some snippets of the analysis, development, and deployment of my app Trade Triggerer. It started as a NodeJS project that accomplished the end-to-end data scraping, data management, conditional checking for trades, and email sendout. The deployment was done in Heroku (just like how I deployed my twitter bot previously). I scrapped all that due to the technical upkeep and the increasing difficulty to analyze data in NodeJS.

Sometime around 2017-18, I've started learning Python from online courses for fun, and eventually re-wrote all the NodeJS functionality in a significantly shorter and simpler code. Thus, Trade Trigger-PY was born and deployed circa Aug 2019. Some technologies I've used for this project are simply: Heroku, GMail API, GSheets API. I originally only was monitoring PH Stock Market, but it was easy to add US stocks and Crypto. Hence, I was receiving these emails every day.

I followed the trading instructions strictly, and I became profitable. However, I stopped for the following reasons:

I was beginning to lose money. It seems I had beginner's luck around 2020-2022 since the market was going up on average as a bounce back to the pandemic.

PH market is not as liquid as my experience in crypto trading.

The US stocks I'm monitoring are very limited, as I focused more on PH.

On April 2023, DLSU deleted alumni emails, where my stocks data are being stored.

On November 2023, Heroku stopped offering free deployments.

Today, I am highly motivated to revive Trade Triggerer for only 1 reason, I don't want money to be a problem for the lifestyle that I want. Learning from my past mistakes, Trade Triggerer Phase 2 will be implemented using the following:

Increased technical analysis - Use of statistical models to analyze historical and current stock data

Start fundamental analysis - Review of historical events that changed market behaviour + Review of balance sheets, starting with banks

Focus on strong International Stocks (US, JPN, EUR, CHN)

Deploy on a local Raspberry Pi

I am still at the beginning. I've only been able to train models using historical data and found promising results. There's a long way to go but I believe I can do the MVP on or before my Birthday :)

Project # 2 - Web scrape properties for sale

For personal use lol. Can't deploy in Heroku anymore; and I dont want to depend on other online alternatives, too. I'll start playing around with raspberry pi for this project.

0 notes

Text

Gold IRA Pros And Cons

Lauran deWinter was actually useful in advising me on the right way to proceed with my current IRA and lay the inspiration for a self-directed IRA in order that I may diversify into owning gold and silver. Loads of purchasers select to go together with the latter to fund their standard rollovers from existing accounts. The IRS accepted precious metals that can be held in a gold IRA include gold, silver, platinum and palladium. Over fourteen IRA-eligible gold coins are listed on their website, and they offer more to account holders. As https://bestgoldira.info -directed IRA account holder, you'll be able to purchase a variety of treasured metals in varied varieties. Many different firms have setup charges which might be either proportion-based or higher than $100. These companies supply competent steerage from financial specialists and enable new prospects to arrange their gold IRAs in a matter of days. Tradition says something bought on this present day will deliver long-time period rewards and returns, and lots of believe buying gold now will guarantee prosperity without end.

youtube

Thus, individuals can read all about current affairs such because the Bitcoin trade, different markets, stocks, and more. Essential note: These investor guides are not just digital downloads or PDF information. Observe: Copyright claims must contain all of the objects specified within the Copyright Coverage. Copyright 2023 Cash Group, LLC. Unique content created by investorideas is protected by copyright legal guidelines aside from syndication rights. Proof coins should be encapsulated of their unique and complete packaging in mint situation. Proof coins must be in unique Mint packaging, in flawless situation with Certificate of Authenticity. Previously, an investor’s only choice was to buy American Eagle gold and silver coins.

Gold IRA rollovers entail lots of paperwork, so some companies and sellers tack on a premium. In the field of valuable metals, this agency stands out as the preferable selection, earning reward from customers and business peers alike. The company's site is straightforward to grasp, which is very convenient as a result of even beginners may comprehend the fundamentals of gold investments. Though the initial investment with the company is sort of expensive, Augusta provides a easy investment mannequin with no hidden fees. It really has a great fame amongst customers, who testify in regards to the credibility of the company. You may make a precious metals IRA account and save your retirement money to function a hedge against inflation. As with the practices of earlier than, central banks are hoarding gold to guard their banknotes and the international locations that they serve from attainable economic turmoil. All investment involves danger and potential loss of funding. Higher Enterprise Bureau and has a 5-star buyer satisfaction ranking on multiple review platforms like Trustpilot and Google.

You can’t deduct a loss from your enterprise in the event you don’t make a revenue from it in at least three out of 5 years. But if you want to make a personal purchase to your regular funding portfolio, you can. Segregated storage allows you to have your metals saved individually from different customers’ metals, while non-segregated storage allows your metals to be stored with different customers’ metals. That way, in case your account grows significantly, you continue to just need to pay one flat payment. Not only is this amount lower than most of their opponents, but it additionally helps you avoid being charged by percentage. This means all or part of your employer contributions should not yours until sure vesting requirements have been met. Vesting intervals may apply to the employer contributions. There have been durations up to now when their prices fell below break-even.

0 notes

Text

Penny Stocks Risk and Rewards Analysis

#penny stocks#penny stocks to buy now#best penny stocks#how to trade penny stocks#penny stock#best penny stocks to buy now#penny stocks for beginners#penny stocks to buy#stock market#penny stock trading#trading penny stocks#stocks to buy#what are penny stocks#top penny stocks#penny stocks 2023#penny stocks 2022#stocks#stock analysis#stocks to buy now#fundamental analysis of penny stocks#how to buy penny stocks#best penny stocks 2022

0 notes

Text

If you are beginner in the stock market and you want to know about stock market then you can read here https://businessinfo29.blogspot.com/2023/11/stock-market-beginners-guide.html

If you want to know online trading procedure in the stock market then you can know here https://businessinfo29.blogspot.com/2024/01/if-you-want-to-start-online-trading-in.html

If you want to know what things should be kept in mind while doing fundamental analysis then you can read here https://businessinfo29.blogspot.com/2023/12/if-you-invest-in-stock-market-or.html

If you want to know how to apply for IPO both offline and online, then you can read here https://businessinfo29.blogspot.com/2024/01/here-are-types-of-issues-in-capita-l.html

0 notes

Text

youtube

Stock Market for Beginners: A Step-by-Step Guide to Financial Freedom 💰📈

#dividend investing#passive income#financial freedom#stock market#stocks#dividend stocks#dividend growth investing#how to make money#smart money#financial education#passive income ideas 2023#best stocks to buy now#stocks to buy now#penny stocks to buy now#best stocks to invest in 2023#trading live#stock market for beginners#make money#make money online 2023#earn money online#make money online#earn money#stocks to buy#how to make money online#Youtube

0 notes

Text

Best Binary Options Brokers 2023

Nowadays, there's a lot of binary options broker but only few was qualified in terms of the security. Quotex was my favorite binary broker in 2023. Before i share my experience, you need to know what is binary options first, here you go:

Binary options trading has gained popularity as an accessible and straightforward financial instrument that allows individuals to speculate on the price movement of various assets. While it offers potential for high returns, it's crucial for traders to understand the basics, risks, and regulatory considerations associated with binary options.

What are Binary Options?

Binary options are financial derivatives with two possible outcomes: a fixed payout if the trader's prediction is correct or a predefined loss if the prediction is incorrect. Traders select an underlying asset, such as currencies, commodities, stocks, or indices, and predict whether the asset's price will rise (call option) or fall (put option) within a specified time frame. The fixed expiration time can range from minutes to hours, offering a quick turnaround for potential profits.

Key Elements of Binary Options Trading

Underlying Assets: Traders can choose from a wide range of underlying assets. Common categories include currency pairs (forex), commodities like gold and oil, stocks of major companies, and indices representing market trends.

Directional Prediction: Traders must predict the future price movement of the selected asset. If they anticipate an increase, they choose a call option; if they expect a decrease, they opt for a put option.

Expiration Time: Binary options have a predefined expiration time, determining when the trade outcome is determined. Short-term options may expire within minutes, while longer-term options can have expiration times extending to days.

Payout Structure: The payout for a successful trade is predetermined, offering transparency and simplicity for traders. However, it's important to note that the potential loss is also fixed and known upfront.

Pros and Cons of Binary Options Trading

Pros:

Simplicity: Binary options trading is relatively straightforward, making it accessible to beginners.

Quick Results: Traders can experience quick results with short expiration times.

Diverse Asset Options: A wide range of assets is available for trading, providing ample opportunities.

Fixed Risk and Reward: Traders know the potential risk and reward before entering a trade.

Cons:

High Risk: Binary options trading involves a high level of risk, and losses can be substantial.

Limited Regulation: The industry has faced regulatory scrutiny, and not all platforms are regulated.

Market Complexity: While the concept is simple, understanding market trends and factors influencing asset prices requires analysis and research.

Potential for Fraud: Some unregulated platforms may engage in fraudulent activities, emphasizing the importance of due diligence.

Regulatory Considerations

Regulatory oversight varies globally, and traders should be aware of the regulatory environment in their jurisdiction. Some countries have banned or heavily regulated binary options trading due to concerns about investor protection and market integrity. It's advisable to choose regulated platforms that adhere to established financial regulations, providing an added layer of security for traders.

Risk Management and Education

Successful binary options trading requires a combination of market knowledge, risk management strategies, and continuous learning. Traders should educate themselves on market analysis techniques, stay informed about global economic events, and develop effective risk management plans to mitigate potential losses.

Conclusion

Binary options trading can be a viable financial instrument for those seeking short-term speculative opportunities. However, the risks involved necessitate a cautious and informed approach. Traders should prioritize education, choose reputable and regulated platforms, and be aware of the regulatory landscape in their region. As with any form of financial trading, responsible and informed decision-making is key to navigating the complexities of binary options and maximizing the potential for success.

600 words positive article binary optionChatGPT

Title: Unlocking Opportunities: The Positive Aspects of Binary Options Trading

Binary options trading, often hailed for its simplicity and accessibility, has become a popular financial instrument offering individuals the potential to capitalize on market movements. In this article, we'll explore the positive aspects of binary options trading, shedding light on its benefits and opportunities.

Accessibility and Simplicity

One of the most notable advantages of binary options trading is its accessibility. Unlike traditional financial markets that may require extensive knowledge and large capital, binary options cater to a broad audience. The simplicity of the trading process allows beginners to quickly grasp the fundamentals, making it an attractive option for those entering the financial markets for the first time.

Quick Returns and Fast-Paced Nature

Binary options provide an opportunity for traders to experience quick returns on their investments. With short expiration times ranging from minutes to hours, traders can witness the outcome of their trades swiftly. This fast-paced nature can be appealing to individuals seeking immediate results, making binary options an exciting and dynamic form of trading.

Diverse Asset Selection

Binary options platforms offer a diverse array of underlying assets for traders to choose from. Whether it's currencies, commodities, stocks, or indices, the variety of options allows traders to explore and diversify their portfolios. This diversity opens up numerous opportunities for profit in different market conditions, providing flexibility to adapt to changing economic landscapes.

Transparent Risk and Reward

Binary options traders benefit from a clear and transparent risk and reward structure. Before entering a trade, traders know the potential profit and the maximum possible loss. This transparency empowers traders to make informed decisions and manage their risk effectively. Knowing the exact parameters of a trade before execution contributes to a more controlled and strategic approach to trading.

Flexibility in Trading Strategies

Binary options offer flexibility in terms of trading strategies. Traders can choose from various expiration times, allowing them to tailor their strategies to different market conditions. Whether employing short-term trading for quick profits or longer-term positions based on a thorough analysis, binary options provide a versatile platform for implementing a range of trading approaches.

Technology and Innovation

The rise of binary options has coincided with advancements in technology, leading to user-friendly trading platforms and tools. These platforms often come equipped with educational resources, market analysis tools, and real-time data, empowering traders with the information they need to make informed decisions. The integration of technology has played a pivotal role in making binary options trading accessible and efficient for a diverse range of participants.

#quotex

0 notes

Text

Navigating the Markets: Unveiling the Best Trading Platforms of 2023

E-Trade: Empowering Traders with Innovation

E-Trade stands out as a powerhouse in the online trading realm, known for its innovative tools and comprehensive research resources. With a user-friendly interface, E-Trade caters to both beginners and seasoned traders. The platform provides a seamless experience, offering a range of investment options, including stocks, options, and ETFs. Real-time market data and educational resources further empower users to make informed decisions.

Interactive Brokers: Unparalleled Global Access

Recognized for its global reach and low-cost structure, Interactive Brokers continues to be a favorite among active traders. The platform boasts a vast selection of tradable assets, including stocks, bonds, options, and futures. With a sophisticated best trading platform interface, advanced charting tools, and an extensive range of research materials, Interactive Brokers appeals to those seeking a professional and feature-rich trading experience.

Robinhood: Democratizing Finance for All

Robinhood disrupted the trading landscape by introducing commission-free trades, making it an attractive option for cost-conscious investors. With a user-friendly mobile app, Robinhood allows users to trade stocks, options, cryptocurrencies, and ETFs seamlessly. The platform's simplicity and zero-commission structure appeal particularly to beginners, while its innovative features like fractional shares open up investing to a broader audience.

TD Ameritrade: The Power of Thinkorswim

TD Ameritrade, now part of Charles Schwab, continues to be a leader in the industry, offering a diverse range of investment products. Thinkorswim, their advanced trading platform, is renowned for its powerful charting tools, technical analysis capabilities, and customizable interfaces. With a commitment to education, TD Ameritrade ensures that traders have the resources they need to enhance their skills and make informed decisions.

Fidelity: A Trustworthy Platform with Robust Research

Fidelity has earned its reputation as a trusted brokerage, providing a wide array of investment options. The platform offers a seamless best forex trading platform experience, complemented by in-depth research tools and educational resources. Fidelity's commitment to customer service and its retirement planning features make it a standout choice for long-term investors.

Webull: Empowering the Mobile Trader

As mobile trading gains momentum, Webull emerges as a go-to platform for those who prefer to trade on the go. With a sleek mobile app, Webull provides commission-free trading of stocks, options, and ETFs. Real-time market data, technical analysis tools, and a community feature for sharing insights make Webull an appealing option for the modern, tech-savvy trader.

0 notes

Text

crypto and stocks

Working with an online stockbroker makes investing and managing your portfolio much easier. However, different stockbrokers are better at different things. Additionally, each broker can charge differing fees and offer contrasting user experiences. If you’re trying to choose the best stockbroker to work with, here are some of the best brokers we recommend.

Trading platforms form the crucial bridge between you and your chosen financial market. As such, whether you’re interested in crypto and stocks, forex, commodities, the best trading platforms, the best trading tools, or cryptocurrencies – you need to find a suitable free trading platform that meets your needs.

Here at Trading Platforms, we strive to bring you the very best trading platforms of 2023 and beyond. This includes trading platforms that offer the best fees and commissions, the most diverse asset classes, and of course – the strongest regulatory standing.

Fidelity Investments is well known for being the lowest-costing online brokerage. They provide great market intelligence resources, and numerous broker tools and you won’t have to pay a single cent for commission fees for stocks and ETF trades! Clients have rated their trade executions and accuracy to be excellent, alongside being the perfect platform for beginners. This is mainly due to the fact that Fidelity Investments has a very detailed research system that will support beginners by providing all the market knowledge needed.

Furthermore, while it is true that Fidelity Investments is only open to US citizens and that these US customers have to sign onto multiple platforms just to gain access to the different trading tools, clients won’t need to hassle about requiring an account minimum. So, if you’re a US citizen looking to gain an easy and safe entry into the online trading market, Fidelity will be the best platform for you to set up your own portfolio — you’ll get to focus on building up your skillsets without having to worry about any bank fees!

0 notes